Energy Indicators

Oil and gas executives expect West Texas Intermediate (WTI) crude oil to end the year as high as $80 a barrel. Employment growth in the oil and gas sector is increasing at a slower rate compared with last year’s period of heightened energy prices, but it is still at robust levels. Input costs are expected to remain elevated through 2023.

Crude prices

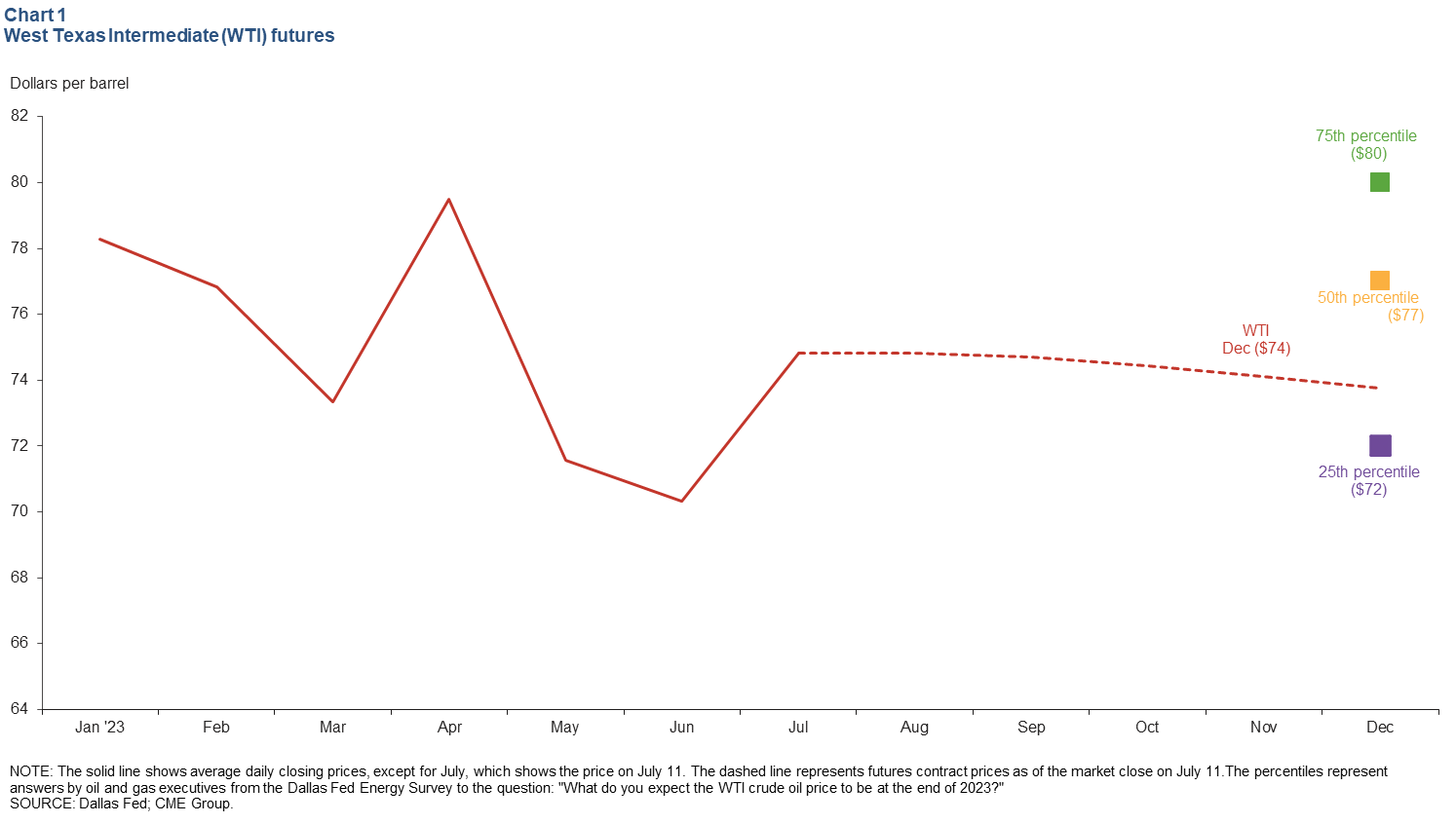

Front-month futures contracts for WTI closed at $75 on July 11. Futures contracts imply a decline of 1.4 percent by the end of the year (Chart 1). In contrast, when asked in the Dallas Fed’s second-quarter Energy Survey, industry executives indicated that they broadly expect the price of WTI to rise by the end of 2023. The median expected price was $77 a barrel, ranging from $72 at the 25th percentile to $80 at the 75th. Outlooks from several financial institutions at the end of June were in the upper end of the survey’s range; some noted that recent softness had more to do with recessionary fears than weakness in fundamentals.

Employment

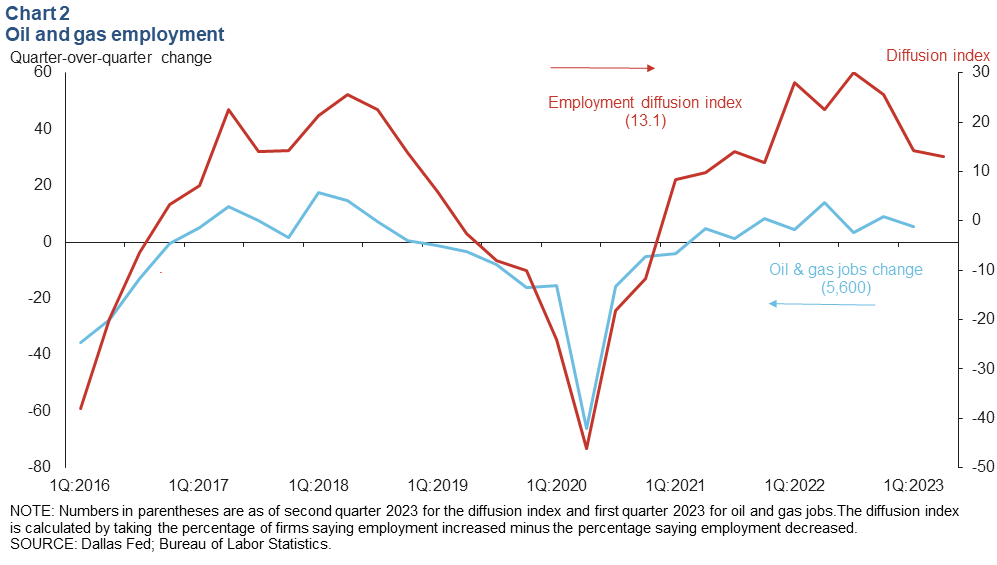

Job growth in the oil patch is slowing. From mid-2021 to mid-2022, when oil prices peaked, hiring for U.S. oil and gas jobs grew at an annualized pace of 10.6 percent. Over the nine months that followed, that pace slowed to 8.7 percent—a result consistent with the weakness seen in the Dallas Fed Energy Survey’s employment index. During the first quarter of the year, the industry added 5,600 jobs (Chart 2).

Finding qualified labor continues to be a challenge, according to feedback from the Dallas Fed survey and industry contacts. The pressure to raise wages remains significant—though pressures have eased somewhat with slowing activity.

The decline in drilling activity this year has not translated into job losses in the sector. On average, for every 100 people employed nationally in the energy industry, 1.1 lost their jobs between January and May 2023, according to the Job Openings and Labor Turnover Survey from the Bureau of Labor Statistics. That is below the average of 1.6 from 2010 to 2019.

Energy Survey special questions

Drilling and completion cost expectations depend on firms’ size

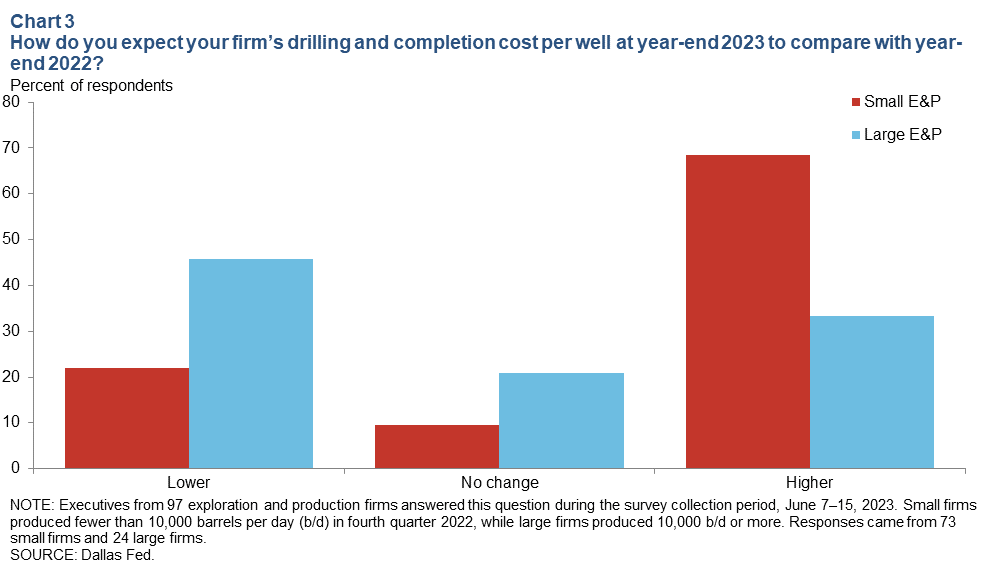

When it comes to drilling and completion costs per well, size matters, according to results from the Dallas Fed Energy Survey. Smaller producers were much less likely to expect lower costs this year (22 percent) than larger firms (46 percent), noting the larger firms' economies of scale. In sharp contrast, smaller firms expect higher costs by year-end 2023 at a much higher rate (69 percent) than large firms (33 percent) (Chart 3).

Oilfield services’ input costs expected to rise in 2023

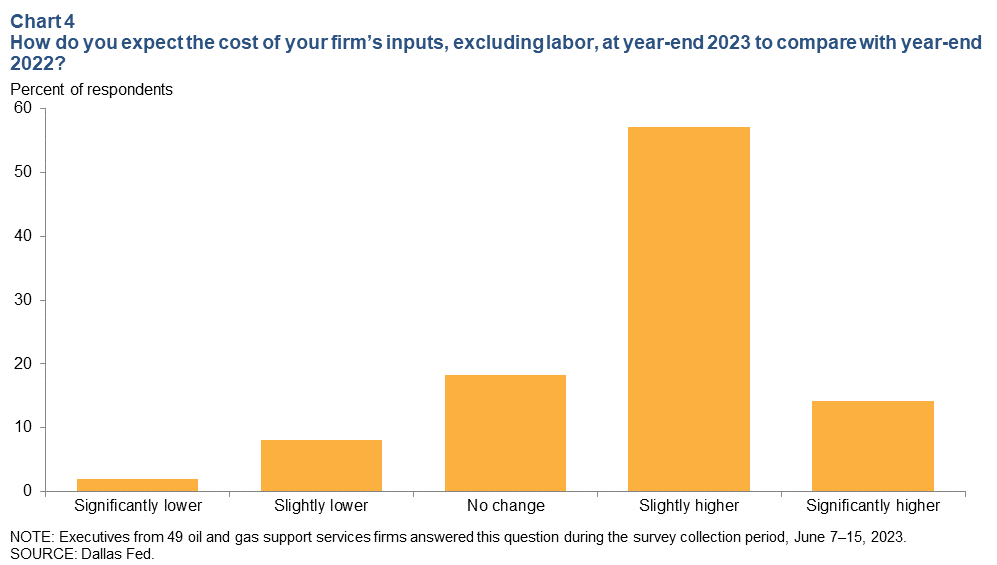

On the other side of that transaction, oilfield services firms expect input costs, excluding labor, to be slightly higher at year-end 2023 compared with year-end 2022 (Chart 4). Seventy-one percent of executives expect costs to be higher, while 10 percent expect them to be lower.

Respondents reported that profits are narrowing, with commodity prices softening, input costs increasing or staying elevated and industry wages rising. Some of the elevated costs firms specifically noted were for steel tubing, services and insurance.

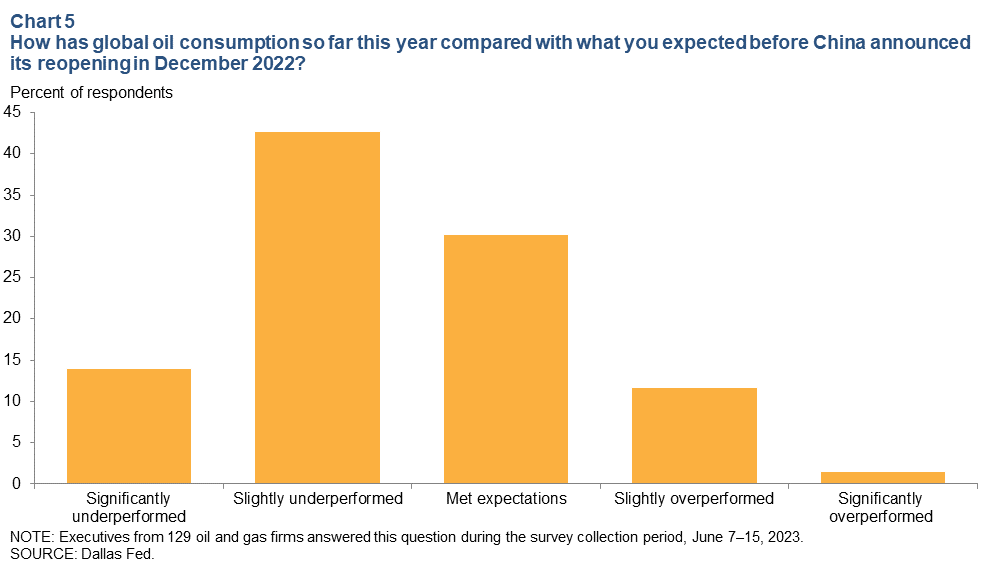

China’s reopening isn’t giving global consumption an expected boost

Oil and gas executives say global consumption after China’s reopening is slightly below their expectations (Chart 5). Survey comments indicate that China still has an upside and that demand will eventually increase but at a rate that is difficult to project.

About Energy Indicators

Questions can be addressed to Kenya Schott at kenya.schott@dal.frb.org. Energy Indicators is released monthly and can be received by signing up for an email alert. For additional energy-related research, please visit the Dallas Fed’s energy home page.