Banking Conditions Survey

April 2020

April 2020

What’s New

For this survey, respondents were asked supplemental questions on the impacts of the coronavirus (COVID-19). Read the special questions results.

Results Tables

Historical data are available from March 2017.

| Total Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

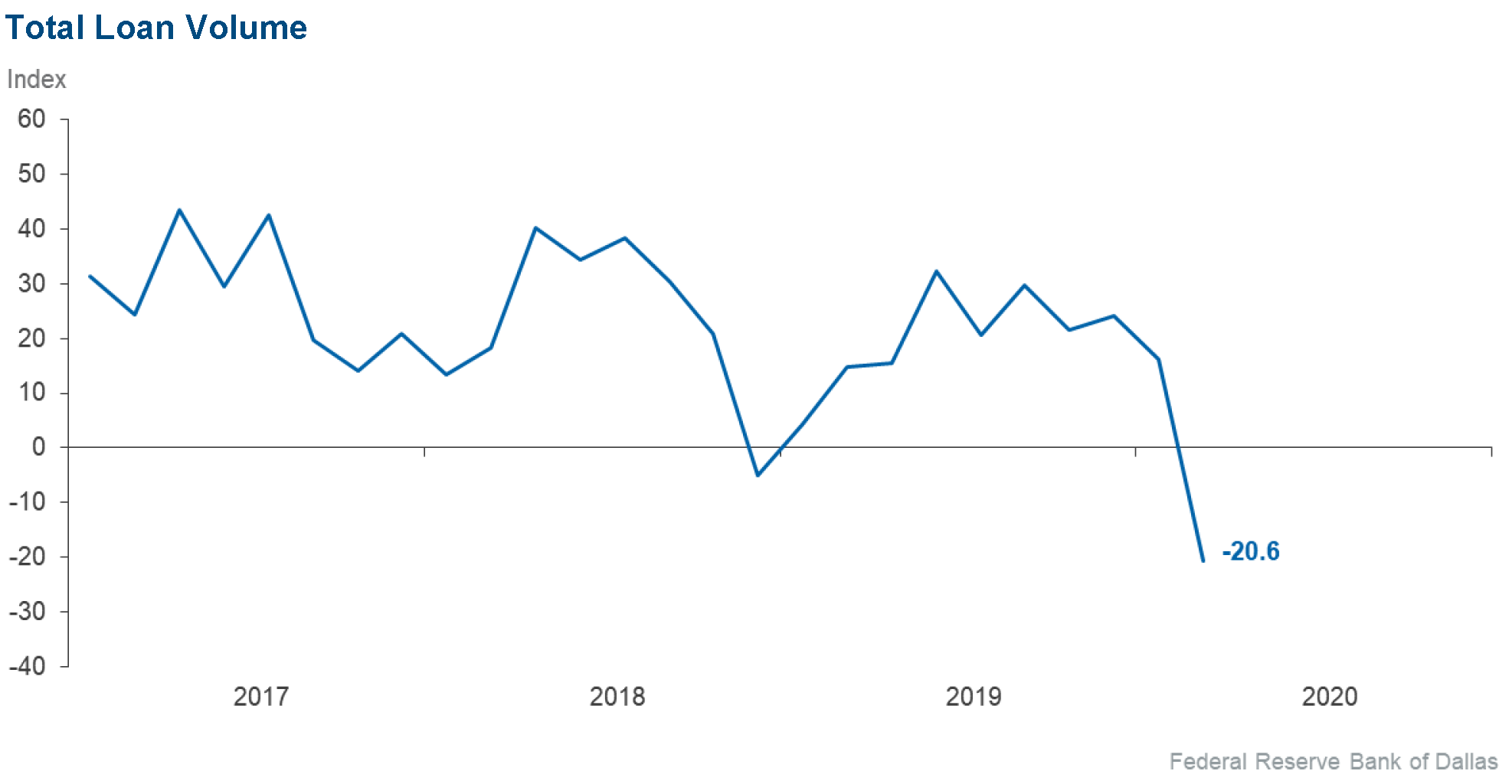

Loan volume | –20.6 | 16.1 | 25.4 | 28.6 | 46.0 |

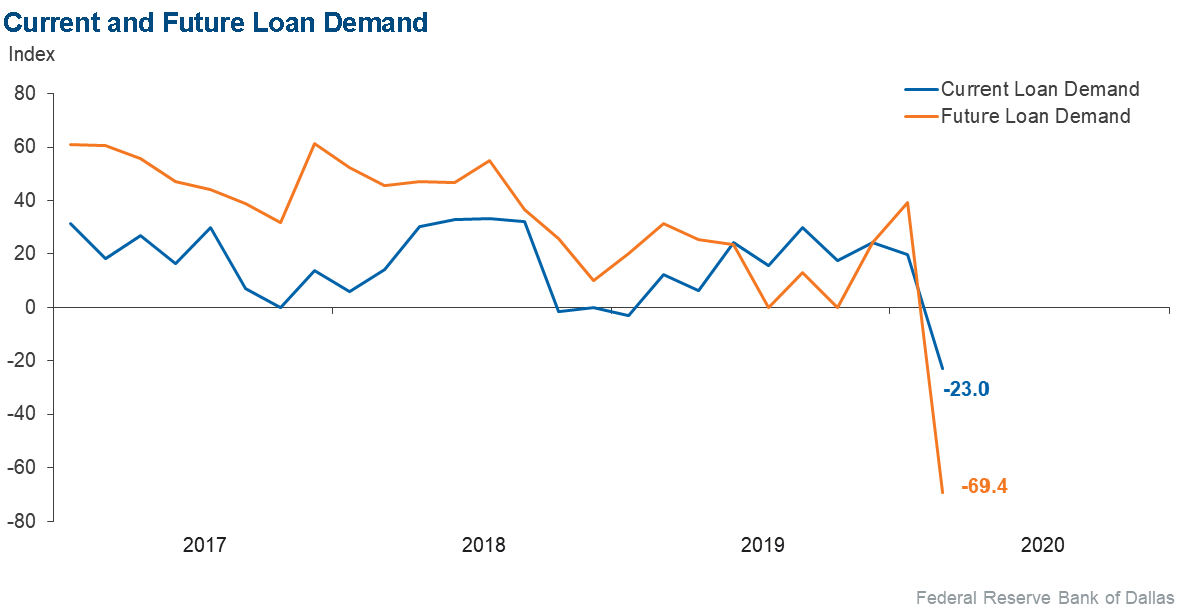

Loan demand | –23.0 | 19.6 | 26.2 | 24.6 | 49.2 |

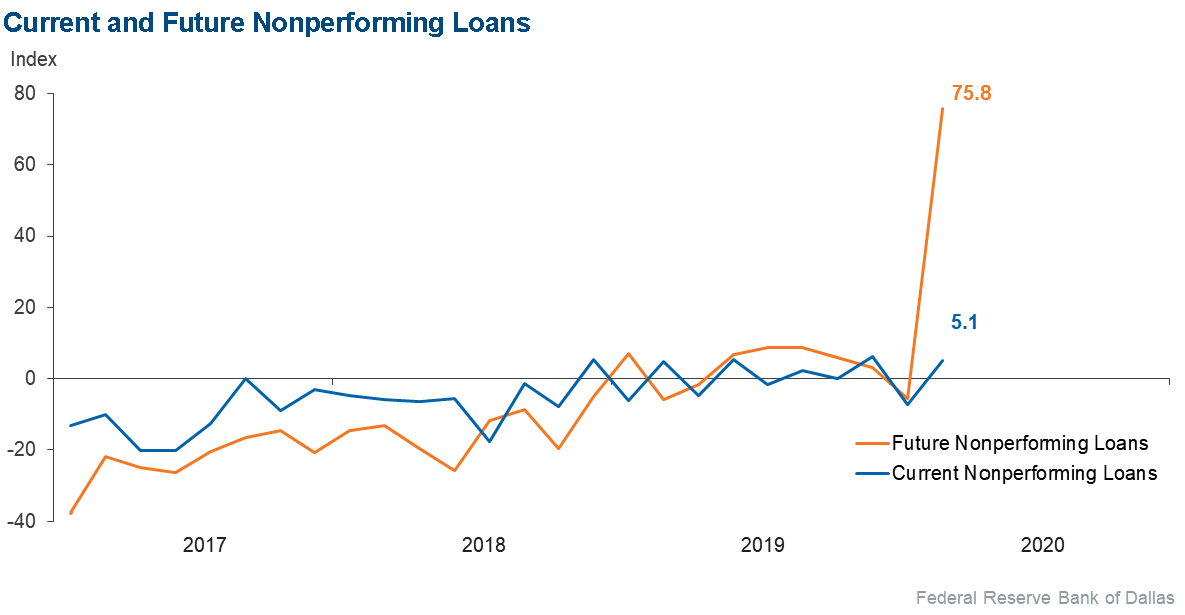

Nonperforming loans | 5.1 | –7.3 | 11.9 | 81.4 | 6.8 |

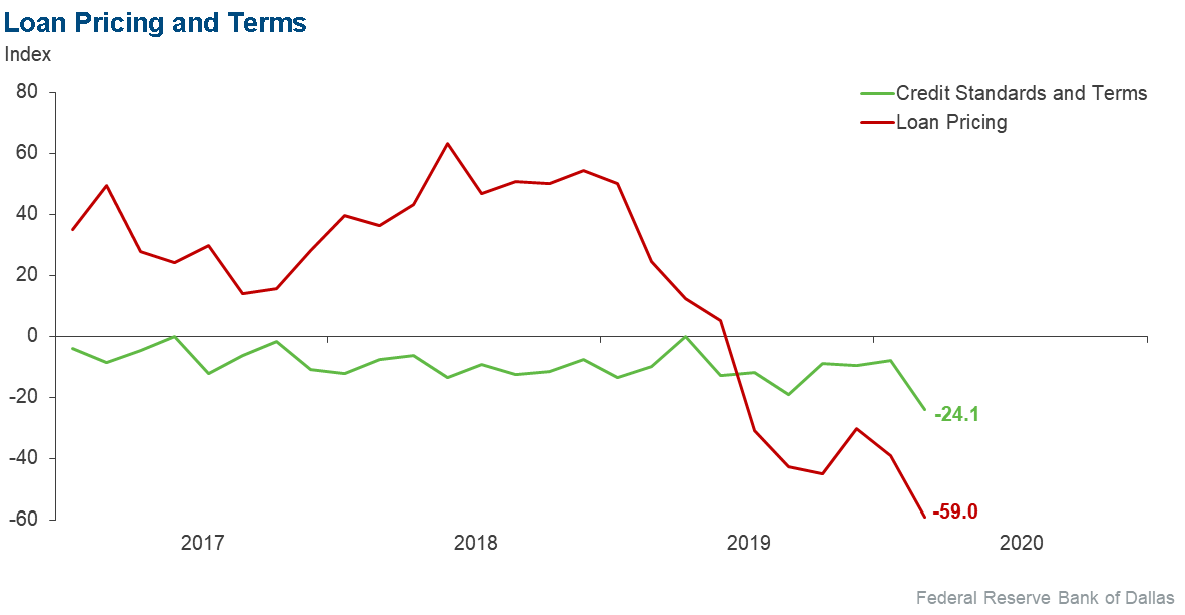

Loan pricing | –59.0 | –39.3 | 3.3 | 34.4 | 62.3 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –24.1 | –8.0 | 5.6 | 64.8 | 29.6 |

| Commercial and Industrial Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

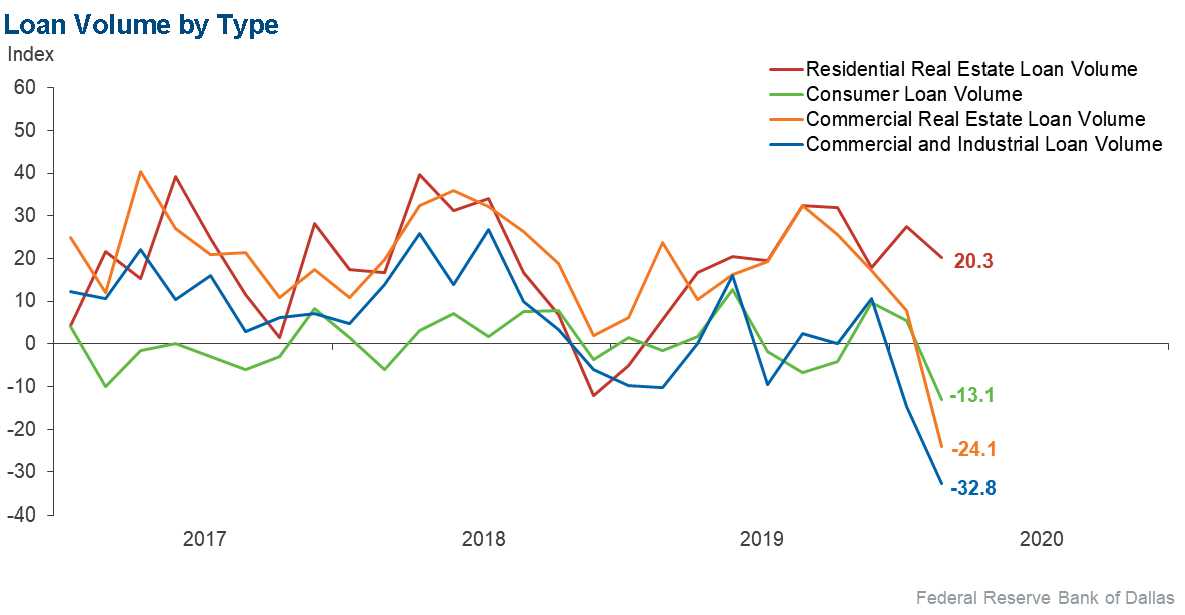

Loan volume | –32.8 | –14.6 | 6.9 | 53.4 | 39.7 |

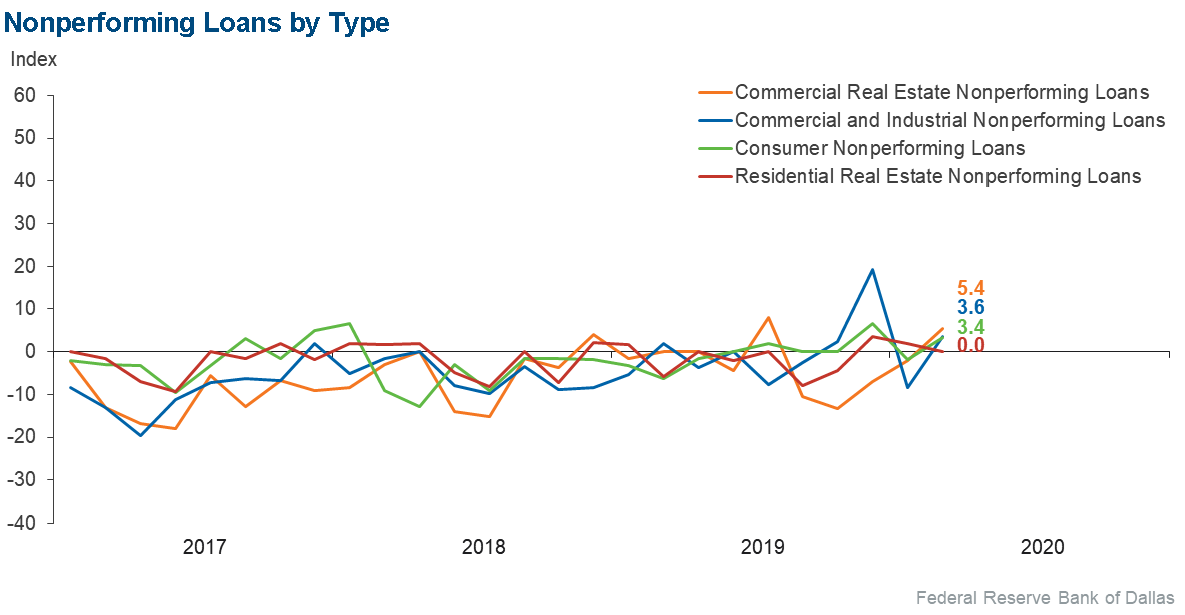

Nonperforming loans | 3.6 | –8.3 | 7.3 | 89.1 | 3.6 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –24.6 | –6.3 | 3.5 | 68.4 | 28.1 |

| Commercial Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | –24.1 | 7.8 | 13.8 | 48.3 | 37.9 |

Nonperforming loans | 5.4 | –2.0 | 7.1 | 91.1 | 1.8 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –26.3 | –6.0 | 1.8 | 70.2 | 28.1 |

| Residential Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 20.3 | 27.5 | 37.3 | 45.8 | 16.9 |

Nonperforming loans | 0.0 | 2.0 | 3.4 | 93.1 | 3.4 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –16.1 | 0.0 | 1.8 | 80.4 | 17.9 |

| Consumer Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | –13.1 | 5.5 | 16.4 | 54.1 | 29.5 |

Nonperforming loans | 3.4 | –1.9 | 11.9 | 79.7 | 8.5 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –8.2 | –3.6 | 4.9 | 82.0 | 13.1 |

| Banking Outlook: What is your expectation for the following items six months from now? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Total loan demand | –69.4 | 39.3 | 9.7 | 11.3 | 79.0 |

Nonperforming loans | 75.8 | –5.5 | 79.0 | 17.7 | 3.2 |

| General Business Activity: What is your evaluation of the level of activity? | |||||

| Indicator | Current Index | Previous Index | % Reporting Better | % Reporting No Change | % Reporting Worse |

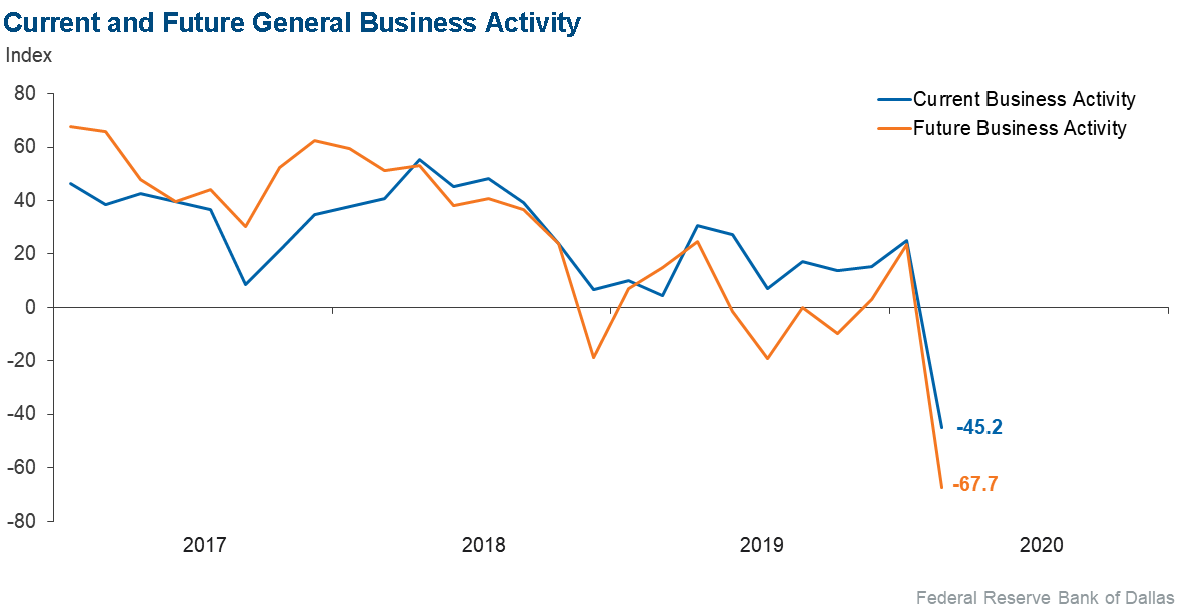

Over the past six weeks | –45.2 | 25.0 | 11.3 | 32.3 | 56.5 |

Six months from now | –67.7 | 23.6 | 11.3 | 9.7 | 79.0 |

Next release: May 11

|

Data for this report were collected March 18–25, and 63 financial institutions—52 banks and 11 credit unions—responded. The Federal Reserve Bank of Dallas conducts the Banking Conditions Survey twice each quarter to obtain a timely assessment of activity at banks and credit unions headquartered in the Eleventh Federal Reserve District. CEOs or senior loan officers of financial institutions report on how conditions have changed for indicators such as loan volume, nonperforming loans and loan pricing. Respondents are also asked to report on their banking outlook and their evaluation of general business activity. Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease (or tightening) from the percentage reporting an increase (or easing). When the share of respondents reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior reporting period. If the share of respondents reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior reporting period. An index will be zero when the number of respondents reporting an increase is equal to the number reporting a decrease. |

April 2020

April 2020

Comments from Survey Respondents

These comments are from respondents’ completed surveys and have been edited for publication.

Coronavirus Concerns

Economic Disruption

- The destruction to the economy by the decisions around COVID-19 concerns me.

- My concerns are that the government has taken drastic measures to curtail a virus that will kill less than the common flu in a year and that these measures will send the economy into a depression.

- We anticipate an increase in problem assets and expect economic productivity to decline significantly as a result of COVID-19. I also anticipate unemployment will be increasing significantly.

- The economic disruption caused by COVID-19 is unprecedented, resulting in the institution working diligently to provide flexibility and accommodations to members impacted or to be impacted by this event. Government support is needed and will be needed for a long period of time.

- Macro effects of the pandemic concern me.

- Like most others in banking, I am very concerned how COVID-19 will impact the economy in the short and long term.

- In light of recent events, many of our competitors and clients are concerned about COVID-19 and the impact it is having on the economy. The extreme measures being taken by the government and Federal Reserve are deeply concerning. While we have not yet seen any major liquidity problems, we are preparing and working with our larger clients to meet their needs during this time.

- The effects of COVID-19 concern me.

- The unknown length of the pandemic is the main focus these days.

Disruption to Business

- We have not seen the effects the coronavirus will have on our bank.

- The past six weeks don’t account for the last 10 days as COVID-19 starts to unfold and impact business. I anticipate significantly lower business activity over the next 30 days.

- I am concerned about COVID-19 and the decline in oil prices.

- We have significant concerns about COVID-19 and its adverse impact on the economy. We expect many businesses to shut down, and we anticipate a significant rise in unemployment. As a result, we expect an increase in loan defaults and losses to the bank in the next six months.

- It is my expectation that the consequences from shutting down the economy as the way to deal with the COVID-19 virus will lead to major issues in the banking industry due to consumers and commercial customers not having the cash flow necessary to provide for their needs. This will be a nightmare!

- COVID-19 and payment deferrals are taking up most of our time now, along with pandemic planning and employee staffing issues.

- We are certainly in uncharted waters; however, our pandemic planning has been a tremendous help. As a community bank, our preparedness has allowed us to help our small business customers in attempts to eliminate potential panic. Our senior management team now meets twice a day to discuss the situation and make future plans.

- Backstops needed for distressed borrowers due to COVID-19.

Business Concerns

- Declining interest rates will have a negative effect on my earnings.

- String demand for payment deferrals.

- The collapse in the price of crude oil will adversely impact our market area significantly.

- My concerns are oil and gas pricing, shutdown of the oil and gas industry, and massive layoffs.

Regulation Concerns

- TRID [TILA-RESPA Integrated Disclosure Rule Implementation] loans are needlessly cumbersome and difficult to do, costing our customers and the bank undue hardship.

- Overwhelming compliance regulations.

Historical Data

Historical data can be downloaded dating back to March 2017. For the definitions, see data definitions.

Questions regarding the Banking Conditions Survey can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Banking Conditions Survey is released on the web.