Banking Conditions Survey

Results Summary

Historical data are available from March 2017.

| Total Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

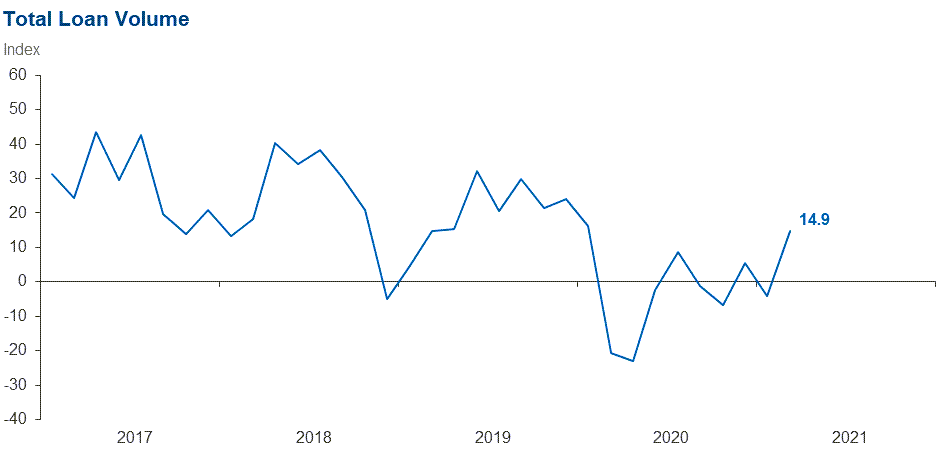

Loan volume | 14.9 | –4.1 | 33.8 | 47.3 | 18.9 |

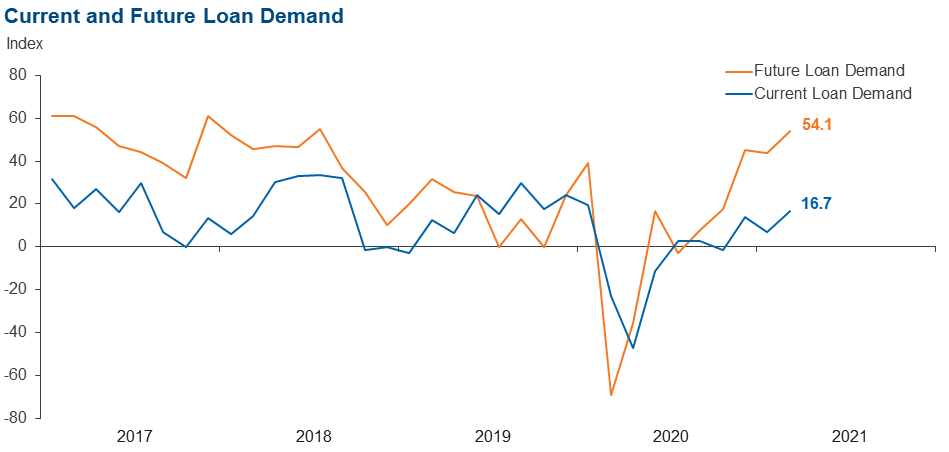

Loan demand | 16.7 | 6.9 | 36.1 | 44.4 | 19.4 |

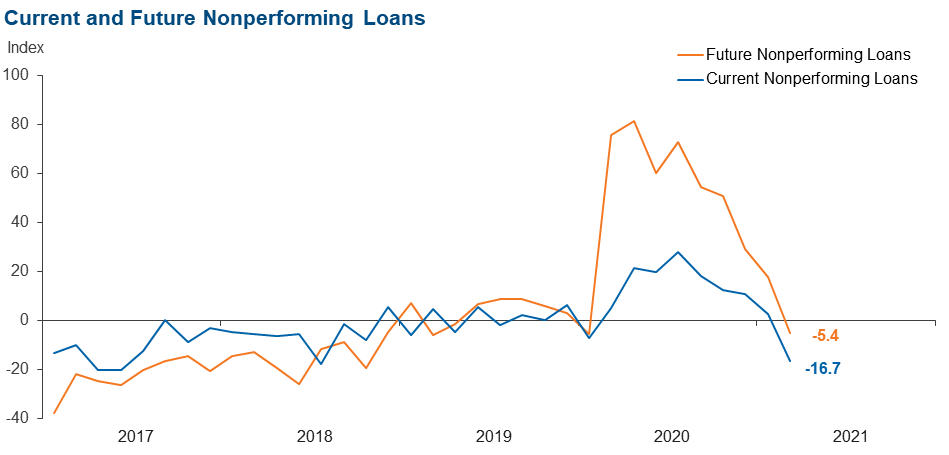

Nonperforming loans | –16.7 | 2.7 | 6.9 | 69.4 | 23.6 |

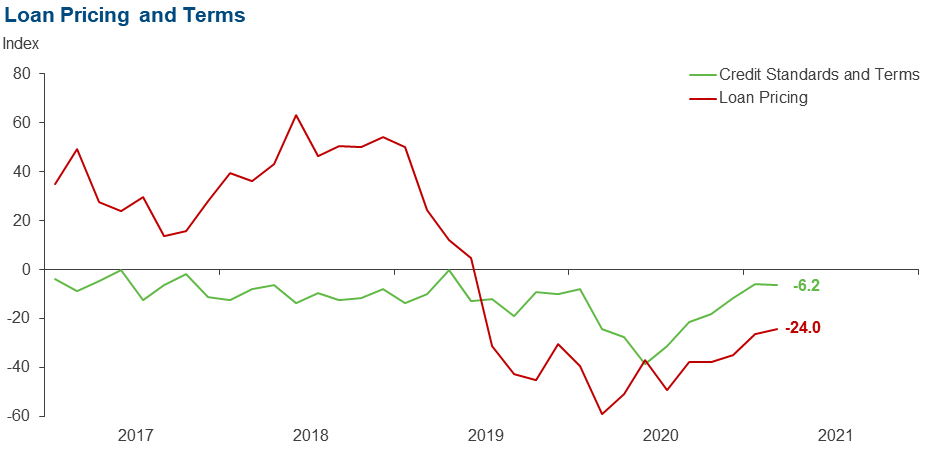

Loan pricing | –24.0 | –26.1 | 4.2 | 67.6 | 28.2 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –6.2 | –5.9 | 4.6 | 84.6 | 10.8 |

| Commercial and Industrial Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

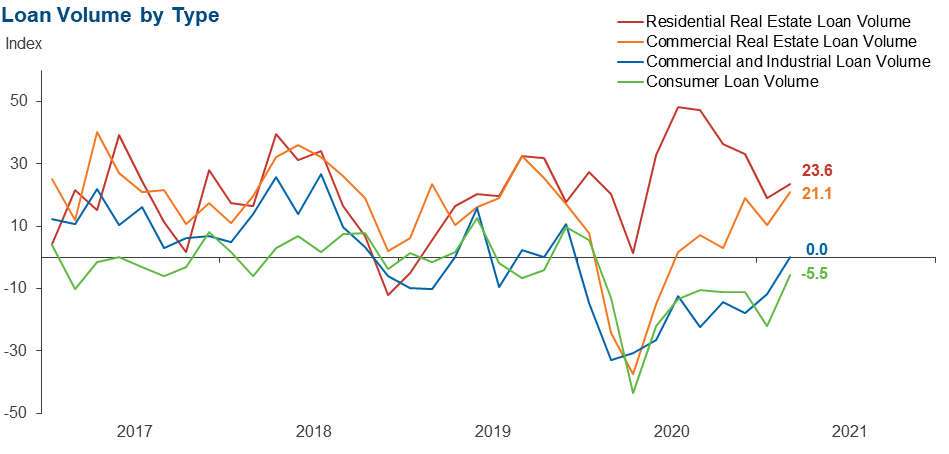

Loan volume | 0.0 | –11.6 | 19.4 | 61.1 | 19.4 |

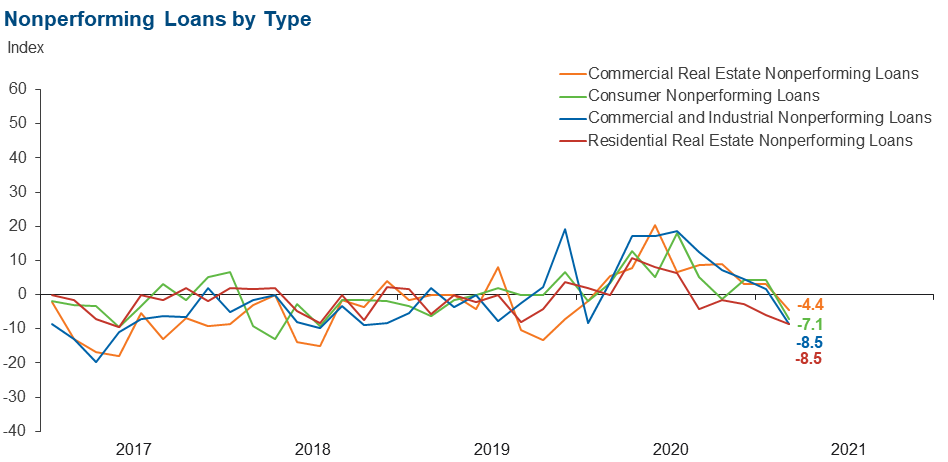

Nonperforming loans | –8.5 | 1.5 | 5.6 | 80.3 | 14.1 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –3.0 | –6.2 | 1.5 | 94.0 | 4.5 |

| Commercial Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 21.1 | 10.3 | 36.6 | 47.9 | 15.5 |

Nonperforming loans | –4.4 | 3.0 | 4.3 | 87.0 | 8.7 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –5.7 | –7.3 | 4.3 | 85.7 | 10.0 |

| Residential Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 23.6 | 19.2 | 37.5 | 48.6 | 13.9 |

Nonperforming loans | –8.5 | –5.9 | 2.8 | 85.9 | 11.3 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –1.4 | –2.9 | 0.0 | 98.6 | 1.4 |

| Consumer Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | –5.5 | –21.9 | 15.3 | 63.9 | 20.8 |

Nonperforming loans | –7.1 | 4.2 | 2.9 | 87.1 | 10.0 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –1.4 | 1.4 | 0.0 | 98.6 | 1.4 |

| Banking Outlook: What is your expectation for the following items six months from now? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Total loan demand | 54.1 | 43.8 | 67.6 | 18.9 | 13.5 |

Nonperforming loans | –5.4 | 17.8 | 15.1 | 64.4 | 20.5 |

| General Business Activity: What is your evaluation of the level of activity? | |||||

| Indicator | Current Index | Previous Index | % Reporting Better | % Reporting No Change | % Reporting Worse |

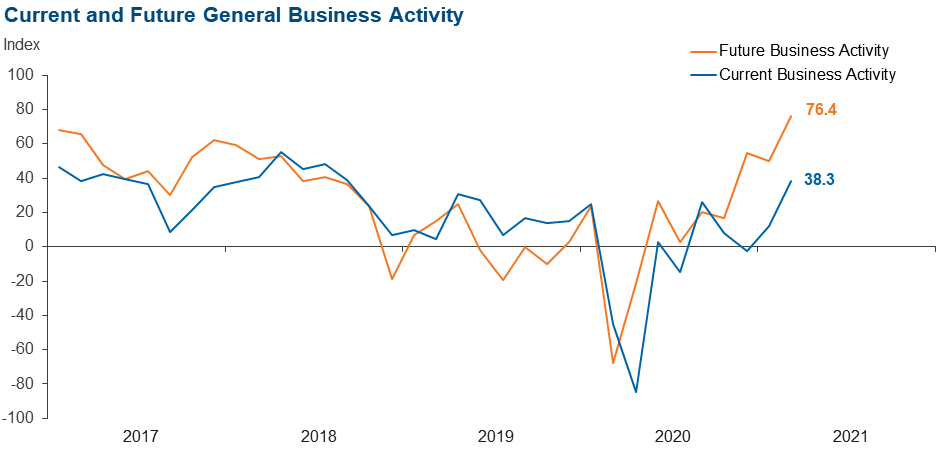

Over the past six weeks | 38.3 | 12.3 | 49.3 | 39.7 | 11.0 |

Six months from now | 76.4 | 50.0 | 79.2 | 18.1 | 2.8 |

Next release: May 17, 2021

Data were collected March 16–24, and 74 financial institutions responded to the survey. The Federal Reserve Bank of Dallas conducts the Banking Conditions Survey twice each quarter to obtain a timely assessment of activity at banks and credit unions headquartered in the Eleventh Federal Reserve District. CEOs or senior loan officers of financial institutions report on how conditions have changed for indicators such as loan volume, nonperforming loans and loan pricing. Respondents are also asked to report on their banking outlook and their evaluation of general business activity.

Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease (or tightening) from the percentage reporting an increase (or easing). When the share of respondents reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior reporting period. If the share of respondents reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior reporting period. An index will be zero when the number of respondents reporting an increase is equal to the number reporting a decrease.

Comments from Survey Respondents

Respondents were given an opportunity to comment on any issues that may be affecting their business.

These comments are from respondents’ completed surveys and have been edited for publication.

- Supply disruptions and commodity cost increases (energy, lumber, building materials) are causing issues for our commercial customers. There seem to be a lot of inflationary forces in play currently.

- Interest rate reductions have helped us capture more indirect deals since late February.

- Heightened scrutiny of the Home Mortgage Disclosure Act (HDMA) along with applying HMDA to small business are issues of concern.

- We are beginning to see the embers of hope that we are on the other side of the COVID-19 pandemic, and businesses remain hopeful that the new round of stimulus will be spent by consumers to improve the economy. Our bank is highly liquid at the moment, as funds from the Paycheck Protection Program [PPP] have been received as well as stimulus funds into deposit accounts. It is still challenging to deploy these excess funds into quality loans and investments given the low interest rate environment we are in.

- We are beginning to see aggressive loan pricing along with some easing credit standards/terms by other banks in our market. We remain flush with liquidity, loan demand remains somewhat restrained, and other investment options remain unattractive.

- We are beginning to see a mix of factors affecting the mortgage area: a rise of 10-year Treasury rates starting to subdue refinance activity, along with supply/demand challenges in various markets, countered by continued optimism for the economic outlook.

- Positive momentum is building, and there is enthusiasm for potential reopening in April/May.

- I believe that with an effective vaccination rollout plan in place, more businesses will open to full capacity, and consumers will feel better about traveling, shopping, etc., thereby allowing the economy to improve.

- Single-family residential interim construction loans have increased by 400 percent as a result of the record-low mortgage rates. Volumes have impacted our ability to process the loans in a timely manner. Other areas of concern deal with the new incoming administration. Emphasis is on increased corporate taxes and increased regulations. Increased government deficit spending leads to concerns about increased inflation.

- The PPP loan deadline of March 31 should not be extended. The small businesses that needed the funds have already applied and received the funds. We are spending a great deal of time answering questions for small businesses that do not qualify or even need the funds.

Historical Data

Historical data can be downloaded dating back to March 2017. For the definitions, see data definitions.

NOTE: The following series were discontinued in May 2020: volume of core deposits, cost of funds, non-interest income and net interest margin.

Questions regarding the Banking Conditions Survey can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Banking Conditions Survey is released on the web.