Energy Indicators

May 25, 2023

Crude inputs into U.S. Gulf Coast refineries have been growing since the end of last year, while inputs into refineries in the rest of the country have been relatively flat. Recovering Chinese demand and sanctions placed on Russia are contributing to rising crude oil exports.

Refining

Crude inputs recover on the Gulf Coast

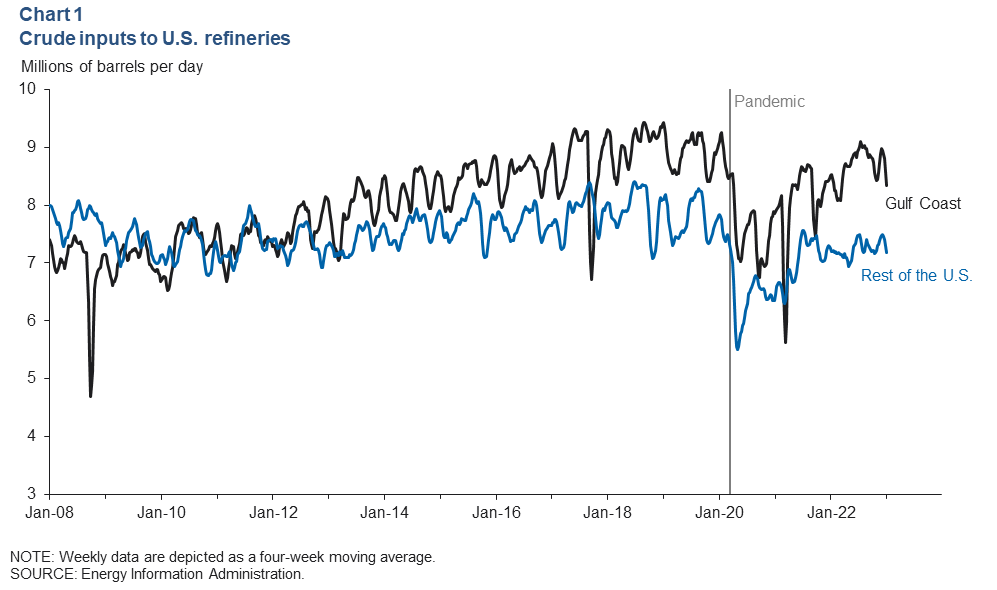

Refineries on the U.S. Gulf Coast processed roughly 8.9 million barrels of crude oil per day (mb/d) over the four weeks ending May 5—the most since December 2022 and above the seasonal high in summer 2021 (Chart 1). The volume of crude processed in the rest of the U.S. has held relatively steady this year after dipping due to winter outages and maintenance and was at 6.9 mb/d over the four-week period.

Several refining capacity expansions, mostly to process low-cost domestic crudes, are in the works along the Gulf Coast. Exxon announced an expansion of its Beaumont, Texas, refinery, which will add 250,000 b/d. Smaller expansions include Citgo Petroleum (adding 38,000 b/d) and Marathon Petroleum (adding 40,000 b/d).

Refining margins down but remain above historical norms

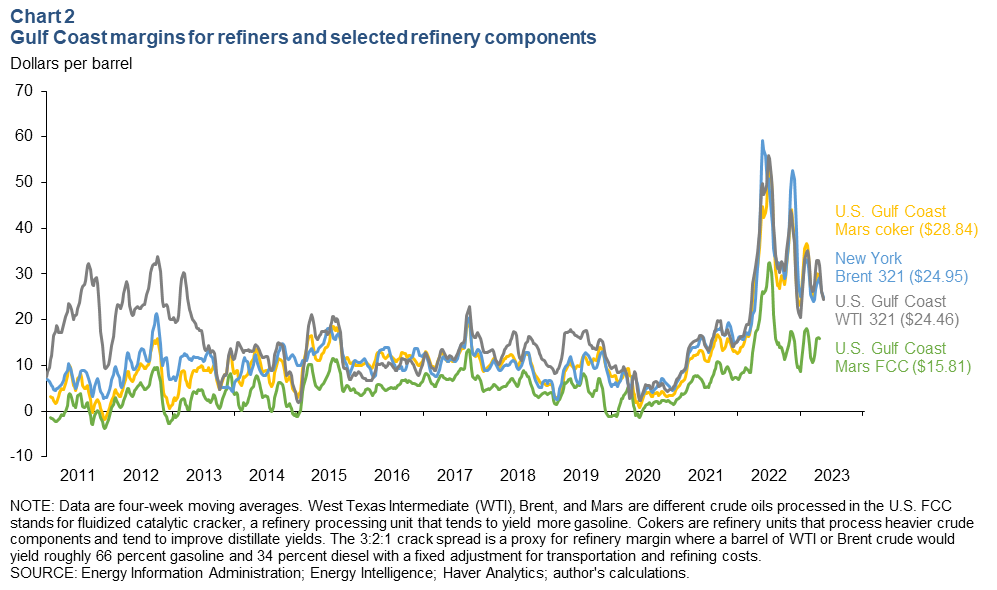

Refinery margins—as proxied by crack spreads, the difference between product values and crude costs—remain elevated this spring at more than double their levels in spring 2021 and are above the five-year average. However, refining margins are 21 percent lower year over year. Gulf Coast Mars coker and Mars FCC cracks now stand at $28.84 and $15.81, respectively (Chart 2).

Margins for U.S. Gulf Coast fluidized catalytic crackers—refinery components that are geared to yield more gasoline—were down 51.4 percent as of mid-April from their high in 2022. Margins for delayed cokers—refinery components that process heavier crudes and tend to yield more distillate—decreased 46.0 percent over that same time frame.

Gasoline inventories tight compared with crude oil

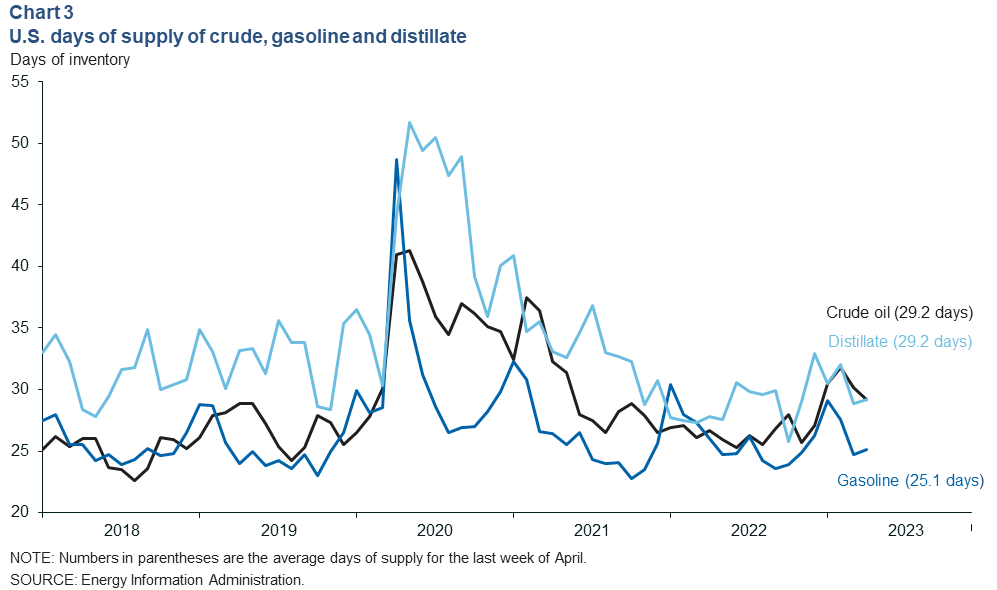

U.S. crude oil inventories increased from the week of April 28 to May 5, while gasoline and distillate stockpiles fell. Crude rose by 2,951 thousand barrels, and gasoline and distillate fell by 3,167 thousand barrels and 4,170 thousand barrels, respectively. Crude stockpiles are now 462.6 million barrels, or 1 percent below the five-year average for this time of year. The crude inventory increase was due in part to a transfer of oil from the Strategic Petroleum Reserve to commercial tanks.

On a forward-cover basis, the average number of days of supply for crude fell by one day, gasoline saw a four-day increase and distillate rose by 0.3 days from March to April (Chart 3). Distillate and gasoline inventories are also below their five-year averages by 12 percent and 17 percent, respectively.

Exports

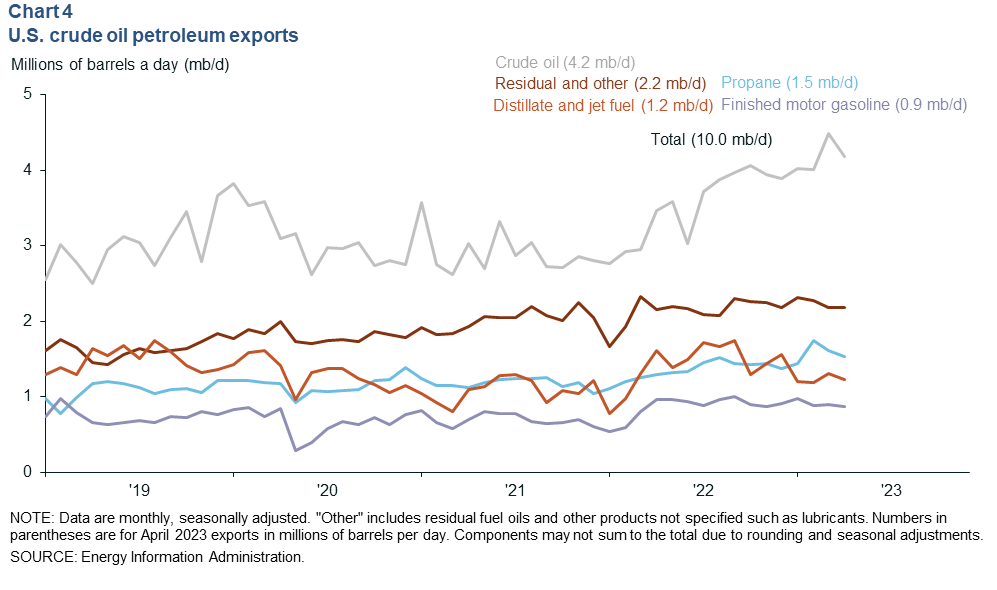

Exports of crude oil were 4.2 mb/d in April—0.72 million barrels above last year’s level (Chart 4). U.S. crude exports had hit a record of 4.5 mb/d in March, fueled by Chinese demand. Pipelines that move oil from the Permian Basin to Corpus Christi, Texas, are reportedly more than 90 percent full as export demand remains healthy.

Exports of distillate and jet fuel have held relatively steady since the start of the year at around 1.2 mb/d. Motor gasoline exports have fallen by 0.04 mb/d year to date, compared with an increase of 0.36 mb/d over the same period in 2022. Residual and other exports are flat year to date; they rose by 1 mb/d over the year prior. The residual and other group consists of products such as bunker fuels for shipping, blending components for fuels, petrochemical feedstocks, and lubricants. Propane has seen the largest growth rate year to date, rising 11 percent.

Petrochemicals

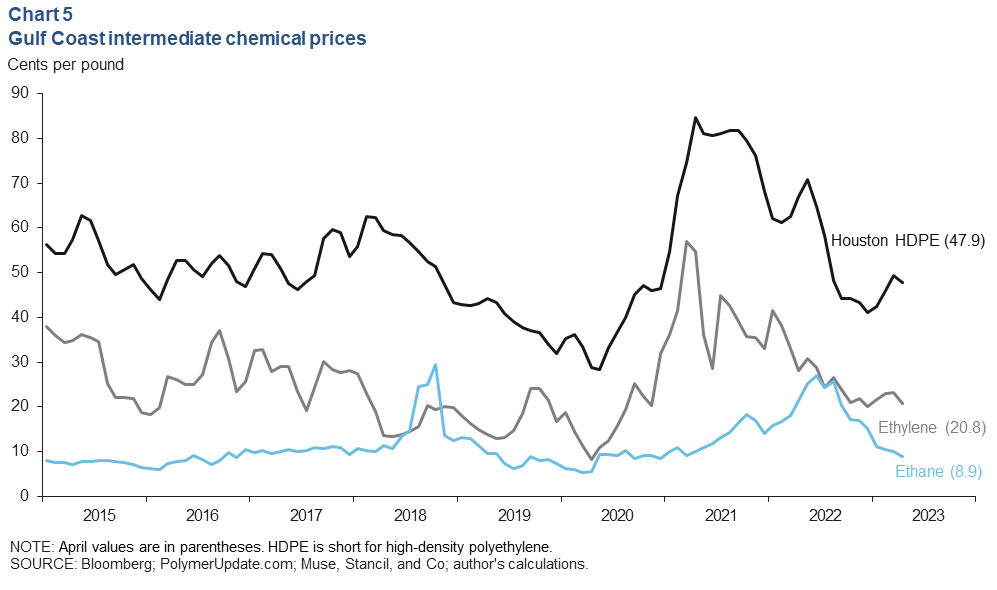

The nominal price of ethane was 8.9 cents per pound in April, down 2.2 cents since the start of the year but still 47 percent above prepandemic levels (Chart 5). Chemical intermediate ethylene has been hovering around 21 cents per pound since November 2022, while high-density polyethylene (HDPE) rose to 47.9 cents per pound in April. This has pushed the HDPE chain margin—the spread between the feedstock cost of ethane and the price of polyethylene—to 39 cents per pound, its healthiest level since May of last year.

The U.S. is a low-cost producer of basic polymers due to the availability of low-priced ethane feedstock, and the sector reached a value of $142 billion in 2022. However, global overcapacity in polyethylene and other basic polymers is expected to remain a challenge to industry margins.

About Energy Indicators

Questions can be addressed to Kenya Schott at kenya.schott@dal.frb.org. Energy Indicators is released monthly and can be received by signing up for an email alert. For additional energy-related research, please visit the Dallas Fed’s energy home page.