Energy Indicators

| Energy dashboard (April 2025) | |||

| WTI price avg. April 7–11 |

WTI price change from 4 weeks prior |

Henry Hub price avg. April 7–11 |

Henry Hub price change from 4 weeks prior |

| $61.24/barrel | -9.32% | $3.68/MMBtu | -12.95% |

Energy executives surveyed by the Dallas Fed reported an increase in the price of oil needed to justify drilling, as economic uncertainty and planned production increases from OPEC+ nations pushed oil prices down. Real total returns on oil and gas equities showed mixed signals for the first quarter of 2025. Seasonally adjusted refining margins continued to decline year over year.

Breakeven and profitability

Break-even prices tick up

West Texas Intermediate (WTI) front-month futures contracts dropped 15 percent year over year to $67 per barrel in March. That is above the $65 average level energy executives said in the March 2025 Dallas Fed Energy Survey they need to profitably drill a new well—a $1-per-barrel increase from last year and on par with the level reported in the April Kansas City Fed energy survey (Chart 1).

Both the January Kansas City Fed survey and the industry Producer Price Index had signaled a slight decline in break-even costs, but both measures reversed in March. A main factor affecting break-even costs is the price of steel tubular goods which typically comprises around 8 to 15 percent of the total drilling and completion costs for a well as noted in analyses by Wood Mackenzie and others. The announcement of 25 percent tariffs on steel imports occurred around the same time and is likely to have contributed to the increase in break-even costs.

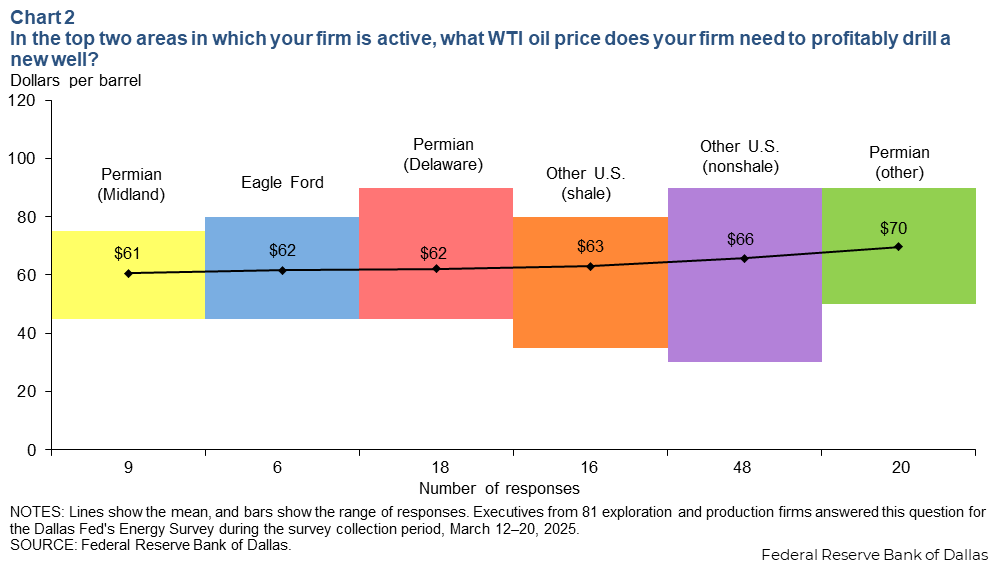

Break-even prices vary widely across and within basins

It is noteworthy that the average break-even oil price among large producers in the Dallas Fed survey increased from $58 per barrel in 2024 to $61 in 2025, and these producers are collectively responsible for the large majority of U.S. onshore crude oil production. In contrast, the average break-even price among smaller producers decreased from $68 per barrel to $66, likely due in part to mergers and acquisitions as well as reduced activity among these firms that typically have higher costs.

However, there is substantial variation in break-even costs among firms, with many operators able to profitably drill new wells with the price of WTI as low as $45 per barrel (Chart 2).

The industry already expected some layoffs at the beginning of 2025 given the trend toward consolidation and merger and acquisition activity. If WTI were to continue to hover in its recent $60- to $64-per-barrel range, further contraction in payrolls is likely. However, without a larger and sustained decline in oil prices, large firms are still largely profitable at current prices, and they are unlikely to cut deeply into their plans for drilling and staffing.

Oil and gas equities provide mixed signals in Q1

Inflation-adjusted total returns (which include the reinvestment of dividends) for oil and gas segments of the S&P 1500 showed mixed signals for the first quarter of this year (Chart 3). From the average value for the last week of December to March, real total returns for integrated oil companies (which produce and refine oil) grew 3.1 percent year to date, while independent exploration and production firms' returns grew 2.5 percent. Returns for oilfield equipment and services firms were down 2.3 percent and refining and marketing was down 3.6 percent year to date. For context, real total returns for the S&P 500 index fell 4.2 percent.

Refining

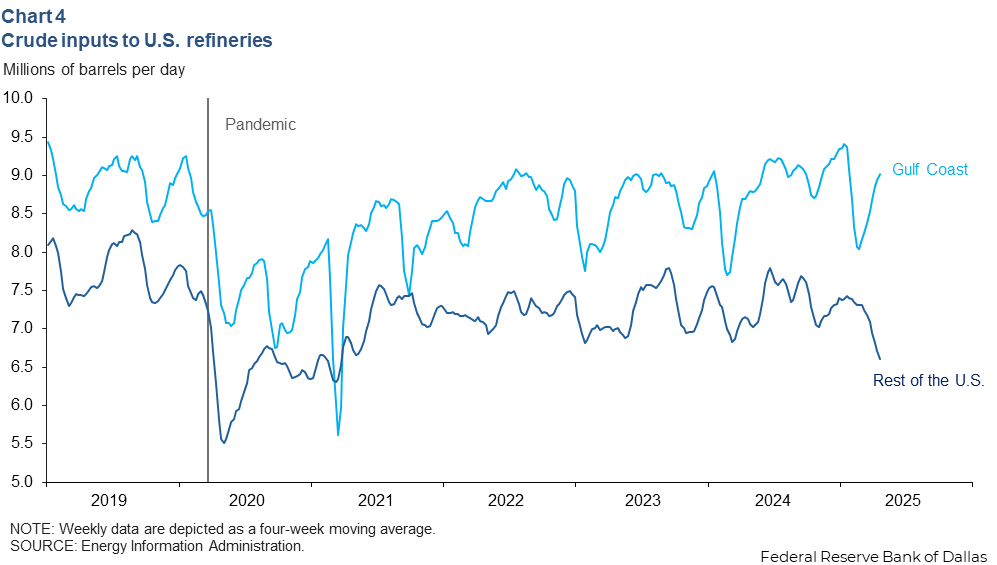

Gulf Coast refinery processing rises as overall U.S. drops

Refiners on the U.S. Gulf Coast processed 9.0 million barrels per day (mb/d) of crude oil over the four weeks ending April 11, while the rest of the U.S. processed 6.6 mb/d (Chart 4). Compared with this time last year, Gulf Coast processing was up 3.0 percent, and the rest of the U.S. was down 7.2 percent. Combined, total U.S. refinery processing is down 1.6 percent year over year in part due to lower refining margins and slowing fuel demand.

Some older refineries are planning to idle or transition offline in the next year. Bloomberg reports California is set to lose a fifth of its crude processing capacity in the next year with Valero idling its Benicia refinery this month. In February, Lyondell completed shutting down a Houston refinery that could process 260,000 barrels per day.

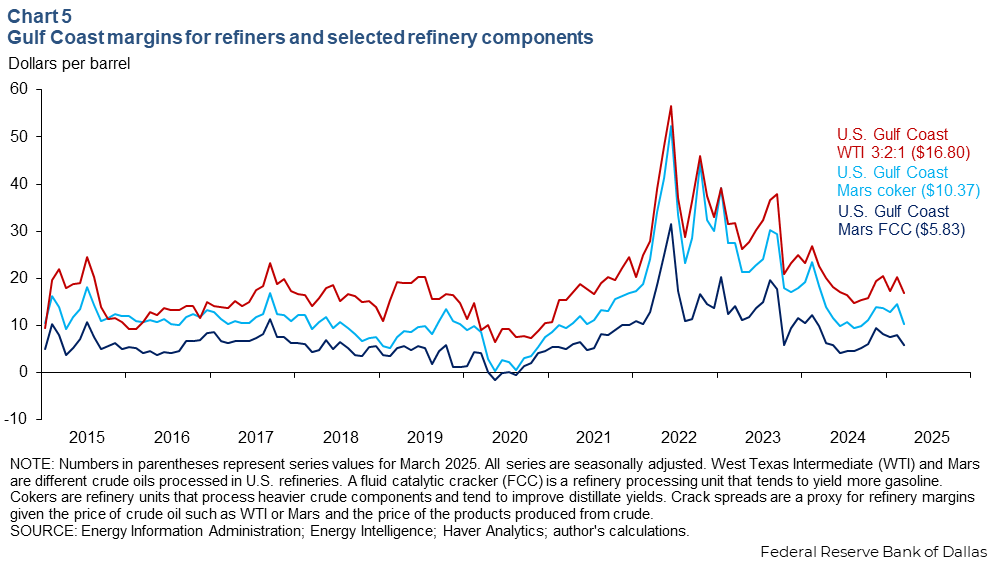

Refining margins continue to decline

The March 2025 3:2:1 spread, a proxy for how much Gulf Coast refiners would net by processing a barrel of crude oil into gasoline and diesel fuels, fell year over year from $27 per barrel of crude to $20, down 24 percent (Chart 5). The decline was driven by the drop in gasoline prices.

Looking in more detail at Gulf Coast refineries, margins for cokers (refinery units that process heavy crudes and are geared to yield distillates such as diesel and jet fuel) declined $8 per barrel, or 43 percent, from a year ago to $10.37.

About Energy Indicators

Questions can be addressed to Sasha Samperio at sasha.samperio@dal.frb.org. Energy Indicators is released monthly and can be received by signing up for an email alert. For additional energy-related research, please visit the Dallas Fed’s energy home page.