Special Questions

Special Questions

February 25, 2019

Results below include responses from participants of all three surveys: Texas Manufacturing Outlook Survey, Texas Service Sector Outlook Survey and Texas Retail Outlook Survey.

Texas Business Outlook Surveys

Data were collected Feb. 12–20, and 384 Texas business executives responded to the surveys.

See data files with a full history of results.

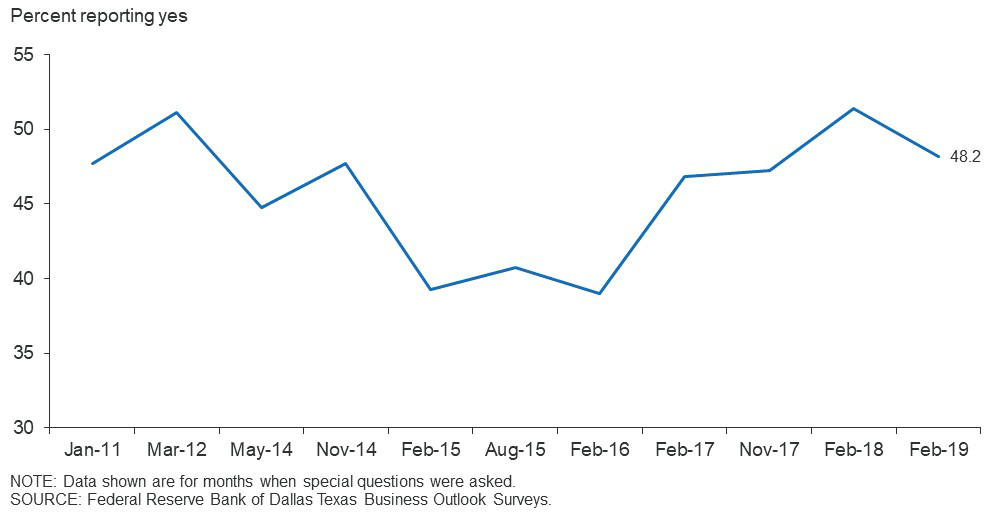

Do you expect your firm to increase employment over the next six to 12 months?

Do you expect your firm to increase employment, leave employment unchanged, or decrease employment over the next six to 12 months?

| Feb. '15 (percent) |

Feb. '16 (percent) |

Feb. '17 (percent) |

Feb. '18 (percent) |

Feb. '19 (percent) |

|

| Increase | 39.3 | 39.0 | 46.9 | 51.4 | 48.2 |

| Leave unchanged | 45.0 | 43.8 | 43.1 | 39.2 | 44.3 |

| Decrease | 15.7 | 17.2 | 10.1 | 9.4 | 7.6 |

Are you having problems finding qualified workers when hiring?

| Feb. '15 (percent) |

Feb. '16 (percent) |

Feb. '17 (percent) |

Feb. '18 (percent) |

Feb. '19 (percent) |

|

| Yes | 66.4 | 62.9 | 63.4 | 64.8 | 65.3 |

| No | 33.6 | 37.1 | 36.6 | 35.2 | 34.7 |

If you are trying to fill low-skill positions, are you having problems finding qualified workers?*

| Feb. '19 (percent) |

||

| Yes | 80.5 | |

| No | 19.5 |

If you are trying to fill mid-skill positions, are you having problems finding qualified workers?*

| Feb. '19 (percent) |

||

| Yes | 86.0 | |

| No | 14.0 |

If you are trying to fill high-skill positions, are you having problems finding qualified workers?*

| Feb. '19 (percent) |

||

| Yes | 77.1 | |

| No | 22.9 |

Is year-to-date production/revenue at your firm stronger, weaker, or about the same as expected?

| Feb. '19 (percent) |

||

| Stronger | 28.1 | |

| Weaker | 17.6 | |

| About the same | 54.3 |

If your firm has experienced weaker-than-expected production/revenue, which factors are the primary drivers? Please select up to three.**

| Feb. '19 (percent) |

||

| Increased uncertainty causing customers to reduce demand | 49.2 | |

| Lower oil prices and/or pipeline capacity constraints slowing energy activity | 23.0 | |

| Weaker global economy hurting global demand | 19.7 | |

| Tariffs hurting global demand | 19.7 | |

| Tariffs hurting domestic demand (through higher input costs and prices) | 19.7 | |

| Higher interest rates slowing construction/housing activity | 18.0 | |

| Labor constraints limiting capacity | 13.1 | |

| Higher cost of credit hurting financing needs | 9.8 | |

| Stronger dollar hurting global demand | 0.0 | |

| Other | 27.9 |

**This question was posed only to firms that responded that their year-to-date production/revenue was weaker than expected.

NOTES: Survey respondents were given the opportunity to provide comments. These comments can be found on the individual survey Special Questions results pages, accessible by the tabs above.

Texas Manufacturing Outlook Survey

Data were collected Feb. 12–20, and 118 Texas manufacturers responded to the survey.

See data files with a full history of results.

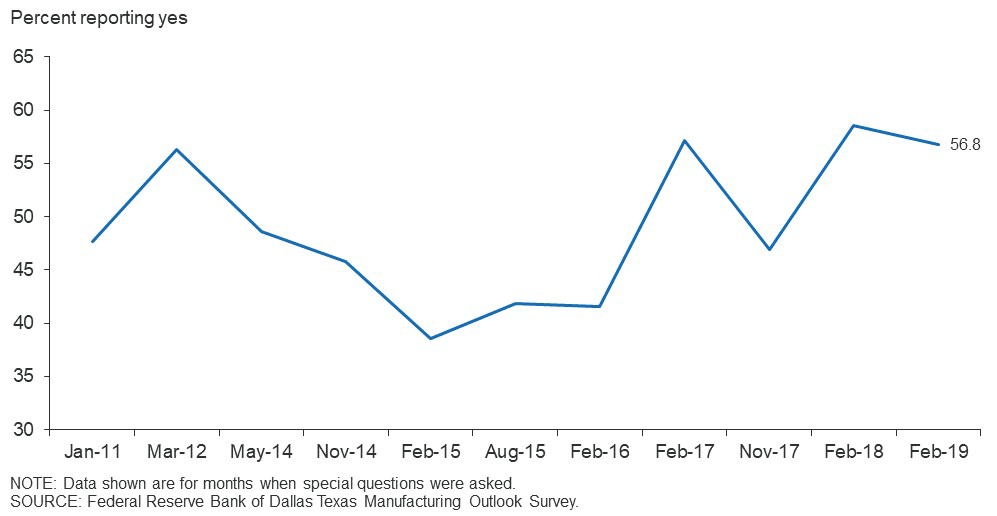

Do you expect your firm to increase employment over the next six to 12 months?

Do you expect your firm to increase employment, leave employment unchanged, or decrease employment over the next six to 12 months?

| Feb. '15 (percent) |

Feb. '16 (percent) |

Feb. '17 (percent) |

Feb. '18 (percent) |

Feb. '19 (percent) |

|

| Increase | 38.6 | 41.6 | 57.1 | 58.6 | 56.8 |

| Leave unchanged | 43.4 | 44.2 | 33.0 | 35.4 | 38.1 |

| Decrease | 18.1 | 14.2 | 9.8 | 6.1 | 5.1 |

Are you having problems finding qualified workers when hiring?

| Feb. '15 (percent) |

Feb. '16 (percent) |

Feb. '17 (percent) |

Feb. '18 (percent) |

Feb. '19 (percent) |

|

| Yes | 69.9 | 66.1 | 68.5 | 69.7 | 66.9 |

| No | 30.1 | 33.9 | 31.5 | 30.3 | 33.1 |

If you are trying to fill low-skill positions, are you having problems finding qualified workers?*

| Feb. '19 (percent) |

||

| Yes | 83.8 | |

| No | 16.2 |

If you are trying to fill mid-skill positions, are you having problems finding qualified workers?*

| Feb. '19 (percent) |

||

| Yes | 83.1 | |

| No | 16.9 |

If you are trying to fill high-skill positions, are you having problems finding qualified workers?*

| Feb. '19 (percent) |

||

| Yes | 70.3 | |

| No | 29.7 |

Is year-to-date production/revenue at your firm stronger, weaker, or about the same as expected?

| Feb. '19 (percent) |

||

| Stronger | 35.0 | |

| Weaker | 23.1 | |

| About the same | 41.9 |

If your firm has experienced weaker-than-expected production/revenue, which factors are the primary drivers? Please select up to three.**

| Feb. '19 (percent) |

||

| Increased uncertainty causing customers to reduce demand | 50.0 | |

| Tariffs hurting global demand | 30.8 | |

| Tariffs hurting domestic demand (through higher input costs and prices) | 30.8 | |

| Weaker global economy hurting global demand | 15.4 | |

| Lower oil prices and/or pipeline capacity constraints slowing energy activity | 15.4 | |

| Higher cost of credit hurting financing needs | 11.5 | |

| Higher interest rates slowing construction/housing activity | 11.5 | |

| Labor constraints limiting capacity | 7.7 | |

| Stronger dollar hurting global demand | 0.0 | |

| Other | 26.9 |

**This question was posed only to firms that responded that their year-to-date production/revenue was weaker than expected

Special Questions Comments

These comments have been edited for publication.

Primary Metal Manufacturing

- Our biggest issue now is finding enough good people to staff the factory floor.

Fabricated Metal Product Manufacturing

- Skilled and semi-skilled workers are difficult to find.

Chemical Manufacturing

- We decreased employment in early January but don't expect further cuts.

Machinery Manufacturing

- Revenue has surpassed our expectations because our competitors are ending the services they used to provide. And our current customers are buying in bigger quantities. Our past support of our customers is paying off in a big way, and they are depending on us for products and services more than ever since they have more work than they expected. Our hiring has increased dramatically, but finding the right people is harder even when we offer higher wages.

Computer and Electronic Product Manufacturing

- We have moderate challenges finding all levels of workers, but the greatest challenge is with our highly skilled positions.

Electrical Equipment, Appliance, and Component Manufacturing

- We were below market in pay due in part to not fully grasping where the market was. We have taken strong measures to correct that, and it appears to be working well since implementing them in January.

Transportation Equipment Manufacturing

- Although our company has always primarily purchased domestic manufactured steel, when tariffs were imposed on imports of steel, the domestic steel mills immediately increased their pricing by 20–22 percent, thereby creating unfavorable competition from foreign manufacturers.

Printing and Related Support Activities

- I think the economy is not doing as well as people think, and in the graphic arts industry that we serve, that is definitely the case.

Texas Service Sector Outlook Survey

Data were collected Feb. 12–20, and 266 Texas business executives responded to the survey.

See data files with a full history of results.

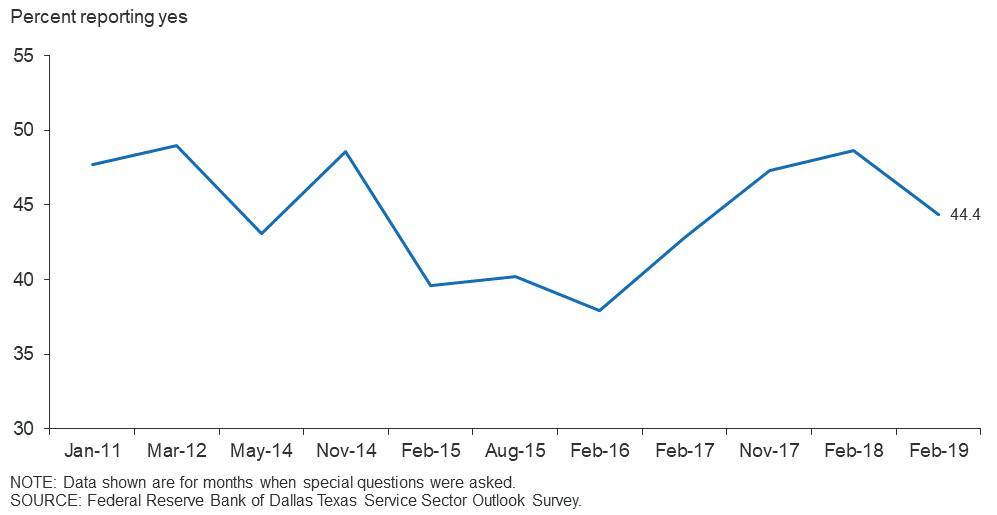

Do you expect your firm to increase employment over the next six to 12 months?

Do you expect your firm to increase employment, leave employment unchanged, or decrease employment over the next six to 12 months?

| Feb. '15 (percent) |

Feb. '16 (percent) |

Feb. '17 (percent) |

Feb. '18 (percent) |

Feb. '19 (percent) |

|

| Increase | 39.6 | 37.9 | 42.8 | 48.7 | 44.4 |

| Leave unchanged | 45.7 | 43.6 | 47.0 | 40.7 | 47.0 |

| Decrease | 14.7 | 18.4 | 10.2 | 10.6 | 8.6 |

Are you having problems finding qualified workers when hiring?

| Feb. '15 (percent) |

Feb. '16 (percent) |

Feb. '17 (percent) |

Feb. '18 (percent) |

Feb. '19 (percent) |

|

| Yes | 65.0 | 61.7 | 61.4 | 62.9 | 64.5 |

| No | 35.0 | 38.3 | 38.6 | 37.1 | 35.5 |

If you are trying to fill low-skill positions, are you having problems finding qualified workers?*

| Feb. '19 (percent) |

||

| Yes | 78.6 | |

| No | 21.4 |

If you are trying to fill mid-skill positions, are you having problems finding qualified workers?*

| Feb. '19 (percent) |

||

| Yes | 87.5 | |

| No | 12.5 |

If you are trying to fill high-skill positions, are you having problems finding qualified workers?*

| Feb. '19 (percent) |

||

| Yes | 80.3 | |

| No | 19.7 |

Is year-to-date production/revenue at your firm stronger, weaker, or about the same as expected?

| Feb. '19 (percent) |

||

| Stronger | 25.0 | |

| Weaker | 15.2 | |

| About the same | 59.8 |

If your firm has experienced weaker-than-expected production/revenue, which factors are the primary drivers? Please select up to three.**

| Feb. '19 (percent) |

||

| Increased uncertainty causing customers to reduce demand | 48.6 | |

| Lower oil prices and/or pipeline capacity constraints slowing energy activity | 28.6 | |

| Weaker global economy hurting global demand | 22.9 | |

| Higher interest rates slowing construction/housing activity | 22.9 | |

| Labor constraints limiting capacity | 17.1 | |

| Tariffs hurting global demand | 11.4 | |

| Tariffs hurting domestic demand (through higher input costs and prices) | 11.4 | |

| Higher cost of credit hurting financing needs | 8.6 | |

| Stronger dollar hurting global demand | 0.0 | |

| Other | 28.6 |

**This question was posed only to firms that responded that their year-to-date production/revenue was weaker than expected

Special Questions Comments

These comments have been edited for publication.

Utilities

- We need more high-skilled immigration. There simply aren't enough U.S. citizens to fill these positions.

Specialty Trade Contractors

- Revenue is up because we have increased margins because our industry is facing a lack of labor, which means there is more work available at higher margins. We can pick and choose the work we want to do.

Pipeline Transportation

- Our increase in employment is associated with new assets being placed into service for which construction commenced about two years ago.

Support Activities for Transportation

- Revenues will increase upon settlement of the China grain tariff. Exports of grain decreased in 2018 and have not recovered at this location due to China being a major customer.

Data Processing, Hosting and Related Services

- We are using all recruiting tools available to hire talented people. We are paying more in wages and increasing benefits to attract folks. There just aren’t enough in the workforce. We are considering recruiting out of state even though we’re hesitant to do so.

Credit Intermediation and Related Activities

- Planning for succession of management in rural markets is a challenge requiring planning in advance of positions coming open. Typically, this results in an overlap of management placement, creating an increase in salary cost for a period of time.

Rental and Leasing Services

- Finding, hiring and retaining positions like heavy-equipment technicians, parts personnel, branch managers and equipment salesmen is very challenging. With so many jobs available today, good employees leave for falsely perceived better opportunities that will be gone as soon as the economy turns down (no later than next year ... hope we make it that long!). We would provide better benefits to our already-excellent package, but there are aspects of the Affordable Care Acts that make benefit expenses nondeductible if you exceed an arbitrary level, limiting the benefits our company can provide to its 689 employees.

Professional, Scientific and Technical Services

- We estimate 2019 will be a stronger business year than 2018 for us.

- We are in need of an additional 75–100 entry-level employees but are not confident we will find them.

Waste Management and Remediation Services

- We will screen several candidates for all skill levels but find applicants are not as qualified as they believe they are for the particular opening. We also shy away from applicants who may have been at several jobs within a short period of time.

Educational Services

- We are not attempting to hire.

Hospitals

- Our reimbursements are deteriorating despite the growing economy. Bad debt is at record levels.

Nursing and Residential Care Facilities

- We are hopeful that the lack of certified nurse aides looking for jobs will improve once they’ve spent their tax refunds.

Amusement, Gambling and Recreation Industries

- There are many times that we have to limit reservations because we do not have enough qualified cooks and waiters to take care of the demand. It is our policy to try and manage the expectations and provide a good experience rather than try and overbook and have people disappointed.

Accommodation

- We do not necessarily have an issue finding qualified workers as much as those who want to work.

Food Services and Drinking Places

- We have a hard time finding folks that want to work in the restaurant sector at all levels. Our turnover has become higher in recent years due to better economic conditions. I do suspect that this may change if the economy starts to slow down.

- We have trouble finding qualified workers in certain areas where our stores are located. The more affluent areas are the bigger concerns. Near the border we are still able to hire fairly easily.

Texas Retail Outlook Survey

Data were collected Feb. 12–20, and 50 Texas retailers responded to the survey.

See data files with a full history of results.

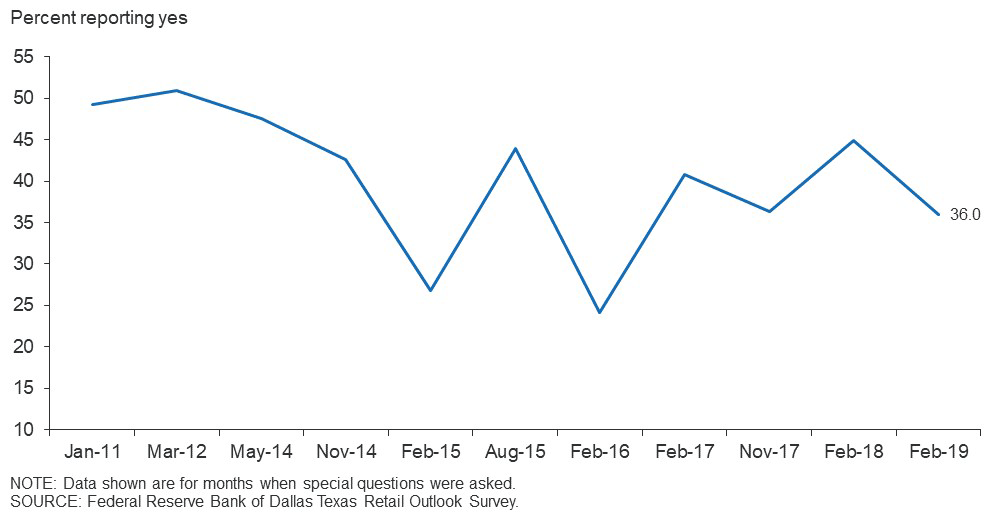

Do you expect your firm to increase employment over the next six to 12 months?

Do you expect your firm to increase employment, leave employment unchanged, or decrease employment over the next six to 12 months?

| Feb. '15 (percent) |

Feb. '16 (percent) |

Feb. '17 (percent) |

Feb. '18 (percent) |

Feb. '19 (percent) |

|

| Increase | 26.8 | 24.1 | 40.7 | 44.9 | 36.0 |

| Leave unchanged | 53.7 | 56.9 | 50.0 | 36.7 | 54.0 |

| Decrease | 19.5 | 19.0 | 9.3 | 18.4 | 10.0 |

Are you having problems finding qualified workers when hiring?

| Feb. '15 (percent) |

Feb. '16 (percent) |

Feb. '17 (percent) |

Feb. '18 (percent) |

Feb. '19 (percent) |

|

| Yes | 75.6 | 67.2 | 76.4 | 75.5 | 65.3 |

| No | 24.4 | 32.8 | 23.6 | 24.5 | 34.7 |

If you are trying to fill low-skill positions, are you having problems finding qualified workers?*

| Feb. '19 (percent) |

||

| Yes | 76.0 | |

| No | 24.0 |

If you are trying to fill mid-skill positions, are you having problems finding qualified workers?*

| Feb. '19 (percent) |

||

| Yes | 85.7 | |

| No | 14.3 |

If you are trying to fill high-skill positions, are you having problems finding qualified workers?*

| Feb. '19 (percent) |

||

| Yes | 70.4 | |

| No | 29.6 |

Is year-to-date production/revenue at your firm stronger, weaker, or about the same as expected?

| Feb. '19 (percent) |

||

| Stronger | 20.4 | |

| Weaker | 12.2 | |

| About the same | 67.3 |

If your firm has experienced weaker-than-expected production/revenue, which factors are the primary drivers? Please select up to three.**

| Feb. '19 (percent) |

||

| Increased uncertainty causing customers to reduce demand | 66.7 | |

| Weaker global economy hurting global demand | 33.3 | |

| Higher cost of credit hurting financing needs | 16.7 | |

| Tariffs hurting domestic demand (through higher input costs and prices) | 16.7 | |

| Higher interest rates slowing construction/housing activity | 16.7 | |

| Lower oil prices and/or pipeline capacity constraints slowing energy activity | 16.7 | |

| Labor constraints limiting capacity | 0.0 | |

| Stronger dollar hurting global demand | 0.0 | |

| Tariffs hurting global demand | 0.0 | |

| Other | 33.3 |

**This question was posed only to firms that responded that their year-to-date production/revenue was weaker than expected

Special Questions Comments

These comments have been edited for publication.

Motor Vehicle and Parts Dealers

- It’s getting harder to find job applicants that can pass a drug test.

- We are expanding our facility. This added capacity will create a need for added personnel.

- One of our retail centers will relocate to a new facility in 2019, and we will hire additional people to accommodate anticipated growth.

- Skilled auto technicians are extremely hard to find, causing wages to increase substantially due to poaching from other dealers.

- Improved quality of managers is responsible for our stronger revenue results.

Building Material and Garden Equipment and Supplies Dealers

- It’s a seasonally slow time of year for our business. Demand was weaker during the government shutdown, but it appears to have picked back up in early February.

Questions regarding the Texas Business Outlook Surveys can be addressed to Emily Kerr at emily.kerr@dal.frb.org,

Sign up for our email alert to be automatically notified as soon as the latest surveys are released on the web.