Special Questions

Special Questions

April 29, 2019

Results below include responses from participants of all three surveys: Texas Manufacturing Outlook Survey, Texas Service Sector Outlook Survey and Texas Retail Outlook Survey.

Texas Business Outlook Surveys

Data were collected April 16–24, and 363 Texas business executives responded to the surveys.

See data files with a full history of results.

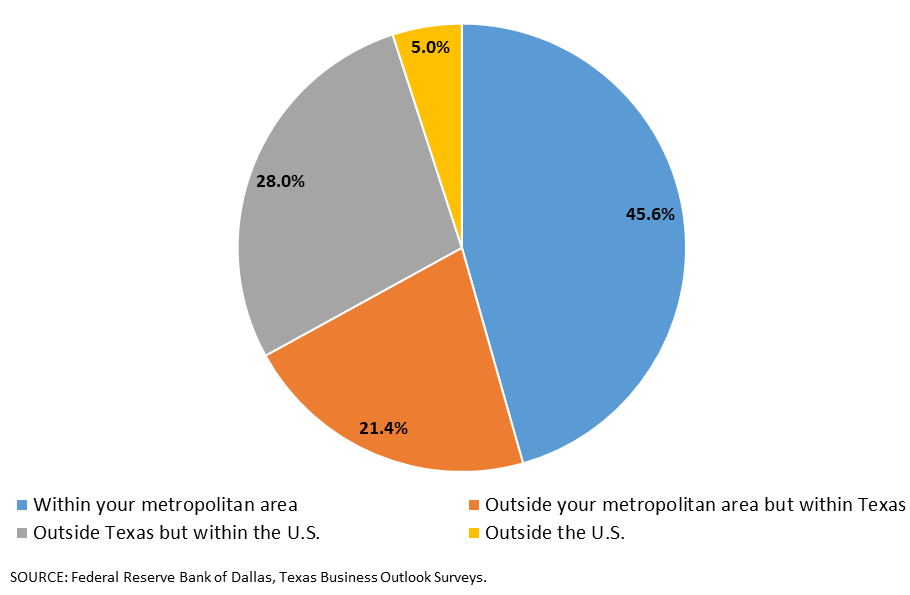

In 2018, approximately what share of your firm’s revenues came from customers in the following geographies?

NOTE: 353 responses.

In 2018, what percentage of your firm’s revenues came directly from oil and gas-related business?

| April '19 (percent) |

||

| None | 52.1 | |

| 1 to 9 percent | 27.9 | |

| 10 to 24 percent | 8.4 | |

| 25 to 49 percent | 3.9 | |

| 50 percent or more | 7.8 |

NOTE: 359 responses.

In 2018, were your firm’s federal corporate income taxes as a share of earnings higher, lower or about the same as in 2017?

| April '19 (percent) |

||

| Higher | 15.4 | |

| Lower | 35.4 | |

| About the same | 49.3 |

NOTE: 345 responses.

What is your firm doing with money resulting from lower 2018 taxes? Please select all that apply.*

| April '19 (percent) |

||

| Increasing capital investments | 57.0 | |

| Raising wages | 44.6 | |

| Paying down debt/increasing savings | 37.2 | |

| Paying bonuses | 25.6 | |

| Increasing hiring | 20.7 | |

| Increasing dividends | 20.7 | |

| Enhancing worker benefits | 17.4 | |

| Doing something else? What? | 9.9 | |

| Buying back stock | 4.1 |

*This question posed only to respondents who answered "lower" to the previous question.

NOTE: 121 responses.

What are the primary drivers of uncertainty regarding your firm’s outlook over the next six months?

These responses have been edited for publication.

Petroleum and Coal Products Manufacturing

- Trade tension and the domestic economy.

Chemical Manufacturing

- Level of economic activity outside the U.S.

- Balancing trade costs.

- Tariffs, labor, raw material pricing.

- Competition from outside the U.S.

Primary Metal Manufacturing

- The good times have lasted a long time. How much longer can they go on? The politicians in Washington, D.C., can kill any business boom by adopting stupid policies.

- Political uncertainties for the 2020 election cycle seem to be the primary uncertainties at this time.

- The cost of money for new development; the overall world economy; will owners keep building.

- Resolution of China trade negotiations and the 232 tariff status are unpredictable negatives. The agriculture market is weak and has impacted distributor and end-user buying. A harsh winter and late warming have delayed and, likely caused the loss of, spring sales.

Fabricated Metal Product Manufacturing

- Sustainability of the current economy.

- Price of oil.

- The economy is a big driver in our industry. The oil and gas market also plays a role in our success. When the cost of oil reaches a certain amount, the large companies will again open the facilities for improvement. Until that dollar threshold is reached, it is very difficult to get the oil and gas business.

- Ability to hire people as business increases; potential increase in tariffs.

- Increasing costs; shortage of skilled and unskilled labor.

- Overall political climate; uncertainty over steel tariff situation.

- With unemployment running around 3 percent, the labor market is nonexistent without offering exorbitant compensation to the leave current employer. Those left unemployed do not want to work and even if hired cannot be incentivized to be productive. There are a few older, experienced workers available; however, if hired, it must accepted that they will retire in short order and, therefore, it’s hard to justify the training and onboarding expense. Again, right now, it’s the labor market.

Nonmetallic Mineral Product Manufacturing

- Housing starts; nonresidential construction household formation; interest/mortgage rates.

- Recovering from crypto virus and rebuilding computer system; health of homebuilding industry.

Machinery Manufacturing

- Oil price volatility; consolidation of oil and gas producers.

- China trade negotiations, the cyclical nature of the electronics industry and, to a lesser extent, the upcoming elections in 2020.

- Oil prices.

- China tariffs; weakened sales for the first quarter; no real explanation for the weakened sales.

- Interest rates and the Democratic proposals to tax, tax, tax business. I’m reinvesting into my business every day to make it bigger and stronger financially. That’s how I see it making it in the long term. The oil and gas business is not the best business since it is unpredictable over the long term. And the downturns are always very challenging.

- Acquisition by a new parent company.

- Trade, tariffs and border uncertainty ... essentially President Trump.

- Ability of the Democrats to effect antibusiness laws and regulations.

Computer and Electronic Product Manufacturing

- Trade tensions with China; tariff uncertainty.

- International volatility.

- The cost and availability of components, but this is easing.

Transportation Equipment Manufacturing

- Due to stiff competition from overseas, our customers will no longer sign long-term agreements. Therefore, our company must plan to make products available on short notice for smaller quantities with no definitive outlook into the future.

- Fuel prices.

- Oil price.

Printing and Related Support Activities

- Technology is primary. The other is price increases.

- The economy.

Food Manufacturing

- World food crisis; federal funding; redirecting relief payments for humanitarian food relief we produce.

- Trade negotiations with China and the European Union.

- That somehow Democrats will raise taxes. We elected to become a C-corp (from an S-corp) following the implementation of the new tax rates, and we are committed to investing those additional earnings to grow our business.

- Our business is highly dependent on sourcing several materials from Bulgaria, China and Mexico. So the following issues have sharply driven up uncertainty for us: U.S.–Mexico border logistics disruptions, increasing tariffs and antitrade rhetoric.

- Slowing sales; increased pressure on retaining skilled workforce.

- Cost of raw materials; availability of workers.

- Price of fuel.

Textile Product Mills

- Tariffs and import policy continue to be a concern. We are watching these closely as we look for new cut-and-sew houses to help us grow. One year ago, we thought we would look to Mexico for cut and sew, but now we are looking locally—even though it has a higher cost, we feel that we have more control over timelines and delivery windows.

Paper Manufacturing

- Lower demand.

Furniture and Related Product Manufacturing

- Brick-and-mortar retail market.

Miscellaneous Manufacturing

- Political instability, socialism, government overspending, increasing taxes, increasing regulation and increasing trade tariffs in foreign markets.

- Health care, since we sell medical equipment.

Support Activities for Mining

- Oil price trends.

Utilities

- Trade wars.

Specialty Trade Contractors

- Revenues will increase because we perform service on HVAC equipment. Service events are higher margins than replacing equipment. We are seeing people delaying capital expenditures and spending on repairs.

Truck Transportation

- Rising interest rates; geopolitical instability; overheated long-term economy.

- Finding enough qualified drivers and mechanics.

- Finding qualified labor/drivers for our industry; expenses are going up faster than price increases.

Pipeline Transportation

- Competition and uncertainty created by Washington.

Support Activities for Transportation

- U.S. border conflicts.

- Cotton season starts in August.

- Grain exports to China; tax credits related to wind products (towers, blades, etc., imports).

Publishing Industries (Except Internet)

- Geopolitical in many different aspects, plus regulatory in the EU [European Union] first, then the U.S. and Asia around data/information and interfaces/rights often associated somehow with security and/or privacy from platforms and networks often using services as barter for data/knowledge.

Data Processing, Hosting and Related Services

- We are not so concerned about the next six months. We are very concerned about next year with all of the election angst/uncertainty. We’re thinking it will shut down or at least delay decision-making on major purchases.

Credit Intermediation and Related Activities

- Regulatory changes.

- General economic activity; interest rates.

Securities, Commodity Contracts, and Other Financial Investments and Related Activities

- Lack of ability to hire employees.

- Employment levels; ability to find qualified candidates; mortgage/interest rates.

- Increases in cost of our labor, materials, supplies, transportation, insurance and property taxes. We haven't been able to really pass these costs along in our selling prices.

Insurance Carriers and Related Activities

- Variability in interest rates and spreads on corporate bonds and mortgages (all affect our annuity sales and investment yield); political discourse and legislation regarding health insurance, which affect our health insurance product; costs of medical care, especially very high-cost treatments.

- Job growth.

Real Estate

- Oil price fall; the Democrats and Republicans unable to govern.

- Consumer demand for housing.

- Border closures; tariffs; upcoming elections; health care uncertainty.

Professional, Scientific and Technical Services

- Finding qualified people that want to become dedicated and loyal employees despite very good wages.

- We are dependent upon new construction but are diversified across housing, commercial, office and industrial sector. Slowdowns like 2001–02 have some but minor effect with no reduction in staff. The 2008 drying up of capital had dynamic effect on both revenue and staff reduction.

- Industry mergers and acquisitions activity; global economic growth.

- Energy prices; stock market correction; recession fears; instability in the federal government.

- Uncertainty in the price of oil and gas; possibility of a recession.

- Continued market instability—economically and politically.

- Slowed growth in the economy and declining leading indicators for manufacturing sectors; uncertainty created by tariffs; uncertainty that will result from upcoming federal elections.

- General business climate.

- USMCA (U.S.–Mexico–Canada Agreement); availability of labor; technological changes in the automotive industry; federal policy.

- No outside drivers.

- How America is and will be perceived.

- Ability to achieve targeted growth.

- Geopolitical issues no doubt are concerning, and this administration’s performance is almost comical in fashion. In all honesty, the extremes to which parties appear to be migrating is very concerning. There seems to be no middle, no possibility of compromise, and that is alarming. Also, a concern that consumer contributions to the economy domestically weaken—which could occur due to a number of factors—and we slide as a result; GDP falls and perhaps we do experience some level of recession. We may have a decent 2019, but I see weakening into 2020 and perhaps beyond, particularly as we see some instability introduced as the election cycle heats up and the expected circus on both sides begins performing. (I think overseas factors will play into it as well with Brexit, general EU [European Union] issues and perhaps some expected shocks in Asia. Economic strength in China is not as good as predicted.) I do not think the Fed [Federal Reserve] will impact triggering the negative as much as other elements of our political failings will. The Fed is likely to get blamed though.

- Congressional action; 2020 elections; Democrats’ socialism.

- Our older product line is not bringing enough returning customers.

Management of Companies and Enterprises

- Regulations; economy; labor force; competitors.

- Oil and gas prices and export capacity. The political climate in D.C. is unsettling, and the perpetual talk for the past two presidencies of impeachment, disrespect and rancor simply are wearing the general public out. Seems as if the population is growing tired of partisan politics, but we continue to reelect polarizing politicians. Compliance whiplash is a reality depending on which party is in power. It causes unrest in the business climate.

Administrative and Support Services

- The military aviation sector is a big part of our service work. It seems to be somewhat unsteady in the past few months. The “uncertainty” that is being talked up is having an effect on our customers’ willingness to take on new business.

- Political discontent; international unrest.

- Political uncertainty.

Waste Management and Remediation Services

- Export market to China, which has a huge impact on the scrap business. While our company does not directly sell material to China, the lack of exports sold to China has a ripple effect throughout the entire recycling industry.

Educational Services

- Changing educational laws in the legislature and educational funding.

Ambulatory Health Care Services

- Greater government involvement in health care.

Nursing and Residential Care Facilities

- Building of additional seniors housing communities. If supply continues to grow, it could negatively impact the occupancy of our communities and the rates we are able to charge.

Performing Arts, Spectator Sports and Related Industries

- Politics and world events.

Accommodation

- The U.S. economy and how the oil and gas industry performs.

- Economic policies—thank God for Mr. Powell [Federal Reserve Chairman]. I don't feel the current administration has much of a strategy.

Food Services and Drinking Places

- Wages; labor.

- Price of oil impacting ability to attract and retain labor in West Texas.

- The economy and market saturation in the hospitality industry as well as labor shortage.

Repair and Maintenance

- Health care costs; regulations (OSHA [Occupational Safety and Health Administration], EPA [Environmental Protection Agency], DOT [Department of Transportation]).

- Lower in-store retail sales means fewer store openings. Without new stores, our product is not needed. Online retail sales are hurting our business. Our product sales price is decreasing, while our costs for labor and materials are increasing.

Religious, Grantmaking, Civic, Professional and Similar Organizations

- The impact of growing national debt on the long-term viability of the U.S. economy and the seeming inability of politicians to bring debt under control.

- Medical reimbursements.

- As a nonprofit organization, we have seen a steady decrease in monetary support.

- Oil prices.

Merchant Wholesalers, Durable Goods

- Federal political outlook and the changing state political shift.

- Right now, we don't have any big drivers for our business. In the past, business was driven by environmental needs, independent power needs, etc. Now, we are focused on replacement of old boilers.

- Problems with tariffs and changes in the market.

Merchant Wholesalers, Nondurable Goods

- The trade war with China.

- Sourcing employees; agricultural commodity prices; keeping farmers and ranchers in business; managing lower margins with increased cost (labor and input).

Motor Vehicle and Parts Dealers

- Our business is the automobile retail and service business. We will be reducing new-vehicle inventory as much as the manufacturers' quotas will permit. We will increase parts and accessory inventories to keep up with increasing service business.

General Merchandise Stores

- Tariff issues; impact on pricing.

Nonstore Retailers

- Competitive pressure to reduce pricing to customers impacting our ability to retain existing customer base; ability to hire and retain qualified labor to service customers.

- Political climate.

NOTES: Survey respondents were given the opportunity to provide comments. These comments can be found on the individual survey Special Questions results pages, accessible by the tabs above.

Texas Manufacturing Outlook Survey

Data were collected April 16–24, and 99 Texas manufacturers responded to the surveys.

See data files with a full history of results.

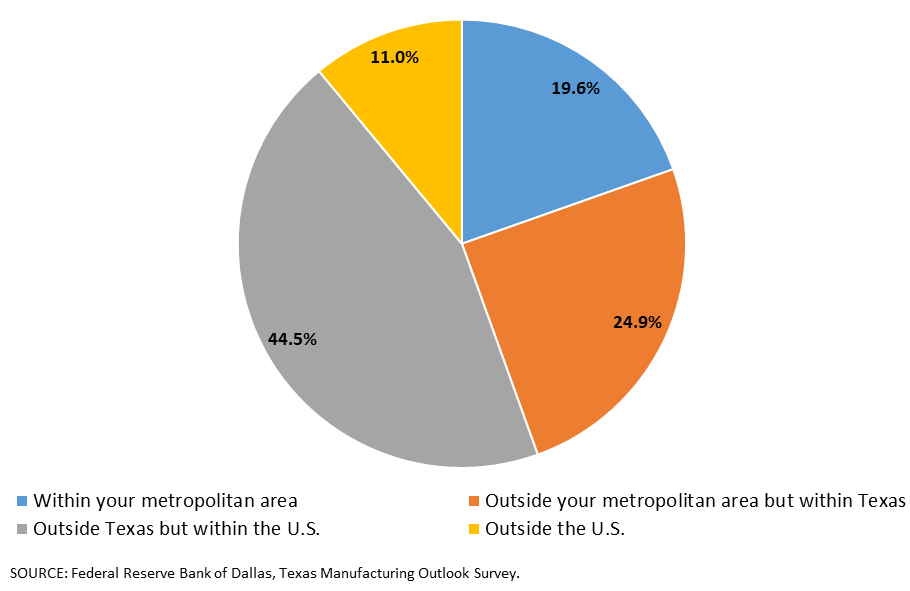

In 2018, approximately what share of your firm’s revenues came from customers in the following geographies?

NOTE: 97 responses.

In 2018, what percentage of your firm’s revenues came directly from oil and gas-related business?

| April '19 (percent) |

||

| None | 54.1 | |

| 1 to 9 percent | 22.4 | |

| 10 to 24 percent | 5.1 | |

| 25 to 49 percent | 2.0 | |

| 50 percent or more | 16.3 |

NOTE: 98 responses.

In 2018, were your firm’s federal corporate income taxes as a share of earnings higher, lower or about the same as in 2017?

| April '19 (percent) |

||

| Higher | 13.4 | |

| Lower | 42.3 | |

| About the same | 44.3 |

NOTE: 97 responses.

What is your firm doing with money resulting from lower 2018 taxes? Please select all that apply.*

| April '19 (percent) |

||

| Increasing capital investments | 78.0 | |

| Raising wages | 56.1 | |

| Paying down debt/increasing savings | 46.3 | |

| Paying bonuses | 29.3 | |

| Increasing hiring | 22.0 | |

| Enhancing worker benefits | 17.1 | |

| Increasing dividends | 17.1 | |

| Doing something else? What? | 9.8 | |

| Buying back stock | 2.4 |

*This question posed only to respondents who answered "lower" to the previous question.

NOTE: 41 responses.

What are the primary drivers of uncertainty regarding your firm’s outlook over the next six months?

These responses have been edited for publication.

Petroleum and Coal Products Manufacturing

- Trade tension and the domestic economy.

Chemical Manufacturing

- Level of economic activity outside the U.S.

- Balancing trade costs.

- Tariffs, labor, raw material pricing.

- Competition from outside the U.S.

Primary Metal Manufacturing

- The good times have lasted a long time. How much longer can they go on? The politicians in Washington, D.C., can kill any business boom by adopting stupid policies.

- Political uncertainties for the 2020 election cycle seem to be the primary uncertainties at this time.

- The cost of money for new development; the overall world economy; will owners keep building.

- Resolution of China trade negotiations and the 232 tariff status are unpredictable negatives. The agriculture market is weak and has impacted distributor and end-user buying. A harsh winter and late warming have delayed and, likely caused the loss of, spring sales.

Fabricated Metal Product Manufacturing

- Sustainability of the current economy.

- Price of oil.

- The economy is a big driver in our industry. The oil and gas market also plays a role in our success. When the cost of oil reaches a certain amount, the large companies will again open the facilities for improvement. Until that dollar threshold is reached, it is very difficult to get the oil and gas business.

- Ability to hire people as business increases; potential increase in tariffs.

- Increasing costs; shortage of skilled and unskilled labor.

- Overall political climate; uncertainty over steel tariff situation.

- With unemployment running around 3 percent, the labor market is nonexistent without offering exorbitant compensation to the leave current employer. Those left unemployed do not want to work and even if hired cannot be incentivized to be productive. There are a few older, experienced workers available; however, if hired, it must accepted that they will retire in short order and, therefore, it’s hard to justify the training and onboarding expense. Again, right now, it’s the labor market.

Nonmetallic Mineral Product Manufacturing

- Housing starts; nonresidential construction household formation; interest/mortgage rates.

- Recovering from crypto virus and rebuilding computer system; health of homebuilding industry.

Machinery Manufacturing

- Oil price volatility; consolidation of oil and gas producers.

- China trade negotiations, the cyclical nature of the electronics industry and, to a lesser extent, the upcoming elections in 2020.

- Oil prices.

- China tariffs; weakened sales for the first quarter; no real explanation for the weakened sales.

- Interest rates and the Democratic proposals to tax, tax, tax business. I’m reinvesting into my business every day to make it bigger and stronger financially. That’s how I see it making it in the long term. The oil and gas business is not the best business since it is unpredictable over the long term. And the downturns are always very challenging.

- Acquisition by a new parent company.

- Trade, tariffs and border uncertainty ... essentially President Trump.

- Ability of the Democrats to effect antibusiness laws and regulations.

Computer and Electronic Product Manufacturing

- Trade tensions with China; tariff uncertainty.

- International volatility.

- The cost and availability of components, but this is easing.

Transportation Equipment Manufacturing

- Due to stiff competition from overseas, our customers will no longer sign long-term agreements. Therefore, our company must plan to make products available on short notice for smaller quantities with no definitive outlook into the future.

- Fuel prices.

- Oil price.

Printing and Related Support Activities

- Technology is primary. The other is price increases.

- The economy.

Food Manufacturing

- World food crisis; federal funding; redirecting relief payments for humanitarian food relief we produce.

- Trade negotiations with China and the European Union.

- That somehow Democrats will raise taxes. We elected to become a C-corp (from an S-corp) following the implementation of the new tax rates, and we are committed to investing those additional earnings to grow our business.

- Our business is highly dependent on sourcing several materials from Bulgaria, China and Mexico. So the following issues have sharply driven up uncertainty for us: U.S.–Mexico border logistics disruptions, increasing tariffs and antitrade rhetoric.

- Slowing sales; increased pressure on retaining skilled workforce.

- Cost of raw materials; availability of workers.

- Price of fuel.

Textile Product Mills

- Tariffs and import policy continue to be a concern. We are watching these closely as we look for new cut-and-sew houses to help us grow. One year ago, we thought we would look to Mexico for cut and sew, but now we are looking locally—even though it has a higher cost, we feel that we have more control over timelines and delivery windows.

Paper Manufacturing

- Lower demand.

Furniture and Related Product Manufacturing

- Brick-and-mortar retail market.

Miscellaneous Manufacturing

- Political instability, socialism, government overspending, increasing taxes, increasing regulation and increasing trade tariffs in foreign markets.

- Health care, since we sell medical equipment.

Special Questions Comments

These comments have been edited for publication.

Primary Metal Manufacturing

- Wages and benefits have really increased, and we expect this trend to continue. Even if growth stops or business slows down, the demand for good employees is going to continue.

Fabricated Metal Product Manufacturing

- We file as an S corporation. However, our Texas margin taxes have increased due to the method the taxes are calculated with.

- We have several locations within Texas. Most of our sales are not in metropolitan areas.

Texas Service Sector Outlook Survey

Data were collected April 16–24, and 264 Texas business executives responded to the surveys.

See data files with a full history of results.

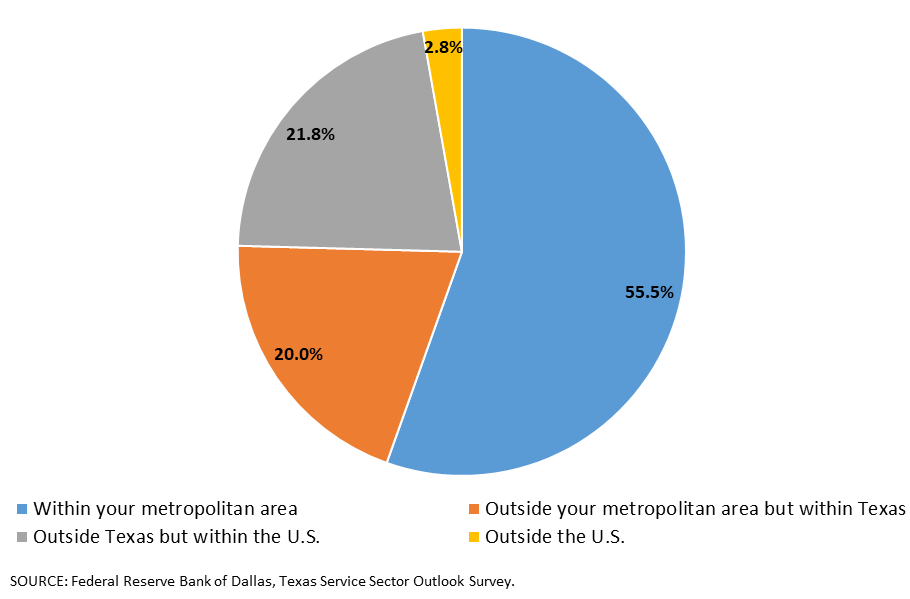

In 2018, approximately what share of your firm’s revenues came from customers in the following geographies?

NOTE: 256 responses.

In 2018, what percentage of your firm’s revenues came directly from oil and gas-related business?

| April '19 (percent) |

||

| None | 51.3 | |

| 1 to 9 percent | 29.9 | |

| 10 to 24 percent | 9.6 | |

| 25 to 49 percent | 4.6 | |

| 50 percent or more | 4.6 |

NOTE: 261 responses.

In 2018, were your firm’s federal corporate income taxes as a share of earnings higher, lower or about the same as in 2017?

| April '19 (percent) |

||

| Higher | 16.1 | |

| Lower | 32.7 | |

| About the same | 51.2 |

NOTE: 248 responses.

What is your firm doing with money resulting from lower 2018 taxes? Please select all that apply.*

| April '19 (percent) |

||

| Increasing capital investments | 46.3 | |

| Raising wages | 38.8 | |

| Paying down debt/increasing savings | 32.5 | |

| Paying bonuses | 23.8 | |

| Increasing dividends | 22.5 | |

| Increasing hiring | 20.0 | |

| Enhancing worker benefits | 17.5 | |

| Doing something else? What? | 10.0 | |

| Buying back stock | 5.0 |

*This question posed only to respondents who answered "lower" to the previous question.

NOTE: 80 responses.

What are the primary drivers of uncertainty regarding your firm’s outlook over the next six months?

These responses have been edited for publication.

Support Activities for Mining

- Oil price trends.

Utilities

- Trade wars.

Specialty Trade Contractors

- Revenues will increase because we perform service on HVAC equipment. Service events are higher margins than replacing equipment. We are seeing people delaying capital expenditures and spending on repairs.

Truck Transportation

- Rising interest rates; geopolitical instability; overheated long-term economy.

- Finding enough qualified drivers and mechanics.

- Finding qualified labor/drivers for our industry; expenses are going up faster than price increases.

Pipeline Transportation

- Competition and uncertainty created by Washington.

Support Activities for Transportation

- U.S. border conflicts.

- Cotton season starts in August.

- Grain exports to China; tax credits related to wind products (towers, blades, etc., imports).

Publishing Industries (Except Internet)

- Geopolitical in many different aspects, plus regulatory in the EU [European Union] first, then the U.S. and Asia around data/information and interfaces/rights often associated somehow with security and/or privacy from platforms and networks often using services as barter for data/knowledge.

Data Processing, Hosting and Related Services

- We are not so concerned about the next six months. We are very concerned about next year with all of the election angst/uncertainty. We’re thinking it will shut down or at least delay decision-making on major purchases.

Credit Intermediation and Related Activities

- Regulatory changes.

- General economic activity; interest rates.

Securities, Commodity Contracts, and Other Financial Investments and Related Activities

- Lack of ability to hire employees.

- Employment levels; ability to find qualified candidates; mortgage/interest rates.

- Increases in cost of our labor, materials, supplies, transportation, insurance and property taxes. We haven't been able to really pass these costs along in our selling prices.

Insurance Carriers and Related Activities

- Variability in interest rates and spreads on corporate bonds and mortgages (all affect our annuity sales and investment yield); political discourse and legislation regarding health insurance, which affect our health insurance product; costs of medical care, especially very high-cost treatments.

- Job growth.

Real Estate

- Oil price fall; the Democrats and Republicans unable to govern.

- Consumer demand for housing.

- Border closures; tariffs; upcoming elections; health care uncertainty.

Professional, Scientific and Technical Services

- Finding qualified people that want to become dedicated and loyal employees despite very good wages.

- We are dependent upon new construction but are diversified across housing, commercial, office and industrial sector. Slowdowns like 2001–02 have some but minor effect with no reduction in staff. The 2008 drying up of capital had dynamic effect on both revenue and staff reduction.

- Industry mergers and acquisitions activity; global economic growth.

- Energy prices; stock market correction; recession fears; instability in the federal government.

- Uncertainty in the price of oil and gas; possibility of a recession.

- Continued market instability—economically and politically.

- Slowed growth in the economy and declining leading indicators for manufacturing sectors; uncertainty created by tariffs; uncertainty that will result from upcoming federal elections.

- General business climate.

- USMCA (U.S.–Mexico–Canada Agreement); availability of labor; technological changes in the automotive industry; federal policy.

- No outside drivers.

- How America is and will be perceived.

- Ability to achieve targeted growth.

- Geopolitical issues no doubt are concerning, and this administration’s performance is almost comical in fashion. In all honesty, the extremes to which parties appear to be migrating is very concerning. There seems to be no middle, no possibility of compromise, and that is alarming. Also, a concern that consumer contributions to the economy domestically weaken—which could occur due to a number of factors—and we slide as a result; GDP falls and perhaps we do experience some level of recession. We may have a decent 2019, but I see weakening into 2020 and perhaps beyond, particularly as we see some instability introduced as the election cycle heats up and the expected circus on both sides begins performing. (I think overseas factors will play into it as well with Brexit, general EU [European Union] issues and perhaps some expected shocks in Asia. Economic strength in China is not as good as predicted.) I do not think the Fed [Federal Reserve] will impact triggering the negative as much as other elements of our political failings will. The Fed is likely to get blamed though.

- Congressional action; 2020 elections; Democrats’ socialism.

- Our older product line is not bringing enough returning customers.

Management of Companies and Enterprises

- Regulations; economy; labor force; competitors.

- Oil and gas prices and export capacity. The political climate in D.C. is unsettling, and the perpetual talk for the past two presidencies of impeachment, disrespect and rancor simply are wearing the general public out. Seems as if the population is growing tired of partisan politics, but we continue to reelect polarizing politicians. Compliance whiplash is a reality depending on which party is in power. It causes unrest in the business climate.

Administrative and Support Services

- The military aviation sector is a big part of our service work. It seems to be somewhat unsteady in the past few months. The “uncertainty” that is being talked up is having an effect on our customers’ willingness to take on new business.

- Political discontent; international unrest.

- Political uncertainty.

Waste Management and Remediation Services

- Export market to China, which has a huge impact on the scrap business. While our company does not directly sell material to China, the lack of exports sold to China has a ripple effect throughout the entire recycling industry.

Educational Services

- Changing educational laws in the legislature and educational funding.

Ambulatory Health Care Services

- Greater government involvement in health care.

Nursing and Residential Care Facilities

- Building of additional seniors housing communities. If supply continues to grow, it could negatively impact the occupancy of our communities and the rates we are able to charge.

Performing Arts, Spectator Sports and Related Industries

- Politics and world events.

Accommodation

- The U.S. economy and how the oil and gas industry performs.

- Economic policies—thank God for Mr. Powell [Federal Reserve Chairman]. I don't feel the current administration has much of a strategy.

Food Services and Drinking Places

- Wages; labor.

- Price of oil impacting ability to attract and retain labor in West Texas.

- The economy and market saturation in the hospitality industry as well as labor shortage.

Repair and Maintenance

- Health care costs; regulations (OSHA [Occupational Safety and Health Administration], EPA [Environmental Protection Agency], DOT [Department of Transportation]).

- Lower in-store retail sales means fewer store openings. Without new stores, our product is not needed. Online retail sales are hurting our business. Our product sales price is decreasing, while our costs for labor and materials are increasing.

Religious, Grantmaking, Civic, Professional and Similar Organizations

- The impact of growing national debt on the long-term viability of the U.S. economy and the seeming inability of politicians to bring debt under control.

- Medical reimbursements.

- As a nonprofit organization, we have seen a steady decrease in monetary support.

- Oil prices

Special Questions Comments

These comments have been edited for publication.

Pipeline Transportation

- In many cases, customers are based in Houston, but the revenue sources are outside Houston.

Support Activities for Transportation

- The port is a governmental enterprise and is not subject to federal income tax.

Insurance Carriers and Related Activities

- Much of our growth is coming from new marketing initiatives in larger cities like San Antonio. Unfortunately, the market for new business growth is in the larger metro areas.

Real Estate

- Increasing wages and benefits and hiring are not a result of the lower taxes as much as they are due to the competitive employment environment and the natural growth of our business.

- We do not know the impact of federal tax changes at this time.

Professional, Scientific and Technical Services

- Our taxes are lower, based on our estimates, but we had to file an extension because we still have work to do before we can determine actual taxes owed. We may not be able to file our final return until September or October.

- We lack marketing funds to promote more and benefit from the good overall economy. We are spending money in research and development to add new products to our portfolio.

- Given we are a partnership, corporate taxes really aren't an issue.

Administrative and Support Services

- I have not filed 2018 taxes yet, so I really don't know—I'm guessing an improvement, but it is too hard to tell at this point in time.

- The economy has the potential to grow, but we need to continue to invest in technology and training. We must keep our cost structure in line in order to make these investments. The level of overregulation in the economy will have a stagnating effect on business in general and act like an additional tax.

Ambulatory Health Care Services

- As a subchapter S corporation, earnings pass through to personal income. However, as a targeted group by the latest tax bill, we will not benefit from the 20 percent business tax deduction, and the capping of deductions of property taxes effectively offsets any slight reduction in the overall personal tax rate.

Nursing and Residential Care Facilities

- Approximately 7.5 percent of our total income is made up from charitable contributions from the oil and gas industry.

Texas Retail Outlook Survey

Data were collected April 16–24, and 53 Texas retailers responded to the surveys.

See data files with a full history of results.

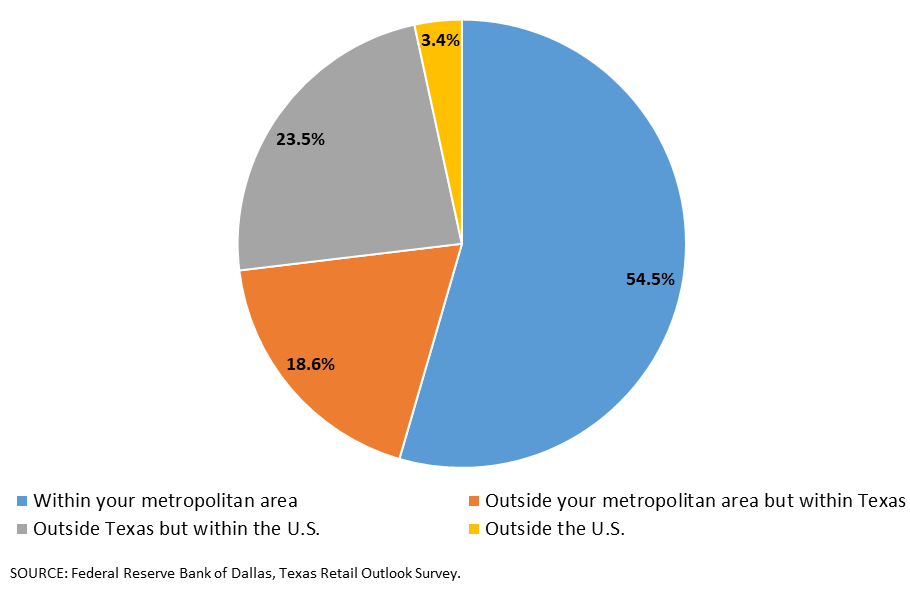

In 2018, approximately what share of your firm’s revenues came from customers in the following geographies?

NOTE: 52 responses.

In 2018, what percentage of your firm’s revenues came directly from oil and gas-related business?

| April '19 (percent) |

||

| None | 53.8 | |

| 1 to 9 percent | 25.0 | |

| 10 to 24 percent | 13.5 | |

| 25 to 49 percent | 3.8 | |

| 50 percent or more | 3.8 |

NOTE: 52 responses.

In 2018, were your firm’s federal corporate income taxes as a share of earnings higher, lower or about the same as in 2017?

| April '19 (percent) |

||

| Higher | 7.8 | |

| Lower | 43.1 | |

| About the same | 49.0 |

NOTE: 51 responses.

What is your firm doing with money resulting from lower 2018 taxes? Please select all that apply.*

| April '19 (percent) |

||

| Increasing capital investments | 50.0 | |

| Raising wages | 36.4 | |

| Paying down debt/increasing savings | 36.4 | |

| Increasing dividends | 27.3 | |

| Enhancing worker benefits | 22.7 | |

| Paying bonuses | 18.2 | |

| Increasing hiring | 13.6 | |

| Buying back stock | 4.5 | |

| Doing something else? What? | 4.5 |

*This question posed only to respondents who answered "lower" to the previous question.

NOTE: 22 responses.

What are the primary drivers of uncertainty regarding your firm’s outlook over the next six months?

These responses have been edited for publication.

Merchant Wholesalers, Durable Goods

- Federal political outlook and the changing state political shift.

- Right now, we don't have any big drivers for our business. In the past, business was driven by environmental needs, independent power needs, etc. Now, we are focused on replacement of old boilers.

- Problems with tariffs and changes in the market.

Merchant Wholesalers, Nondurable Goods

- The trade war with China.

- Sourcing employees; agricultural commodity prices; keeping farmers and ranchers in business; managing lower margins with increased cost (labor and input).

Motor Vehicle and Parts Dealers

- Our business is the automobile retail and service business. We will be reducing new-vehicle inventory as much as the manufacturers' quotas will permit. We will increase parts and accessory inventories to keep up with increasing service business.

General Merchandise Stores

- Tariff issues; impact on pricing.

Nonstore Retailers

- Competitive pressure to reduce pricing to customers impacting our ability to retain existing customer base; ability to hire and retain qualified labor to service customers.

- Political climate.

Special Questions Comments

These comments have been edited for publication.

Building Material and Garden Equipment and Supplies Dealers

- We are glad to see that the Fed [Federal Reserve] has paused raising interest rates. Increases in the rates hurt small business as they increase the cost of capital.

General Merchandise Stores

- We are a retailer. Approximately 11 percent of our total company sales is retail sales of gasoline.

Questions regarding the Texas Business Outlook Surveys can be addressed to Emily Kerr at emily.kerr@dal.frb.org,

Sign up for our email alert to be automatically notified as soon as the latest surveys are released on the web.