Special Questions

Special Questions

December 30, 2019

Results below include responses from participants of all three surveys: Texas Manufacturing Outlook Survey, Texas Service Sector Outlook Survey and Texas Retail Outlook Survey.

Texas Business Outlook Surveys

Data were collected Dec. 16–24, and 322 Texas business executives responded to the surveys.

See data files with a full history of results.

What annual percent change in wages and input prices did your firm experience in 2019, and what do you expect for 2020? Also, by how much did your firm change selling prices in 2019, and by how much do you expect to change selling prices in 2020?

| 2019 actual (percent)* |

2020 expected (percent)* |

|

| Wages | 3.9 | 3.8 |

| Input prices (excluding wages) | 3.4 | 3.3 |

| Selling prices | 2.4 | 2.8 |

NOTE: 275 responses.

*Shown are trimmed means with the lowest and highest five percent of responses omitted.

For each category below, please select the extent to which your firm raised wages (excluding benefits) over the past 12 months:

| None | Less than four percent | Four percent or more | |

| Low-skill positions (typically require high school diploma or less and minimal work experience) | 22.2 | 50.7 | 27.2 |

| Mid-skill positions (typically requires some college or technical training) | 16.4 | 49.3 | 34.2 |

| High-skill positions (typically requires college degree or higher) | 18.5 | 41.3 | 40.3 |

NOTES: 304 responses.

How has your firm’s operating margin, defined as earnings before interest and taxes (EBIT) as a share of total revenue, changed over the past six months?

| Dec. ’18 (percent) |

May ’19 (percent) |

Dec. ’19 (percent) |

|

| Increased substantially | 7.2 | 6.2 | 8.1 |

| Increased slightly | 23.1 | 22.9 | 28.5 |

| Remained the same | 24.4 | 29.1 | 22.7 |

| Decreased slightly | 34.2 | 33.6 | 28.5 |

| Decreased substantially | 11.1 | 8.2 | 12.3 |

NOTES: 309 responses.

What net impact have U.S. and foreign tariffs implemented since last year had on your firm overall, and what do you expect for the longer term?

| Current (2019) |

Longer term (2020–2021) |

|||

| Jun. ’19 (percent) |

Dec. ’19 (percent) |

Jun. ’19 (percent) |

Dec. ’19 (percent) |

|

| No impact | 57.6 | 49.2 | 28.7 | 36.8 |

| Positive | 4.8 | 4.4 | 9.6 | 7.4 |

| Negative | 28.4 | 37.9 | 36.5 | 34.2 |

| Don’t know | 9.3 | 8.5 | 25.2 | 21.6 |

NOTES: 317 responses.

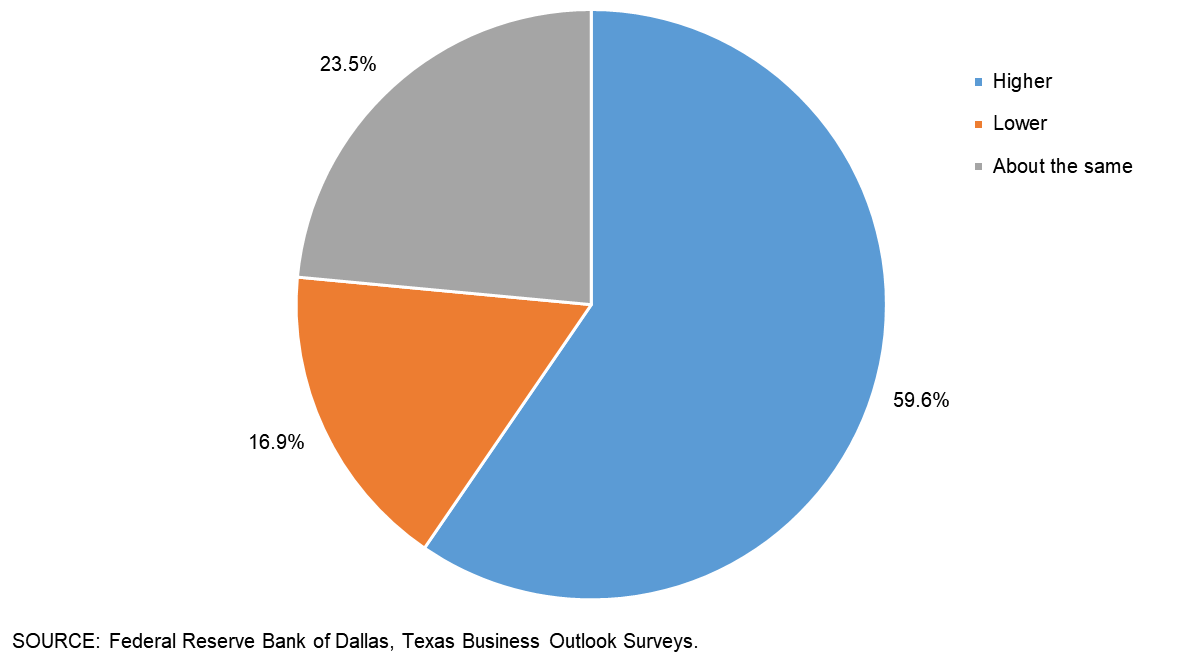

How do you expect your firm’s production, revenue or sales in 2020 to compare with 2019?

| Dec. ’19 (percent) |

|

| Higher | 59.6 |

| Lower | 16.9 |

| About the same | 23.5 |

NOTES: 319 responses.

NOTE: Survey respondents were given the opportunity to provide comments. These comments can be found on the individual survey Special Questions results pages, accessible by the tabs above.

Texas Manufacturing Outlook Survey

Data were collected Dec. 16–24, and 96 Texas manufacturers responded to the surveys.

See data files with a full history of results.

What annual percent change in wages and input prices did your firm experience in 2019, and what do you expect for 2020? Also, by how much did your firm change selling prices in 2019, and by how much do you expect to change selling prices in 2020?

| 2019 actual (percent)* |

2020 expected (percent)* |

|

| Wages | 3.4 | 3.5 |

| Input prices (excluding wages) | 3.2 | 3.2 |

| Selling prices | 2.2 | 3.0 |

NOTE: 83 responses.

*Shown are trimmed means with the lowest and highest five percent of responses omitted.

For each category below, please select the extent to which your firm raised wages (excluding benefits) over the past 12 months:

| None | Less than four percent | Four percent or more | |

| Low-skill positions (typically require high school diploma or less and minimal work experience) | 14.0 | 54.8 | 31.2 |

| Mid-skill positions (typically requires some college or technical training) | 11.7 | 54.3 | 34.0 |

| High-skill positions (typically requires college degree or higher) | 19.1 | 43.6 | 37.2 |

NOTES: 94 responses.

How has your firm’s operating margin, defined as earnings before interest and taxes (EBIT) as a share of total revenue, changed over the past six months?

| Dec. ’18 (percent) |

May ’19 (percent) |

Dec. ’19 (percent) |

|

| Increased substantially | 11.0 | 11.4 | 8.6 |

| Increased slightly | 24.2 | 23.8 | 24.7 |

| Remained the same | 17.2 | 22.9 | 20.4 |

| Decreased slightly | 35.4 | 33.3 | 26.9 |

| Decreased substantially | 12.1 | 8.6 | 19.4 |

NOTES: 93 responses.

What net impact have U.S. and foreign tariffs implemented since last year had on your firm overall, and what do you expect for the longer term?

| Current (2019) |

Longer term (2020–2021) |

|||

| Jun. ’19 (percent) |

Dec. ’19 (percent) |

Jun. ’19 (percent) |

Dec. ’19 (percent) |

|

| No impact | 45.1 | 33.3 | 20.7 | 22.6 |

| Positive | 8.8 | 11.5 | 18.0 | 18.3 |

| Negative | 40.7 | 47.9 | 31.5 | 34.4 |

| Don’t know | 5.3 | 7.3 | 29.7 | 24.7 |

NOTES: 96 responses.

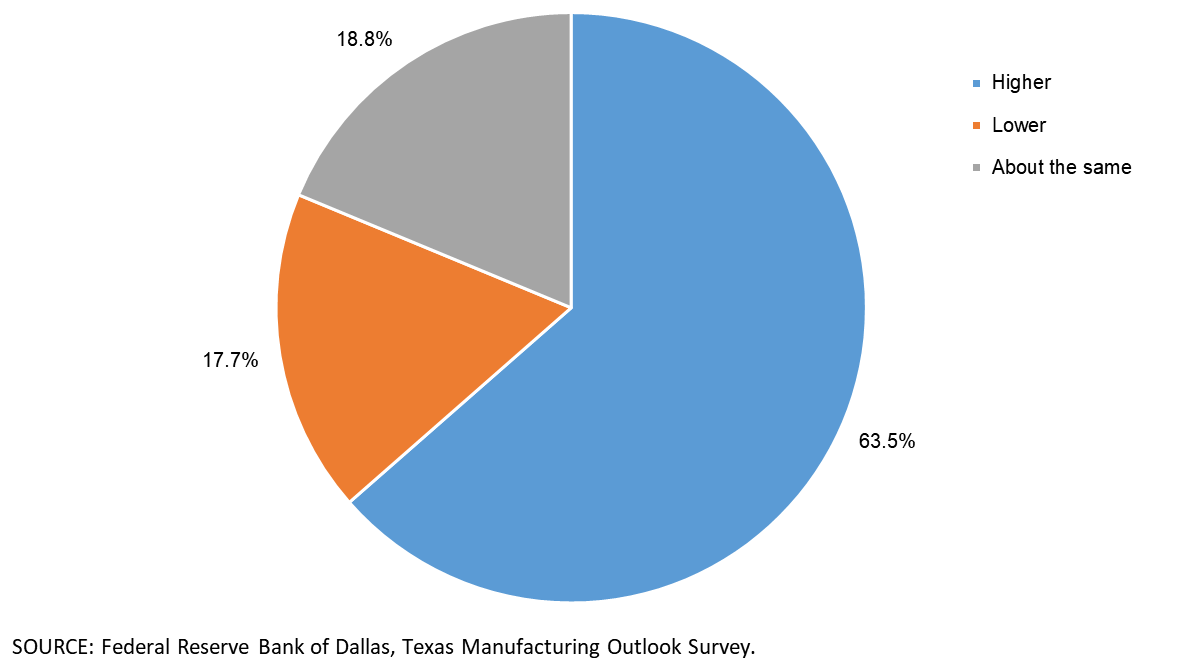

How do you expect your firm’s production, revenue or sales in 2020 to compare with 2019?

| Dec. ’19 (percent) |

|

| Higher | 63.5 |

| Lower | 17.7 |

| About the same | 18.8 |

NOTES: 96 responses.

If you expect higher production, revenue or sales in 2020, why?

These comments have been edited for publication.

Chemical Manufacturing

- Significant investment in robotics and automation and other lean manufacturing efforts.

- Increased demand in the largest market, and growth in multiple sectors.

- Consumer confidence improving after election and impeachment proceedings.

Primary Metal Manufacturing

- Depleting backlog of low-selling-price jobs, and new jobs sold will be at higher prices.

- Most of our sales are to various agriculture markets. Our customers have deferred purchases the past 18 months, so we are likely to see some increase as the deferrals end and the positive impact of partial resolution of the trade situation with China starts to have a positive impact on agriculture sales and, therefore, on our sales.

- Price increases will help offset the sharp rise in production costs associated with new labor.

Fabricated Metal Product Manufacturing

- Commercial construction is still moving ahead at a great pace. As long as no election changes are made, business should continue as it normally does in an election year.

- Cheap Chinese coils are no longer being dumped into the United States. Tariffs used to be just on raw materials, which hurt U.S. manufacturers, so they moved to Mexico and imported the coils they built there back to the U.S. or imported Chinese-made coils. Now the tariffs are on the imported finished goods, too. This helps level the playing field for U.S. manufacturers.

- The economy is growing, and modular construction is growing as a form of permanent construction.

- We are gearing up for new markets. We are optimistic for future business.

- The markets in which we operate are very solid and showing solid performance. The tariffs have not impacted our business at all. We are entering 2020 with a backlog about 15 to 20 percent higher than the same period last year.

- Manufacturing in the U.S. will continue to grow and be strong.

- Texas is the place to be for manufacturing, considering the expense of trucking. Also, reshoring of products is a large opportunity for us.

Nonmetallic Mineral Product Manufacturing

- Increase in backlog due to higher infrastructure spending.

- Revenues will increase due to 1) market share increase, and 2) continued selling price increases.

Machinery Manufacturing

- When the Chinese tariff issue is solved, we expect a rapid increase in business.

- Market share growth.

- Positive attitude.

- More energy activity.

- A general increase in capital equipment purchases and the introduction of new product lines.

Computer and Electronic Product Manufacturing

- Increased profits lead to more investment in business growth as our sales and marketing efforts expand. Additional new products were introduced in 2019 that will lead to increased sales in 2020.

- Industry confidence.

Transportation Equipment Manufacturing

- Increased production volumes and higher average sales price per unit.

- More aggressive pricing.

- We use our largest show as an indicator for both our current business, but more importantly for my forecast. This show just ended and the buyer confidence level we saw for high-end products rivaled 2016 numbers. I have been using this show as a gauge for the first quarter of my business for 20 years and it has been incredibly accurate for my industry.

- We added additional salespeople, developed new sales sources and increased foreign military sales.

Food Manufacturing

- Increased consumer awareness of the variety of products we now offer.

- Added new machinery that will go into full production early next year.

- New customer in pipeline, and current customer expanding into Walmart.

- We expect to increase our production slightly over 2019 but focus on higher-priced items which seem to be in higher demand, which will increase our revenue approximately 11 percent for the first six months of 2020. We are focused on shifting our sales mix to higher-margin items, which will have a positive effect on EBIT [earnings before interest and taxes] during the same time period.

- We believe we will add new customers.

- New clients, new products.

- More aggressive sales strategy in terms of promotional pricing and advertising.

Wood Product Manufacturing

- Dallas and the commercial and housing markets are booming.

Furniture and Related Product Manufacturing

- We expect an increase of 18–20 percent, driven by the strong economy and further boosted by the foreign tariffs.

- Increased marketing efforts; new products.

- Brick and mortar retail coming back.

Paper Manufacturing

- We are working on a lot of new projects that should result in higher revenues.

- Increased sales effort. It could affect margin/selling prices negatively.

- The consumer goods flexible-packaging sector is growing better than GDP. We are adding production capacity, which will allow us to reduce our backlog and increase our share.

Printing and Related Support Activities

- In part from an increase in pricing we implemented. We are really just now seeing the results from that, plus we have some significant publishing customer opportunities for next spring.

- Positive sales efforts leading into next year.

Miscellaneous Manufacturing

- Product life-cycle timing issues and improved competitiveness by investments in technology for both operations and product innovations coming to market.

If you expect lower production, revenue or sales in 2020, why?

These comments have been edited for publication.

Chemical Manufacturing

- Lower car sales decreases demand.

Fabricated Metal Product Manufacturing

- Competition from low-cost countries. Market price being driven lower.

- Oil and gas prices.

- Expected slowdown in domestic oil new-well drilling.

- General slowdown in the automotive industry and, therefore, lower production driven by lower customer demand.

Machinery Manufacturing

- Election years are notoriously bad years … instability.

Computer and Electronic Product Manufacturing

- It’s time to gain new customers to replace revenue lost due to increased losses due to tariffs.

Transportation Equipment Manufacturing

- The media has gotten the public thinking negatively. The China deal has hurt trucking volumes; however, we need to stay the course and get them on a level field. Short-term hurt, long-term gain.

Food Manufacturing

- Milk has been trending down for years, and we don’t see that changing soon.

Wood Product Manufacturing

- Increase selling prices to increase real dollar margins. The tariffs have destroyed the domestic lumber prices and all the other costs, especially fleet insurance, have doubled. It is very hard to make money with depressed lumber prices. We are selling more product—just not getting enough for it.

Miscellaneous Manufacturing

- Chinese competition and tariffs.

If you expect production, revenue or sales to be about the same in 2020, why?

These comments have been edited for publication.

Chemical Manufacturing

- We do not anticipate improvement in the oilfield business.

Fabricated Metal Product Manufacturing

- No immediate indication the RFQs [requests for quotations] will actually lead to purchase orders.

Nonmetallic Mineral Product Manufacturing

- We’ve had a good year. 2020 should be the same.

Computer and Electronic Product Manufacturing

- Concern over tariff taxes.

- It is an election year, so we can’t determine where we will be at the end of 2020. The outcome of the election could swing business heavily in either direction. The best scenario will be steady business as this year has been.

- We are down double digits. If the macro economy stabilizes, so too should our revenue.

Transportation Equipment Manufacturing

- Our costs will be higher, which we will attempt to offset by selling more volume overseas.

Food Manufacturing

- Election year.

Apparel Manufacturing

- 2019 volumes have hit an all-time high, and 2020 should be comparable.

Printing and Related Support Activities

- We are in a stagnant industry.

Special Questions Comments

These comments have been edited for publication.

Primary Metal Manufacturing

- Our margins are spreading for the first time in several years.

Machinery Manufacturing

- Wages are flat due to extreme pricing pressure. We see competitors quoting cost or less to get work, us included. Our health insurance went up 15 percent for 2020. It must be nice to have a fixed market.

Transportation Equipment Manufacturing

- Part of our revenue decline is switching from retail to wholesale distribution in 2019.

- The tariffs on imported steel have hurt U.S. manufacturers who were already using U.S. steel. The day the imports were imposed, the U.S. steel mills immediately increased their prices (up to 25 percent). Therefore, we saw our prices increase immediately to the higher level. The more complicated issue is that tariffs were not imposed at the same time on finished-goods manufacturing from steel in the Asian countries. The American manufacturers were quickly hit with foreign competitors who manufactured the raw steel into finished parts and shipped to the U.S. with no tariffs attached. Until our government can apply tariffs to all steel and aluminum products manufactured from the restricted countries, a huge imbalance has been created for the U.S. manufacturer.

Food Manufacturing

- Rather than implement raises for many of our factory workers, including supervisors and plant managers, we are offering bonuses based on achieving key performance indicators on a quarterly basis.

- Here’s to hoping tariffs in 2020–2021 are nonexistent. That would be positive.

Wood Product Manufacturing

- Make a deal and end these silly tariffs. They are a tax on the American people, not punishment to the importers. The law of unintended consequences can’t be repealed.

Texas Service Sector Outlook Survey

Data were collected Dec. 16–24, and 226 Texas business executives responded to the surveys.

See data files with a full history of results.

What annual percent change in wages and input prices did your firm experience in 2019, and what do you expect for 2020? Also, by how much did your firm change selling prices in 2019, and by how much do you expect to change selling prices in 2020?

| 2019 actual (percent)* |

2020 expected (percent)* |

|

| Wages | 4.1 | 3.9 |

| Input prices (excluding wages) | 3.5 | 3.4 |

| Selling prices | 2.5 | 2.7 |

NOTE: 192 responses.

*Shown are trimmed means with the lowest and highest five percent of responses omitted.

For each category below, please select the extent to which your firm raised wages (excluding benefits) over the past 12 months:

| None | Less than four percent | Four percent or more | |

| Low-skill positions (typically require high school diploma or less and minimal work experience) | 25.8 | 48.8 | 25.4 |

| Mid-skill positions (typically requires some college or technical training) | 18.6 | 47.1 | 34.3 |

| High-skill positions (typically requires college degree or higher) | 18.2 | 40.2 | 41.6 |

NOTES: 210 responses.

How has your firm’s operating margin, defined as earnings before interest and taxes (EBIT) as a share of total revenue, changed over the past six months?

| Dec. ’18 (percent) |

May ’19 (percent) |

Dec. ’19 (percent) |

|

| Increased substantially | 5.3 | 4.0 | 7.9 |

| Increased slightly | 22.6 | 22.5 | 30.1 |

| Remained the same | 27.9 | 31.7 | 23.6 |

| Decreased slightly | 33.7 | 33.7 | 29.2 |

| Decreased substantially | 10.6 | 8.0 | 9.3 |

NOTES: 216 responses.

What net impact have U.S. and foreign tariffs implemented since last year had on your firm overall, and what do you expect for the longer term?

| Current (2019) |

Longer term (2020–2021) |

|||

| Jun. ’19 (percent) |

Dec. ’19 (percent) |

Jun. ’19 (percent) |

Dec. ’19 (percent) |

|

| No impact | 63.4 | 56.1 | 32.5 | 42.9 |

| Positive | 2.9 | 1.4 | 5.6 | 2.8 |

| Negative | 22.6 | 33.5 | 38.9 | 34.1 |

| Don’t know | 11.1 | 9.0 | 23.1 | 20.3 |

NOTES: 221 responses.

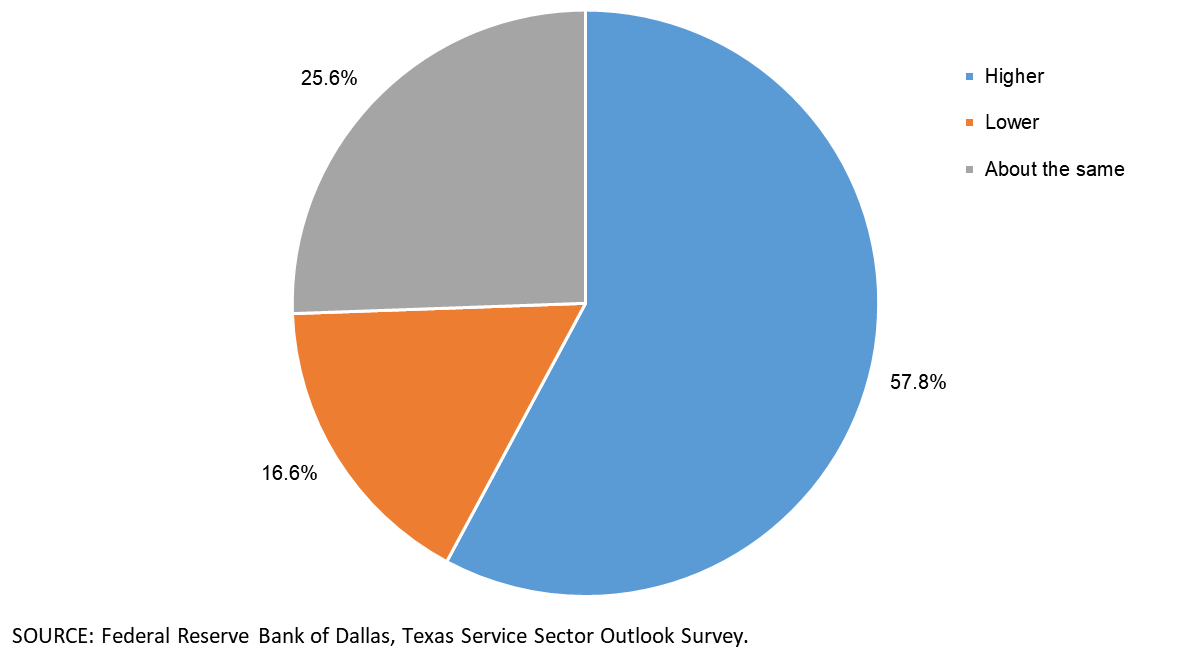

How do you expect your firm’s production, revenue or sales in 2020 to compare with 2019?

| Dec. ’19 (percent) |

|

| Higher | 57.8 |

| Lower | 16.6 |

| About the same | 25.6 |

NOTES: 223 responses.

If you expect higher production, revenue or sales in 2020, why?

These comments have been edited for publication.

Support Activities for Mining

- Expanding market area and greater sales penetration.

Utilities

- Rate increase of 5 percent proposed for FY [fiscal year] 2020–21.

- We are expecting a better year in 2020 compared with 2019.

Specialty Trade Contractors

- We see capital expenditure spending decreasing; however, we are in the repair and replacement business—when cap ex decreases, repair increases. Repair is a better margin than replacement; however it takes more techs to repair than replace, so there are more man hours.

- The roll out of 5G will certainly create many new opportunities in 2020, and we are seeing a lot of posturing that indicates we will be able to fill in a lot of blanks for our customers.

Truck Transportation

- Trucking is expected to increase volumes.

- Our backlog of projects is greater than last year at this time.

Pipeline Transportation

- There is continued growth in the Permian Basin. Although, the rate of growth in oil volumes for 2020 is expected to be less than 2019, we still expect solid production gains.

Support Activities for Transportation

- Decreased regulation.

Warehousing and Storage

- Crude pipelines from the Permian Basin in West Texas have commenced operations in the third quarter, with another one expected to go in service in first quarter 2020. We expect 2020 revenues to be higher than 2019 by approximately 25 percent.

Publishing Industries (Except Internet)

- Increased adoption of learning and education-related enterprise plans and market demand for advanced tech-enabled solutions.

Data Processing, Hosting and Related Services

- We hired more sales people, so volume will increase.

Credit Intermediation and Related Activities

- Economic uncertainty has been reduced.

- We expect an increase in loan origination in 2020.

- Expanded into new markets in 2018 and 2019. Expect continued growth from these new markets.

- Launching new business unit.

- Internal growth accompanied by the status quo from the capital markets during an election year.

Securities, Commodity Contracts, and Other Financial Investments and Related Activities

- Adoption of technology, hiring during 2019 and improved processes will allow more time to focus on growth.

- We are increasing our sales and marketing spend. We expect to take more existing contracts in the market. We have also outsourced a number of processes and increased efficiency through software integration. We are working to reduce face-to-face/person-to-person customer interaction through phone calls/visits and move to more chat interaction to reduce expenses.

Insurance Carriers and Related Activities

- Growth in market share.

- Better sales team, improved marketing and lead generation, and diversified distribution channel.

- Merger with a more regional firm.

- Continued growth in the economy and less available underwriting capacity for catastrophe-exposed property and higher casualty insurance pricing from insurance carriers.

- Increased investment in sales staff.

- General growth.

Real Estate

- More capital available.

- Additional resources allocated to this.

- Increased 2019 investment leading to 2020 profit.

- We are very disciplined real estate developers, and we are in a region that has very solid growth prospects and good residential development. So, we are developing neighborhood retail to serve those areas and buying value-add projects in underserved areas in other growth markets that we are confident can be improved; thus, we have a positive opinion of our growth.

Professional, Scientific and Technical Services

- Generally improved business climate.

- We raised our prices slightly in 2019 and expect growth in our business.

- Increased sales activity.

- Resolution of market uncertainty in trade issues is driving activity. Expect 2020 to be brutal for the election process, which may negatively impact activity.

- There is still demand in Texas that remains strong. Due to a labor force shortage, we are seeing the ability to push off work and not lose it in the short term. That may change for the long term if we don’t backfill the labor shortage.

- Our program to increase market share and expand into new markets.

- USMCA [U.S.–Mexico–Canada Agreement].

- Increase in amounts charged to clients.

- Continued opportunities due to strong regional economy. Growth will be limited by insufficient labor pool.

- U.S. and global economies are very strong that we see from our vantage point. President Trump’s policy is actually helping both U.S. companies like us and companies overseas. Only ones doing badly are companies in China we think.

- More consultants to take the work we are currently turning away.

- Adding new service line; raising rates slightly.

- Charging higher rates.

- Continued growth in Austin area.

- Growth in a few focused areas. Adding head count and will capture more hours.

- More business.

Management of Companies and Enterprises

- We hope to have additional clients.

Administrative and Support Services

- Investment in capital and people, as well as new services and improved marketing and sales automation.

- We are working with new customers who are taking us to new markets.

- Experienced strong volume growth (> 10 percent) in 2019 and expect volume growth to exceed 7.5 percent in 2020.

- Increased business activity and full employment in the area. People have money, and they have needs.

Educational Services

- Increased prices.

- New customers added due to Texas growth.

Ambulatory Health Care Services

- Increased sales volume and increased pricing.

- Consumer confidence remains high and will thus drive GDP [gross domestic product]. As cosmetic dentists, we thrive in a high-confidence environment. Growth will come from higher close rates on big cases as younger doctors gain experience and credibility in the market.

- New clinic opened after capital investment this year.

Hospitals

- Population growth.

Nursing and Residential Care Facilities

- We are expanding our services.

- Our campus renovations will be completed in January 2020.

Social Assistance

- Higher production per man hour because of improved production methodologies. Higher pricing.

Performing Arts, Spectator Sports and Related Industries

- More opportunity.

Food Services and Drinking Places

- I am planning to promote catering.

- Increased traffic.

- We will add franchises.

- We are expecting business activity to pick up in West Texas—oilfield dependent.

- This is based on current trends and a planned price increase.

Repair and Maintenance

- New customers and adding more employees.

Personal and Laundry Services

- Increase marketing efforts, more client retention requirements from employees and optimism.

Religious, Grantmaking, Civic, Professional and Similar Organizations

- Inflation.

- The mere cost of everything rising. The new overtime rule restrictions and policies.

If you expect lower production, revenue or sales in 2020, why?

These comments have been edited for publication.

Utilities

- If the oil and gas workforce reductions materialize, I expect to see a material impact on economic activity.

Support Activities for Transportation

- Lower volume and more competition given the softening conditions.

Credit Intermediation and Related Activities

- Interest rates have decreased, resulting in loans repricing at lower rates.

- Production should be about the same. Revenue will be less due to declining interest rates and net interest margin.

Securities, Commodity Contracts, and Other Financial Investments and Related Activities

- Lower sales, same or lower sales prices, and higher costs that cannot be passed on to consumers.

Professional, Scientific and Technical Services

- Uncertainty due to tariffs has reduced investments in energy and petrochemical projects, which reduces demand for consulting work.

- Our industry reduced its premium rates by 8 to 10 percent.

- Potential for impending recession due to trade policy, deficits, lack of cohesive long-term policies for health care, immigration, taxation and trade.

Management of Companies and Enterprises

- Lower interest rates.

- Increased expenses and lower interest income.

- Election years always hurt sales.

Administrative and Support Services

- Uncertainty in election year.

Accommodation

- Oil and gas industry.

Food Services and Drinking Places

- Change in public attitudes toward our business.

- Less availability of workers in order to produce.

Religious, Grantmaking, Civic, Professional and Similar Organizations

- Tightening economy and uncertainty.

- While indicators are that the economy is strong (and the president never misses an opportunity to tell us this), we all know things move in cycles and this one has gone on for way too long. New set of rules for the economy? Don’t know. But caution now prevails.

If you expect production, revenue or sales to be about the same in 2020, why?

These comments have been edited for publication.

Broadcasting (Except Internet)

- While we believe the general economy in West Texas will slow down substantially in 2020 compared with 2019, we also believe enough new businesses will spend money on marketing that our radio business will grow sales by 1 or 2 percent. Believing that radio is the most cost-effective form of advertising, we have greater opportunity in a down market because the entry cost is low compared with other forms of mass marketing.

Insurance Carriers and Related Activities

- The real estate market is slowing due to low inventory.

Rental and Leasing Services

- We are a heavy construction machinery dealer in Texas. The construction machinery industry is way overcrowded with manufacturers, dealers and national equipment rental companies. We cannot see margins or revenues increasing in 2020. What will increase is the cost of doing business: regulatory, bureaucracy costs, litigation costs, insurance costs, taxation; they will all increase and they all come out of a shrinking bottom line.

Professional, Scientific and Technical Services

- Currently at or near capacity. Substantial capital expenditure would be required to increase capacity, and there are too many political unknowns to inconvenience me to spend the amount of money needed.

Management of Companies and Enterprises

- Most of our revenue is tied to the amount of loans we make and interest rates. We don’t expect loan volume to increase much, and interest rates are currently expected to be stable.

- Political winds will likely delay any opportunities for increase in rate of growth, thus loan demand for banks will remain stable. Low interest rates have been in place for some time, and borrowers’ appetites for new cap ex spending and refinancing is nearer the end in this cycle.

- We have had two really good years in a row and expect another one in 2020. The obvious unknown is the presidential election.

Ambulatory Health Care Services

- Unlike retail, health care generally remains consistent.

- Reimbursement pressure.

Amusement, Gambling and Recreation Industries

- We could potentially do more, but we simply cannot get enough people to fill the positions to make that happen.

Accommodation

- Lower demand offset by increased rate.

- We are in the hotel industry, and our particular market is driven by conventions within the city. As it happens, 2020 is a flat year in comparison with 2019. No real indications that anything new or different will be occurring to grow demand beyond current levels for leisure business.

Religious, Grantmaking, Civic, Professional and Similar Organizations

- General activity has been sluggish.

Special Questions Comments

These comments have been edited for publication.

Data Processing, Hosting and Related Services

- Hiring highly skilled technical people has been the No. 1 challenge in 2019 and is expected to be the biggest challenge in the coming years. Compared with just three years ago, our wages, benefits and recruiting fees to attract these workers has increased at least 35 percent, and the amount of time (months) it takes to find the right people has at least tripled. As a cloud service fintech provider, salaries are our highest expense.

Credit Intermediation and Related Activities

- Loan demand has slowed somewhat, and volume will be required to partially offset lower yields. Interest expense has been reduced, which helps offset lower yields on loans.

- Auto tariffs could have an impact next year.

Rental and Leasing Services

- Tariffs impact us in the cost of the products we buy from our manufacturers, which make us less competitive with those that buy less from the areas being taxed by the tariffs.

Professional, Scientific and Technical Services

- Unlike what the press reports, we expect 2020 to be the strongest business year of recent time as the U.S.–China deal has been done and U.S.–Mexico–Canada trade deal is also to be approved by Congress. President Trump’s policies are actually producing strong growth worldwide, with the U.S. being the biggest beneficiary.

Administrative and Support Services

- It is hard to know how tariffs impact our consulting business directly but they clearly weigh on clients’ planning/expectations during 2019, which impacts clients’ decision-making processes. It could be noise that needs to be filtered out.

Educational Services

- There is increased trade certainty going into the 2020 year, and I am optimistic it will add to GDP growth.

- I don’t think impeachment will have any economic or political impact simply because there is scant evidence supporting the articles. I think 2020 will be a quite robust year for equities and economic growth.

Ambulatory Health Care Services

- Outpatient imaging remains a deflationary business. We have no control over reimbursement/payment, so we continue to be extremely efficient in order to make a profit. We are seeing failures of competitors due to constant cuts. At the same time, we are one of the most (likely the most) cost-efficient deliverers of high-quality health care in Houston.

Texas Retail Outlook Survey

Data were collected Dec. 16–24, and 46 Texas retailers responded to the surveys.

See data files with a full history of results.

What annual percent change in wages and input prices did your firm experience in 2019, and what do you expect for 2020? Also, by how much did your firm change selling prices in 2019, and by how much do you expect to change selling prices in 2020?

| 2019 actual (percent)* |

2020 expected (percent)* |

|

| Wages | 4.1 | 3.4 |

| Input prices (excluding wages) | 3.4 | 3.8 |

| Selling prices | 2.9 | 3.8 |

NOTE: 37 responses.

*Shown are trimmed means with the lowest and highest five percent of responses omitted.

For each category below, please select the extent to which your firm raised wages (excluding benefits) over the past 12 months:

| None | Less than four percent | Four percent or more | |

| Low-skill positions (typically require high school diploma or less and minimal work experience) | 17.8 | 51.1 | 31.1 |

| Mid-skill positions (typically requires some college or technical training) | 13.6 | 54.5 | 31.8 |

| High-skill positions (typically requires college degree or higher) | 20.9 | 32.6 | 46.5 |

NOTES: 45 responses.

How has your firm’s operating margin, defined as earnings before interest and taxes (EBIT) as a share of total revenue, changed over the past six months?

| Dec. ’18 (percent) |

May ’19 (percent) |

Dec. ’19 (percent) |

|

| Increased substantially | 2.6 | 2.3 | 9.3 |

| Increased slightly | 10.3 | 15.9 | 20.9 |

| Remained the same | 23.1 | 27.3 | 14.0 |

| Decreased slightly | 41.0 | 43.2 | 39.5 |

| Decreased substantially | 23.1 | 11.4 | 16.3 |

NOTES: 43 responses.

What net impact have U.S. and foreign tariffs implemented since last year had on your firm overall, and what do you expect for the longer term?

| Current (2019) |

Longer term (2020–2021) |

|||

| Jun. ’19 (percent) |

Dec. ’19 (percent) |

Jun. ’19 (percent) |

Dec. ’19 (percent) |

|

| No impact | 58.3 | 39.1 | 25.5 | 41.3 |

| Positive | 0.0 | 0.0 | 6.4 | 4.3 |

| Negative | 27.1 | 43.5 | 40.4 | 34.8 |

| Don’t know | 14.6 | 17.4 | 27.7 | 19.6 |

NOTES: 46 responses.

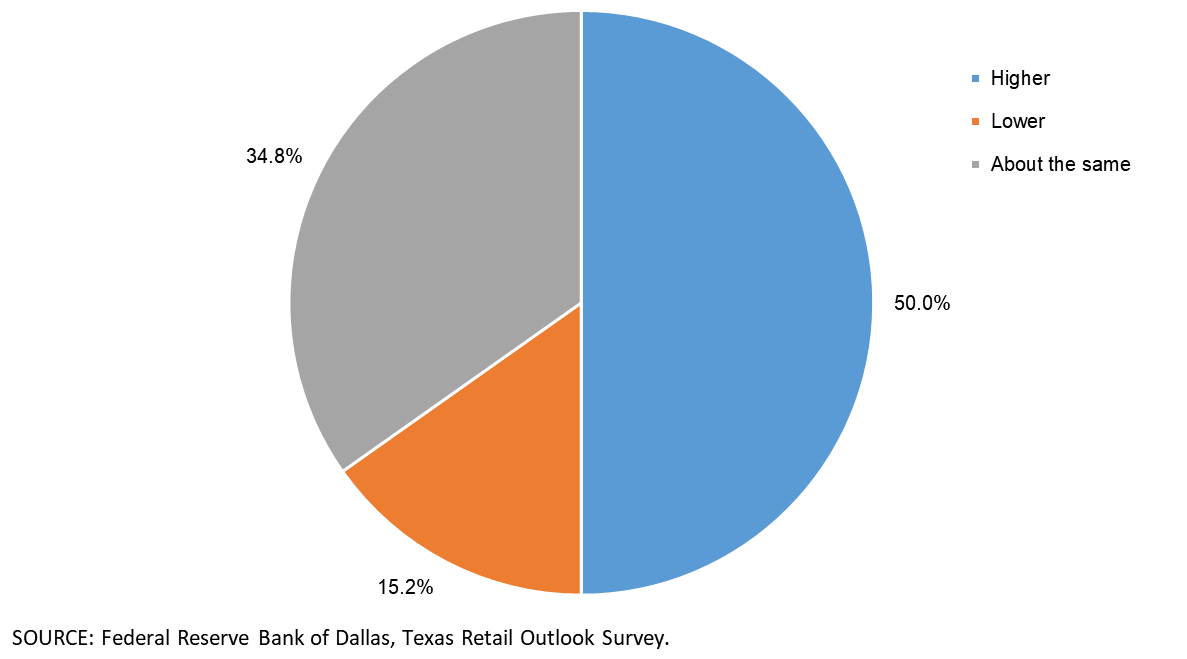

How do you expect your firm’s production, revenue or sales in 2020 to compare with 2019?

| Dec. ’19 (percent) |

|

| Higher | 50.0 |

| Lower | 15.2 |

| About the same | 34.8 |

NOTES: 46 responses.

If you expect higher production, revenue or sales in 2020, why?

These comments have been edited for publication.

Merchant Wholesalers, Durable Goods

- Aggressive selling.

- New customer acquisition in aerospace manufacturing.

- We are going to hire more people and add additional products.

- Overall industry growth and continued market share capture.

Merchant Wholesalers, Nondurable Goods

- We’ve added a new account for 2020.

Motor Vehicle and Parts Dealers

- We expect sales to be flat, revenue up (increase in cost of vehicles) and don’t see anything to suggest our margins will improve. Net profit will be down this year from last, and we don’t anticipate any significant changes in 2020.

- We will have to increase production/revenue/sales in 2020 to overcome losses incurred in 2019. This will have to include volume increases as well as some price increases.

- Inflationary and increased business.

Furniture and Home Furnishings Stores

- Current order file is strong for this time of year.

Building Material and Garden Equipment and Supplies Dealers

- I think people are tired of fighting over politics, and things are getting normal; most business people I know have plenty of cash.

- Revenue should increase in 2019 because of new operations coming online. However, wages and other costs should also increase.

Nonstore Retailers

- Focused sales efforts to gain new customers in all of our Texas markets: Austin, DFW, El Paso, Houston and San Antonio.

If you expect lower production, revenue or sales in 2020, why?

These comments have been edited for publication.

Merchant Wholesalers, Nondurable Goods

- Fewer customers.

Building Material and Garden Equipment and Supplies Dealers

- We’re in the construction industry and are seeing a slowdown in the Florida market.

- Retail competition.

If you expect production, revenue or sales to be about the same in 2020, why?

These comments have been edited for publication.

Merchant Wholesalers, Nondurable Goods

- We still have the uncertainty of political maneuvering in 2020 as an election year.

Motor Vehicle and Parts Dealers

- We see sales volume holding steady but expect a slight increase in our luxury vehicle brands.

Clothing and Clothing Accessories Stores

- We are closing about 60 stores, but we believe our transition to off-price will increase sales at stores that were formerly department stores. The net impact should be about the same sales as the prior year.

Special Questions Comments

These comments have been edited for publication.

Merchant Wholesalers, Durable Goods

- Our China costs have increased with the tariffs, and we are not bound to customer contracts (as a distributor), so we raise our prices and pass the higher costs through.

Motor Vehicle and Parts Dealers

- Our cost prices are not in our control for our purchases from the automakers. The tariffs affect their costs and are passed to us as they go up or down.

- It’s very difficult to determine accurately the cost increases on vehicles due to changes in equipment and options being made standard or being deleted from the standard equipment. In general, new-vehicle manufacturers are using variable incentives to offset price increases as needed.

- We have seen the market for preowned vehicles soften due to increased incentives on new vehicles, especially in leasing.

Questions regarding the Texas Business Outlook Surveys can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest surveys are released on the web.