Special Questions

Special Questions

May 26, 2020

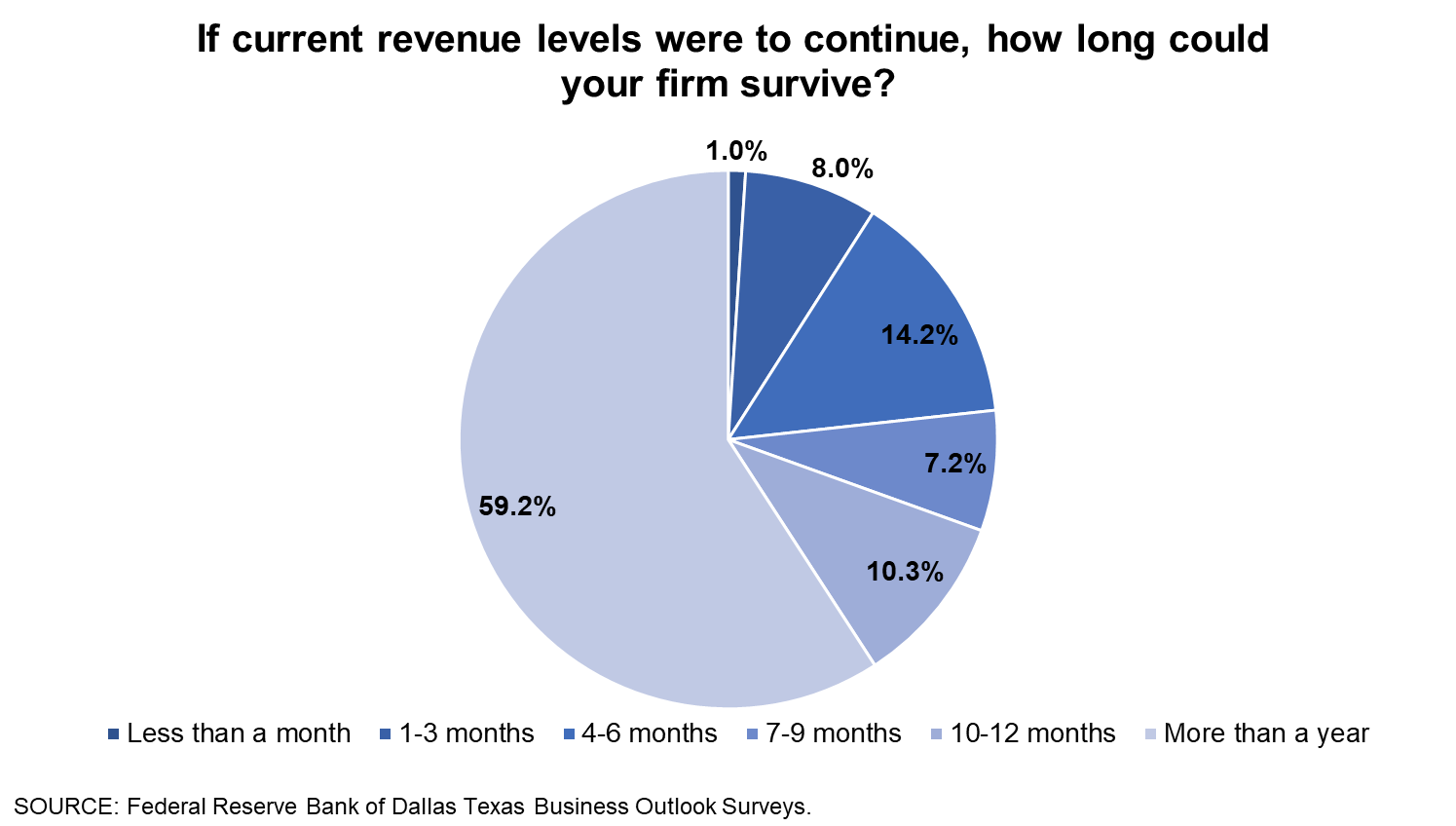

For this month’s survey, Texas business executives were asked supplemental questions on the impacts of COVID-19 and reduced activity in the energy industry as a result of low oil prices. Results below include responses from participants of all three surveys: Texas Manufacturing Outlook Survey, Texas Service Sector Outlook Survey and Texas Retail Outlook Survey.

Texas Business Outlook Surveys

Data were collected May 12–20, and 399 Texas business executives responded to the surveys.

How do your firm’s current revenues compare with a typical May? For example, if revenues are down 20 percent from normal, enter 80 percent. If revenues are up 20 percent, enter 120 percent.

| Share of respondents (percent) |

Average response (percent) |

||

| Entries less than 100 | 81.2 | 59.9 | |

| Entries of exactly 100 | 8.6 | 100.0 | |

| Entries greater than 100 | 10.2 | 161.0 | |

| All entries | 100.0 | 73.7 |

NOTE: 383 responses.

NOTE: 387 responses.

Have you applied for a PPP (Paycheck Protection Program) loan?

| Percent | |||

| Yes | 60.4 | ||

| No | 39.6 |

NOTE: 391 responses.

If you applied for a PPP loan, have you received it?

| Percent | |||

| Yes | 93.1 | ||

| No, but we have been approved | 1.3 | ||

| No, we are awaiting approval | 3.9 | ||

| No, we were denied funding | 1.7 |

NOTES: 233 responses. This question was only posed to those indicating they applied for a PPP loan.

How did receiving the PPP loan benefit your firm? Please select all that apply.

| Percent | |||

| Prevented layoffs and/or furloughs | 77.8 | ||

| Prevented wage reductions | 65.7 | ||

| Helped us pay bills and/or rent | 52.3 | ||

| Allowed for rehiring of workers | 20.8 | ||

| Other | 14.8 |

NOTE: 216 responses. This question was only posed to those indicating they received a PPP loan.

How could the PPP have been more effective in helping your firm?

This question was only posed to those indicating they applied for a PPP loan, and 146 business executives submitted an answer. The most common responses were a longer time frame for spending the money, clearer terms for loan forgiveness, more flexibility in how the money can be spent, and a smoother application and payout process.

Have you taken any of the following steps regarding employment in response to COVID-19? Please select all that apply.

| Percent | |||

| Increased working from home | 68.9 | ||

| Reduced work hours (including cutting overtime) | 43.2 | ||

| Reduced or suspended bonuses | 33.4 | ||

| Paid time off | 23.4 | ||

| Furloughs | 19.8 | ||

| Layoffs | 18.5 | ||

| Reduced wages | 16.7 | ||

| Other | 11.1 | ||

| None | 11.1 |

NOTE: 389 responses.

Have you attempted to recall any laid off/furloughed workers or increase hours among current workers?

| Percent | |||

| Yes | 33.3 | ||

| No | 66.7 |

NOTES: 186 responses. This question was only posed to those indicating they laid off/furloughed workers or reduced work hours.

Were there any impediments to recalling workers or increasing hours? Please select all that apply.

| Percent | |||

| Fear of infection | 60.0 | ||

| Lack of child care | 46.7 | ||

| Generous unemployment benefits | 43.3 | ||

| Other | 6.7 | ||

| None | 30.0 |

NOTES: 60 responses. This question was only posed to those indicating they attempted to recall any laid off/furloughed workers or increase hours among current workers.

Was any part of your business shut down due to state/local operational restrictions?

| Percent | |||

| Yes | 35.1 | ||

| No | 64.9 |

NOTE: 388 responses.

In light of Gov. Abbott’s “Open Texas” plan which took effect May 1, has your business reopened to the maximum allowable level?

| Percent | |||

| Yes | 45.5 | ||

| No | 54.5 |

NOTES: 134 responses. This question was only posed to those indicating any part of their business was shut down.

What will it take for your business to reopen to the maximum allowable level?

This question was only posed to those indicating any part of their business was shut down and had yet to reopen to the maximum allowable level under Gov. Abbott’s “Open Texas” plan. The responses can be found on the individual survey Special Questions results pages, accessible by the tabs above.

Have your firm’s revenues been negatively impacted by reduced activity in the energy industry as a result of low oil prices?

| Percent | |||

| Yes | 48.7 | ||

| No | 51.3 |

NOTE: 382 responses.

Above you note that your May revenues are down from typical levels. Approximately what share of this decline is due to reduced activity in the energy industry as a result of low oil prices?

| Percent | |||

| Less than a quarter | 57.0 | ||

| More than a quarter but less than half | 20.3 | ||

| More than half but less than three-quarters | 10.1 | ||

| More than three-quarters | 12.7 |

NOTES: 158 responses. This question was only posed to those indicating current revenues are down from a typical May and that their firm's revenues have been negatively impacted by reduced activity in the energy industry.

Survey respondents were given the opportunity to provide comments. These comments can be found on the individual survey Special Questions results pages, accessible by the tabs above.

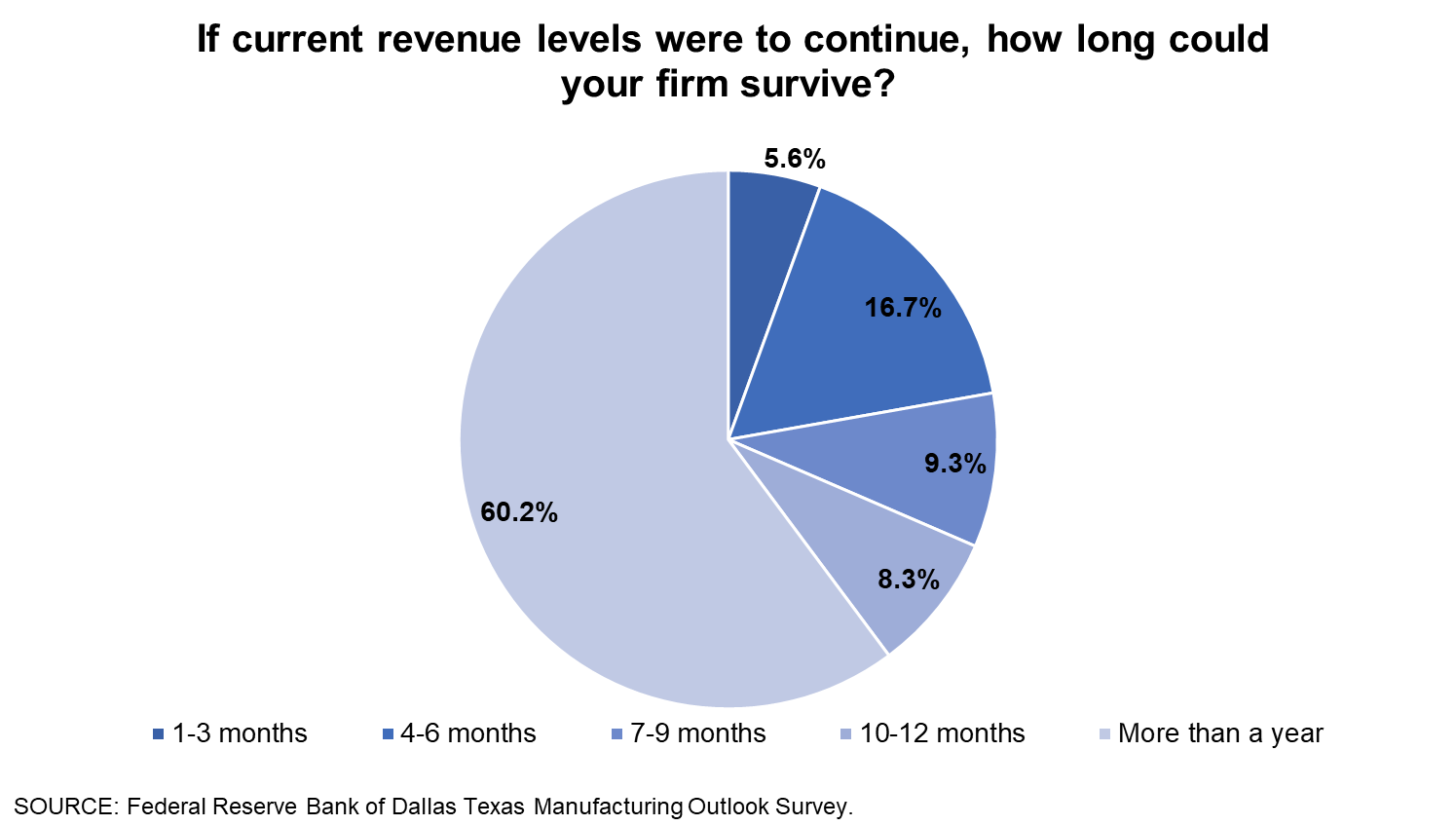

Texas Manufacturing Outlook Survey

Data were collected May 12–20, and 112 Texas manufacturers responded to the survey.

How do your firm’s current revenues compare with a typical May? For example, if revenues are down 20 percent from normal, enter 80 percent. If revenues are up 20 percent, enter 120 percent.

| Share of respondents (percent) |

Average response (percent) |

||

| Entries less than 100 | 78.0 | 60.2 | |

| Entries of exactly 100 | 5.5 | 100.0 | |

| Entries greater than 100 | 16.5 | 120.6 | |

| All entries | 100.0 | 72.3 |

NOTE: 109 responses.

NOTE: 108 responses.

Have you applied for a PPP (Paycheck Protection Program) loan?

| Percent | |||

| Yes | 67.0 | ||

| No | 33.0 |

NOTE: 109 responses.

If you applied for a PPP loan, have you received it?

| Percent | |||

| Yes | 98.6 | ||

| No, but we have been approved | 0.0 | ||

| No, we are awaiting approval | 0.0 | ||

| No, we were denied funding | 1.4 |

NOTES: 73 responses. This question was only posed to those indicating they applied for a PPP loan.

How did receiving the PPP loan benefit your firm? Please select all that apply.

| Percent | |||

| Prevented layoffs and/or furloughs | 83.3 | ||

| Prevented wage reductions | 65.3 | ||

| Helped us pay bills and/or rent | 50.0 | ||

| Allowed for rehiring of workers | 18.1 | ||

| Other | 13.9 |

NOTE: 72 responses. This question was only posed to those indicating they received a PPP loan.

How could the PPP have been more effective in helping your firm?

This question was only posed to those indicating they applied for a PPP loan, and 47 manufacturers submitted an answer. The most common responses were a longer time frame for spending the money, clearer terms for loan forgiveness, more flexibility in how the money can be spent, and a smoother application and payout process.

Have you taken any of the following steps regarding employment in response to COVID-19? Please select all that apply.

| Percent | |||

| Increased working from home | 68.8 | ||

| Reduced work hours (including cutting overtime) | 50.5 | ||

| Paid time off | 32.1 | ||

| Reduced or suspended bonuses | 31.2 | ||

| Layoffs | 17.4 | ||

| Furloughs | 12.8 | ||

| Reduced wages | 12.8 | ||

| Other | 8.3 | ||

| None | 12.8 |

NOTE: 109 responses.

Have you attempted to recall any laid off/furloughed workers or increase hours among current workers?

| Percent | |||

| Yes | 21.1 | ||

| No | 78.9 |

NOTES: 57 responses. This question was only posed to those indicating they laid off/furloughed workers or reduced work hours

Were there any impediments to recalling workers or increasing hours? Please select all that apply.

| Percent | |||

| Fear of infection | 50.0 | ||

| Lack of child care | 41.7 | ||

| Generous unemployment benefits | 33.3 | ||

| Other | 25.0 | ||

| None | 41.7 |

NOTES: 12 responses. This question was only posed to those indicating they attempted to recall any laid off/furloughed workers or increase hours among current workers.

Was any part of your business shut down due to state/local operational restrictions?

| Percent | |||

| Yes | 11.9 | ||

| No | 88.1 |

NOTE: 109 responses.

In light of Gov. Abbott’s “Open Texas” plan which took effect May 1, has your business reopened to the maximum allowable level?

| Percent | |||

| Yes | 61.5 | ||

| No | 38.5 |

NOTES: 13 responses. This question was only posed to those indicating any part of their business was shut down.

What will it take for your business to reopen to the maximum allowable level?

This question was only posed to those indicating any part of their business was shut down and had yet to reopen to the maximum allowable level under Gov. Abbott’s “Open Texas” plan. These comments are from respondents’ completed surveys and have been edited for publication.

- Reopening all functions and restoration of product demand.

- Return of business levels of 2019; it will be a long road back.

- We need our customers to reopen so we have somewhere to send our products and a means of getting paid for them.

- Business must improve. We can’t hire people if we don’t have orders.

- Opening up of all businesses fully—not this partial situation.

- Ramping up to maintain social distance, availability of vendor materials, our dealers fully functioning and retail customers returning to showrooms.

Have your firm’s revenues been negatively impacted by reduced activity in the energy industry as a result of low oil prices?

| Percent | |||

| Yes | 50.5 | ||

| No | 49.5 |

NOTE: 107 responses.

Above you note that your May revenues are down from typical levels. Approximately what share of this decline is due to reduced activity in the energy industry as a result of low oil prices?

| Percent | |||

| Less than a quarter | 36.7 | ||

| More than a quarter but less than half | 22.4 | ||

| More than half but less than three-quarters | 12.2 | ||

| More than three-quarters | 28.6 |

NOTES: 49 responses. This question was only posed to those indicating current revenues are down from a typical May and that their firm's revenues have been negatively impacted by reduced activity in the energy industry.

Special Questions Comments

These comments have been edited for publication.

Chemical Manufacturing

- We are operating at minimum rates due to low demand. Our products eventually go into automobiles and electrical infrastructure, and much of our production is exported.

Plastics and Rubber Product Manufacturing

- Oil prices are greatly impacting overall revenue. The worldwide rig count is down 38 percent vs. this time last year. Domestically, the U.S. rig count is down 62 percent overall. WTI [West Texas Intermediate oil] is hovering around $25–30 a barrel. Breakeven for most producers is around $40 per barrel. Until oil can stabilize at $40 per barrel, production will remain at a standstill. What we need is the easing of stay-at-home restrictions. As more people get back on the road, demand will increase and drillers will be able to begin producing again as oil stabilizes.

Nonmetallic Mineral Product Manufacturing

- It is too soon to see the impact of lower oil prices. This will likely occur as state tax revenues decline and highway projects get delayed or canceled due to lack of funding next year.

- Regarding the energy industry, the impact has not been felt yet. But it will be, and soon.

- A portion of our product line goes to the oilfield exploration/drilling area. With the drop on oil prices, this demand has decreased considerably, although we have been receiving a small number of orders in the past couple of weeks from smaller firms in this segment.

Primary Metal Manufacturing

- Demand for our products is way off.

Fabricated Metal Manufacturing

- We service commercial aircraft, and that business will be in for a long recovery period for many reasons.

- The construction industry is being primarily driven by retail customers in the second quarter. The increase is fairly significant.

- We have one customer in the drilling industry, and their purchases from us are down 50 percent. They also asked for longer terms and a reduction in prices.

- Energy will get worse before it gets better, especially the Permian. Many small to midsize customers are laying off and closing.

Machinery Manufacturing

- With oil prices falling, our customers have suspended projects, reduced budgets, or pushed out delivery dates into 2021. We need stability and confidence in oil prices so customers and banks will fund projects and order our products.

- We were much more affected by the energy crash than COVID-19. That is common with most energy-related business, especially in the Permian Basin.

- It’s really the combination of COVID-19 and weak oil prices that caused the downturn. Once demand evaporated, who’s to say what came first and why.

- We are in trouble and we need to end all foreign aid, shut China off completely, ramp up domestic manufacturing on a World War II scale and get this country moving again.

Computer and Electronic Product Manufacturing

- Oil prices have reduced some activity, but COVID-19 has impaired the ability of companies to operate (even essential ones), which has delayed the ability of our customers to increase sales. Plants have delayed purchasing or gone to minimal shifts, reducing the demand for products from some of our customers. We believe this is temporary (even though oil prices will be lower for a while). In short, I would say that oil wasn’t helping, but the virus response prolongs and exaggerates the impact.

- We have reduced work hour demands in order to minimize pressure on employees to come to work. This allows those more sensitive or susceptible (due to age) to take off without worry. This has reduced our shipments, primarily due to the lower manufacturing hours applied. Most of our employees are back at work operating under the new precautions we have in place.

- In early March, we reduced salaries by 12 percent. Since that time, we have reinstated salaries to the pre-March-reduction level. We remain optimistic that we can continue at these levels for a few months; however, we will need business to turn back to normal in the fourth quarter of this year.

Transportation Equipment Manufacturing

- We have a long lead time and a production backlog that was over nine months in February, so current revenues have not seen a significant decline, aside from March, since we are building orders that came in 2019. However, we have seen a sharp decline in new orders, so we are anticipating a significant reduction in our 2021 forecast.

- Low energy prices are a plus.

Food Manufacturing

- We are extremely fortunate relative to other businesses.

Wood Product Manufacturing

- We’re not sure what will happen with homebuilders. We are concerned there may be a major reduction in the amount of homes being built. Texas is better than other states, with more people moving here.

Paper Manufacturing

- Running 30 percent off in manufacturing means running a pretty big loss each month. The PPP [Paycheck Protection Program] has helped for at least eight weeks.

- My concern for the near term and the long run is just the unknown. To this point in time, my business has been negatively affected, but not to the extent that I feared it might be.

Miscellaneous Manufacturing

- Our revenues are down 50 percent, predominately due to the automotive shutdown. Our other market sectors, which are varied, are also down, but not to the extent that automotive is down. Even during the Great Recession, our automotive business never completely stopped like it has due to the pandemic.

- If the shutdown continues any longer, we will have permanent 20–30 percent wage reductions across the board.

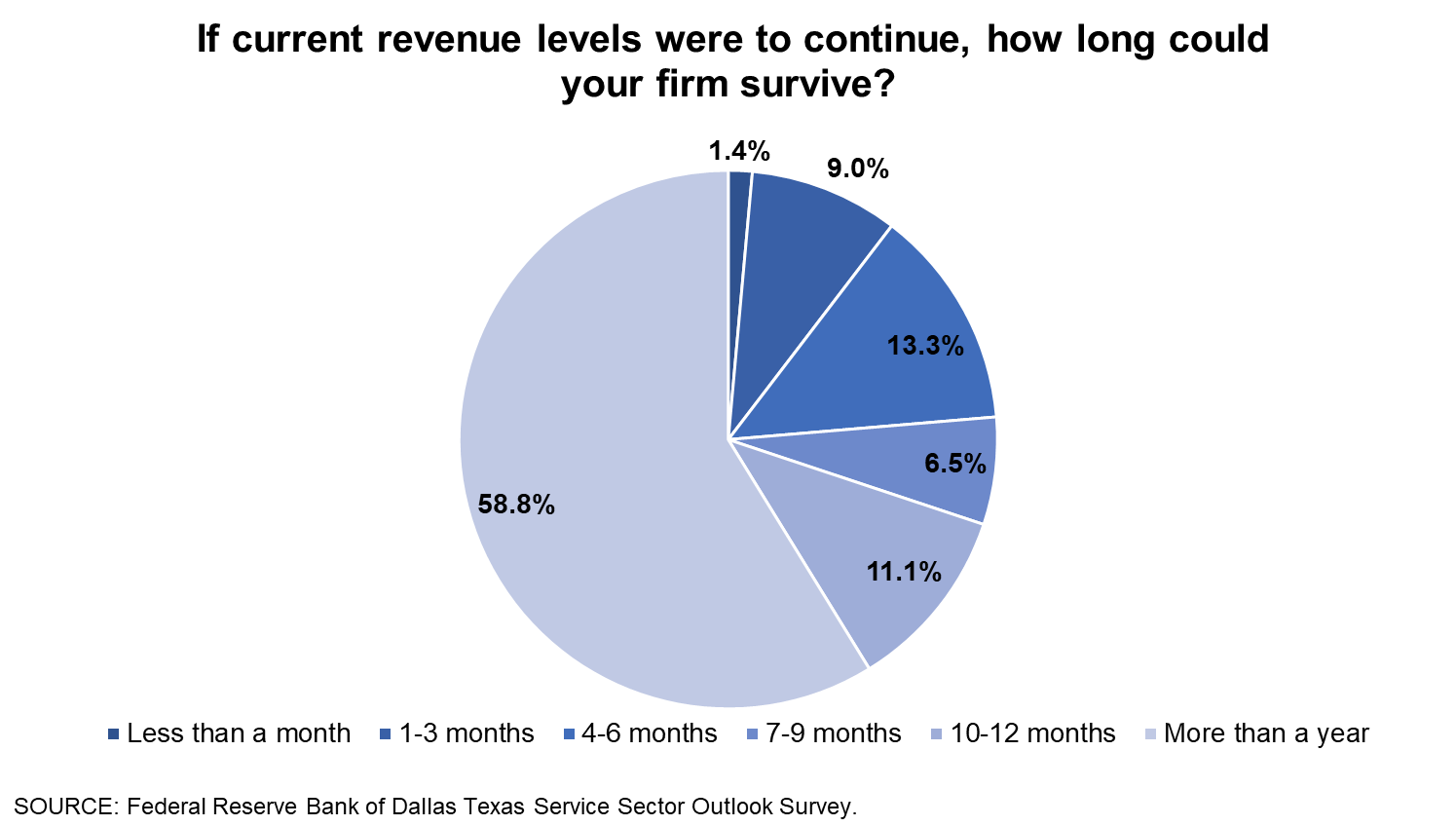

Texas Service Sector Outlook Survey

Data were collected May 12–20, and 287 Texas business executives responded to the survey.

How do your firm’s current revenues compare with a typical May? For example, if revenues are down 20 percent from normal, enter 80 percent. If revenues are up 20 percent, enter 120 percent.

| Share of respondents (percent) |

Average response (percent) |

||

| Entries less than 100 | 82.5 | 59.9 | |

| Entries of exactly 100 | 9.9 | 100.0 | |

| Entries greater than 100 | 7.7 | 195.6 | |

| All entries | 100.0 | 74.2 |

NOTE: 274 responses.

NOTE. 279 responses.

Have you applied for a PPP (Paycheck Protection Program) loan?

| Percent | |||

| Yes | 57.8 | ||

| No | 42.2 |

NOTE: 282 responses.

If you applied for a PPP loan, have you received it?

| Percent | |||

| Yes | 90.6 | ||

| No, but we have been approved | 1.9 | ||

| No, we are awaiting approval | 5.6 | ||

| No, we were denied funding | 1.9 |

NOTES: 160 responses. This question was only posed to those indicating they applied for a PPP loan.

How did receiving the PPP loan benefit your firm? Please select all that apply.

| Percent | |||

| Prevented layoffs and/or furloughs | 75.0 | ||

| Prevented wage reductions | 66.0 | ||

| Helped us pay bills and/or rent | 53.5 | ||

| Allowed for rehiring of workers | 22.2 | ||

| Other | 15.3 |

NOTE: 144 responses. This question was only posed to those indicating they received a PPP loan.

How could the PPP have been more effective in helping your firm?

This question was only posed to those indicating they applied for a PPP loan, and 99 business executives submitted an answer. The most common responses were a longer time frame for spending the money, clearer terms for loan forgiveness, more flexibility in how the money can be spent, and a smoother application and payout process.

Have you taken any of the following steps regarding employment in response to COVID-19? Please select all that apply.

| Percent | |||

| Increased working from home | 68.9 | ||

| Reduced work hours (including cutting overtime) | 40.4 | ||

| Reduced or suspended bonuses | 34.3 | ||

| Furloughs | 22.5 | ||

| Paid time off | 20.0 | ||

| Layoffs | 18.9 | ||

| Reduced wages | 18.2 | ||

| Other | 12.1 | ||

| None | 10.4 |

NOTE: 280 responses.

Have you attempted to recall any laid off/furloughed workers or increase hours among current workers?

| Percent | |||

| Yes | 38.8 | ||

| No | 61.2 |

NOTES: 129 responses. This question was only posed to those indicating they laid off/furloughed workers or reduced work hours.

Were there any impediments to recalling workers or increasing hours? Please select all that apply.

| Percent | |||

| Fear of infection | 62.5 | ||

| Lack of child care | 47.9 | ||

| Generous unemployment benefits | 45.8 | ||

| Other | 2.1 | ||

| None | 27.1 |

NOTES: 48 responses. This question was only posed to those indicating they attempted to recall any laid off/furloughed workers or increase hours among current workers.

Was any part of your business shut down due to state/local operational restrictions?

| Percent | |||

| Yes | 44.1 | ||

| No | 55.9 |

NOTE: 279 responses.

In light of Gov. Abbott’s “Open Texas” plan which took effect May 1, has your business reopened to the maximum allowable level?

| Percent | |||

| Yes | 43.8 | ||

| No | 56.2 |

NOTES: 121 responses. This question was only posed to those indicating any part of their business was shut down.

What will it take for your business to reopen to the maximum allowable level?

This question was only posed to those indicating any part of their business was shut down and had yet to reopen to the maximum allowable level under Gov. Abbott’s “Open Texas” plan. These comments are from respondents’ completed surveys and have been edited for publication.

Increased business activity

- Increased sales.

- Have all businesses open up.

- Demand for product.

- Customer orders.

- Being open and having pre-COVID volume are two very different things. More openings require significant financial commitment, which is not backed by revenue.

- Call volume and interest in our product are very high; however, there is a reluctance to move forward. It will take a big increase in overall consumer confidence to make a difference.

- The energy sector recovering enough to need consulting services.

- Full reopening of all other businesses in the community.

- Consumer confidence.

- Reduction in social distancing guidelines.

- Allowable gatherings with no limitations.

- Travel and the relaxation of limitations on gatherings.

- Lifting of the national order not to travel. We also need the airlines to increase their schedules.

- Continuation of businesses opening and virus leveling (and not an increase in cases).

Increased occupancy allowance

- We need more than 75 percent of the seating capacity opened. And no spikes in COVID-19 counts after reopening.

- One-hundred percent occupancy.

- Social distancing, constant sanitation and percent of occupancy are not practical.

- Running a restaurant/private club is not feasible at 25 percent capacity. In addition, the steps that are needed to ensure our employees and members/guests are healthy are huge. Our plans are to open on June 1 as long as the capacity is increased to 50 percent and there is not a spike in new cases. We are continuing to do takeout, which has been good.

- Opening fully to allow in-person conferences and courtroom hearings.

More guidance and/or preparations for reopening safely

- Knowing how to open a public entertainment facility while being safe for staff and the public. There may be an “Open Texas” plan, but it came without guidance or particulars on practical application.

- Clear and consistent guidelines.

- Safety measures for assembling students again.

- Cleaning protocols in place and social distancing formalized in the office.

- We will start on May 18 with a test run in our Dallas office. Once we have all protocols down and working well, we will increase the allowed in-office participation to the amount permitted under government orders and then extend to other offices/locations when permitted.

- Honest information from government instead of partisan statements to gain favor.

- Facility renovations and reconfiguration of staff work space. Access to adequate cleaning supplies. Additional technology to support increased remote service delivery. Security and possible contracted staff to conduct customer and staff prescreening prior to facility entry.

- Planning and equipping offices for the return of workers.

- Getting a better grip of COVID-19 by state and local officials. They’re guessing due to pressure from voters, who will be the first to point the finger right back at our governor or mayor if anything goes wrong.

- Obtain equipment for noninvasive temperature taking and other items to comply with Texas Health and Human Services guidelines.

Favorable virus developments and/or employees feeling safe

- Testing, demonstrated successful treatment, more serious voluntary compliance with social distancing and/or mask-wearing in public settings, and a vaccine. I hate to have a glass-half-empty view, but I am fairly certain we will see a second wave of infections. I am not sure the public in general is cognizant of that possibility.

- Widespread testing; effective treatments.

- Ninety-five percent of employees are working from home. I will not open until we are assured that the pandemic is under control and that a vaccine will be available.

- The pandemic has not reached levels acceptable to ensure the safety of workers. [Texas] Gov. Abbott has not followed the CDC [Centers for Disease Control] nor scientific facts.

- Communitywide success with the reopening, with no meaningful spike in COVID cases.

- Continued reduction with hospitalization rates, improvement with consumer travel confidence, and clarity with a reopening timeline.

- Staff feeling safe in their environment.

- Employees feeling comfortable returning to a high-rise office shared with other firms.

- We are waiting for it to be safe for our employees. That will require a vaccine and/or effective treatment.

- Child care and employee confidence in safety measures.

- Adequate testing to ensure that staff in our office can keep from being infected by other employees; extremely effective treatments and/or an effective vaccine.

More time

- Another three weeks.

- Phase 3 [of the reopening].

- Time, reduction in COVID cases and continued reassessment of personal space needed. Also, obtaining necessary PPE [personal protection equipment] to operate.

- Time.

- Time and money.

- We will open the lobbies beginning May 18, with full staff practicing all recommended precautions.

- Should be to maximum [level of reopening] in June.

Other

- At this point, nothing. It can’t happen. No events, catering, etc. We have no intention of trying to pack our restaurant at this time.

- Depends on our clients and their states.

- As an acute-care hospital, we will continue to limit elective procedures until we are confident that we can handle a full load while caring for COVID-19 patients as needed.

Have your firm’s revenues been negatively impacted by reduced activity in the energy industry as a result of low oil prices?

| Percent | |||

| Yes | 48.0 | ||

| No | 52.0 |

NOTE: 275 responses.

Above you note that your May revenues are down from typical levels. Approximately what share of this decline is due to reduced activity in the energy industry as a result of low oil prices?

| Percent | |||

| Less than a quarter | 66.1 | ||

| More than a quarter but less than half | 19.3 | ||

| More than half but less than three-quarters | 9.2 | ||

| More than three-quarters | 5.5 |

NOTES: 109 responses. This question was only posed to those indicating current revenues are down from a typical May and that their firm's revenues have been negatively impacted by reduced activity in the energy industry.

Special Questions Comments

These comments have been edited for publication.

Utilities

- It's difficult to delineate between [demand declines due to] COVID-19 and low oil prices at this point in time. We should know more over the next few months.

Specialty Trade Contractors

- We are counting on [the Federal Reserve] to do the right thing as [they] have done in the past. We have 100 percent trust in the decisions [they] make and want to make sure [they] continue to do the right actions regardless of the politics that can sway things one way or the other.

Air Transportation

- The effect [of COVID-19] has been catastrophic—unprecedented in aviation history.

Truck Transportation

- We're a truck repair shop. We've seen a greatly reduced number of trucks running because no one is making things to be hauled. We need America to get back to work so there is something for trucks to haul.

Support Activities for Transportation

- We are uncertain what percent of revenues are attributed to the energy industry. As a trucking company, we are seeing energy companies with trucks trying to move into other segments of transportation, increasing available capacity and decreasing rates.

Warehousing and Storage

- We're in a bit of an odd position. Because of the tremendous growth in the second half of 2019, even in this depressed state, we are well above any previous May. We are roughly 20 percent off our highs set in March, however, and we expect that to worsen to perhaps 35 percent off of our highs over the next several months. We have not taken any employee actions at this time, other than a freeze on future hiring.

Data Processing, Hosting and Related Services

- Ours is a recurring-revenue technology business.

Credit Intermediation and Related Activities

- Primarily in the service sector either by individuals being laid off or the companies dependent on the oil-industry activity. The suspension of UIL [University Interscholastic League] athletic activities and schools has had an impact on some businesses.

- We expect to see some of our customers negatively impacted by the energy industry. Normal slowdowns in the energy sector hit us about six months after the slowdown.

Insurance Carriers and Related Activities

- Our business was essential, by definition, and so we worked from home and continued pretty much unchanged. But, we will have numerous clients whose insurance is based on payrolls or receipts, and their year-end insurance audit will be negative or lower.

Real Estate

- The drop in oil prices has affected the real estate industry because many are not buying homes now because of loss of jobs or loss of income from oil wells.

- Projected energy job losses will generate a significant headwind for us for the next 18 months.

Rental and Leasing Services

- An oil bust such as what we have in the Permian Basin greatly reduces the business in my four stores that serve that market. Those stores are down through April by over 25 percent, and the bust really didn't kick the door open until April. We will not feel the impact of the bust as much in North Texas or Central Texas, but West Texas and South Texas are already significantly being impacted. We suspect those stores that serve oil will be down 30 to 50 percent this year. This hurts our equipment rental business the most, then whole good sales. Usually, parts and service will be flat or up as people try to keep what they have running.

Professional, Scientific and Technical Services

- At present we are holding our own. Volatility in energy can actually impact us favorably as our clients scramble to adapt. Longer term our views are less certain. We will continue to watch and adapt as best we can.

- Collections have been good so far, but we are starting to see a slowdown that will impact revenue in the months ahead. The pipeline of deals has slowed, especially in real estate and finance.

- Overall, energy-related revenue may be down, but increases in related restructuring work may totally offset it.

- Since we are a software technology company, most of our employees can work from home, and we are less affected by the COVID-19 shutdown. But, our revenue is getting affected as our buyers are mid-size and large companies in the United States, the European Union, and Asia.

- Our strong year-to-year growth relates to business already under contract pre-COVID-19. Engineering services tend to lag behind overall economic downturns (historically 12–18 months but uncertain for current conditions). Delayed bond elections, voter sentiments for future bond elections and state and local funding in 2021 and 2022 could have a material impact on our future work.

- Multiple-person workshops are not considered viable by my clients with social distancing. Online has not been tried but has been suggested.

- We service the retail grocery industry, which has been navigating increased activity and demand with limited resources. Overall activity for us has increased, but pressures on cash have restricted revenue collection.

- We have fewer leads, but the leads we have are more serious about doing business—fewer tire kickers.

Administrative and Support Services

- As an entrepreneur, I am used to drastic changes, but this one is completely out of my hands. I see retirement in my future, but my employees worry me tremendously. So, I will keep working until I can afford it [retirement].

- Due to a large backlog that was generated off of fourth quarter 2019 and the first two months of 2020, the short term is OK. The main concern is that new contracts are only selling at 30 percent of normal. Once the backlog is gone, the current sales pace will not fill the void.

- Lack of energy demand and the resulting drop in prices will have a more lasting impact on the local economy than COVID-19.

- We have not applied [for the Paycheck Protection Program (PPP)] because we are not yet eligible as a government agent tourism office. That may change with [Coronavirus Aid, Relief and Economic Security (CARES) Act Phase Four]; however, in Texas, government agencies can't get loans without going through the AG's [attorney general’s] office (two-month process, minimum), so it still may not be an option for us.

- First, we would have not been able to stay in business without PPP. We had already supplemented two payrolls because of reduced revenues. The uncertainties of how long this would last would have kept us from investing more into the business. We still are concerned that this could last longer than the PPP; although activity is increasing, any [virus] resurgence could be detrimental.

- This is very disruptive to a solid business environment. We need to get people back to work. The initial slowing of the spread worked, and now since the hospitals are prepared, we need to move forward and manage the risk like all the other risks we face daily.

- The oil industry provides many high-end clients who are now on the sidelines of travel.

Educational Services

- Current revenues have not been impacted by oil prices, but future revenues will be since the state provides 23 percent of our funding. They have asked us to plan for 5 to 10 percent cuts to this funding source beginning Sept. 1 or sooner.

Ambulatory Health Care Services

- We focus on cosmetic dentistry, which is discretionary and requires larger expenditures; most folks borrow or use credit to pay. Internet searches for cosmetic dentistry and the number of requests for a smile consult we receive are actually leading indicators of the consumer confidence indices. Since most have to borrow, if they're concerned about current/future employment, they postpone searches for our primary service.

Hospitals

- We expect to see a lag in activity reduction as workers lose their insurance coverage and/or relocate.

Nursing and Residential Care Facilities

- We must continue to take care of our 10,000+ senior residents, so we cannot reduce our number of employees or their work hours. While we are doing what we can to "reopen" where possible, the need to restrict access to nonessential visitors continues and is expected to continue for at least a few more months. Our revenues have decreased, our expenses have increased and, therefore, our liquidity is suffering. We desperately need widespread testing of our residents and employees so that we can be aware of the level of risk present in our buildings. We also need PPE [personal protective equipment] to be provided to us free of charge like it has been to traditional health care companies. We are investigating whether a PPP loan under the alternative-size requirements might be available to us.

Social Assistance

- Our placement rate has been negatively impacted as a result of the low oil prices.

Amusement, Gambling and Recreation Industries

- We operate an amusement park, so are completely shut down, both in seasonal employment and the ability to open for customers.

Accommodation

- Our locations in West Texas have been negatively impacted, as work slowed or stopped—less business activity, less demand for lodging.

Food Services and Drinking Places

- People are afraid to come out and eat. Coming out to eat is not a good experience with nothing on tables and no one there. It has cost us to reopen our dining rooms. We are better off with them closed until all is back to normal, if we ever get there.

Religious, Grantmaking, Civic, Professional and Similar Organizations

- Our service area covers Wichita Falls and surrounding counties (we are headquartered in Dallas). The contraction in spending there is remarkable, almost like a temperature change. People there are truly scared of the future.

- The only industry we serve is the oil and gas industry. The combination of COVID-19 and low oil prices has essentially destroyed our business model.

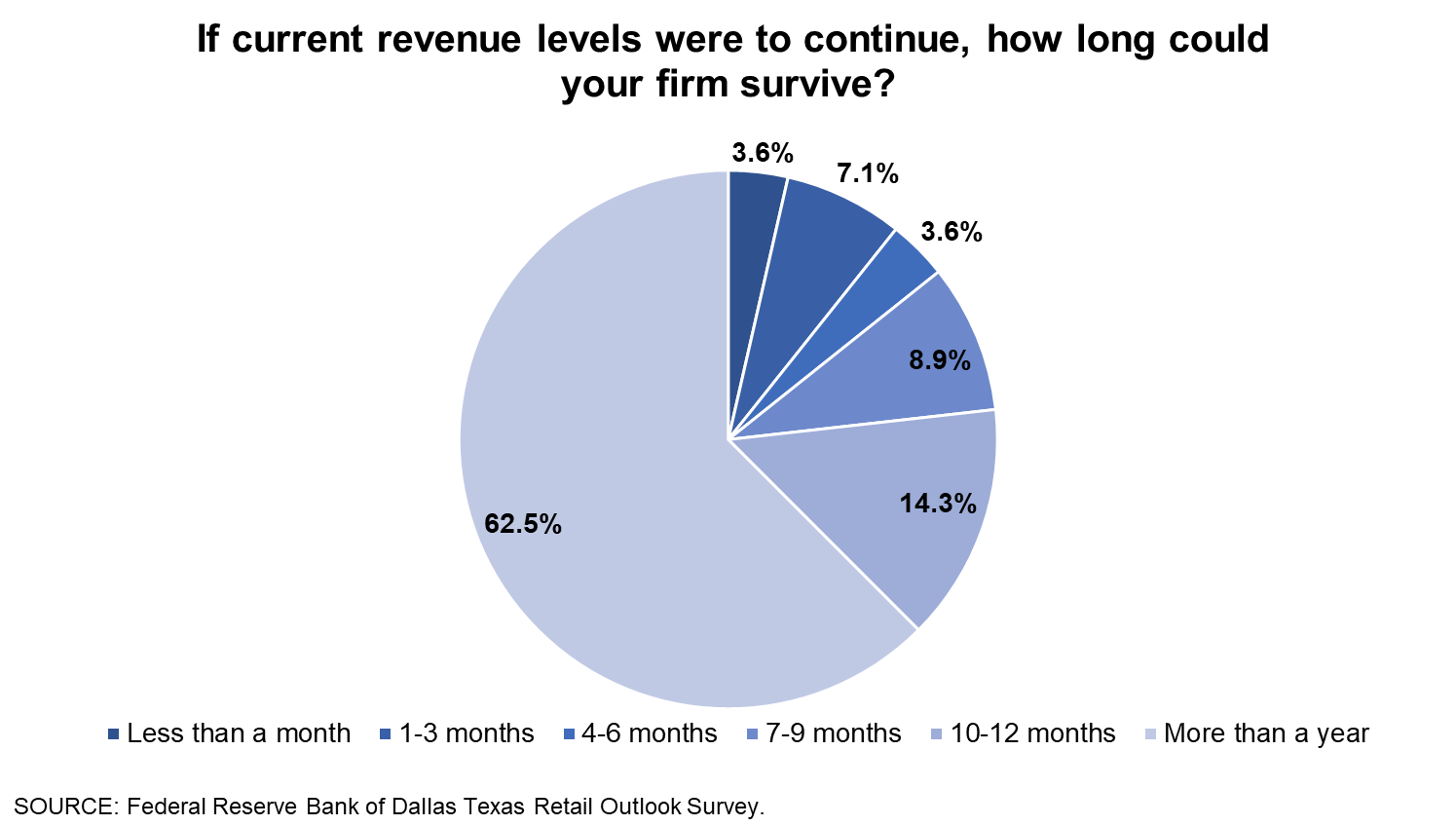

Texas Retail Outlook Survey

Data were collected May 12–20, and 57 Texas retailers responded to the survey.

How do your firm’s current revenues compare with a typical May? For example, if revenues are down 20 percent from normal, enter 80 percent. If revenues are up 20 percent, enter 120 percent.

| Share of respondents (percent) |

Average response (percent) |

||

| Entries less than 100 | 90.7 | 63.3 | |

| Entries of exactly 100 | 7.4 | 100.0 | |

| Entries greater than 100 | 1.9 | 120.0 | |

| All entries | 100.0 | 67.1 |

NOTE: 54 responses.

NOTE. 56 responses.

Have you applied for a PPP (Paycheck Protection Program) loan?

| Percent | |||

| Yes | 67.9 | ||

| No | 32.1 |

NOTE: 56 responses.

If you applied for a PPP loan, have you received it?

| Percent | |||

| Yes | 97.3 | ||

| No, but we have been approved | 0.0 | ||

| No, we are awaiting approval | 2.7 | ||

| No, we were denied funding | 0.0 |

NOTES: 37 responses. This question was only posed to those indicating they applied for a PPP loan.

How did receiving the PPP loan benefit your firm? Please select all that apply.

| Percent | |||

| Prevented layoffs and/or furloughs | 80.6 | ||

| Prevented wage reductions | 69.4 | ||

| Helped us pay bills and/or rent | 58.3 | ||

| Allowed for rehiring of workers | 22.2 | ||

| Other | 13.9 |

NOTE: 36 responses. This question was only posed to those indicating they received a PPP loan.

How could the PPP have been more effective in helping your firm?

This question was only posed to those indicating they applied for a PPP loan, and 20 retailers submitted an answer. The most common responses were a longer time frame for spending the money, clearer terms for loan forgiveness, more flexibility in how the money can be spent, and a smoother application and payout process.

Have you taken any of the following steps regarding employment in response to COVID-19? Please select all that apply.

| Percent | |||

| Increased working from home | 58.9 | ||

| Reduced work hours (including cutting overtime) | 53.6 | ||

| Reduced or suspended bonuses | 32.1 | ||

| Furloughs | 26.8 | ||

| Paid time off | 26.8 | ||

| Layoffs | 21.4 | ||

| Reduced wages | 21.4 | ||

| Other | 7.1 | ||

| None | 12.5 |

NOTE: 56 responses.

Have you attempted to recall any laid off/furloughed workers or increase hours among current workers?

| Percent | |||

| Yes | 51.5 | ||

| No | 48.5 |

NOTES: 33 responses. This question was only posed to those indicating they laid off/furloughed workers or reduced work hours.

Were there any impediments to recalling workers or increasing hours? Please select all that apply.

| Percent | |||

| Fear of infection | 53.3 | ||

| Lack of child care | 33.3 | ||

| Generous unemployment benefits | 26.7 | ||

| Other | 0.0 | ||

| None | 26.7 |

NOTES: 15 responses. This question was only posed to those indicating they attempted to recall any laid off/furloughed workers or increase hours among current workers.

Was any part of your business shut down due to state/local operational restrictions?

| Percent | |||

| Yes | 38.2 | ||

| No | 61.8 |

NOTE: 55 responses.

In light of Gov. Abbott’s “Open Texas” plan which took effect May 1, has your business reopened to the maximum allowable level?

| Percent | |||

| Yes | 70.0 | ||

| No | 30.0 |

NOTES: 20 responses. This question was only posed to those indicating any part of their business was shut down.

What will it take for your business to reopen to the maximum allowable level?

This question was only posed to those indicating any part of their business was shut down and had yet to reopen to the maximum allowable level under Gov. Abbott’s “Open Texas” plan. These comments are from respondents’ completed surveys and have been edited for publication.

- Customers will have to reopen [their businesses] to the maximum level first.

- We could do so tomorrow but are planning to wait until June 1. We want to see testing results peak and then decline before resuming normal operations. We are not missing a beat as we have 90 full-time employees (40 percent of our workforce) working from home, which started mid-March.

- Internal planning.

- Our primary customers are restaurants. When they are allowed to reopen close to 100 percent, we’ll be able to justify incurring expenses associated with fully “reopening” our business. We can’t do so until we are at roughly 80 percent of pre-COVID-19 revenue levels for a sustained period of time—i.e., 45–60 days—to ensure it is a real revenue increase versus a one-time restocking of the supply chain that proves to not be sustainable.

- Easing of restrictions from customers and fewer infections.

- As a vending company, many of our customers have not fully returned to work or have remained closed. Those that reopen may have much of their workforce working remotely now. Our business relies significantly on head count within a business to establish that business as a customer. Otherwise, the account is not profitable. Either we need things to return fully to the way they were or we need to aggressively sell our services to obtain new customers.

- Not sure, but additional testing and a drop in the daily levels would help.

Have your firm’s revenues been negatively impacted by reduced activity in the energy industry as a result of low oil prices?

| Percent | |||

| Yes | 61.1 | ||

| No | 38.9 |

NOTE: 54 responses.

Above you note that your May revenues are down from typical levels. Approximately what share of this decline is due to reduced activity in the energy industry as a result of low oil prices?

| Percent | |||

| Less than a quarter | 67.7 | ||

| More than a quarter but less than half | 16.1 | ||

| More than half but less than three-quarters | 9.7 | ||

| More than three-quarters | 6.5 |

NOTES: 31 responses. This question was only posed to those indicating current revenues are down from a typical May and that their firm's revenues have been negatively impacted by reduced activity in the energy industry.

Special Questions Comments

Merchant Wholesalers, Durable Goods

- We are impacted by energy, with less capital for investments.

- The federal unemployment benefits are hindering workers from wanting to go back. Why work when you make more at home?

Motor Vehicle and Parts Dealers

- Our business is in Houston. Most of the large energy company layoffs occurred in May, therefore, we expect significant decline in revenue for the remainder of this year.

- We have been hit with a tremendous drop in used car prices in April and are seeing some small rebound in May. We will not see full recovery for a while, and this will have a negative impact on new-car business. [There is] a lot of uncertainty around rental car companies dumping their rental fleet into the already-soft used car market.

Building Material and Garden Equipment and Supplies Dealers

- [Declining] oil revenues have reduced dividend and royalty checks to our customers who spend in our store.

- We need to get everyone back to work.

Nonstore Retailers

- We have one warehouse in Houston, and I'm sure a portion of lost business is associated with reduced energy activity, but I'd say it's less than 5 percent.

Questions regarding the Texas Business Outlook Surveys can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest surveys are released on the web.