Special Questions

Special Questions

Texas Business Outlook Surveys

Data were collected June 15–23, and 382 Texas business executives responded to the surveys.

| Feb '21 (percent) |

June '21 (percent) |

|

| Yes | 35.5 | 61.0 |

| No | 64.5 | 39.0 |

NOTE: 377 responses.

| June '21 (percent) |

|

| Improved significantly | 2.2 |

| Improved slightly | 16.6 |

| No change | 21.4 |

| Worsened slightly | 41.0 |

| Worsened significantly | 18.8 |

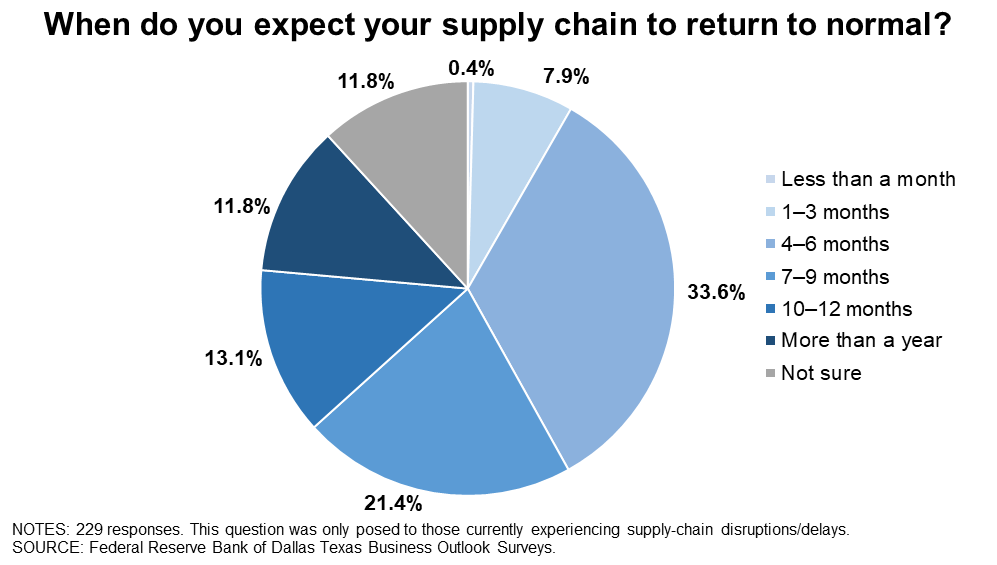

NOTES: 229 responses. This question was posed only to those who are experiencing supply-chain disruptions or delays.

| June '21 (percent) |

|

| Yes | 60.3 |

| No | 39.7 |

NOTE: 378 responses.

| Apr. '21 (percent) |

June '21 (percent) |

|

| Lack of available applicants/no applicants | 66.7 | 70.4 |

| Generous unemployment benefits | 47.7 | 47.3 |

| Workers looking for more pay than is offered | 33.8 | 42.5 |

| Lack of technical competencies (hard skills) | 41.2 | 37.2 |

| Lack of experience | 38.4 | 30.1 |

| Lack of workplace competencies (soft skills) | 26.9 | 27.0 |

| Inability to pass drug test and/or background check | 19.9 | 21.7 |

| Lack of child care | 11.6 | 13.3 |

| Fear of COVID-19 infection | 8.3 | 8.4 |

| Other | 10.6 | 6.2 |

| None | 9.7 | 5.3 |

NOTES: 226 responses. This question was posed only to those who are currently trying to hire or recall workers.

| June '21 (percent) |

|

| Improved significantly | 0.0 |

| Improved slightly | 17.0 |

| No change | 47.8 |

| Worsened slightly | 20.1 |

| Worsened significantly | 15.1 |

NOTES: 159 responses. This question was only posed to those noting a lack of available applicants/no applicants.

Survey respondents were given the opportunity to provide comments. These comments can be found on the individual survey Special Questions results pages, accessible by the tabs above.

Texas Manufacturing Outlook Survey

Data were collected June 15–23, and 103 Texas manufacturers responded to the survey.

| Feb '21 (percent) |

June '21 (percent) |

|

| Yes | 61.8 | 86.1 |

| No | 38.2 | 13.9 |

NOTE: 101 responses.

| June '21 (percent) |

|

| Improved significantly | 2.3 |

| Improved slightly | 11.5 |

| No change | 23.0 |

| Worsened slightly | 43.7 |

| Worsened significantly | 19.5 |

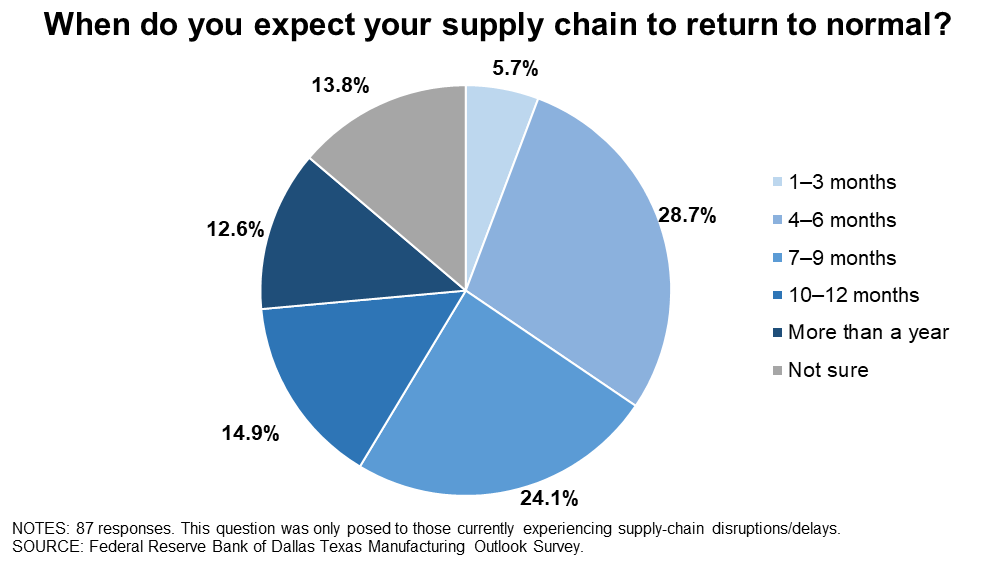

NOTES: 87 responses. This question was posed only to those who are experiencing supply-chain disruptions or delays.

| June '21 (percent) |

|

| Yes | 69.3 |

| No | 30.7 |

NOTE: 101 responses.

| Apr. '21 (percent) |

June '21 (percent) |

|

| Lack of available applicants/no applicants | 75.7 | 77.1 |

| Generous unemployment benefits | 60.0 | 55.7 |

| Workers looking for more pay than is offered | 32.9 | 47.1 |

| Lack of technical competencies (hard skills) | 51.4 | 42.9 |

| Lack of experience | 42.9 | 35.7 |

| Lack of workplace competencies (soft skills) | 32.9 | 30.0 |

| Inability to pass drug test and/or background check | 30.0 | 28.6 |

| Lack of child care | 8.6 | 11.4 |

| Fear of COVID-19 infection | 2.9 | 4.3 |

| Other | 10.0 | 5.7 |

| None | 4.3 | 1.4 |

NOTES: 70 responses. This question was posed only to those who are currently trying to hire or recall workers.

| June '21 (percent) |

|

| Improved significantly | 0.0 |

| Improved slightly | 13.0 |

| No change | 44.4 |

| Worsened slightly | 24.1 |

| Worsened significantly | 18.5 |

NOTES: 54 responses. This question was only posed to those noting a lack of available applicants/no applicants.

Special Questions Comments

These comments have been edited for publication.

- Most of our blue-collar jobs include varying degrees of manual work. We are using temp agencies, prison release programs, high school contacts, etc. We cannot find people willing to work (and pass a drug test). We do not believe higher wages will solve the problem. Oftentimes, workers who are hired will just quit showing up or leave during a break. This causes problems with production schedules. As states end the federal unemployment add-ons, lower unemployment benefits may help.

- No doubt the federal PPP [Paycheck Protection Program] and unemployment benefits hurt us the past few weeks. As those programs end, we are seeing more applicants.

- [Difficulty hiring] may change in states that are forgoing the additional unemployment benefits. Time will tell.

- Commodity cost increases for steel, wood and fabrics and uncertain availability are all impacting hard-number contracts and construction quotes.

- We are not seeing applicants, and the ones we are seeing seek very unrealistic wages.

- Our entire community is experiencing a lack of available applicants willing to work on a regular basis.

- Thank you, governor, for eliminating the $300 federal supplement to unemployment. We need to get people back to work.

- The number of people applying for open positions is down across the board. Our pay rate is competitive for the area but nowhere near what people are asking. Fifteen dollars per hour is not possible in the current environment, and we can’t compete with the larger companies that are offering $17–20 per hour to be a night-stocker. To make matters worse, summer is coming.

- We were an essential business and operated fully during the pandemic; therefore, we maintained all of our employees, plus a few new hires.

- Raw material pricing has more than doubled from 2020, if you can get materials.

- I am seeing some lead times out as long as 57 weeks. This is four-to-five times more than we have seen on parts historically.

- Until the general workforce is forced to work to make a living, my company and all others are going to have problems. We continually hear that it is much easier to stay home and draw generous unemployment benefits than it is to work. This is very discouraging for employers and conflicts with what I think is the true “American way.”

- I am really glad to see many states, including ours, removing the $300 federal payment for unemployment. There are way too many jobs available, yet now people have gotten used to state-plus federal unemployment monies and they have not returned to work. That should improve quickly.

- Last week, we saw (for the first time in several months) a net increase in the number of direct-labor employees. During the previous several months, we had more direct-labor employees leave than we were able to hire. This is a good indication that the labor supply/demand is beginning to normalize. We have not had an issue finding indirect and salaried employees who have higher skills.

- We need to hire production and shipping workers.

Texas Service Sector Outlook Survey

Data were collected June 15–23, and 279 Texas business executives responded to the survey.

| Feb '21 (percent) |

June '21 (percent) |

|

| Yes | 25.5 | 51.8 |

| No | 74.5 | 48.2 |

NOTE: 276 responses.

| June '21 (percent) |

|

| Improved significantly | 2.1 |

| Improved slightly | 19.7 |

| No change | 20.4 |

| Worsened slightly | 39.4 |

| Worsened significantly | 18.3 |

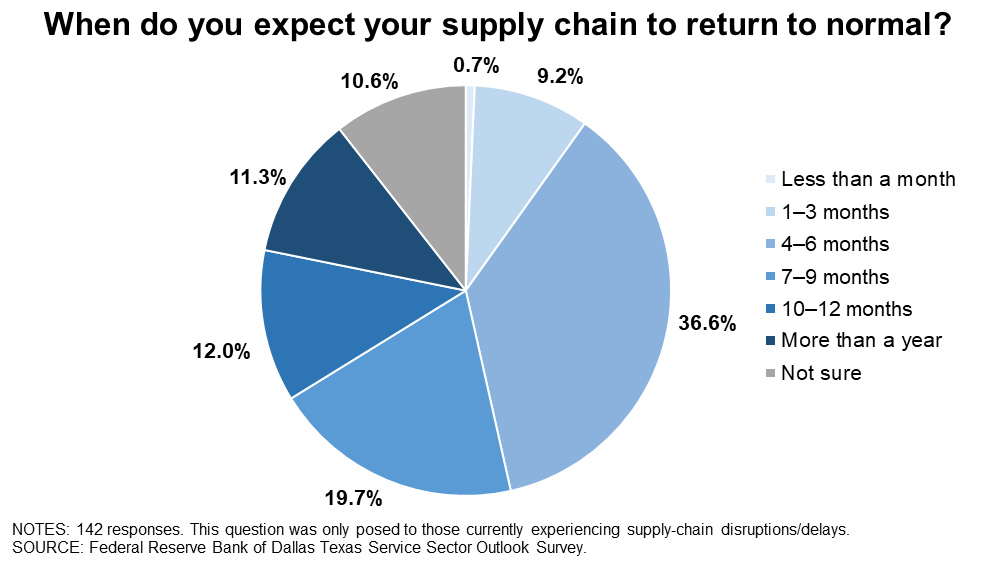

NOTES: 142 responses. This question was posed only to those who are experiencing supply-chain disruptions or delays.

| 57.0 |

| 43.0 |

| June '21 (percent) |

|

| Yes | 57.0 |

| No | 43.0 |

NOTE: 277 responses.

| Apr. '21 (percent) |

June '21 (percent) |

|

| Lack of available applicants/no applicants | 62.3 | 67.3 |

| Generous unemployment benefits | 41.8 | 43.6 |

| Workers looking for more pay than is offered | 34.2 | 40.4 |

| Lack of technical competencies (hard skills) | 36.3 | 34.6 |

| Lack of experience | 36.3 | 27.6 |

| Lack of workplace competencies (soft skills) | 24.0 | 25.6 |

| Inability to pass drug test and/or background check | 15.1 | 18.6 |

| Lack of child care | 13.0 | 14.1 |

| Fear of COVID-19 infection | 11.0 | 10.3 |

| Other | 11.0 | 6.4 |

| None | 12.3 | 7.1 |

NOTES: 156 responses. This question was posed only to those who are currently trying to hire or recall workers.

| June '21 (percent) |

|

| Improved significantly | 0.0 |

| Improved slightly | 19.0 |

| No change | 49.5 |

| Worsened slightly | 18.1 |

| Worsened significantly | 13.3 |

NOTES: 105 responses. This question was only posed to those noting a lack of available applicants/no applicants.

Special Questions Comments

These comments have been edited for publication.

- We did not lay off any workers.

- We need truck mechanics. Truck repair is highly technical in today's world.

- We are not recalling workers because we did not have layoffs during the pandemic.

- We are involved in the global supply chain. We are not seeing any sign of relief on the delays and disruptions there.

- We did not lay anyone off, so have not had to try to recall anyone in the current year.

- Hiring skilled software developers has never been more difficult. We have resorted to hiring people outside of Dallas–Fort Worth and outside of Texas and still cannot fill all the open positions. We are now negotiating with an offshore firm to provide additional software development resources to help with our delivery backlog.

- We had to hire during the last year-plus as certain competitors were not ready for remote work.

- The paper shortage has hurt our ability to market via direct-mail solicitations to customers.

- Government regulations are hurting the labor market.

- The applicant pool has dried up while compensation and benefits have improved. We have had to take the foot off the growth pedal because we cannot find qualified candidates. We hear the same story from most of the companies we work with.

- We have hired a couple of technical people who were unhappy with the lack of work-from-home options at a previous employer.

- Politicians created this employment shortage under the disguise of COVID relief payments; they should have ended six months ago!

- For us, the issue is around equipment needed to support knowledge workers and complete capital projects, primarily around builds for new space. Longer lead times and price increases have created some issues we are having to carefully navigate. Hopefully, this lessens in the coming months. On the personnel front, we have a lot of turnover and are having trouble replacing with the same quality. No one moved in 2020, and this year has accelerated with a pick-up in demand—a material pickup in demand and attrition.

- There appears be a scarcity of applicants with 15 to 20 years’ experience who can hit the ground running. With increased demand, experienced staff is of high value.

- There is no work, therefore, no need for supply chain or workers.

- I'm not directly involved in the hiring process so don't know the impediments. For hiring I am involved in, it's too soon in the process to know impediments.

- We have hired temporary workers to assist in a deposit product conversion. We have not been reducing staff.

- Our supply chain is our candidates—qualified professionals. There is a definite shortage of qualified professionals for the number of the positions that need to be filled.

- Hiring has always been a challenge. The current situation is miserable. I have full-time employees getting food stamps at the rate of $1,000-plus per child per month. They will get up and walk on you in a heartbeat if they don't like something.

- It seems like possible new hires want to play "let's make a deal" on vacation time, personal time, pay scale, how to be recognized and rewarded. My favorite: what motivations can your company provide for my growth?

- It is very frustrating to not have applicants.

- Lower-skilled employee [hiring] is worse, while hiring skilled employees is better than expected. Newly educated college applicants have been really impressive.

- It’s my thought that in the health care industry, where the majority of the workforce is women, the COVID experience has been hard for them managing their jobs as well as their children at home. This led to a complete shutdown of folks seeking new jobs. I am hoping that with the summer holidays being here and schools opening up with onsite schooling, the health care workforce will have a semblance of normalcy that may lead to the needed nurses and other workers to connect to the acute workforce need in the communities. Another major impact of COVID has been a significant amount of senior health care workers taking retirement to avoid any possible COVID infection. All those retirees now have to be replaced also.

- Hiring continues to be a struggle for all the reasons noted above. Just getting applicants to apply and then show up for the interview is a monumental task. For everyone we schedule to come in to interview, fewer than 50 percent actually show up. Apparently, individuals are just applying so they can maintain their unemployment benefits.

- We are finding folks just taking full advantage of the unemployment and federal subsidy benefits at this time.

- Hiring has been to replace people departing for non-COVID-related reasons.

Texas Retail Outlook Survey

Data were collected June 15–23, and 47 Texas retailers responded to the survey.

| Feb '21 (percent) |

June '21 (percent) |

|

| Yes | 64.4 | 87.2 |

| No | 35.6 | 12.8 |

NOTE: 47 responses.

| June '21 (percent) |

|

| Improved significantly | 0.0 |

| Improved slightly | 22.0 |

| No change | 17.1 |

| Worsened slightly | 34.1 |

| Worsened significantly | 26.8 |

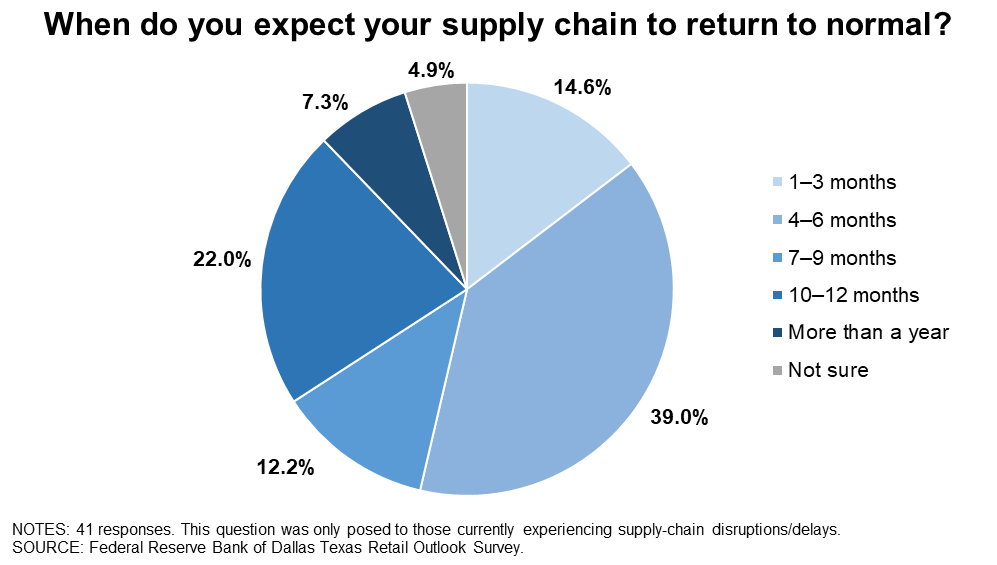

NOTES: 41 responses. This question was posed only to those who are experiencing supply-chain disruptions or delays.

| June '21 (percent) |

|

| Yes | 53.2 |

| No | 46.8 |

NOTE: 47 responses.

| Apr. '21 (percent) |

June '21 (percent) |

|

| Lack of available applicants/no applicants | 80.0 | 76.0 |

| Generous unemployment benefits | 48.0 | 52.0 |

| Lack of technical competencies (hard skills) | 56.0 | 48.0 |

| Workers looking for more pay than is offered | 24.0 | 36.0 |

| Lack of workplace competencies (soft skills) | 24.0 | 36.0 |

| Inability to pass drug test and/or background check | 32.0 | 36.0 |

| Lack of experience | 32.0 | 32.0 |

| Lack of child care | 12.0 | 12.0 |

| Fear of COVID-19 infection | 4.0 | 4.0 |

| Other | 4.0 | 8.0 |

| None | 0.0 | 4.0 |

NOTES: 25 responses. This question was posed only to those who are currently trying to hire or recall workers.

| June '21 (percent) |

|

| Improved significantly | 0.0 |

| Improved slightly | 15.8 |

| No change | 47.4 |

| Worsened slightly | 21.1 |

| Worsened significantly | 15.8 |

NOTES: 19 responses. This question was only posed to those noting a lack of available applicants/no applicants.

Special Questions Comments

These comments have been edited for publication.

- I would have thought the supply-chain issue would have corrected by now or at least shown improvement, but that does not seem to be the case. I think [it’s] due to labor shortages and the lack of availability of containers.

- Poultry supplies are the hardest hit. Our lead time for chicken orders has increased from seven days to 21 days, and often the supplier is also reducing the order size. We are told this will resolve in the next six weeks.

- Many potential employees only want full-time [work].

- We were lucky enough to retain all of our workers through the pandemic. We are a small family-owned business with many long-term employees and used the PPP [Paycheck Protection Program] money to retain all of them.

- We continue to experience a lack of response to online employment posts for accountants, sales people and general laborers.

- Don't consider raising interest rates; economic conditions are fragile, and headwinds are on the horizon!

- There is a truck driver shortage, specifically in the fuel industry, but it seems to be not limited to hazmat drivers. Fuel haulers specifically are increasing driver pay to entice them to stay on, come back and/or pull from the non-hazmat-driver pool.

- Unemployment is more than we usually offer as pay. So why work?

Questions regarding the Texas Business Outlook Surveys can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest surveys are released on the web.