Special Questions

Special Questions

Texas Business Outlook Surveys

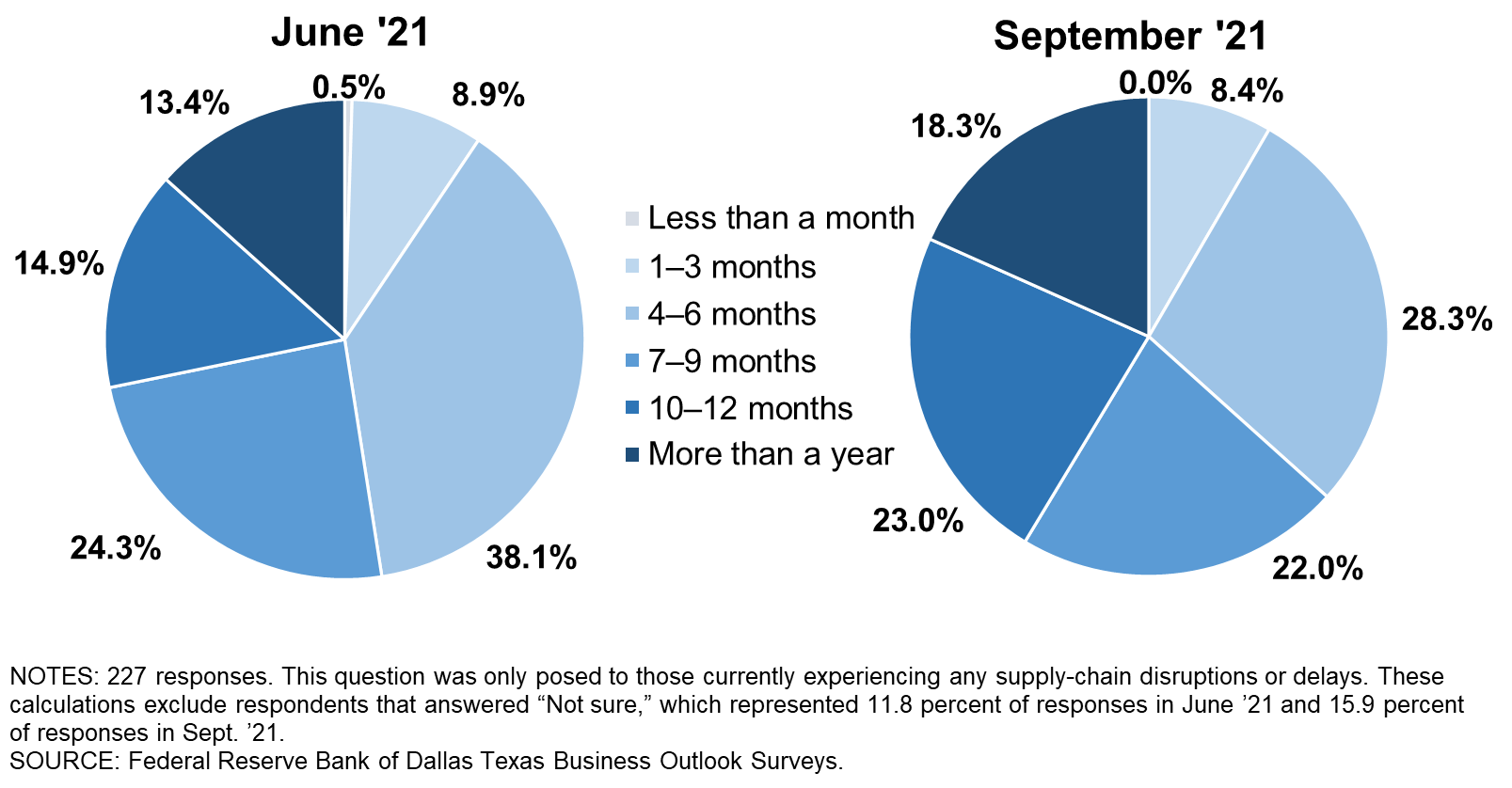

Data were collected September 14–22, and 358 Texas business executives responded to the surveys.

| Feb. '21 (percent) |

Jun. '21 (percent) |

Sept. '21 (percent) |

|

| Yes | 35.5 | 61.0 | 64.5 |

| No | 64.5 | 39.0 | 35.5 |

NOTE: 352 responses.

| Jun. '21 (percent) |

Sept. '21 (percent) |

|

| Improved significantly | 2.2 | 1.3 |

| Improved slightly | 16.6 | 17.3 |

| No change | 21.4 | 30.5 |

| Worsened slightly | 41.0 | 34.1 |

| Worsened significantly | 18.8 | 16.8 |

NOTES: 226 responses. This question was only posed to those currently experiencing any supply-chain disruptions or delays.

Survey respondents were given the opportunity to provide comments. These comments can be found on the individual survey Special Questions results pages, accessible by the tabs above.

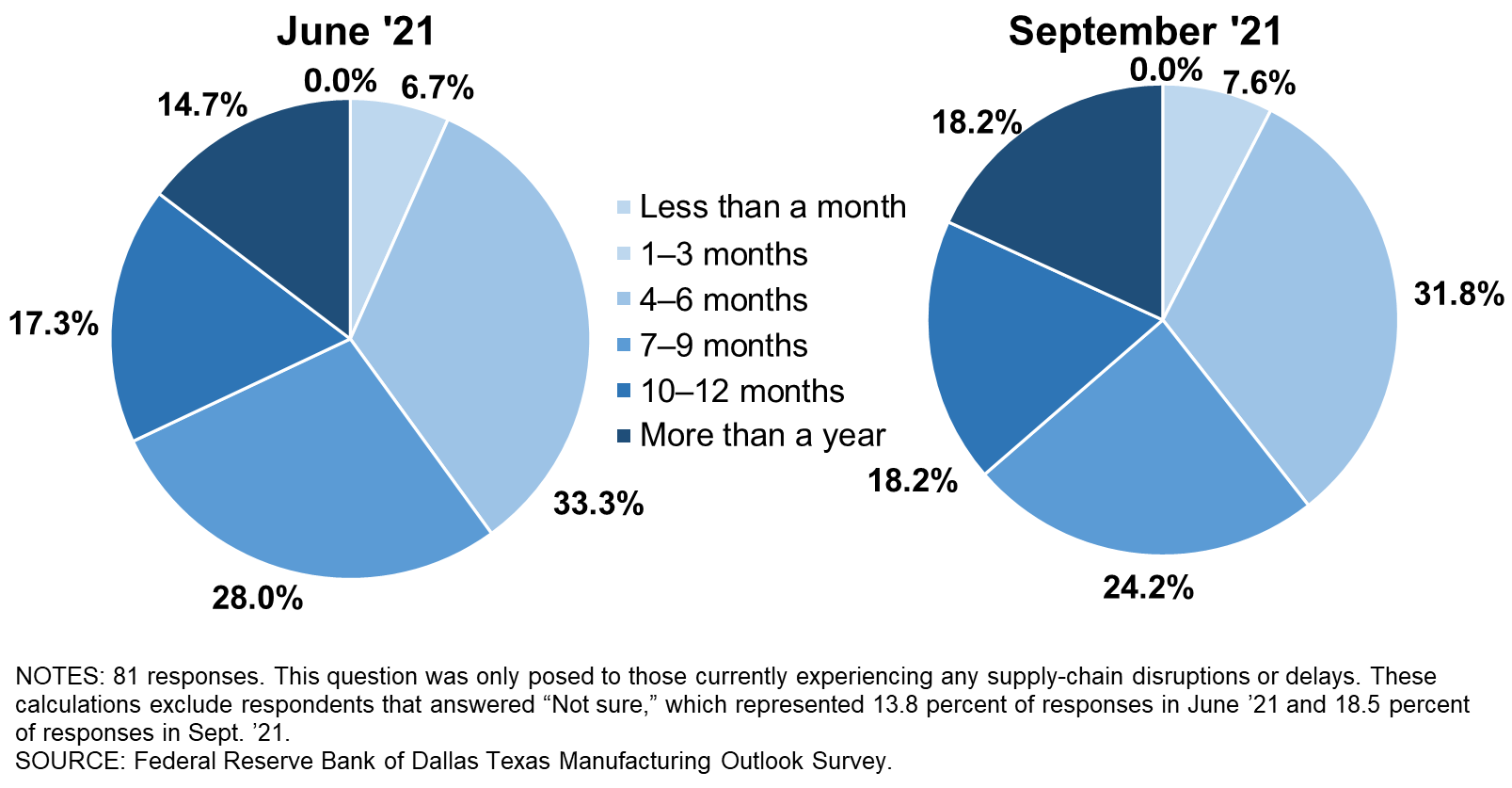

Texas Manufacturing Outlook Survey

Data were collected September 14–22, and 90 Texas manufacturers responded to the survey.

| Feb. '21 (percent) |

Jun. '21 (percent) |

Sept. '21 (percent) |

|

| Yes | 61.8 | 86.1 | 92.0 |

| No | 38.2 | 13.9 | 8.0 |

NOTE: 88 responses.

| Jun. '21 (percent) |

Sept. '21 (percent) |

|

| Improved significantly | 2.3 | 1.3 |

| Improved slightly | 11.5 | 10.0 |

| No change | 23.0 | 31.3 |

| Worsened slightly | 43.7 | 37.5 |

| Worsened significantly | 19.5 | 20.0 |

NOTES: 80 responses. This question was only posed to those currently experiencing any supply-chain disruptions or delays.

These comments are from respondents’ completed surveys and have been edited for publication.

Chemical Manufacturing

- Technical components needed to maintain assets seem to be in short supply. Lead times are extending for materials, and materials are very difficult to find.

Plastics and Rubber Products Manufacturing

- The lack of workers continues to drive our supply-chain issues. Many of our suppliers comment that the lead time is due to being short-handed and significantly backlogged. This is compounded by the delays their suppliers are experiencing for the same reasons. As with the beginning of this pandemic, pricing continues to be a headache. Many of our suppliers are unable to guarantee pricing merely days after they respond to our RFQ [request for quotation]. This all circles back to the lack of workers and the inability of companies worldwide to replenish stock.

Nonmetallic Mineral Product Manufacturing

- Import costs were $3,500 per container in January. Now they are $22,000 each. And delivery from Asia was 2–3 months and is now 5–6 months. All of this material on the water is paid for, so it is a big eater of cash. And everything is going way up in cost. Many raw materials are up 25–45 percent since the beginning of the year. Inflation is going to skyrocket by the end of the fourth quarter.

Petroleum and Coal Products Manufacturing

- Weather-related disruption.

Primary Metal Manufacturing

- Numerous vendors are announcing price increases and product availability issues.

- Trucking and getting drivers. Getting products in a reasonable time. Lead times are very extended on a few products.

Fabricated Metal Manufacturing

- Stainless steel that is used in emergency pipe repair products is not available at any price. Steel is in extremely short supply. American iron and steel regulations are causing delay, cancellation and re-engineering of many significant projects. The shortage of material is affecting the hiring and employment of manufacturers, distributors and contractors.

- There are shortages on all raw materials, and prices continue to escalate on a weekly basis.

- We are seeing decreased steel-smelter scheduled production on some steel beams and components. This has also decreased local steel warehouse inventory on certain sizes and types of steel.

- Steel materials are in short supply, causing many of our construction materials to be delayed or not available at all.

Machinery Manufacturing

- Incoming sea container and electronic parts delays.

- The metals market continues to command premium prices. Freight costs are escalating, particularly for imported containers. Supplier lead times are increasing everywhere.

Computer and Electronic Product Manufacturing

- We manufacture printed circuit assemblies, so we are severely impacted by the chip shortages. Inventories are high for other parts while we wait for the uncertain deliveries of the remaining parts we need. We and our customers are being forced to go to secondary markets to find available parts, which is ramping up pricing across the board. In other cases, products are having to be redesigned to utilize more available parts, which takes time and resources and causes further delay. The situation may be improving, but it is very difficult to tell completely. Overall, it is similar to what we have experienced the last four months, and it just continues.

- Chip manufacturers have abruptly stopped producing lower-price components in favor of building more in-demand expensive components.

Transportation Equipment Manufacturing

- Steel mills in the U.S. have completely quit taking orders. No indication of when they will begin taking orders.

- We are experiencing supply-chain constraints from all vendors: raw material, metal processing, logistics/shipping and customer approvals (military and government). Each constraint was independent over the last 12 months; however, the last three months we have seen consecutive and even compounding negative impacts on our cycle times (results being longer cycle times), costs (more expedited orders) and on-time deliveries (reduction in last three months). What was once manageable now seems uncontrollable.

- Suppliers tell us that supply should improve, but we are somewhat skeptical. If it doesn’t improve, our growth plans will be negatively affected.

Furniture and Related Product Manufacturing

- They can’t find employees.

- Delays in subcontractors getting materials, from rebar to drywall, have created delays in finish work.

Wood Product Manufacturing

- Vendors have no clue as to what is going on. Shipping costs are creating a bigger problem on the supply chain. Sea containers’ cost is forcing us to bring more manufacturing in-house. We are having a hard time with plate steel not being available. If you can find it, the cost is three to four times what it was a year ago. Hardwood has the same problem. If you can find it, the cost is three to four times what it was a year ago. We need new vehicles, but they are not available due to the chip shortage.

Paper Manufacturing

- We are having a very difficult time getting raw materials shipped in with any kind of regularity. Lead times are three or four times longer than normal. Additionally, the labor market is absolutely terrible, with no one looking for jobs. I cannot understand why our government officials can’t see that their policies enable people who do not want to work, to not work.

Printing and Related Support Activities

- It’s the same story you are probably hearing from others: rampant inflation, with everyone raising prices for supplies, raw materials, shipping and even repair services. Glue suppliers are unable to get raw materials to make the adhesives; corrugated and chipboard industries are raising prices and slowing down deliveries something fierce. Anything coming in from China has an undetermined lead time due to container shortages and space issues on boats.

Food Manufacturing

- Prices have increased in most raw materials and freight, and some materials have become scarce even at a higher price. Even when availability has not been compromised, lead times have increased, forcing inventory increases to prevent cuts in our part of the supply chain.

- Food ingredients are abundant. Food packaging supplies are getting more difficult to obtain. Lead times have increased significantly.

- Lack of availability of dry vans and containers. Demand for raw-ingredient staple crops used in bulk feeding has increased due to “survivalist” feeding scenarios.

Textile Product Mills

- Seventy percent of our delinquent raw-materials suppliers are citing that their delays are due to high turnover and absenteeism (from government subsidies). The quality of goods has dropped as a result, due to the need of retraining employees. One supplier in South Carolina is reporting 45–50 percent employee turnover per month. As long as the government subsidies continue, we expect suppressed sales and reduced growth potential. The remaining 30 percent of supply delinquency issues come from raw-material component shortages in the chemical industry.

Special Questions Comments

These comments have been edited for publication.

- Macroeconomic concerns are just as important as the microeconomic ones.

- Aerospace and medical raw-material supply seems adequate at this time, while oil and gas material supply has already become a major challenge. We are truly concerned about raw material supply being available to meet oil and gas demand, as major customers have requested preparation plans and provided guidance on an expected increase in volume in fourth quarter 2021 through all of 2022.

- We are starting to see some pressures of firms making the AP [accounts payable] in a timely manner.

- COVID protocols are an issue. We recently updated our requirements to be more in line with Centers for Disease Control guidelines. However, we continue to have two or three people out each week due to direct-contact quarantine. The strain on our operations is significant, which results in excessive overtime for those who are able to continue working. While it has improved, hiring continues to be an issue. The lack of qualified applicants is noticeable, along with the [lack of a] willingness to work. It seems like when we fill one position, another opens up. Hopefully, as more people get vaccinated, the situation will improve.

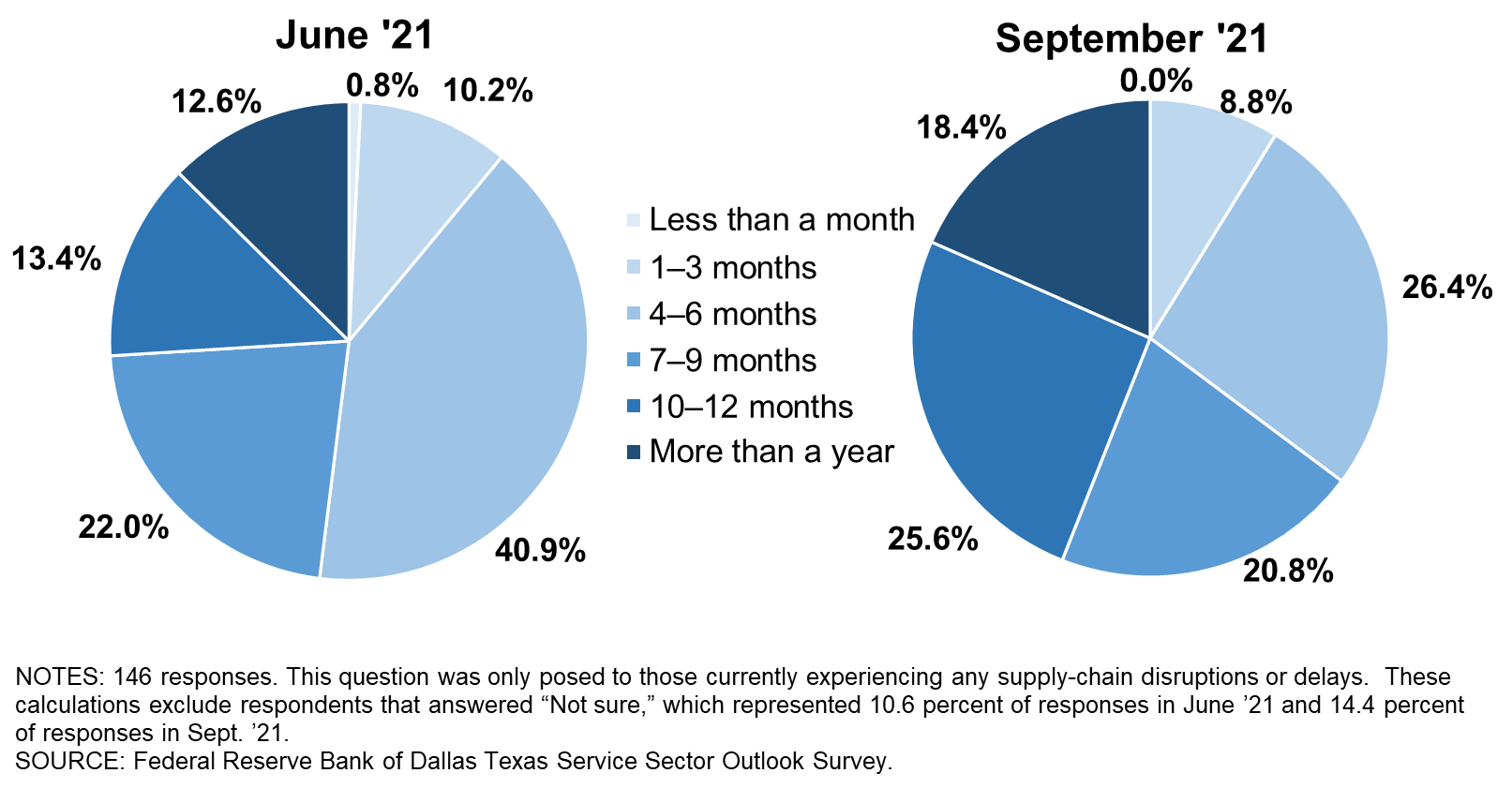

Texas Service Sector Outlook Survey

Data were collected September 14–22, and 268 Texas business executives responded to the survey.

| Feb. '21 (percent) |

Jun. '21 (percent) |

Sept. '21 (percent) |

|

| Yes | 25.5 | 51.8 | 55.3 |

| No | 74.5 | 48.2 | 44.7 |

NOTE: 264 responses.

| Jun. '21 (percent) |

Sept. '21 (percent) |

|

| Improved significantly | 2.1 | 1.4 |

| Improved slightly | 19.7 | 21.2 |

| No change | 20.4 | 30.1 |

| Worsened slightly | 39.4 | 32.2 |

| Worsened significantly | 18.3 | 15.1 |

NOTES: 146 responses. This question was only posed to those currently experiencing any supply-chain disruptions or delays.

These comments are from respondents’ completed surveys and have been edited for publication.

Truck Transportation

- We're having a terrible time getting truck-repair parts. It doesn't matter what brand of truck. The parts are on national backorder six weeks or more out. Things with chips in them are even worse.

Support Activities for Transportation

- Port and terminal congestion and global equipment imbalances. This means that we are not able to access equipment that needs to be moved.

Warehousing and Storage

- Contractors not willing to bid on work with defined timelines because of uncertainty in obtaining raw materials to do the work.

Credit Intermediation and Related Activities

- The main issue we face is technology in the area of computers due to low inventory of chips for computers.

- Hardware related to IT and security technology.

Securities, Commodity Contracts, and Other Financial Investments and Related Activities

- HVAC [heating, ventilation and air conditioning] equipment, steel trusses.

- We provide capital to construction, and many materials are delayed, delaying the start of a number of projects. In addition, costs of major materials such as lumber and steel remain escalated, even as lumber has somewhat stabilized.

Insurance Carriers and Related Activities

- Computer equipment.

Real Estate

- Building materials for homes being built or remodeled for our clients.

- Construction materials shortages and price increases are still slowing the ability to deliver projects. Additionally, current lack of employees for skilled trades is delaying and slowing delivery of projects probably more than the lack of materials. Additionally, with the borders closed, it adds more uncertainty to retail for the upcoming holiday season and I believe it is also impacting the availability of labor, especially in the construction industry.

- New homes are taking longer to build, affecting inventory of new homes.

Rental and Leasing Services

- Chip issues, which affect many items we buy for continued business.

- We are a construction machinery and material handling equipment dealer. I have over a year’s worth of inventory on order right now—most won't arrive until third quarter 2022, some won't arrive until 2023! Who has that kind of crystal ball? The economy probably crashes by then under the leadership our country enjoys today. We are accumulating cash and raising lines of credit to be ready for that sea of inventory when it releases, probably all at once, and the market goes to hell simultaneously! Supply-chain interruptions besides labor are tires, semi’s, steel, wiring harnesses, seats, arm rests, engines, etc.

Professional, Scientific and Technical Services

- Increased shipping costs and lead times. Increased raw material prices. Scarcity of certain spare parts and components.

- Our supply-chain issues are different from most businesses. We are severely impacted by the Internal Revenue Service’s operational issues created by staffing shortages and COVID-19 disruptions. We cannot get responses to client tax problems we need to resolve. Delays in processing correspondence and failure to even answer telephone calls have created major difficulties in timely serving our clients and adversely affected our costs. This is a problem of such significance that it has impacted all tax professionals nationwide. There is no near-term solution in sight.

- Office supplies, computers.

- Steel used in rebar in reinforced concrete has become tighter on the supply side, resulting in higher costs. However, we have passed the peak, albeit not by much.

- Cost of construction materials continues to climb; i.e., stainless steel went up $2,000 in one week. Very difficult to assess market conditions and estimate construction cost. Delays due to supply chain, COVID-related stop/start, inclement weather.

- Construction materials are both increasing in cost and requiring double and triple the delivery time than pre-COVID, causing significant impact to cost of projects and length of construction. Reaching a point that we may have owners delay or cancel projects.

- Vehicles—need to replace used vehicles. Normal replacement, just few available.

Management of Companies and Enterprises

- Almost everything we buy. We're in the process of building two bank buildings, and we are months behind because we can't get building materials.

Administrative and Support Services

- There are shortages at all levels. Trucking is an issue as well. Every segment of the chain is severely affected by labor shortages.

- Unable to obtain laptops in a timely manner.

- Internally from our office supplies to inspection equipment consumables, supply-chain delays and backordering issues have affected our operations. Our customers who maintain and manufacture items for aircraft and general maintenance items have been affected by their delivery times, which affect our inspection times from the RFQs [requests for quotation] that were generated months earlier. Things seem to be slipping further behind schedule, which is affecting all of our bottom lines.

Educational Services

- Delays in parts and materials continue.

Ambulatory Health Care Services

- Just-in-time [inventory management] applies also to human capital, which also has been disrupted. Products— from drugs to supplies to nonmedical items—are on backorder. Prices are up, supply is down, demand is up.

Hospitals

- Transportation disruptions are the chief concern at this time. No particular supply or equipment item stands out—all are vulnerable to unreliable trucking and other transportation modes.

Social Assistance

- Our vendors are running behind due to supply-chain issues.

Accommodation

- Technology equipment is suffering due to the chip shortage.

- Textiles are running behind. I am building a new restaurant, and materials/FF&E [furniture, fixtures and equipment] items are backordered.

Food Services and Drinking Places

- It seems to change rapidly; one week it might be cups and straws, the next hash browns, the next beef.

- High prices, looking for items via four-to-five different vendors and lucky to find it. Forcing to order online with delivery fee, which leads to extra expense for my business. Our energy bill doubled the charge for September; they said because the cost of energy is high. We need help to level the field for us.

- It’s everything: food items, tiles, equipment, wood, stainless steel, napkins, furniture, oysters, coffee.

- From disposables, to meats, to product, to grocery. It's a disaster out there.

- The shortages are being caused by a lack of labor to run the factories that produce our supplies.

Repair and Maintenance

- Limited availability of materials, with a 20 percent increase in cost.

- HVAC equipment shortages. Significant cost increases on certain products.

Special Questions Comments

These comments have been edited for publication.

- As a services business, there is no real “supply chain” since we carry no inventory of goods.

- We are not seeing [disruptions] at the bank level, but our customers, especially homebuilders, are seeing disruptions, which are causing delays in completing construction.

- Some of my clients are [seeing supply-chain disruptions] specifically with goods being shipped from China.

- We do not see any improvement in the supply chain at this time. It is worse than it was in third and fourth quarters 2020.

- As an independent consultant, I really have no supply-chain issues.

- Again, this nationwide vaccine policy is anti-business. If this mandate causes any increase in trucker unemployment, it will have significant negative impact to the national supply chain.

- I would like to know why we are worse off at this time than the beginning of the pandemic.

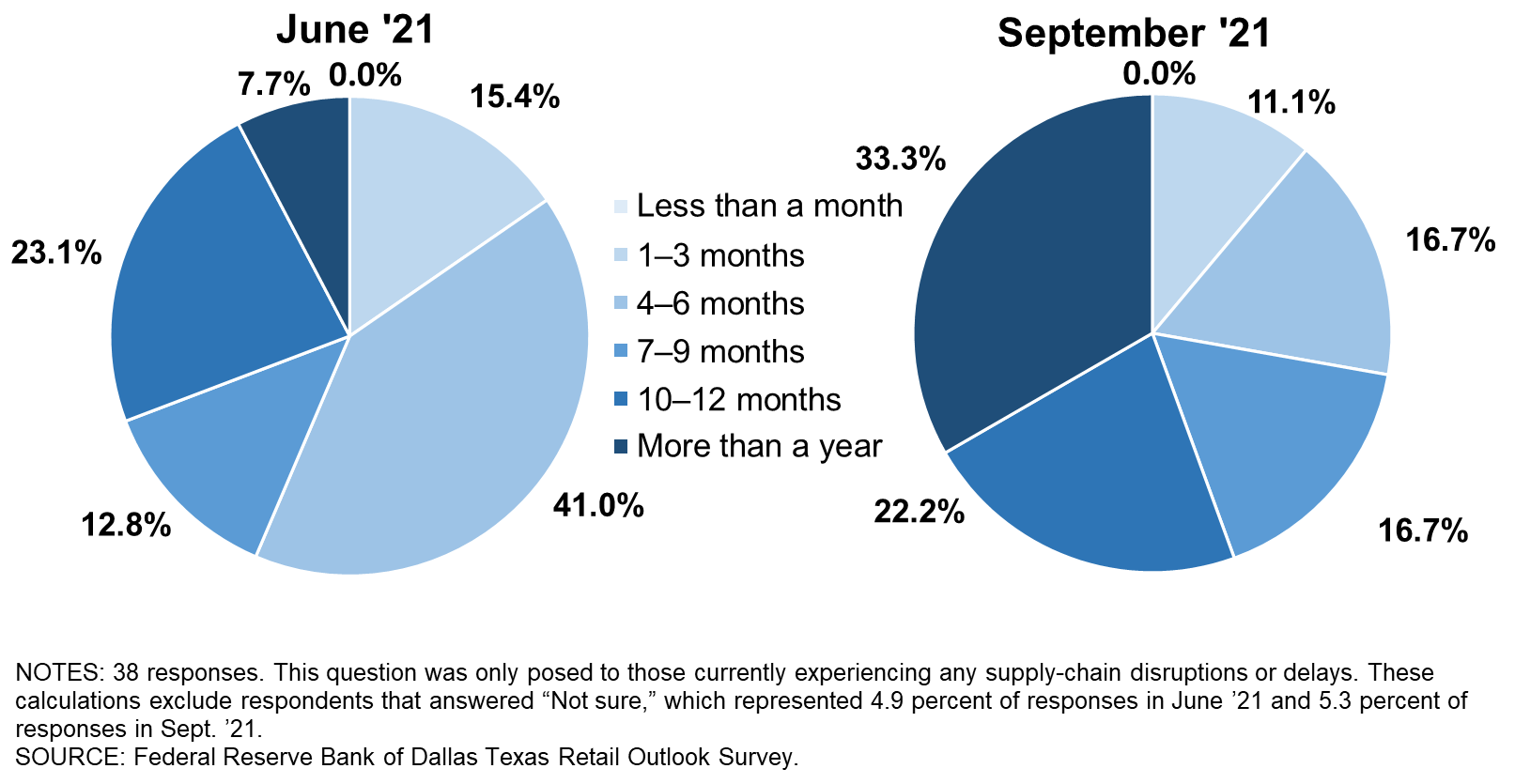

Texas Retail Outlook Survey

Data were collected September 14–22, and 48 Texas retailers responded to the survey.

| Feb. '21 (percent) |

Jun. '21 (percent) |

Sept. '21 (percent) |

|

| Yes | 64.4 | 87.2 | 80.9 |

| No | 35.6 | 12.8 | 19.1 |

NOTE: 47 responses.

| Jun. '21 (percent) |

Sept. '21 (percent) |

|

| Improved significantly | 0.0 | 0.0 |

| Improved slightly | 22.0 | 23.7 |

| No change | 17.1 | 28.9 |

| Worsened slightly | 34.1 | 15.8 |

| Worsened significantly | 26.8 | 31.6 |

NOTES: 38 responses. This question was only posed to those currently experiencing any supply-chain disruptions or delays.

These comments are from respondents’ completed surveys and have been edited for publication.

Merchant Wholesalers, Durable Goods

- It's a little bit of everything—chips, steel, labor, second-level vendors that supply our manufacturers. We are getting by, but it doesn't seem to be improving much month to month. We are bullish on the future, but it may take some time to get out of the supply issues we are experiencing.

- Every industry is being affected by the global supply-chain upheaval. As distributors, our job is to maintain a diversified supply chain, which is what we have done (three years before COVID). We have received a steady flow of inventory, which has helped us serve our customers and grow our market share.

- New equipment is so far behind it is affecting our ability to purchase used equipment.

- I believe that we have finally met an international gridlock. Whether conserving export containers, rail equipment or truck availability, all are 100 percent saturated. Our orders can't get out. Vendors’ orders are delayed by months. The supply-chain issues will only be exacerbated by current transportation issues. Transportation problem has been a long time coming, but I feel we have reached an urgently critical moment.

Merchant Wholesalers, Nondurable Goods

- Workers aren't returning to production plants, and production has been reduced by 30 percent in the protein plants I source from (beef, chicken, pork). Consumption hasn't changed, so production can't meet demand. My product costs are rising from these suppliers. Plants have raised selling prices to pay higher wages and attract stay-at-home workers, and their input costs are higher for similar reasons. (They're paying more for raw materials from the growers.)

- We cannot get import product from Port of Houston to our warehouse in northwest Houston. Variety of excuses. Four-to-six-week delays at this time. This is costing us business. Domestic suppliers are not much better. All suppliers are allocating us material. It is a game of alternatives for our customers. We are scrambling to fulfill orders. We hope it improves over the next quarter or so.

- Logistics. Missed pickups and deliveries due to truck driver shortages.

Motor Vehicle and Parts Dealers

- Chip shortage.

- New-car inventory is at an all-time low. [Prices of] used cars have been driven up by the shortage of new cars.

- Chips, COVID-19 and the preowned market. Very challenging business model today. New-vehicle inventory is all but depleted. No confidence in information/availability in supply chain. Preowned values are high and market is volatile. Like playing monopoly except it is real money.

- The combination of COVID outbreaks and chip shortages has severely handicapped the auto industry.

Nonstore Retailers

- Our suppliers don't deliver our full purchase order; several items are typically left off entirely. In a vending operation, you typically have a planogram to standardize what you sell through your machines. When big sellers and/or numerous SKUs [stock keeping unit numbers] are left off, it leaves us scrambling to substitute other products and still maintain the same level of sales. Imagine you are a regular Coke fan, and all you find in your vending machine are Diet Cokes.

Special Questions Comments

These comments have been edited for publication.

- Thank God we are in Texas; it seems to be better here than what other companies outside of Texas are experiencing. I think they have the compounded problem of heavy government oversight especially on the COVID front, which makes it really hard for them to operate.

- As a food-service exporter, I'm also impacted by the West Coast shipping delays. Last time I checked, there were almost 70 ships waiting to be worked (unloaded/loaded) in the Los Angeles/Long Beach ports. We've pulled our export business from LA/LB, because we can't get equipment (containers, chassis, generator sets) to export our orders. When we are able to source the equipment, we can't get a driver to move the container or a warehouse to load it. We are now shipping those orders out of Houston.

- We need to hire a significant number of qualified people. We employ approximately 900 people and would add 10 percent to our head count if business was back to normal and applicants met our qualifications.

- Consumer demand is still very strong, but we see common sense starting to prevail as it relates to prices.

Questions regarding the Texas Business Outlook Surveys can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest surveys are released on the web.