Special Questions

Special Questions

Texas Business Outlook Surveys

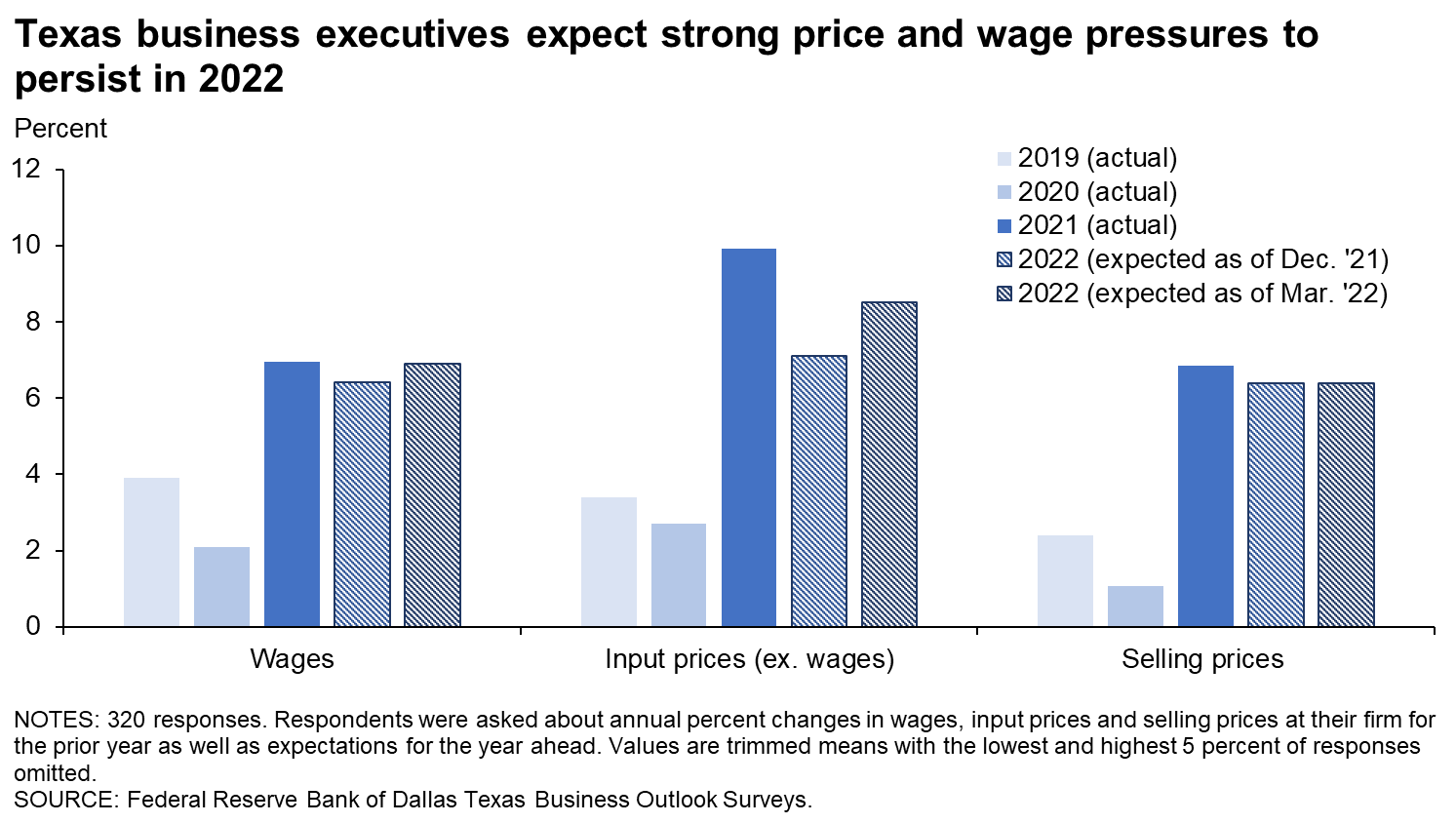

Data were collected March 15–23, and 339 Texas business executives responded to the surveys.

| 2019 | 2020 | 2021 | 2022 | |||||

| Expected (percent) |

Actual (percent) |

Expected (percent) |

Actual (percent) |

Expected (percent) |

Actual (percent) |

Expected (percent) |

Expected (percent) |

|

| Wages | 4.0 | 3.9 | 3.8 | 2.1 | 4.3 | 7.0 | 6.4 | 6.9 |

| Input prices (excluding wages) | 3.8 | 3.4 | 3.3 | 2.7 | 3.7 | 9.9 | 7.1 | 8.5 |

| Selling prices | 2.8 | 2.4 | 2.8 | 1.1 | 3.4 | 6.9 | 6.4 | 6.4 |

| Data collected | Dec. '18 | Dec. '19 | Dec. '19 | Dec. '20 | Dec. '20 | Dec. '21 | Dec. '21 | Mar. '22 |

NOTES: 320 responses. Averages are calculated as trimmed means with the lowest and highest 5 percent of responses omitted.

| Mar. '22 (percent) |

|

| Significant positive impact | 1.8 |

| Slight positive impact | 9.0 |

| No impact | 23.4 |

| Slight negative impact | 38.9 |

| Significant negative impact | 21.0 |

| Don’t know | 6.0 |

NOTE: 334 responses.

Respondents experiencing an impact were asked to elaborate on the nature of the impact. These comments can be found on the individual survey Special Questions results pages, accessible by the tabs above.

| Mar. '22 (percent) |

|

| Significant positive impact | 0.3 |

| Slight positive impact | 3.9 |

| No impact | 48.0 |

| Slight negative impact | 28.2 |

| Significant negative impact | 9.0 |

| Don’t know | 10.5 |

NOTE: 333 responses.

Respondents experiencing an impact were asked to elaborate on the nature of the impact. These comments can be found on the individual survey Special Questions results pages, accessible by the tabs above.

| July '20 (percent) |

Aug. '21 (percent) |

Dec. '21 (percent) |

Mar. '22 (percent) |

|

| Supply-chain disruptions | 16.9 | 40.8 | 44.3 | 50.0 |

| Limited operating capacity due to staffing shortages (difficulty hiring, absenteeism, COVID-19 infections and quarantining, vaccine mandates, etc.) | 21.4 | 31.8 | 45.8 | 38.6 |

| Weak demand | 57.3 | 23.9 | 19.4 | 15.1 |

| Reduced productivity due to alternative work arrangements | 14.8 | 9.0 | 9.2 | 7.2 |

| Limited operating capacity due to state/local restrictions | 20.6 | 5.4 | 4.3 | 2.1 |

| Other | 16.1 | 13.5 | 14.2 | 15.7 |

| None/not applicable | 12.4 | 21.1 | 14.8 | 18.4 |

NOTE: 332 responses.

Survey respondents were given the opportunity to provide comments. These comments can be found on the individual survey Special Questions results pages, accessible by the tabs above.

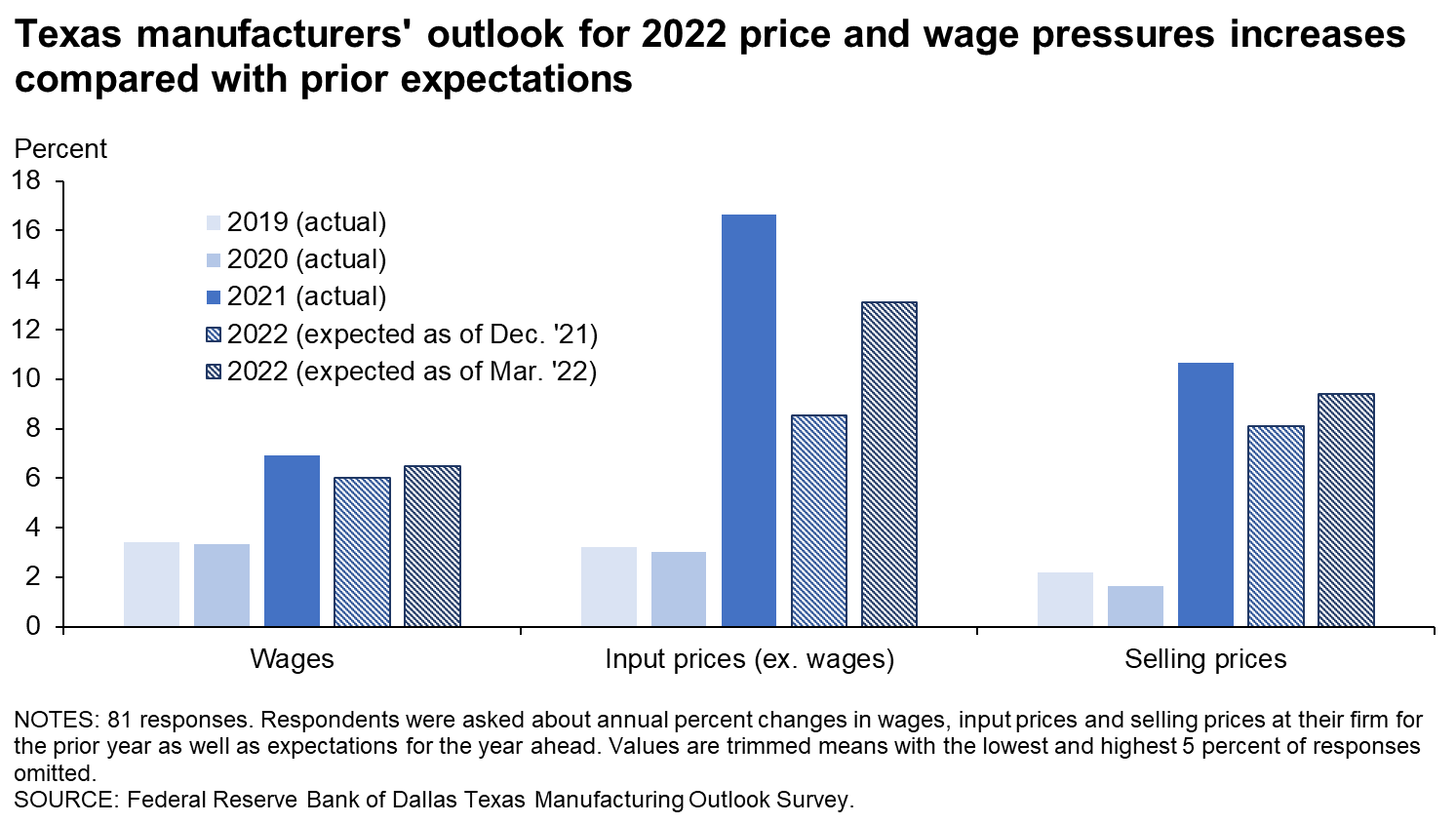

Texas Manufacturing Outlook Survey

Data were collected March 15–23, and 86 Texas manufacturers responded to the survey.

| 2019 | 2020 | 2021 | 2022 | |||||

| Expected (percent) |

Actual (percent) |

Expected (percent) |

Actual (percent) |

Expected (percent) |

Actual (percent) |

Expected (percent) |

Expected (percent) |

|

| Wages | 3.9 | 3.4 | 3.5 | 3.3 | 4.2 | 6.9 | 6.0 | 6.5 |

| Input prices (excluding wages) | 4.0 | 3.2 | 3.2 | 3.0 | 4.6 | 16.7 | 8.5 | 13.1 |

| Selling prices | 3.0 | 2.2 | 3.0 | 1.6 | 3.9 | 10.7 | 8.1 | 9.4 |

| Data collected | Dec. '18 | Dec. '19 | Dec. '19 | Dec. '20 | Dec. '20 | Dec. '21 | Dec. '21 | Mar. '22 |

NOTES: 81 responses. Averages are calculated as trimmed means with the lowest and highest 5 percent of responses omitted.

| Mar. '22 (percent) |

|

| Significant positive impact | 1.2 |

| Slight positive impact | 9.5 |

| No impact | 9.5 |

| Slight negative impact | 40.5 |

| Significant negative impact | 34.5 |

| Don’t know | 4.8 |

NOTE: 84 responses.

Respondents experiencing an impact were asked to elaborate on the nature of the impact.

These comments are from respondents’ completed surveys and have been edited for publication.

Chemical Manufacturing

- Some product prices are a function of wholesale gasoline prices.

Fabricated Metal Product Manufacturing

- Increase in business from oil, gas and mining customers.

- We service oil tools, so higher energy prices mean higher demand for our service.

- Hopefully, major energy producers will start purchasing capital equipment.

Machinery Manufacturing

- More sales activity.

- Orders are up slightly; demand is building for facilities equipment in the oil and gas fields.

Miscellaneous Manufacturing

- Our business is primarily oil and gas related. We have seen order volumes increase and many requests to pull in existing orders.

These comments are from respondents’ completed surveys and have been edited for publication.

Petroleum and Coal Products Manufacturing

- Raw material costs.

Chemical Manufacturing

- Higher variable costs.

- Increased cost of manufacturing.

- The shift of the demand/supply imbalance is driving inflationary prices.

- Less profit.

Plastics and Rubber Product Manufacturing

- Freight costs.

Nonmetallic Mineral Product Manufacturing

- Incoming and outgoing freight and delivery costs are increasing fast.

- Doing business became more expensive.

- Cost of shipping.

- Natural gas prices have increased considerably, and energy (fuel) is a significant component of our production cost basis.

Primary Metal Manufacturing

- Costs of fuel for rolling stock, shipping and materials have increased significantly. Customers are unwilling to help absorb these increases through additional price increases or surcharges.

- It takes an enormous amount of electricity to produce steel in an electric furnace.

- Higher fuel costs for natural gas and higher pass-through fuel costs for electricity are likely to drive our manufacturing costs higher. We have raised our selling prices considerably given the impact of the Russia–Ukraine war’s impact on our steel raw material costs and the higher energy costs. The higher energy (diesel) costs have also impacted our shipping costs; those freight rates have risen much more than just a pass-through of the higher diesel prices.

- When gas and diesel fuel go up, all of our vendors’ costs go up, as does inbound and outbound freight. Maybe we can raise prices, maybe not. Depends on the market. But enough increases will cause the market to have a general price increase.

- Directly affects our bottom line.

Fabricated Metal Product Manufacturing

- We run numerous company vehicles.

- Pricing for services, including transportation and galvanizing (nickel and zinc) have increased significantly.

- Higher cost for the delivery of our products.

- Transportation expense.

- Power cost escalations add to the cost of manufacturing.

- Shipping costs have increased.

- All transportation costs are increasing.

- Freight cost increase.

- The delivery cost of our modular buildings has increased.

- Energy costs increase the cost of everything.

Machinery Manufacturing

- Raw materials and transportation increases.

- Our energy costs doubled from normal costs in recent months.

- The cost per kWh [kilowatt hour] on electricity January through February averaged 0.077/kWh in 2021 versus 0.096/ kWh in 2022, a 24.7 percent increase. Natural gas across the same horizon was $6.01/Mcf [thousand cubic feet] versus $8.40/Mcf, a 39.8 percent increase.

- Costs more to produce.

- Isn’t it obvious that energy is in everything that we do and use?

- Our primary customers are in trucking. High diesel prices lower our sales.

Computer and Electronic Product Manufacturing

- Shipping charges increase the price of everything on top of existing price increases.

- Everything we ship in and out is done via trucking. Gas and diesel prices can affect us.

Transportation Equipment Manufacturing

- Energy flows through everything, directly and indirectly. Since we are in the internal combustion vehicle sector, we get the brunt of a flawed energy policy.

- New freight increases on every shipment.

- Higher utility and fuel costs.

- Increase in drayage rates for incoming/outgoing goods is not significant in relation to the selling price of goods.

- Our customers are owners of ambulance fleets, and a significant portion of their operating costs is fuel. So rising gas prices are causing our customers to reallocate fixed budgets, resulting in a loss of new orders for ambulances and related parts and services.

- Higher electrical bills.

Food Manufacturing

- Freight prices have continued to rise because of increased fuel prices.

- Higher propane costs are significant for our price structure. The freight price increase driven by several variables, including fuel price increases, also is becoming a big challenge.

- Oil prices will likely increase packaging (film) costs for our company.

- Added cost of transportation and utilities.

Textile Product Mills

- We’re a luxury consumer goods maker (pillows and bedding), so higher energy prices mean less disposable income and less demand for our products.

Paper Manufacturing

- Higher cost.

- Freight and power.

Printing and Related Product Manufacturing

- Paying more to bring materials and supplies in for jobs.

- Prices for raw materials have increased, and the overall uncertainty has impacted our outlook.

- Higher freight in and freight out; film is made from oil, and we’re already getting hit with film price hikes.

Wood Product Manufacturing

- Costs increases.

Furniture and Related Product Manufacturing

- Gas prices for delivery, and gas surcharges from vendors.

Miscellaneous Manufacturing

- Increased cost of freight and shipping.

- Increased expenses.

| Mar. '22 (percent) |

|

| Significant positive impact | 0.0 |

| Slight positive impact | 3.6 |

| No impact | 38.1 |

| Slight negative impact | 32.1 |

| Significant negative impact | 19.0 |

| Don’t know | 7.1 |

NOTE: 84 responses.

Respondents experiencing an impact were asked to elaborate on the nature of the impact.

These comments are from respondents’ completed surveys and have been edited for publication.

Primary Metal Manufacturing

- While our costs (raw material and energy) have risen substantially, we have raised our selling prices even more so we will see a higher gross profit. The open question is, how much will these higher selling prices negatively impact incoming sales orders, which seems to already be the case.

Food Manufacturing

- Requests for food relief into Ukraine and neighboring countries.

These comments are from respondents’ completed surveys and have been edited for publication.

Chemical Manufacturing

- Supply chain.

- Increased materials prices and longer delivery times.

- Volatility and knee-jerk reaction in raw materials.

- I expect higher steel prices and a general drag on economies.

Plastics and Rubber Product Manufacturing

- While the impact isn’t immediate, we expect we’ll see a reduction in orders due to the sanctions against Russia as we, and some of our customers, do business with Russian entities.

- Demand is decreasing.

Primary Metal Manufacturing

- Russia is the second-largest producer of aluminum in the world. If aluminum is sanctioned, prices will rise even higher than the record high we currently have.

- Shortages of commodities, metals, aluminum, nickel and fuel.

- Continued strain on raw materials and additional supply-chain disruptions.

- On occasion, we get scrap metal out of Russia, and that will stop for now.

Fabricated Metal Product Manufacturing

- Significant uncertainty and price escalations in stainless steel availability and pricing.

- Gives market uncertainty, and we provide services to larger corporations.

- Steel price increase.

- Higher raw materials costs (metal prices specifically).

- Too much uncertainty to start and/or expand production facilities.

Machinery Manufacturing

- Uncertainty causes a delay in purchases.

- Orders not being fulfilled.

- Prices are going up for everything, and raw materials are taking even longer to get here.

- Steel costs are going to go up as Ukraine mills are closed or damaged. One of Europe's biggest iron and steel plants has been badly damaged as the Russian forces lay siege to the city, There will be an eventual impact in the U.S.

Computer and Electronic Product Manufacturing

- Low morale.

Transportation Equipment Manufacturing

- Nickel is unobtainable at present.

- It is preoccupying all news cycles. We are in the luxury part of the economy where decisions can be postponed until consumers feel better about life.

- Our only customer, the U.S. Department of Defense, has slowed down purchases until they have a clearer picture of what will develop out of the Ukraine war.

- In addition to rising fuel prices, the war is causing additional supply-chain constraints that are further impacting the cost and availability of our raw materials for production.

Food Manufacturing

- The increased cost of corn due to the disruption in the global market has created some higher undertones for the future costs of beef and pork, which are our primary inputs for our meat products.

- Added food inflation.

Textile Product Mills

- The uncertainty and second-order effects (market uncertainty, energy prices) reduce demand.

Paper Manufacturing

- Corn starch price volatility.

Printing and Related Product Manufacturing

- Increased energy prices have a direct impact on our costs, and the potential supply-chain impacts from the war will also impact our business.

Furniture and Related Product Manufacturing

- Some materials are not available, like Russian birch.

Miscellaneous Manufacturing

- We cannot ship to Ukraine and will not sell or ship to Russia.

- It is causing further delays and reduced production of items from the European Union.

- Raw material suppliers are not able to quote or accept orders. We are utilizing existing raw material inventories but will need a long-term solution once we see some market stabilization.

| July '20 (percent) |

Aug. '21 (percent) |

Dec. '21 (percent) |

Mar. '22 (percent) |

|

| Supply-chain disruptions | 25.2 | 72.2 | 75.9 | 72.6 |

| Limited operating capacity due to staffing shortages (difficulty hiring, absenteeism, COVID-19 infections and quarantining, vaccine mandates, etc.) | 31.1 | 44.4 | 56.3 | 46.4 |

| Weak demand | 65.0 | 21.1 | 19.5 | 15.5 |

| Reduced productivity due to alternative work arrangements | 10.7 | 8.9 | 12.6 | 6.0 |

| Limited operating capacity due to state/local restrictions | 3.9 | 2.2 | 2.3 | 4.8 |

| Other | 8.7 | 11.1 | 13.8 | 11.9 |

| None/not applicable | 10.7 | 7.8 | 0.0 | 6.0 |

NOTE: 84 responses.

Special Questions Comments

These comments have been edited for publication.

- Supply-chain constraints continue to be a major issue. If it isn’t delivery, then it is availability or pricing, or all of the above. It is getting harder and harder to gauge the market when not even our suppliers know what is going to happen month to month.

- U.S. engagement in a war could impact our business.

- American iron and steel regulation and laws enacted by the pure water and recent infrastructure laws require that all iron and steel used in products furnished by any state revolving funds [recipients] be poured or melted in the U.S. No foreign castings or steel is allowed unless a waiver is sought and approved. This delays the planning, design, bidding and construction process as well as escalating the total cost up to 25 percent of the total project before a waiver will be considered.

- We are experiencing long lead times from multiple suppliers; everyone seems busy, and everyone is struggling to fill their material requirements.

- Everything that we buy and use requires energy to move or produce.

- The impact from energy pricing is hard to predict because some demand for product will increase with the higher prices, yet costs will also increase for us. The war has little impact in the short term, but certain materials could become constrained (raw materials used for some electronic components) should the war continue for a lengthy period of time, and this would add significant disruption in an already challenging marketplace for electronic components.

- We expect inflationary pressures to slow/destroy end-demand at some point but have not seen that yet.

- Energy, inflation, employee recruiting/retention issues, pending interest hikes, pressure on the dollar, dysfunctional administration, international tension with a war—did I leave anything out? That spells recession and is about as negative an outlook as can be painted.

- Currently, supply-chain disruptions are the primary constraint to our business, restricting production output, resulting in lower sales and margins, and forcing steep cost cuts across our business—which is ultimately resulting in lost jobs.

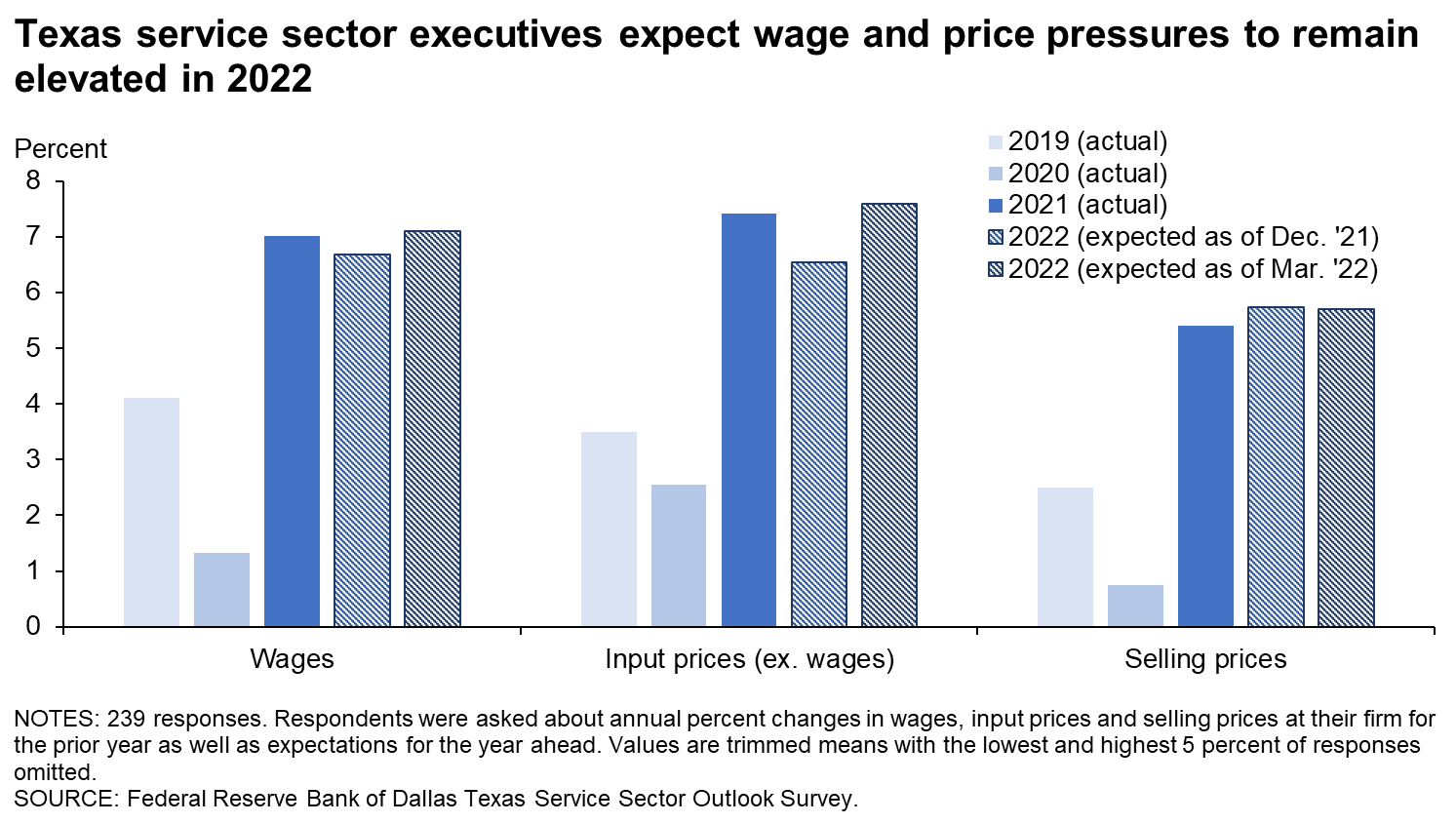

Texas Service Sector Outlook Survey

Data were collected March 15–23, and 253 Texas business executives responded to the survey.

| 2019 | 2020 | 2021 | 2022 | |||||

| Expected (percent) |

Actual (percent) |

Expected (percent) |

Actual (percent) |

Expected (percent) |

Actual (percent) |

Expected (percent) |

Expected (percent) |

|

| Wages | 4.0 | 4.1 | 3.9 | 1.3 | 4.4 | 7.0 | 6.7 | 7.1 |

| Input prices (excluding wages) | 3.8 | 3.5 | 3.4 | 2.6 | 3.2 | 7.4 | 6.5 | 7.6 |

| Selling prices | 2.7 | 2.5 | 2.7 | 0.8 | 3.2 | 5.4 | 5.7 | 5.7 |

| Data collected | Dec. '18 | Dec. '19 | Dec. '19 | Dec. '20 | Dec. '20 | Dec. '21 | Dec. '21 | Mar. '22 |

NOTES: 239 responses. Averages are calculated as trimmed means with the lowest and highest 5 percent of responses omitted.

| Mar. '22 (percent) |

|

| Significant positive impact | 2.0 |

| Slight positive impact | 8.8 |

| No impact | 28.0 |

| Slight negative impact | 38.4 |

| Significant negative impact | 16.4 |

| Don’t know | 6.4 |

NOTE: 250 responses.

Respondents experiencing an impact were asked to elaborate on the nature of the impact.

These comments are from respondents’ completed surveys and have been edited for publication.

Water Transportation

- We sell oilfield equipment; we move crude by barge (higher prices generally lead to more moves particularly as WTI [West Texas Intermediate crude oil] is at a discount to Brent).

Telecommunications

- Work-at-home jobs more attractive.

Credit Intermediation and Related Activities

- We are in southeast Texas and have several service companies in the area, and with the increased prices of oil, things are moving.

Securities, Commodity Contracts, and Other Financial Investments and Related Activities

- Energy clients will have stronger balance sheets.

Real Estate

- Higher energy prices may increase job creation, which positively affects home sales.

- Our properties in Houston have some energy industry tenants.

Rental and Leasing Services

- Obviously, higher fuel prices are an extreme negative when you run over 350 company vehicles and service trucks. However, a booming oil patch is usually a net positive for us because it greatly increases sales and rentals. Of course, that requires we have the equipment, which we don't due to supply chains today.

Professional, Scientific and Technical Services

- Clients in the energy sector are spending more.

- Greater industry activity.

- Clients cutting budgets to balance additional expenses.

- We provide engineering services to energy companies. Higher energy prices usually translate to increased profitability for energy companies, which results in more engineering work.

- Cost for transportation. Seeing price rises from our vendors.

- As oil moved into the $80–$90 range, I saw a positive impact on my business in that it was a supply-demand situation that was not created by extreme events (the war in Ukraine and sanctions). The current price above $100, which was driven by various restrictions on supplies, is not really helping as it has created an unknown environment for investment.

Administrative and Support Services

- Energy services clients will see improved market conditions.

Educational Services

- Increased costs, both wages and energy, can’t be passed on. We have to absorb these costs, and it affects the bottom line.

Amusement, Gambling and Recreation Industries

- Cost of shipping, electricity and paint.

Religious, Grantmaking, Civic, Professional and Similar Organizations

- We provide services to the oil and gas industry

- Increased interest and attendance in our publications and events.

These comments are from respondents’ completed surveys and have been edited for publication.

Utilities

- It costs more to run vehicles, etc.

- Higher cost for construction and capital improvement projects.

Air Transportation

- Jet fuel.

- Fuel is more than 20 percent of expenses and is up over 50 percent in less than six months.

Truck Transportation

- High price of fuel.

- Fuel prices.

- All of my customers are truckers, and now they don't have money for repairs. They're spending extra for diesel.

Support Activities for Transportation

- We are a freight forwarding and international delivery company.

- We have fuel surcharges that help mitigate but there obviously could be an impact on the economy with prolonged energy prices.

- Our current fuel charges were not adequate to cover the steep and rapid increase in cost. We are losing money on fuel and are restructuring our rates to accommodate.

Warehousing and Storage

- Cost to operate cranes, trucks and other vehicles goes up, but that is not a significant cost to our business.

Telecommunications

- We are a service-based company with a field operations team serving the greater Houston area. Operating costs will jump substantially as a result of the rise in fuel prices coupled with the fact that they are occurring during our peak demand periods: March–September.

Data Processing, Hosting and Related Services

- Fewer employees will commute to work (and also use it as an excuse not to come to the office).

Credit Intermediation and Related Activities

- Higher cost for businesses related to transportation, agriculture and cost of goods. Extemporaneous events resulting from the out-of-the-ordinary events occurring simultaneously are accelerating the impact to the economy.

- The bank has provided $100 per month to help the marketing officers, lending officers and branch managers [with the costs of] the higher oil price.

- Gas pricing has raised the cost of everything. I shouldn't need to explain this.

- Energy price increases have an impact on everything we buy from office supplies, paper and ink to electricity. We cannot significantly change our pricing, but our revenue tends to increase proportionate to the increase in real estate valuation, and we will also be more aggressive in charging customers for ancillary services that we have generally provided for free in the past.

- Higher utility costs and higher costs for staff to get to work.

Securities, Commodity Contracts, and Other Financial Investments and Related Activities

- It adds to the pressure on employees to find higher-paying jobs.

- Higher travel costs and costs of construction materials.

Insurance Carriers and Related Activities

- Commuting costs for employees have gone up.

- Some of our insurance clients with truck and diesel fuel exposure are feeling the pinch of inflation.

- Travel expenses.

- Costs more to operate and get around.

Real Estate

- Supplies cost more because of gas prices to deliver.

- Input cost (asphalt) pricing increases.

- Increased costs will damper leasing activity and slow collections.

- Higher cost to real estate agents showing properties.

- The amount of driving we do this time of year is higher than other times of the year, so higher gas prices will make it more expensive to operate.

Rental and Leasing Services

- We truck large amounts of equipment to long distances; the bills are more than originally quoted, and we have no way to capture the additional expenditures.

Professional, Scientific and Technical Services

- Increasing production costs.

- Energy prices/inflation factor into tourism and lodging decisions, which affects the hotel/motel industry that we work in. Oil producers/refiners cashing in on uncertainty to boost profits has adverse effects on lodging and tourism.

- Raises cost of construction, which can limit our clients’ ability to go forward with a project. This can reduce our workload.

- We have many employees who have a long commute to the office, and increased gas prices hurt. We are trying to relieve some of the pain by giving out gas cards to the staff.

- Increased cost to operate because of the cost to travel to client locations for meetings.

- Increased freight expenses.

- Employee cost-of-living raises are a conversation now. Travel expenses are increased. Shipping and courier fees increased.

- Our travel and mileage to see our clients.

- Higher fuel prices.

- Increased transportation costs for materials to job sites has caused concerns for those planning future development.

- Lowered our margins.

- Gas prices for business travel.

- Commuting employees.

- Increased gas cost because we drive to various job sites.

Management of Companies and Enterprises

- Customers are restricted by amount of money they have available for spending on extra items each month.

- Retail spending could suffer, thus hurting retail tenants and throwing off inventory levels.

- Energy sector in Texas has seen a significant positive impact; however, higher energy prices are an increased cost to nearly all other business sectors.

Administrative and Support Services

- Fuel costs have risen by 36 percent. We may have to implement a fuel surcharge.

- We are a mobile service. Driving vehicles is our mainstay.

- Travel.

- Fuel surcharges by every vendor have forced us to pass along the same.

- May impact amount of travel within our service area.

- I run a staffing business. The cost of getting to and from work will start to affect cost-benefit of working. Some of our clients in surrounding communities will need to raise wages substantially to incentivize choosing their company over a much closer option.

- The daily operating costs of our technician vehicle fleet has increased 24 percent from the same time frame last month.

Educational Services

- Heating and cooling of lab spaces, fuel surcharges on deliveries of equipment and training supplies, fuel for employees who are on the road quite a bit.

- Expected increased cost of travel and utilities typically seen as fixed and stable.

- Commuters are choosing not to travel between sites as mileage reimbursement is not adequate.

- Cost of goods and services going up.

- Visitors reluctant to drive to campus.

Ambulatory Health Care Services

- Many employees drive significant distances to come to work. Their commuting cost is greater, prompting them to seek higher wages or, in the case of one employee, another job opportunity closer to her home.

- Fuel prices negatively impact our business.

- Mileage reimbursement and direct gasoline purchasing will cause some increase in costs.

- Higher transportation cost, higher cost to manufacture.

- Primarily for pricing of supplies and prostheses.

- Employees asking for raises due to higher pump prices.

- Higher operating cost not offset by any change in the selling prices.

Hospitals

- Fuel costs.

- Increased utility costs adds to general inflation.

Nursing and Residential Care Facilities

- Higher energy costs affect the price of all goods purchased, natural gas to our businesses and home, fuel for company and employee vehicles, and costs of raw food. In addition, ERCOT [Electric Reliability Council of Texas] surcharges will begin affecting electricity rates starting in April.

Social Assistance

- Transportation makes up about 5 percent of our total revenue.

- As the cost of diesel fuel increases, our cost to pick up and deliver food will increase.

Amusement, Gambling and Recreation Industries

- Increase delivery fees and prices of COG [cost of goods].

Food Services and Drinking Places

- I use natural gas in my restaurant. I used to pay $420 on average, today I am paying $748 on average.

- Utility costs up.

- Vendors are passing along increased fuel costs.

- Higher cost to deliver product and more customer uncertainty regarding family budget.

- Costs are being passed on by vendors.

- Vendor shipping costs have increased due to fuel and wage hikes, increasing our input costs.

Repair and Maintenance

- Increase in fleet operating costs, some of which we cannot pass on.

- Freight costs have increased 25 percent; raw material costs increased 8 percent.

Religious, Grantmaking, Civic, Professional and Similar Organizations

- Increased transportation costs.

Support Activities for Mining

- Some increased revenue because of higher energy prices impacting our services, but also higher costs.

Specialty Trade Contractors

- Gas for service trucks.

- Higher cost of fuel, and we are a mobile company.

| Mar. '22 (percent) |

|

| Significant positive impact | 0.4 |

| Slight positive impact | 4.0 |

| No impact | 51.4 |

| Slight negative impact | 26.9 |

| Significant negative impact | 5.6 |

| Don’t know | 11.6 |

NOTE: 249 responses.

Respondents experiencing an impact were asked to elaborate on the nature of the impact.

These comments are from respondents’ completed surveys and have been edited for publication.

Support Activities for Transportation

- More business and trade in North America.

Warehousing and Storage

- As an exporter of Texas energy, may see some positive outflows as Europe looks to replace supplies previously provided by Russia.

Securities, Commodity Contracts, and Other Financial Investments and Related Activities

- Demand increase for our assets in Europe.

Rental and Leasing Services

- We really don't know yet but cannot imagine it improves supply-chain issues, and it increases lots of costs.

Educational Services

- As global prices for oil trickle higher because of the conflict, we are seeing increased prices at the pump. I have to mention wheat; Ukraine is one of the world's largest exporters, and that will have an extra inflationary effect at the grocery store.

- Millions of families who have left Ukraine with their children have prompted us to explore the possibility of translating some of our resources for children into Ukrainian.

Amusement, Gambling and Recreation Industries

- Being able to obtain product.

Religious, Grantmaking, Civic, Professional and Similar Organizations

- Increased interest and attendance in our publications and events.

These comments are from respondents’ completed surveys and have been edited for publication.

Utilities

- Higher gas prices.

- We have had supply-chain issues.

Water Transportation

- We had a small office in Moscow, which we closed.

Truck Transportation

- Continued added disruption to the material supply chains for our business.

Pipeline Transportation

- In addition to the significant uncertainty brought about by the Russia–Ukraine conflict, the conflict seems to have accelerated inflation and supply-chain pressures. For example, cold rolled steel is trading at an all-time high. This means that capital projects are more difficult to justify as they may not be profitable. Most other commodities are trading at all-time highs as well, making it difficult to justify buying supplies.

Publishing Industries (Except Internet)

- General fog about the future risk, so it delays some actions and client decisions.

Data Processing, Hosting and Related Services

- The prospect of war creates uncertainty in buyers.

Credit Intermediation and Related Activities

- Disruption in delivery of construction materials and increases in price of same.

- The war of aggression on Ukraine by Russia tends to dampen decision-making and make people more cautious.

- Customer uncertainty causing a slowdown in sales and new business.

- Just the concern of customers created by the anxiety over the unknown outcome of the current global circumstance.

- It has caused uncertainty in the capital markets, which happens every time there is a "hot" conflict and is relatively short lived.

Securities, Commodity Contracts, and Other Financial Investments and Related Activities

- Creates some uncertainty in the market.

- Raising a lot of uncertainty and unease.

Insurance Carriers and Related Activities

- Uncertainty in financial markets depressing some asset values.

- Just attitude about the uncertainty of it all.

Real Estate

- Uncertainty over the long-term economic impact.

- Its impact is indirect because it causes fuel costs to rise and uncertainty to increase, which is a damper on consumer confidence, thus impacting us.

- General uncertainty and concerns over escalating tensions clouding future investments.

- Buyers do not like what is happening to the people in Ukraine. Some feel uncomfortable spending money when there is suffering in Ukraine in our faces every day on our TVs and cellphones.

Professional, Scientific and Technical Services

- Eastern European, Asian and Chinese businesses will be affected (reduce sales and revenue); European sales will be lower also.

- Anxiety over market fluctuations causing clients to question future earnings.

- Rising interest rates, inflation and war create more uncertainty.

- Clients are unsure, and we spend time just reassuring them.

- Uncertainty about travel and the business environment encourages consumers to stay home or travel less than they would normally.

- Russian customers no longer able to pay invoices.

- It has increased economic uncertainty, which will delay many of our clients’ decisions on real estate holdings and occupancy.

- Increased cybersecurity awareness and preparedness.

- Some of our international clients are more cautious.

- Morale is low because of uncertainty in the world.

- Ukraine produces neon required for manufacturing of silicon chips. This may affect U.S. vehicle production.

- Asset fees to the client accounts in the stock market will be less due to the lower account values.

Management of Companies and Enterprises

- Fuel.

- Increased uncertainty in the marketplace.

- Further driving up energy prices and cost to do business. America must become energy independent and return to increased development of fossil fuels. Green energy is not dependable and is too expensive.

Administrative and Support Services

- All costs are rising, making it impossible to pay a decent wage with the cost increases for everything.

- Uncertainty, cost increases.

- Clients not executing deals due to uncertainty.

- Higher energy prices and some concern about potential impact on supply chain.

- Feeds a sense of uncertainty and reevaluation of overall market conditions.

Educational Services

- Increase in cyberattacks on the network infrastructure.

Ambulatory Health Care Services

- Overall impact to global supply model.

Hospitals

- Slightly exacerbates supply-chain concerns.

Accommodation

- The continued uncertainty has slowed the short-term booking pace. Too soon to tell if this will be sustained.

Food Services and Drinking Places

- Living again in uncertain times, price increases again, gasoline price increase affects everything, all my vendors increase prices because of the high price in gasoline, gasoline prices drive all the other items up.

- Overall negative customer sentiment.

Repair and Maintenance

- Increased uncertainty for customers and their capital projects. which may be deferred or canceled.

- Uneasiness.

Religious, Grantmaking, Civic, Professional and Similar Organizations

- We have an office in Moscow and significant activities there that we will need to wind down.

Specialty Trade Contractors

- Uncertainty.

- Stock market impact and negative anticipated supply-chain impact.

| July '20 (percent) |

Aug. '21 (percent) |

Dec. '21 (percent) |

Mar. '22 (percent) |

|

| Supply-chain disruptions | 13.8 | 30.2 | 32.8 | 42.3 |

| Limited operating capacity due to staffing shortages (difficulty hiring, absenteeism, COVID-19 infections and quarantining, vaccine mandates, etc.) | 17.8 | 27.5 | 42.0 | 35.9 |

| Weak demand | 54.3 | 24.9 | 19.3 | 14.9 |

| Reduced productivity due to alternative work arrangements | 16.3 | 9.1 | 8.0 | 7.7 |

| Limited operating capacity due to state/local restrictions | 26.8 | 6.4 | 5.0 | 1.2 |

| Other | 18.8 | 14.3 | 14.3 | 16.9 |

| None/not applicable | 13.0 | 25.7 | 20.2 | 22.6 |

NOTE: 248 responses.

Special Questions Comments

These comments have been edited for publication.

- I believe that our location in the Permian Basin (the energy business) is the reason that we have not had a negative impact from higher energy prices and the Russia–Ukraine war—yet.

- We are doing development (in staff and systems) to offer more services.

- We expect to see, but haven't seen, higher activity in the energy sector; it has not materialized yet.

- A shortage of qualified workers is hampering capacity to take on more work to meet demand. Upward pressure on wages and benefits is a constant threat to any growing business. Wage inflation is real and does not translate into higher productivity.

- My business is private-equity driven and expansion driven. The state of affairs politically, the war and climbing costs have slowed any desire to grow in the current economy.

- We are severely understaffed across all divisions.

- My long-term fear: supply chain, supply chain, supply chain. I can adjust for a fair amount of increase in fuel charges, but if I cannot get the equipment to perform my services, it's a moot point. We need to open as many gas and diesel-producing sites as we can right now. I, too, am in favor of going to clean energy. I think it’s a national security issue, but so is our economy. I know it is more of a political issue than a production issue, and this is a ridiculous Democratic stance.

- Real answers are not truly known beyond the next few days or weeks. Currently, we are as busy as we have ever been. That can and will change if circumstances change in a dramatic way.

- We are not at 100 percent operating hours due to staffing shortages.

- Our overall food costs have continued to increase, and we have seen this elevate at a higher level due to inflationary pressures. Wages continue to increase, and there are still material hiring challenges in the restaurant space.

- I could increase my labor by 30 percent today if I had qualified employees applying. I will need to hire an additional 60 to 70 employees for my six new barbershops under construction.

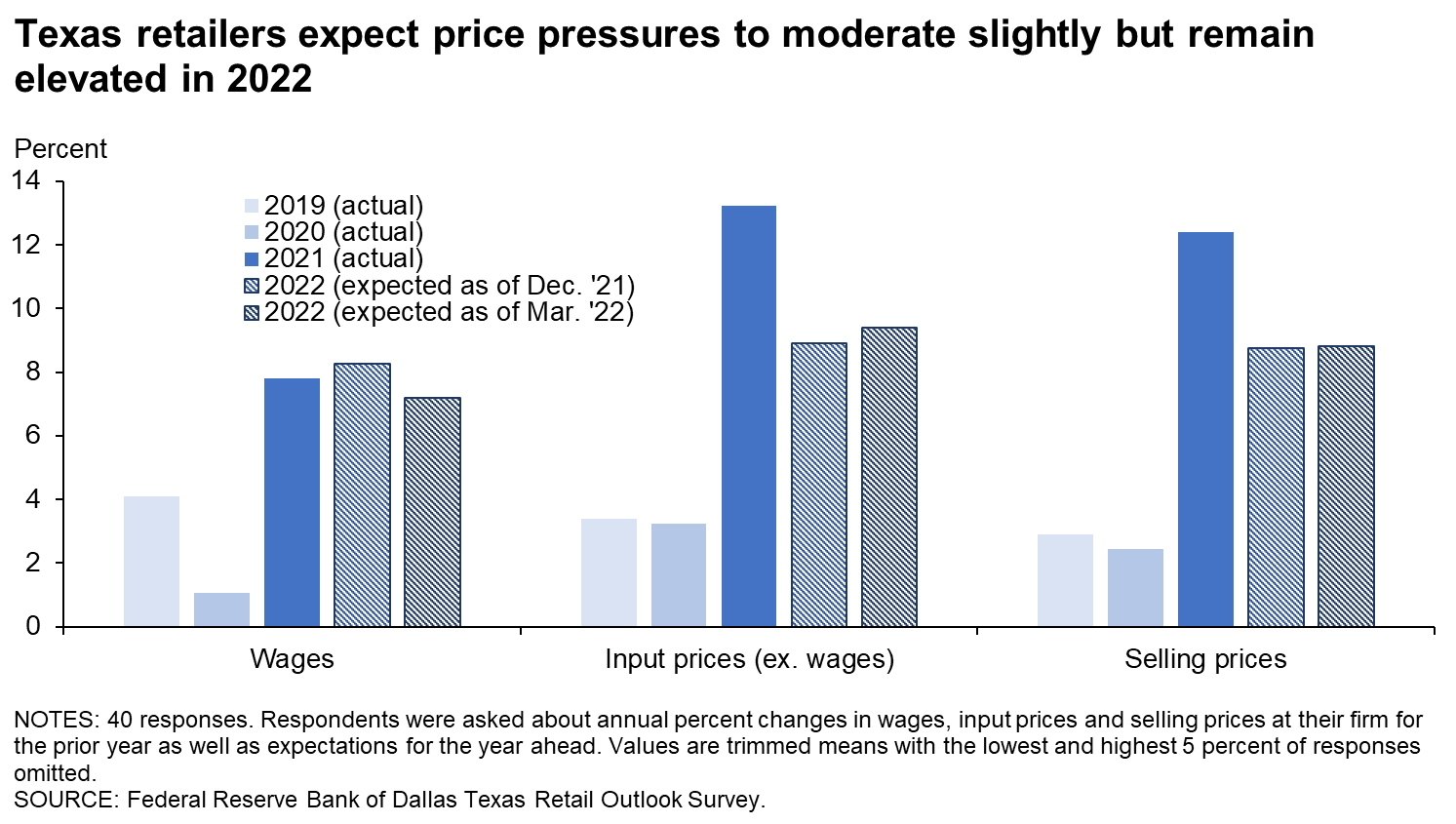

Texas Retail Outlook Survey

Data were collected March 15–23, and 42 Texas retailers responded to the survey.

| 2019 | 2020 | 2021 | 2022 | |||||

| Expected (percent) |

Actual (percent) |

Expected (percent) |

Actual (percent) |

Expected (percent) |

Actual (percent) |

Expected (percent) |

Expected (percent) |

|

| Wages | 3.1 | 4.1 | 3.4 | 1.1 | 3.0 | 7.8 | 8.3 | 7.2 |

| Input prices (excluding wages) | 3.6 | 3.4 | 3.8 | 3.3 | 2.6 | 13.2 | 8.9 | 9.4 |

| Selling prices | 3.2 | 2.9 | 3.8 | 2.4 | 2.9 | 12.4 | 8.7 | 8.8 |

| Data collected | Dec. '18 | Dec. '19 | Dec. '19 | Dec. '20 | Dec. '20 | Dec. '21 | Dec. '21 | Mar. '22 |

NOTES: 40 responses. Averages are calculated as trimmed means with the lowest and highest 5 percent of responses omitted.

| Mar. '22 (percent) |

|

| Significant positive impact | 2.4 |

| Slight positive impact | 2.4 |

| No impact | 19.0 |

| Slight negative impact | 45.2 |

| Significant negative impact | 28.6 |

| Don’t know | 2.4 |

NOTE: 42 responses.

Respondents experiencing an impact were asked to elaborate on the nature of the impact.

These comments are from respondents’ completed surveys and have been edited for publication.

Merchant Wholesalers, Durable Goods

- We do a lot of work on engines in the oilfield space. Per-barrel prices going up means more work on engines, resulting in more repairs and parts, which is a significant part of our business. Anything that causes an uptick in the oilfield business helps us tremendously.

- Much of the manufacturing in Texas is related to the oil and gas industry, so when energy prices are up, there is typically more related manufacturing, which is good for our business, because that's the industry we serve.

These comments are from respondents’ completed surveys and have been edited for publication.

Merchant Wholesalers, Durable Goods

- Our shipping has gone up thousands [of dollars] per delivery, and we have to eat those costs in order to continue business or our customers will go elsewhere. People don't like price increases and would rather go to someone else than feel like you are constantly raising prices even if they know it is because of our government’s energy policies.

- Fuel and transportation costs are a negative impact.

- Incoming freight costs much higher.

- Increased energy prices result in increased fuel costs related to deliveries.

Merchant Wholesalers, Nondurable Goods

- Just overall freight issues; surcharges on most items.

- Higher energy costs directly impact the cost of transportation. Transportation costs are 15 percent of our gross margin, and fuel is driving up those costs another 5 percent (0.75 percent of gross margin). We are not sure if this is transitory, so it will eat into our profit if we can't pass it along.

Motor Vehicle and Parts Dealers

- The price at the pump.

- Cost of freight has gone up.

- Customers are again prematurely trading trucks and large SUVs for more fuel-efficient vehicles. Hybrid electric vehicles are in strong demand.

- Cost to operate has increased.

- We sell trucks. Higher fuel costs can hurt truck sales. Also, higher fuel expenses for parts delivery etc.

- Fuel prices being higher normally decreases our sales.

- Rising oil and gasoline prices adversely affecting less-efficient-vehicle sales. The increased cost is also adding expense to operating our vehicles.

Furniture and Home Furnishings Stores

- Fuel costs escalated so quickly, we are not able to pass along this additional cost.

Building Material and Garden Equipment and Supplies Dealers

- We use significant amounts of diesel and other fuel products.

- Have a large fleet of diesel and gasoline trucks for deliveries within 150 miles of our business, and that expense has drastically gone up.

Food and Beverage Stores

- Freight charges from suppliers; fuel cost for delivery fleet.

Miscellaneous Store Retailers

- Higher gas prices.

Nonstore Retailers

- We have a fleet to deliver our services, so we have seen our fuel expense increase.

| Mar. '22 (percent) |

|

| Significant positive impact | 2.4 |

| Slight positive impact | 2.4 |

| No impact | 52.4 |

| Slight negative impact | 28.6 |

| Significant negative impact | 2.4 |

| Don’t know | 11.9 |

NOTE: 42 responses.

Respondents experiencing an impact were asked to elaborate on the nature of the impact.

These comments are from respondents’ completed surveys and have been edited for publication.

Motor Vehicle and Parts Dealers

- Uncertainty increased. Gas prices increased.

- Causing supply-chain issues for some manufacturers especially [German auto manufacturers].

- Attitude and distraction.

Furniture and Home Furnishings Stores

- Consumers have started delaying or canceling projects.

Building Material and Garden Equipment and Supplies Dealers

- Some lumber and building materials are imported from Russia, and with this slowing/stopping, it negatively affects an already-tight supply chain.

| July '20 (percent) |

Aug. '21 (percent) |

Dec. '21 (percent) |

Mar. '22 (percent) |

|

| Supply-chain disruptions | 51.0 | 73.8 | 78.4 | 78.6 |

| Limited operating capacity due to staffing shortages (difficulty hiring, absenteeism, COVID-19 infections and quarantining, vaccine mandates, etc.) | 22.4 | 23.8 | 40.5 | 26.2 |

| Weak demand | 49.0 | 26.2 | 18.9 | 19.0 |

| Reduced productivity due to alternative work arrangements | 12.2 | 7.1 | 8.1 | 4.8 |

| Limited operating capacity due to state/local restrictions | 20.4 | 4.8 | 5.4 | 0.0 |

| Other | 20.4 | 7.1 | 2.7 | 7.1 |

| None/not applicable | 6.1 | 9.5 | 5.4 | 11.9 |

NOTE: 42 responses.

Special Questions Comments

- [It is silly to] imply that the war is the reason our energy prices are high when it is 95 percent the president’s executive orders to halt drilling and stop pipelines. If we are energy independent, we don't have to rely on others for supply, so we then have better control of the market even with OPEC. Our gasoline, natural gas and petroleum prices were way up before the war even started, which has to do with policy. Whether you are for or against fossil fuels, you should not let that dictate where you place the cause of our energy price increase.

- We export food to restaurants operating outside the United States (mainly Central and South America). As our costs rise, the foreign operators can't pass on the higher costs with menu increases, as they will price-out their clientele. In the short run, they will eat the increases, but long term, it will force them to seek other sources of supply to restore their margins.

- Vehicle inventories and parts delays are significant.

Questions regarding the Texas Business Outlook Surveys can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest surveys are released on the web.