Texas Service Sector Activity Declines But at Slower Pace

Texas Service Sector Outlook Survey

May 27, 2020

Texas Service Sector Activity Declines But at Slower Pace

What’s New This Month

For this month’s survey, Texas business executives were asked supplemental questions on the impacts of COVID-19 and reduced activity in the energy industry as a result of low oil prices. Results for these questions from the Texas Manufacturing Outlook Survey, Texas Service Sector Outlook Survey and Texas Retail Outlook Survey have been released together. Read the special questions results.

This month’s data release also includes annual seasonal factor revisions. Once per year, the Federal Reserve Bank of Dallas revises the historical data for the Texas Manufacturing Outlook Survey after calculating new seasonal adjustment factors. Annual seasonal revisions result in slight changes in the seasonally adjusted series. Read more information on seasonal adjustment.

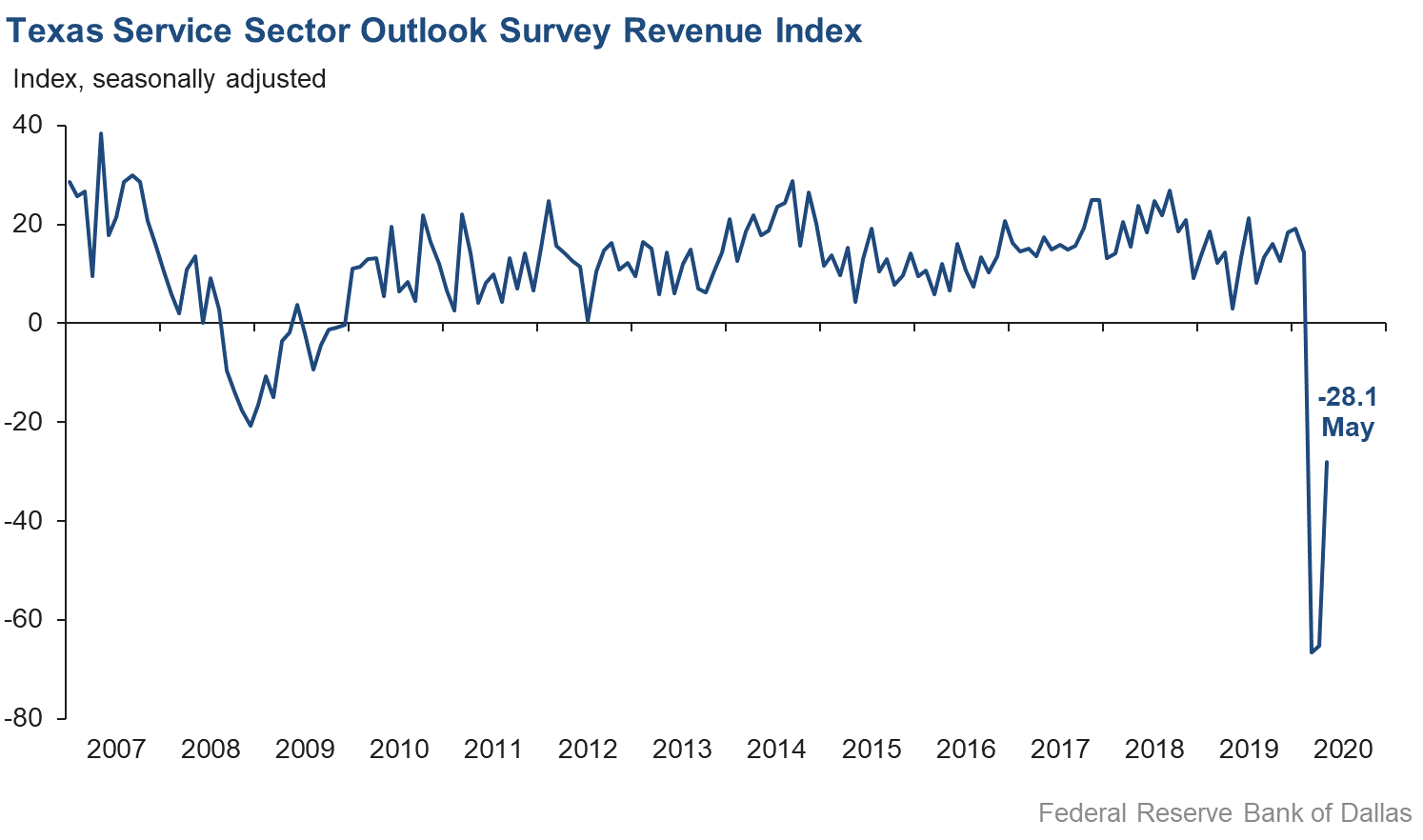

The freefall decline that characterized Texas service sector activity in March and April showed signs of abating in May, according to business executives responding to the Texas Service Sector Outlook Survey. The revenue index, a key measure of state service sector conditions, rebounded sharply from -65.3 in April to -28.1 in May. While nearly half of respondents continued to note declines in revenue compared with last month, the rising share of firms noting increased revenue—up about 13 percentage points to 21.4 percent in May—suggests a significant slowing in the rate of deterioration.

Labor market indicators reflected declines in employment and further shortening of workweeks but at a much-reduced rate compared with April. The employment index rose about 24 points to -10.4, indicating a continued net decline in jobs. The hours worked index surged over 33 points to -9.4, with just over a quarter of respondents now noting cuts in employee hours compared with over half of firms in April.

While perceptions of broader business conditions remained pessimistic in May, the scale of observed weakness abated significantly. The general business activity index regained over 42 points for a level of -41.7, while the company outlook index similarly surged about 40 points to -30.2. Meanwhile, the outlook uncertainty index declined, although at 26.2, it is still well above historical norms.

Wages continued to see declines, while price pressures were mixed in May. The wages and benefits index rose from -23.8 to -7.2, suggesting continued net declines in employee earnings, albeit at a slower pace. The selling prices index added 11 points but remained in negative territory at -19.7. Conversely, the input prices index returned to positive territory, rising over 10 points to 9.9 and suggesting net inflation in firms’ input costs.

Respondents’ expectations regarding future business conditions were notably less pessimistic than in April. The future general business activity index increased over 23 points to a reading of -11.1, with nearly one-third of respondents expecting improvement six months from now compared with 43 percent expecting worsening conditions. The future company outlook index similarly improved 24 points to -5.9. Other indexes of future service sector activity, such as revenue and employment, rose back to positive territory for the first time since February and reflected expectations of improvement over the next six months.

Texas Retail Outlook Survey

May 27, 2020

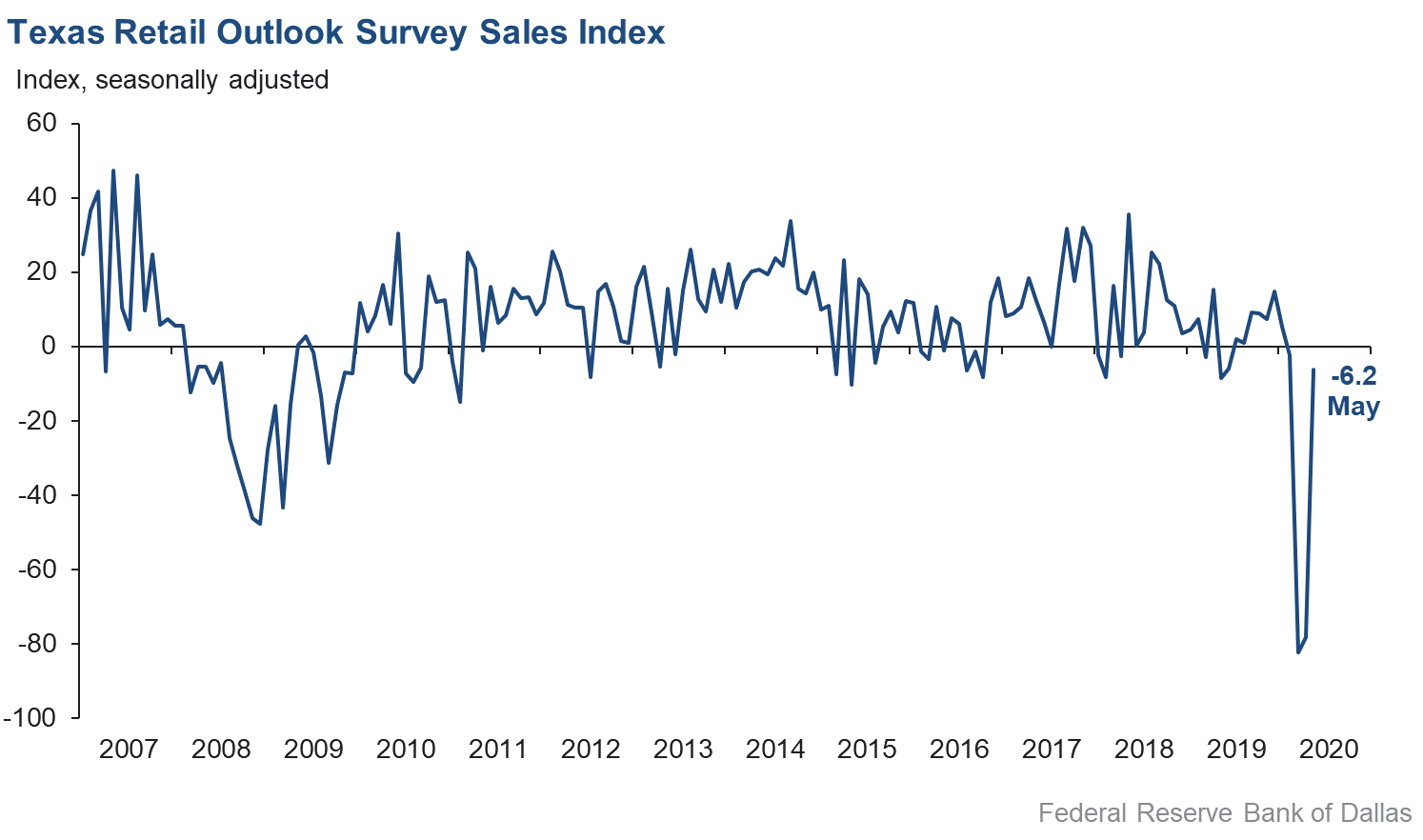

Texas Retail Sales Decline Eases Notably

The decline in state retail sales slowed considerably in May, according to business executives responding to the Texas Retail Outlook Survey. The sales index, a key measure of state retail activity, rebounded from -78.2 in April to -6.2 in May. While nearly 40 percent of respondents reported declining sales compared with April, over 30 percent reported increases—up sharply from last month’s 6.3 percent. Inventories continued to decline at a rapid pace, with the inventories index picking up four points but holding negative at -41.8.

Retail labor market indicators improved significantly, despite still suggesting a moderate contraction in May. The employment index added over 40 points to -7.2, with the share of retailers cutting jobs falling from over 50 percent in April to just 19 percent in May. The hours worked index rose over 48 points to -15.5, with over one-fifth of respondents increasing hours compared with 37 percent cutting hours.

Retailers’ perceptions of broader business conditions were significantly less pessimistic than April’s readings. The general business activity index surged 67 points to -17.9, while the company outlook index rebounded from an all-time low of -84.6 to -12.8. The outlook uncertainty index also fell sharply to 5.4, well below last year’s average of 13.5.

Retail wages continued to decline in May, while price pressures were mixed. The wages and benefits index increased over 13 points but remained deeply negative at -21.4. The selling prices index picked up from an all-time low of -38.5 in April to -9.1 in May, while input prices rose back into positive territory at 3.2.

Retailers’ perceptions of future conditions turned sharply optimistic in May after the extreme pessimism of April. The future general business activity index rose 47 points to 24.3, its best reading since January 2018. The future company outlook index rose 53 points to 29.9. Other indexes of future retail activity, such as sales and employment, turned positive and suggest an anticipation of healthier future activity relative to last month’s expectations.

The Texas Retail Outlook Survey is a component of the Texas Service Sector Outlook Survey that uses information only from respondents in the retail and wholesale sectors.

Next release: June 30, 2020

|

Data were collected May 12–20, and 239 Texas service sector and 57 retail sector business executives responded to the survey. The Dallas Fed conducts the Texas Service Sector Outlook Survey monthly to obtain a timely assessment of the state’s service sector activity. Firms are asked whether revenue, employment, prices, general business activity and other indicators increased, decreased or remained unchanged over the previous month. Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase. When the share of firms reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior month. If the share of firms reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior month. An index will be zero when the number of firms reporting an increase is equal to the number of firms reporting a decrease. Data have been seasonally adjusted as necessary. |

Texas Service Sector Outlook Survey

May 27, 2020

Historical data are available from January 2007 to the most current release month.

| Business Indicators Relating to Facilities and Products in Texas Current (versus previous month) | ||||||||

| Indicator | May Index | Apr Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Revenue | –28.1 | –65.3 | +37.2 | 11.0 | 3(–) | 21.4 | 29.0 | 49.5 |

Employment | –10.4 | –34.5 | +24.1 | 6.2 | 3(–) | 9.6 | 70.3 | 20.0 |

Part–Time Employment | –14.5 | –32.8 | +18.3 | 1.3 | 3(–) | 6.1 | 73.3 | 20.6 |

Hours Worked | –9.4 | –42.9 | +33.5 | 2.2 | 3(–) | 18.7 | 53.2 | 28.1 |

Wages and Benefits | –7.2 | –23.8 | +16.6 | 14.1 | 3(–) | 11.6 | 69.6 | 18.8 |

Input Prices | 9.9 | –0.7 | +10.6 | 25.0 | 1(+) | 23.1 | 63.7 | 13.2 |

Selling Prices | –19.7 | –30.7 | +11.0 | 5.1 | 3(–) | 6.0 | 68.3 | 25.7 |

Capital Expenditures | –23.2 | –47.8 | +24.6 | 10.0 | 3(–) | 10.4 | 56.0 | 33.6 |

| General Business Conditions Current (versus previous month) | ||||||||

| Indicator | May Index | Apr Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | –30.2 | –71.8 | +41.6 | 4.9 | 3(–) | 16.1 | 37.6 | 46.3 |

General Business Activity | –41.7 | –83.9 | +42.2 | 2.7 | 3(–) | 15.2 | 27.9 | 56.9 |

| Indicator | May Index | Apr Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Outlook Uncertainty† | 26.2 | 43.2 | –17.0 | 13.5 | 28(+) | 46.9 | 32.4 | 20.7 |

| Business Indicators Relating to Facilities and Products in Texas Future (six months ahead) | ||||||||

| Indicator | May Index | Apr Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Revenue | 6.6 | –22.6 | +29.2 | 36.8 | 1(+) | 42.6 | 21.5 | 36.0 |

Employment | 4.5 | –12.6 | +17.1 | 21.6 | 1(+) | 26.8 | 50.9 | 22.3 |

Part–Time Employment | –8.0 | –16.8 | +8.8 | 6.4 | 3(–) | 13.0 | 66.0 | 21.0 |

Hours Worked | 12.9 | –5.1 | +18.0 | 5.3 | 1(+) | 25.8 | 61.3 | 12.9 |

Wages and Benefits | 13.9 | –1.4 | +15.3 | 36.0 | 1(+) | 26.2 | 61.6 | 12.3 |

Input Prices | 24.1 | 2.6 | +21.5 | 43.8 | 161(+) | 33.4 | 57.3 | 9.3 |

Selling Prices | 1.2 | –15.4 | +16.6 | 22.9 | 1(+) | 21.3 | 58.6 | 20.1 |

Capital Expenditures | –8.3 | –27.5 | +19.2 | 23.4 | 3(–) | 22.5 | 46.7 | 30.8 |

| General Business Conditions Future (six months ahead) | ||||||||

| Indicator | May Index | Apr Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | –5.9 | –29.9 | +24.0 | 16.0 | 3(–) | 30.9 | 32.3 | 36.8 |

General Business Activity | –11.1 | –34.3 | +23.2 | 12.7 | 3(–) | 31.6 | 25.6 | 42.7 |

Texas Retail Outlook Survey

May 27, 2020

Historical data are available from January 2007 to the most current release month.

| Business Indicators Relating to Facilities and Products in Texas Retail (versus previous month) | ||||||||

| Indicator | May Index | Apr Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Retail Activity in Texas | ||||||||

Sales | –6.2 | –78.2 | +72.0 | 5.7 | 4(–) | 32.1 | 29.7 | 38.3 |

Employment | –7.2 | –47.6 | +40.4 | 1.9 | 3(–) | 11.7 | 69.4 | 18.9 |

Part–Time Employment | –12.9 | –40.7 | +27.8 | –2.1 | 3(–) | 5.6 | 75.9 | 18.5 |

Hours Worked | –15.5 | –63.8 | +48.3 | –2.0 | 4(–) | 21.8 | 40.9 | 37.3 |

Wages and Benefits | –21.4 | –34.7 | +13.3 | 9.3 | 3(–) | 5.1 | 68.4 | 26.5 |

Input Prices | 3.2 | –23.8 | +27.0 | 18.6 | 1(+) | 15.6 | 72.0 | 12.4 |

Selling Prices | –9.1 | –38.5 | +29.4 | 9.8 | 3(–) | 13.8 | 63.3 | 22.9 |

Capital Expenditures | –27.6 | –60.5 | +32.9 | 7.9 | 3(–) | 7.6 | 57.2 | 35.2 |

Inventories | –41.8 | –46.0 | +4.2 | 2.9 | 4(–) | 13.3 | 31.6 | 55.1 |

Companywide Retail Activity | ||||||||

Companywide Sales | –23.7 | –75.0 | +51.3 | 7.1 | 4(–) | 26.4 | 23.5 | 50.1 |

Companywide Internet Sales | –13.1 | –33.2 | +20.1 | 6.3 | 3(–) | 16.7 | 53.5 | 29.8 |

| General Business Conditions, Retail Current (versus previous month) | ||||||||

| Indicator | May Index | Apr Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | –12.8 | –84.6 | +71.8 | 3.1 | 5(–) | 27.2 | 32.8 | 40.0 |

General Business Activity | –17.9 | –84.8 | +66.9 | –1.2 | 5(–) | 24.6 | 32.9 | 42.5 |

| Outlook Uncertainty Current (versus previous month) | ||||||||

| Indicator | May Index | Apr Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Outlook Uncertainty† | 5.4 | 41.0 | –35.6 | 11.6 | 5(+) | 37.5 | 30.4 | 32.1 |

| Business Indicators Relating to Facilities and Products in Texas, Retail Future (six months ahead) | ||||||||

| Indicator | May Index | Apr Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Retail Activity in Texas | ||||||||

Sales | 33.1 | –13.4 | +46.5 | 31.8 | 1(+) | 56.3 | 20.5 | 23.2 |

Employment | 4.6 | –8.1 | +12.7 | 11.8 | 1(+) | 20.6 | 63.4 | 16.0 |

Part–Time Employment | –2.1 | –18.6 | +16.5 | 0.5 | 3(–) | 13.4 | 71.1 | 15.5 |

Hours Worked | 15.8 | –2.5 | +18.3 | 2.6 | 1(+) | 30.8 | 54.2 | 15.0 |

Wages and Benefits | 20.3 | –1.0 | +21.3 | 27.0 | 1(+) | 28.5 | 63.3 | 8.2 |

Input Prices | 21.8 | –12.5 | 34.3 | 32.6 | 1(+) | 30.9 | 60.0 | 9.1 |

Selling Prices | 24.5 | –10.9 | +35.4 | 28.7 | 1(+) | 39.6 | 45.3 | 15.1 |

Capital Expenditures | –5.5 | –23.2 | +17.7 | 17.1 | 3(–) | 21.8 | 50.9 | 27.3 |

Inventories | 5.3 | –24.7 | +30.0 | 7.8 | 1(+) | 35.8 | 33.8 | 30.5 |

Companywide Retail Activity | ||||||||

Companywide Sales | 19.8 | –14.6 | +34.4 | 30.3 | 1(+) | 44.2 | 31.4 | 24.4 |

Companywide Internet Sales | 28.6 | 5.2 | +23.4 | 21.7 | 2(+) | 38.1 | 52.4 | 9.5 |

| General Business Conditions, Retail Future (six months ahead) | ||||||||

| Indicator | May Index | Apr Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | 29.9 | –23.1 | +53.0 | 16.6 | 1(+) | 47.5 | 34.9 | 17.6 |

General Business Activity | 24.3 | –22.4 | +46.7 | 12.3 | 1(+) | 47.3 | 29.7 | 23.0 |

*Shown is the number of consecutive months of expansion or contraction in the underlying indicator. Expansion is indicated by a positive index reading and denoted by a (+) in the table. Contraction is indicated by a negative index reading and denoted by a (–) in the table.

**Shown is the number of consecutive months of improvement or worsening in the underlying indicator. Improvement is indicated by a positive index reading and denoted by a (+) in the table. Worsening is indicated by a negative index reading and denoted by a (–) in the table.

†Added to survey in January 2018.

Data have been seasonally adjusted as necessary, with the exception of the outlook uncertainty index which does not yet have a sufficiently long time series to test for seasonality.

Texas Service Sector Outlook Survey

May 27, 2020

Texas Retail Outlook Survey

May 27, 2020

Texas Service Sector Outlook Survey

May 27, 2020

Comments from Survey Respondents

These comments are from respondents’ completed surveys and have been edited for publication.

Support Activities for Mining

- There is just so much uncertainty with the oil price and the coronavirus issues.

Utilities

- Businesses are beginning to open, but we aren't seeing any increased demand. It appears that most people are still working from home and are not yet comfortable shopping or dining in person for one reason or another.

- The COVID-19 virus has really dampened expectations for our company. Bad debt continues to increase due to our customers not working.

Air Transportation

- Business is bad; traffic and revenue are off 90 percent from a year ago, though trending better than April.

Pipeline Transportation

- We are dependent on global energy demand, which depends on the trajectory of recovery from the coronavirus.

Support Activities for Transportation

- By the end of May, we plan to expand into another market area, which will increase costs (payroll and cost to provide services) and hopefully increase revenue within the six-month period.

Warehousing and Storage

- We are finally starting to see the downturn in exports of crude oil and finished products that would be expected considering the extreme demand destruction worldwide that has happened over the past two months. We are responding by cutting capital spending and finding ways other than employee cuts to reduce expenses. We are seeing better pricing for raw materials and services and expect that to continue as our suppliers have to get more competitive to try to steal what little market share of work there is. We believe the next nine to 12 months are going to be tough but expect to see some improvement by the end of the year and hopefully be back to pre-COVID levels by the end of 2021.

Publishing Industries (Except Internet)

- Most forecast business is taking longer than hoped to advance or close orders due to the coronavirus and related budget effects. Opportunities are there but harder to manage with travel difficulties and increasing client sensitivity to budgets and decision approvals. Focus on and client interest in targeted growing key sectors don't translate into bingo as planned.

Broadcasting (Except Internet)

- April had very little revenue. May is better because businesses are reopening (even if only on a limited basis). Business volumes should increase over the next six months (but we expect they will still be below pre-COVID numbers).

Telecommunications

- The broad decrease in economic activity has turned our near-term outlook from cautious to grim. The COVID-19 pandemic is impacting from both the demand and supply sides. As a small business providing broadband services, a larger portion of our growth is dependent upon customers moving into new homes and buying our services. Given that mortgage closings and new-home starts are down, naturally our demand is falling. Compounding this lack of demand is the loss of revenue from our small retail business customers that have suspended their operations. From the supply side, as a capital-intensive industry, we are experiencing longer lead times for critical components to supply our network as a result of lower factory/manufacturing output—fiber cable and network equipment as examples. As a result, we are expecting to see rising input prices in the coming months. Lastly, we are also anticipating further deterioration as a result of the oil industry and its impact on Houston businesses and consumers.

Data Processing, Hosting and Related Services

- The difference between this month's and last month's "outlook" is primarily the unknown of when businesses will start making purchasing decisions again. To prompt sales interest and purchases in June, we're developing new highly targeted digital offerings. More skilled talent has become available due to furloughs and layoffs, so we've hired more in the local DFW [Dallas–Fort Worth] market.

Credit Intermediation and Related Activities

- Community banking has changed due to the pandemic event. Most employees and customers have adapted very effectively. It is amazing how the banking industry has responded to the current environment and has provided a good example of how versatile private entities can respond to a major event like COVID-19. Community banks were prepared for a pandemic as well as, if not better than, any industry, primarily due to prior preparation for such an occurrence. The exhausting effort to provide the support and distribution of the [Paycheck] Protection Program is a good example of the ability of banks in general to adjust to meeting the needs of their community and customers. The government regulators’ relaxing of regulatory restraint has proven the tremendous value that deregulation can have for any industry. It is important to acknowledge the government for the speed of the reaction to the pandemic. There were many challenges faced in having to alter the way business as usual was conducted by government entities, but by partnering with the private and public sector together, they accomplished the objectives.

- Interest rate compression is impacting revenues. The PPP [Paycheck Protection Program] caused a massive amount of overtime and capital expenditure to bring system efficiency in place. There is an expectation of continued downgrading of loans due to COVID-19.

- We have concerns with businesses closing and charge-offs due to COVID-19 and decreased economic activity.

- We expect to see greater problems for our customers in the first or second quarter of 2021. Government funds and payment forbearance will help customers and businesses for the next six months. If the economy has not rebounded by this time, businesses will begin to shut down.

- The credit markets have completely seized. We are in the process of making a significant capital investment and hiring about 100 people, but access to lending is making it difficult.

Securities, Commodity Contracts, and Other Financial Investments and Related Activities

- The majority of our business was to serve the oil and gas industry. That piece of the business is gone; I don't expect any upward movement between now and 2021. The non-oil-and-gas-related portion of the business is very slow. These are exceedingly tough, tough times for us. Significant cost reductions have been made in every area, even to the extent of discontinuing some parts of the business. Enough said.

- The oil-price drop adds to the pain of the COVID-19 shutdown.

Insurance Carriers and Related Activities

- I am not convinced that we have really turned the corner on this downturn. I remain hopeful, and our business is mostly stable, but travel, hospitality and restaurants are going to have a long road to recovery. And social distancing is killing everybody, including churches and special events.

Real Estate

- I deal with dislocation in the marketplace, and when companies and lenders start to foreclose or sellers need to quickly sell real estate, or with more bankruptcies, my prospects go up.

- The lack of reopening the economy is delaying any hope of recovery. The sooner Texas reopens, the sooner we can start the recovery. The high-risk people need to remain very vigilant, and everyone and every organization needs to continue the masks, cleaning and sanitizing. We need to improve monitoring and tracking until we can define a treatment regime and, ultimately, a vaccine. Keeping business closed is a disaster for individuals and for the communities that depend on the sales and property tax revenue. Keeping children out of school will create a disincentive to work and is going to create a whole generation of children that will be delayed in their educational growth and socialization. The sad part is that the most at risk will be the ones most harmed in this whole mess.

- Texas is a great state and has handled the coronavirus very well. People are cautious but are ready to get out and spend money. Older people are less inclined to get outside their homes.

Rental and Leasing Services

- I am 71 years old and lived through a number of busts including the oil patch of '82—everyone thought it was at least 10 years off until it was the next day. Everyone thought we'd recover by the end of the year; we did 10 years later. This recovery, if we are blessed to survive at all, will be long, slow and difficult at every turn! The government has subsidized thousands of businesses that, if they had been run correctly and profitably to begin with, would not have needed the assistance. We have wasted billions helping poor companies survive to continue to destroy the market. Regardless, I am going to get to pay all that government largesse back forever in huge tax increases.

Professional, Scientific and Technical Services

- The situation will continue to worsen until either an effective treatment and/or a vaccine is developed. The energy sector business will be down for years due to the virus and the Saudi/Russia price war (which effectively targets U.S. production). No amount of storage will suffice to hold oil markets up.

- Our business has remained steady due to a strong pre-COVID-19 backlog and continued strong project opportunities. Our longer-term outlook expects weaker conditions in light of continued uncertainties related to managing the virus spread, sustaining return-to-work status, length/depth of decreased state funding and eventual impact. We expect smaller market opportunities over the next 24 months and will have to increase market share to sustain current levels of business.

- Things are getting slightly better in May versus April. Our biggest customers are what affects our overall revenue. Big customers seem to be purchasing somewhat lower amounts but still buying software licenses. The next two months will show if we have recovered from COVID-19 business-wise.

- Our company successfully pursued a PPP loan, which has improved our economic outlook.

- We furloughed our contract employees (4 percent of total), reduced wages across the board by 10 percent, eliminated overtime, are working from home (about 80 percent of staff regularly) and have applied for and received a PPP loan. While SARS CoV2 has reduced our workload to a degree across all sectors, the steep reduction in oil pricing will likely have the largest and longest effects. We are planning at this time to return to the office June 1 but are watching all available sources and will adjust our plan as necessary.

- My busy season has been extended because of the overall extension of tax return due dates. I am also busier because of the stimulus loans and the surrounding confusion.

- We expect demand to be down for May and June before starting to return. Right now, our revenues are still at or above early-year projections for this time, but we do expect the drop in demand. But, we also only expect that drop to be in the 5–10 percent range.

- Obviously COVID-19 is the issue. The uncertainty, the fear and the inability to get back to work is jeopardizing our economy.

- We work primarily with nonprofit organizations in building their capacity. COVID-19 has definitely illuminated the lack of capacity some of our nonprofit clients have in dealing with a crisis, internal communications, relationships with donors and succession planning. Our workload has increased while much of our pipeline has dwindled because nonprofits don't want to start any new projects or are afraid of losing funding to pay for capacity-building work. Although we are putting in more hours right now and our cash flow is strong, we anticipate a decrease this summer and fall as nonprofits brace themselves for their revenue to decrease. The uncertainty of it all causes increased stress.

- The high level of unemployment has slowed the commercial real estate industry significantly. Investors are pulling out of the market at a rate we have never seen. Issues with valuing assets is the main problem. What will the multifamily market look like once the stimulus runs out? What will the office market look like on the other side of this? There is no way to determine what the real estate market will look like in the months to follow, so our outlook for commercial is dismal at best. On the other hand, the residential industry is still booming due to low interest rates. There is not a better time to buy a house. How long this can last is unknown, but with unemployment continuing to rise and lenders raising credit score requirements, we don't see how this can continue long term. We know we will get through this, but the damage to our economy will take years to recover from.

- April saw a slight decrease in hours—about 2 percent. May looks like it will be a larger decrease—maybe 10 percent.

- The volatility of the stock market and constantly changing economic outlook is tied to the reopening of the economy.

- We are seeing a softening in demand for engineering services that will impact our work in the third and fourth quarters.

Management of Companies and Enterprises

- The SBA [Small Business Administration] PPP program has put a large amount of loans and deposits on our books, which has helped our income. We have hired additional people to help us with the volume.

- Uncertainty levels will continue to be impacted by COVID-19 unknowns and the overall economic impact related to it.

Administrative and Support Services

- Our company is a travel service provider for corporate and government accounts. Due to the pandemic, the DOD [Department of Defense] has canceled all trips through June 30. Some airlines have gone out of business, reduced the number of flights, adjusted cabins to meet COVID-19 rules, etc. Travelers are scared to fly anywhere either for business or leisure. Without a vaccine and a treatment in the near future, I can’t imagine that travel will come back this year or next at the same level it was earlier this year. I received a PPP loan for payroll and administrative expenses, but after that I cannot think of a solution.

- We need to manage the fear and get back to work.

- We remain optimistic, but cutting expenses to offset the decrease in revenue and profits is low-hanging fruit, so we expect to see cuts in labor and cap ex [capital expenditure] spending, unfortunately.

- With the loss of so many restaurant customers, it is unknown when and if they will come back to use outside services.

- So much for hiring people. The situation has not changed very much; it is still tough to find people.

- The travel industry is the hardest hit and will be the last to rebound.

- The key questions are how the recovery takes shape (U, V or swoosh) and whether it is a "jobless" recovery or not.

Waste Management and Remediation Services

- Obviously, the impact of the public health emergency has brought about a lot of uncertainty, other than knowing the business climate for our customers has changed. We are part of the nation's essential supply chain and have maintained operations throughout the last two months. We're operating as long as our manufacturing customers are open and running. My concern is that as Phase 1 and Phase 2 are implemented, our employees will begin to let down their guard, believing the threat of the virus has decreased. I believe just the opposite, i.e., the threat will increase.

Educational Services

- As states (Texas) begin to transition back to opening and workers move back into the workforce, I think it will provide a great signal for the beginning of economic growth, spurred on by more activity and an easiness in the public going about their business in a safe manner. I think there is pent-up demand to purchase by consumers, and that should bode well for GDP [gross domestic product] in the coming quarters. You can only keep the American consumer locked down for a short amount of time and then they will head toward the flood gates. One thing I know is that we deal with and manage risk every day. Americans understand that but are willing to accommodate in the short term, and I mean very short term. But when the time is up, citizenry will let you know in the form of protest and outright defiance.

- For higher education, planning is becoming more difficult rather than less because the students and parents we serve want certainty that we can't provide, the health response to reopening won't be understood for several more weeks, and [there is] the likelihood of a fall/winter resurgence for six months. Every plan we make changes.

Ambulatory Health Care Services

- The need for emergency food has grown overnight by 400 percent as vulnerable people and people who have lost jobs must depend on the food bank to ensure that they have the food they need to weather this pandemic.

- All our employees returned to work this week. Despite positions rated as [dangerous] even before COVID-19—dental hygienist, dentist, [and] dental assistant—none were affected negatively by high unemployment insurance program rates, likely because they are all compensated at or above unemployment insurance rate levels. There is no incentive other than fear to keep them from returning to work.

- We are functioning at about 65 percent of normal volumes. We continue to maintain a full payroll (received a paycheck loan from SBA last week after a three-week wait).We are spacing appointments and are near capacity due to COVID-19 restrictions but anticipate extending hours. We have hired three new additional screeners, so payroll costs are high, but we are confident that viability will be maintained over the next several months.

- The long-term impact to health care providers (across the spectrum) may last for the remainder of our careers and lives—emotionally, physically, financially and in ways never even considered. Being a physician during COVID-19 is an impossible job; the fate of America is dependent on the results from a swab; too many patients dying; employees inside crying; tragedies and business collapse—reason to sob.

- The unconstitutional closings of outpatient and physicians' offices and surgeries were not based on medical science, but false assumptions, false predictions and falsified data, which are still being created. These actions have destroyed many lives, families and businesses in the medical field, financially and in other ways, forever.

Nursing and Residential Care Facilities

- We are incurring additional expenses related to COVID-19 (PPE [personal protective equipment] and other supplies, premium pay (1.5X) for employees at communities with COVID-positive cases and sterilization/disinfecting) with no governmental relief available to us because we are not included in their definition of "health care." At the same time, access to our communities is restricted due to state and local governmental orders and because we want to ensure the safety of our residents, so we are having limited move-ins of new residents while resident move-outs are occurring at a normal rate. This is resulting in declining occupancy and revenue. The only governmental "relief" available to us is the payroll tax deferral, which is helpful in the short term but has to be repaid in time. This is a very challenging time for the senior-living industry and our company in particular. All of our resources and efforts are being applied to take care of our vulnerable seniors, but our resources to do so are dwindling.

Social Assistance

- Because we offer workforce development services, the need for our services has substantially increased; the levels are tied to the number of unemployment claimants which, when they begin looking for jobs, will depend on the labor demands of employers as the economy reopens. However, it is not expected that employers will be able to rapidly recover, which will continue stressing local public organizations such as city and county governments.

Museums, Historical Sites and Similar Institutions

- We are working on the complexities of "opening" while keeping everyone safe without good direction or consensus from political leaders.

Accommodation

- We closed March 20 and will reopen June 1. Our May and April were the same: no business. We are opening June 1 but are not believing we will see a great deal of demand during the summer months. Our biggest issue is that group business is not likely to return until fall at the earliest. Many say that is optimistic. To open, we have reduced our footprint considerably. This is going to take time and a feeling from consumers that it is safe to visit a hotel or restaurant.

Food Services and Drinking Places

- We have seen an increase in business with the new 25 percent occupancy change. We are hoping the governor will continue to slowly open operations in Texas. Our local government in El Paso is pushing against the governor, so we are not sure if we will be able to open at a larger capacity soon or not. With the opening, we were able to bring back a number of our staff, and our sales have improved. We are still holding off on large cap ex that had been planned. Even with improvements, we are still losing money, so cap ex is not feasible right now.

- We can only seat 25 percent of normal capacity, but expenses remain higher. The result is causing us to lose money daily.

- This is so much worse than anyone realizes.

- The cost of beef is off the chart—expecting relief soon.

- Besides the national economy, the Texas economy will be down because of oil prices.

- COVID-19 has shut down the restaurant industry. May is better than April, as we are able to open at a 25 percent occupancy, but overall this is not a viable option.

Religious, Grantmaking, Civic, Professional and Similar Organizations

- We need stability at the federal level and it just is not there.

- We received a Paycheck Protection Program loan, and it helped us get through April, [and is expected to help in] May and part of June, but when we have completed the two-month period covered by the loan, we expect a RIF [reduction in force]. Our revenue has been reduced by 75 percent due to the combination of COVID-19 and low oil prices, and a business recovery looks a long way off.

- We need to get the economy open and shift focus from the virus to economy-related. Businesses are bleeding out.

Merchant Wholesalers, Durable Goods

- We still feel uncertain although we had a good month. After receiving the PPP loan, we were able to hire back employees who were on unemployment, as well as increase hours for those we decreased and hired one more person. It's hard to say if we just had a good month or if things are looking up, so there is still some uncertainty in that regard.

Merchant Wholesalers, Nondurable Goods

- I am concerned for our farmers and ranchers. Our livestock producers will have grave issues if we cannot get our processing plants open to full capacity. Consumers are seeing price increases and shortages of beef, pork and poultry. Yet our livestock producers are drowning in inventory.

- PPP has helped us from decreasing hours and decreasing employees. We are still operating as a drive-thru business even with Gov. [Greg] Abbott starting to relax some rules. We own our store and sublease some additional space. One is to a nursery, the other is to an evening bar and recreational space. They will be shutting their doors after one year of operations due to spacing and capacity restrictions. The nursery is doing great. Looking forward, we see a tough business environment for several months but will do our best to hang on. We have 40-plus families who depend on it.

- We're still holding out for the stay-at-home orders to be lifted in Texas and other markets we serve. Until casual dining opens and gains more patrons, we're waiting to service what I perceive to be significant pent-up demand for dining out.

Motor Vehicle and Parts Dealers

- While the business level for May has increased, I now think that business will slow again in the summer as the stimulus winds down. The damage to the economy is more long term than realized.

- With the auto manufacturers shut down, inventories will become short before returning to normal.

- Don't be misled by the increase; April was a tough month for our industry. SAAR [seasonally adjusted annualized rate of sales] at 8.6 million tells the story. Conditions may be improving, but the crisis remains.

- Our retail business increased the end of April and seems to be holding steady on the sales side. Our service repair business is improving from a very poor April.

Building Material and Garden Equipment and Supplies Dealers

- In Texas, between oil prices and COVID-19, it does not look good.

Clothing and Clothing Accessories Stores

- We are not essential, so stores were closed the entire month of April with some reopening May 15. The company filed for reorganization May 11.

Nonstore Retailers

- Rather than deteriorating, sales seemed to stabilize in mid-May. We have worked diligently on product mix to increase the amount of popular food and beverage items to maximize sales.

Historical Data

Historical data can be downloaded dating back to January 2007.

Indexes

Download indexes for all indicators. For the definitions of all variables, see Data Definitions.

Texas Service Sector Outlook Survey |

Texas Retail Outlook Survey |

| Unadjusted | Unadjusted |

| Seasonally adjusted | Seasonally adjusted |

All Data

Download indexes and components of the indexes (percentage of respondents reporting increase, decrease, or no change). For the definitions of all variables, see Data Definitions.

Texas Service Sector Outlook Survey |

Texas Retail Outlook Survey |

| Unadjusted | Unadjusted |

| Seasonally adjusted | Seasonally adjusted |

Questions regarding the Texas Service Sector Outlook Survey can be addressed to Christopher Slijk at christopher.slijk@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Texas Service Sector Outlook Survey is released on the web.