Shift from utility to corporate financing for renewables presents risk

Power purchase agreements (PPAs) are essential for the development of renewable energy projects such as wind and solar farms in the United States. In some regions, utility companies have been the primary buyers under these long-term contracts. However, an increasing number of corporations are now seeking PPAs to directly obtain renewable energy, bypassing traditional electricity procurement. The increase in corporate PPAs relative to utility PPAs means more opportunities for renewable energy developers, but it also presents higher counterparty and merchant tail risks for lenders involved in renewable energy project financing.

PPAs play crucial role for renewable energy project development

A PPA is a long-term (typically 10- to 30-year) contract between an energy producer and a buyer. PPAs lock in electricity prices and quantities, offering buyers protection against future price increases in the volatile energy market. A PPA can involve either physical delivery of electricity to the buyer or indirect delivery so that both buyer and seller transact in the open market but agree to offset the volatile market price to reach the pre-specified virtual PPA price. For sellers, PPAs guarantee stable revenue, which is critical for securing financing and covering the high up-front costs of building renewable energy facilities. The revenue from a PPA often serves as the primary source of loan repayment.

The market shift from utility to corporate PPAs

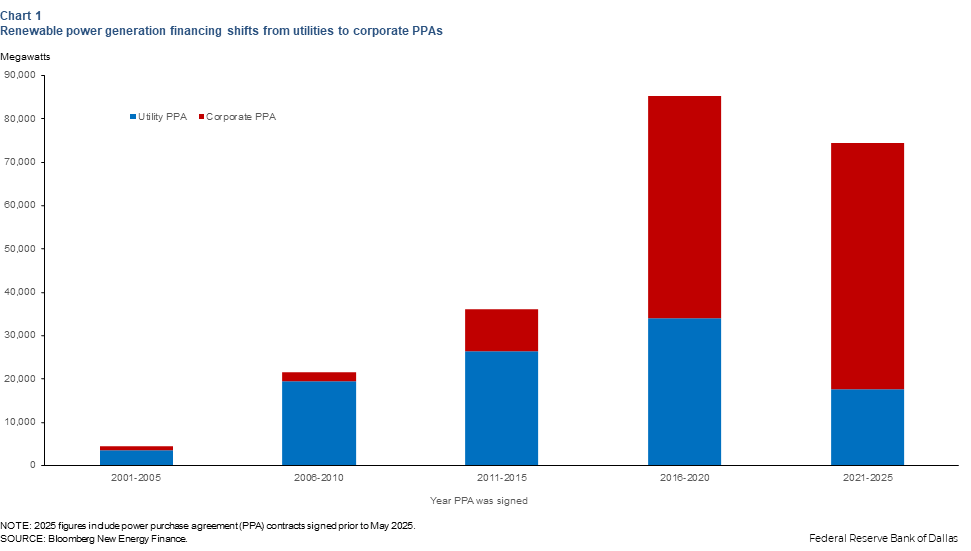

Historically, utility PPAs, in which an electric utility operating in a regulated market buys electricity from an electricity producer, dominated the wind and solar PPA markets, encouraged by regulatory standards such as the Public Utility Regulatory Policies Act and renewable portfolio standards. During the early stages of renewable energy penetration in 2001-2015, 80 percent of installed capacities under PPAs were with utilities, mostly comprised of vertically integrated utility companies in regulated markets, totaling 49 gigawatts (Chart 1).

During the past decade, the corporate PPA market has grown substantially, with corporate buyers now using these contracts to fulfill sustainability goals. For example, Walmart signed three PPAs with EDP Renewables wind projects in 2018. In 2024, the retailer signed an additional PPA with a solar project in Texas, also developed by EDP Renewables. In deregulated markets, retail electric providers and energy traders often secure long-term contracts directly with wind and solar projects through corporate PPAs while they largely purchase electricity in wholesale markets.

According to data from Bloomberg New Energy Finance, corporate PPAs have led to 108 gigawatts of installed capacity, representing 68 percent of PPAs signed from 2016-2025 (Chart 1). There has also been increasing demand from big tech companies recently, driven by their data center development and the substantial electricity use for generative artificial intelligence.

Corporate buyers have weaker credit profiles compared to utilities

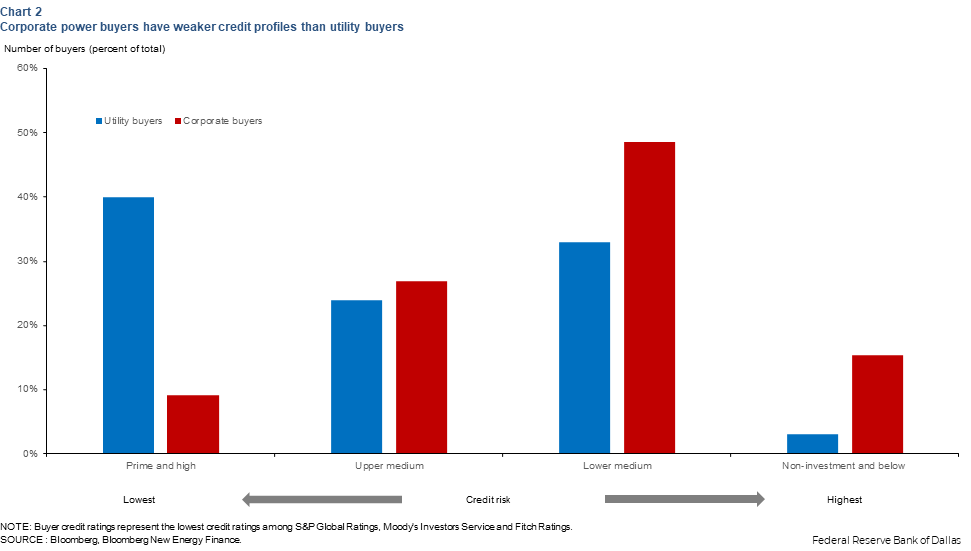

Corporate buyers generally have weaker credit profiles compared to utility companies. Utility companies benefit from stable cash flow and government regulations that ensure cost recovery, whereas corporations face greater sensitivity to economic downturns, industry headwinds and technological changes. A corporate buyer, even a large one, may have a lower credit rating or a greater risk of fluctuations in its financial stability over the PPA’s 10- to 30-year term.

About half of corporate buyers are rated lower medium grade by the top three U.S. credit rating agencies, indicating moderate default risk, and 16 percent are rated non-investment grade with higher risk of default (Chart 2). In contrast, 40 percent of utility buyers are rated in the prime and high grade categories, with the vast majority of remaining utility buyers rated upper medium or lower medium grade. Only 3 percent of utility buyers fall into the non-investment-grade category. The lower credit profiles of corporate buyers present higher counterparty risk for renewable projects than before 2016 when utilities dominated PPAs, thereby increasing risk for lenders who provide loans for renewable project development.

Corporate PPAs have shorter contract terms compared with utility PPAs

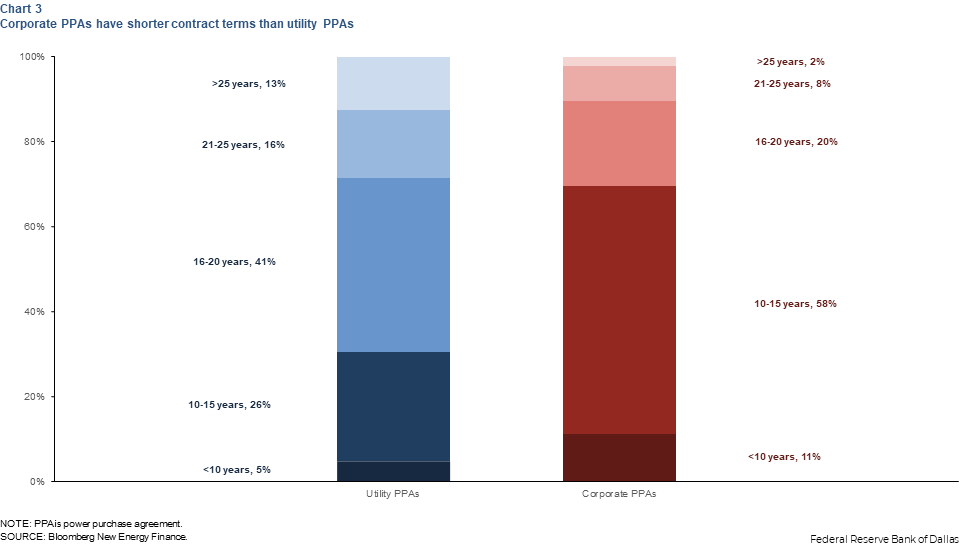

Corporate PPAs typically have shorter contract terms than utility PPAs. A shorter contract term makes a renewable project with a corporate PPA vulnerable to market price volatility when the agreement expires. From a financing perspective, this is particularly significant because many renewable projects are financed with 15- to 20-year debt amortization schedules. The maturity mismatch commonly found with corporate PPAs means contracts expire before loans are fully paid off, creating what is known as merchant tail risk.

For PPAs signed after 2015, 69 percent of corporate PPAs have terms shorter than 15 years (Chart 3), while the life expectancy of utility-scale solar and wind projects is longer than 20 years. Utility PPAs have relatively longer contract terms: 70 percent of utility PPAs have contract terms longer than 15 years.

How to mitigate risk for lenders in the corporate PPA market

PPAs play a critical role in the rapid development of renewable projects that present unique risks for lenders. The shift toward corporate PPAs presents distinct and generally higher risk implications for lenders compared with utility PPAs.

To mitigate counterparty and merchant tail risk, lenders should conduct thorough due diligence on the creditworthiness of corporate buyers, diversify their portfolios to reduce exposure to any single counterparty and consider structuring loans with shorter amortization periods that align more closely with PPA contract terms. Additionally, lenders may explore hedging strategies to protect against market price volatility during the merchant tail period.

By taking these proactive measures, lenders can better navigate the complexities and risks associated with financing renewable energy projects under corporate PPAs.

About the author