Renewable energy projects present unique lender risks, need for oversight

Commercial renewable energy projects, led by rapid growth of wind and solar power over the past decade, pose unique risks for lenders who have acquired credit exposure to the sector. Moreover, these risks are evolving as electricity markets change and technology develops. Maintaining an active risk management program allows lenders to respond to changes in the industry that can impact credit performance.

Renewable energy projects involve considerable upfront capital expenditure, according to the U.S. Energy Information Administration. Average construction costs are $1,661 per kilowatt for wind and $2,921 for solar-photovoltaic, both considerably costlier than the $696 for a natural gas-based power plant.

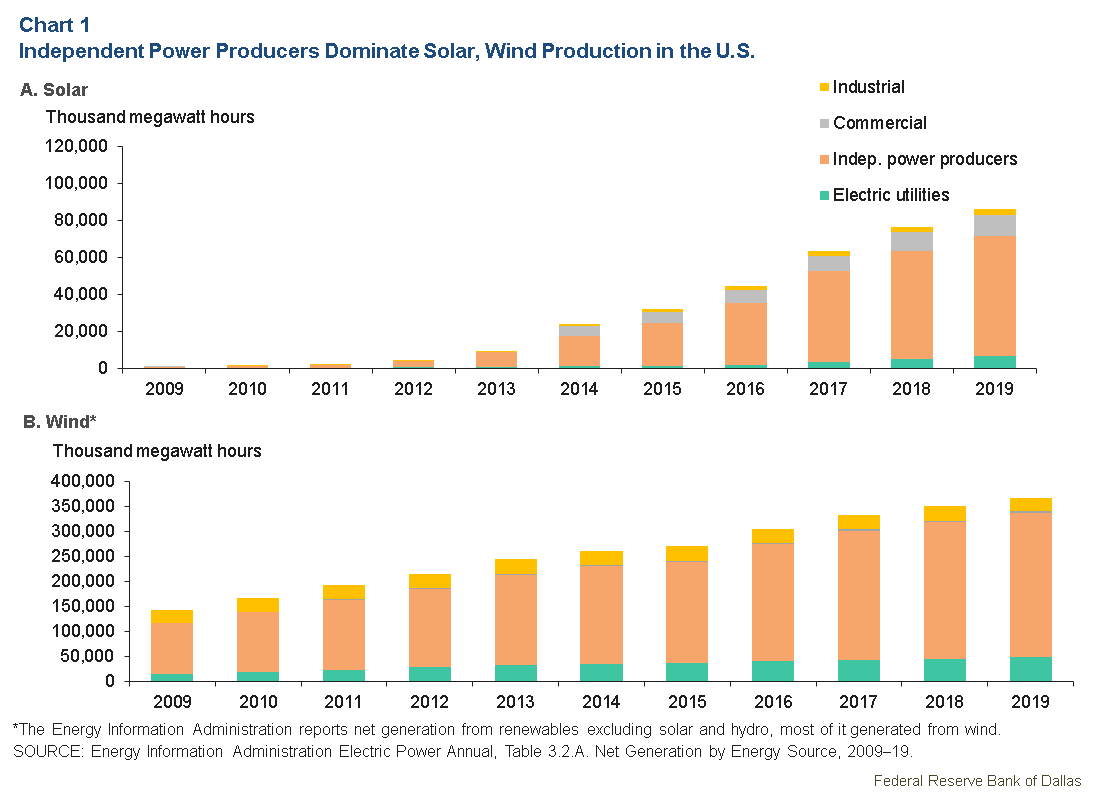

Independent power producers predominate solar, wind projects

Independent power producers are the major players in solar and wind projects and face distinct risks (Chart 1). These producers have two notable characteristics: They generate electricity for public consumption, and they are not classified as electric utilities.

Independent power producers are not vertically integrated like utilities in traditionally regulated markets. Instead, they are solely engaged in the generation of electricity, though still subject to some oversight . Risks exist at various stages of the electricity value chain. There is “resource risk” for commercial solar and wind projects—the risk that the sun doesn’t shine, or the wind doesn’t blow as much as projected, and less electricity is generated than anticipated. Weak winds in the North Sea in the summer and fall last year illustrate how lower-than-expected resource availability affects earnings of renewable projects.

Forecasting project performance is another risk area. Overly optimistic solar generation estimates can impair project cash flow, according to 2021 Solar Risk Assessment by kWh Analytics, a San Francisco solar data analyst. Projects with persistent resource underperformance could push cash debt service coverage ratios—a measure of the cash available to make debt payments—below those used during underwriting.

Challenges of moving power from generation to customer

Once electricity is generated by a renewable independent power producer, it needs to be moved from the point of generation to the point of consumption. This process is referred to as transmission and distribution. As electricity moves to the point of consumption, there are a couple of key risks—specifically, congestion and curtailment.

Congestion risk occurs from insufficient grid capacity, the equivalent of a motorist stuck in rush-hour traffic. Congestion risk is important because it can create divergence in the settlement price points in a market—the difference between the price of electricity at generation and at another point in its delivery to market when it may be subject to marketplace repricing. This difference in settlement price points is called basis risk, and it can negatively affect a borrower’s repayment ability.

Curtailment risk is the possibility of a project not producing even though resources are available to generate electricity. There are two primary reasons for curtailment—congestion and a supply/demand imbalance.

This could occur on a fall day when the sun is shining, the wind is blowing, but people have their windows open and thermostats turned off, and therefore, the supply of electricity exceeds demand.

In 2019, this happened with some regularity, according to data from the Lawrence Berkeley National Laboratory. The wind curtailment rate in the upper Midwest service area of the Midcontinent Independent System Operator power grid was 5.5 percent during the year, while within the Electric Reliability Council of Texas system—which accounts for about 90 percent of Texas’ electrical load—it was 2.7 percent. Across the U.S., the wind curtailment rate was 2.6 percent.

Curtailment can be significant during certain seasons in some regional electricity markets. Lost generation due to curtailment affects a generator’s revenue stream, and in turn, may diminish the cash flow available to repay lenders.

Counterparty risks for providers

Independent power producers also encounter financial risks, most notably counterparty risk and merchant risk.

Counterparty risk arises from the fact that generators are often paid for the electricity that they produce via a single “offtake agreement”—covering all that they produce—with a utility or corporation. The imminent bankruptcy of California’s largest utility, Pacific Gas and Electric, in 2019 rippled through to the Topaz solar farm, which sold power to the power company and whose debt was subsequently downgraded.

Merchant risk arises when a portion of a power generation company’s production is sold into the wholesale market, exposing the generator to potentially volatile market prices, such as were present in February 2021 when Texas suffered through unusually cold temperatures.

Necessity of prudent loan underwriting, ongoing monitoring

There has been rapid growth in renewable energy investment and in installed capacity for solar- and wind-based electricity-generating facilities. A vigorous risk management program can mitigate potential problems facing banks and nonbank financial institutions engaged in financing these facilities—whether as agents, loan participants or direct lenders.

The extent and level of the risk management program may be informed by the level and complexity of debt arrangements and should be sufficient to provide the lending institution’s management and board of directors with adequate market information to make informed decisions about the risks involved.

Establishment of prudent underwriting standards and ongoing credit monitoring processes allow lenders to identify, measure, monitor and control credit risks associated with these projects. Periodic review of a project’s performance is critical to assessing the ongoing repayment ability over the life of a project.

Such credit review should allow lenders to update credit-risk ratings consistent with changes in market fundamentals or payment performance.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.