Global Perspectives: John Hess on U.S. oil reserves, climate change

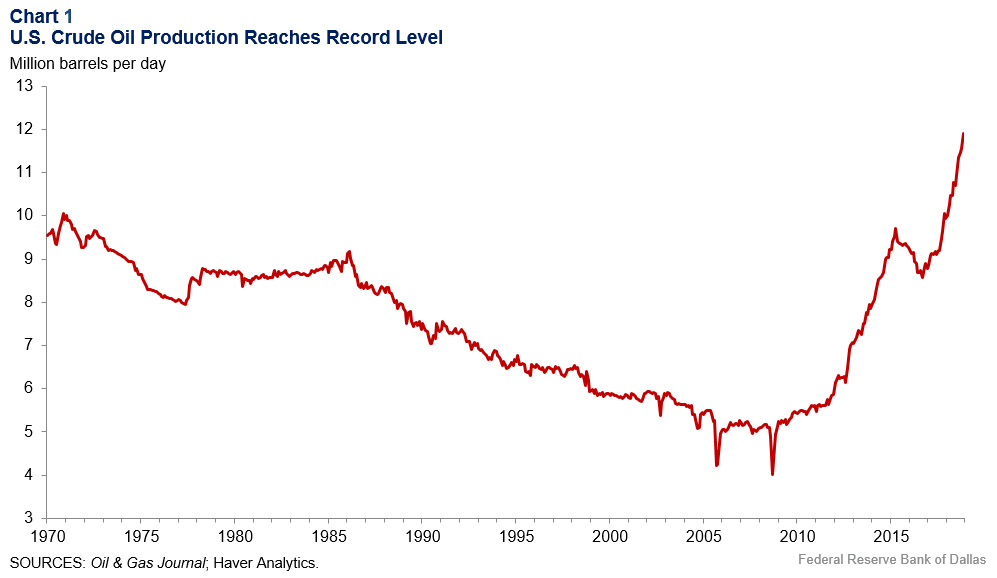

Few sectors of the U.S. economy have undergone as radical a transformation in recent years as the energy sector, and few loom as large in the economic fortunes of Texas and the Eleventh District. U.S. crude oil production now exceeds the previous peak attained in 1970, and the U.S. is now the world’s largest producer (Chart 1).

This structural transformation has been driven by innovations in the technology of oil production, notably hydraulic fracturing and horizontal drilling in shale formations. Whether or not one classifies these innovations as disruptive, they have fundamentally changed the landscape of the energy business in the past decade.

But there is more to the story. As important as shale production has been, there are also new developments in offshore exploration and production that may arguably dwarf shale’s effects.

And we should not forget the ongoing debate about climate change as we consider the relative contributions of fossil fuels versus renewables in meeting global energy needs in coming decades.

Last month, the Federal Reserve Bank of Dallas hosted John Hess, CEO of independent energy firm Hess Corp., as part of the Bank’s Global Perspectives speaker series. This series was launched at the beginning of 2016 with the objective of bringing leaders from business, academia and policymaking to the Dallas Fed to share their insights on global, national and regional developments.

Hess and Dallas Fed President Rob Kaplan discussed the prospects for shale production and the energy sector and the resulting challenges. The following are excerpts from the conversation, edited for clarity and presented by topic.

The search for U.S. reserves

Hess: We’re about 70 percent “United States” in terms of our production. We’re in North Dakota in the Bakken [shale formation]. We’re one of the leading oil and gas producers there, producing about 125,000 barrels a day of oil and gas and going up in the next couple of years to 200,000 barrels a day.

We’re also in the deepwater Gulf of Mexico. We’re one of the five top producers there, and we have about 70,000 barrels a day of production.

What’s interesting about the Gulf of Mexico is that 10 years ago, about 8,800 blocks were under lease to companies like ours. Today, the number of blocks leased in the Gulf of Mexico is 2,500. So, there’s been a liquidation of leases in the Gulf of Mexico, in part because so much money went to shale, and in part because oil prices are so low and you have to make tough choices.

Limits of shale supplies

Hess: We decided to stay in the offshore business, but also in the onshore business, because what people don’t realize is that shale is about 6 percent of world oil supply. It will grow probably to 10 percent of world oil supply by 2025 and then it plateaus. Even though there’s an obsession about it here in this country and probably a rational fear [of it] in the rest of the world, shale is not the next Saudi Arabia. It’s an important part of the short cycle of the mix of oil supply in the world, but we’re going to need a lot more than shale.

Impact of climate change on energy

Hess: First of all, climate change is real. And I think it’s probably the greatest challenge our society has. How do you grow energy by a third by 2040 and decrease our carbon footprint at the same time? Most people don’t understand the “how”; they understand the “what.”

We all agree on the what, but on the how I would recommend work at Princeton [University] called The Princeton Wedges. You can go to Google. It will come right up, and it explains what you have to do to grow supply for that 30 percent increase in demand growth, but also decrease the carbon footprint. [Strategies to reduce and manage carbon are collectively outlined in 15 wedges.] Each wedge is an initiative.

Each one is pretty Herculean in what you have to do. You have to go from 400 nuclear plants to 1,200 nuclear plants. By the way, after Fukushima [the nuclear disaster in Japan], I don’t think the public will is there, and each plant probably costs $10 billion. Someone’s going to pay for it, and not many people have balance sheets that can accommodate that.

You have to convert a coal electric plant to a natural gas electric plant every week for 45 years. You have to do 2 million windmills. Instead of having 30 miles per gallon, you’ve got to have 60. You have to stop deforestation.

You get the point. You have to do 15 of these Herculean things.

Understanding environmental challenges

Hess: I think what we, as an industry, have failed to do is make people understand the enormous tasks we have ahead [and] where we need more energy. Oil and gas will probably be 50 percent of the mix even with 300 million electric vehicles on the road by 2040.

We are all for engaging on the subject, but we want to make sure the public, government officials and businesses have a common understanding.

About the Author

Mark A. Wynne

Wynne is vice president and associate director of research in the Research Department at the Federal Reserve Bank of Dallas.

The views expressed are those of the author and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.