Risks abound If China uses debt to stimulate economy from current downturn

The Chinese economy is losing steam. Retail sales growth in China is the weakest in 15 years. Fixed-asset investment growth is the slowest on record, and in December 2018, the manufacturing purchasing managers index (PMI) fell below 50, indicating that the Chinese manufacturing sector is contracting.

As China considers how to work through these difficulties, its chances of success may depend on how it finances the debt it incurs while attempting to boost economic activity.

This is hardly the first time China has had to reckon with an economic slowdown. The current slump marks the fourth time the Chinese manufacturing PMI has slipped below 50 in the last 10 years. It previously indicated contraction during the global slowdown of 2008, the China slowdown of 2012 and a subsequent China slowdown in 2015.

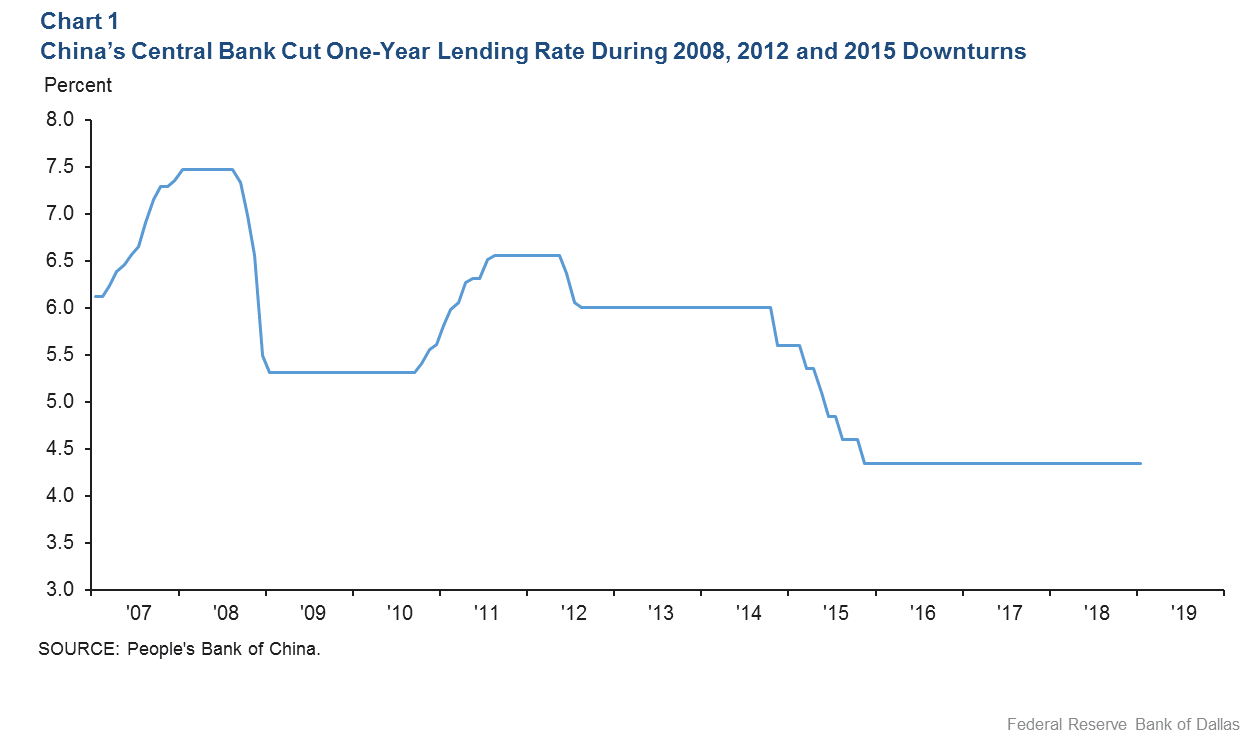

When the Chinese economy starts weakening, the country’s central bank has typically turned to monetary stimulus to get things moving. The People’s Bank of China cut interest rates in the downturns of 2008, 2012 and 2015 (Chart 1).

Increasing private sector debt

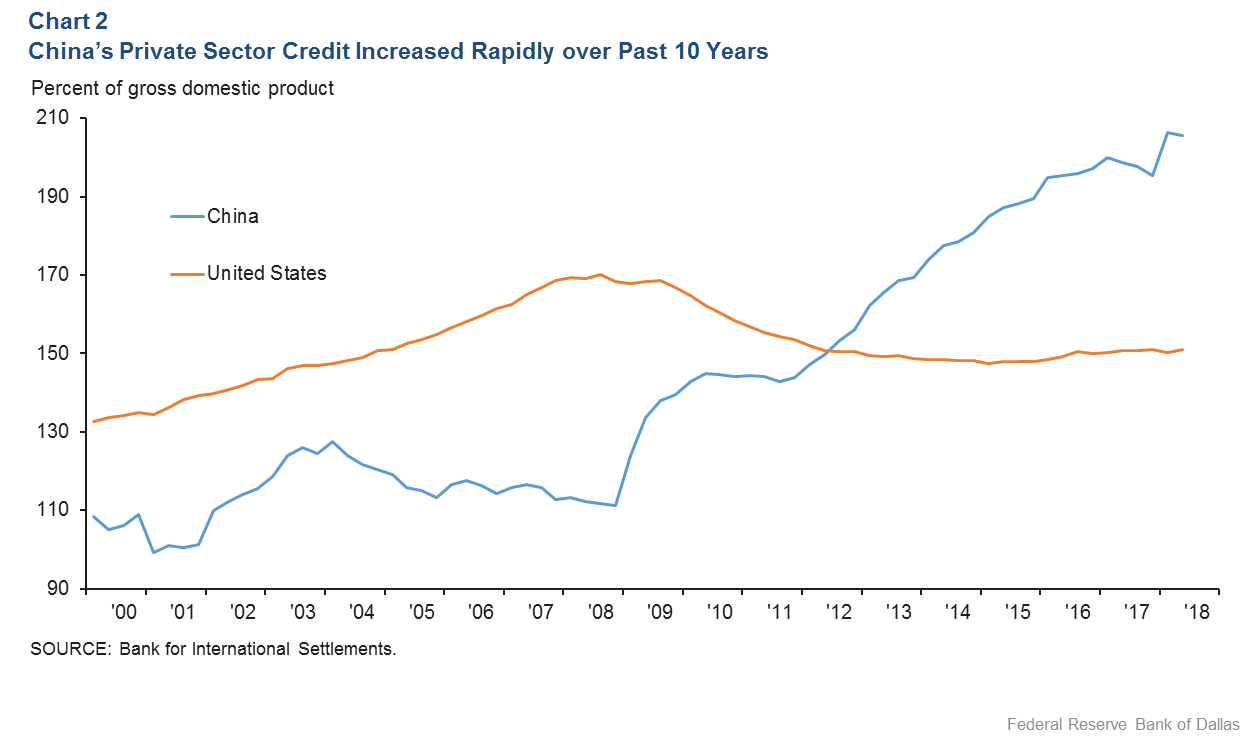

These repeated cycles of monetary stimulus have produced a massive increase in China’s private sector debt. Credit to the nonfinancial private sector as a share of gross domestic product (GDP) has increased from 113 percent at the beginning of 2008 to 205 percent in 2018, according to the Bank for International Settlements. By contrast, from 2000 to the eve of the global financial crisis in 2008, the same ratio in the U.S. increased from 132 percent to 170 percent (Chart 2).

How did a 38-percentage-point increase in the private sector debt-to-GDP ratio in the U.S. between 2000 and 2007 contribute to a large-scale banking and financial crisis, yet a debt buildup in China that was more than twice as large didn’t do the same?

Three co-authors and I addressed this question in a 2015 article. At the time, the private, nonfinancial sector debt-to-GDP ratio in China was (only) 180 percent. We argued that the Chinese debt buildup was safer than in many similar, earlier periods of rapid credit growth because domestic savings, not foreign borrowing, financed this mountain of debt.

Rapid debt growth during other crises

In this 2015 article, we discussed a number of recent periods of rapid credit growth, such as in the U.S. and the U.K. before the global financial crisis, the eurozone periphery countries Greece and Spain before the eurozone crisis, and East Asian countries Indonesia and Thailand before the East Asia financial crisis.

In each instance, a crisis began after the private sector credit-to-GDP ratio had risen by 30 to 40 percentage points over a five-year period. By comparison, the credit-to-GDP ratio in China increased by 70 percentage points over a five-year period before 2015.

What made China different in 2015 from the other periods of rapid credit growth occurring in the U.S. and the U.K., the eurozone periphery or East Asia countries?

All those episodes coincided with large current-account deficits, meaning foreign borrowing financed the credit boom. China, conversely, has been running a current-account surplus during this time of rapid credit growth, meaning that domestic savings financed China’s credit boom.

Calculating chances of banking crisis

To gauge the impact of high rates of credit growth on the probability of a subsequent banking crisis, data for a large panel of countries were used to model the incidence of banking crises, controlling for a range of economic factors as well as the growth in credit.

The incidence of a banking crisis in a given year and in a given country is regressed on that country’s credit growth over the previous five years and other country-specific variables. These variables included the current-account surplus or deficit as a ratio of GDP; the output gap (the difference between GDP and its theoretical potential); the inflation rate; and whether the value of the country’s currency was set via a fixed or floating rate.

The change in the probability of a banking crisis resulting from a one-percentage-point increase in the private sector credit-to-GDP ratio is derived from the regression. Specifically, the estimated credit-to-GDP coefficients can be interpreted as the “marginal effect” of an increase in the credit-to-GDP ratio on the probability of a banking crisis.

The regression also allows for the possibility of an interaction between credit growth and the current account. By allowing for this interaction, the marginal effect becomes a function of a country’s current- account balance. The marginal effect of credit growth on the probability of a crisis depends on whether the current account is in surplus or deficit.

The regression results indicate that the estimated marginal effect in the credit-to-GDP varies negatively with a country’s current-account balance. It is smaller in countries with a current-account surplus and higher in countries with a current-account deficit.

Thus, the estimates from this statistical model suggest that a credit boom financed from domestic savings is much less likely to end in a banking crisis than a credit boom financed from foreign borrowing. China’s credit growth of 70 percent of GDP before 2015 financed from domestic savings was less likely to end in a crisis than a smaller credit boom financed from foreign borrowing.

China’s shifting current-account position

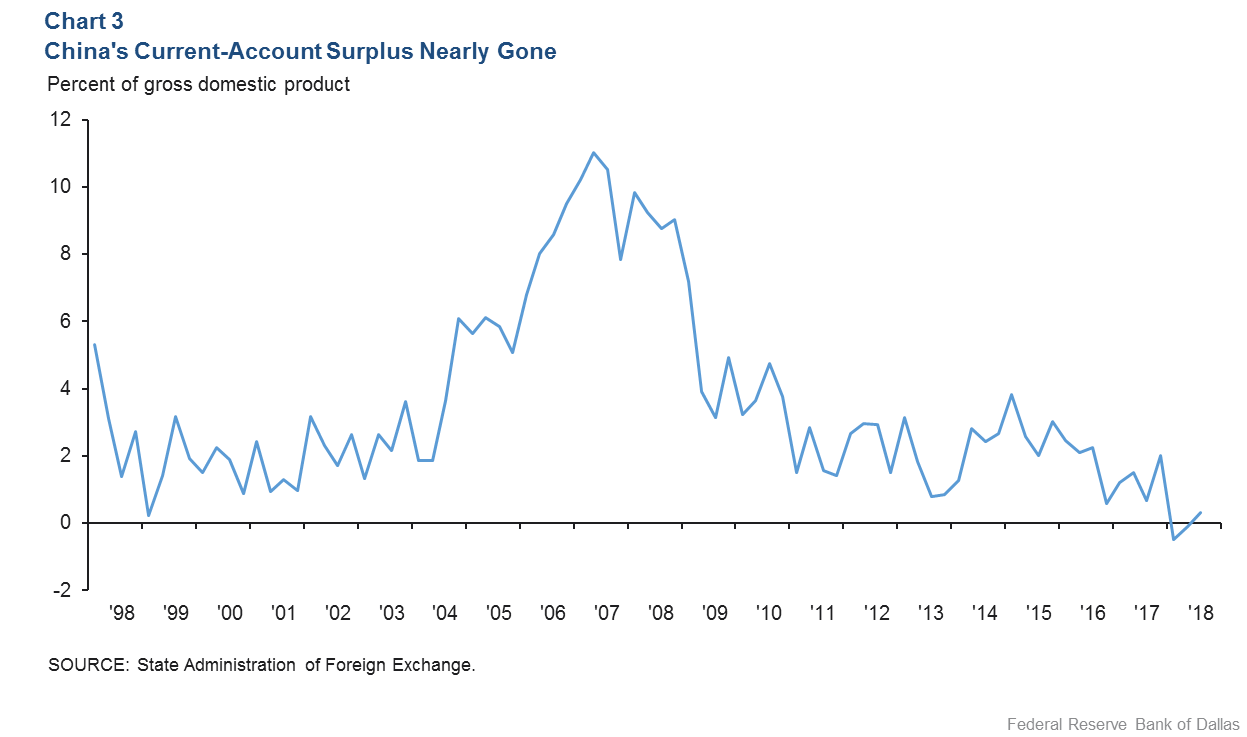

In 2015, China had a current-account surplus of 3 percent of GDP, meaning there was enough domestic savings to finance all domestic investment with enough left over to buy foreign assets worth 3 percent of GDP.

China’s current account has since deteriorated. The current account slipped into deficit in early 2018 and is currently bouncing right around zero (Chart 3). Chinese policymakers could resort to more debt-fueled stimulus, as they did before, but foreign borrowing would be required to finance a surge in new debt and investment.

The full extent of Chinese policymakers’ response to the current downturn isn’t well known. Will Chinese policymakers take a page out of their familiar playbook from 2008, 2012 and 2015 and unleash a new wave of debt-fueled stimulus to quell the slowdown? Dependence on foreign borrowing and not domestic savings will increase the riskiness of using this familiar policy tool.

About the Author

Scott Davis

Davis is a senior research economist and advisor in the Research Department at the Federal Reserve Bank of Dallas.

The views expressed are those of the author and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.