Solving a puzzle: More nonrenewable resources without higher prices

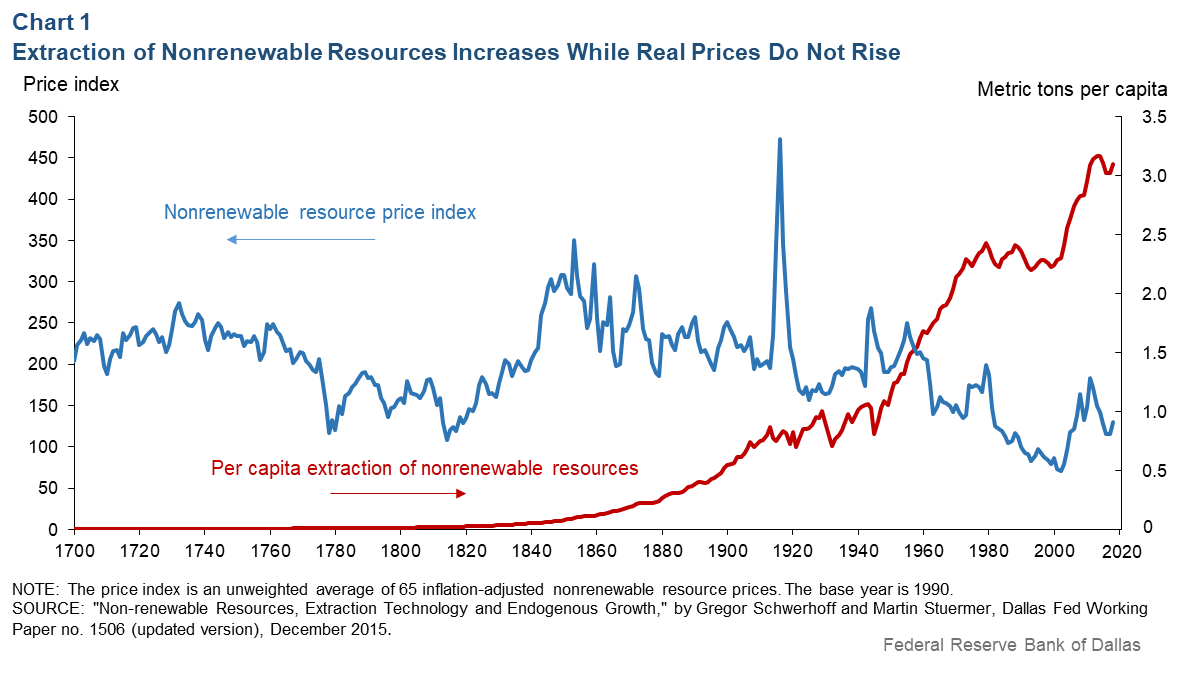

Economic intuition suggests nonrenewable resources such as metals or fossil fuels become scarcer and more expensive over time. However, a new dataset covering the years 1700 to 2018 indicates otherwise.

Not only has the production of nonrenewables increased, but inflation-adjusted prices don’t appear to have risen. A Dallas Fed working paper proposes an explanation: Innovation in extraction technology exploits a geological law where greater quantities of a resource are found in progressively lower-grade deposits. Production of nonrenewable resources rises at nonincreasing prices to meet growing global demand.

Puzzling long-run trends

The working paper draws on the three-century-long dataset that documents extraction and real (inflation-adjusted) prices of 65 nonrenewables. Over the period, world real gross domestic product has grown by a factor of 17, while global resource extraction has increased from roughly 5 kilograms per capita to more than 3,000. Simultaneously, the prices of most nonrenewables have either remained little changed or decreased (Chart 1).

This is curious. How are nonrenewable resources extracted in ever-increasing quantities, and why do prices change so little over the long term?

Technology and the extraction conundrum

The increasing extraction of nonrenewable commodities confounds conventional economic intuition because the dynamic does not consider the large amount of resources buried in Earth’s crust and underestimates firms’ ability to develop technology to access them.

Only a small slice of Earth’s enormous amount of nonrenewable resources is economically extractable with current technology (Table 1). We refer to these relatively small, available quantities as reserves.

Table 1: Nonrenewable Resources in the Earth’s Crust

| Resource | Crustal abundance (bil. mt) | Reserves (bil. mt) | Annual output (bil. mt) |

| Copper | 1,510,000 | 0.8 | 0.02 |

| Iron | 1,392,000,000 | 83 | 0.06 |

| Coal | 15,000,000 | 511 | 3.9 |

| Crude oil | 241 | 4.4 | |

| Natural gas | 179 | 3.3 | |

| NOTE: Bil. mt refers to billion metric tons. Data on the crustal abundance of hydrocarbons, i.e. coal, crude oil, and natural gas, are only available as a total of all organic carbon in the Earth’s crust. | |||

| SOURCE: "Non-renewable Resources, Extraction Technology and Endogenous Growth," by Gregor Schwerhoff and Martin Stuermer, Dallas Fed Working Paper no. 1506 (updated version), December 2015. | |||

For example, the crustal abundance of copper is about 1,500,000 billion metric tons; its reserves total only 0.8 billion metric tons. If reserves were fixed, we would exhaust copper reserves in about 40 years at the current annual output. Similarly, the estimated abundance of hydrocarbons is very large in the Earth’s crust, while reserves and annual output are much smaller.

Technological innovation changes what are considered reserves. As reserves deplete, firms exploit technological innovations to explore and convert previously inaccessible deposits into more reserves. This suggests copper reserves have considerable room to grow. If all the Earth’s copper were accessible, it would take about 77,000,000 years to exhaust at the current rate of production.

The reality is more complicated. Some deposits will never be accessible. What’s more, our reserve exhaustion calculations assumed constant consumption and production for such resources, which might not be true. This calculation can be repeated with exponentially increasing production, and potential reserves would still last hundreds or even thousands of years.

Thus, development of technology enables the increasing extraction of resources by creating new reserves, which mitigates scarcity.

Accessing low-grade deposits

For nongeologists, gold provides a good example of the power of technological innovation. A gold nugget is a high-grade deposit, while specks of gold in a stream are a low-grade deposit. If a firm has a choice between a low-grade or a high-grade deposit, it will tend to choose to extract the high-grade deposit first before considering the lesser gold specks, which will require more advanced technologies.

Crude oil offers another example. A century ago in the Permian Basin of West Texas, firms extracted conventional pools of oil. These high-grade deposits were most accessible. As they were depleted, firms had no choice but to find oil in lower-grade, unconventional deposits. The focus eventually turned to oil trapped in the pores of shale. Technological innovation yielded hydraulic fracturing, a method to extract tight oil from the Permian’s shale formations.

Technological innovation is not a constant process. As deposits decrease in grade, innovation in grade-specific extraction technology becomes costlier. For example, the low-grade oil deposits trapped in shale formations demand increasingly sophisticated technological innovation; whereas, high-grade conventional deposits do not.

Geology affects prices

So if developing technologies for lower deposits becomes costlier, why have most inflation-adjusted nonrenewable resource prices not increased over the long term? Geology helps answer this question. L.H. Ahrens and his fundamental law of geochemistry states that greater quantities of a resource are locked in more troublesome lower grades, which in turn implies that a new technology’s higher development costs may be mitigated by the ever-greater supply of the resource it opens.

A practical example of this is the shale oil revolution in 2014. Although the development of hydraulic fracturing technology was most likely costlier than the development of earlier conventional methods, there is more unconventional oil.

The International Energy Agency estimates there are 1.5 trillion barrels of crude oil in conventional or high-grade deposits and 4.5 trillion barrels in unconventional or low-grade deposits, including natural gas liquids. Although the technology required to extract unconventional oil is more expensive to develop, there is much more of the resource of this grade to extract.

Fossil fuel extraction, green technology

The result of this interplay between extraction technology and geology is an equilibrium of an increasing abundance of economically extractable nonrenewable resources at nonincreasing prices.

These findings lead to further questions. For example, technological innovation will likely supply an increasing flow of fossil fuels at nonincreasing prices over the long term even as policymakers consider the need to transition to clean energy sources.

Demand-side intervention, such as a carbon tax or emissions trading, might depress the development of fossil fuel extraction technology and make the development of renewable energy technologies more attractive. At the same time, availability of critical metals needed for the energy transition may not face constraints if historical trends in extraction technology continue.

About the Authors

The views expressed are those of the authors and should not be attributed to the Federal Reserve Bank of Dallas or the Federal Reserve System.