Energy Indicators

December 11, 2020

U.S. oil and gas employment ticked up in November—the first improvement since February. Benchmark natural gas prices were up in November, as were U.S. gas exports. Pricing also softened for ethylene and polyethylene, key Gulf Coast petrochemicals.

Employment

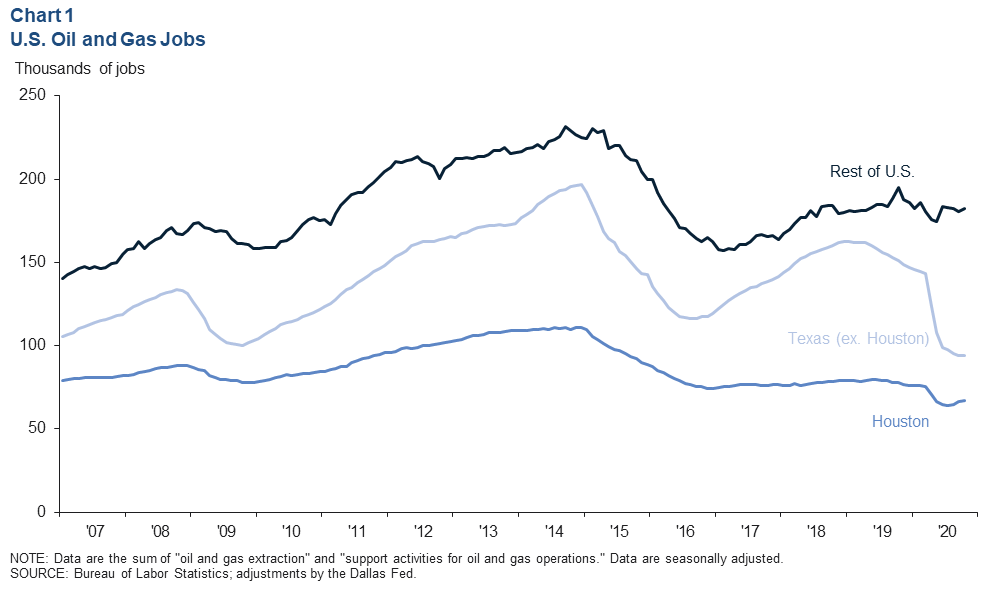

Oilfield activity has increased since summer, and oil and gas payroll employment for extraction and support activities ticked up in the most-recent estimates. Still subject to revision, Houston saw oil and gas jobs rise by nearly 3,000 to 67,100 over the three months ending in October (Chart 1).

Outside of Houston, oil and gas employment in the rest of Texas eroded by another 4,000 jobs to 93,900 for the three months ending in October—a much slower pace than earlier in the pandemic. In the rest of the U.S., oil and gas extraction and support jobs held flat by comparison, dropping only 600 jobs over that same period due to a one-month increase of 2,000 jobs in November.

Nationally, oil and gas payrolls were down 79,500 jobs from the most recent peak in January 2019 and down 63,200 since February 2020. That puts recent industry employment levels back where they were in January 2010 when the shale boom was just beginning to take off.

Natural gas

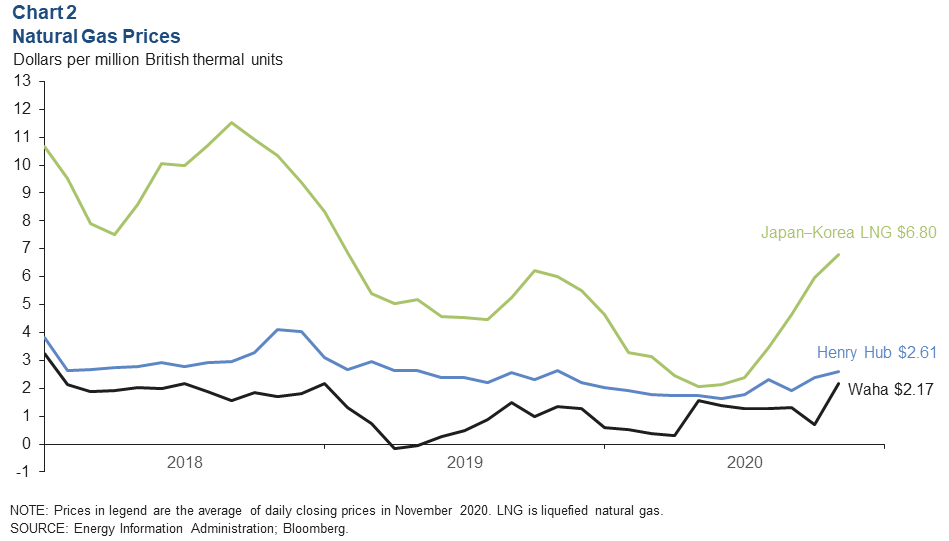

After daily closing prices briefly climbed to over $3 per million British thermal units (MMbtu) in late October, benchmark Henry Hub eased to average $2.61 per MMbtu in November (Chart 2). That is the highest monthly price in a year. Closer to the wellhead in West Texas, the Waha natural gas price rose to its highest monthly average in nearly two years at $2.17. Seasonal demand, the return of exports, and lower current and expected associated gas production from oil wells contributed to the rally.

Liquefied natural gas (LNG) prices have also improved in Asia, a target market for much of U.S. LNG exports. The benchmark Japan–Korea front-month futures price rose to average $6.80 in November. This was its highest level since early 2019 when rising global supplies of LNG met a fall in demand as Japan restarted nuclear power plants, displacing demand for natural gas.

Exports

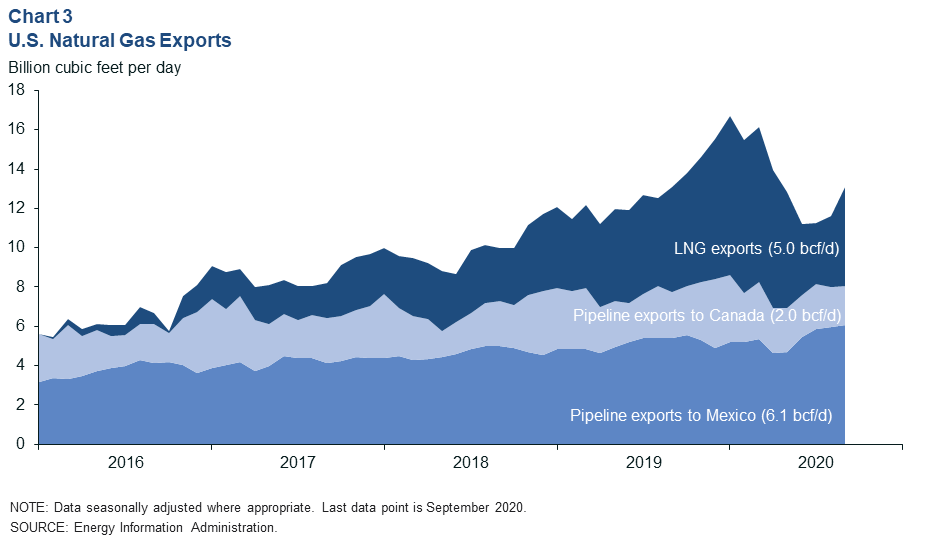

Natural gas exports plunged as low as 11.2 billion cubic feet per day (bcf/d) by mid-2020 after reaching a record high of 16.7 bcf/d in January (Chart 3). Pipeline exports to Mexico dipped early in the pandemic, then recovered strongly over the summer months to a record 6.1 bcf/d in September.

However, most of the volatility came from LNG. LNG exports averaged 7.9 bcf/d in first quarter 2020 but plummeted to 3.1 bcf/d in July as the global pandemic crushed power and industrial sector demand for natural gas globally. LNG exporters reported multiple cancellations of contract cargos over the summer. Relatively few U.S. LNG cargos are sold in spot markets, as most are part of long-term supply contracts.

Ethylene

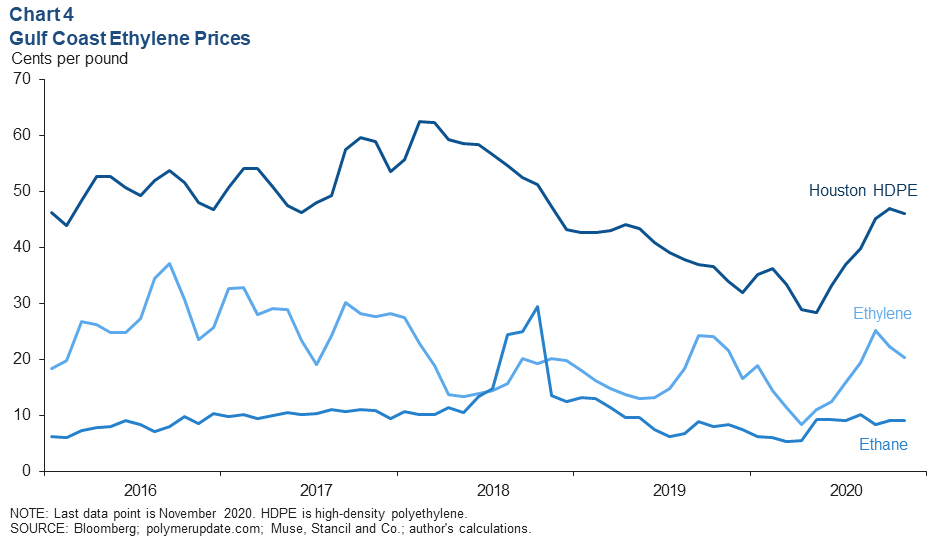

Ethane is co-produced with natural gas from oil and gas wells and is used mainly as a raw material to produce ethylene—an intermediate product used to make many other petrochemicals like polyethylene and styrene. The average cost of Gulf Coast ethane for ethylene production held steady from October to November at 9.1 cents per pound (Chart 4). The Gulf Coast price of ethylene fell from a September high of 25.1 cents per pound to 20.3 in November, due in part to the return of capacity that had been shut down due to an active hurricane season.

Polymer prices like high-density polyethylene eased modestly in November to 46.1 cents per pound, putting the spread between ethane and polyethylene the past two months at its highest level since July 2018.

About Energy Indicators

Questions can be addressed to Jesse Thompson at jesse.thompson@dal.frb.org. Energy Indicators is released monthly and can be received by signing up for an email alert. For additional energy-related research, please visit the Dallas Fed’s energy home page.