Energy Indicators

Oil and gas executives expect the rig count to remain at current levels at the start of next year. Exploration and production (E&P) firms—especially the smaller ones—are preparing to see higher well completion and drilling costs in 2024. The rig count has declined since the start of the year, but business activity has picked up somewhat significantly in the third quarter. Finally, oil prices increased markedly this summer, and crude stocks are within historical norms but have declined recently.

Energy Survey

Rig count expected to stay flat

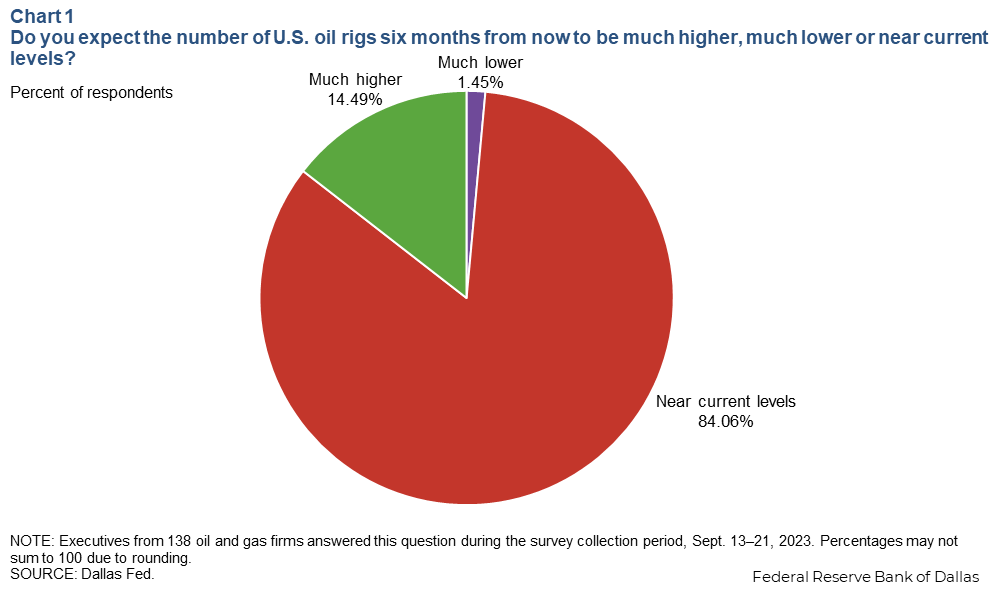

Just over 84 percent of oil and gas executives interviewed for the Dallas Fed Energy Survey expect the number of U.S. oil rigs to be about 500 by March 2024, similar to the number in September 2023 when the question was asked. Fifteen percent expect it to be much higher (Chart 1). Small and large E&P firm responses were similar to the aggregate, with 14 percent expecting a much higher rig count. That share was higher (22 percent) among oilfield service firms.

Small firms facing higher well costs

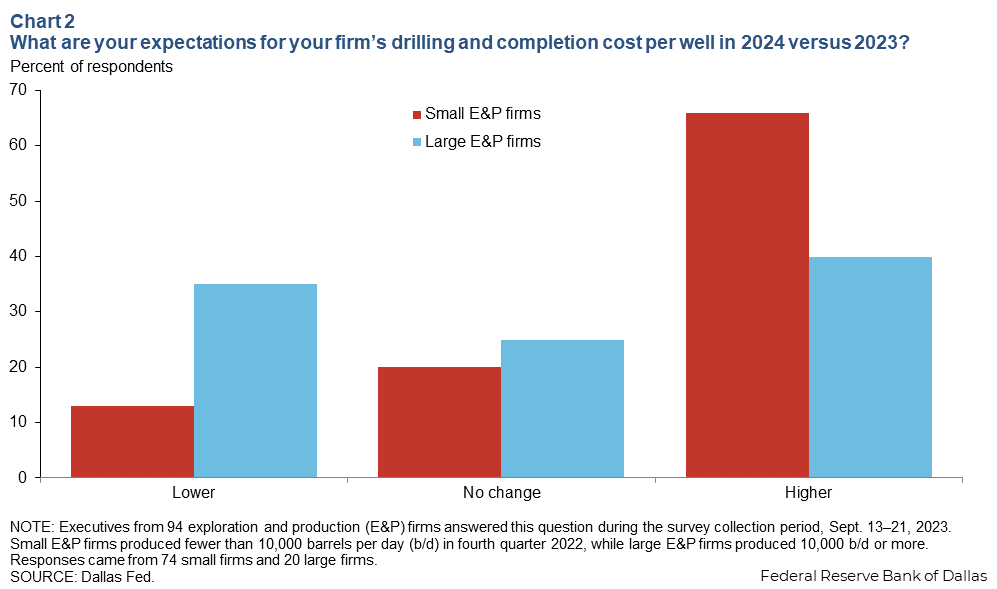

Small E&P firms are looking at higher drilling and completion costs per well next year. Sixty-six percent of them expect drilling and completion costs per well to be higher in 2024 versus 2023, while only 40 percent of large E&P firms expect the same (Chart 2).

Direction of activity level depends on who you ask

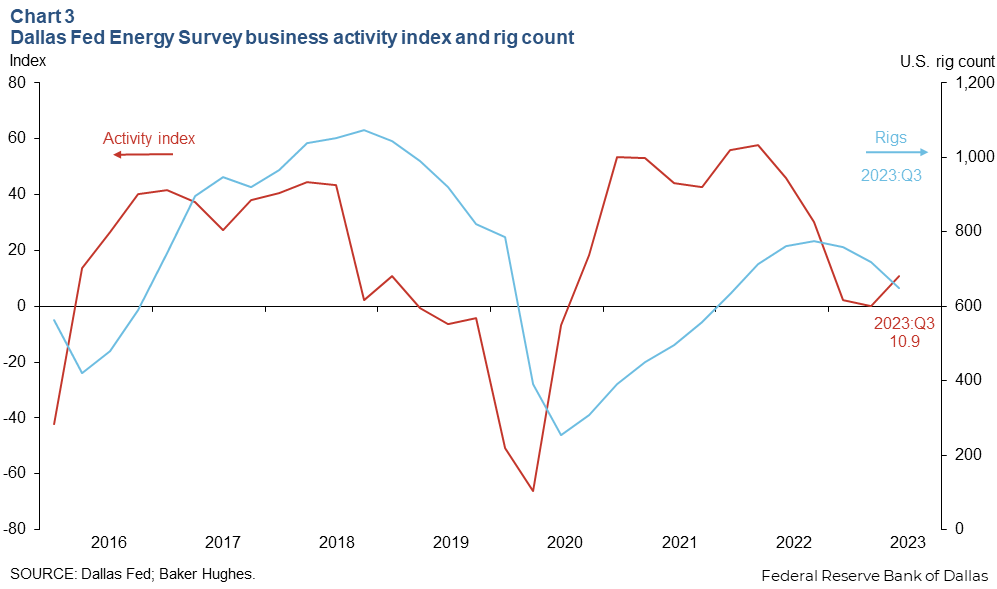

During the third quarter, the rig count declined 7 percent, but the business activity indexed increased 11 percent (Chart 3). The explanation for this depends on whether you ask production companies or support service firms. Support service firms’ activity index declined to 12.2 in the third quarter. E&P firms’ business activity index climbed to 22.5. The increase in the latter is associated with an increase in the share of firms reporting higher capital expenditures that may not yet have resulted in increased oilfield activity.

U.S. crude oil

Price of oil rises over summer

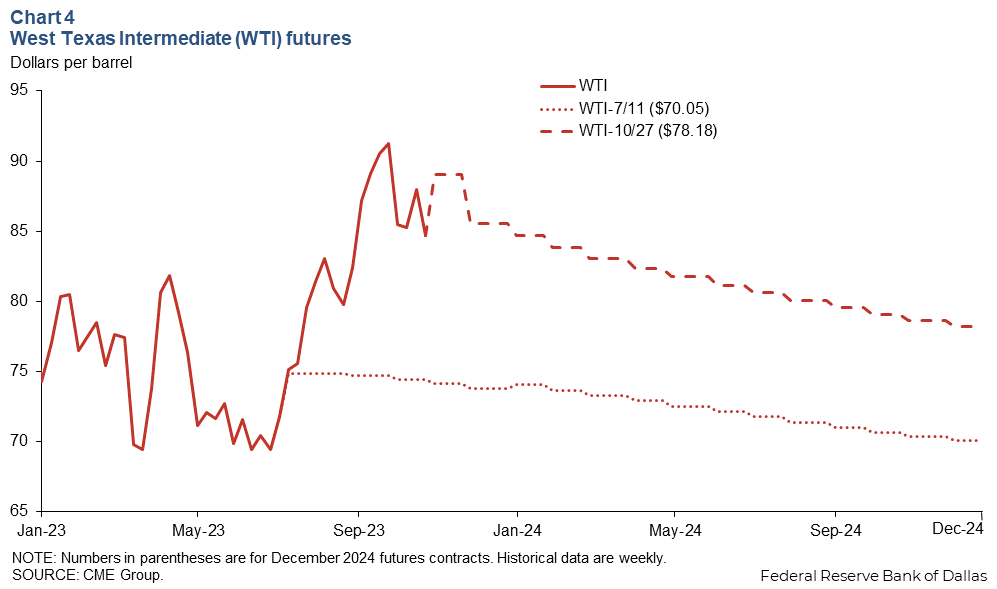

Front-month futures contracts for West Texas Intermediate closed at $86 a barrel on Oct. 27 compared with $74 a barrel on July 11. On July 11, futures contracts implied a crude price of $70 per barrel by the end of 2024. At the close on Oct. 27, futures contracts for December 2024 had risen to $78 per barrel (Chart 4).

Several factors contributed to the rise in the front-month price. Increased optimism in the U.S. economy allowing forecasters to take a recession out of their base cases, supply cuts by Saudi Arabia and Russia, and resilient consumer demand have all put upward pressure on prices since mid-summer. Finally, the recent blip in the October futures strip may be due to geopolitical tensions in Israel.

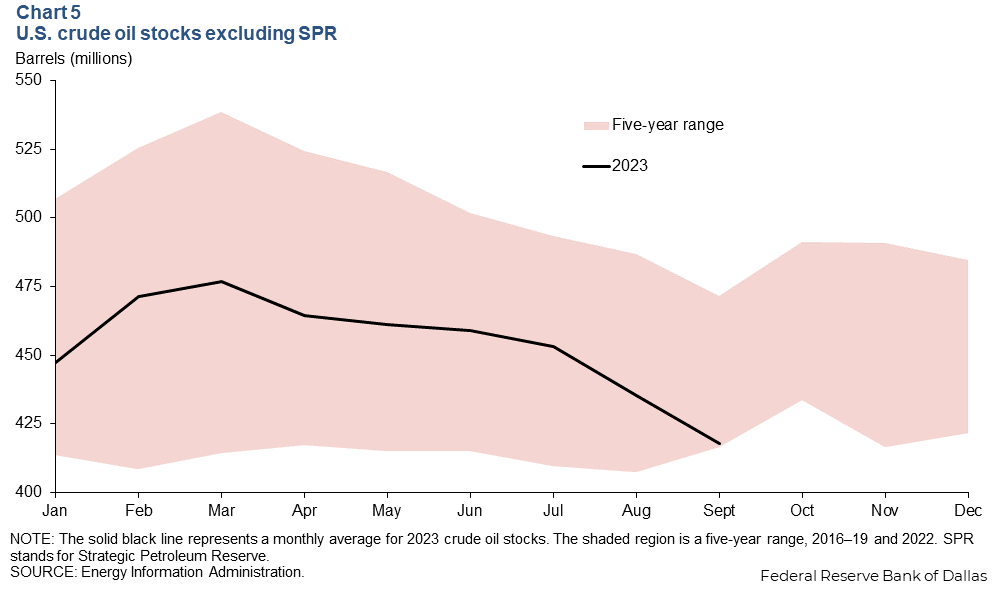

Crude stocks see recent declines with expectation of increases later in year

So far in 2023, commercial crude oil stocks have stayed loosely in line with the five-year average (excluding the pandemic). However, in September, there were 418 million barrels of crude oil in storage—24 million barrels below the five-year average for that month (Chart 5).

In the week of Sept. 15–22, crude oil inventories fell by 2.2 million barrels due partly to strong refining and export demand. However, the Energy Information Administration projected in October 2023 that U.S. crude oil inventories would climb by 3.3 million barrels by year-end.

About Energy Indicators

Questions can be addressed to Kenya Schott at kenya.schott@dal.frb.org. Energy Indicators is released monthly and can be received by signing up for an email alert. For additional energy-related research, please visit the Dallas Fed’s energy home page.