Energy Indicators

Natural gas liquids (NGLs) production increased in 2023, and exports grew to new heights. U.S. chemical production improved in 2023, helped by easing input costs. The petrochemicals sector saw softening prices, and the basic chemicals sector saw increasing real export values.

Natural gas liquids

Production sees strong growth in 2023

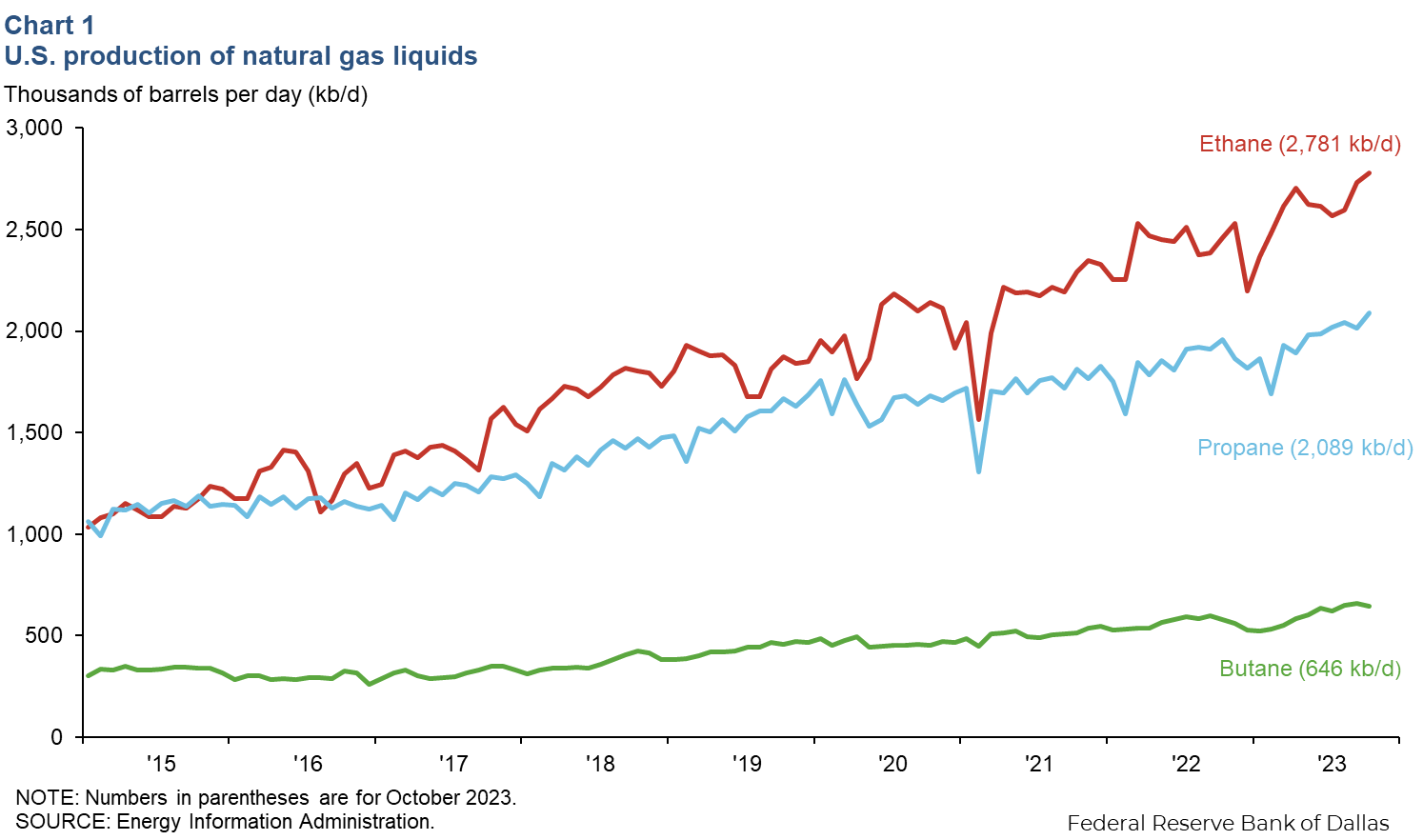

From the beginning of 2023 until October, U.S. ethane production increased 17 percent to 2,781 thousand barrels per day (kb/d), propane rose 12 percent to 2,089 kb/d, and butane jumped 24 percent to 646 kb/d (Chart 1). Collectively called NGLs, they are sources of heat for many applications like heating and cooking and important inputs into refining and petrochemical product manufacturing.

The rise in U.S. NGL production is due mainly to an increase in associated gas production—methane and other products that are co-produced with oil from oil wells. Associated gas from the Permian Basin (mainly the Wolfcamp, Spraberry and Bone Spring shale formations) averaged a combined 13.7 billion cubic feet per day (bcf/d) from January 2023 to July 2023—triple the amount produced in 2018 over the same time frame.

Demand for butane increases when refiners shift to winter blends for gasoline that require a 10 percent butane concentration versus the summer blend that only requires 2 percent. Ethane is either left mixed in with the natural gas sold to households and businesses for heat and power (within limits) or used as a petrochemical feedstock. Production of the latter hit an all-time high in October because of increased domestic natural gas production, driven by the associated gas mentioned above. Propane prices rose heading into winter, even as production continued to break records.

NGL exports extend upward trend

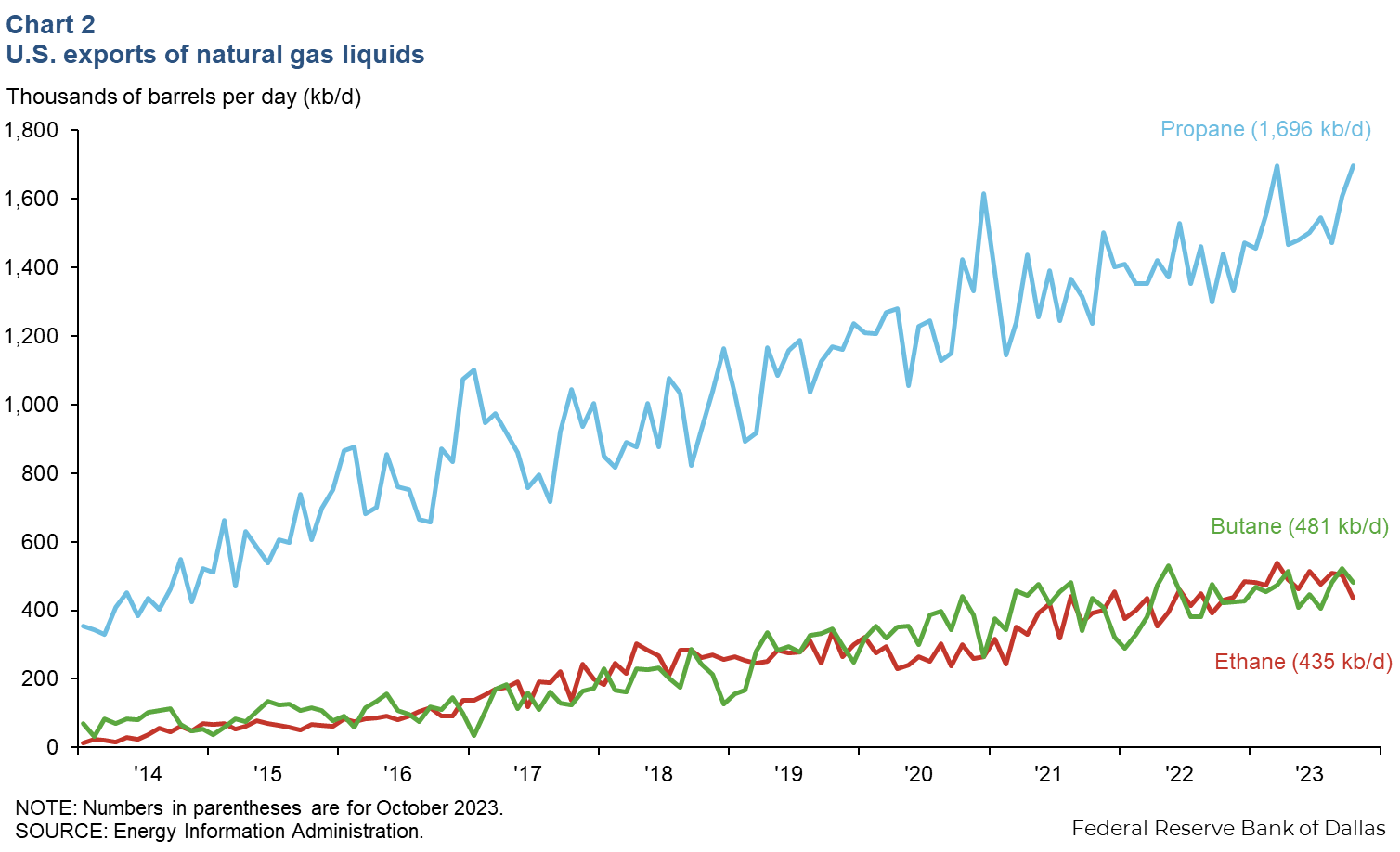

Exports of propane were 1,696 kb/d in October 2023—up 257 kb/d versus a year ago (Chart 2). Over the same time frame, total U.S. natural gas liquids exports increased by 321 kb/d.

U.S. propane exports in 2023 were mainly headed to Japan, followed by China and South Korea. Propane headed to China increased from 182 kb/d in October 2022 to 247 kb/d in October 2023—a 36 percent increase. Exports to Asia have increased in recent years due in part to the region’s demand for propylene, a chemical that can be made from propane that is used to manufacture intermediate products like propylene glycol and polypropylene, both versatile plastics.

Exports of butane are also mainly headed to Japan, followed by Indonesia and Morocco. Portable gas stoves, which are fueled by butane gas cartridges, are commonly used in Japan. The largest share of U.S. exports of ethane went to China as the nation’s demand for ethylene has increased in recent years. (Ethane, but also propane, can be used as the raw material input in production.)

The Panama Canal is seeing the worst drought in its history, limiting the number of ships transits possible. This could hamper U.S. exports of NGLs (especially propane) as the canal is the preferred route for products headed to Japan. Restrictions limiting vessel traffic through the canal has caused a spike in freight rates.

Chemicals

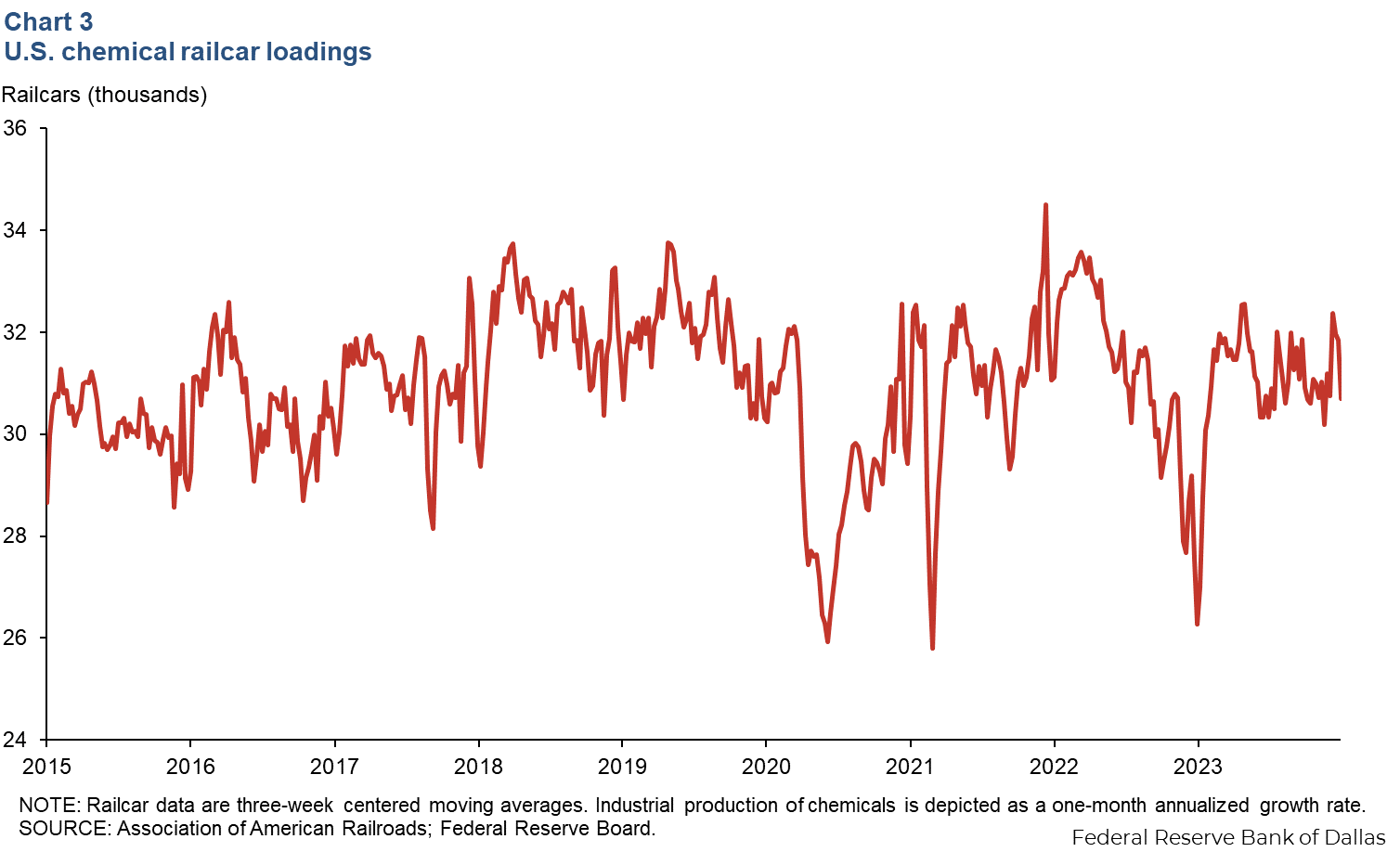

Chemical railcar loadings moderate from early 2023

The three-week average pace of chemical railcar loadings has eased from its 2023 peak of 32,544 on April 29 to 30,7001 cars on Dec. 30, 2023 (Chart 3). Railcar loadings were up 17 percent year over year, with third quarter on average being the strongest with 31,426 cars. Chemical railcar loadings account for about 20 percent of chemical transportation by tonnage, with trucks, barges and pipelines carrying the rest.

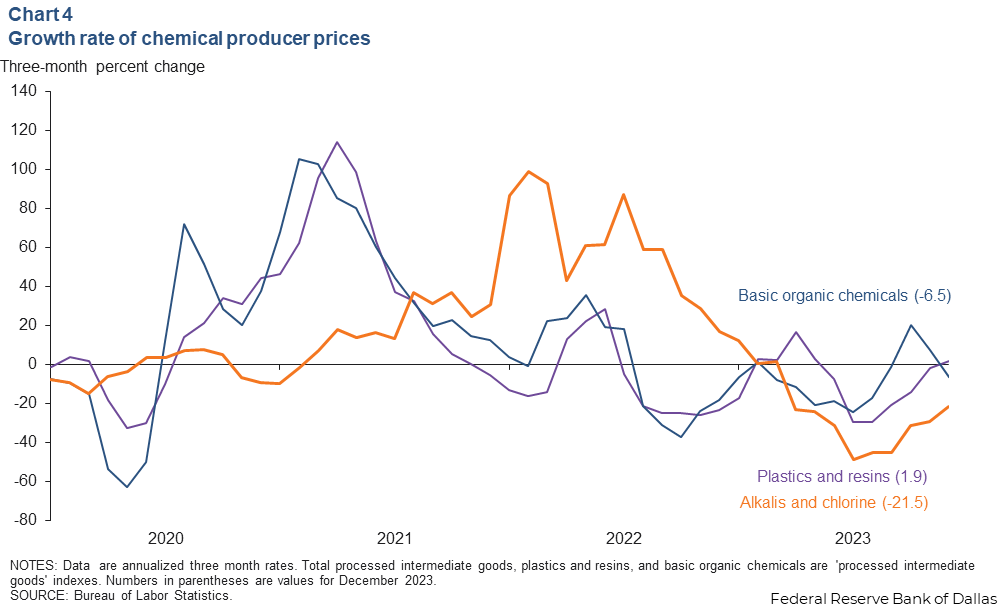

Producer prices down in 2023 for major chemical intermediates

Over the three months ending December 2023, producer price indexes (PPIs) for alkalis and chlorine declined 21.5 percent. Basic organic chemicals producer prices declined 6.5 percent, and plastics and resins producer prices rose 1.9 percent (Chart 4).

Since December 2022, PPIs for plastics and resins and basic organic chemicals eased mid-year but have since stabilized somewhat. Alkalis and chlorine prices fell continuously in 2023, though the pace slowed toward year end. The alkalis and chlorine producer prices index peaked in January 2023 and had dropped 2.7 percent by December 2023.

Input costs for these chemical intermediates are closely tied to energy prices—mainly natural gas. Brent crude oil and Henry Hub natural gas prices have declined 7.9 percent and 25.7 percent, respectively, from January 2023 to December 2023. Over that same time, the producer price index for all chemicals declined 19.5 percent.

Chemicals in the chlor-alkali family are needed for everything from water purification and construction productions to aluminum and pharmaceuticals, making them an important indicator for trends in industrial production. Plastics and resins (like polymers) include packaging materials, textile and industrial fibers, and biomedical devices. Basic organic chemicals—like ethylene and benzene—are used in the production of myriad plastic products from grocery bags to car parts.

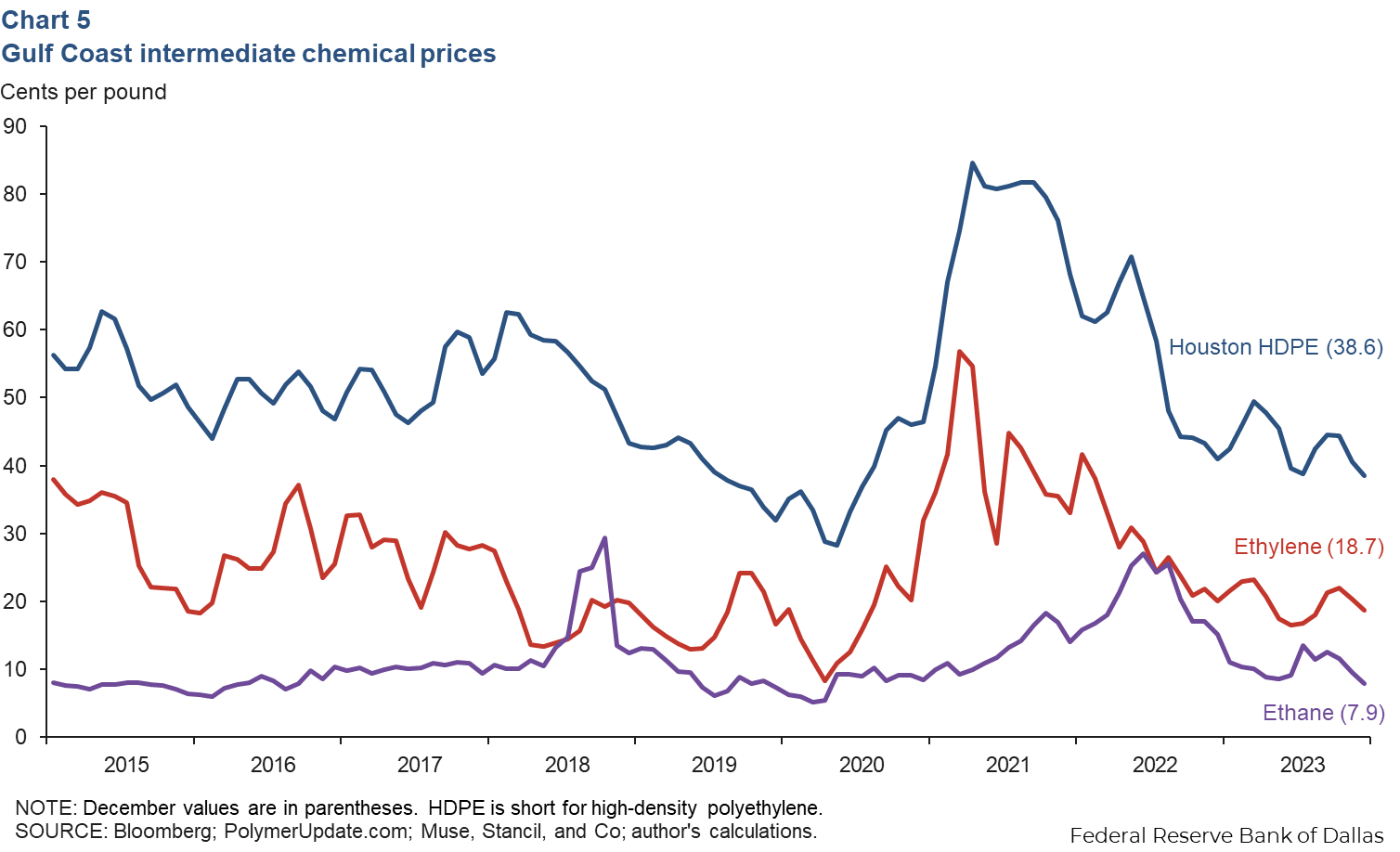

Intermediate chemical prices fall

The nominal price of ethane was 7.9 cents per pound in December 2023, down 28.7 percent since the start of 2023 and 53 percent below prepandemic levels (Chart 5). Chemical intermediate ethylene has been hovering around 20 cents per pound since August 2023, while high-density polyethylene (HDPE) fell to 38.6 cents per pound in December. This pushed the HDPE chain margin—the spread between the feedstock cost of ethane and the price of polyethylene—down to 30.7 cents per pound, its lowest level since July 2023.

Ethane, which is tied to the price of natural gas in the U.S., is a low-cost feedstock, giving the U.S. a comparative advantage over other global producers in Europe and Asia who are mostly dependent on oil-derived feedstocks to produce chemical intermediates. A proxy for this cost advantage is the ratio of the price of Brent crude to Henry Hub natural gas, which averaged 30.5 in December 2023, versus 14.1 a year prior. According to industry feedback, a ratio over 7 translates into a significant export advantage.

Ethylene prices in the U.S. are expected to ease in 2024 due to lower average energy prices year over year and increased supplies from the start-up of new chemical facilities, barring any unplanned outages at other plants. The price of HDPE declined in December due in part to a combination of soft global demand and falling feedstock costs. However, industry contacts note that global overcapacity in polymers due to large new chemical complexes in Asia will keep downward pressure on chain margins for some time, though the U.S. is likely to retain a cost advantage due to the production of NGLs from shale.

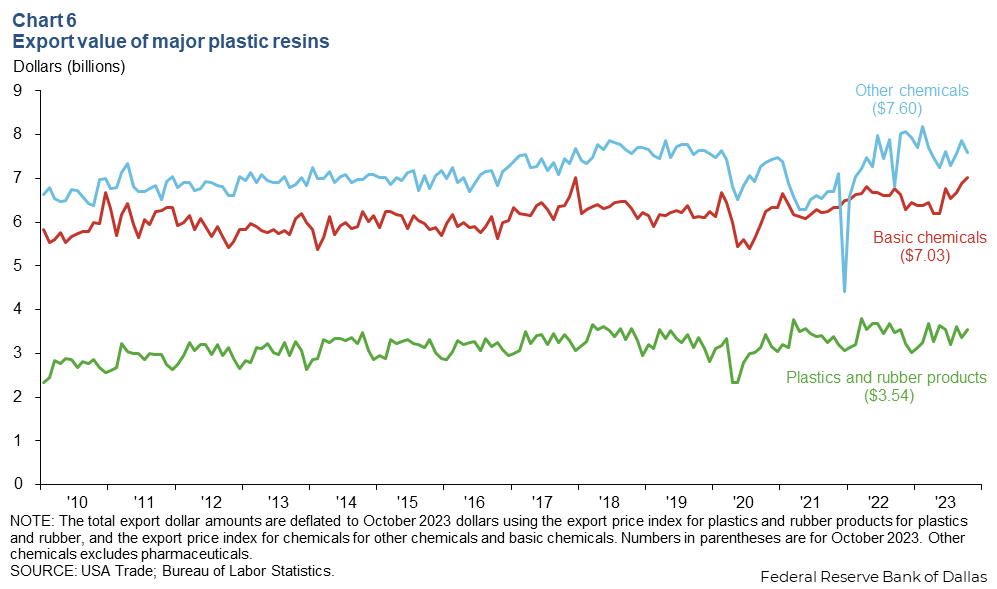

Basic chemical exports growing

The export value of basic chemicals was $7.0 billion in October 2023—$390 million above October 2022’s value (Chart 6). Over the same period, other chemicals’ export value—which excludes pharmaceuticals and basic chemicals—shrank by $440 million. Plastic and rubber products decreased by $10 million.

From August to October 2023, the real export value of plastic and rubber products has been steady, near $3.5 billion. Over the same time frame, other chemicals (excluding pharmaceuticals) grew 3.5 percent. Basic chemicals saw a 5.4 percent increase ($360 million) owed mainly to a rise in petrochemical and plastic resin exports.

The leading destinations for U.S. chemical exports by dollar value in 2022 were Mexico (26.8 percent), Canada (26.3 percent) and China (12.0 percent). Texas is the top exporter of these chemicals in the U.S., accounting for roughly 30 percent of all chemical exports.

About Energy Indicators

Questions can be addressed to Kenya Schott at kenya.schott@dal.frb.org. Energy Indicators is released monthly and can be received by signing up for an email alert. For additional energy-related research, please visit the Dallas Fed’s energy home page.