Energy Indicators

| Energy dashboard (August 2025) | |||

| WTI price avg. Aug. 26–29 |

WTI price change from 4 weeks prior |

Henry Hub price avg. June 2–6 |

Henry Hub price change from 4 weeks prior |

| $64.00/barrel | -7.2% | $2.87/MMBtu | -4.7% |

Global oil inventories are expected to grow in 2025 as analysts expect flat demand growth and an increase in OPEC+ production. A majority of Dallas Fed Energy survey firms reported tariffs increased the cost of drilling new wells. Imports of oil country tubular goods (OCTG) suggest firms hiked imports ahead of tariffs in the first half of 2025. Most energy survey firms also reported a West Texas Intermediate price of $60 a barrel is too low to support increased production. A consensus of forecasts expects U.S. crude production to be flat through 2025 and into 2026.

Oil balances and OPEC

Global inventories expected to rise

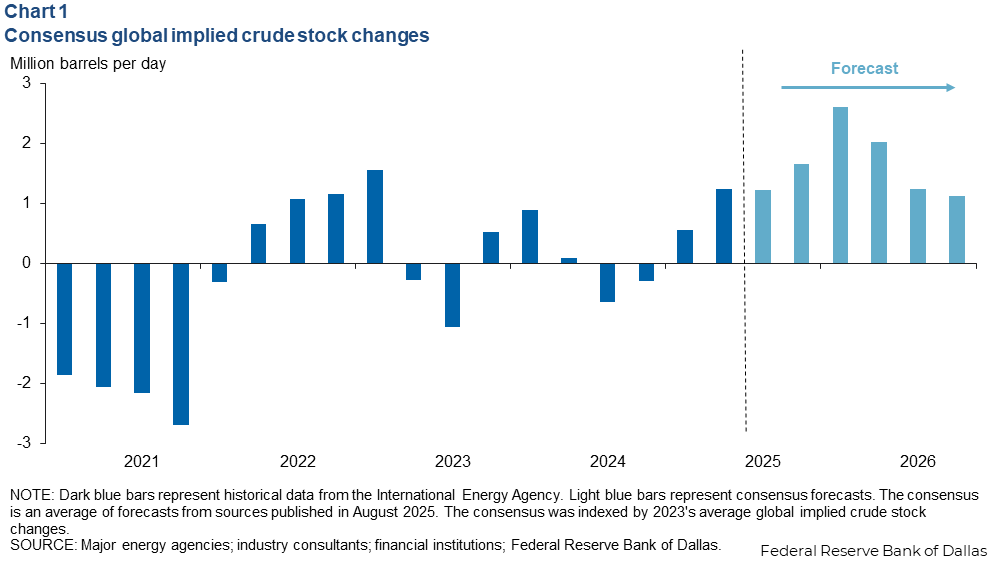

According to a consensus of projections by major energy agencies, consultancies and investment banks, global oil supply is expected to outpace consumption growth in the second half of 2025, yielding an average implied rise in inventories of 1.5 million barrels per day (mb/d) (Chart 1). This is driven mainly by assumptions regarding the likely pace of production increases from OPEC+ amid anemic global demand growth.

Most OPEC+ countries slightly overproducing

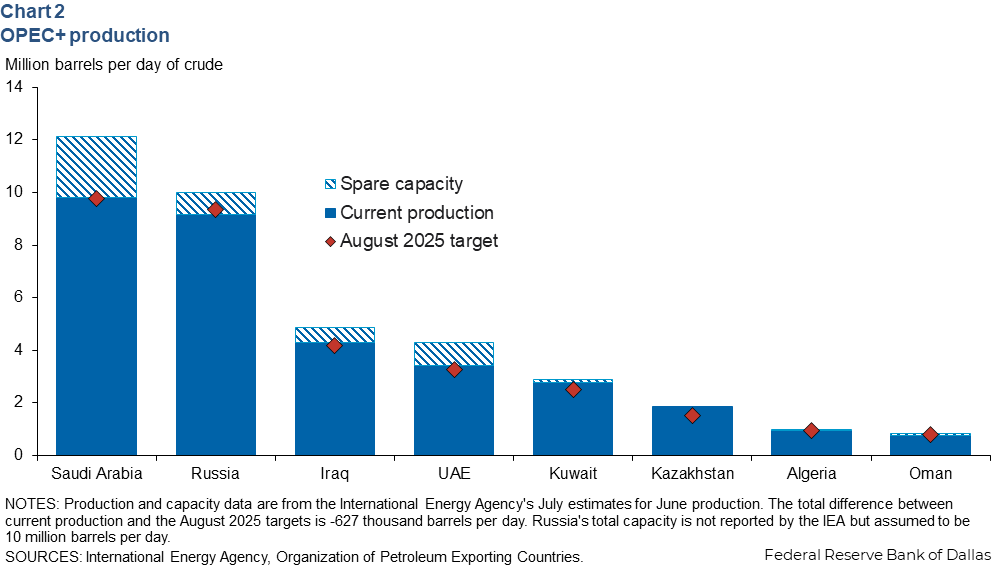

The eight highest-producing OPEC+ countries were estimated in July to have produced 32.9 mb/d (Chart 2). Compared with August 2025 production targets, these nations were collectively overproducing by 0.6 mb/d.

Steel tariffs and oil

Majority of firms report tariffs increase new well costs

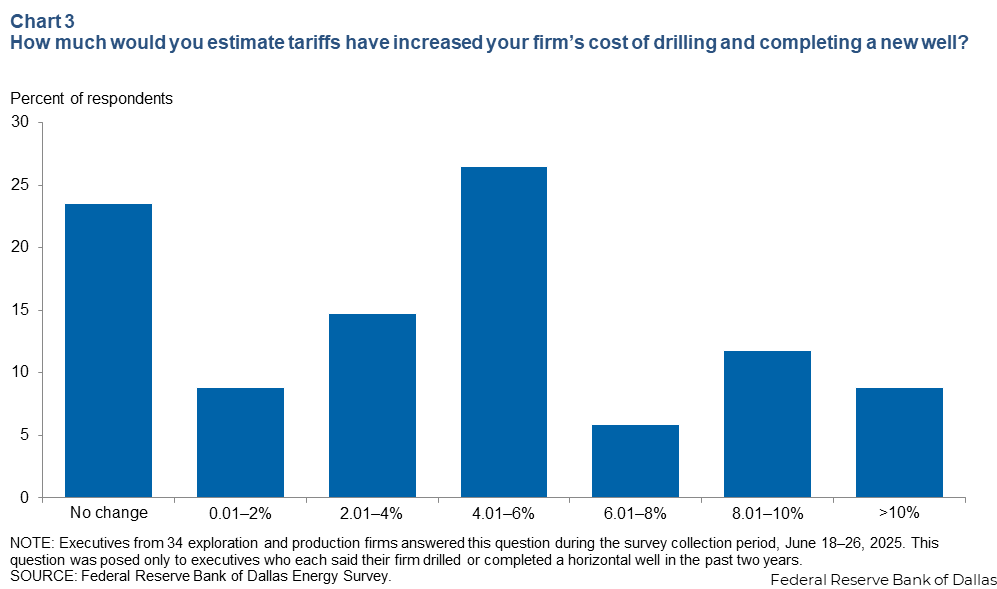

In the second quarter Dallas Fed Energy Survey, 76 percent of exploration and production firms reported that tariffs increased the cost of drilling and completing new wells (Chart 3). Cost increases centered on 4 to 6 percent. The reported impact of tariffs on costs tended to be lower for large producers than small.

OCTG imports tick down slightly

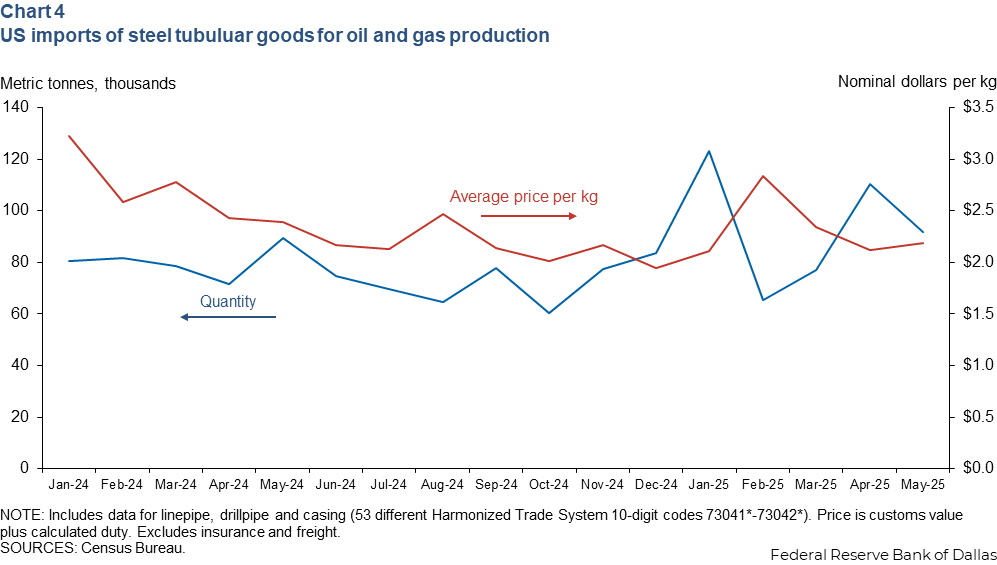

In May 2025, the quantity of oil country tubular goods (OCTG) imported into the U.S. ticked down to 91.8 thousand metric tonnes from 110.3 thousand tonnes in April (Chart 4). The price was stable at $2.19 per kilogram on average (here defined as customs unit value plus the calculated tariff).

The stability is notable as rising tariff costs offset downward trends in steel prices due in part to soft global demand and excess capacity mainly in China. Surges in the quantity of OCTG imports in the first half of 2025 are consistent with purchasers importing goods early to get ahead of tariffs, limiting the total cost impact.

U.S. production outlook

WTI prices too low to support raising production

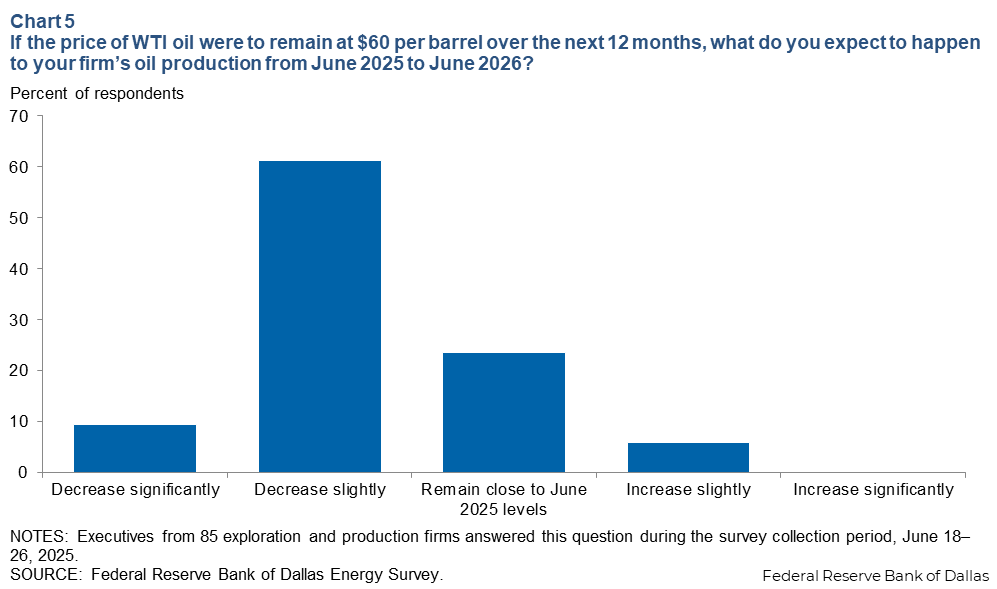

In the Dallas Fed’s second quarter energy survey, executives from exploration and production firms were asked: “If the price of WTI oil were to remain at $60 per barrel over the next 12 months, what do you expect to happen to your firm’s oil production from June 2025 to June 2026?” Of the executives who responded, 70 percent reported that production would decrease slightly or significantly (Chart 5).

In the first quarter energy survey, firms reported needing $65 per barrel on average to drill profitably. However, large firms, which drive most of the production, on average only needed $61 per barrel to drill profitably.

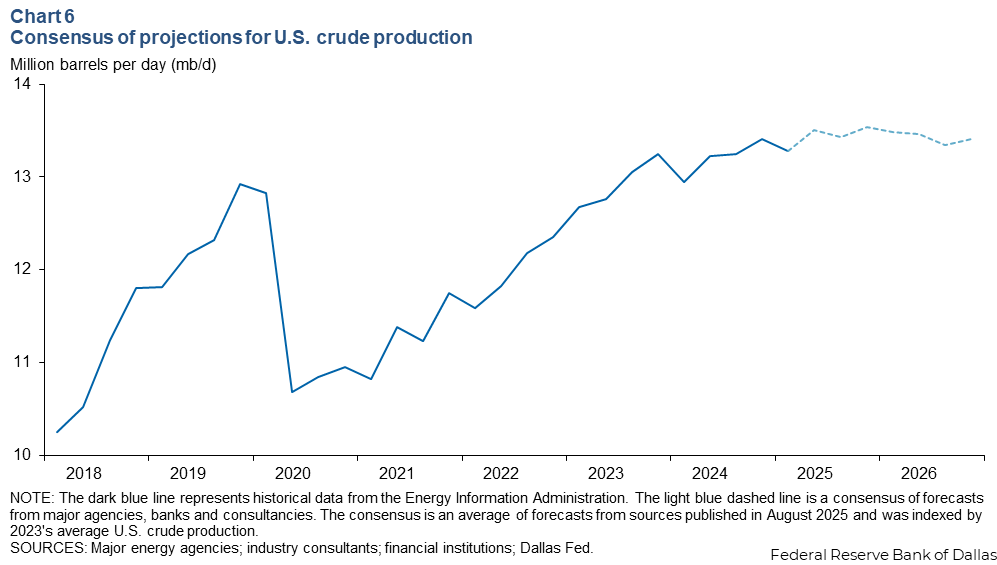

U.S. oil production projected to be flat through 2026

According to a consensus average of several projections, U.S. crude oil production is expected to plateau. Fourth quarter 2025 crude production is expected to be 13.5 mb/d, a 0.1 mb/d uptick from fourth quarter 2024 (Chart 6). The consensus forecast for fourth quarter 2026 is 13.4 mb/d, a slight decline.

About Energy Indicators

Questions can be addressed to Adefemi Abimbola or Jesse Thompson. Energy Indicators is released monthly and can be received by signing up for an email alert. For additional energy-related research, please visit the Dallas Fed’s energy home page.