Austin Economic Indicators

June 3, 2022

Austin’s economy continued to grow in April. The Austin Business-Cycle Index expanded at a solid pace, as the unemployment rate remained near prepandemic levels, and Austin’s employment increased at a hearty rate. COVID-19 hospitalizations ticked up ahead of Memorial Day weekend. Austin’s existing-home sales in April inched up as the median home price reached a new record high. Private sector average hourly earnings continued to trend upward.

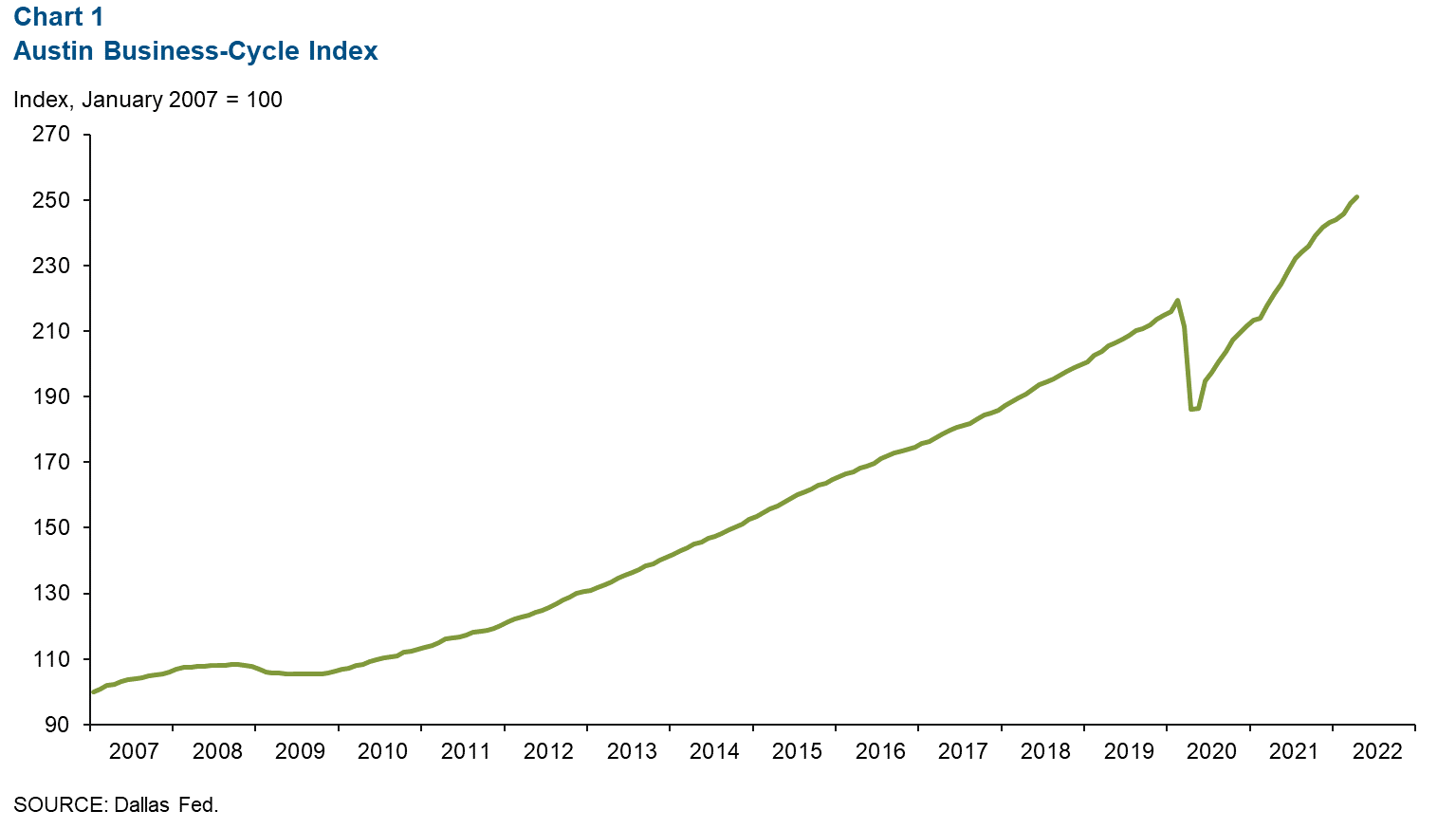

Business-cycle index

The Austin Business-Cycle Index—a broad measure of economic activity—rose an annualized 10.7 percent in April after increasing a robust 16.4 percent in March (Chart 1).

Labor market

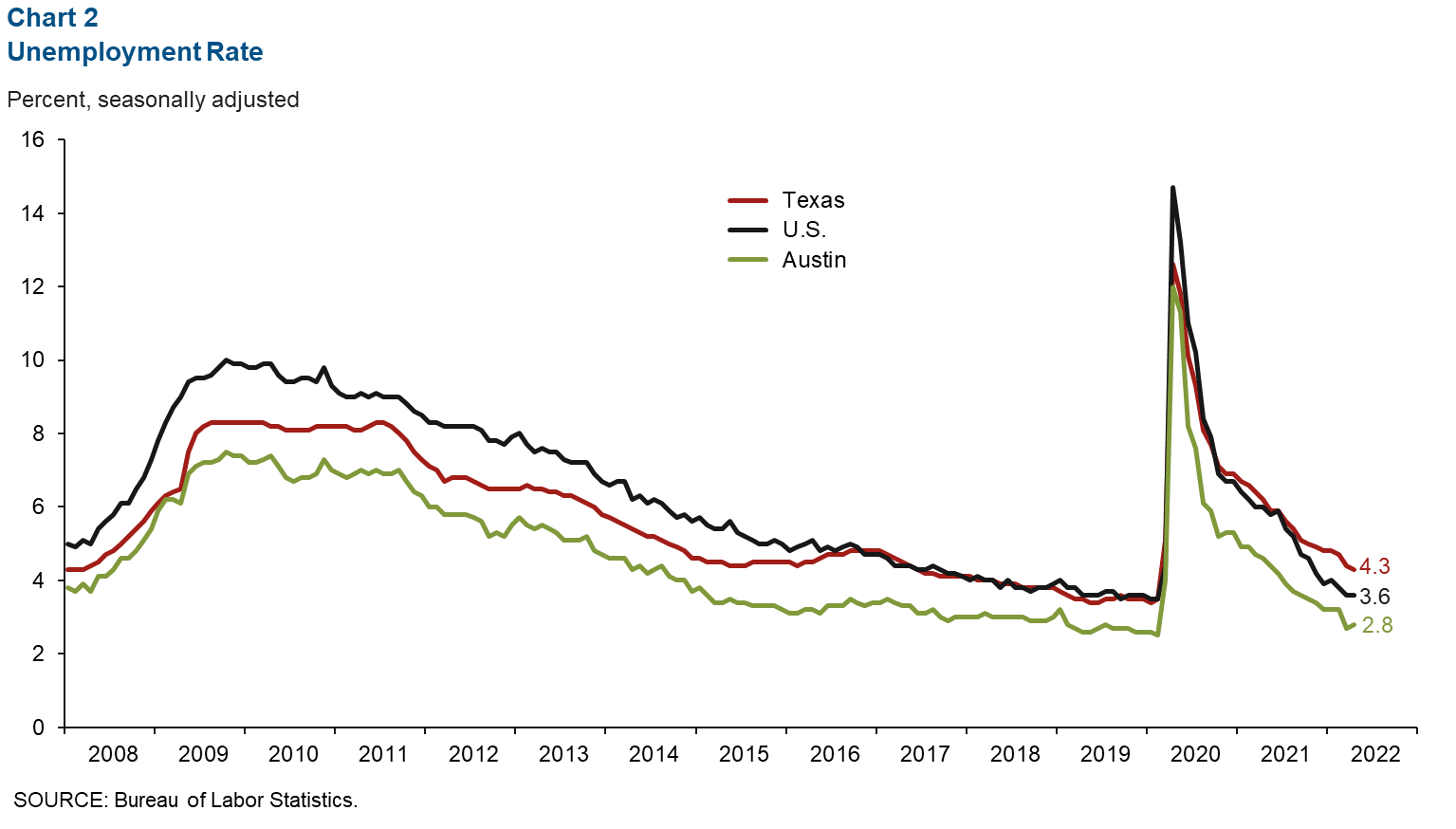

Unemployment rate inches up

Austin’s unemployment rate slightly ticked up to 2.8 percent in April after falling to a revised 2.7 percent in March (Chart 2). Despite a slight uptick, Austin’s unemployment rate remains well below the state’s jobless rate of 4.3 percent and the nation’s rate of 3.6 percent. The metro labor force declined at a 3.7 percent annualized rate in April after growing a revised 4.7 percent in March. In comparison, the state’s labor force increased by 3.8 percent in April, and the nation’s declined by 2.6 percent.

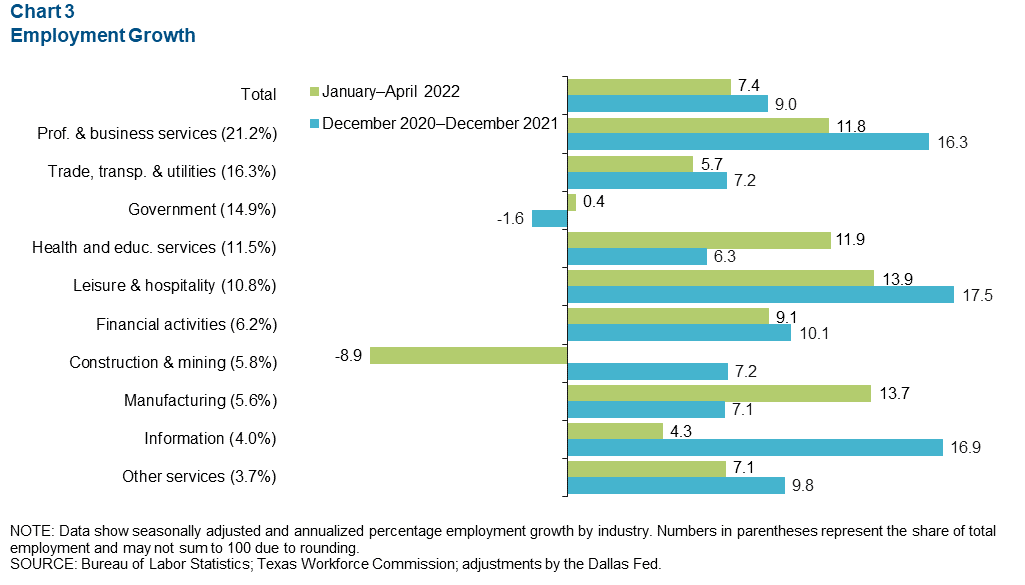

Payroll gains positive across most sectors

Austin employment increased at a 7.4 percent annualized pace, or by 21,731 net jobs, for the three months ending in April (Chart 3). The leisure and hospitality sector (up 13.9 percent, or 4,245 jobs) led overall growth, followed closely by manufacturing (up 13.7 percent, or 2,195 jobs). Construction and mining was the only sector to see a net decline in employment for April (down 8.9 percent, or 1,697 jobs). As of March, Austin payrolls were 7.9 percent above prepandemic (February 2020) levels. Austin employment rose 9.0 percent year over year in December 2021.

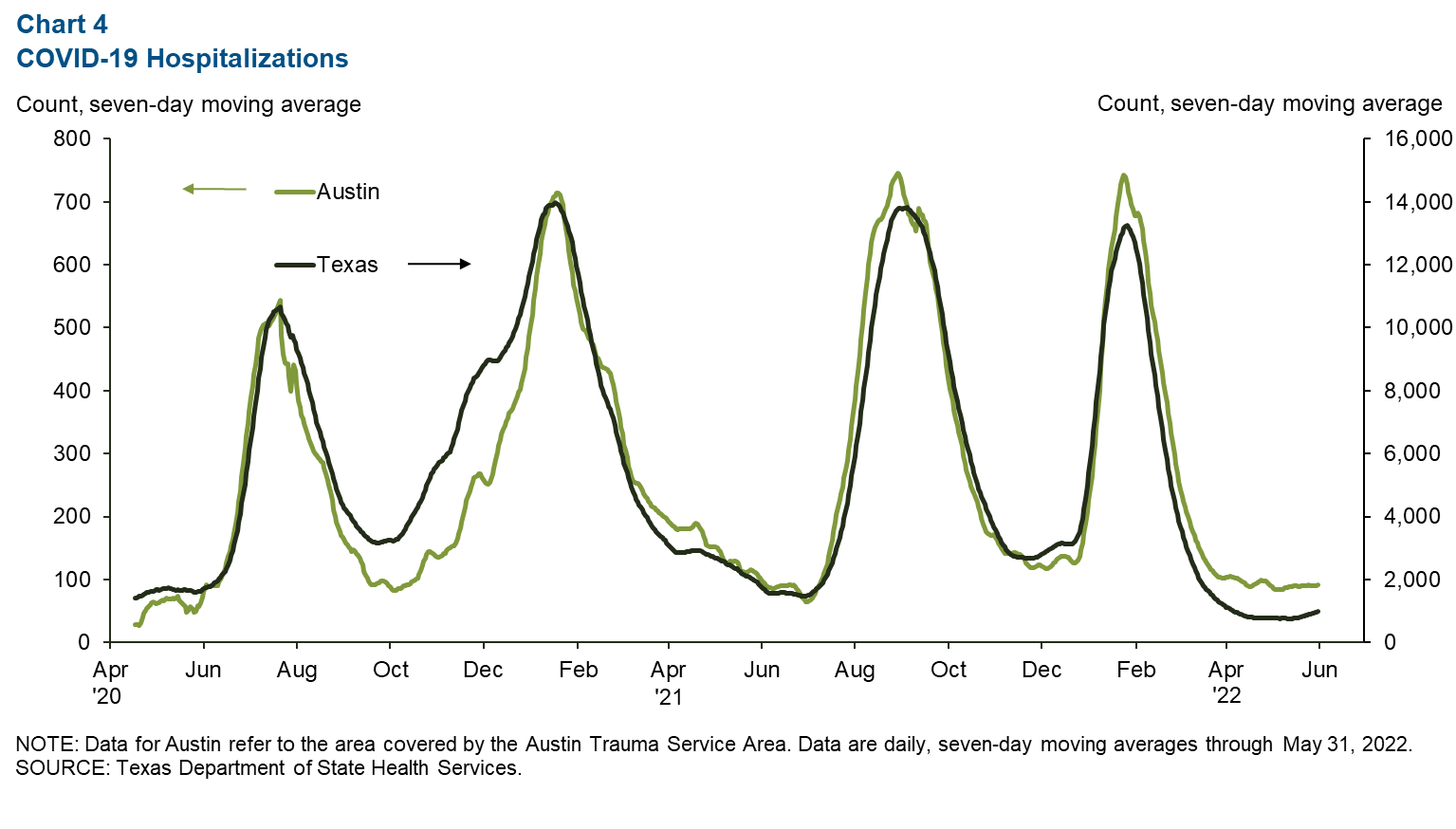

COVID-19 statistics

The number of people hospitalized with COVID-19 in Austin and Texas saw a moderate increase in May (Chart 4). COVID-19 hospitalizations in Austin and Texas remained far below their January peak. As of May 31, 92 people in Austin and 999 in the state were hospitalized with COVID-19.

Real estate

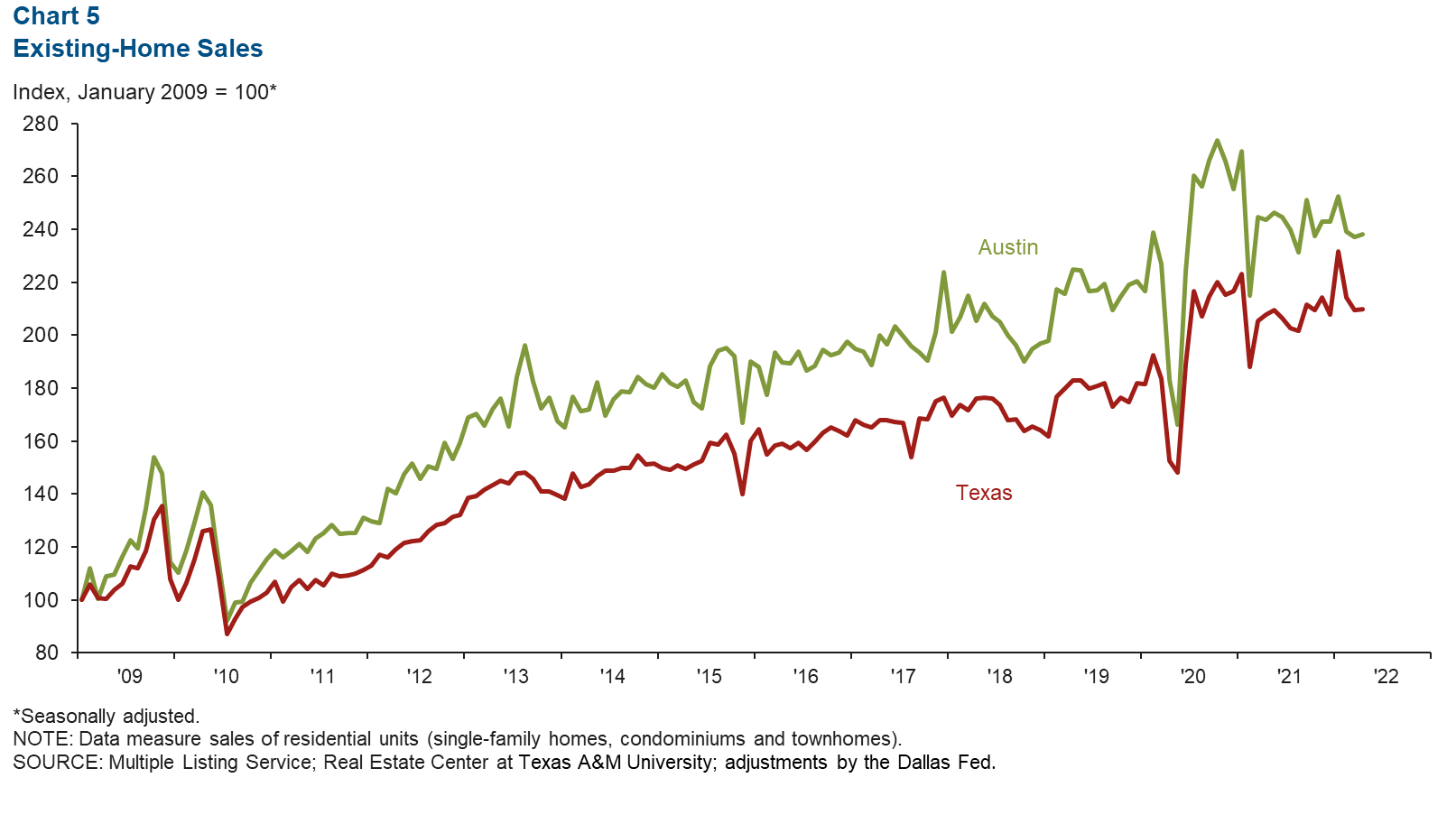

Austin’s existing-home sales increased by 0.5 percent in April after posting a 0.8 percent contraction in March (Chart 5). This compares with the state’s 0.2 percent gain in April and 2.2 percent contraction in March. Compared with 2021, year-to-date existing-home sales were down 0.6 percent in the metro and up 5.0 percent statewide. In April, median home prices reached a new high both in the metro and state. The median price of homes sold was $529,959 in the metro—a 10.7 percent rise year over year. The median price in the state was $346,760—an 11.0 percent jump year over year.

Wages

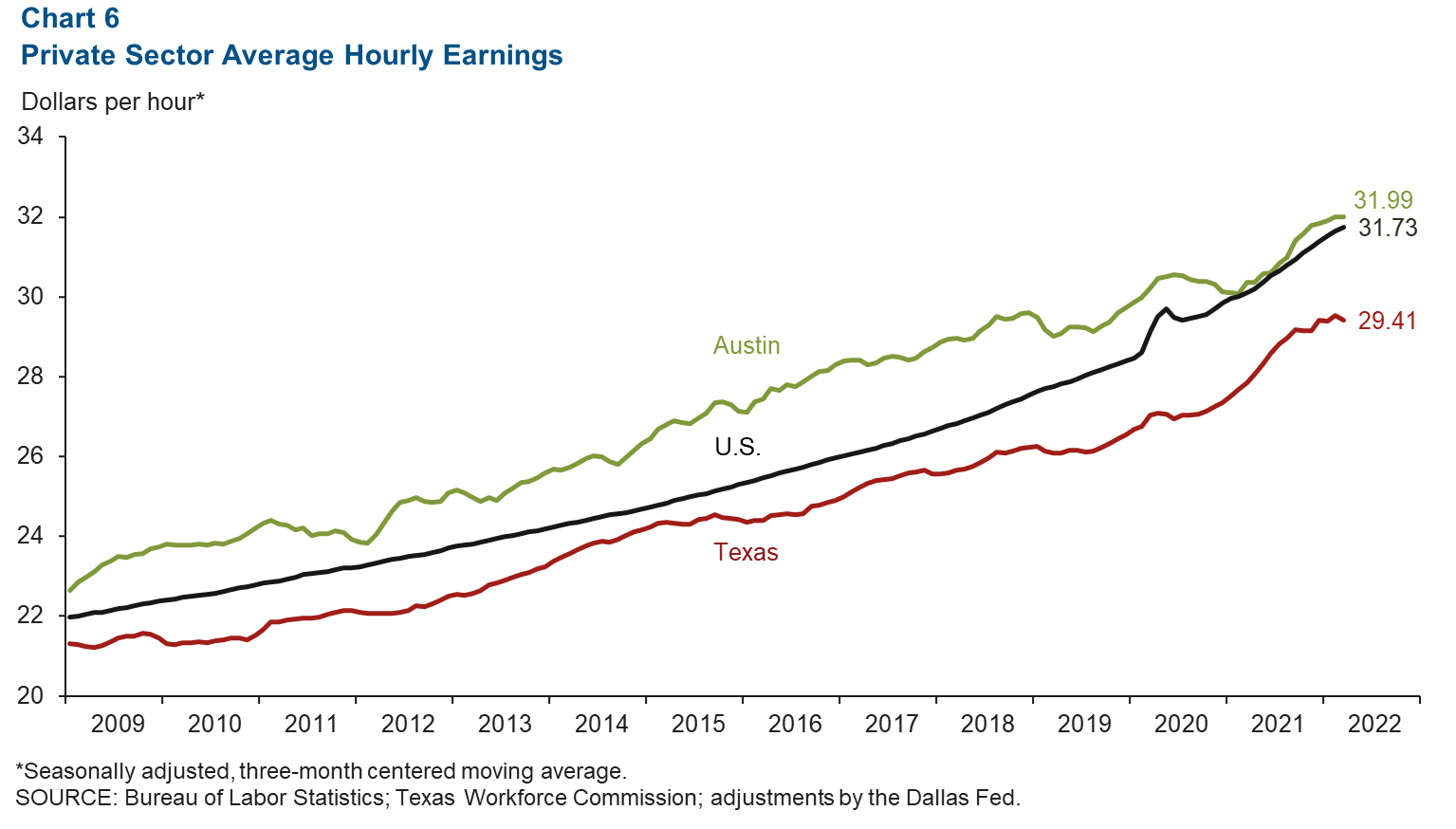

Private sector average hourly wages in Austin moderated in April (Chart 6). Year-over-year wages increased 4.8 percent in Austin, compared with a 6.2 percent rise in Texas. The three-month centered moving average of average hourly wages in Austin held roughly flat at $31.99, slightly higher than the national average of $31.73 and well above the state average of $29.41.

NOTE: Data may not match previously published numbers due to revisions.

About Austin Economic Indicators

Questions can be addressed to Mytiah Caldwell at Mytiah.Caldwell@dal.frb.org. Austin Economic Indicators is released on the first Thursday of every month.