Dallas-Fort Worth Economic Indicators

The Dallas–Fort Worth (DFW) economy continued to expand in August. Job growth was modest, and the unemployment rate edged up in both metros. While recent job growth has been below last year’s strong pace, labor market indicators suggest this is likely due to continued tightness in labor markets rather than an underlying weakness in the local economy.

Labor Market

Employment Gains Modest in August

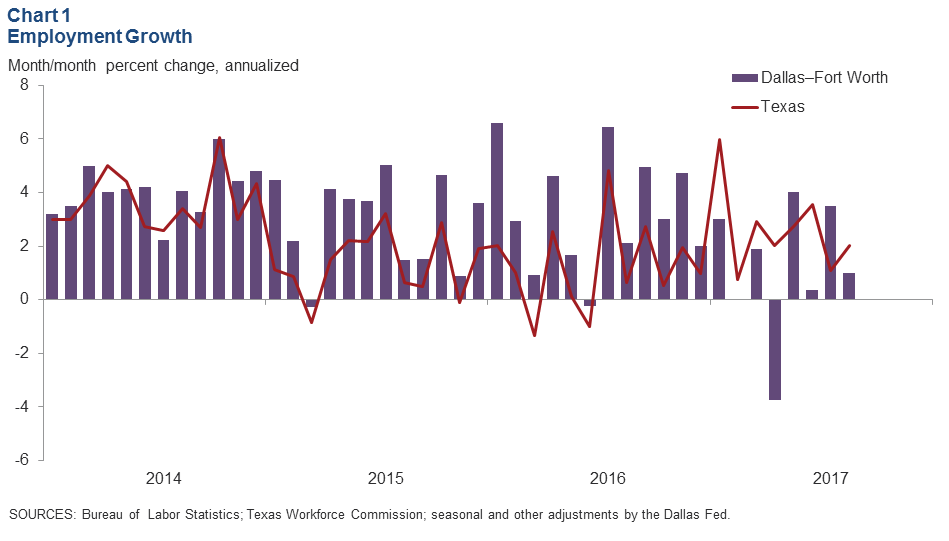

DFW jobs grew at a 1 percent annualized rate in August, slower than July’s downwardly revised 3.5 percent increase (Chart 1). Payrolls in Fort Worth contracted 2.1 percent, while in Dallas they expanded by 2.3 percent in August. Fort Worth year-to-date employment growth of 1.6 percent annualized has outperformed Dallas at 1.1 percent. Considerably slower employment gains in Dallas this year relative to 2016 are likely due to a tight labor market.

Employment Growth Is Broad Based

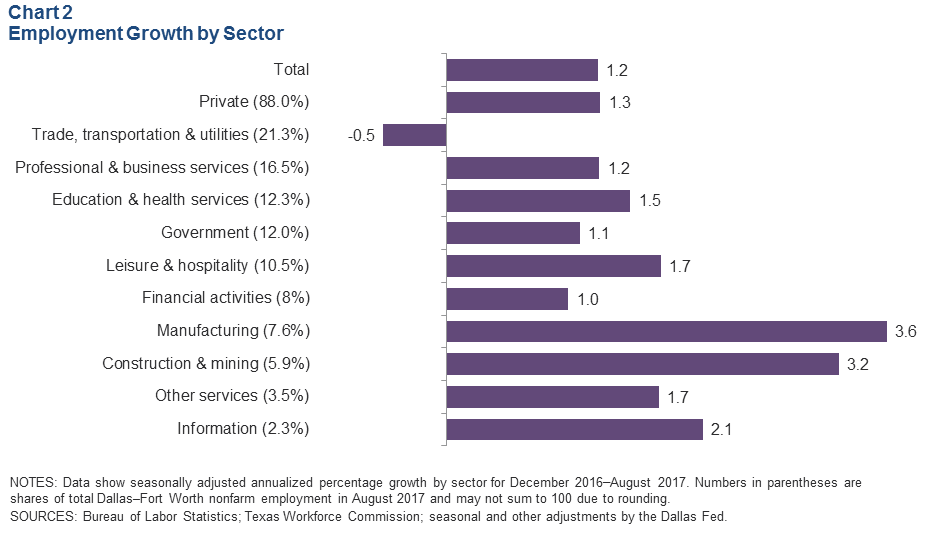

DFW jobs increased at a modest 1.2 percent annualized rate year to date (Chart 2). Job gains have been broad based across major sectors. The top two contributors to year-to-date growth were the manufacturing and construction and mining sectors, which added a combined 10,700 jobs. Large service sectors such as professional and business services, education and health services, leisure and hospitality and financial activities have seen modest growth year to date compared with the same period last year. Job losses were limited to the trade, transportation and utilities sector (2,600 jobs), which makes up more than a fifth of the metro area’s employment.

Unemployment Edges Up

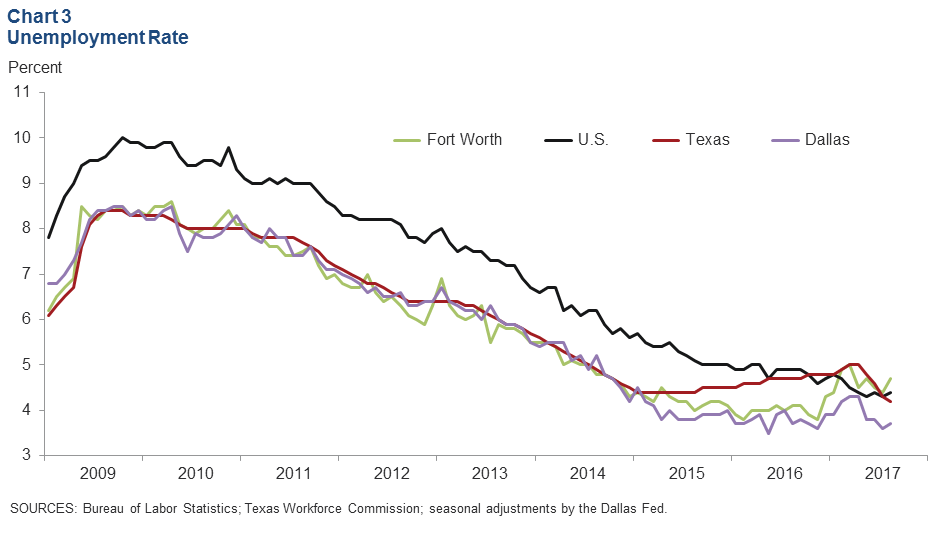

Unemployment in Dallas ticked up to 3.7 percent in August, and the rate in Fort Worth rose from 4.4 percent to 4.7 percent (Chart 3). The labor market in the metroplex remained tight, with unemployment in Dallas lower than both the state and the U.S. figures at 4.2 percent and 4.4 percent, respectively.

Business-Cycle Indexes

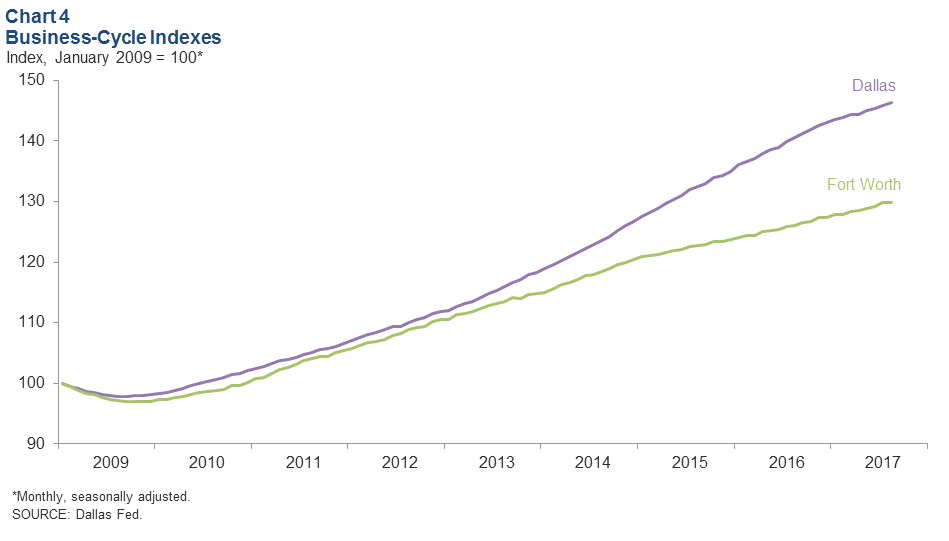

The Dallas business-cycle index grew an annualized 4.5 percent in August, ahead of July’s 3.8 percent pace (Chart 4). Growth in Fort Worth’s business-cycle index was nearly flat in August, following July’s strong 7.0 percent annualized increase. Year over year, the Dallas index was up a solid 4.2 percent, and the Fort Worth index was up 3.0 percent.

Housing Market

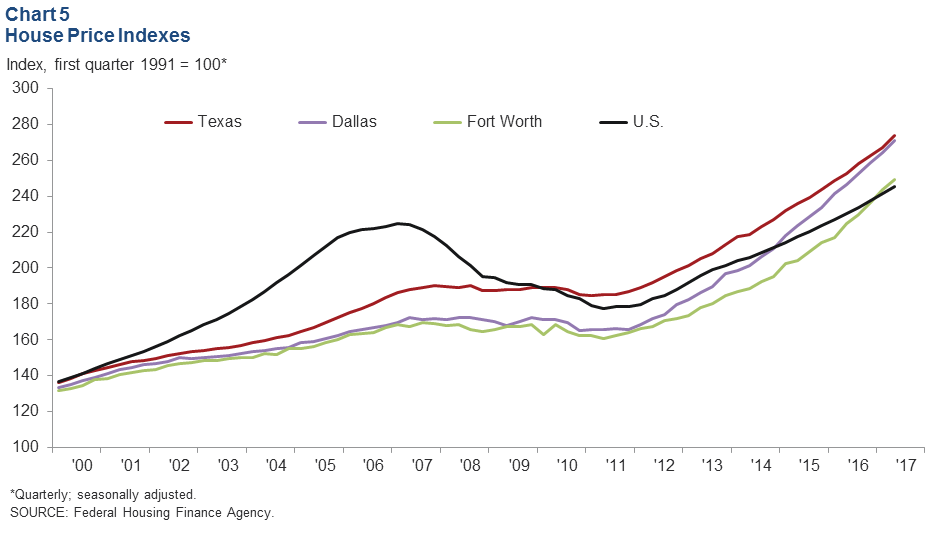

Home Prices Rise

Home price gains in the metroplex continued to outpace those in the U.S. (Chart 5). Prices rose 2.5 percent in Dallas and 2.4 percent in Fort Worth in second quarter 2017, matching the state’s 2.4 percent increase but faster than the nation’s 1.6 percent increase, according to the Federal Housing Finance Agency purchase-only house price index. On a year-over-year basis, prices were up 9.9 percent in Dallas and 10.8 percent in Fort Worth—both higher than in Texas at 8.3 percent and the nation at 6.6 percent.

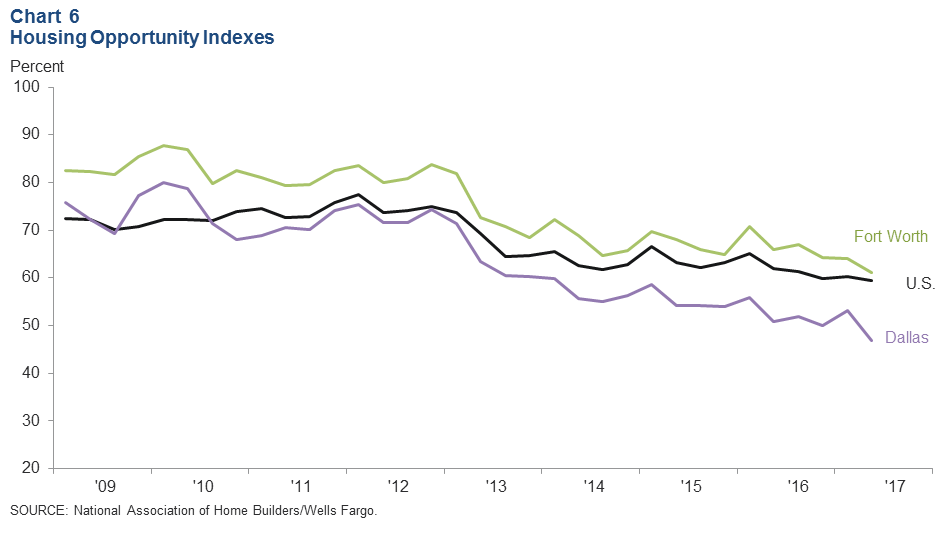

Affordability Dips Further

Record home price appreciation since 2012 has eroded housing affordability in the metroplex. According to the National Association of Home Builders/Wells Fargo Housing Opportunity indexes, only 47 percent of the homes (new and existing) sold in Dallas in second quarter 2017 were affordable for a median-income family—below the national figure of 59.4 percent (Chart 6). Affordability has been declining in Dallas since 2010, and the index has dropped markedly from its peak set in first quarter 2010 amid the U.S. housing bust. Despite having a lower median home sales price than Austin, affordability in Dallas is the lowest among major Texas metros. Affordability in Fort Worth dipped as well from 64 percent in the first quarter to 61.2 percent in the second, but the metro remains more affordable relative to Dallas and the nation.

NOTE: Data may not match previously published numbers due to revisions.

About Dallas–Fort Worth Economic Indicators

Questions can be addressed to Laila Assanie at laila.assanie@dal.frb.org. Dallas–Fort Worth Economic Indicators is published every month on the Tuesday after state and metro employment data are released.