El Paso Economic Indicators

April 7, 2020

Note: Most of the data included in this release precede the coronavirus (COVID-19) outbreak in the U.S.

El Paso’s economy continued to expand in February, with jobs rising 2.7 percent year to date. Both home sales and median prices hit their highest levels since 2005. Maquiladora employment weakened, with employment just under 276,570 in January.

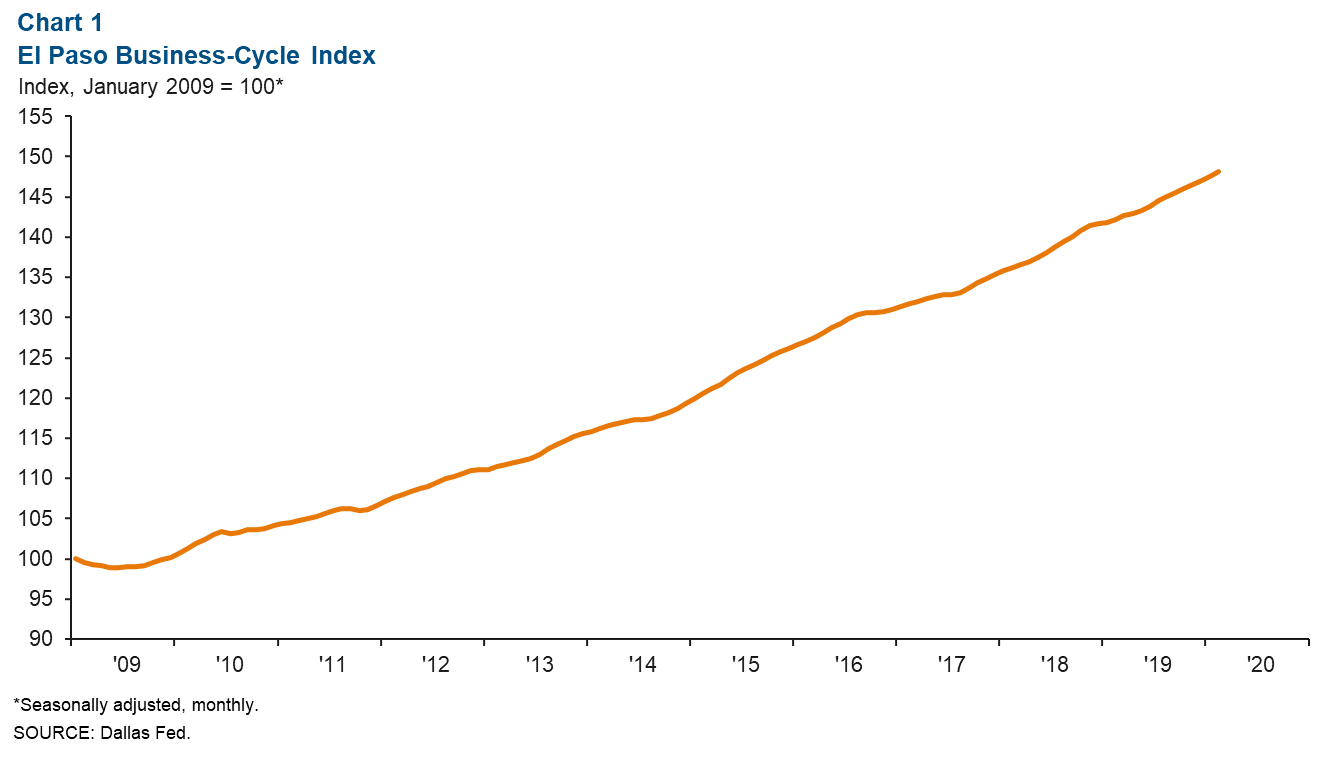

Business-Cycle Index

The El Paso Business-Cycle Index rose an annualized 4.6 percent in February (Chart 1). Gains in the index were likely due to a strengthening labor market.

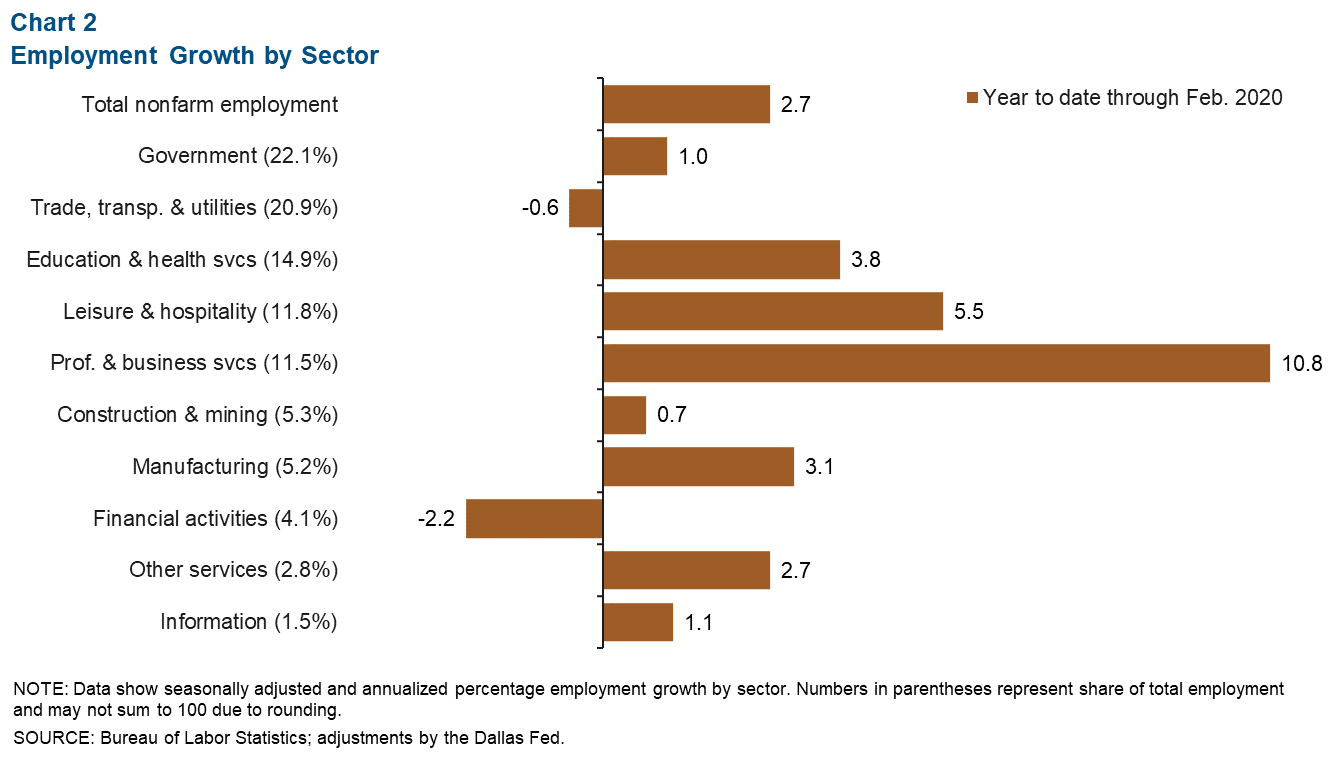

Labor Market

Year to date through February, El Paso jobs expanded an annualized 2.7 percent, adding 1,455 jobs (Chart 2). Professional and business services posted the strongest growth—up 10.8 percent year to date—followed by leisure and hospitality (5.5 percent) and education and health services (3.8 percent). El Paso’s unemployment rate in February was 3.7 percent, slightly above the 3.5 percent figure for both Texas and the U.S.

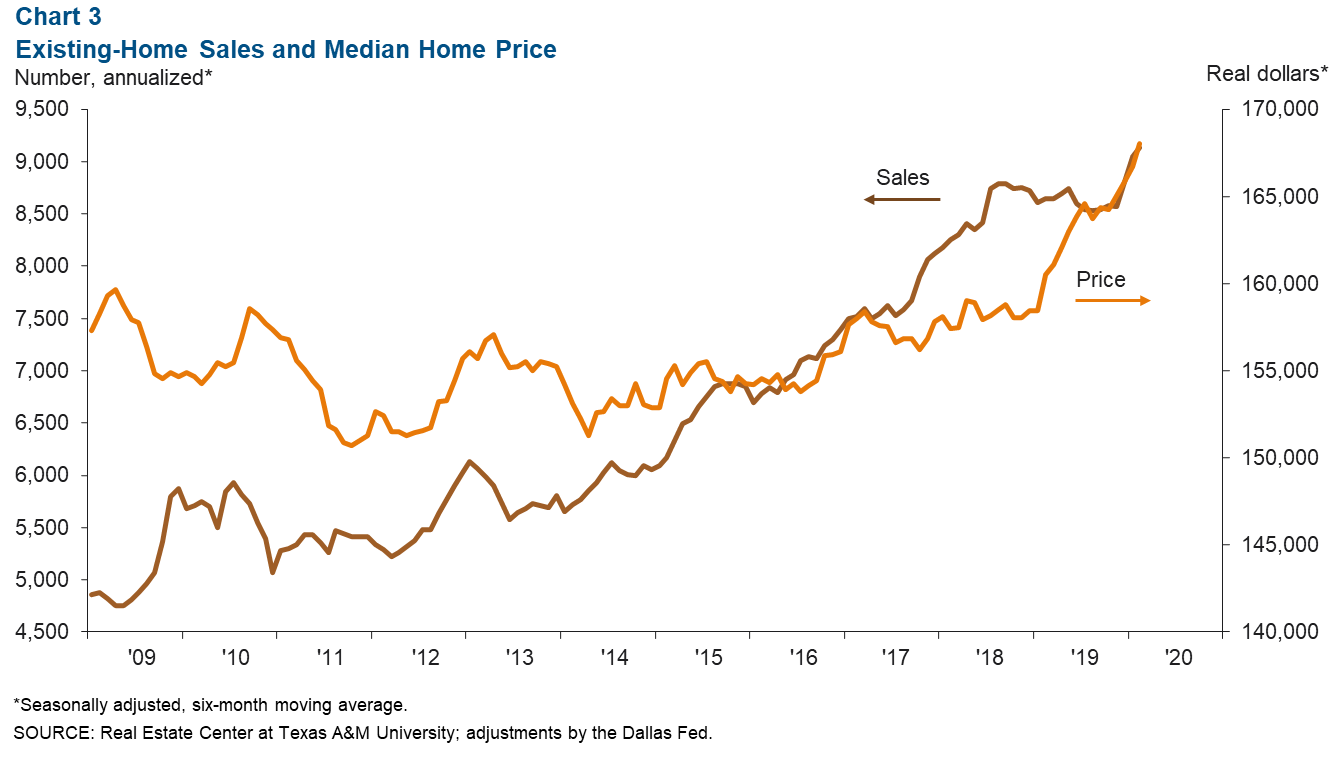

Housing Market

Year-over-year existing-home sales in El Paso increased for the third consecutive month in February (Chart 3). Annualized sales totaled 9,132—5.6 percent above the same period a year ago. Median-home prices stood at $168,040, up 4.7 percent from February 2019. Meanwhile, existing-home inventories continue to fall, totaling 2.9 months in February, well below the six months associated with a balanced market.

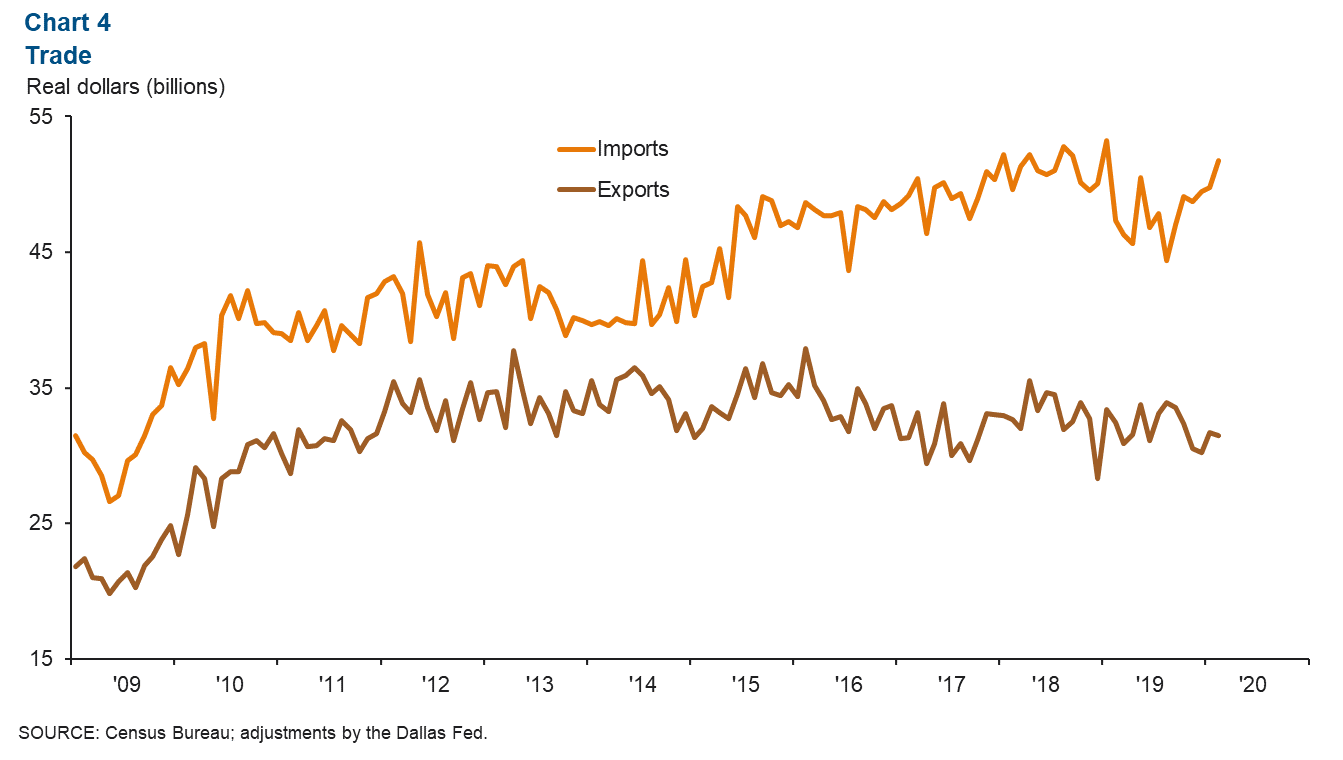

Trade

Annualized total trade in El Paso was $83.3 billion in February, up 4.3 percent from a year prior. Year-over-year growth in total trade was driven by gains of 9.3 percent in imports, while exports declined by 2.9 percent (Chart 4). Exports totaled an annualized $31.5 billion, while imports equaled $51.8 billion.

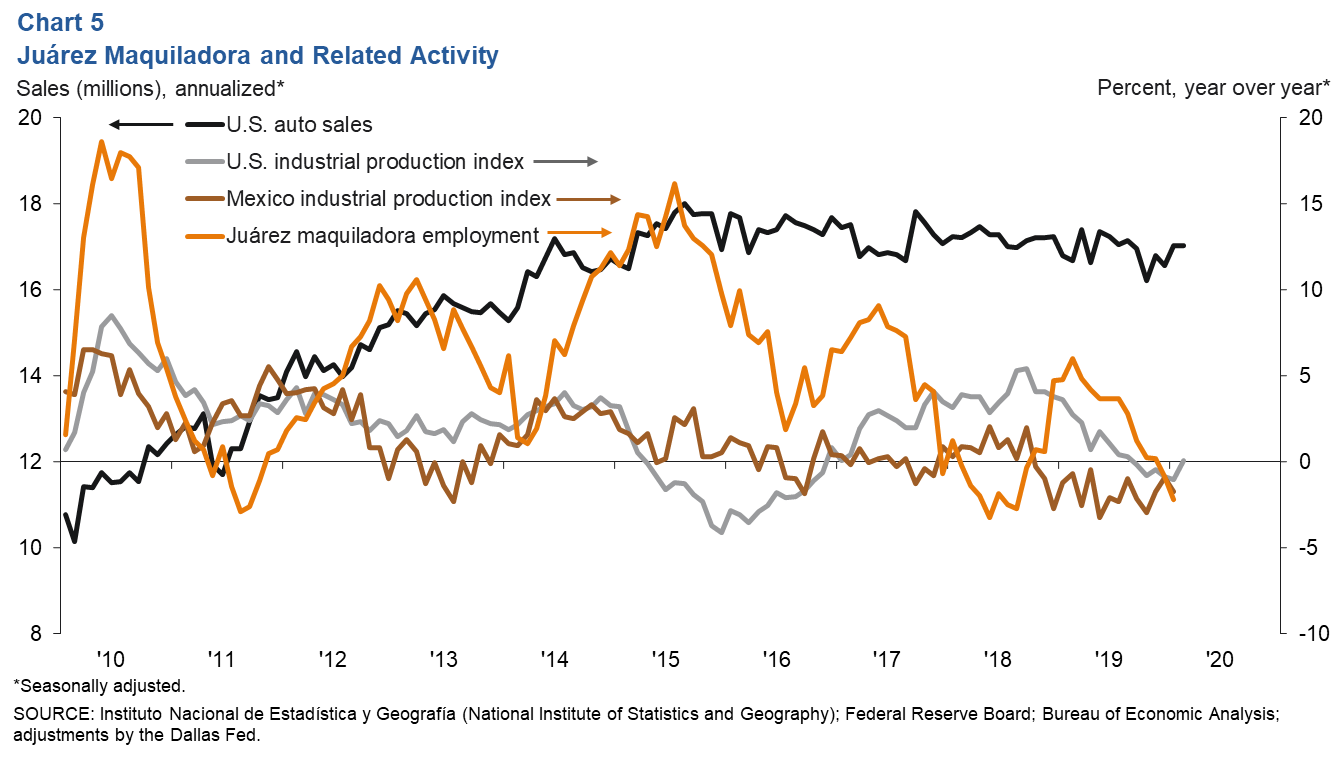

Industrial Production and Maquiladora Activity

U.S. industrial production was flat in February relative to a year ago (Chart 5). Mexico’s industrial production activity declined by 1.7 percent in January 2020 from a year prior. The Institute for Supply Management manufacturing index fell to 49.1 in March from 50.1 in February. Production, new orders and employment weakened due to supply-chain disruptions caused by COVID-19. U.S. and Mexican production and manufacturing trends are important to the local economy because of cross-border manufacturing relationships.

Juárez’s year-over-year maquiladora employment fell in January by 2.2 percent, with jobs totaling just under 276,570. According to Mexico’s IMMEX series, Juárez lost 6,216 manufacturing jobs compared with a year earlier. U.S. auto and light-truck production ticked up 1.1 percent in February at 10.8 million units compared with a year earlier. U.S. auto sales also rose 2.1 percent to 17 million units in February 2020 from 16.7 million units in February 2019. Auto sales are closely linked to the local economy because roughly half of maquiladoras in Juárez are auto related.

NOTE: Data may not match previously published numbers due to revisions. The El Paso metropolitan statistical area includes El Paso and Hudspeth counties.

About El Paso Economic Indicators

Questions can be addressed to Keighton Allen at keighton.allen@dal.frb.org. El Paso Economic Indicators is released on the fourth Wednesday of every month.