El Paso Economic Indicators

March 18, 2021

The El Paso economy softened in January. Employment slumped despite a slowing in COVID-19 deaths and hospitalizations and strengthening vaccination efforts throughout the metro. Trade volumes weakened further, while manufacturing conditions improved. Automotive production and sales dipped, with both below prepandemic levels.

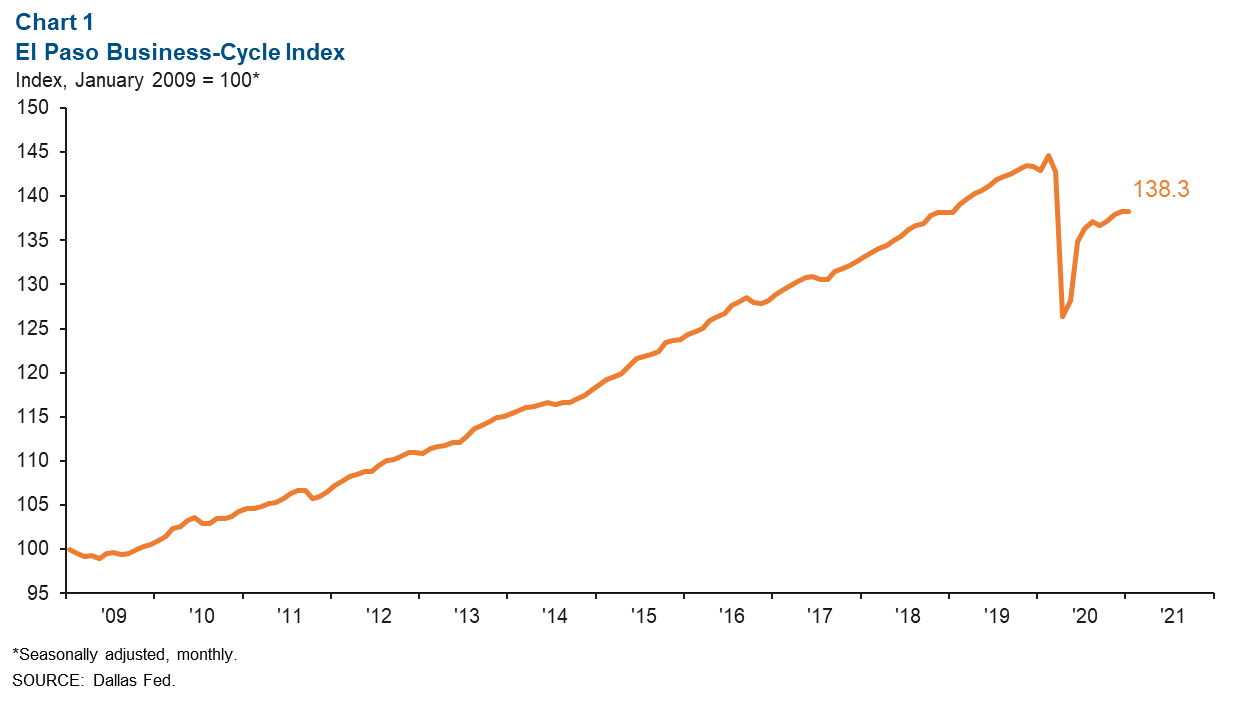

Business-Cycle Index

The El Paso Business-Cycle Index dipped an annualized 0.2 percent to 138.3 in January (Chart 1). The recent decline in the index is attributed to diminished employment growth in the metro. Since the start of the pandemic, the index has fallen an annualized 4.8 percent.

Labor Market

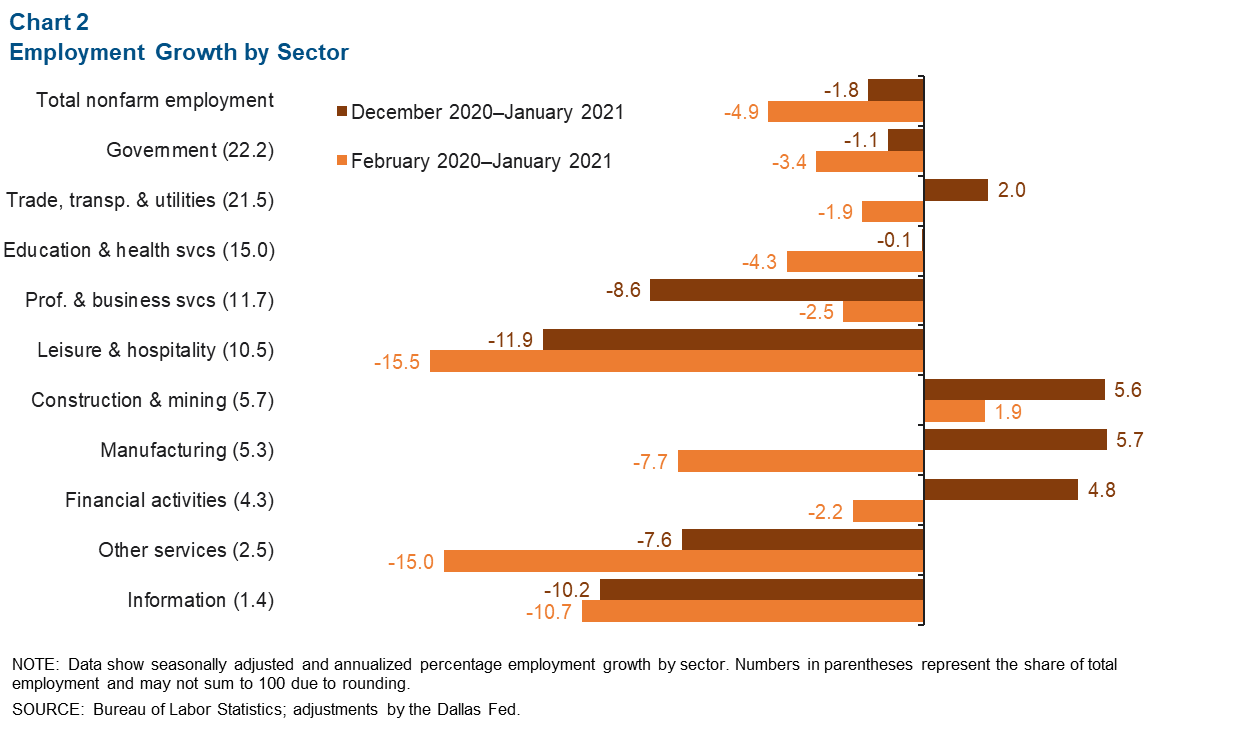

January employment fell an annualized 1.8 percent, largely due to a loss of 348 leisure and hospitality jobs and 274 professional and business services jobs (Chart 2). Sectors that saw gains included trade, transportation and utilities (110 jobs), construction and mining (81), manufacturing (76) and financial activities (52).

Since February 2020, the El Paso labor market has lost 14,660 jobs (nonannualized). Only construction and mining saw job gains, adding approximately 300 jobs. Job losses since the onset of the pandemic were largely driven by leisure and hospitality (5,437 jobs), government (2,224), education and health services (1,931), other services (1,268), manufacturing (1,257) and trade, transportation and utilities (1,220).

The El Paso unemployment rate fell from 7.8 percent in December to 7.6 percent in January. The Texas unemployment rate also ticked down to 6.8 percent in January, while the U.S. unemployment rate fell to 6.2 percent in February.

COVID-19 Pandemic

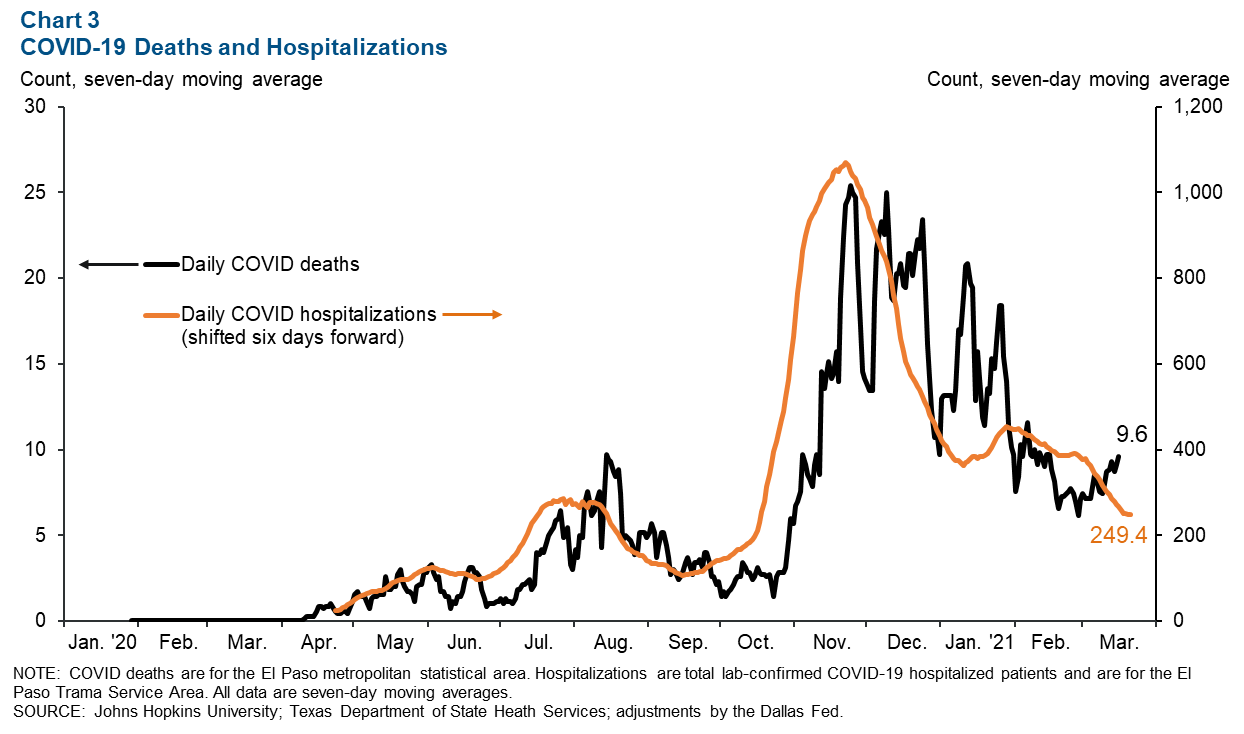

Containing the spread of COVID-19 and the inoculation of the population are critical to preserving human lives and economic recovery. Daily COVID-19 deaths and hospitalizations in the El Paso area have generally trended down since their peak in late November (Chart 3). The ratio of COVID-19 hospitalizations to total hospital capacity is a statistic that is vital to fully reopening the economy. As of March 15, COVID-19 patients accounted for 11.5 percent of total hospital capacity in the El Paso Trauma Service Area; the statewide figure was 6.2 percent.

The number of people receiving the COVID-19 vaccine in the El Paso metropolitan statistical area currently outpaces the state’s vaccination rate. As of March 15, 29.1 percent of the El Paso metro’s population age 16 and older were vaccinated with at least one dose of a COVID-19 vaccine, while the state’s rate was 24.8 percent. Moreover, 16.3 percent of El Pasoans age 16 and older have been fully vaccinated versus 12.9 percent in Texas.

Trade

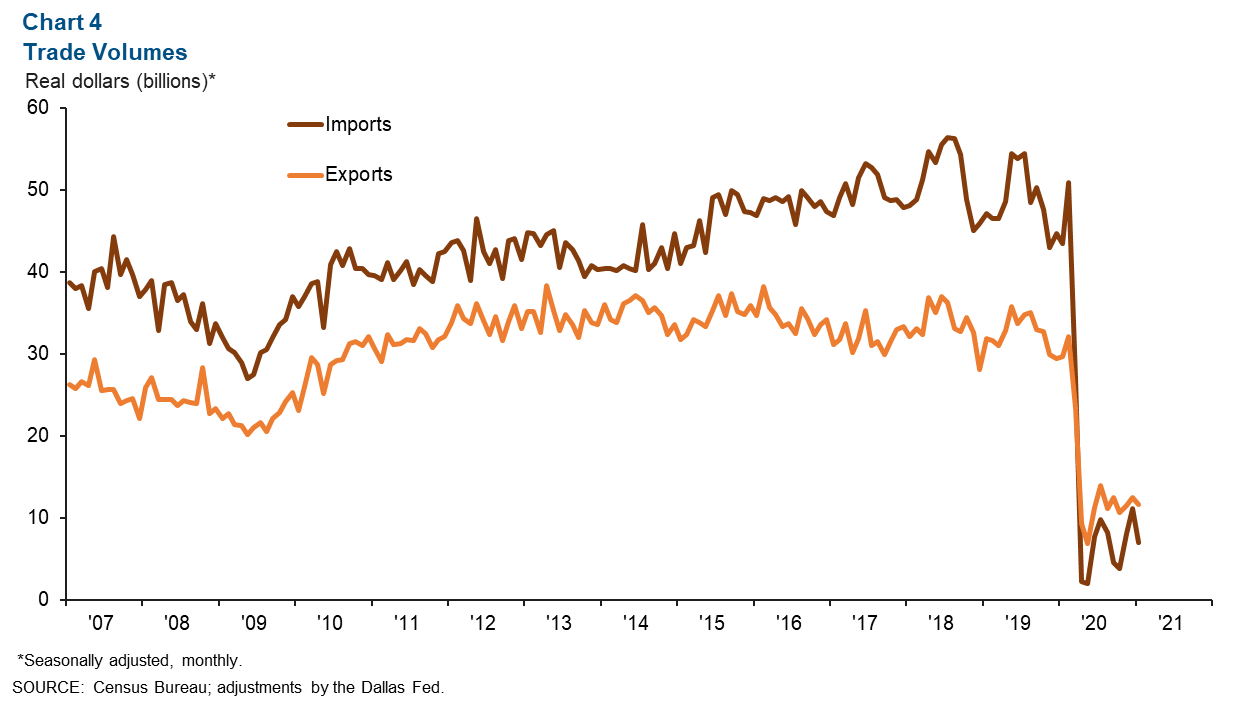

Annualized total trade in El Paso was $18.6 billion in January, down 74.5 percent from $73.1 billion a year earlier (Chart 4). Monthly trade volumes also fell 21.5 percent, with exports falling 7.4 percent and imports dropping 37.2 percent. Annualized exports totaled $11.6 billion in January, a year-over-year decrease of 61.0 percent, while imports totaled $7.0 billion, an 83.8 percent decline from January 2020.

Industrial Production and Maquiladora Activity

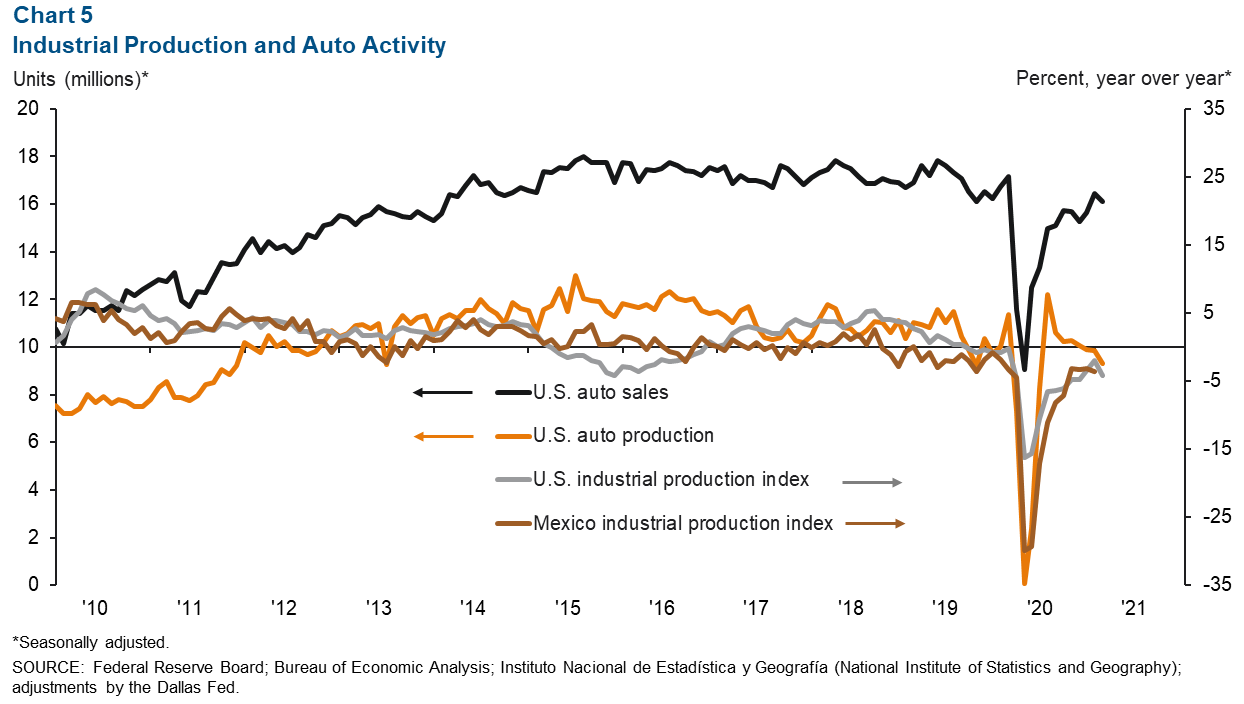

The monthly U.S. industrial production index fell from 107.1 in January to 104.7 in February and was down 4.2 percent year over year (Chart 5). Mexico’s industrial production index grew from 97.8 in December to 98.0 in January but was down 3.7 percent compared with a year ago. The Institute for Supply Management manufacturing index was 60.8 in February, up from January’s figure of 58.7. February’s figure indicates continued expansion in the manufacturing sector for the ninth month in a row—above the threshold of 50.

U.S. auto and light-truck production fell from 9.8 million units in January to 9.3 million units in February and was 18.3 percent lower than February 2020’s production figure of 11.4 million units. Meanwhile, monthly auto sales also fell in February, totaling 16.1 million, and were 6.2 percent down from a year prior. Auto sales are closely linked to the local economy because roughly half of maquiladoras in Juárez are auto related.

NOTE: Data may not match previously published numbers due to revisions. The El Paso metropolitan statistical area includes El Paso and Hudspeth counties.

About El Paso Economic Indicators

Questions can be addressed to Keighton Hines at keighton.hines@dal.frb.org. El Paso Economic Indicators is released on the fourth Wednesday of every month.