El Paso Economic Indicators

June 24, 2022

El Paso’s economy contracted in May. The metro’s business-cycle index dipped for the first time in 18 months, employment fell for the third straight month and the unemployment rate ticked up. However, trade volumes through the El Paso district strengthened, and industrial and manufacturing activity expanded.

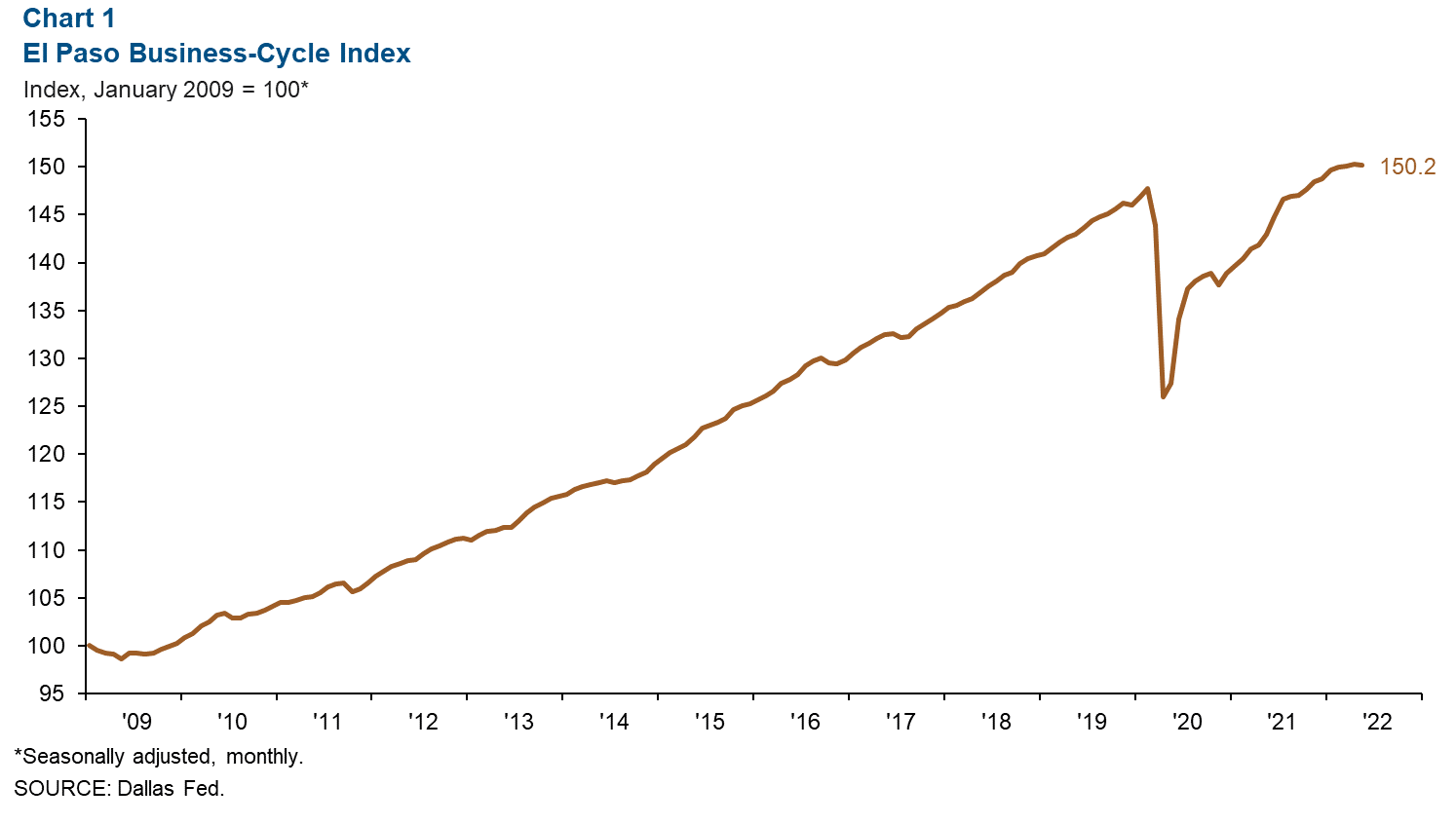

Business-cycle index

The El Paso Business-Cycle Index fell an annualized 0.6 percent in May after expanding 1.2 percent in April (Chart 1). Compared with May 2021, the index is up 5.1 percent.

Labor market

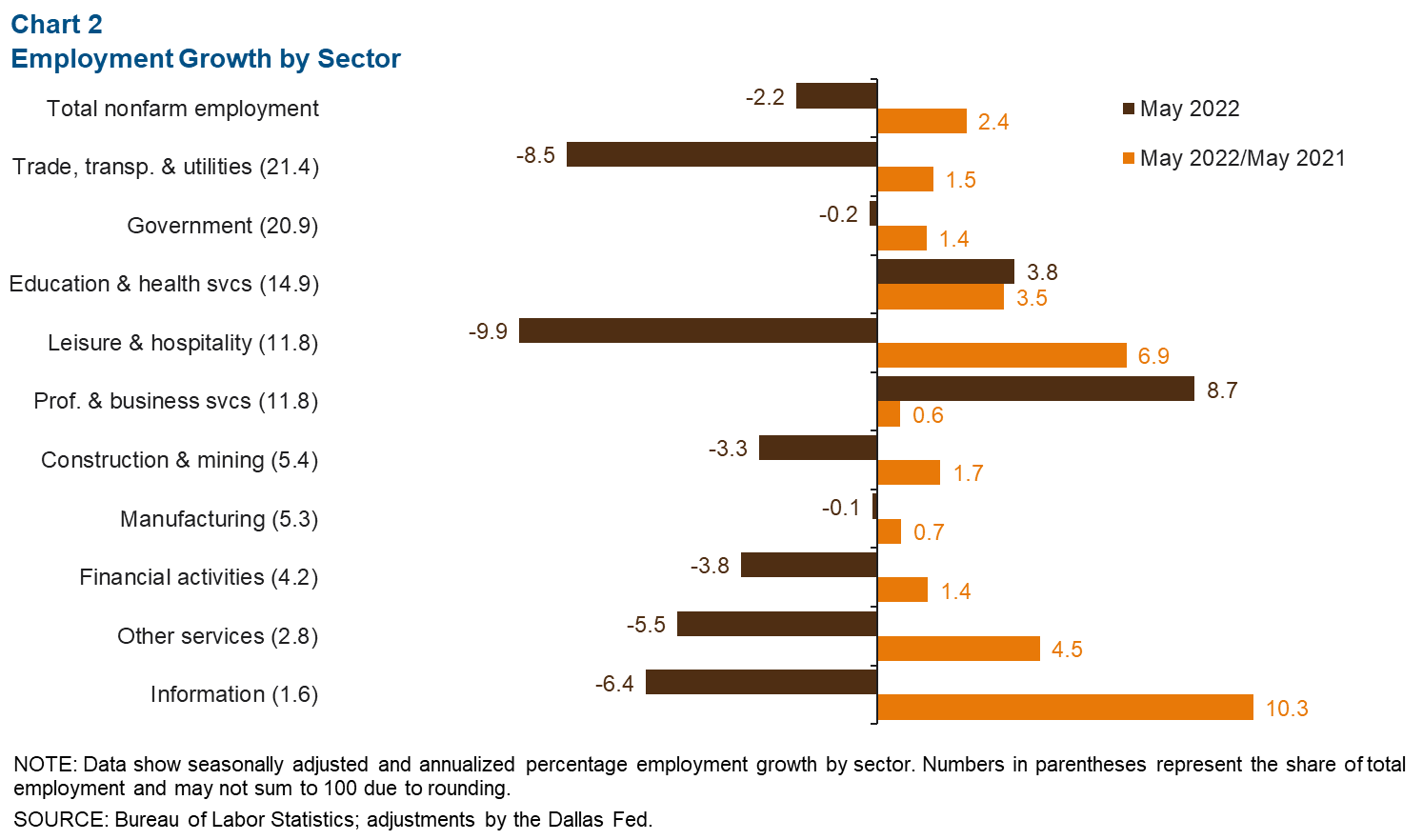

Payrolls contract further

El Paso’s total nonfarm employment fell 2.2 percent (-610 jobs) in May after also declining in April and March (Chart 2). Job losses were widespread but largest in trade, transportation and utilities (-520 jobs), leisure and hospitality (-330) and construction and mining (-50). The only sectors adding positions were professional and business services (260 jobs) and education and health services (150).

Compared with last year, metro employment is up 2.4 percent, or by 7,730 jobs. Gains were broad based, with sizable increases in the leisure and hospitality (2,450 jobs), education and health services (1,630) and trade, transportation and utilities (1,050) sectors.

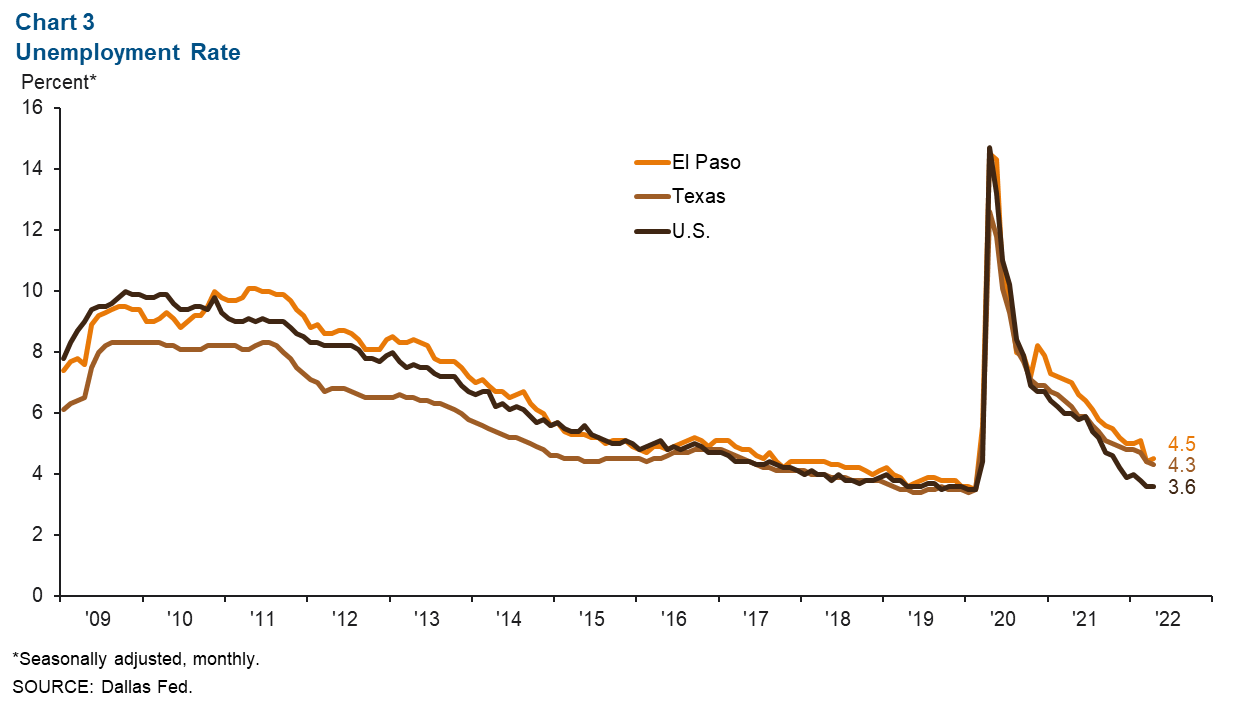

Unemployment edges up

El Paso’s unemployment rate ticked up from 4.4 percent in April to 4.5 percent in May (Chart 3). In contrast, the Texas figure dipped to 4.3 percent, while the U.S. rate remained at 3.6 percent in May.

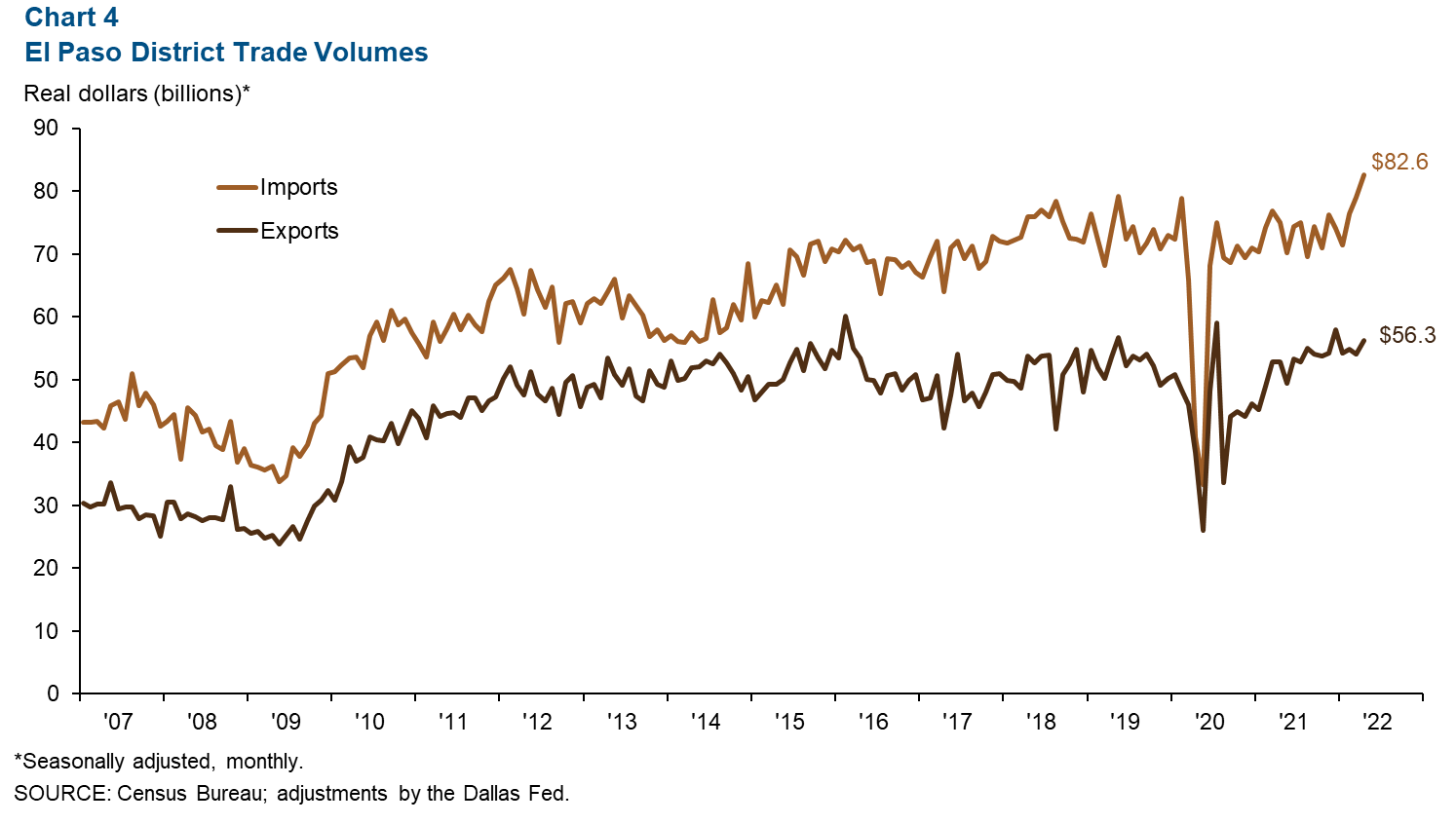

Trade

Annualized monthly trade through the El Paso district rose 4.3 percent to $138.9 billion in April (Chart 4). The increase was driven by import growth of 4.5 percent and export growth of 4.0 percent. Most of that trade came through the Ysleta (52 percent) and Santa Teresa (29 percent) ports of entry, while the El Paso port of entry made up 19 percent.

Industrial production and maquiladora-related activities

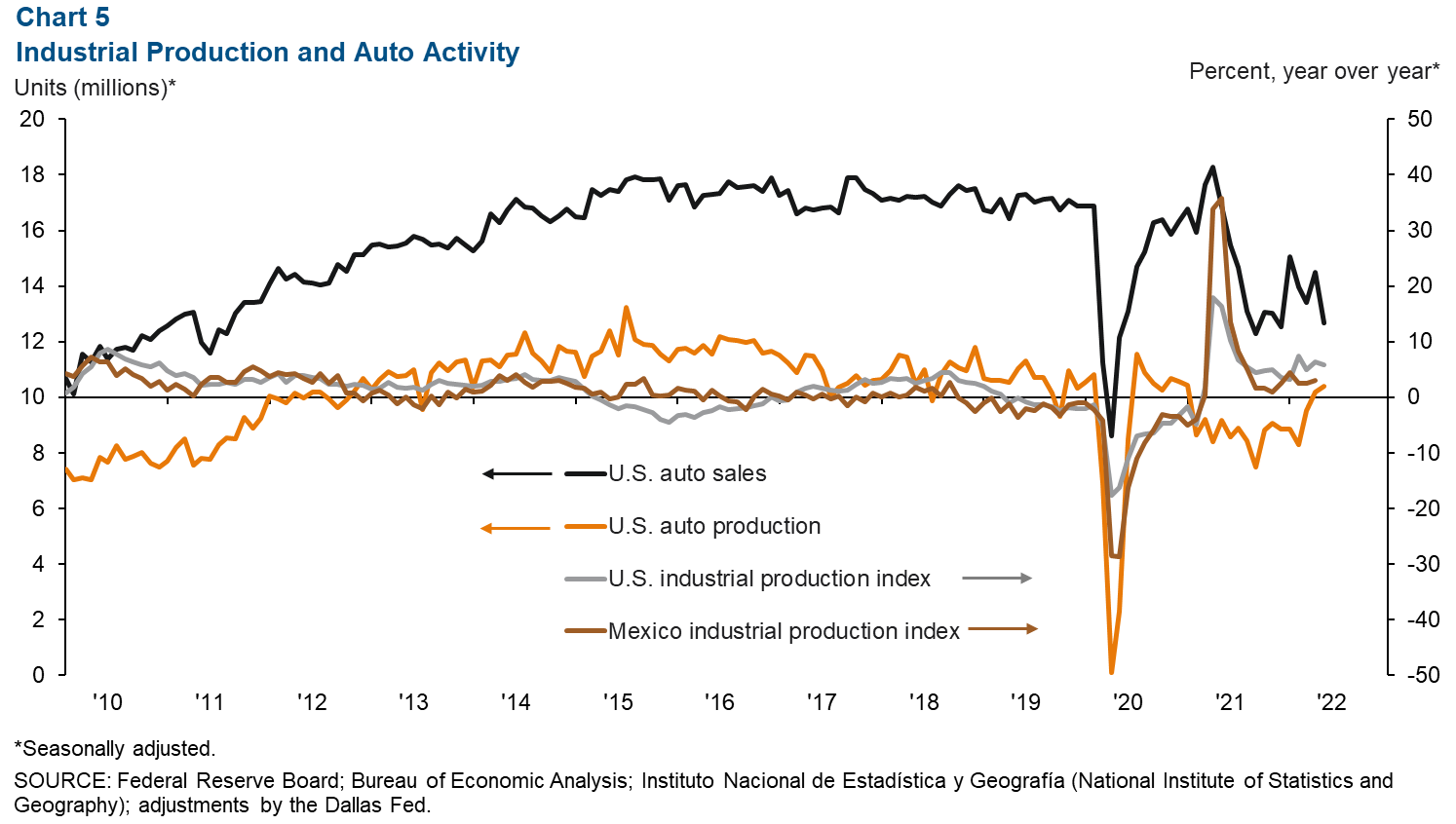

The monthly U.S. industrial production (IP) index edged up 0.2 percent to 105.7 in May and was up 5.8 percent from a year ago (Chart 5). Mexico’s IP index also expanded, from 100.8 in March to 101.3 in April, and was 2.9 percent higher than a year ago. The Institute for Supply Management (ISM) manufacturing index rose from April’s 55.4 to 56.1 in May but was down 5.5 percentage points from a year ago. The ISM index figure remained above 50, indicating expansion in the manufacturing sector. Comments from ISM panelists indicated that labor availability was somewhat improved, but supply constraints and price pressures continued.

U.S. auto and light-truck production rose from 10.2 million units in April to 10.4 million in May. In contrast, monthly auto sales fell, from 14.5 million in April to 12.7 million in May. Industrial and auto activity are closely linked to the El Paso-area economy because of cross-border manufacturing relationships. Roughly half of maquiladoras in Juárez are auto related.

NOTE: Data may not match previously published numbers due to revisions. The El Paso metropolitan statistical area includes El Paso and Hudspeth counties.

About El Paso Economic Indicators

Questions can be addressed to Keighton Hines at keighton.hines@dal.frb.org. El Paso Economic Indicators is published every month after state and metro employment data are released.