El Paso Economic Indicators

October 27, 2022

Declines in El Paso’s business-cycle index and payroll employment signaled diminishing economic activity. However, unemployment continued its downward trend. Single-family housing construction slowed due to high mortgage rates. U.S. auto production remained largely unchanged, while auto sales increased.

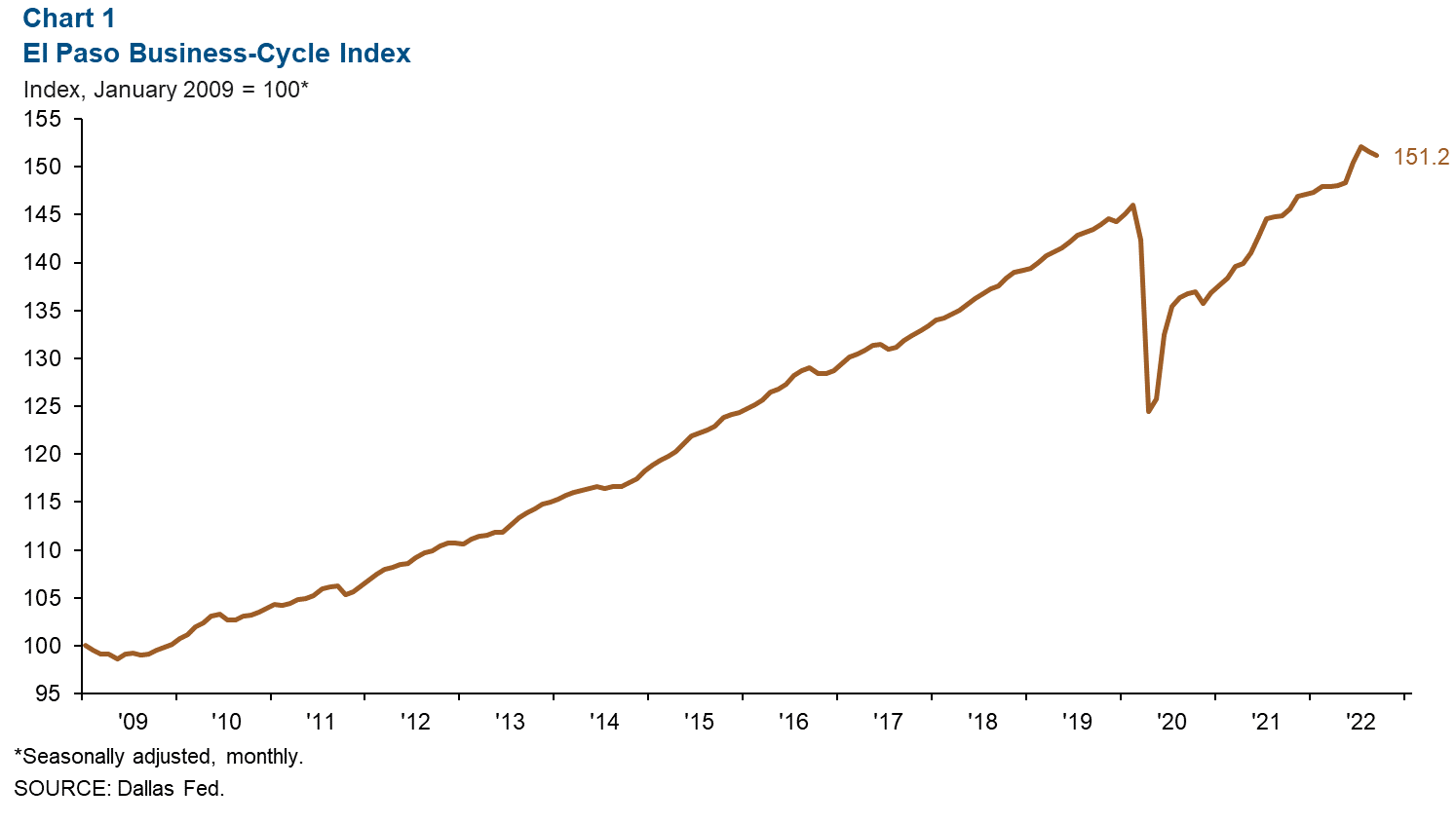

Business-cycle index

El Paso’s Business-Cycle Index fell an annualized 3.0 percent in September (Chart 1). This marks the second consecutive month of decline after almost two years of growth. The index is still up 3.6 percent year to date.

Labor market

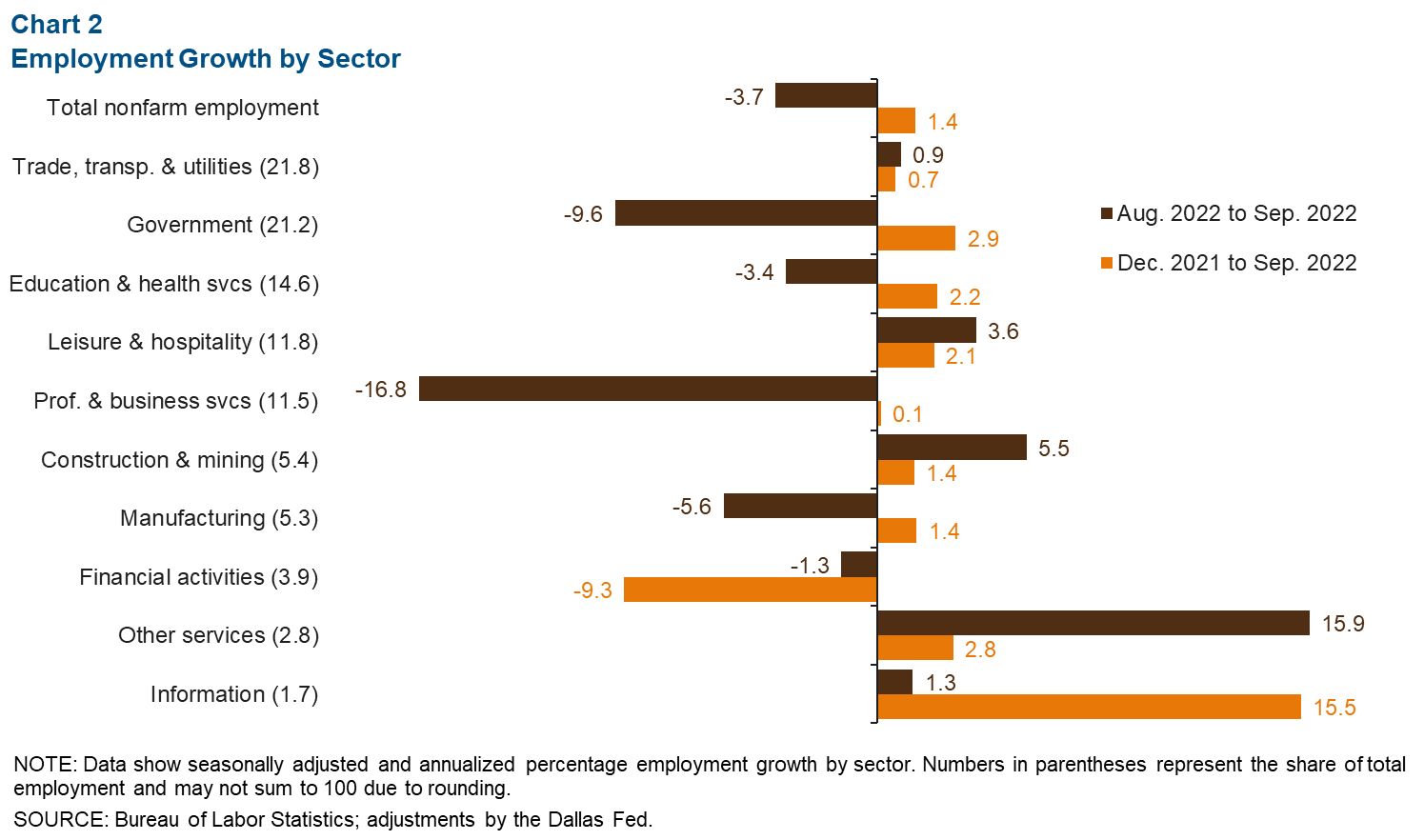

September payrolls shrink

El Paso’s nonfarm payroll employment shrank an annualized 3.7 percent (1,045 jobs) in September (Chart 2). Employment losses were concentrated in government (587) and professional and business services (583). The construction and mining sector and other services experienced strong growth, respectively gaining 79 and 111 jobs.

With 1.4 percent employment growth year to date, payrolls are expanding slower in El Paso than in Texas (4.8 percent) and the U.S. (3.4 percent). Financial activities is the only sector that has contracted in 2022, down 9.3 percent (961 jobs).

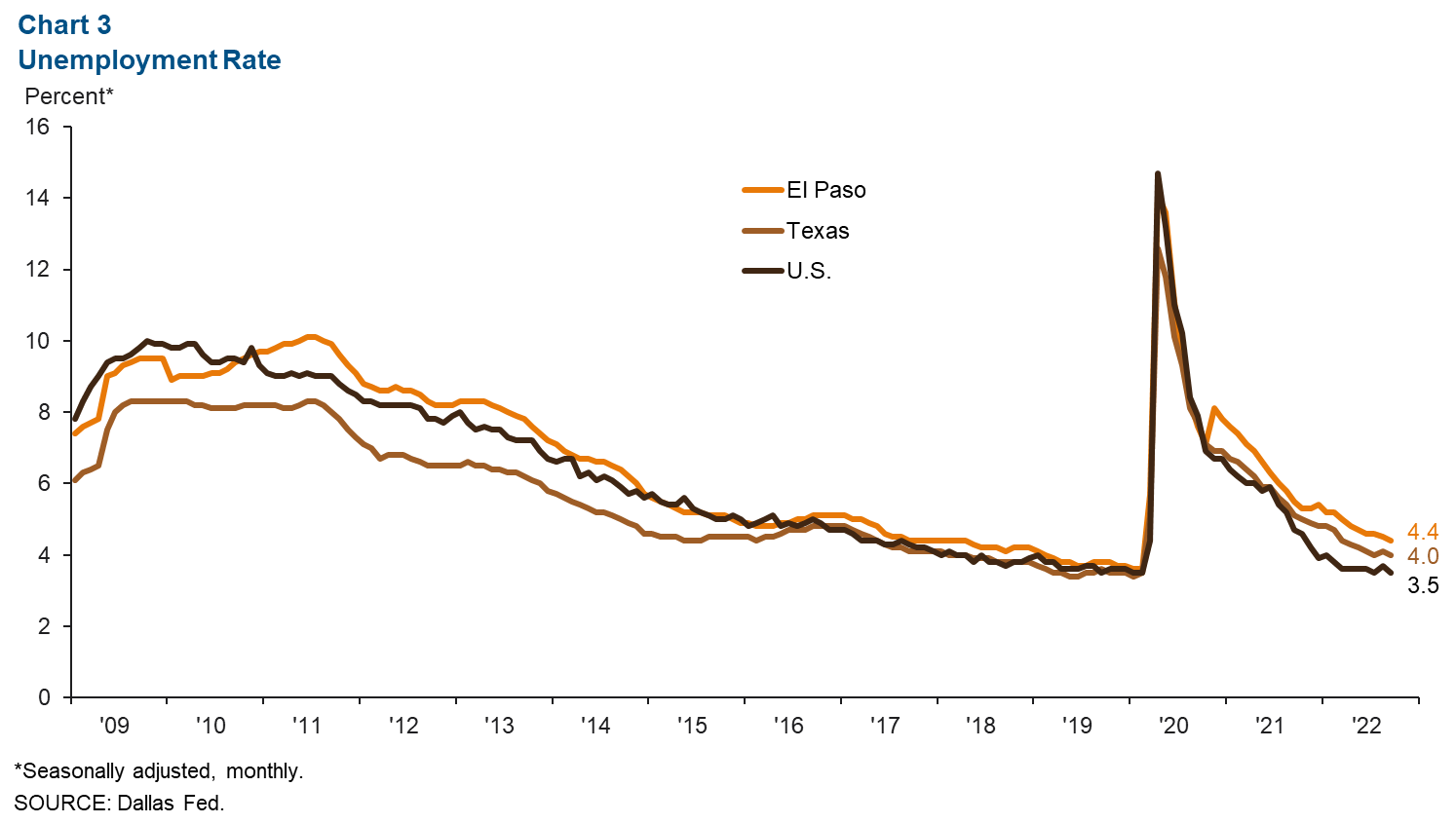

Unemployment rate falls

The unemployment rate declined in El Paso for yet another month, falling to 4.4 percent (Chart 3). The measure still exceeds prepandemic levels and is higher locally than in Texas (4.0) and the U.S. (3.5).

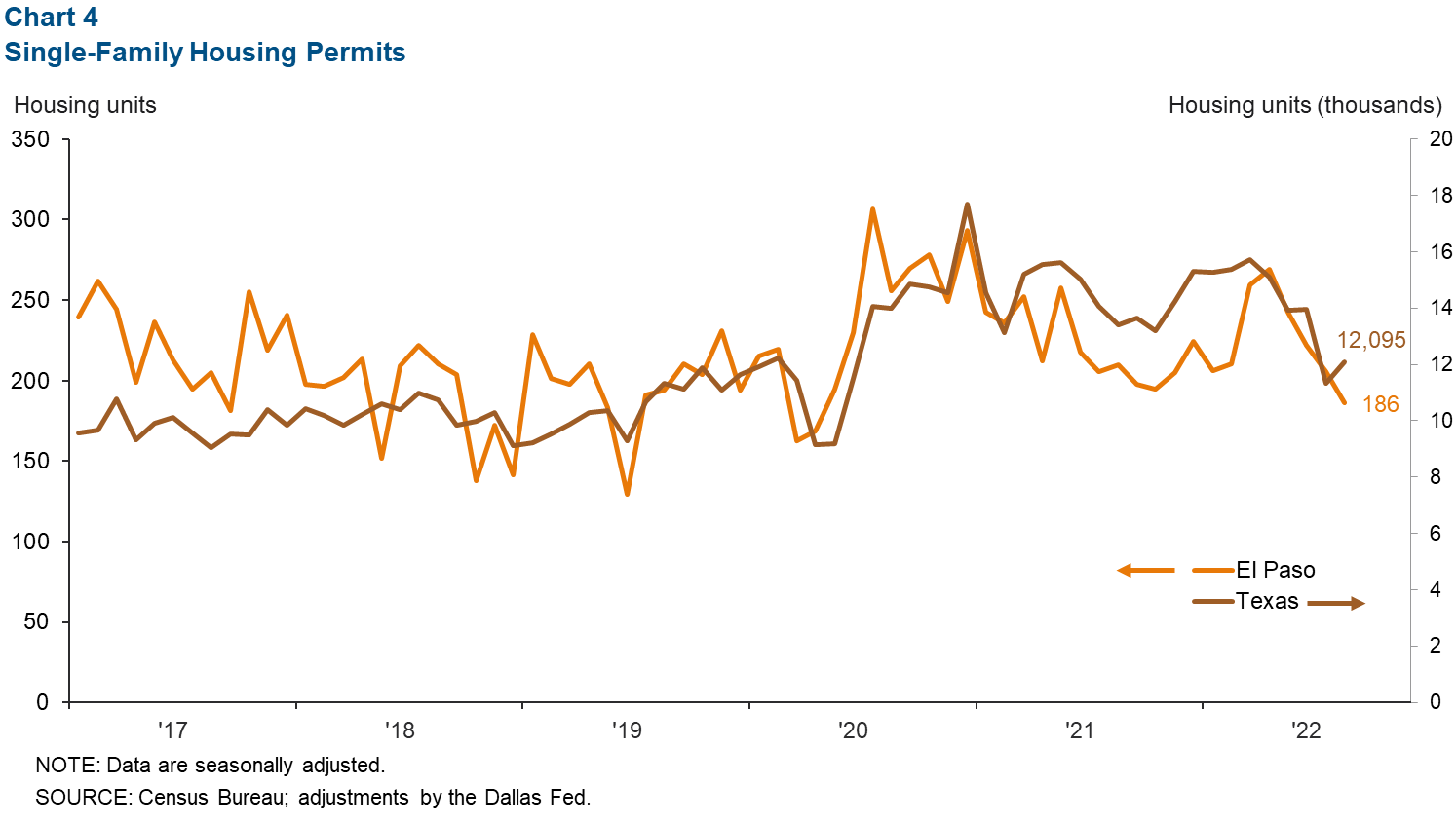

Housing construction

As inflation persists and mortgage rates rise, home construction is slowing in El Paso. New single-family housing permits totaled 186 units in August (seasonally adjusted), down 11.3 percent from one year ago (Chart 4). The monthly number of new permits has declined 24.5 percent so far this year in El Paso and 29.8 percent in Texas.

Industrial production and maquiladora-related activities

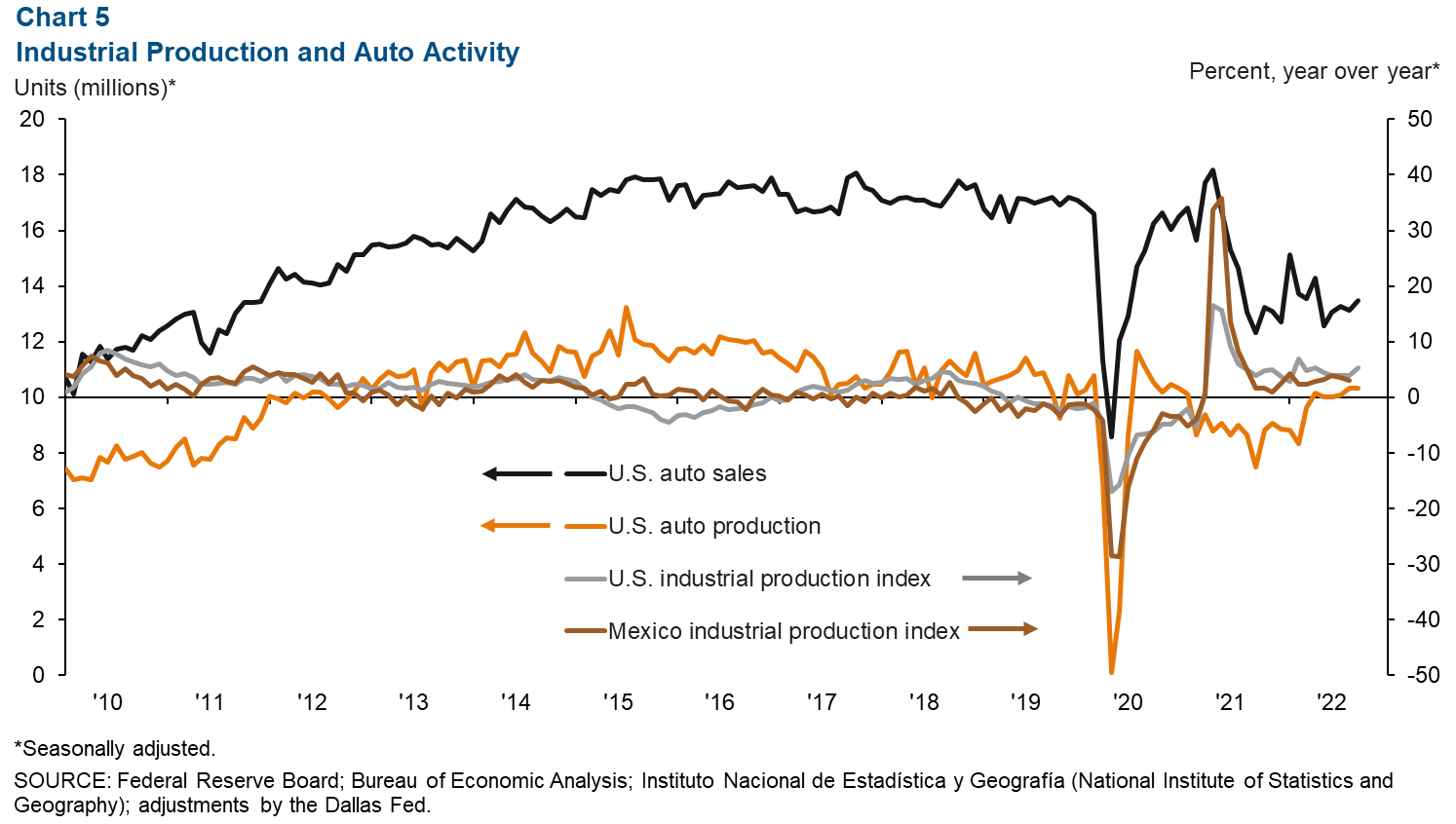

The U.S. industrial production (IP) index has risen 5.3 percent from last year and was up 0.4 percent from August to September (Chart 5). Mexico’s IP Index increased 3.0 percent from August 2021 to August 2022 and was unchanged from July to August. The Institute for Supply Management (ISM) manufacturing index dropped 1.9 percent in September but stayed just above 50. ISM figures above 50 signal growth.

U.S. auto production changed little from August to September―monthly production totaled 10.3 million units―while sales rose 2.9 percent (non-annualized) to 13.5 million units. Production has jumped 38.2 percent from September last year, and sales have risen 9.6 percent. Industrial and auto activity are closely linked to the El Paso-area economy because of cross-border manufacturing relationships. Roughly half of maquiladoras in Juárez are auto related.

NOTE: Data may not match previously published numbers due to revisions. The El Paso metropolitan statistical area includes El Paso and Hudspeth counties.

About El Paso Economic Indicators

Questions or suggestions can be addressed to Aparna Jayashankar at Aparna.Jayashankar@dal.frb.org. El Paso Economic Indicators is published every month after state and metro employment data are released.