San Antonio Economic Indicators

February 2, 2021

After contracting in November, the San Antonio Business-Cycle Index rose in December as unemployment and job numbers improved. Fourth-quarter job growth was broadly positive across sectors. Local consumer spending declined after spiking in mid-December, and home sales activity moved sideways in December. The number of individuals currently hospitalized with COVID-19 decreased after peaking in late January.

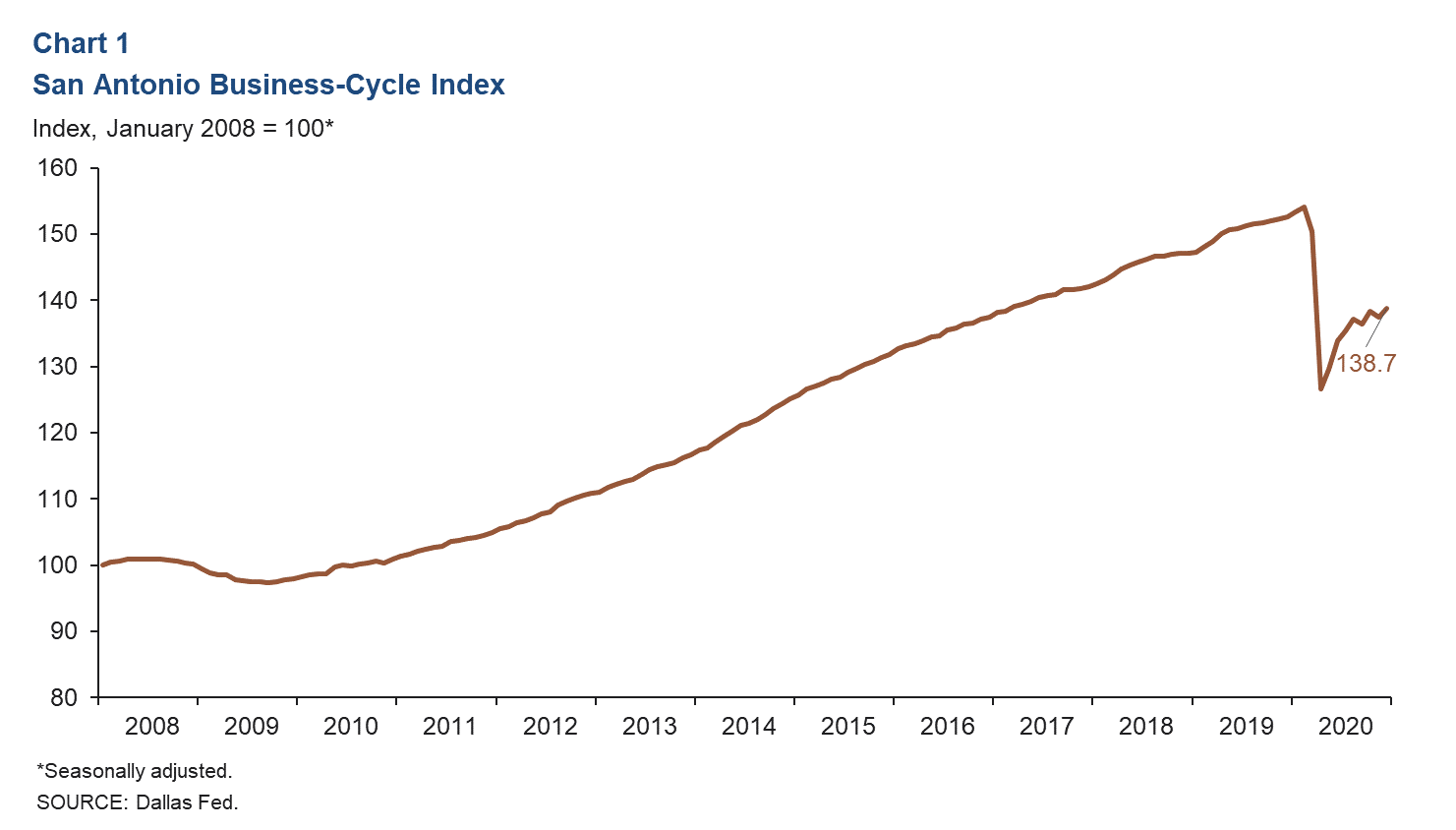

Business-Cycle Index

The San Antonio Business-Cycle Index—a broad measure of economic activity in the metro—rose 1.0 percent in December, a moderate improvement over the prior month (Chart 1). The expansion was mainly due to the recent payroll gains and drop in the unemployment rate.

Labor Market

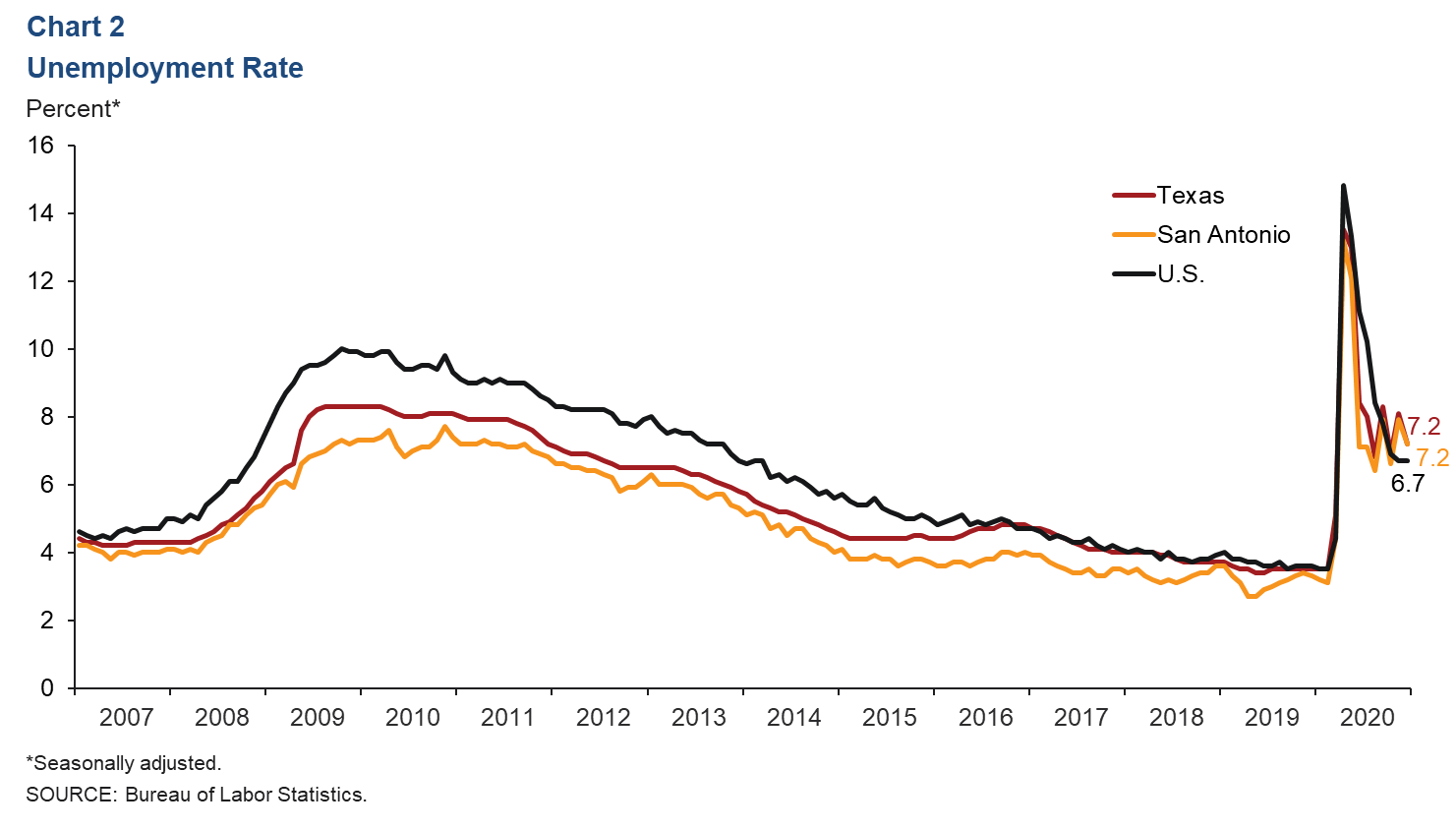

Unemployment Rate Ticks Down

The metro’s unemployment rate fell in December to 7.2 percent from a six-month high of 7.9 percent in November. The state unemployment rate also declined in December to 7.2 percent, while the national rate remained unchanged at 6.7 percent (Chart 2).

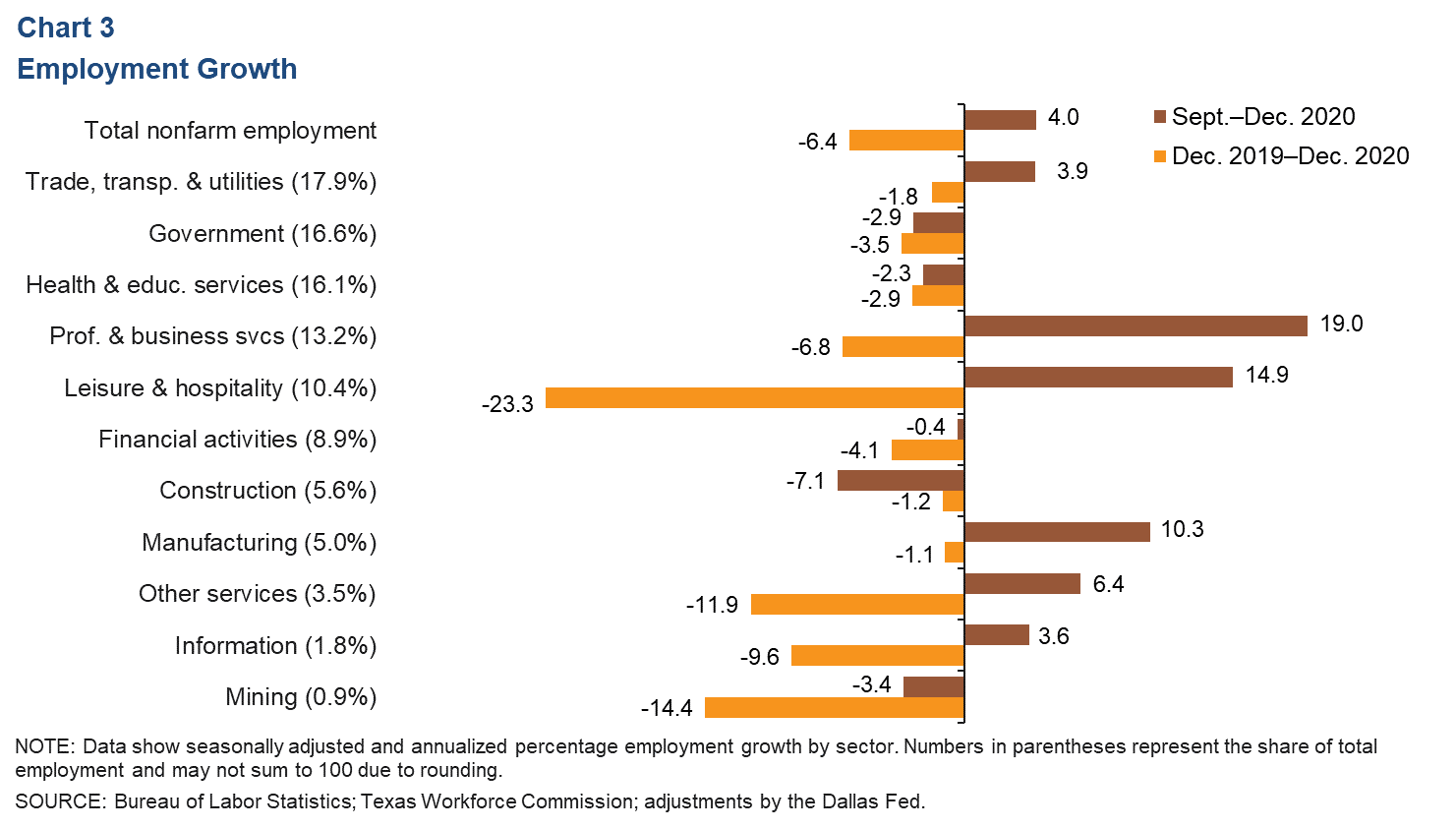

Job Growth Broad Based in Fourth Quarter

Net new payrolls in San Antonio increased an annualized 4.0 percent (9,820 jobs) in the fourth quarter (Chart 3). Sectors posting gains were professional and business services (19.0 percent, or 5,720 jobs), followed by leisure and hospitality (14.9 percent, or 3,615 jobs) and manufacturing (10.3 percent, or 1,240 jobs). Sectors posting declines were construction (-7.1 percent, or 1,060 jobs), mining (-3.4 percent, or 80 jobs), government (-2.9 percent, or 1,230 jobs), health and education services (-2.3 percent, or 970 jobs) and financial activities (-0.4 percent, or 90 jobs). While job gains have been broad based since May, they have not been large enough to offset the losses in March and April. In 2020, employment declined across all sectors and was down 6.4 percent, or by 69,670 jobs, overall.

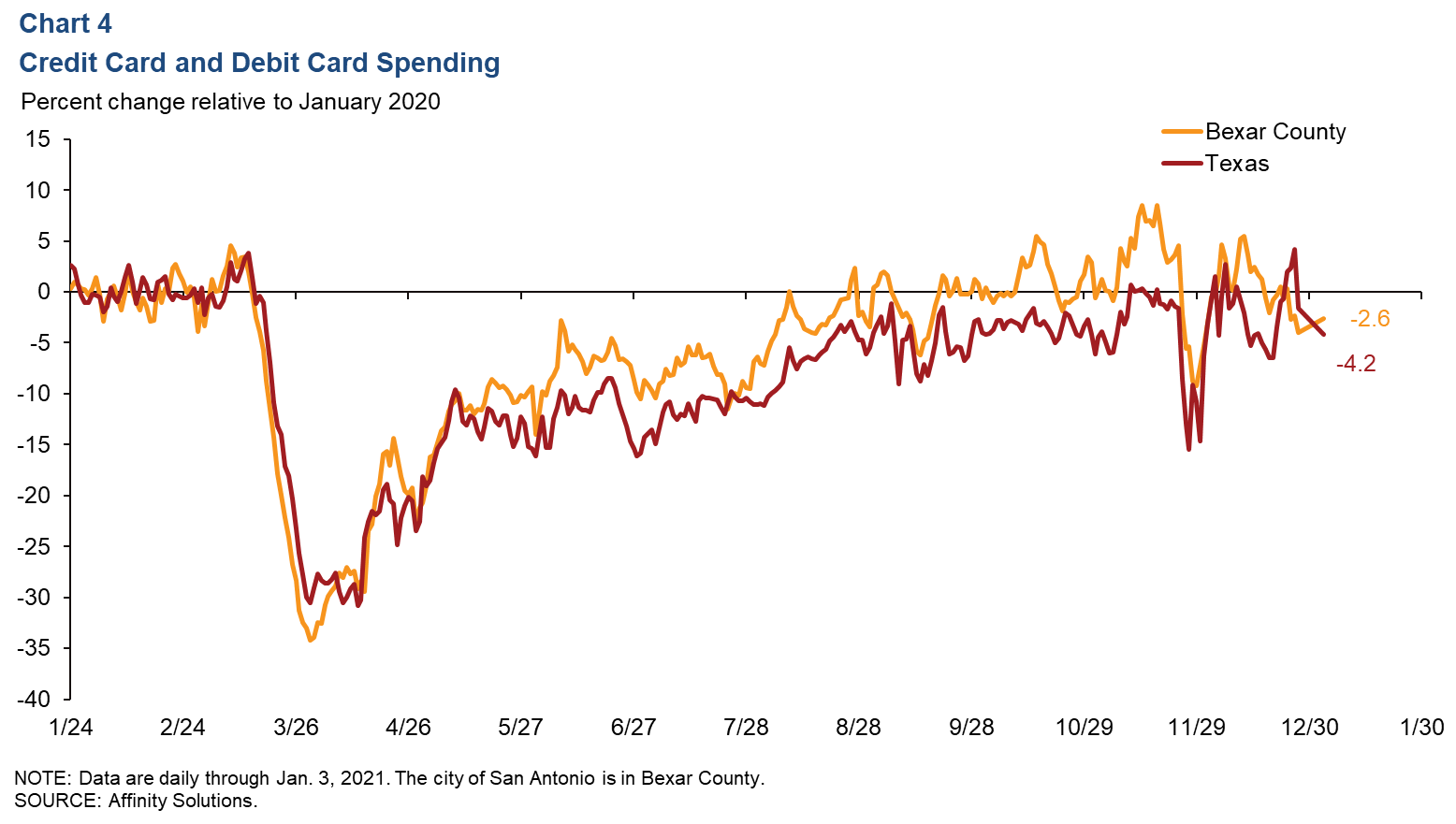

Consumer Spending

Since early April, credit and debit card spending by Bexar County residents has trended upward, surging temporarily above prepandemic levels in early September, mid-October and mid-November. Consumer spending plummeted in early December, recovered to prepandemic levels mid-month and then fell again. As of Jan. 3, spending was down 2.6 percent in Bexar County and 4.2 percent in the state relative to January 2020 (Chart 4).

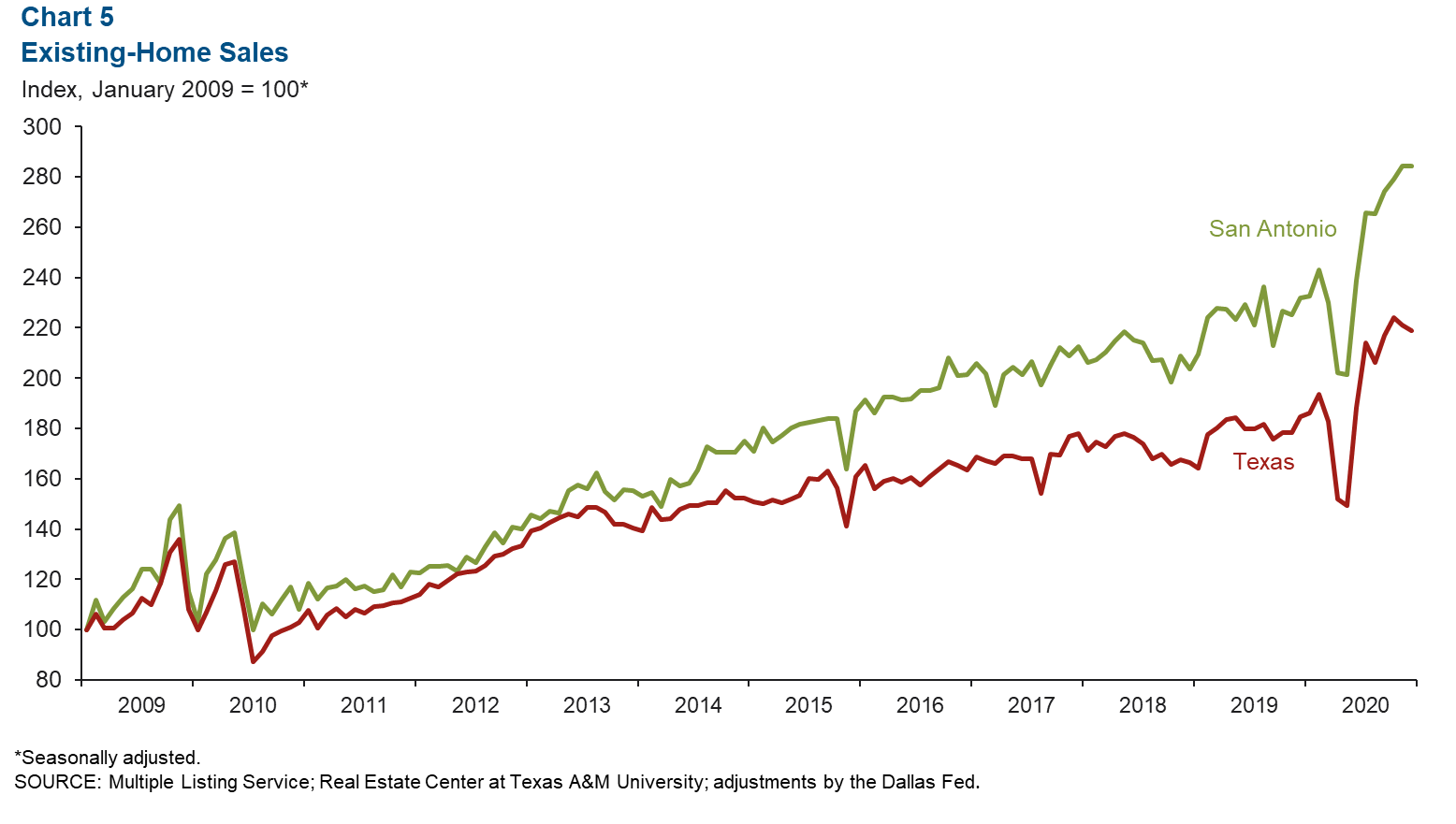

Real Estate

Existing-home sales in December remained unchanged in San Antonio but declined 1.0 percent in the state (Chart 5). In 2020, the metro’s home sales were up 11.3 percent from 2019—the largest year-over-year increase since 2014 and slightly above the state’s 9.6 percent growth. The median price of homes sold in December was $260,781 in the metro—a 15-year-record rise of 9.4 percent year over year—and $268,375 in Texas, a 7.5 percent gain.

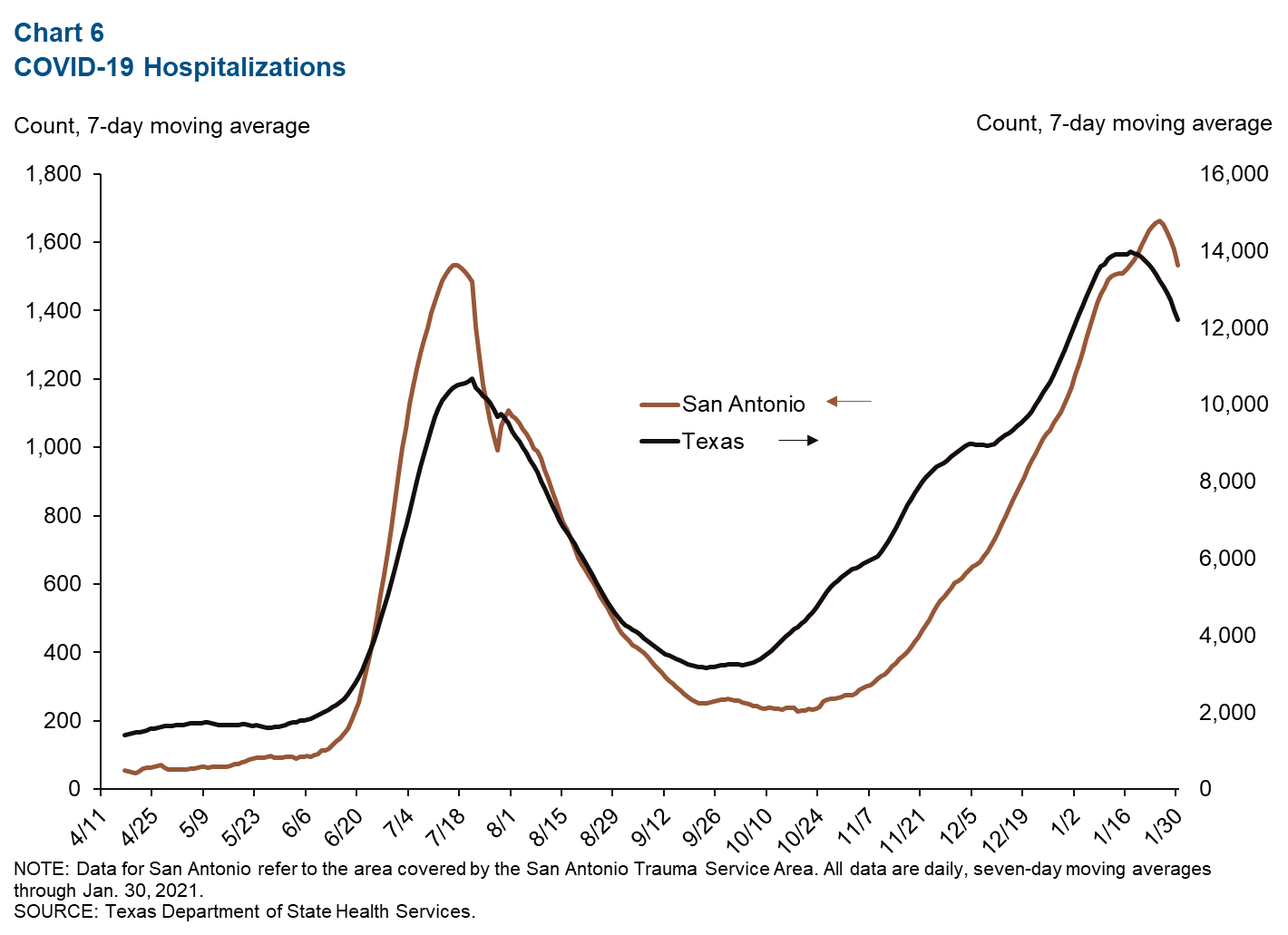

COVID-19 Hospitalizations

The number of individuals currently hospitalized with COVID-19 in San Antonio has been on the decline since peaking Jan. 25 at 1,661 (Chart 6). At the state level, the number currently hospitalized peaked Jan. 17 at 13,977. As of Jan. 30, the numbers were 1,533 in San Antonio and 12,212 in Texas.

NOTE: Data may not match previously published numbers due to revisions.

About San Antonio Economic Indicators

Questions can be addressed to Judy Teng at judy.teng@dal.frb.org. San Antonio Economic Indicators is published every month on the Thursday after state and metro employment data are released.