San Antonio Economic Indicators

August 27, 2021

Growth in the San Antonio Business-Cycle Index decelerated in July as payrolls declined. The unemployment rate fell. Consumer spending moved sideways but remained above pre-COVID-19 levels. Home-sales activity recovered slightly in July, and COVID-19 hospitalizations continued to surge in recent weeks.

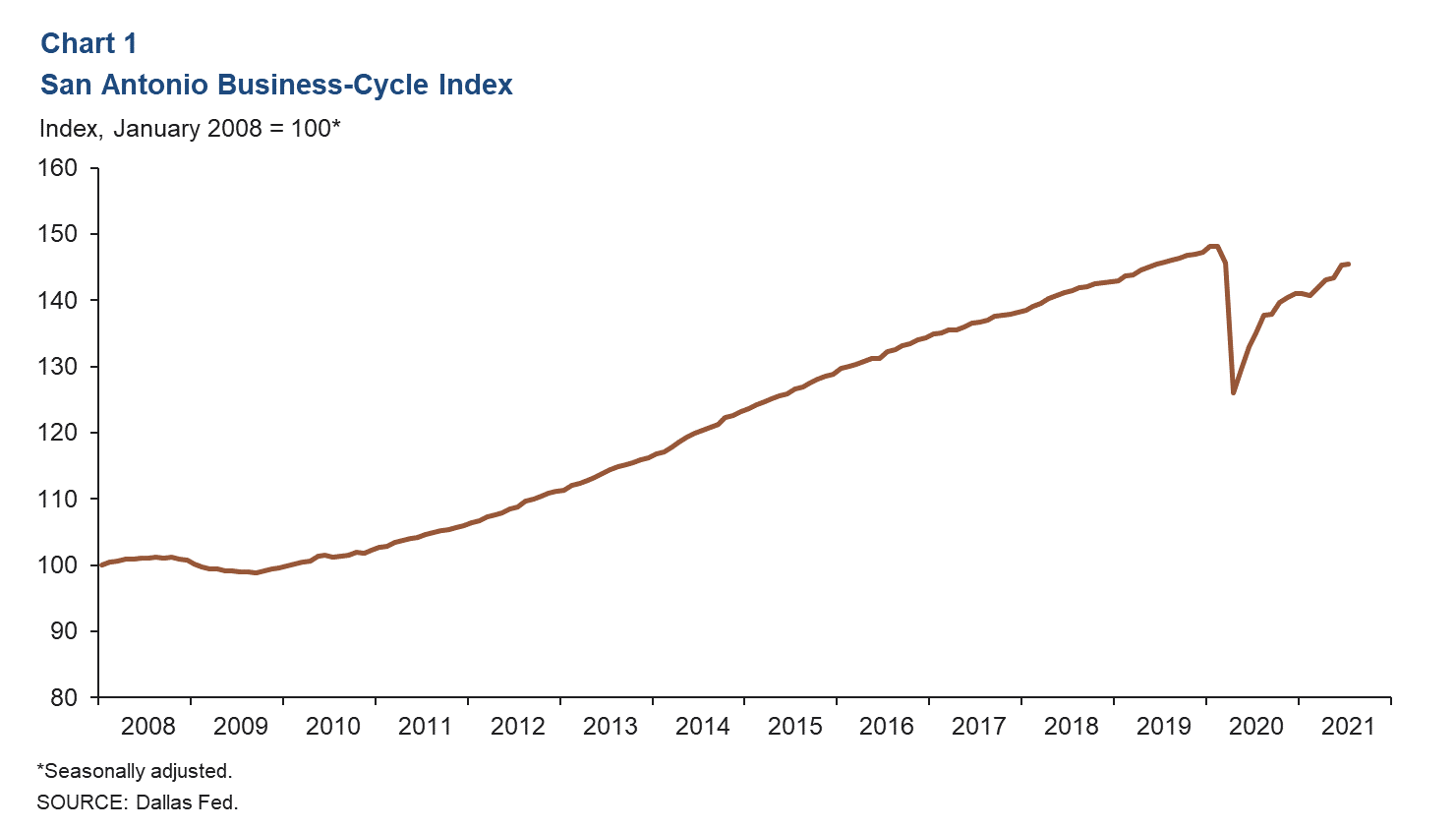

Business-Cycle Index

Growth in the San Antonio Business-Cycle Index—a broad measure of economic activity in the metro—decelerated to an annualized 1.5 percent in July after a robust expansion of 16.5 percent in June (Chart 1). Recent weakness in the index can be attributed to a net job decline in the metro area last month.

Labor Market

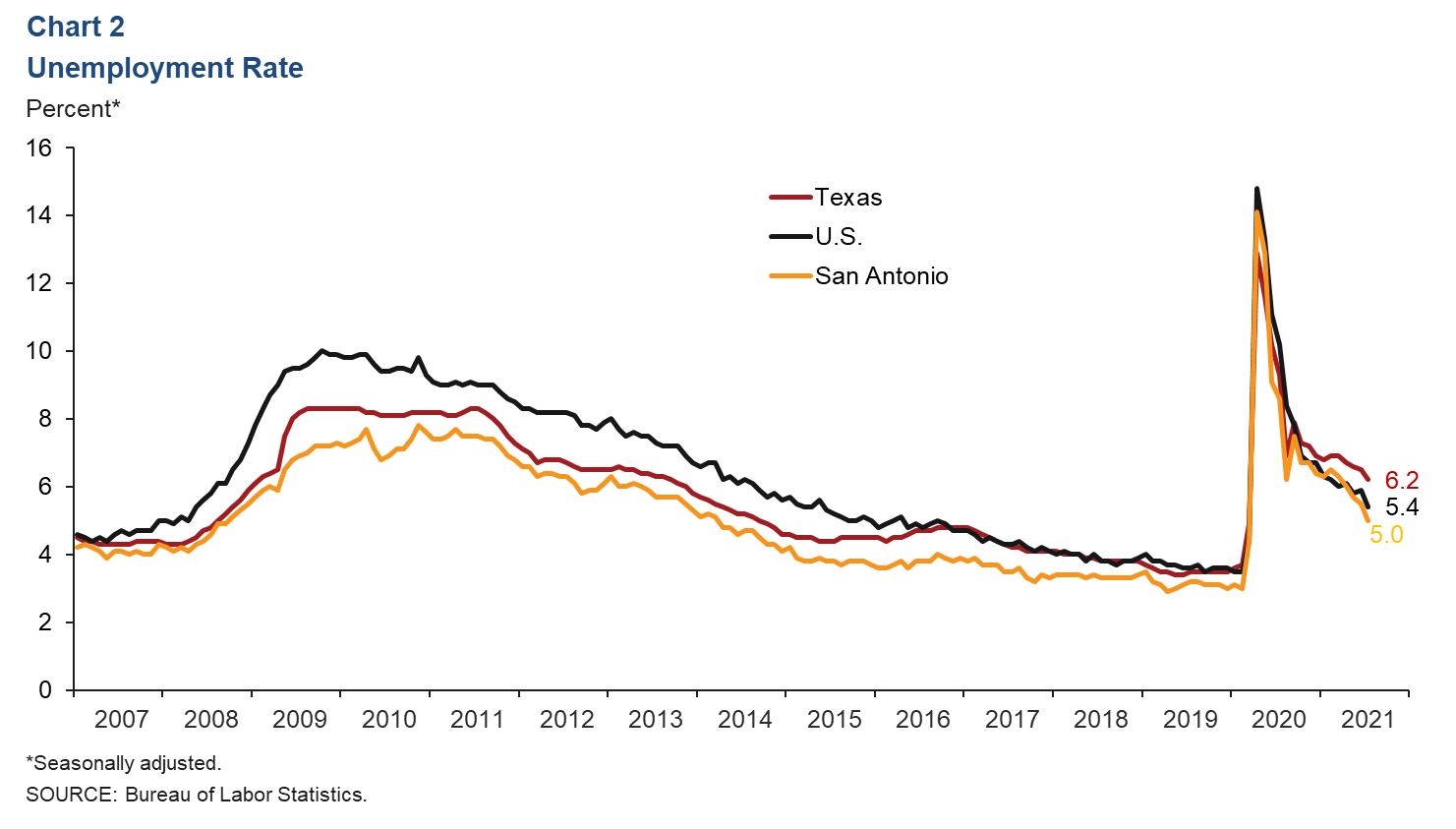

Unemployment Rate Ticks Down

The metro’s unemployment rate declined further in July to 5.0 percent, the lowest since March 2020. The state’s jobless rate fell slightly to 6.2 percent, and the nation’s rate fell to 5.4 percent (Chart 2).

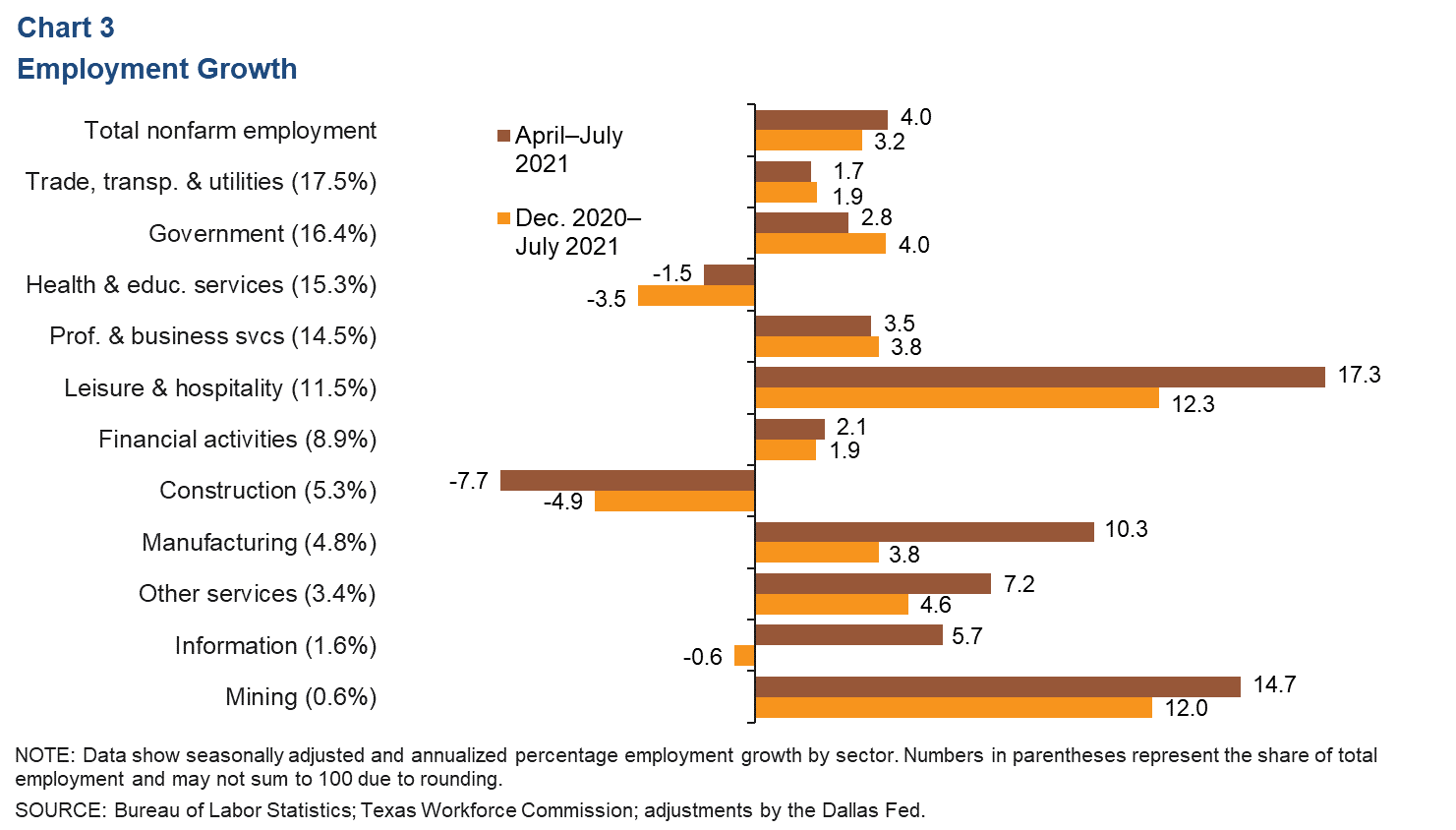

Recent Job Gains Broad Based

Net payrolls in San Antonio grew an annualized 4.0 percent (10,430 jobs) in the three months ending in July, with gains across most sectors (Chart 3). Leisure and hospitality led the growth (17.3 percent, or 4,855 jobs) and was followed by mining (14.7 percent, or 225 jobs), manufacturing (10.3 percent, or 1,250 jobs) and other services (7.2 percent, or 620 jobs). Industries that posted net declines were construction (-7.7 percent, or 620 jobs) and health and education services (-1.5 percent, or 620 jobs). In March and April 2020 combined, 136,764 jobs were lost as the pandemic hit. As of July 2021, 80 percent of those jobs had been recovered.

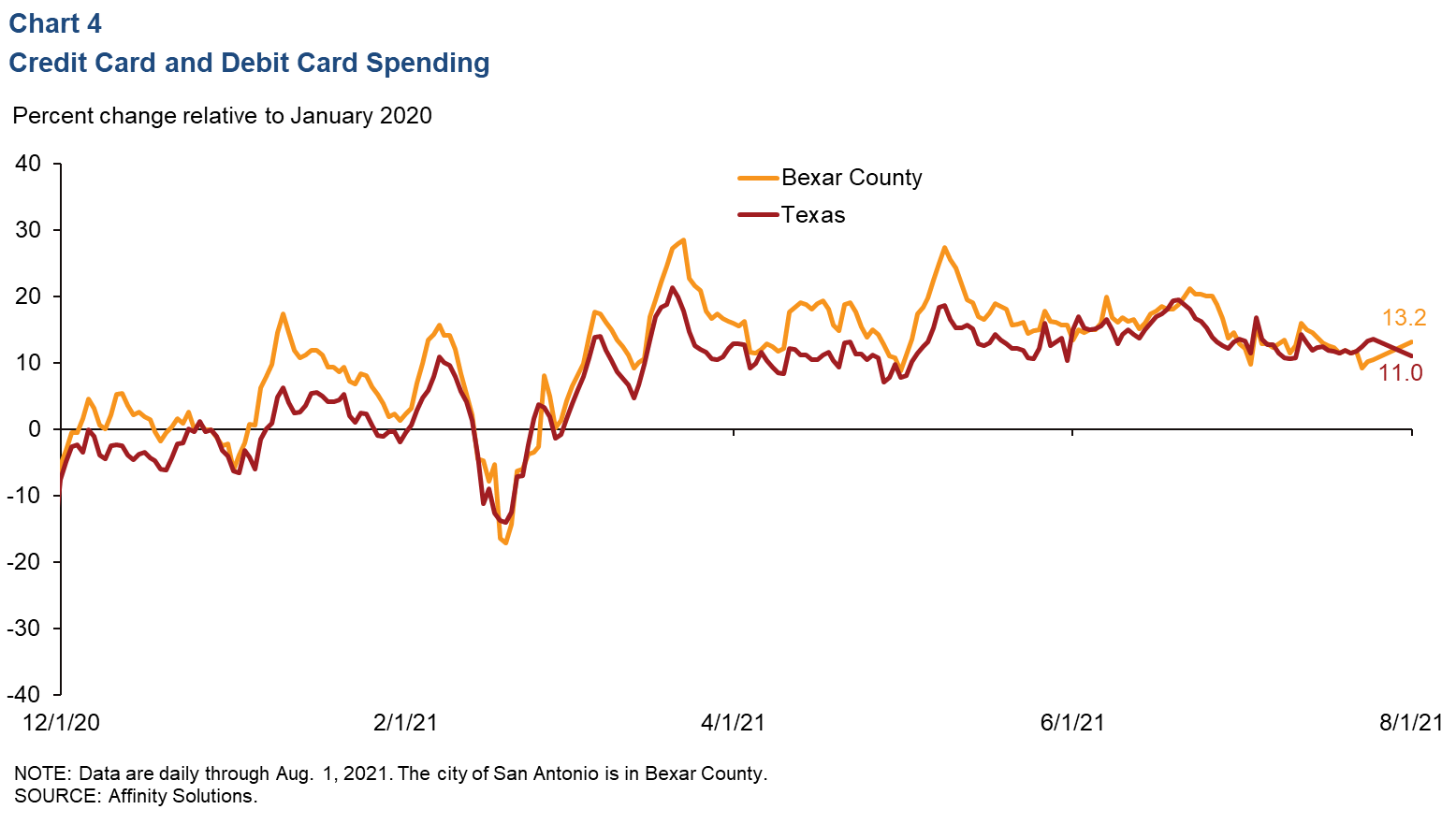

Consumer Spending

Since early February 2021, consumer spending has remained generally above January 2020 levels, except for the brief dip to below prepandemic levels during the week of Winter Storm Uri in mid-February. Spending in recent weeks has moved sideways; as of Aug. 1, it was 13.2 percent higher in Bexar County and 11.0 percent higher in Texas relative to January 2020 (Chart 4).

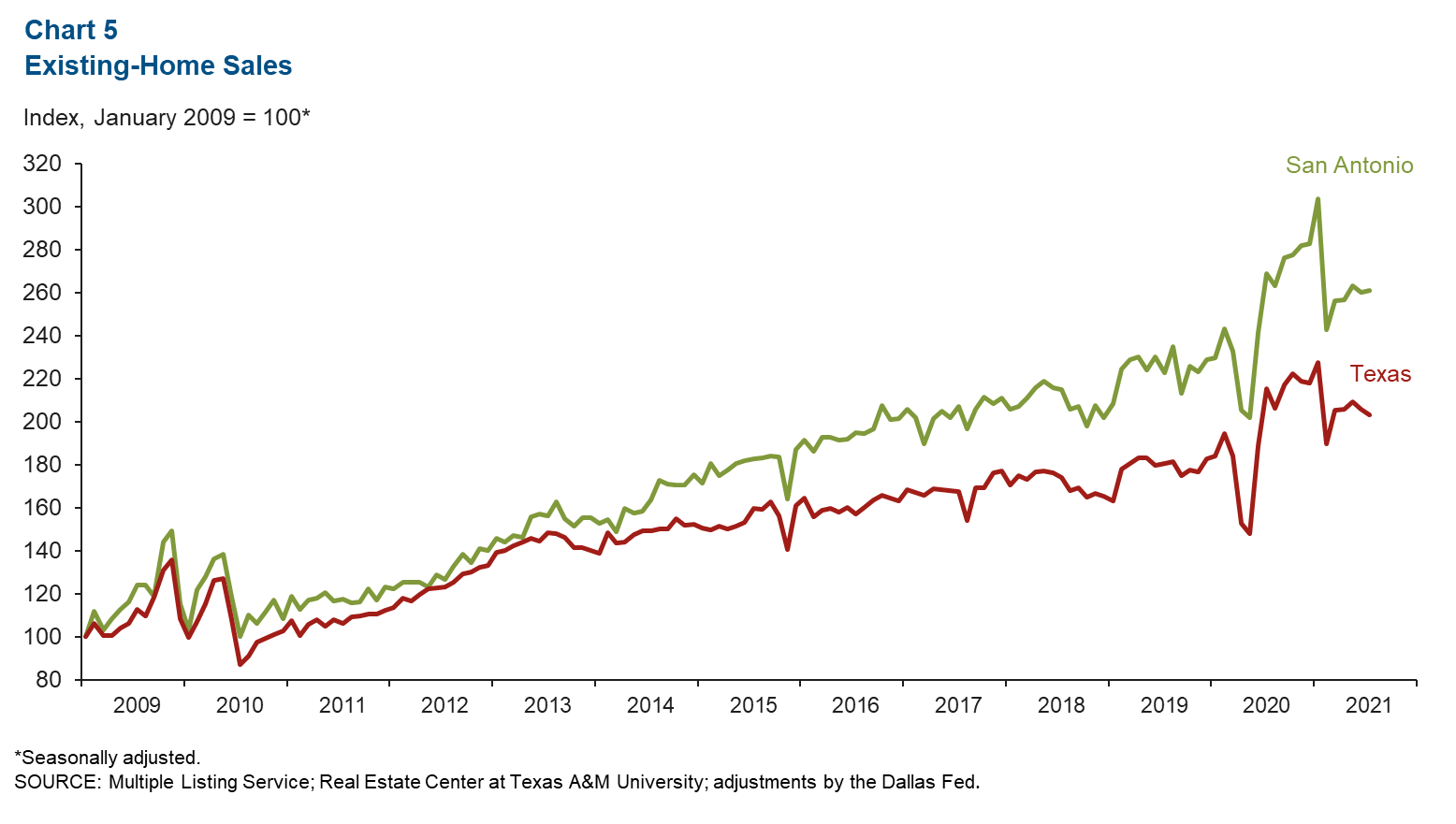

Real Estate

Metro existing-home sales increased a mere 0.3 percent in July after contracting 1.2 percent in June (Chart 5). Statewide, sales fell 1.3 percent in July. In the first seven months of the year, the metro’s home sales were up 13.5 percent compared with the same period in 2020—slightly below the state’s 14.0 percent increase. The median price of homes sold in San Antonio in July was $284,398—a 8.8 percent increase year over year. In the state, the median home price in July was $301,580, a 10.0 percent jump.

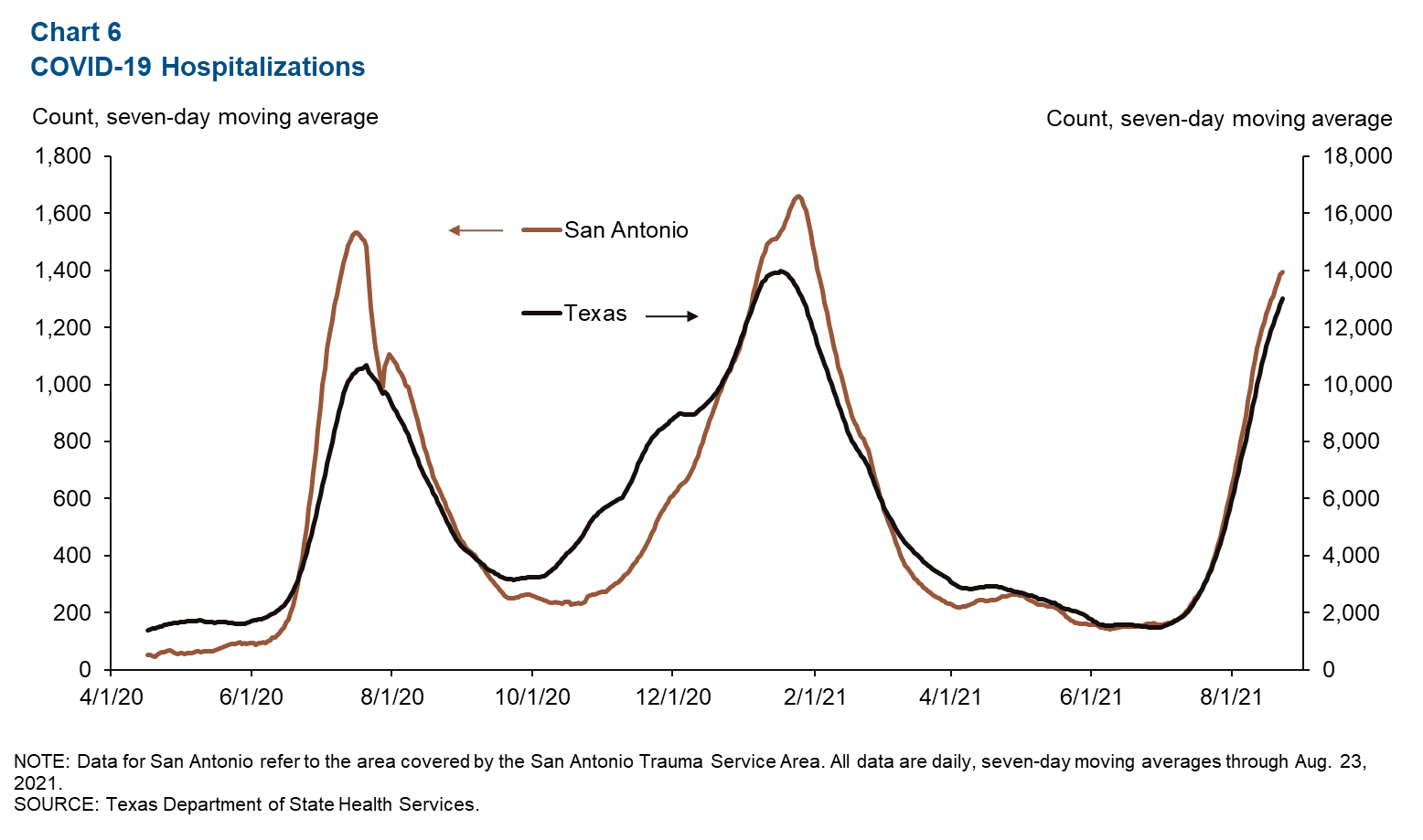

COVID-19 Statistics

The number of people currently hospitalized with COVID-19 in San Antonio has been climbing since early July (Chart 6). As of Aug. 23, 13,002 people were hospitalized in Texas with COVID-19, the highest since late January 2021. In San Antonio, 1,395 were hospitalized, the highest since early February. The recent sharp rise in hospitalizations is likely due to the spread of the more-contagious COVID-19 Delta variant.

NOTE: Data may not match previously published numbers due to revisions.

About San Antonio Economic Indicators

Questions can be addressed to Judy Teng at judy.teng@dal.frb.org. San Antonio Economic Indicators is published every month during the week after state and metro employment data are released.