Southern New Mexico Economic Indicators

First Quarter 2022

The Las Cruces economy expanded in February. Payroll employment reached its prepandemic level, unemployment fell, and the metro’s housing market remained robust. Monthly trade volumes were below prepandemic levels. New Mexico’s rig count rose, though oil production dipped slightly. Commodity prices soared.

Labor market

Las Cruces payroll gains solid

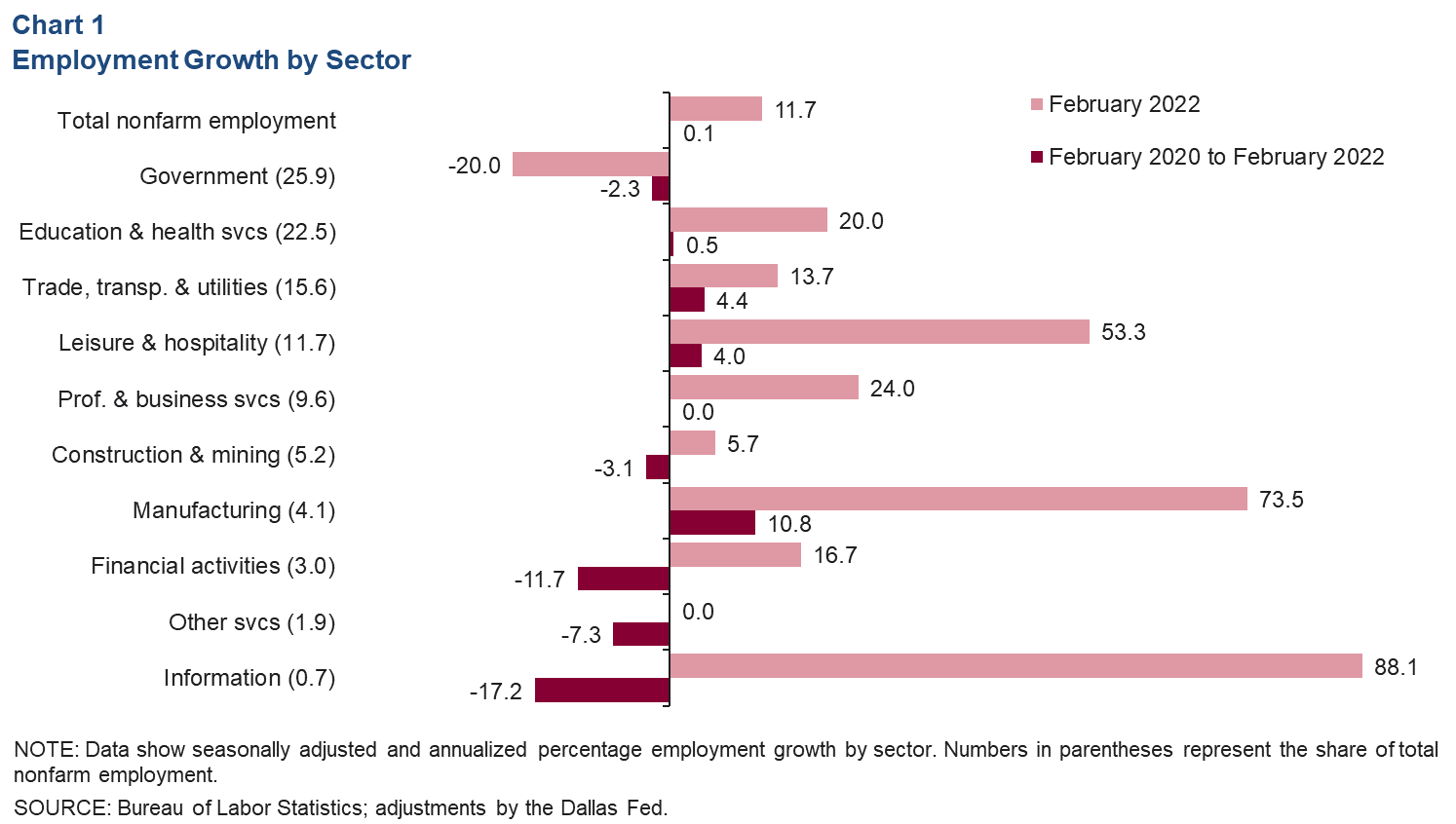

Las Cruces employment expanded an annualized 11.7 percent, or by 685 jobs, in February (Chart 1). Employment gains were widespread but were particularly notable in leisure and hospitality (306 jobs), education and health services (253), manufacturing (137), professional and business services (127), and trade, transportation and utilities (124). Employment increases were more modest in information, financial activities and construction and mining. Payrolls were unchanged in the other services sector and contracted in government, which was down 362 jobs.

The February "Major Employment Developments" report by the New Mexico Department of Workforce Solutions’ Economic Research & Analysis Bureau estimates that approximately 1,230 jobs will be created in the southern New Mexico region in coming years. These jobs will be in the aviation, film and television production, solar generation, manufacturing and warehousing industries and will primarily be located in Chaves and Doña Ana counties.

Two years since the onset of the pandemic, Las Cruces payrolls are completely recovered and are up by 90 jobs as of February. Sectors that experienced net job gains include trade, transportation and utilities (490 jobs), leisure and hospitality (335), manufacturing (298), and education and health services (80). Professional and business services positions were in line with February 2020 levels, while employment was down in government (-459 jobs), financial activities (-294), construction and mining (-121), other services (-109) and information (-105).

Unemployment rate changes mixed

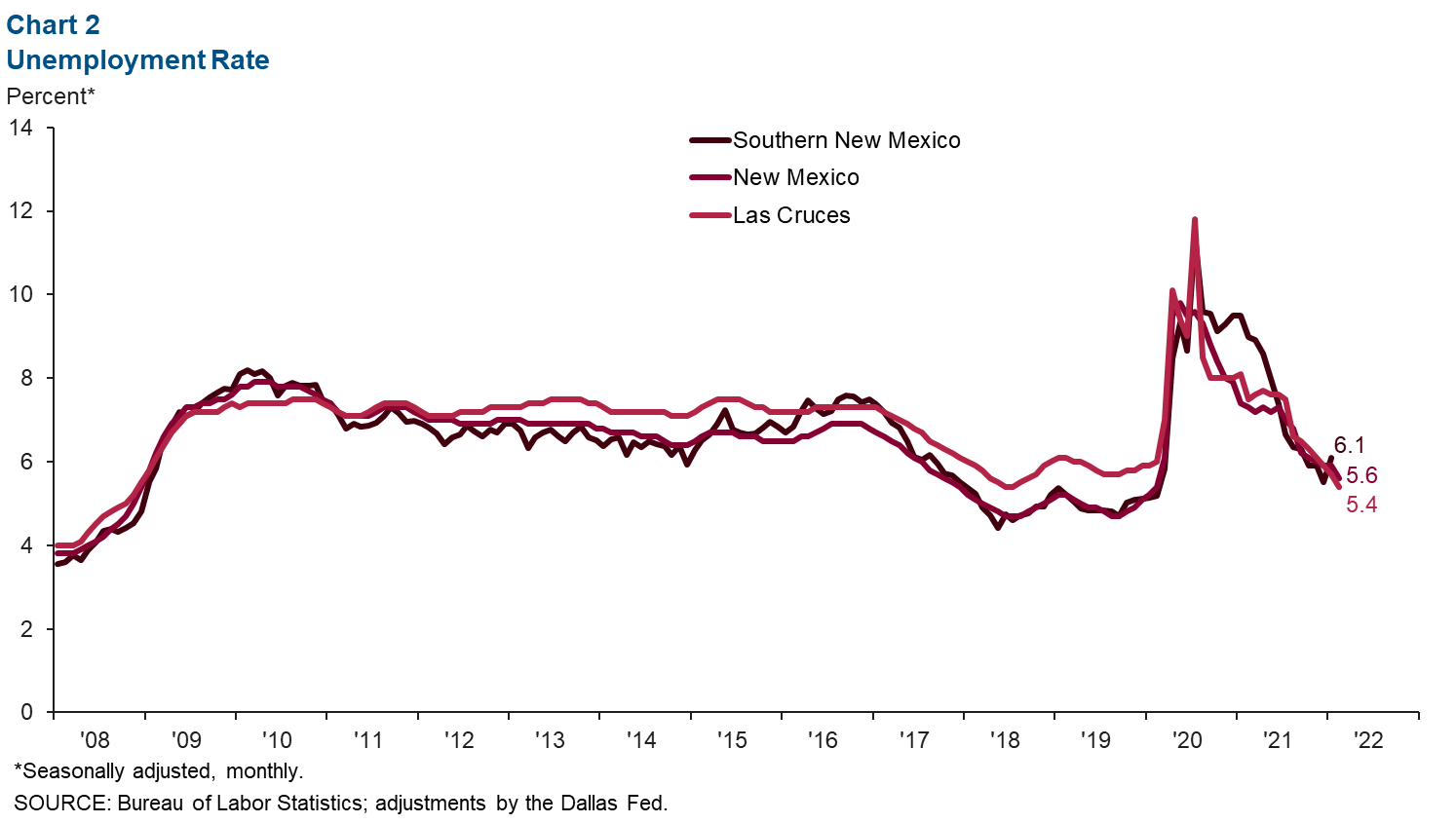

Las Cruces’ unemployment rate fell from 5.7 percent in January to 5.4 percent in February (Chart 2). New Mexico’s jobless rate fell from 5.9 percent in January to 5.6 percent in February. However, southern New Mexico’s unemployment rate was 6.1 percent in January, up from 5.5 percent the prior month. Luna County’s unemployment rate remained the highest in southern New Mexico at 12.8 percent, while De Baca County’s rate was the lowest in the region at 3.9 percent.

Housing market

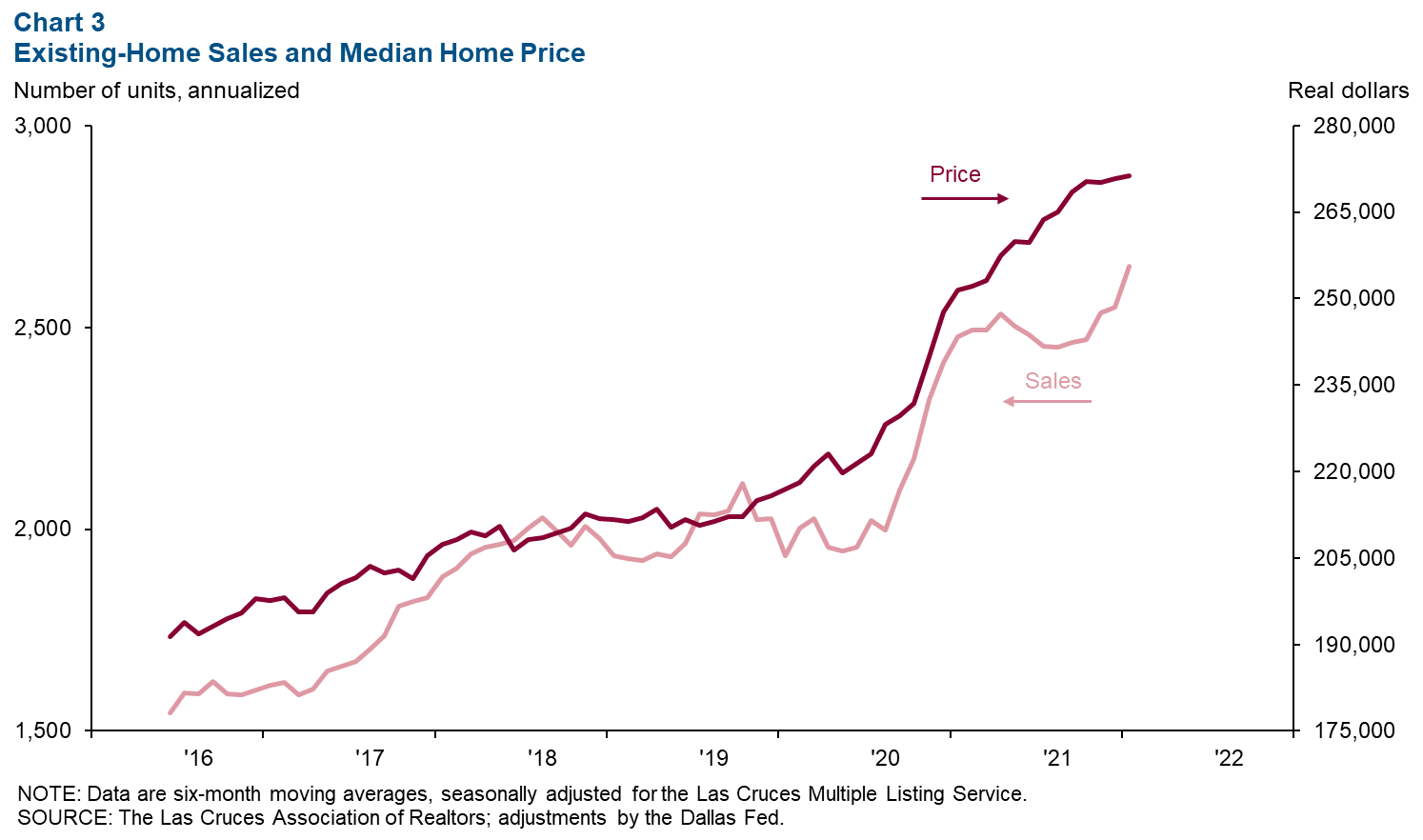

Las Cruces home sales totaled an annualized 2,651 in January, up 4.0 percent from December and 7.0 percent from a year ago (Chart 3). The inflation-adjusted median home price in Las Cruces (based on a six-month moving average) was $271,272 in January, 2.2 percent higher than the prior month and up 7.9 percent from January 2021.

Trade

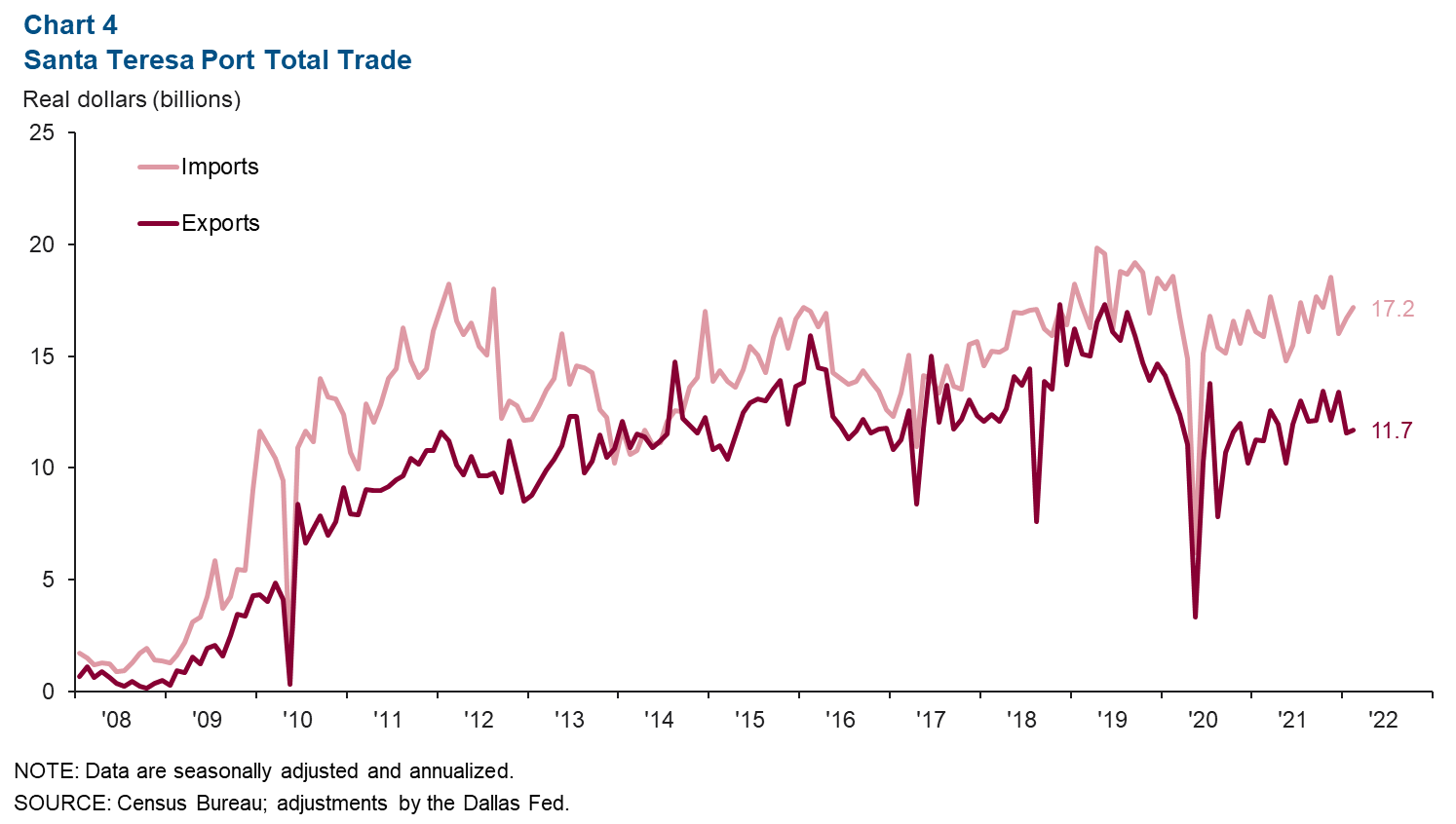

In February, annualized total trade primarily through the Santa Teresa port in southern New Mexico totaled $28.9 billion, 2.1 percent below January but up 6.7 percent from February 2021 when monthly trade was $27.1 billion (Chart 4). The monthly drop was driven by a decrease of 2.6 percent in imports and 1.4 percent in exports. Imports were $17.2 billion, and exports totaled $11.7 billion in February.

Commodity markets

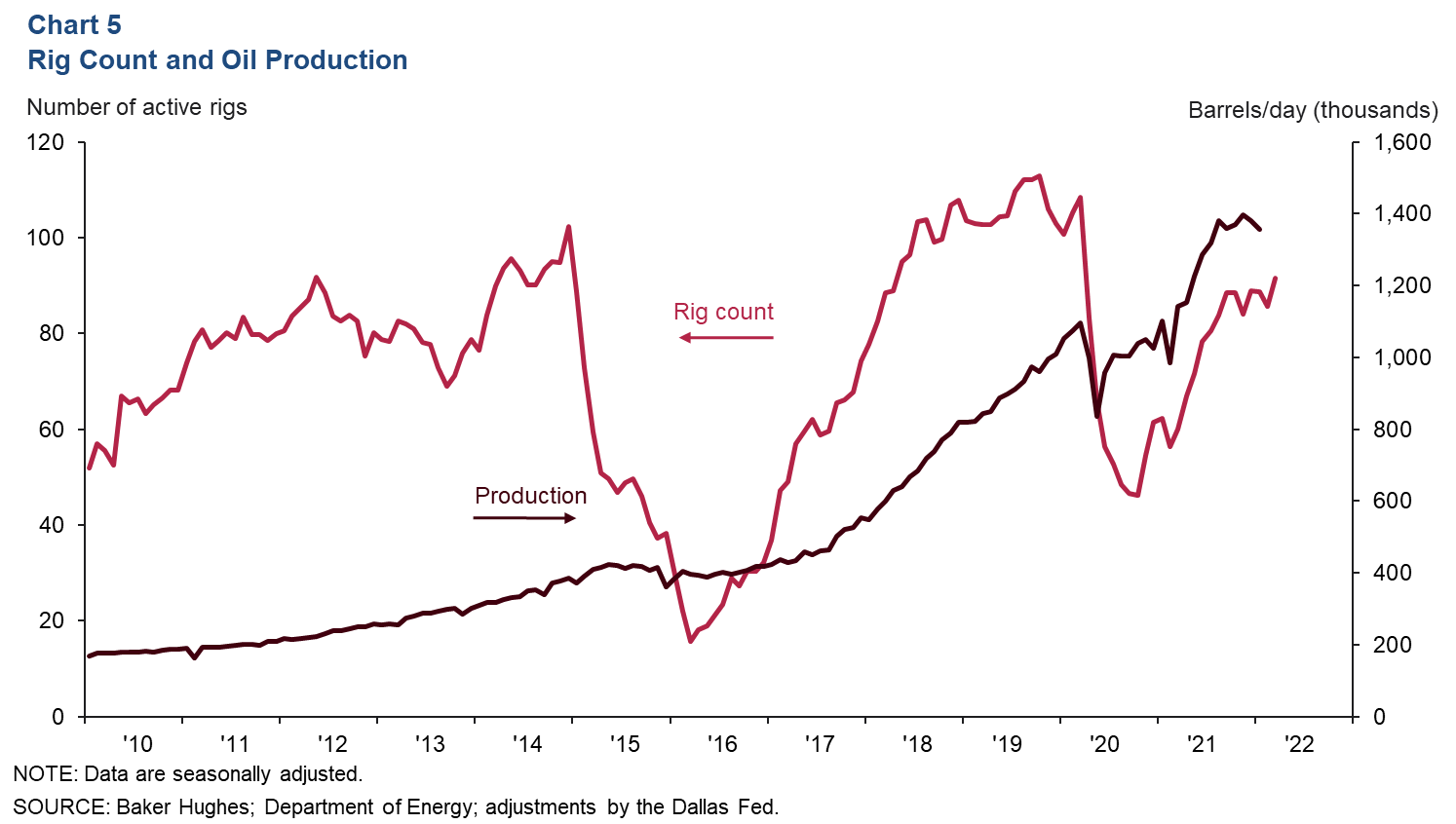

Rig count ticks up, production falls

The New Mexico rig count rose from 86 in February to 91 in March (Chart 5). Meanwhile, oil production in January fell 1.8 percent from the previous month to 1.36 million barrels per day but was up 23 percent from a year prior.

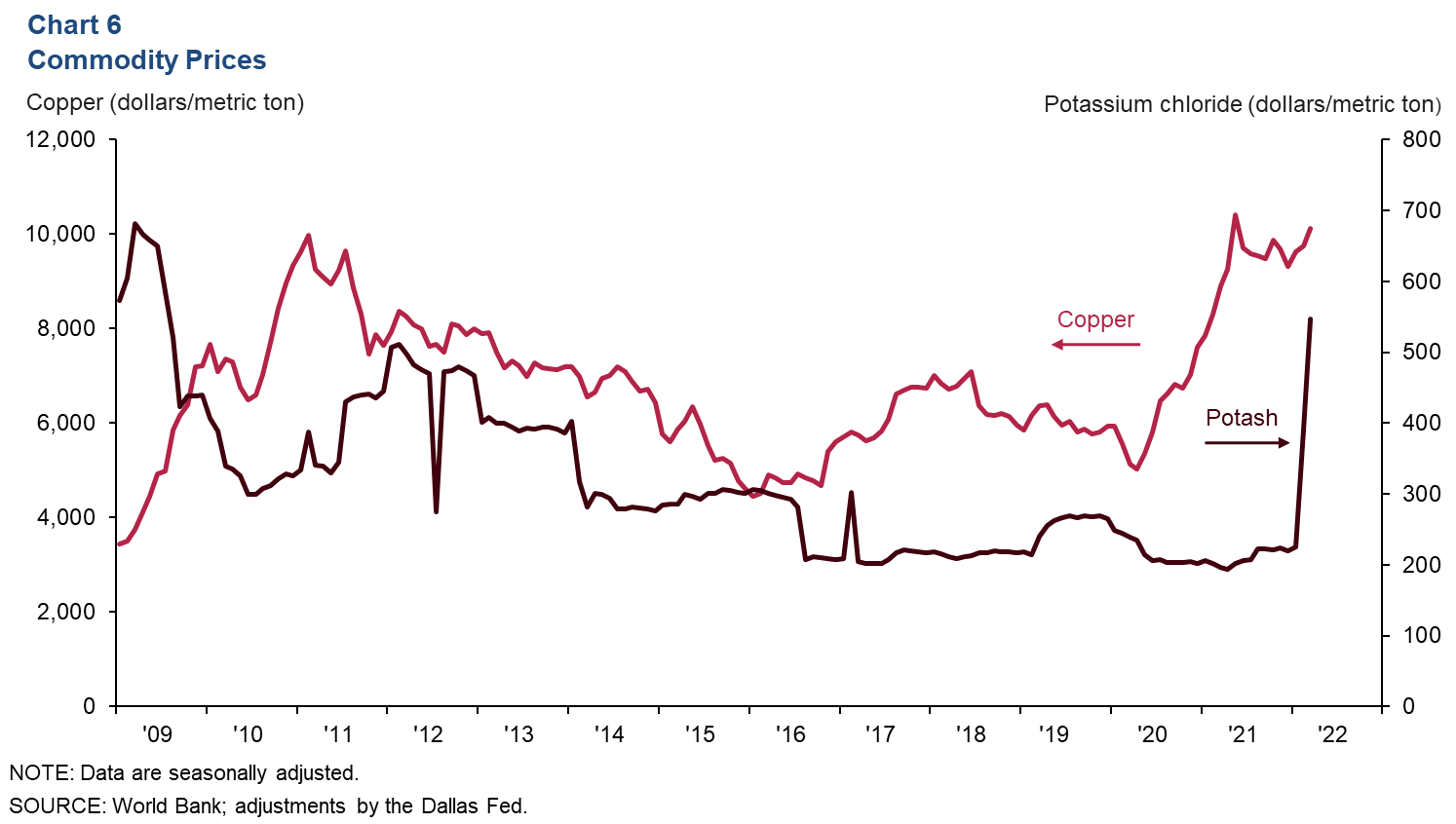

Potash prices soar, copper prices edge up

In addition to oil and natural gas, southern New Mexico's economy is dependent on other commodities, such as potash, copper and silver. Potash prices increased dramatically following the Russian invasion of Ukraine, the subsequent sanctions and rising food prices, reaching an average of $546.62 per metric ton in March 2022. Potash prices increased 40 percent from February and nearly tripled from March 2021 (Chart 6). Copper prices also rose from $9,754 per metric ton in February to $10,123 in March and were up 13.8 percent year over year.

NOTES: Data may not match previously published numbers due to revisions. All New Mexico counties within the Federal Reserve’s Eleventh District are counted as part of southern New Mexico. Las Cruces is excluded from southern New Mexico to better gauge unemployment levels outside the region’s largest population center.

About Southern New Mexico Economic Indicators

Questions can be addressed to Keighton Hines at Keighton.Hines@dal.frb.org. Southern New Mexico Economic Indicators is released quarterly.