U.S. Economy

Real-Time Population Survey (RPS)

June 19, 2020

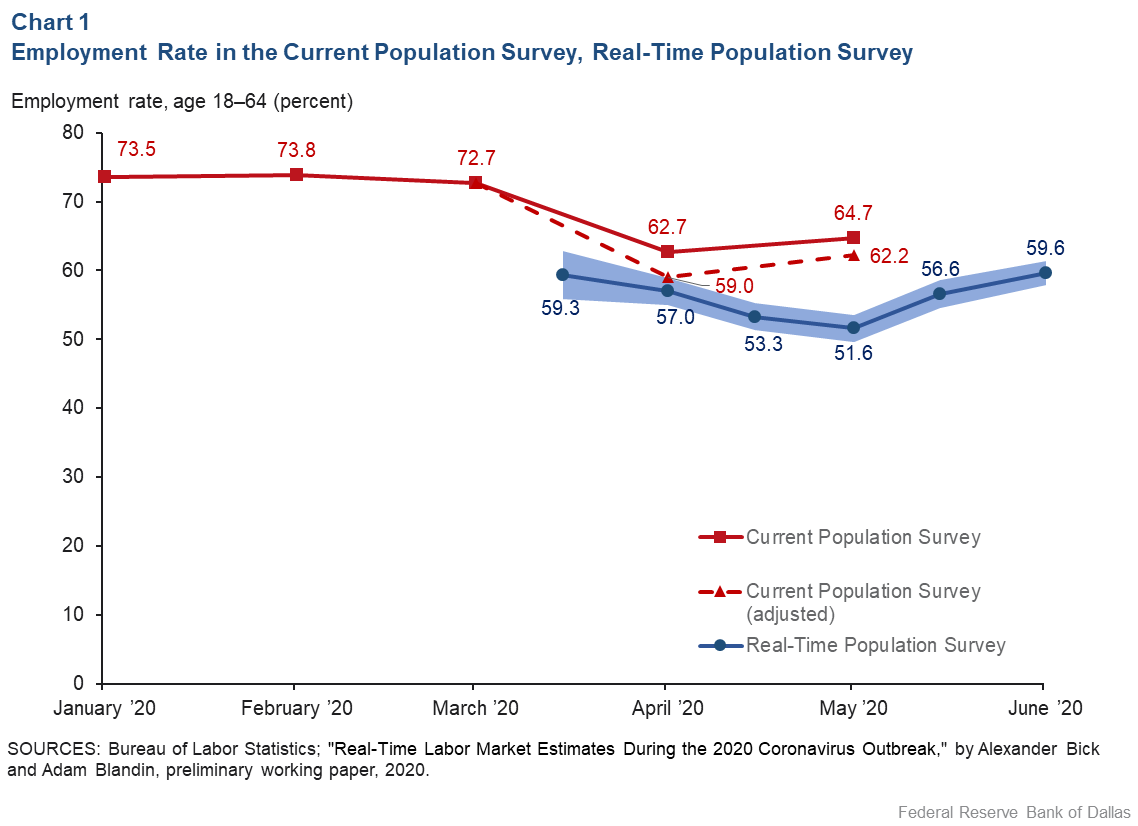

Employment Rate Rises Again

- The employment rate for working-age adults (18–64) was 59.6 percent in the RPS for the week of June 7–13, an increase relative to the estimate of 56.6 percent for the week of May 24–30.

- In mid-May, the employment rate in the RPS of 51.6 percent was below the most recent Current Population Survey (CPS) estimate of 64.7 percent for working-age adults (18–64). The Bureau of Labor Statistics, which draws on the CPS for its unemployment rate report, estimates that about 5 million individuals “with a job but absent from work because of the coronavirus” were misclassified as employed during the CPS interviewing process.

In contrast, the RPS did not record an unusually high number of persons not at work, suggesting that the same misclassification did not occur in the RPS. Reclassifying the individuals absent from work in the CPS survey leads to an adjusted employment rate among working-age adults of 62.2 percent for the week of May 10–16. This is still substantially above the RPS estimated employment rate.

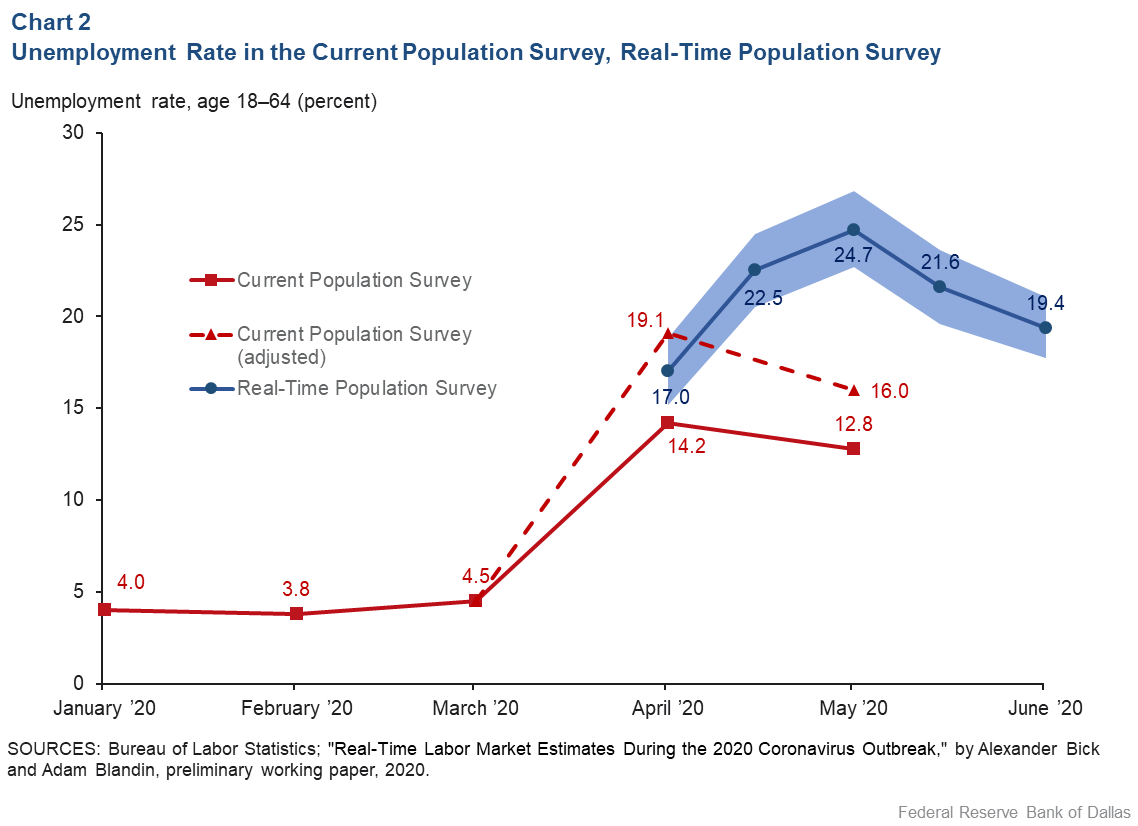

Unemployment Rate Declines Further

- The unemployment rate in the RPS was 19.4 percent for June 7–13, a decrease relative to the estimate of 21.6 percent for May 24–30.

- In mid-May, the unemployment rate of 24.7 percent in the RPS was above the official CPS estimate of 12.8 percent and the alternate estimate of 16.0 percent after reclassifying all those “absent from work because of the coronavirus’’ as unemployed.

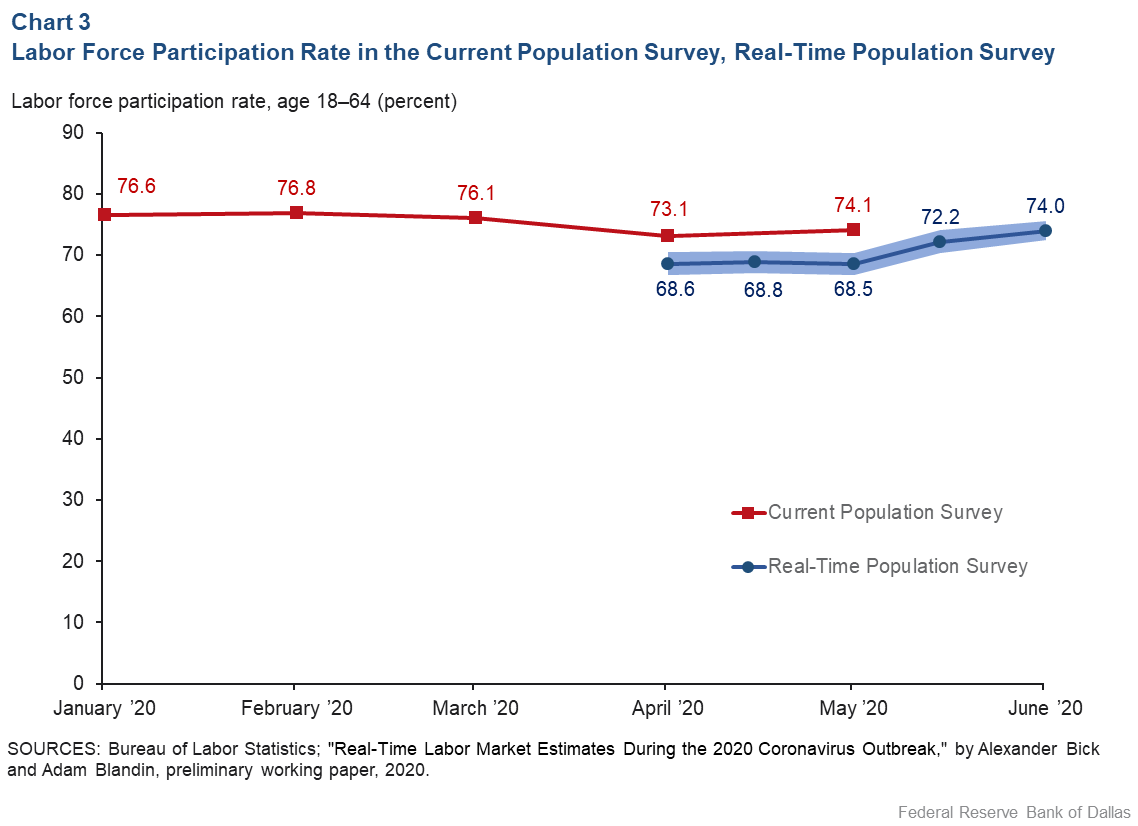

Labor Force Participation Increases

- The labor force participation rate was 74.0 percent in the RPS for June 7–13, an increase relative to the estimate of 72.2 percent for May 24–30.

- In mid-May, the RPS participation rate estimate of 68.5 percent was below the CPS estimate of 74.1 percent.

RPS Authors

The RPS was developed by Alexander Bick, an associate professor at WP Carey School of Business at Arizona State University; Adam Blandin, an assistant professor in the Department of Economics at Virginia Commonwealth University; in collaboration with Karel Mertens, a senior economic policy advisor in the Research Department at the Federal Reserve Bank of Dallas.