Banking Conditions Survey

For this month’s survey, Eleventh District business executives were asked supplemental questions on the impacts of the COVID-19 pandemic, profitability and expectations. Read the special questions results.

Results Summary

Historical data are available from March 2017.

| Total Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

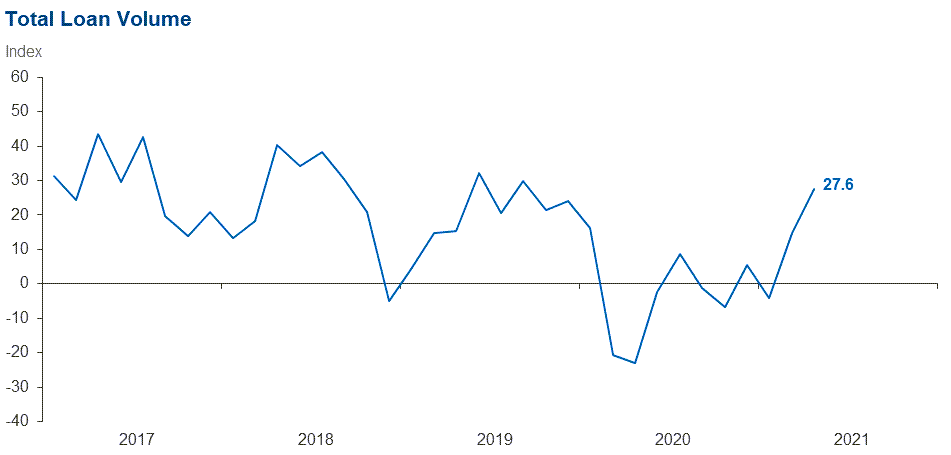

Loan volume | 27.6 | 14.9 | 43.5 | 40.6 | 15.9 |

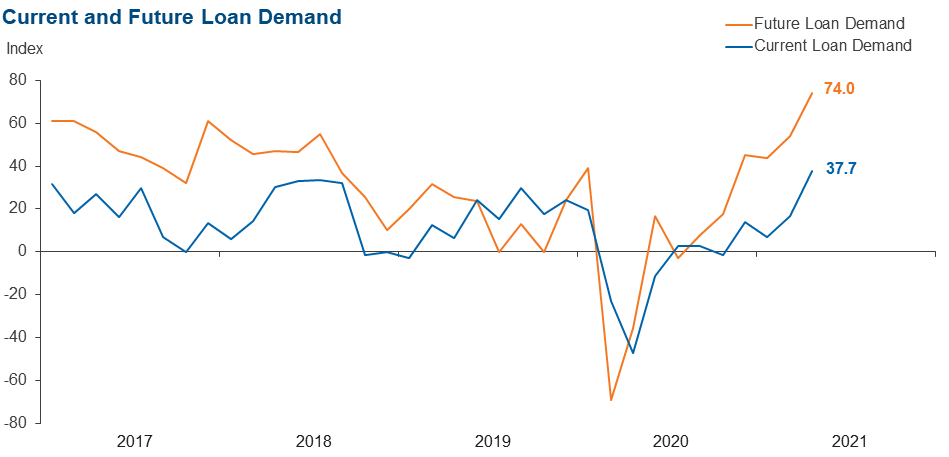

Loan demand | 37.7 | 16.7 | 52.2 | 33.3 | 14.5 |

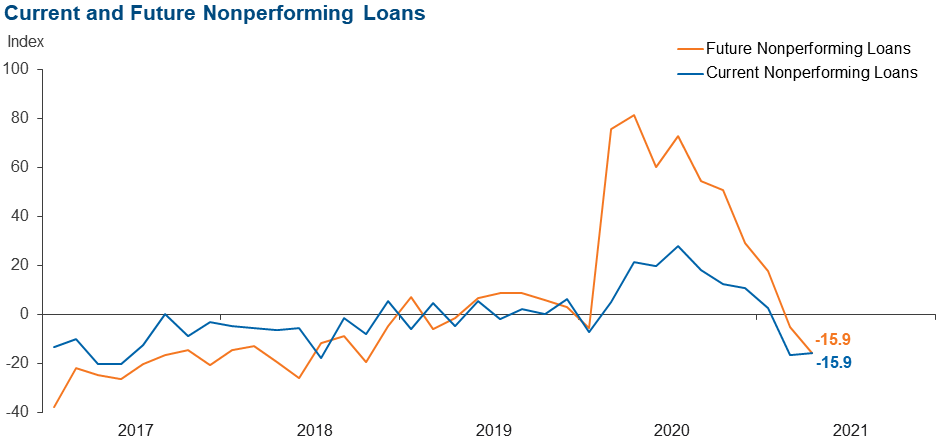

Nonperforming loans | –15.9 | –16.7 | 8.7 | 66.7 | 24.6 |

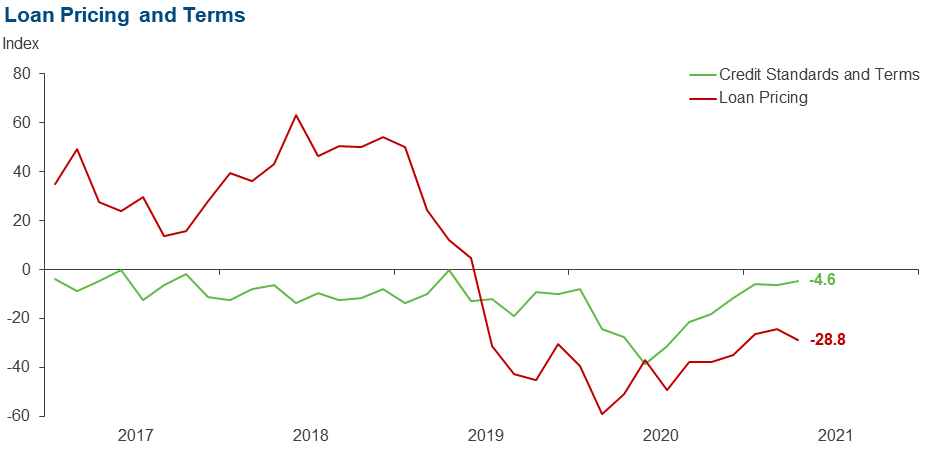

Loan pricing | –28.8 | –24.0 | 3.0 | 65.2 | 31.8 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –4.6 | –6.2 | 1.5 | 92.4 | 6.1 |

| Commercial and Industrial Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

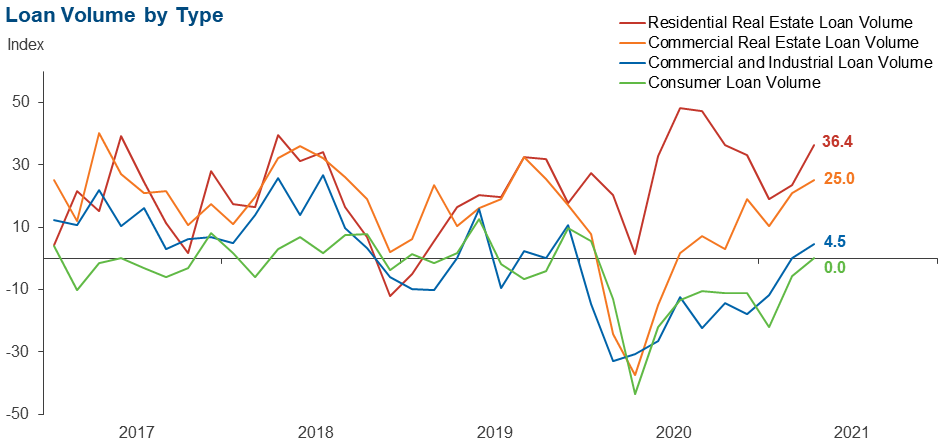

Loan volume | 4.5 | 0.0 | 19.7 | 65.2 | 15.2 |

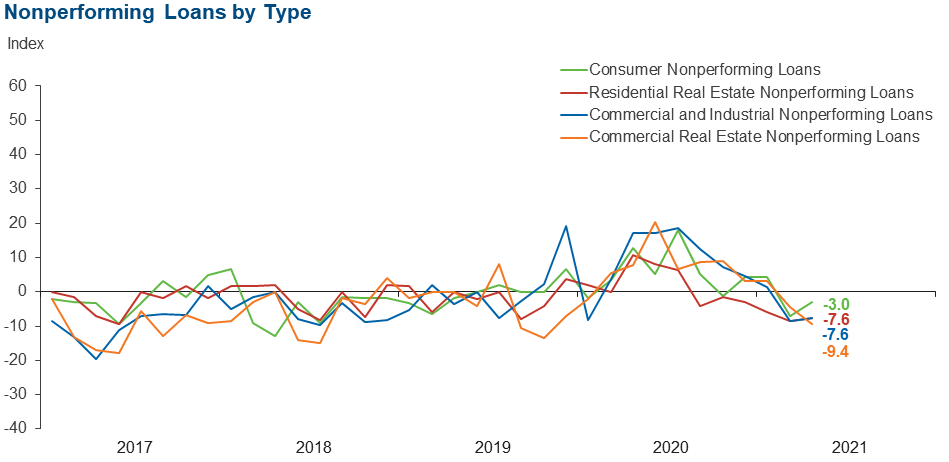

Nonperforming loans | –7.6 | –8.5 | 4.5 | 83.3 | 12.1 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –3.1 | –3.0 | 0.0 | 96.9 | 3.1 |

| Commercial Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 25.0 | 21.1 | 35.9 | 53.1 | 10.9 |

Nonperforming loans | –9.4 | –4.4 | 4.7 | 81.3 | 14.1 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | 0.0 | –5.7 | 1.6 | 96.8 | 1.6 |

| Residential Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 36.4 | 23.6 | 47.0 | 42.4 | 10.6 |

Nonperforming loans | –7.6 | –8.5 | 3.0 | 86.4 | 10.6 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | 1.5 | –1.4 | 1.5 | 98.5 | 0.0 |

| Consumer Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 0.0 | –5.5 | 15.9 | 68.1 | 15.9 |

Nonperforming loans | –3.0 | –7.1 | 4.4 | 88.2 | 7.4 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | 1.5 | –1.4 | 1.5 | 98.5 | 0.0 |

| Banking Outlook: What is your expectation for the following items six months from now? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Total loan demand | 74.0 | 54.1 | 78.3 | 17.4 | 4.3 |

Nonperforming loans | –15.9 | –5.4 | 8.7 | 66.7 | 24.6 |

| General Business Activity: What is your evaluation of the level of activity? | |||||

| Indicator | Current Index | Previous Index | % Reporting Better | % Reporting No Change | % Reporting Worse |

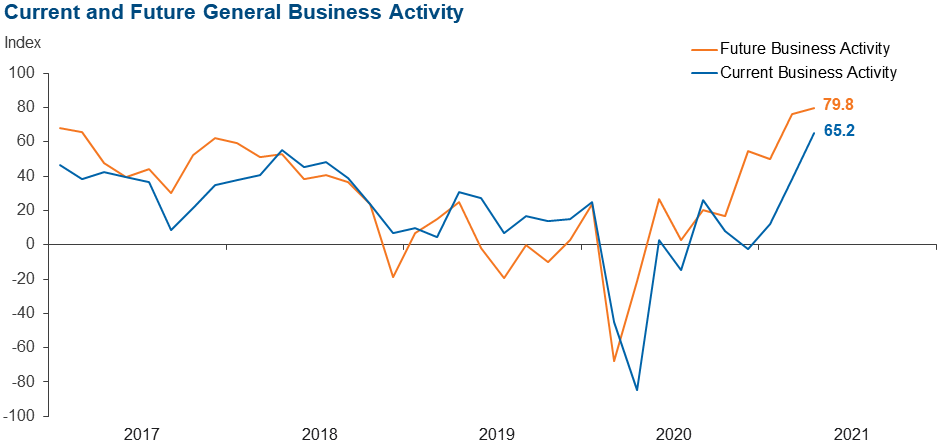

Over the past six weeks | 65.2 | 38.3 | 68.1 | 29.0 | 2.9 |

Six months from now | 79.8 | 76.4 | 81.2 | 17.4 | 1.4 |

Next release: June 28, 2021

Data were collected May 4–12, and 69 financial institutions responded to the survey. The Federal Reserve Bank of Dallas conducts the Banking Conditions Survey twice each quarter to obtain a timely assessment of activity at banks and credit unions headquartered in the Eleventh Federal Reserve District. CEOs or senior loan officers of financial institutions report on how conditions have changed for indicators such as loan volume, nonperforming loans and loan pricing. Respondents are also asked to report on their banking outlook and their evaluation of general business activity.

Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease (or tightening) from the percentage reporting an increase (or easing). When the share of respondents reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior reporting period. If the share of respondents reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior reporting period. An index will be zero when the number of respondents reporting an increase is equal to the number reporting a decrease.

Comments from Survey Respondents

Respondents were given an opportunity to comment on any issues that may be affecting their business.

These comments are from respondents’ completed surveys and have been edited for publication.

- Macro issues from the pandemic to legislative regulatory/tax issues.

- Things have clearly opened up in Texas—higher traffic counts and more crowds at restaurants and entertainment venues. However, supply chain and labor issues will definitely cause inflationary pressures on businesses.

- Competitive rate environment for new credits. Banks and credit unions are offering five- to 10-year commercial loans priced at prime rate fixed for term. The spread between the treasury yield and loan price does not cover risk and production cost of a new loan.

- Increased fraud since the pandemic—money mule schemes are on the rise. Targets are simple-minded individuals looking for companions online that do not understand what is taking place or that they are being taken advantage of.

- Competition from government-related lending institutions. Increased government regulations.

- We are facing decreased margins due to the sustained low rate environment. We have excess liquidity and are finding it difficult to price or acquire loans or investments with adequate returns.

- In the Central Texas area, we have observed a notable increase in road travel over the past several months (e.g., increased activity at travel stops, hotel stays). Our bank remains flush with liquidity. We continue to see growth in our personal and commercial checking account deposits. It has been challenging to deploy our excess liquidity to generate reasonable margins, especially with commercial loan demand remaining somewhat restrained.

- We are fortunate to serve a market that is expanding and developing.

- Increases in key commodity prices such as steel, lumber and copper are impacting business margins negatively and putting real estate construction projects that have not yet started on hold.

- Hopefully, our households and businesses will start spending their stimulus money. I am hoping for deposits to decline, and we can improve our net interest margins.

- Our small businesses are seeing a serious shortage in supply of labor. Costs are increasing across the board for every industry. I do not think it is transitory. High costs are here to stay for some time—12–18 months.

- We are looking closer at our asset liability modeling as we are concerned about inflation and rising interest rates. This is a major concern for us as we move through 2021. We know that the target movement is 2023, but we are not believing that they can hold off that long on rate increases. We are optimistic on the recovery and see signs of economic activity. Loan performance from our portfolio has been amazingly good, and we don't really see any bumps on the horizon.

- With the economic recovery well underway, forward-looking risks that we are monitoring include interest rates (too low on the short end, risk of inflation longer term) along with concerns about potential increases in consumer regulatory developments focused on already-supervised institutions versus un(der)-regulated Fintech and other providers of consumer credit and payment services.

- Future inflation and related interest rate increases.

- While we do expect business activity to improve, we believe it will be constrained by the lack of workers. Our small business customers are telling us they cannot find workers and believe it is a result of the increased unemployment benefits. The lack of workers is also disrupting the supply chain and the inventories of small businesses. In addition, the excess liquidity and low rate environment are negatively impacting loan demand.

- A major segment of our business is originating and holding residential mortgage loans. The prolonged low interest rates caused us to put a floor on our rates, thus decreasing our opportunities in the current lending environment. We are also concerned about inflation. Our construction customers are indicating prices for materials as well as labor have increased dramatically. They indicate that with all of the free government money, they are having a hard time finding anyone willing to work.

- Inflation.

Historical Data

Historical data can be downloaded dating back to March 2017. For the definitions, see data definitions.

NOTE: The following series were discontinued in May 2020: volume of core deposits, cost of funds, non-interest income and net interest margin.

Questions regarding the Banking Conditions Survey can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Banking Conditions Survey is released on the web.