Banking Conditions Survey

For this survey, Eleventh District banking executives were asked supplemental questions on credit standards, loan demand, and succession planning. Read the special questions results.

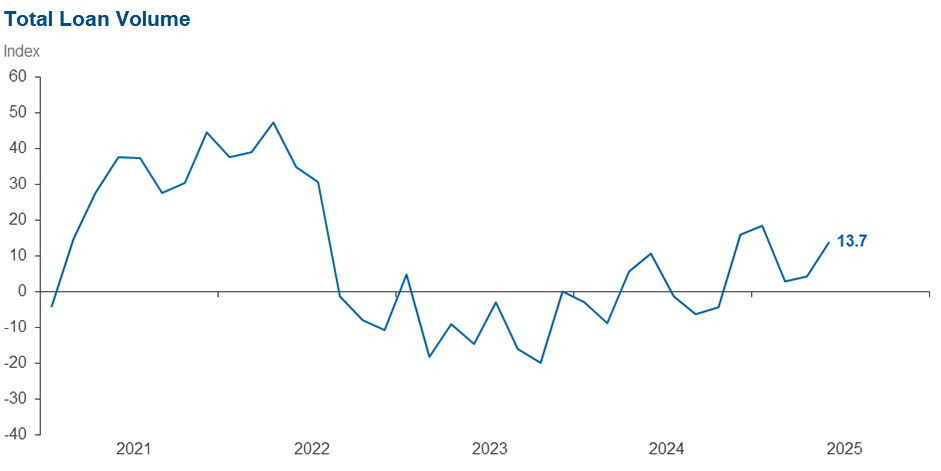

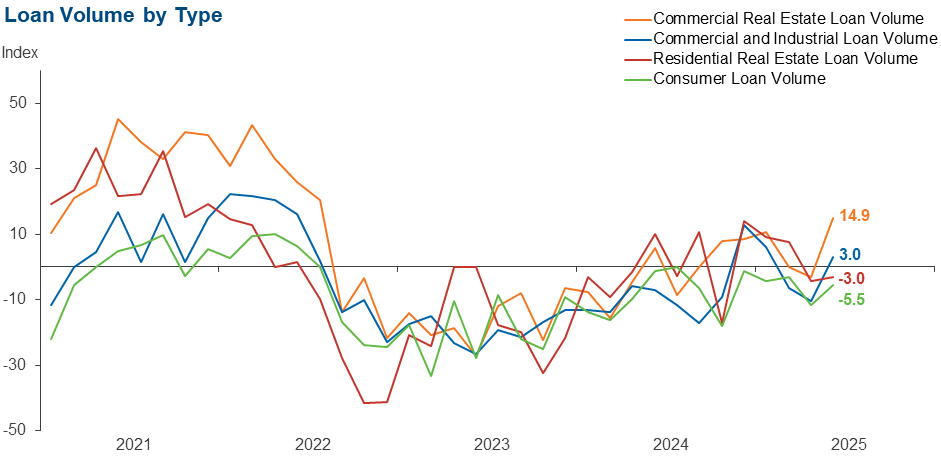

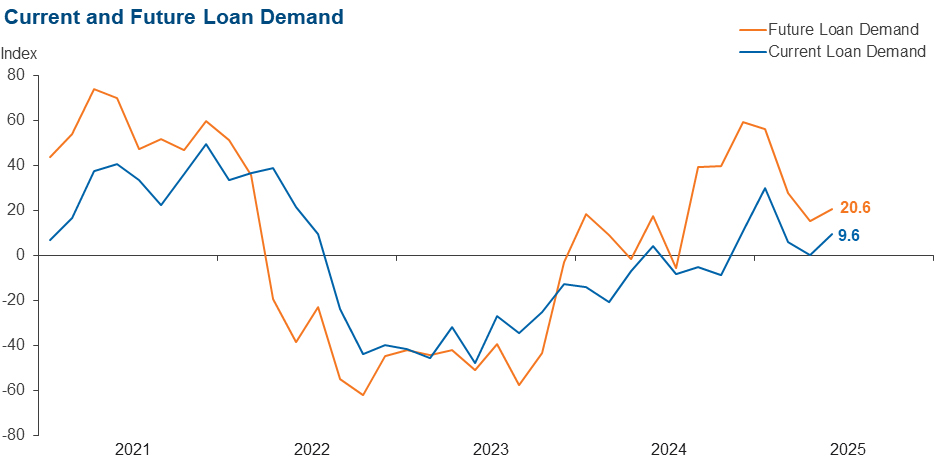

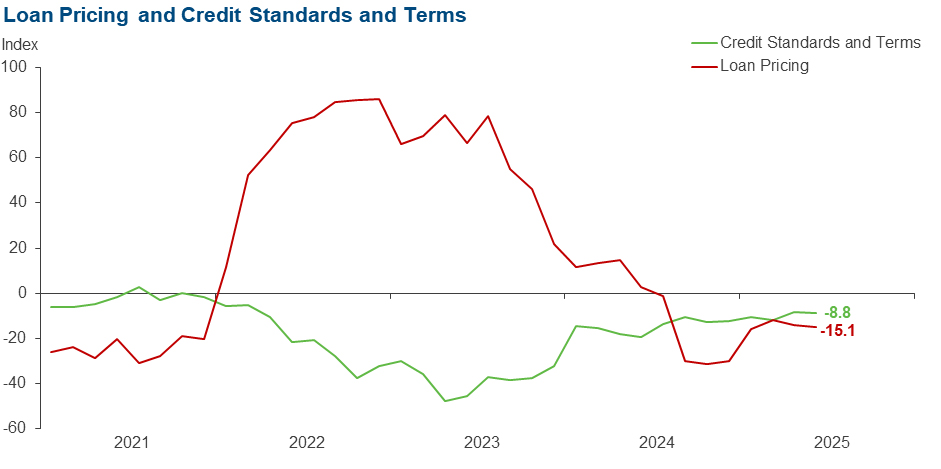

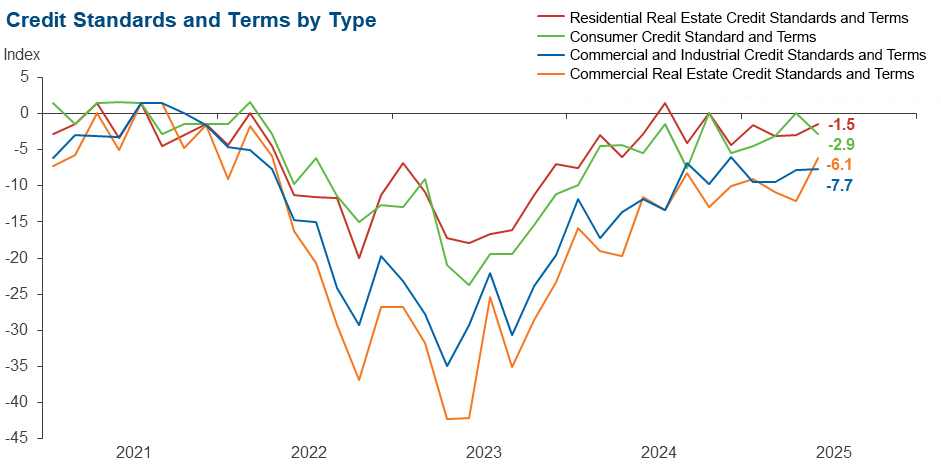

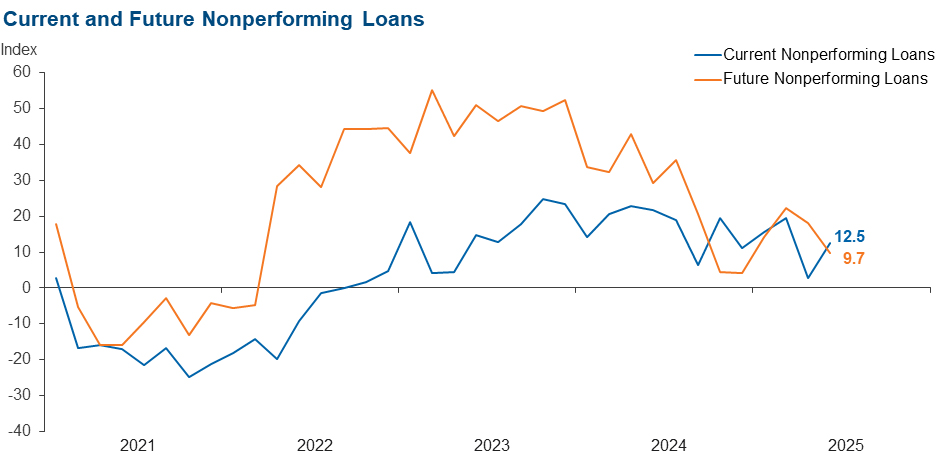

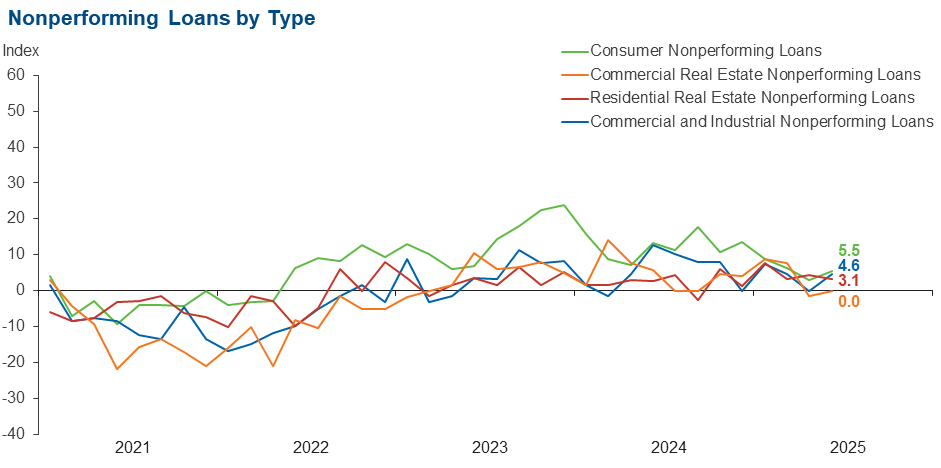

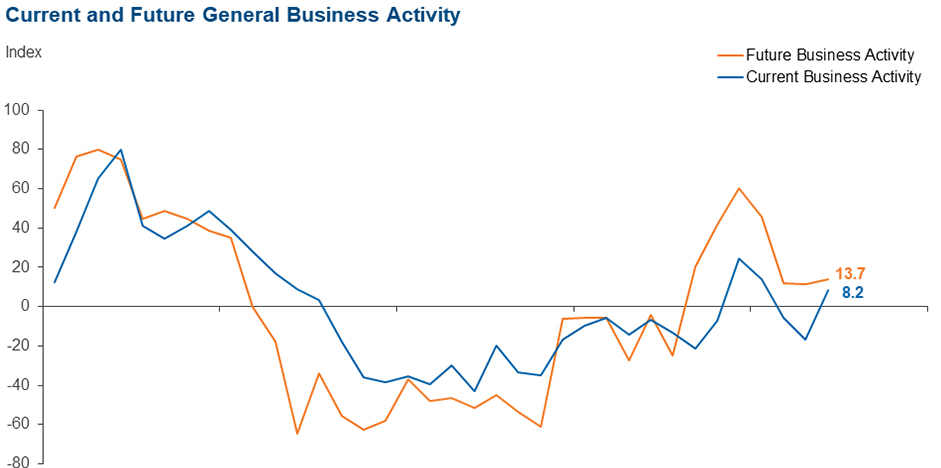

Loan volume and demand accelerated in June after little to no growth in the prior survey. Strength was driven by commercial lending, while volumes continued to decline slightly for mortgages and consumer loans. Credit tightening continued, but loan pricing declined. Increases in loan nonperformance were markedly more widespread than in the prior period. Bankers reported rising general business activity. Bankers’ outlooks remain mixed. Survey respondents expect an improvement in loan demand and business activity six months from now, but loan nonperformance is expected to increase.

Next release: August 18, 2025

Data were collected June 17–25, and 73 financial institutions responded to the survey. The Federal Reserve Bank of Dallas conducts the Banking Conditions Survey twice each quarter to obtain a timely assessment of activity at banks and credit unions headquartered in the Eleventh Federal Reserve District. CEOs or senior loan officers of financial institutions report on how conditions have changed for indicators such as loan volume, nonperforming loans and loan pricing. Respondents are also asked to report on their banking outlook and their evaluation of general business activity.

Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease (or tightening) from the percentage reporting an increase (or easing). When the share of respondents reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior reporting period. If the share of respondents reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior reporting period. An index will be zero when the number of respondents reporting an increase is equal to the number reporting a decrease.

Results Summary

Historical data are available from March 2017.

| Total Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 13.7 | 4.2 | 41.1 | 31.5 | 27.4 |

Loan demand | 9.6 | 0.0 | 35.6 | 38.4 | 26.0 |

Nonperforming loans | 12.5 | 2.8 | 22.2 | 68.1 | 9.7 |

Loan pricing | –15.1 | –13.9 | 0.0 | 84.9 | 15.1 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –8.8 | –8.3 | 1.5 | 88.2 | 10.3 |

| Commercial and Industrial Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 3.0 | –10.5 | 19.4 | 64.2 | 16.4 |

Nonperforming loans | 4.6 | 0.0 | 7.6 | 89.4 | 3.0 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –7.7 | –7.8 | 0.0 | 92.3 | 7.7 |

| Commercial Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 14.9 | –3.0 | 35.8 | 43.3 | 20.9 |

Nonperforming loans | 0.0 | –1.5 | 9.0 | 82.1 | 9.0 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –6.1 | –12.1 | 1.5 | 90.9 | 7.6 |

| Residential Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | –3.0 | –4.3 | 23.5 | 50.0 | 26.5 |

Nonperforming loans | 3.1 | 4.4 | 7.6 | 87.9 | 4.5 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –1.5 | –3.0 | 0.0 | 98.5 | 1.5 |

| Consumer Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | –5.5 | –11.5 | 16.4 | 61.6 | 21.9 |

Nonperforming loans | 5.5 | 2.9 | 11.0 | 83.6 | 5.5 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –2.9 | 0.0 | 0.0 | 97.1 | 2.9 |

| Banking Outlook: What is your expectation for the following items six months from now? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Total loan demand | 20.6 | 15.2 | 42.5 | 35.6 | 21.9 |

Nonperforming loans | 9.7 | 18.1 | 20.8 | 68.1 | 11.1 |

| General Business Activity: What is your evaluation of the level of activity? | |||||

| Indicator | Current Index | Previous Index | % Reporting Better | % Reporting No Change | % Reporting Worse |

Over the past six weeks | 8.2 | –16.9 | 30.1 | 47.9 | 21.9 |

Six months from now | 13.7 | 11.2 | 32.9 | 47.9 | 19.2 |

Survey participants are given the opportunity to submit comments on current issues that may be affecting their businesses. Some comments have been edited for grammar and clarity.

- The regulatory burden and inconsistencies [are concerns].

- The certainty to the tariff policy is uncertainty, which is impacting business, with investment remaining on the sidelines.

- Vacancy rates for office buildings have increased in the San Antonio market within the last nine months from 10 percent to 15 percent, and higher cap rates are leading to reduced property valuations.

- Geopolitical risks and the impact on future business activity are concerns, along with interest rates remaining high and the effect that it has on both businesses and consumers.

- Tariffs, Middle East war and high real estate prices relative to the current interest rates have caused some sluggishness in our markets.

- Political uncertainty, inflation uncertainty, world stability all seem to factor into business community banking and loan demand. Whiplash is the best description I can supply for the industry. Not that they object to the changes, it’s just change, and I believe that business and businessmen like stability and certainty.

- Heightened levels of uncertainty (both economic and regulatory) are creating a challenging path forward with respect to planning and forecasting.

- Today we are worried about the Stablecoin Bill and how that could impact the banking industry, if we have a new competitor that Washington is not going to provide the same level of oversight to.

- Tariffs and now a Middle East conflict continue to create massive uncertainly for our clients and economy.

- We are seeing a dramatic slowdown in construction due to a lack of laborers in the construction sector. Contractors are attributing this labor shortage to increased Immigration and Customs Enforcement raids at construction job sites. Illegal workers are afraid to show up at construction job sites for fear of deportation. Accordingly, this is causing a dramatic slowdown in the construction sector. This has been confirmed by multiple contractors and construction trade organizations.

- Trade policy, and uncertainty about how this affects inflation, remains the primary concern. Instability in the Middle East could increase gasoline prices — another potential tax on the consumer that is already stressed.

Historical data can be downloaded dating back to March 2017. For the definitions, see data definitions.

NOTE: The following series were discontinued in May 2020: volume of core deposits, cost of funds, non-interest income and net interest margin.

Questions regarding the Banking Conditions Survey can be addressed to Mariam Yousuf at mariam.yousuf@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Banking Conditions Survey is released on the web.