Banking Conditions Survey

Results Summary

Historical data are available from March 2017.

| Total Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

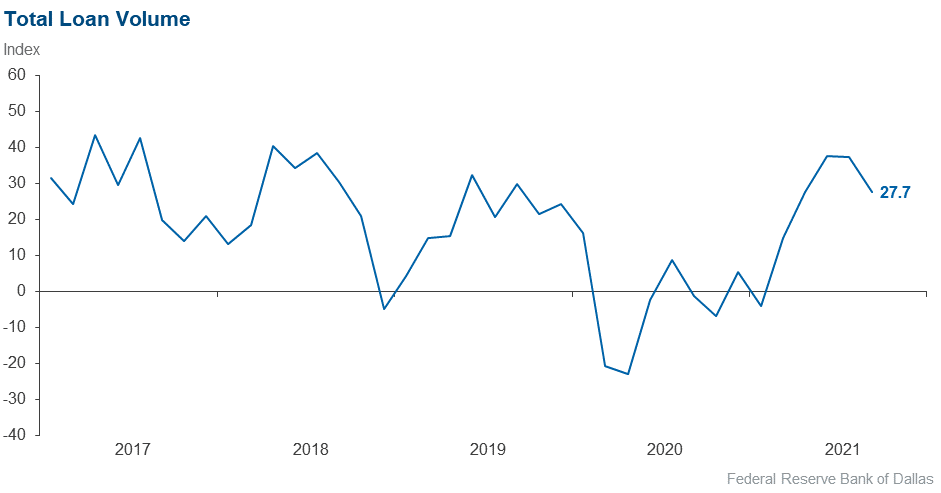

Loan volume | 27.7 | 37.3 | 44.4 | 38.9 | 16.7 |

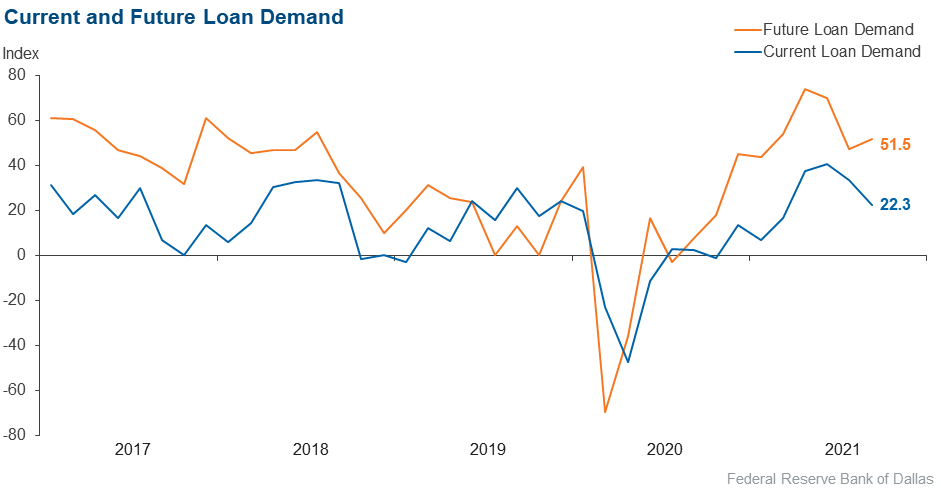

Loan demand | 22.3 | 33.7 | 41.7 | 38.9 | 19.4 |

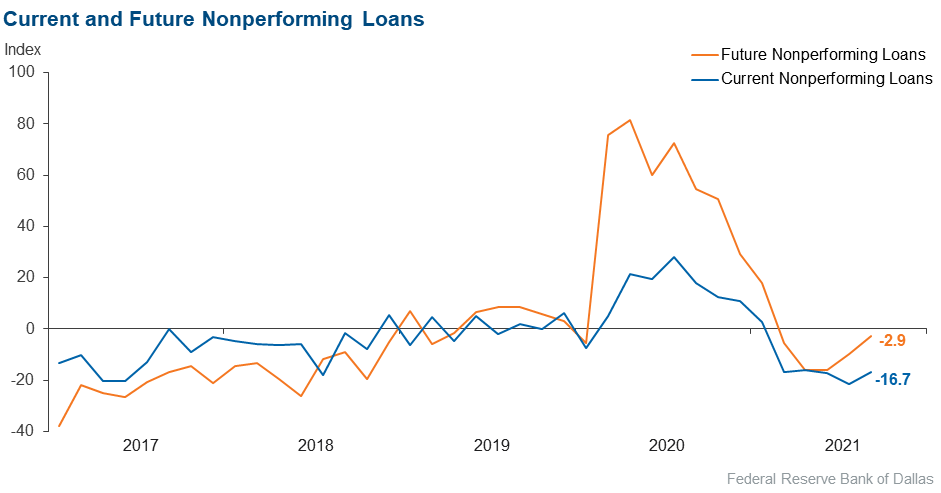

Nonperforming loans | –16.7 | –21.6 | 8.3 | 66.7 | 25.0 |

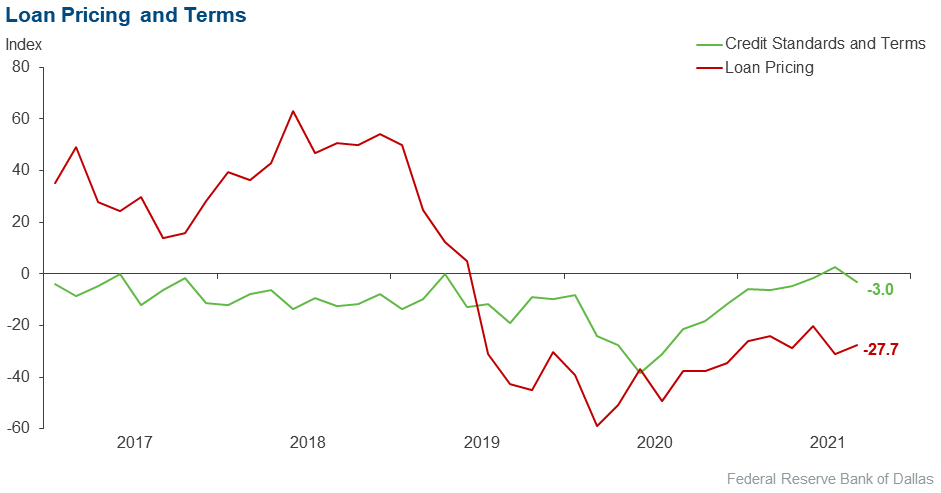

Loan pricing | –27.7 | –31.0 | 4.2 | 63.9 | 31.9 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –3.0 | 2.8 | 3.0 | 91.0 | 6.0 |

| Commercial and Industrial Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

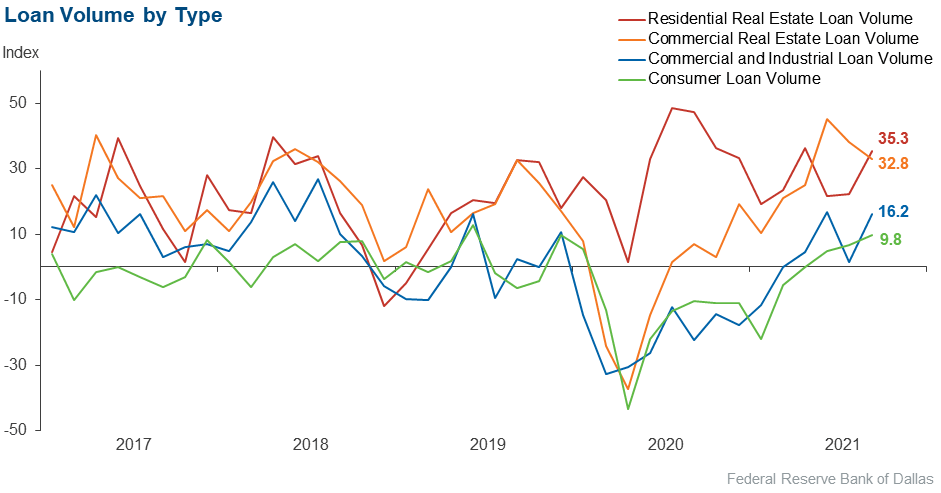

Loan volume | 16.2 | 1.4 | 29.4 | 57.4 | 13.2 |

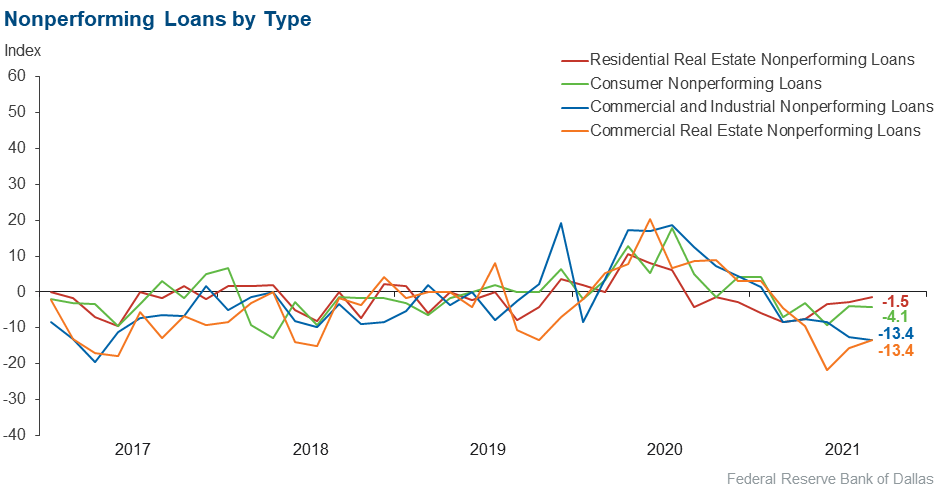

Nonperforming loans | –13.4 | –12.5 | 4.5 | 77.6 | 17.9 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | 1.5 | 1.5 | 3.0 | 95.5 | 1.5 |

| Commercial Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 32.8 | 38.0 | 38.8 | 55.2 | 6.0 |

Nonperforming loans | –13.4 | –15.7 | 0.0 | 86.6 | 13.4 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | 1.5 | 1.4 | 4.5 | 92.5 | 3.0 |

| Residential Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 35.3 | 22.2 | 45.6 | 44.1 | 10.3 |

Nonperforming loans | –1.5 | –2.8 | 5.9 | 86.8 | 7.4 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –4.5 | 1.4 | 0.0 | 95.5 | 4.5 |

| Consumer Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 9.8 | 6.8 | 18.3 | 73.2 | 8.5 |

Nonperforming loans | –4.1 | –4.0 | 5.6 | 84.7 | 9.7 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –2.9 | 1.4 | 0.0 | 97.1 | 2.9 |

| Banking Outlook: What is your expectation for the following items six months from now? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Total loan demand | 51.5 | 47.3 | 62.9 | 25.7 | 11.4 |

Nonperforming loans | –2.9 | –9.6 | 17.4 | 62.3 | 20.3 |

| General Business Activity: What is your evaluation of the level of activity? | |||||

| Indicator | Current Index | Previous Index | % Reporting Better | % Reporting No Change | % Reporting Worse |

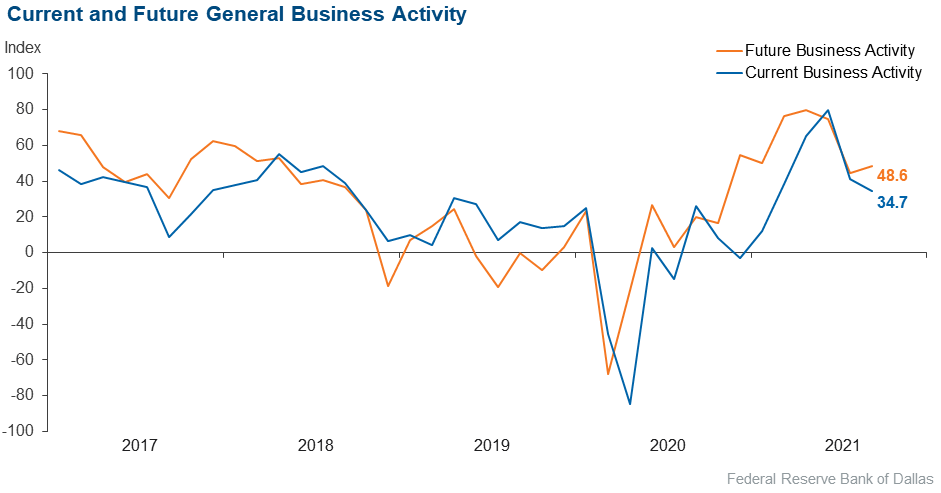

Over the past six weeks | 34.7 | 41.3 | 48.6 | 37.5 | 13.9 |

Six months from now | 48.6 | 44.6 | 62.5 | 23.6 | 13.9 |

Next release: November 15, 2021

Data were collected September 21–29, and 72 financial institutions responded to the survey. The Federal Reserve Bank of Dallas conducts the Banking Conditions Survey twice each quarter to obtain a timely assessment of activity at banks and credit unions headquartered in the Eleventh Federal Reserve District. CEOs or senior loan officers of financial institutions report on how conditions have changed for indicators such as loan volume, nonperforming loans and loan pricing. Respondents are also asked to report on their banking outlook and their evaluation of general business activity.

Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease (or tightening) from the percentage reporting an increase (or easing). When the share of respondents reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior reporting period. If the share of respondents reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior reporting period. An index will be zero when the number of respondents reporting an increase is equal to the number reporting a decrease.

Comments from Survey Respondents

Respondents were given an opportunity to comment on any issues that may be affecting their business.

These comments are from respondents’ completed surveys and have been edited for publication.

- The macro factors of the COVID impacts, world economy and the D.C. political impasse are influencing current and future economic activity.

- Supply-chain issues continue to create uncertainty, leading some borrowers to over-purchase inventory when it is available, which may lead to pockets of surplus inventories.

- Future government stimulus could be damaging. It is not needed and could elongate the low-rate environment from excess liquidity in the banking system. Additional stimulus means tightening NIM [net interest margin] with growing IRR [internal rate of return] and rising credit risk. It has the potential unintended consequence of reducing the soundness of the industry.

- We have seen a slight slowdown in loan demand. Labor shortages seem to be affecting businesses slightly, although they have improved in recent weeks. We continue to see depressed margins and high liquidity levels in which we have difficulty finding good yielding securities or loans to deploy excess funds.

- For 2021, we can expect credit to experience pockets of turbulence brought on by continued supply-chain disruptions, inflation, changing consumer behaviors, surprises (e.g., Texas freeze), while the overall economy will experience government fiscal headwinds causing a deceleration in GDP [gross domestic product] growth. Overall credit quality will return within our tolerance standards; however, we will need to maintain a prudent cushion within the Allowance for Loan and Lease Losses (ALLL) to account for ongoing uncertainty as we are not yet out of the COVID-19 woods.

- Inflation, supply-chain issues and businesses can’t find employees to hire. All have become significant factors.

- Increased regulations that are unclear and hard to comply with. Cyber, cyber and cyber.

- There is renewed uncertainty driven by the Delta variant, government regulation and stimulus programs, as well as the overall economic/geopolitical environment is resulting in a bit of a pause to the otherwise positive outlook. The resolution of the pandemic and regulatory and economic uncertainty will provide for a more-clear path forward.

- The slowness of getting people vaccinated and the politicization of the vaccination process are issues. Also, the inability of Congress to work together with the president on a moderate legislation agenda.

- Along with the CECL [Current Expected Credit Losses] mandate, which is totally useless for smaller institutions, we now are faced with federal leadership driving up inflation, the cost of goods, shortage of skilled workers willing to work (staying at home receiving free money from said government), excessive spending bills, excessive government debt and now the threat of an IRS power grab. We are praying for better leadership and preparing for the worst.

- Deposits continue to flow into our institution, which others are experiencing as well.

- We have seen very positive trends in loan demand and business activity as a whole. All industry sectors appear to be doing well. Our commercial client base in our West Texas markets was struggling a little but we are now seeing significant improvement in overall economic health there as well.

Historical Data

Historical data can be downloaded dating back to March 2017. For the definitions, see data definitions.

NOTE: The following series were discontinued in May 2020: volume of core deposits, cost of funds, non-interest income and net interest margin.

Questions regarding the Banking Conditions Survey can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Banking Conditions Survey is released on the web.