Banking Conditions Survey

Loan Demand Accelerates in the Eleventh District

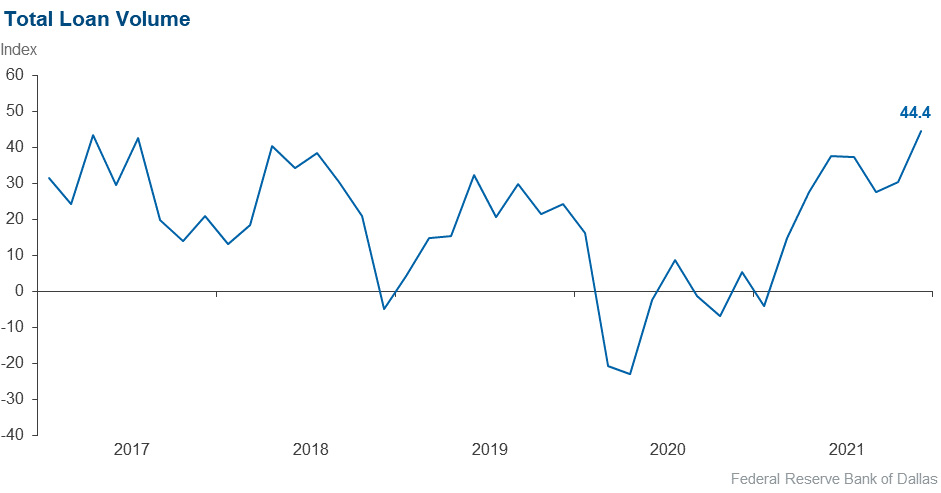

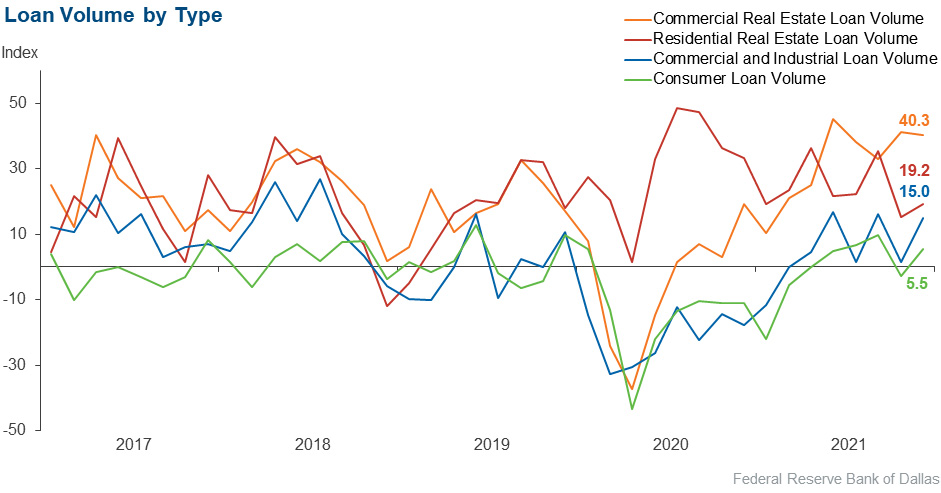

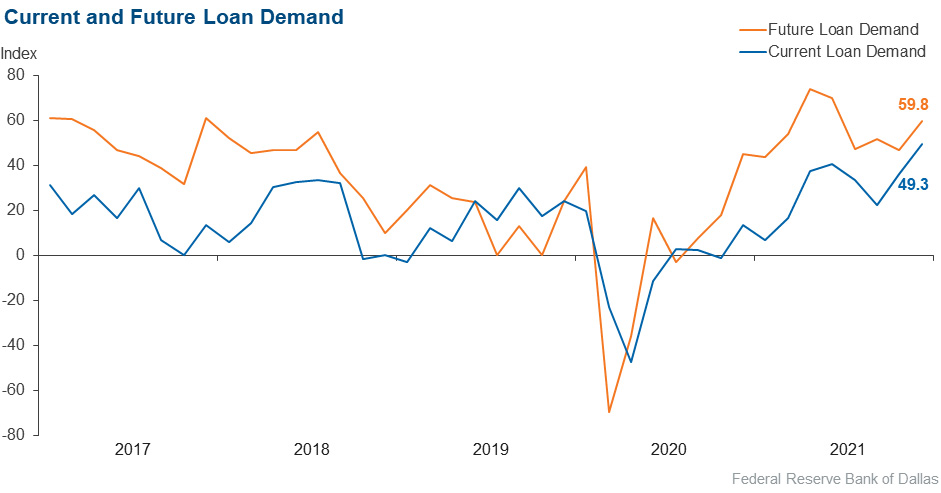

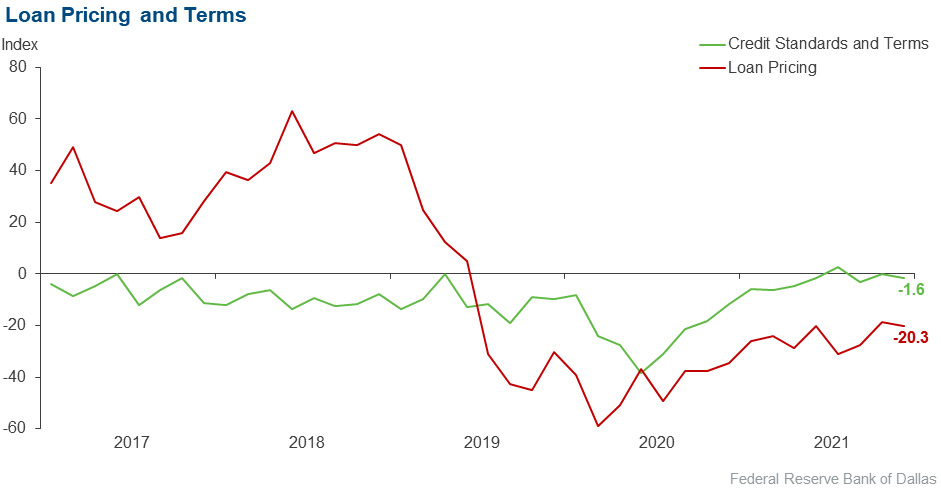

Loan demand picked up pace over the past six weeks, driving up overall loan-volume growth. Loan volumes increased across lending types, led by commercial real estate. Volume growth accelerated for consumer and industrial loans, and commercial loans increased after weakness last period. Nonperforming loans continued to decrease, and credit standards and terms remained largely unchanged. General business activity improved further, though contacts expressed concern over inflation, supply-chain disruptions and labor shortages. Outlooks for loan demand and general business activity six months from now remained optimistic.

Next release: February 14, 2022

Data were collected December 13–21, and 72 financial institutions responded to the survey. The Federal Reserve Bank of Dallas conducts the Banking Conditions Survey twice each quarter to obtain a timely assessment of activity at banks and credit unions headquartered in the Eleventh Federal Reserve District. CEOs or senior loan officers of financial institutions report on how conditions have changed for indicators such as loan volume, nonperforming loans and loan pricing. Respondents are also asked to report on their banking outlook and their evaluation of general business activity.

Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease (or tightening) from the percentage reporting an increase (or easing). When the share of respondents reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior reporting period. If the share of respondents reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior reporting period. An index will be zero when the number of respondents reporting an increase is equal to the number reporting a decrease.

Results Summary

Historical data are available from March 2017.

| Total Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 44.4 | 30.4 | 56.9 | 30.6 | 12.5 |

Loan demand | 49.3 | 36.3 | 56.3 | 36.6 | 7.0 |

Nonperforming loans | –21.1 | –24.7 | 12.7 | 53.5 | 33.8 |

Loan pricing | –20.3 | –18.8 | 2.9 | 73.9 | 23.2 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –1.6 | 0.0 | 4.5 | 89.4 | 6.1 |

| Commercial and Industrial Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 15.0 | 1.5 | 26.9 | 61.2 | 11.9 |

Nonperforming loans | –13.4 | –4.6 | 4.5 | 77.6 | 17.9 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –1.6 | 0.0 | 3.1 | 92.2 | 4.7 |

| Commercial Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 40.3 | 41.3 | 47.8 | 44.8 | 7.5 |

Nonperforming loans | –20.9 | –17.2 | 3.0 | 73.1 | 23.9 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –1.6 | –4.8 | 4.6 | 89.2 | 6.2 |

| Residential Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 19.2 | 15.1 | 32.4 | 54.4 | 13.2 |

Nonperforming loans | –7.4 | –6.1 | 4.4 | 83.8 | 11.8 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –1.5 | –3.0 | 0.0 | 98.5 | 1.5 |

| Consumer Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 5.5 | –2.9 | 19.4 | 66.7 | 13.9 |

Nonperforming loans | 0.0 | –4.4 | 8.3 | 83.3 | 8.3 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –1.4 | –1.5 | 0.0 | 98.6 | 1.4 |

| Banking Outlook: What is your expectation for the following items six months from now? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Total loan demand | 59.8 | 47.0 | 68.1 | 23.6 | 8.3 |

Nonperforming loans | –4.1 | –13.2 | 18.1 | 59.7 | 22.2 |

| General Business Activity: What is your evaluation of the level of activity? | |||||

| Indicator | Current Index | Previous Index | % Reporting Better | % Reporting No Change | % Reporting Worse |

Over the past six weeks | 48.6 | 41.2 | 52.8 | 43.1 | 4.2 |

Six months from now | 38.8 | 44.8 | 56.9 | 25.0 | 18.1 |

Comments from Survey Respondents

Respondents were given an opportunity to comment on any issues that may be affecting their business.

These comments are from respondents’ completed surveys and have been edited for publication.

- Managing through inflationary pressures and supply-chain logistical issues remains a challenge.

- Demand for and cost of talent in our market continues to be a top concern. We are competing with many employers outside the industry for talent. Post-COVID trends of people staying out of the workforce complicates things. Both factors result in shortages and rising costs.

- Net interest margins remain squeezed, forcing profitability capacity below historical expectations. Commercial loan demand is gradually increasing. Deposit growth for 2021 remains strong and exceeds historical trends. Competition for key talent requires modification to existing compensation structure.

- Inflation, the yield curve and the regulatory environment are issues of concern.

- Inflation concerns persist with some commercial clients. In addition, we are concerned that the consumer may be starting to feel the pinch of higher prices and cost of living in our area. Our margins are low, but we expect these to increase in 2022.

- As soon as supply meets demand, our loan volume should increase.

- Economic risks revolve around inflation and supply-chain problems as decades of tailwinds turn into headwinds. Commercial and industrial borrowers are asking for inventory advance rates and caps to be loosened in order to purchase more safety stock and pay suppliers up front for long lead items. Given the combination of strong demand, spot shortages, reconfigured supply chains and inflation, we expect an ongoing game of non-industry-specific commercial and industrial borrower credit problem “whack-a-mole” into 2023. Overall credit quality, however, will continue to recover from COVID.

- Inflation is starting to cause business customers to become apprehensive about taking on new debt. This along with shortages of labor and pressure on increased wages are issues of concern.

- We continue to see robust loan demand. There seems to be increased business, and customers are racing to lock in low interest rates, sensing that there is an increase in the future. Banks and credit unions, however, seem to be in a race to the bottom on interest rates, causing net interest margins to be squeezed. One interesting note is our balance sheet continues to grow. Deposits are increasing beyond our expectations.

- We are continuing to cautiously watch rate and inflation trends. Modest improvement in the rate environment (closer to "normal" yield curve) would be beneficial to relieve margin pressures and improve investment yields. More concerning, an increase in inflationary pressures could dampen consumer loan demand and drive additional stress in the labor market.

- Inflation is a big concern along with the challenges in finding people who want to work.

- Declines in investment-and-operating-fee income are affecting bottom-line performance. I anticipate increases to the balances in our ALLL [allowance for loan and lease losses] account over the next six months, which may impact profitability.

- We are starting a core conversion for 2023.

- Inflation and staffing are the two biggest concerns, followed by regulators fighting amongst themselves.

- As we become ever-so dependent on other countries that are not friends of the U.S., we can expect higher costs and everything that goes along with that.

- We continue to be concerned about the inflationary elements of our local economies. We have seen home values increase 10 percent or more in less than a year and are seeing record-high home values for our markets. This large increase in home values coupled with moderate increases over the last several years have us concerned about a housing-price bubble.

- The banking outlook is good but cautious due to uncertainty in the stock market outlook. Of additional concern is the advent of cryptocurrency and its potential impact on banking.

Historical Data

Historical data can be downloaded dating back to March 2017. For the definitions, see data definitions.

NOTE: The following series were discontinued in May 2020: volume of core deposits, cost of funds, non-interest income and net interest margin.

Questions regarding the Banking Conditions Survey can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Banking Conditions Survey is released on the web.