Banking Conditions Survey

Loan Demand Growth Continues; Outlooks Remain Optimistic

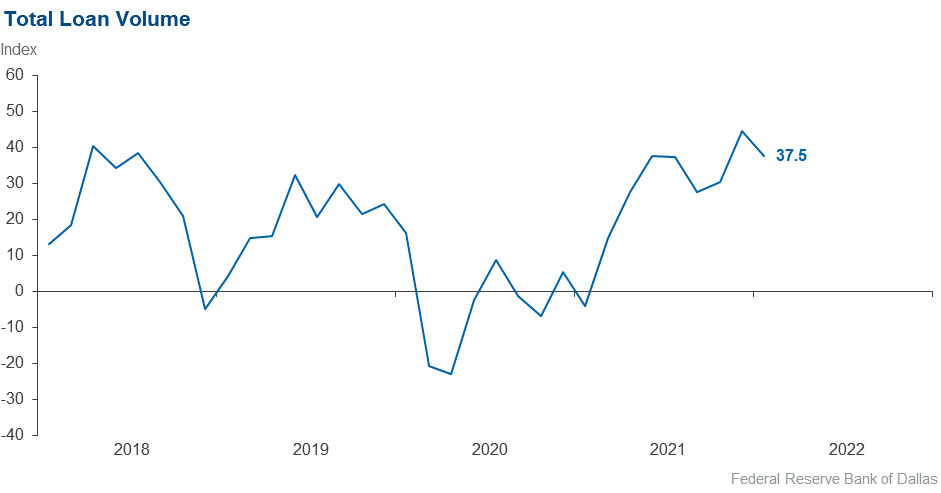

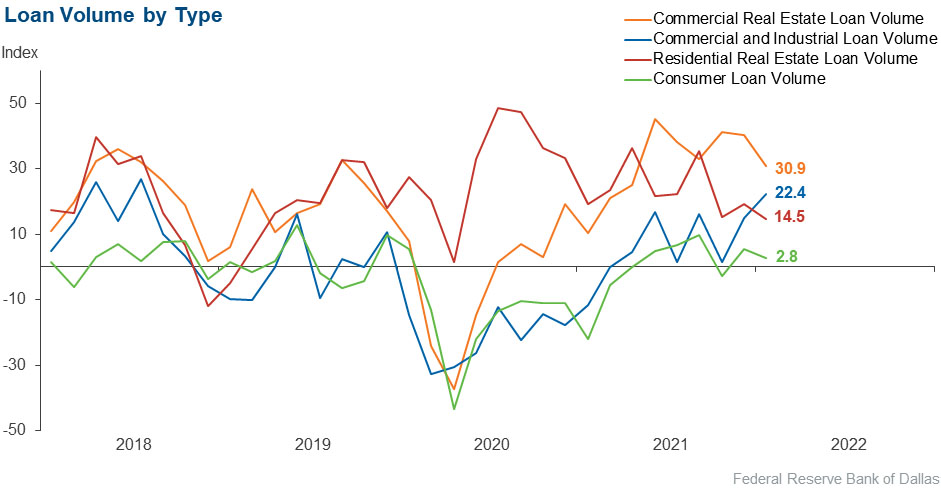

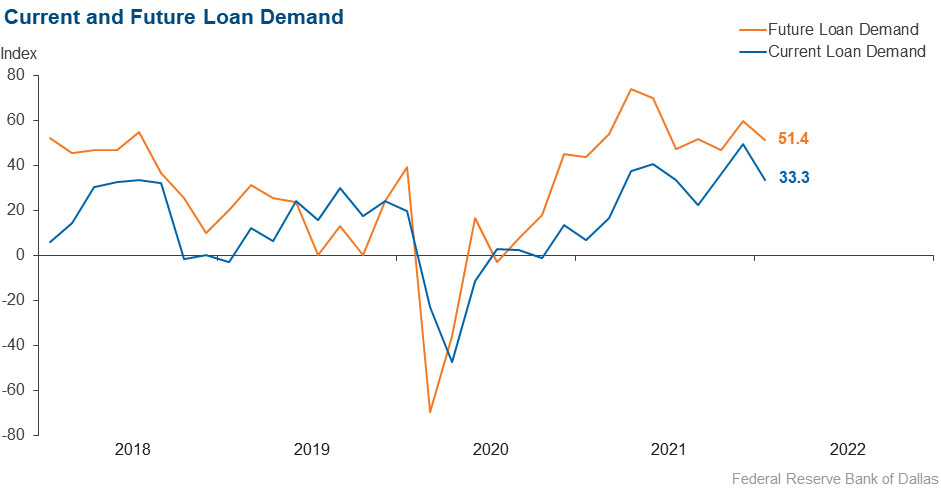

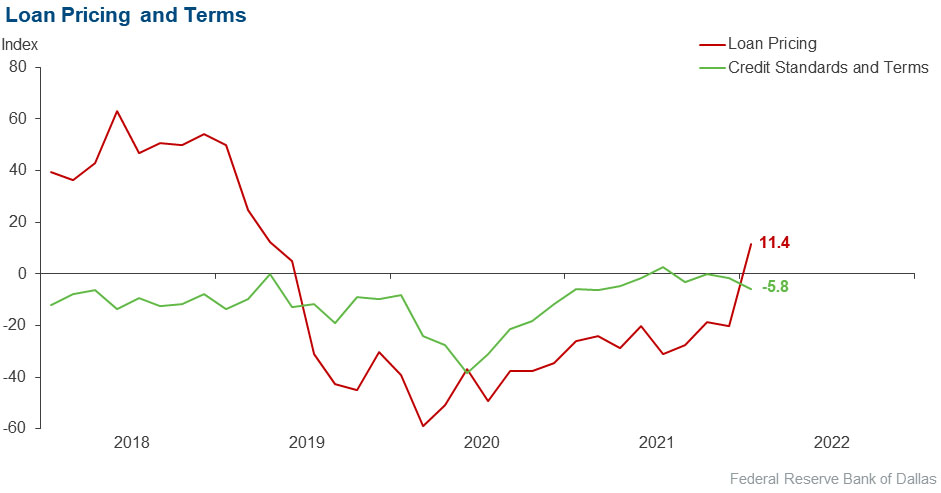

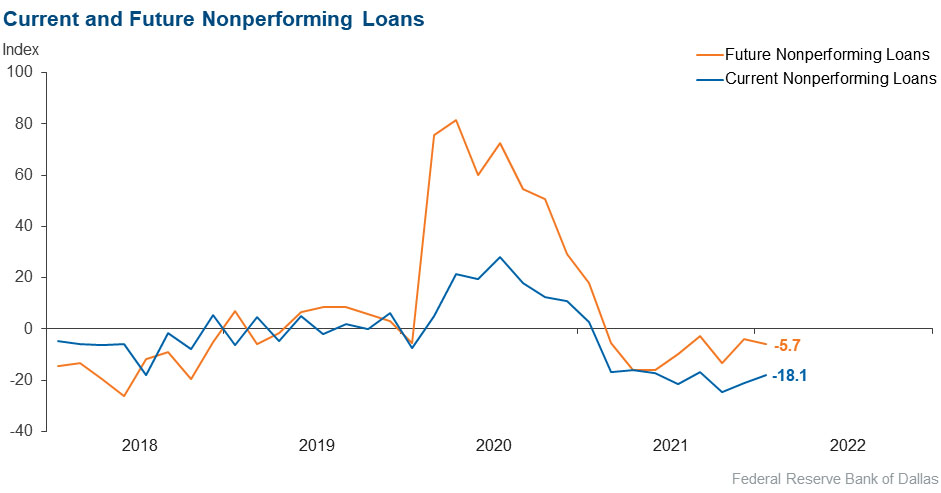

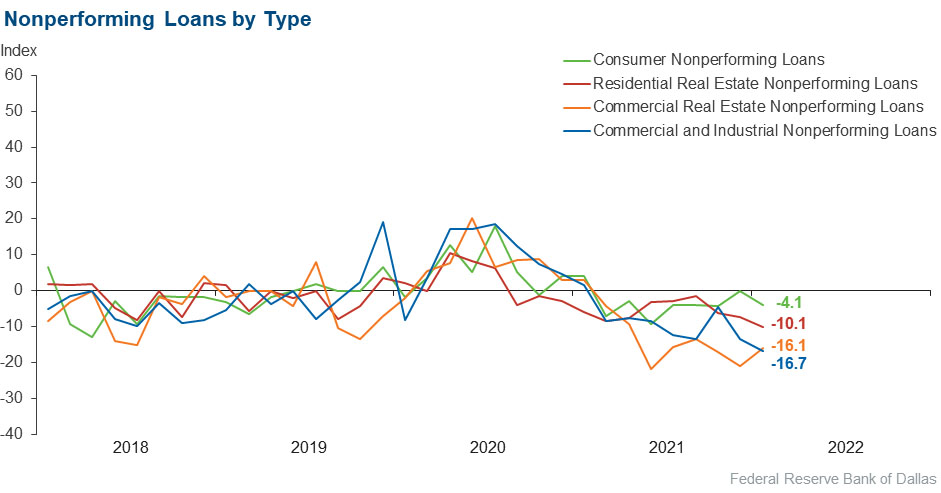

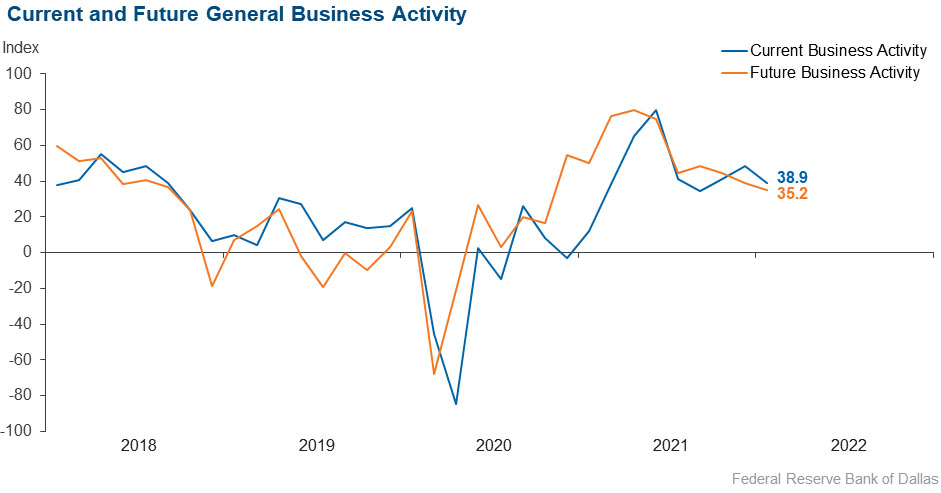

Loan demand increased over the past six weeks, as did loan volumes, though both rose at a slightly slower pace than in the prior period. Loan volume increases spanned lending types, led by commercial real estate. Nonperforming loans continued to decrease, and credit standards and terms tightened slightly. Loan pricing increased for the first time since mid-2019. Contacts expressed concerns about the effects of interest rate increases, inflation and staffing shortages. However, general business activity continued to improve, and outlooks for loan demand and general business activity six months from now remain optimistic.

Next release: April 4, 2022

Data were collected February 1–9, and 72 financial institutions responded to the survey. The Federal Reserve Bank of Dallas conducts the Banking Conditions Survey twice each quarter to obtain a timely assessment of activity at banks and credit unions headquartered in the Eleventh Federal Reserve District. CEOs or senior loan officers of financial institutions report on how conditions have changed for indicators such as loan volume, nonperforming loans and loan pricing. Respondents are also asked to report on their banking outlook and their evaluation of general business activity.

Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease (or tightening) from the percentage reporting an increase (or easing). When the share of respondents reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior reporting period. If the share of respondents reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior reporting period. An index will be zero when the number of respondents reporting an increase is equal to the number reporting a decrease.

Results Summary

Historical data are available from March 2017.

| Total Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 37.5 | 44.4 | 51.4 | 34.7 | 13.9 |

Loan demand | 33.3 | 49.3 | 45.8 | 41.7 | 12.5 |

Nonperforming loans | –18.1 | –21.1 | 9.7 | 62.5 | 27.8 |

Loan pricing | 11.4 | –20.3 | 20.0 | 71.4 | 8.6 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –5.8 | –1.6 | 1.4 | 91.3 | 7.2 |

| Commercial and Industrial Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 22.4 | 15.0 | 34.3 | 53.7 | 11.9 |

Nonperforming loans | –16.7 | –13.4 | 3.0 | 77.3 | 19.7 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –4.6 | –1.6 | 1.5 | 92.4 | 6.1 |

| Commercial Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 30.9 | 40.3 | 44.1 | 42.6 | 13.2 |

Nonperforming loans | –16.1 | –20.9 | 1.5 | 80.9 | 17.6 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –9.0 | –1.6 | 0.0 | 91.0 | 9.0 |

| Residential Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 14.5 | 19.2 | 33.3 | 47.8 | 18.8 |

Nonperforming loans | –10.1 | –7.4 | 0.0 | 89.9 | 10.1 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –4.4 | –1.5 | 0.0 | 95.6 | 4.4 |

| Consumer Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 2.8 | 5.5 | 16.7 | 69.4 | 13.9 |

Nonperforming loans | –4.1 | 0.0 | 4.2 | 87.5 | 8.3 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –1.4 | –1.4 | 0.0 | 98.6 | 1.4 |

| Banking Outlook: What is your expectation for the following items six months from now? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Total loan demand | 51.4 | 59.8 | 62.5 | 26.4 | 11.1 |

Nonperforming loans | –5.7 | –4.1 | 12.9 | 68.6 | 18.6 |

| General Business Activity: What is your evaluation of the level of activity? | |||||

| Indicator | Current Index | Previous Index | % Reporting Better | % Reporting No Change | % Reporting Worse |

Over the past six weeks | 38.9 | 48.6 | 48.6 | 41.7 | 9.7 |

Six months from now | 35.2 | 38.8 | 52.1 | 31.0 | 16.9 |

Comments from Survey Respondents

Respondents were given an opportunity to comment on any issues that may be affecting their business.

These comments are from respondents’ completed surveys and have been edited for publication.

- Staffing shortages, supply-chain shortages and wage/salary inflation continue to be issues.

- There is a slight concern that loan demand will slow as rates increase. Another barrier is acquiring talent—costs of employees continue to increase due to a shortage in the workforce.

- Presently, banks are challenged by loan production surpassing the extraordinary rate of payoffs. Many of the payoffs were the result of borrowers who saw opportunities to take advantage of the significant increase in their property values. There are also concerns around the anticipated rate hikes, as this may deteriorate future lending opportunities.

- The greatest concern going into 2022 will be the impact from the Federal Reserve interest rate changes and the potential negative impact they will have on borrowing demand.

- We saw a slight slowdown in January due to the [COVID-19] omicron variant hitting our region, but things have drastically improved. Businesses are still concerned about labor shortages affecting their normal operations.

- A concern we have is what effect rising rates will have on the local economy.

- Issues affecting our business include: 1. The focus on interest rate stress-testing; bumping cushions 2. Inflation shocks centered in commercial and industrial in 2021—steel, resin, etc. 3. Inflation shocks in real estate construction projects nearing completion that are seeing contingency budgets exhausted due to higher lumber and steel prices in 2021, thus requiring more equity and/or loan dollars to finish. 4. The expectation of a turbulent 2022 with one-off credit issues not tied to specific industry trends, but to specific issues around supply chains, labor and compressed margins.

- Trying to increase net interest margin in a rising rate environment [is a concern].

- We continue to have regulatory whiplash concerns. We also have continued concerns regarding inflation.

- We have continued concerns regarding excess liquidity. We also have concerns about a commercial real estate bubble.

- We anticipate the need to navigate an interesting environment over the next six months, with higher interest rates and inflation in a mixed consumer and regulatory environment.

- Inflation, international events and ongoing pandemic concerns are affecting our business.

- Continued inflation, competition for labor, and the continuous spread of COVID require ongoing changes to our growth strategy.

- One issue is regulatory policy that will reduce our ability to serve our customers. An example is the Consumer Finance Protection Bureau’s implementation of section 1017 of the Dodd–Frank Act. Also, reputation risk positions by regulators are limiting our ability to lend in the oil and gas area or to have customers in the sale or manufacturing of firearms or ammunition.

- Our concerns are: 1. Inflation; 2. Economy; 3. Increased regulations; 4. COVID; 5. Deficit spending by the federal government; 6. Staffing shortages.

- Global war fears, distrust of our own government, open borders—these are all causing great concern with our members.

- We remain concerned regarding inflated commercial and residential real estate values. We have customers requesting to extract “paper” equity even on purchase transactions that occurred less than 12 months ago.

Historical Data

Historical data can be downloaded dating back to March 2017. For the definitions, see data definitions.

NOTE: The following series were discontinued in May 2020: volume of core deposits, cost of funds, non-interest income and net interest margin.

Questions regarding the Banking Conditions Survey can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Banking Conditions Survey is released on the web.