Banking Conditions Survey

Loan Volume Growth Decelerates, Outlooks Worsen

For this survey, respondents were asked supplemental questions on deposit rates. Read the special questions results.

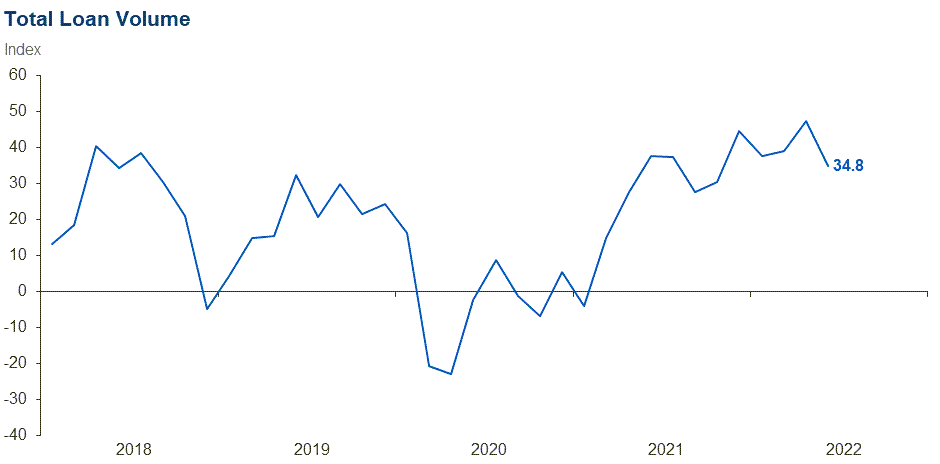

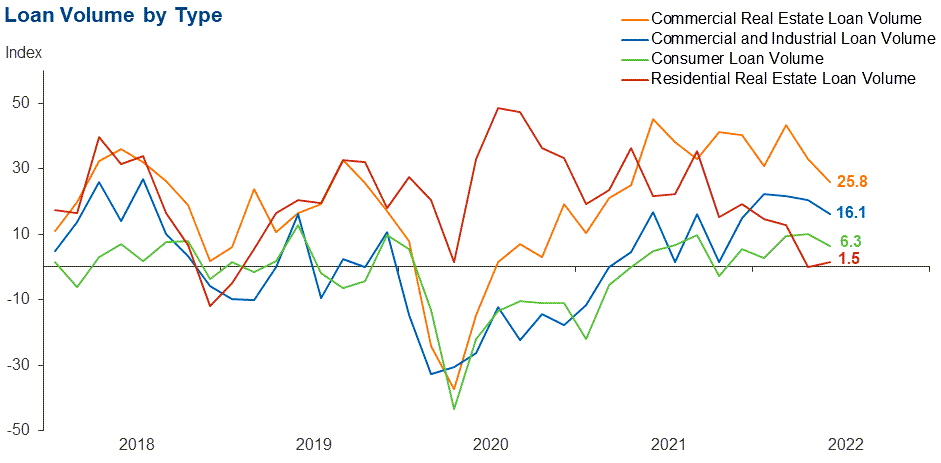

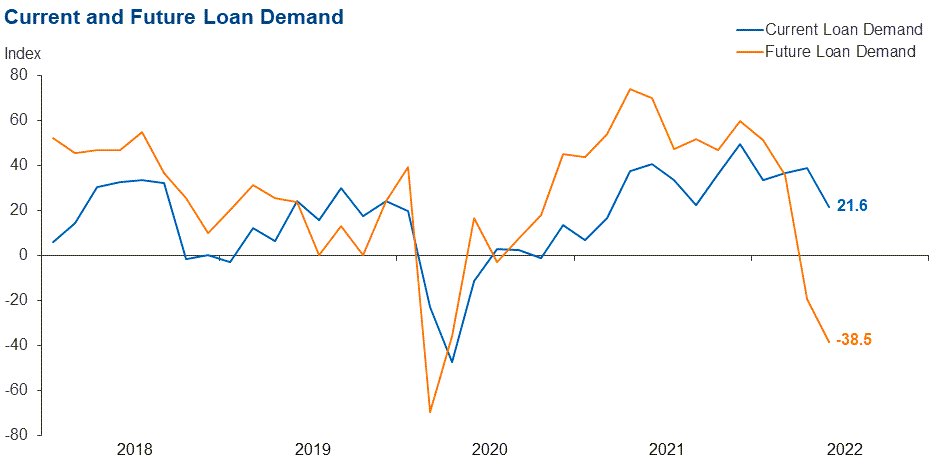

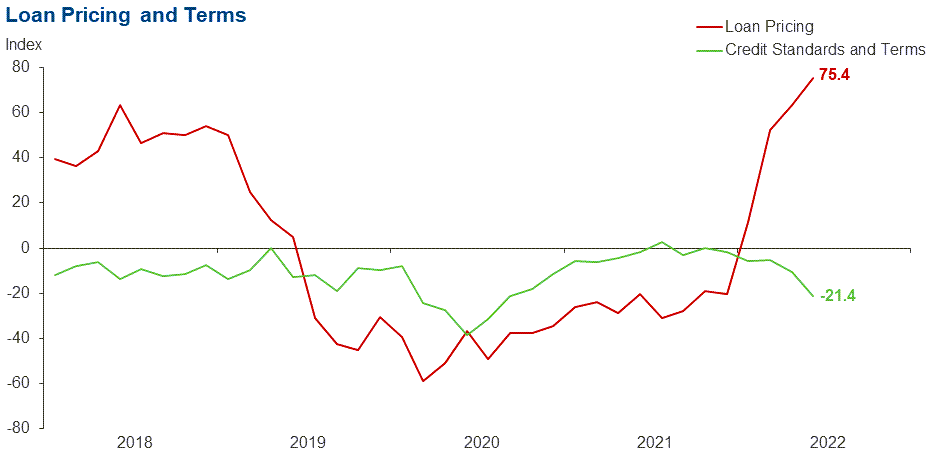

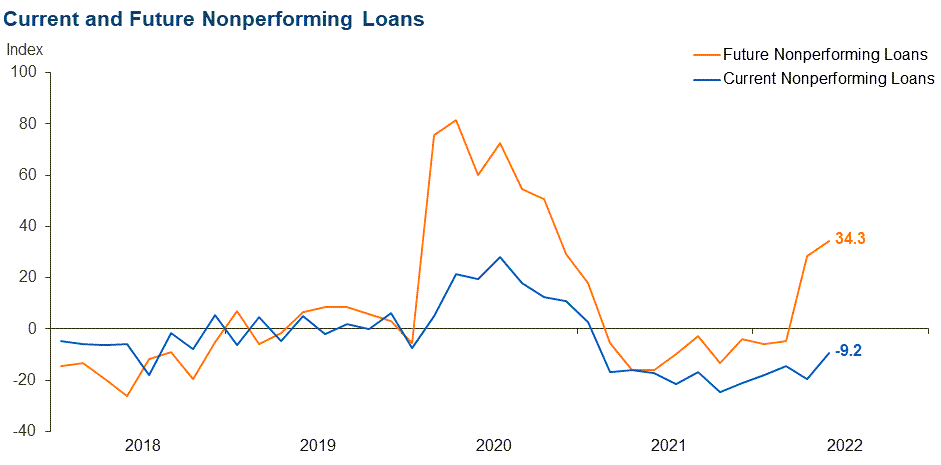

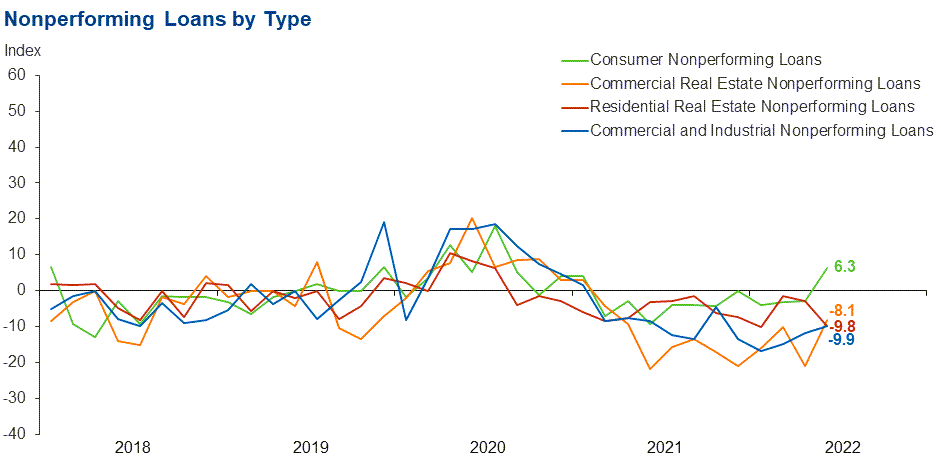

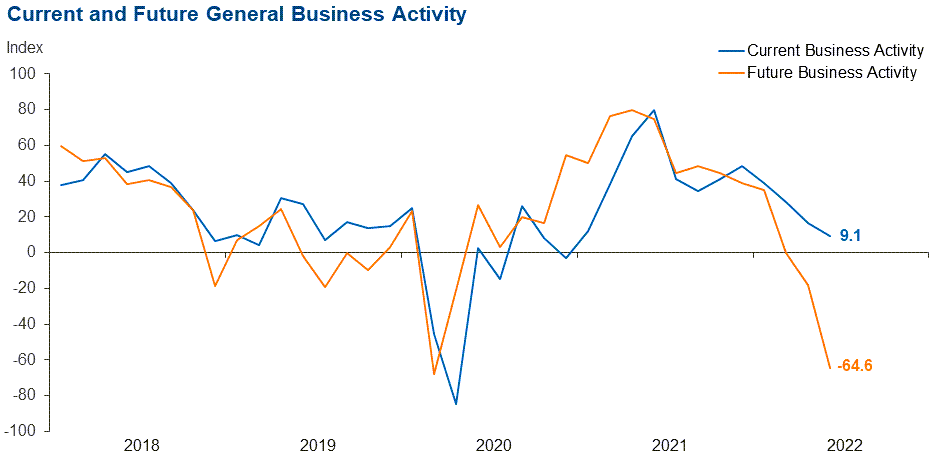

Loan volume growth moderated over the past six weeks amid broad increases in loan pricing. Volume growth was strongest in commercial real estate loans, followed by commercial and industrial loans, though a deceleration was seen in both. Residential real estate loan volumes saw no change for a second period in a row after two years of solid growth. Nonperforming loans continued to decrease overall, though an uptick was seen in nonperforming consumer loans. Credit standards and terms tightened notably. Looking six months ahead, contacts expect that general business activity and loan demand will decrease, and nonperforming loans will increase.

Next release: August 22, 2022

Data were collected June 14–22, and 66 financial institutions responded to the survey. The Federal Reserve Bank of Dallas conducts the Banking Conditions Survey twice each quarter to obtain a timely assessment of activity at banks and credit unions headquartered in the Eleventh Federal Reserve District. CEOs or senior loan officers of financial institutions report on how conditions have changed for indicators such as loan volume, nonperforming loans and loan pricing. Respondents are also asked to report on their banking outlook and their evaluation of general business activity.

Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease (or tightening) from the percentage reporting an increase (or easing). When the share of respondents reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior reporting period. If the share of respondents reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior reporting period. An index will be zero when the number of respondents reporting an increase is equal to the number reporting a decrease.

Results Summary

Historical data are available from March 2017.

| Total Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 34.8 | 47.2 | 51.5 | 31.8 | 16.7 |

Loan demand | 21.6 | 38.9 | 38.5 | 44.6 | 16.9 |

Nonperforming loans | –9.2 | –19.7 | 6.2 | 78.5 | 15.4 |

Loan pricing | 75.4 | 63.4 | 76.9 | 21.5 | 1.5 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –21.4 | –10.6 | 1.6 | 75.4 | 23.0 |

| Commercial and Industrial Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 16.1 | 20.3 | 29.0 | 58.1 | 12.9 |

Nonperforming loans | –9.9 | –11.9 | 4.9 | 80.3 | 14.8 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –14.8 | –7.7 | 0.0 | 85.2 | 14.8 |

| Commercial Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 25.8 | 32.9 | 41.9 | 41.9 | 16.1 |

Nonperforming loans | –8.1 | –20.9 | 3.2 | 85.5 | 11.3 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –16.2 | –5.9 | 3.2 | 77.4 | 19.4 |

| Residential Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 1.5 | 0.0 | 31.7 | 38.1 | 30.2 |

Nonperforming loans | –9.8 | –3.0 | 3.3 | 83.6 | 13.1 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –11.3 | –4.5 | 1.6 | 85.5 | 12.9 |

| Consumer Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 6.3 | 9.9 | 18.8 | 68.8 | 12.5 |

Nonperforming loans | 6.3 | –2.8 | 9.5 | 87.3 | 3.2 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –9.7 | –2.9 | 0.0 | 90.3 | 9.7 |

| Banking Outlook: What is your expectation for the following items six months from now? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Total loan demand | –38.5 | –19.4 | 21.5 | 18.5 | 60.0 |

Nonperforming loans | 34.3 | 28.5 | 40.6 | 53.1 | 6.3 |

| General Business Activity: What is your evaluation of the level of activity? | |||||

| Indicator | Current Index | Previous Index | % Reporting Better | % Reporting No Change | % Reporting Worse |

Over the past six weeks | 9.1 | 16.7 | 36.4 | 36.4 | 27.3 |

Six months from now | –64.6 | –18.0 | 7.7 | 20.0 | 72.3 |

Comments from Survey Respondents

Respondents were given an opportunity to comment on any issues that may be affecting their business.

These comments are from respondents’ completed surveys and have been edited for publication.

- The yield curve as the Federal Reserve attempts to tame the inflation tiger [is an issue of concern].

- Rapidly rising interest rates will be a significant factor in underwriting commercial real estate loans. While cap rates and values may lag in the time they take to adjust, underwriting project cash flow to debt service is getting tight and requires “trended rents” to make the projected debt service coverage work.

- Operating costs continue to escalate, while lending demand is expected to decline. We have concerns the Federal Reserve will fail in its attempt to engineer a soft landing, with the recent inversion of the yield curve possibly signaling a real risk of a recession. Drought conditions have worsened throughout Texas and New Mexico.

- Inflation is driving all conversations and decisions. We are contemplating across-the-board compensation adjustments to assist our team members. Loan decisions are being delayed, and our loan pipeline has decreased considerably.

- Asset/liability management seems to be a hot topic to senior management. Supply-chain constraints and a tight labor market are still on our commercial account holders’ minds, but they seem to be managing these through increased prices of goods and services to the consumer. So far, the consumer is tolerating these well, but we believe that continued high prices for an extended period will eventually lead to spending “exhaustion” and a slowdown in economic activity.

- Home prices were expensive in the low-rate environment over the past several years but now are unaffordable for most given the current rates.

- Rising rates, slowing economy and deceasing loan demand [are issues of concern].

- Politicization of the banking industry and wild swings of regulation that are not approved legislation by Congress [are issues of concern].

- Recession clouds are looming. Rising increase rates will slow real estate loans to a crawl.

- We are beginning to see the impact of inflation and volatility in equity markets impacting operational expenditures and net share flows. We have continued concerns related to the future of regulatory actions driving up costs to financial institutions and adversely impacting members over the next year, potentially in combination with continuing inflationary pressures.

- Inflation, rising oil prices, Russian/Ukrainian war, potential recession, increasing rise in delinquency and charge offs, declining stock market values and lack of leadership in Washington [are issues of concern].

- Inflation will continue to cause significant uncertainty in the marketplace.

- Overall, the economy appears to be headed in the wrong direction. Inflation is too high, labor market participation is too low, labor wages are increasing too rapidly (but not fast enough to keep up with inflation) and the Consumer Financial Protection Bureau is creating an adversarial relationship with the industry. Too many negatives outweigh the positives of the economy.

- The Biden administration is making decisions that are negatively impacting our membership and thereby causing us to anticipate a declining financial market overall. I do not anticipate any relief from this administration.

- We are preparing for a slowdown in loan volume as interest rates rise. We also anticipate a decrease in commercial and residential real estate values due to the slowdown in investor demand.

Historical Data

Historical data can be downloaded dating back to March 2017. For the definitions, see data definitions.

NOTE: The following series were discontinued in May 2020: volume of core deposits, cost of funds, non-interest income and net interest margin.

Questions regarding the Banking Conditions Survey can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Banking Conditions Survey is released on the web.