Banking Conditions Survey

Loan Demand Falls Sharply, Bankers Expect Further Declines Ahead

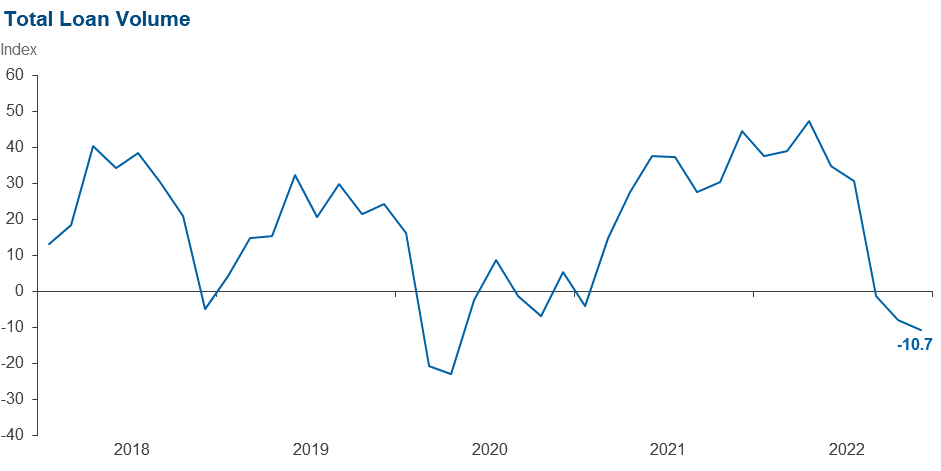

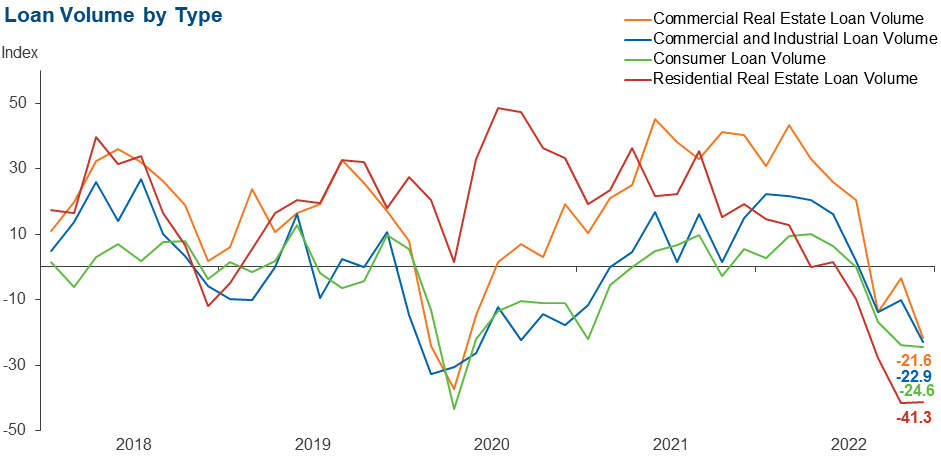

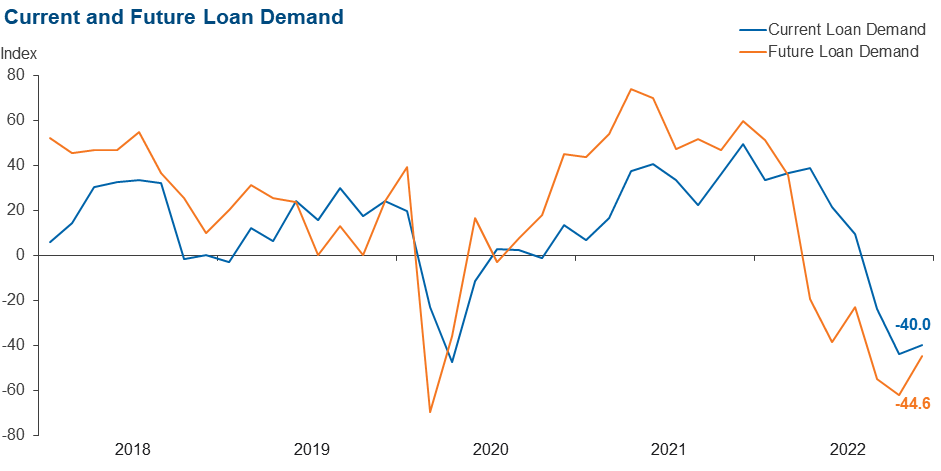

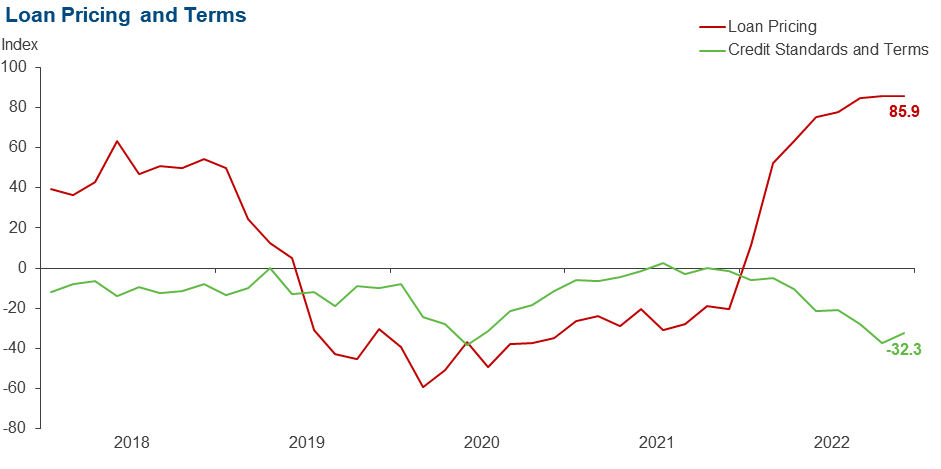

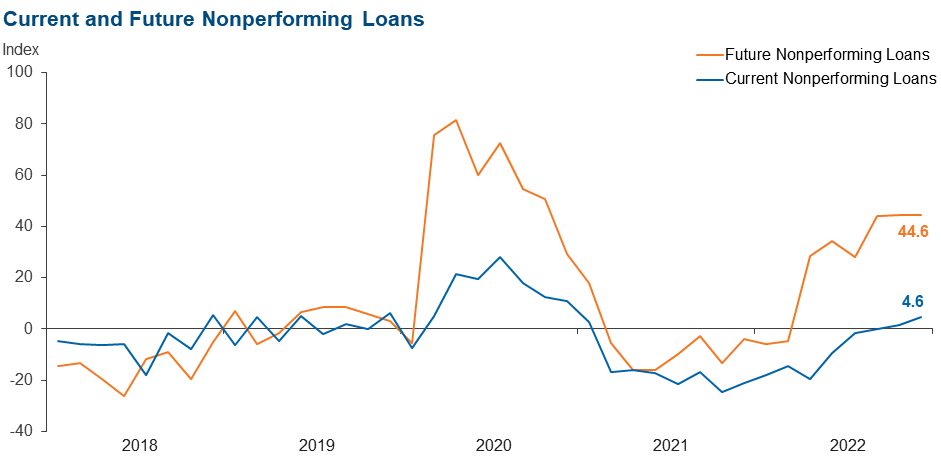

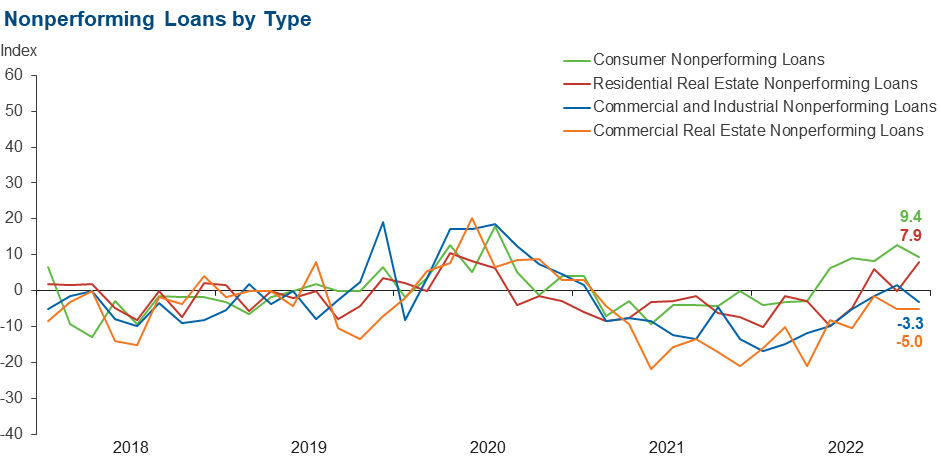

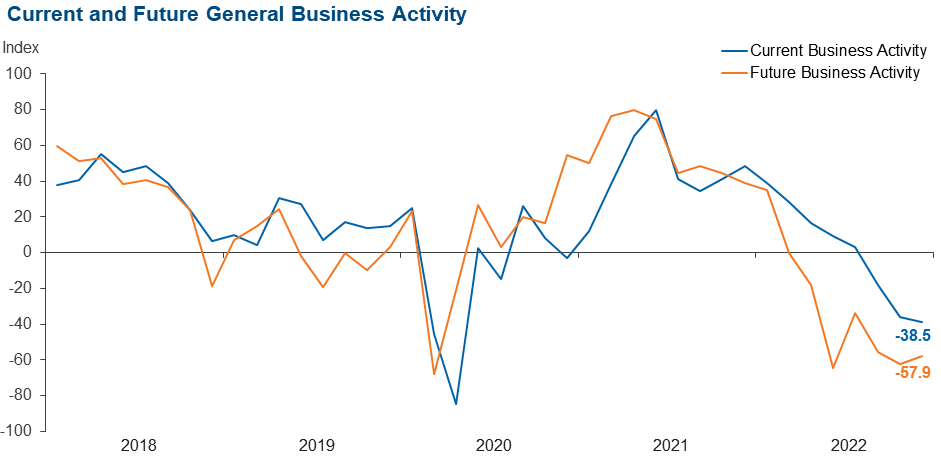

Loan volumes declined for the third period in a row, and loan demand continued to fall sharply. Volume declines were across all loan categories and led by residential real estate, and commercial real estate and commercial and industrial loans experienced an accelerated decline from the prior period. Loan nonperformance increased slightly overall, with the rise stemming from residential real estate and consumer loans. Contacts again overwhelmingly reported loan price increases, and credit standards and terms continued to tighten. Business activity experienced a significant decline, and expectations for the next six months are for loan demand and business activity to decline further and loan nonperformance to increase.

Next release: February 20, 2023

Data were collected December 20–28, and 65 financial institutions responded to the survey. The Federal Reserve Bank of Dallas conducts the Banking Conditions Survey twice each quarter to obtain a timely assessment of activity at banks and credit unions headquartered in the Eleventh Federal Reserve District. CEOs or senior loan officers of financial institutions report on how conditions have changed for indicators such as loan volume, nonperforming loans and loan pricing. Respondents are also asked to report on their banking outlook and their evaluation of general business activity.

Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease (or tightening) from the percentage reporting an increase (or easing). When the share of respondents reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior reporting period. If the share of respondents reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior reporting period. An index will be zero when the number of respondents reporting an increase is equal to the number reporting a decrease.

Results Summary

Historical data are available from March 2017.

| Total Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | –10.7 | –7.8 | 26.2 | 36.9 | 36.9 |

Loan demand | –40.0 | –43.7 | 10.8 | 38.5 | 50.8 |

Nonperforming loans | 4.6 | 1.6 | 16.9 | 70.8 | 12.3 |

Loan pricing | 85.9 | 85.7 | 85.9 | 14.1 | 0.0 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –32.3 | –37.5 | 0.0 | 67.7 | 32.3 |

| Commercial and Industrial Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | –22.9 | –10.0 | 8.2 | 60.7 | 31.1 |

Nonperforming loans | –3.3 | 1.7 | 4.9 | 86.9 | 8.2 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –19.7 | –29.3 | 0.0 | 80.3 | 19.7 |

| Commercial Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | –21.6 | –3.5 | 16.7 | 45.0 | 38.3 |

Nonperforming loans | –5.0 | –5.1 | 3.3 | 88.3 | 8.3 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –26.7 | –36.8 | 0.0 | 73.3 | 26.7 |

| Residential Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | –41.3 | –41.7 | 14.3 | 30.2 | 55.6 |

Nonperforming loans | 7.9 | 0.0 | 12.7 | 82.5 | 4.8 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –11.3 | –20.0 | 1.6 | 85.5 | 12.9 |

| Consumer Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | –24.6 | –23.8 | 15.4 | 44.6 | 40.0 |

Nonperforming loans | 9.4 | 12.7 | 14.1 | 81.3 | 4.7 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –12.7 | –15.0 | 0.0 | 87.3 | 12.7 |

| Banking Outlook: What is your expectation for the following items six months from now? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Total loan demand | –44.6 | –61.9 | 20.0 | 15.4 | 64.6 |

Nonperforming loans | 44.6 | 44.4 | 47.7 | 49.2 | 3.1 |

| General Business Activity: What is your evaluation of the level of activity? | |||||

| Indicator | Current Index | Previous Index | % Reporting Better | % Reporting No Change | % Reporting Worse |

Over the past six weeks | –38.5 | –36.0 | 9.2 | 43.1 | 47.7 |

Six months from now | –57.9 | –62.5 | 10.9 | 20.3 | 68.8 |

Comments from Survey Respondents

Respondents were given an opportunity to comment on any issues that may be affecting their business.

These comments are from respondents’ completed surveys and have been edited for publication.

- Macro and regulatory headwinds will decrease economic growth, most likely resulting in a recession.

- Credit quality has been so strong, there is only one direction it can go. The rapid rise in Federal Reserve rates will slow down the economy; however, the effect in Texas should be muted due to the strength of the business environment here, including the contributions from the energy sector, favorable regulation and in-migration of businesses and people from other parts of the country.

- Retaining deposits [is an issue of concern].

- Rising rates [are an issue of concern].

- We are concerned about the rising interest rates and the ability to repay debt, but to date we have not seen any issues. The consumers and businesses seem to be adapting quickly to the new rates. While raising interest rates seems to slow the economy down, it also is a cost to businesses that are passing the increased cost along. Our area is still growing due to the large amount of industrial investment into new plants.

- We continued to be challenged with the pace of interest rate increases and inflation impacts on the membership. Interest rate increases are (as designed) raising costs of members borrowing funds, decreasing auto and home availability for certain borrowers. On the deposit front, "rate specials" and high rates by liquidity-pressed financial institutions are beginning to result in modest deposit outflows. This is combined with inflation, driving members to draw down pandemic-era savings, and concerns regarding potential higher credit risk and an active regulatory environment. All these things are collectively driving a fair amount of uncertainty as we wrap up 2022 and focus on 2023.

- The continued increase in prices has led to increases in wages, which have major impacts on operating expenses. Additionally, the rising interest rates have forced deposit rates to increase faster than modeled in various ALM [asset and liability management] planning scenarios.

- The increase in short-term commercial loan rates and higher mortgage rates has slowed loan growth in both of these areas. Commercial real estate loans originated three to five years ago with interest rate adjustments are being monitored for potential negative cash flow situations.

Historical Data

Historical data can be downloaded dating back to March 2017. For the definitions, see data definitions.

NOTE: The following series were discontinued in May 2020: volume of core deposits, cost of funds, non-interest income and net interest margin.

Questions regarding the Banking Conditions Survey can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Banking Conditions Survey is released on the web.