Banking Conditions Survey

For this survey, Eleventh District banking executives were asked supplemental questions on outlook concerns and commercial real estate lending and interest rates. Read the special questions results.

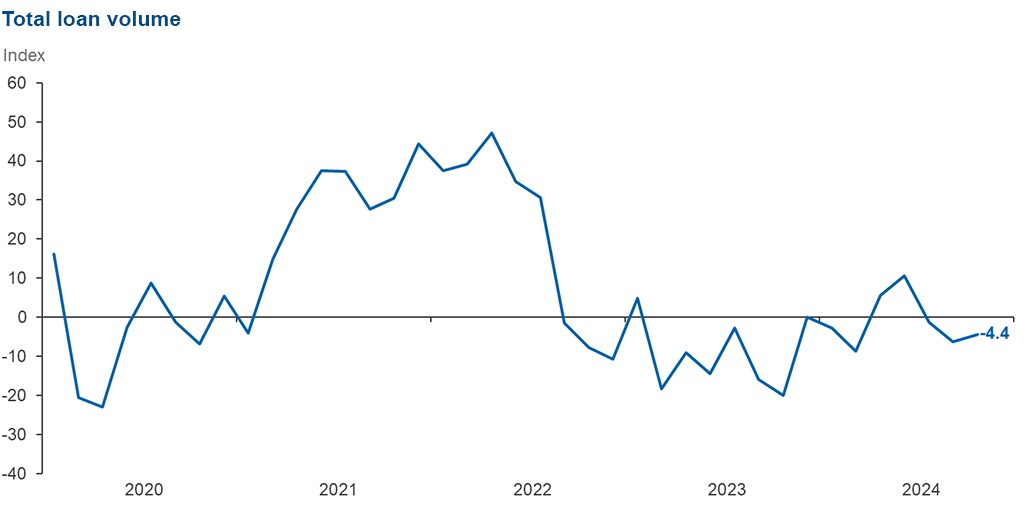

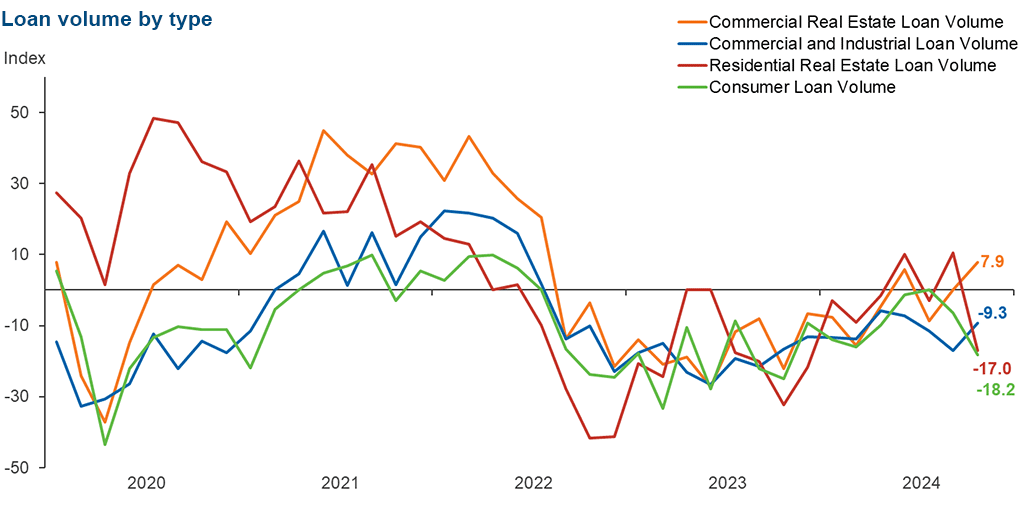

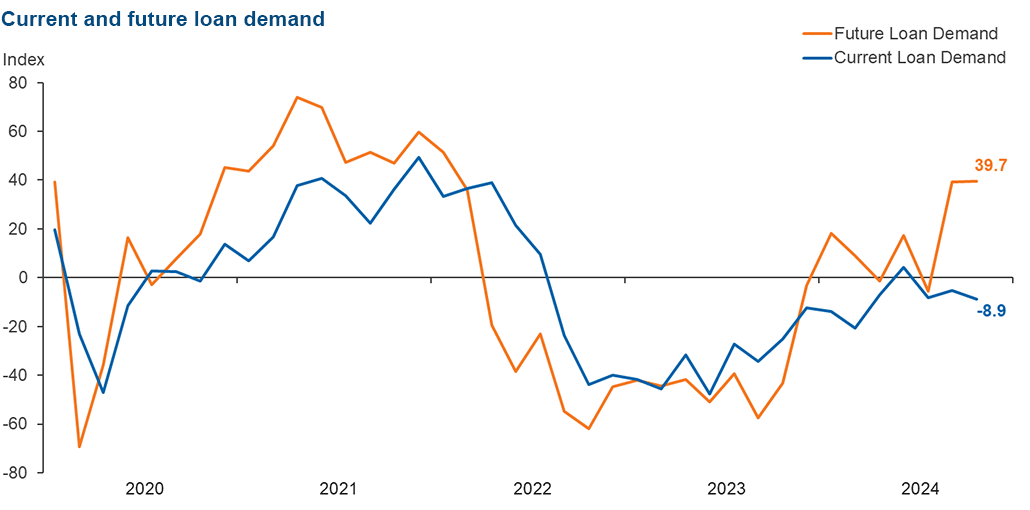

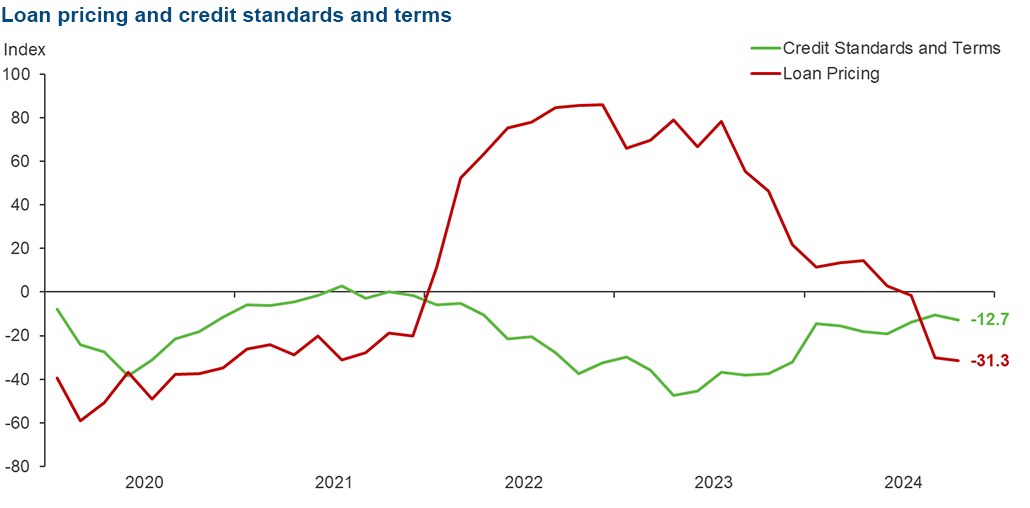

Loan volume and loan price declines continued in November, as did credit tightening, with the pace of change similar to six weeks ago. Overall, loan nonperformance rose at a sharply accelerated pace, driven by an increase in delinquency for residential and commercial real estate loans. Despite that, bankers’ outlooks are optimistic. They expect a significant improvement in loan demand and business activity six months from now.

Next release: December 30, 2024

Data were collected November 5–13, and 80 financial institutions responded to the survey. The Federal Reserve Bank of Dallas conducts the Banking Conditions Survey twice each quarter to obtain a timely assessment of activity at banks and credit unions headquartered in the Eleventh Federal Reserve District. CEOs or senior loan officers of financial institutions report on how conditions have changed for indicators such as loan volume, nonperforming loans and loan pricing. Respondents are also asked to report on their banking outlook and their evaluation of general business activity.

Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease (or tightening) from the percentage reporting an increase (or easing). When the share of respondents reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior reporting period. If the share of respondents reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior reporting period. An index will be zero when the number of respondents reporting an increase is equal to the number reporting a decrease.

Results Summary

Historical data are available from March 2017.

| Total Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | –4.4 | –6.2 | 29.4 | 36.8 | 33.8 |

Loan demand | –8.9 | –5.2 | 26.9 | 37.3 | 35.8 |

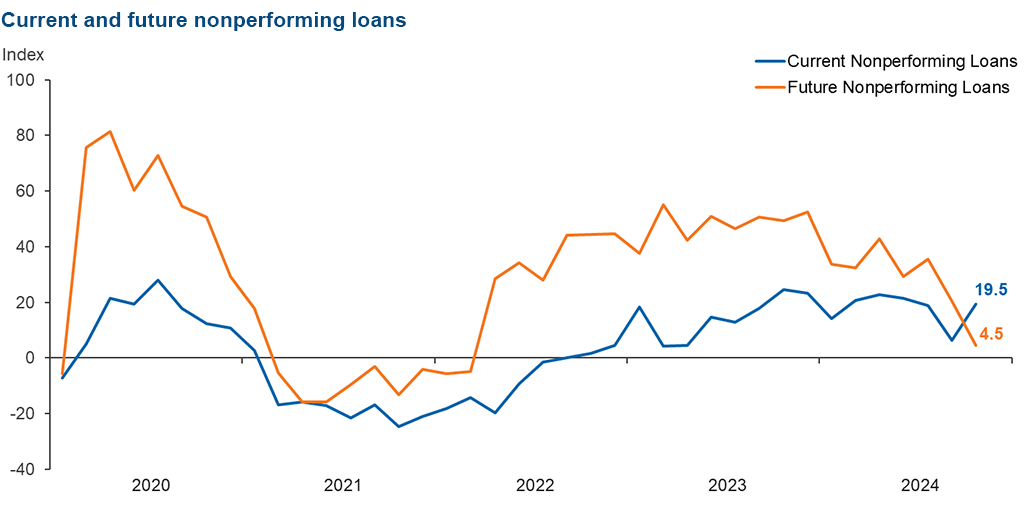

Nonperforming loans | 19.5 | 6.4 | 29.9 | 59.7 | 10.4 |

Loan pricing | –31.3 | –30.0 | 4.5 | 59.7 | 35.8 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

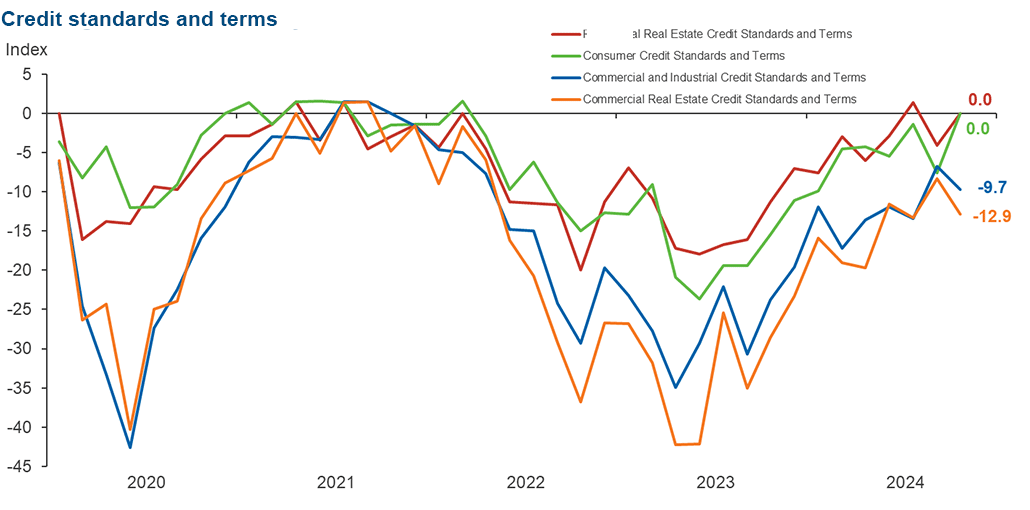

Credit standards and terms | –12.7 | –10.5 | 0.0 | 87.3 | 12.7 |

| Commercial and Industrial Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | –9.3 | –17.1 | 18.8 | 53.1 | 28.1 |

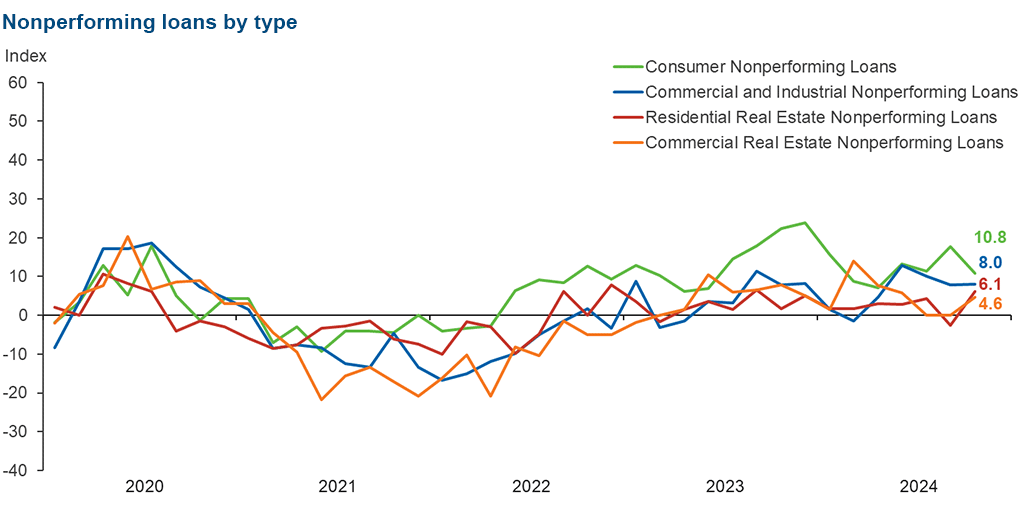

Nonperforming loans | 8.0 | 7.9 | 14.5 | 79.0 | 6.5 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –9.7 | –6.8 | 0.0 | 90.3 | 9.7 |

| Commercial Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 7.9 | 0.0 | 31.3 | 45.3 | 23.4 |

Nonperforming loans | 4.6 | 0.0 | 10.9 | 82.8 | 6.3 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –12.9 | –8.3 | 0.0 | 87.1 | 12.9 |

| Residential Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | –17.0 | 10.6 | 13.8 | 55.4 | 30.8 |

Nonperforming loans | 6.1 | –2.6 | 12.3 | 81.5 | 6.2 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | 0.0 | –4.1 | 1.6 | 96.8 | 1.6 |

| Consumer Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | –18.2 | –6.4 | 9.1 | 63.6 | 27.3 |

Nonperforming loans | 10.8 | 17.7 | 15.4 | 80.0 | 4.6 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | 0.0 | –7.6 | 1.6 | 96.9 | 1.6 |

| Banking Outlook: What is your expectation for the following items six months from now? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Total loan demand | 39.7 | 39.3 | 55.9 | 27.9 | 16.2 |

Nonperforming loans | 4.5 | 20.5 | 19.4 | 65.7 | 14.9 |

| General Business Activity: What is your evaluation of the level of activity? | |||||

| Indicator | Current Index | Previous Index | % Reporting Better | % Reporting No Change | % Reporting Worse |

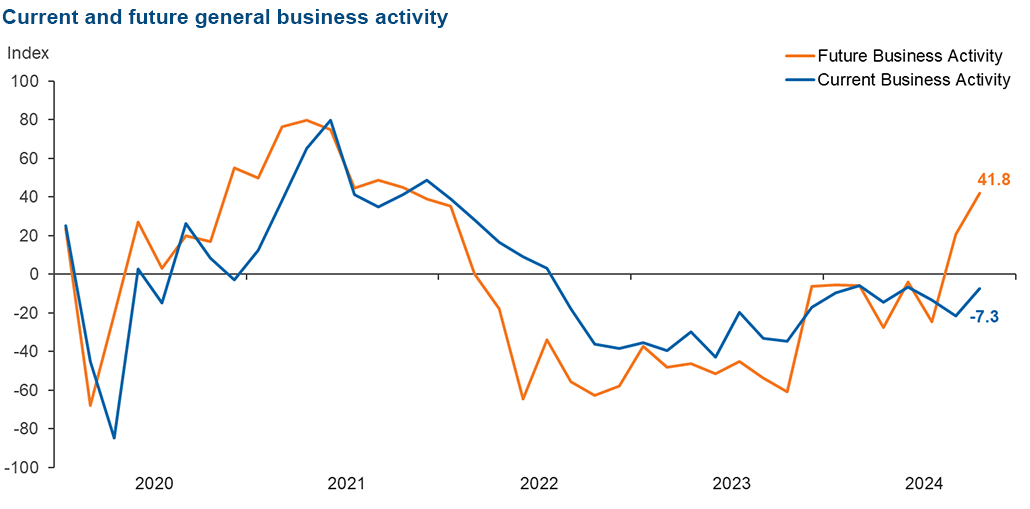

Over the past six weeks | –7.3 | –21.5 | 22.1 | 48.5 | 29.4 |

Six months from now | 41.8 | 20.5 | 55.2 | 31.3 | 13.4 |

Respondents were given an opportunity to comment on any issues that may be affecting their business.

These comments are from respondents’ completed surveys and have been edited for publication.

- Lower rates and the outcome of national elections should lead to increased activity and business investment.

- The macro impacts of uncertainty from the election and the future direction of fiscal policies have resulted in depressed loan activity.

- We expect that the Republican election sweep will result in increased capital spending and loan demand due to perception that there will be a more favorable operating climate for businesses.

- Private middle-market C&I [commercial and industrial] firms continue to be burdened by inflation as embedded labor and supply costs are keeping pressure on margins. Small businesses that can't raise prices are closing.

- Middle- and lower-income families are hurting from lack of Federal Reserve action, as are retailers who depend on these segments. The Federal Reserve should continue to aggressively lower rates.

- Continued increases in banking regulations are not sustainable for community banks. Sections 1033 and 1071, to name a few, are going to be very expensive for community banks to implement. Our community bank’s commitment to compliance is strong, but our expenses in personnel and software are tremendous. It will eventually put community banks out of business. Also, the FDIC’s signal not to insure a community bank’s deposits sent a message to consumers and businesses to only bank with the “Too Big to Fail” banks. I guess community banks are “Too Small to Save.”

- We are watching what will actually happen with election results and further rate reductions by the Federal Reserve, particularly when cuts will occur. Consumer debt is affecting borrowing capacity.

- General activity has increased slightly since the election. We are waiting to see if that is a trend.

- We have definitely seen the residential market switch to a buyers’ market, with the number of listings increasing and seller concessions increasing. Prices have remained stable, but active listings are seeing prices being lowered.

- We are concerned about the outcome of the elections and the impact on bank regulation. Tax policy is a concern because of the conversation about an increase, talk of a 28 percent tax rate versus the current 21 percent. The change in tax rates is a detriment to bank valuations and the perceived “investability” of the banking system.

Historical data can be downloaded dating back to March 2017. For the definitions, see data definitions.

NOTE: The following series were discontinued in May 2020: volume of core deposits, cost of funds, non-interest income and net interest margin.

Questions regarding the Banking Conditions Survey can be addressed to Mariam Yousuf at mariam.yousuf@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Banking Conditions Survey is released on the web.