Banking Conditions Survey

For this survey, Eleventh District banking executives were asked supplemental questions on outlook concerns, commercial real estate and the impact of tariffs. Read the special questions results.

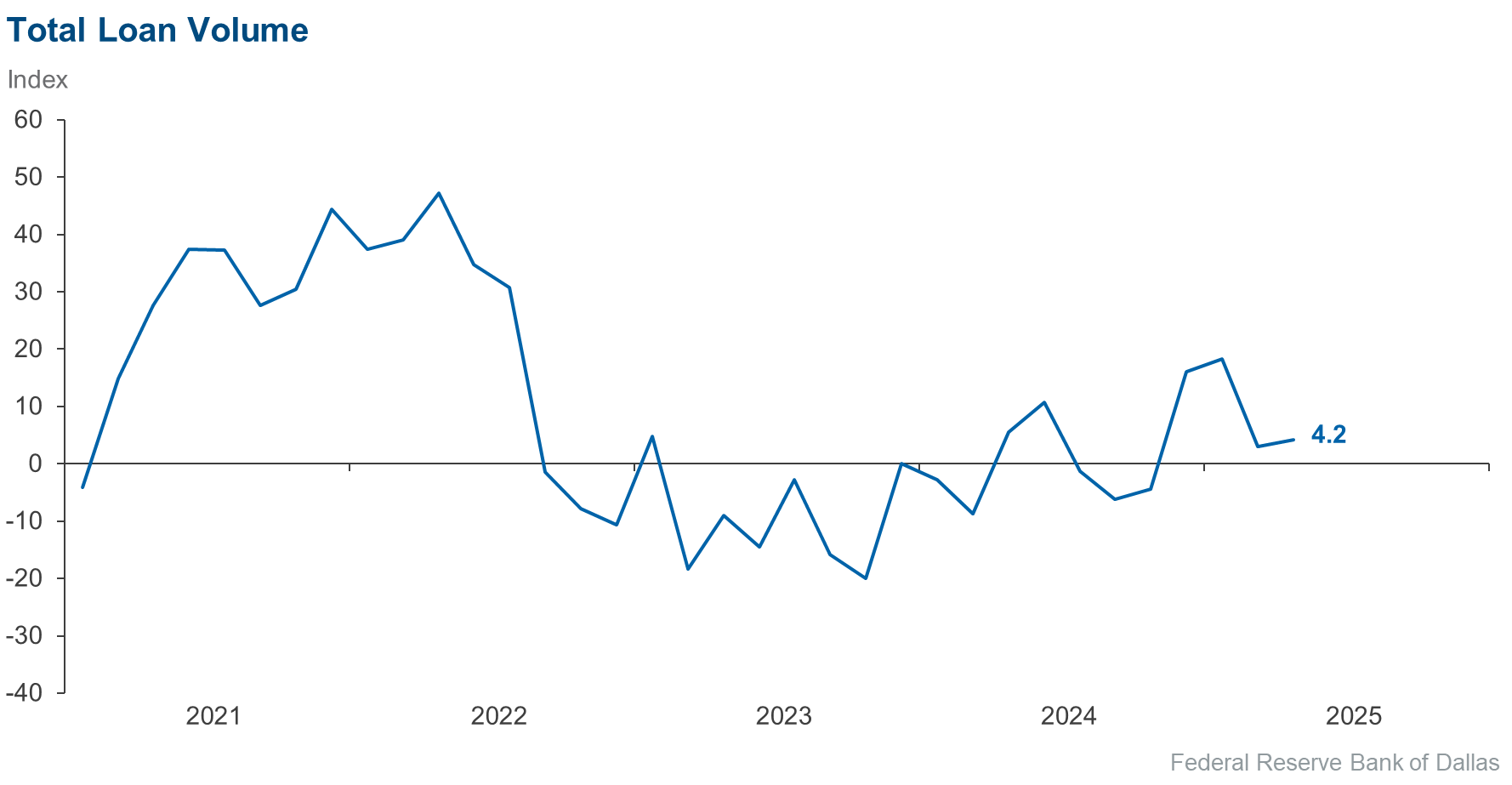

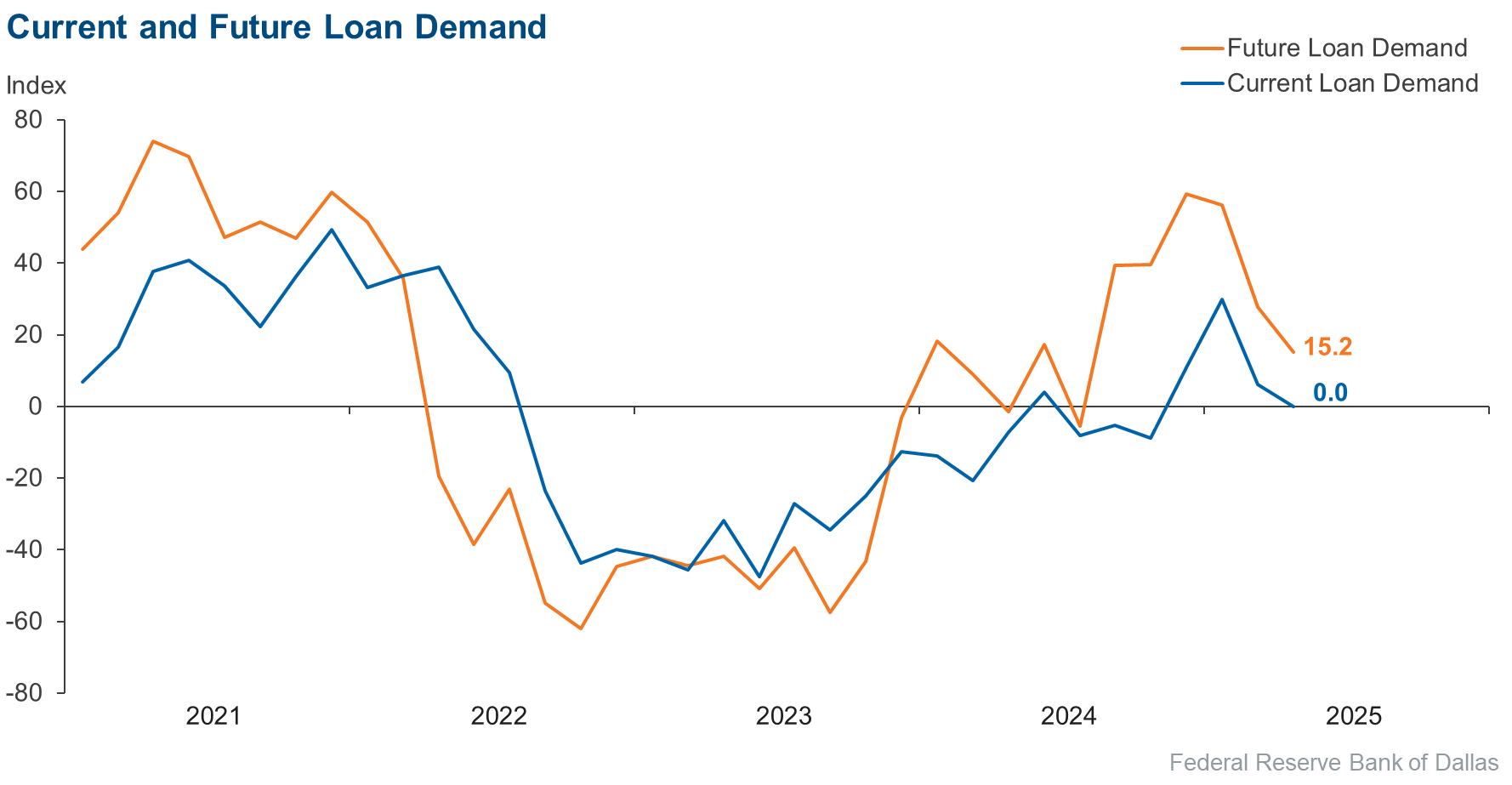

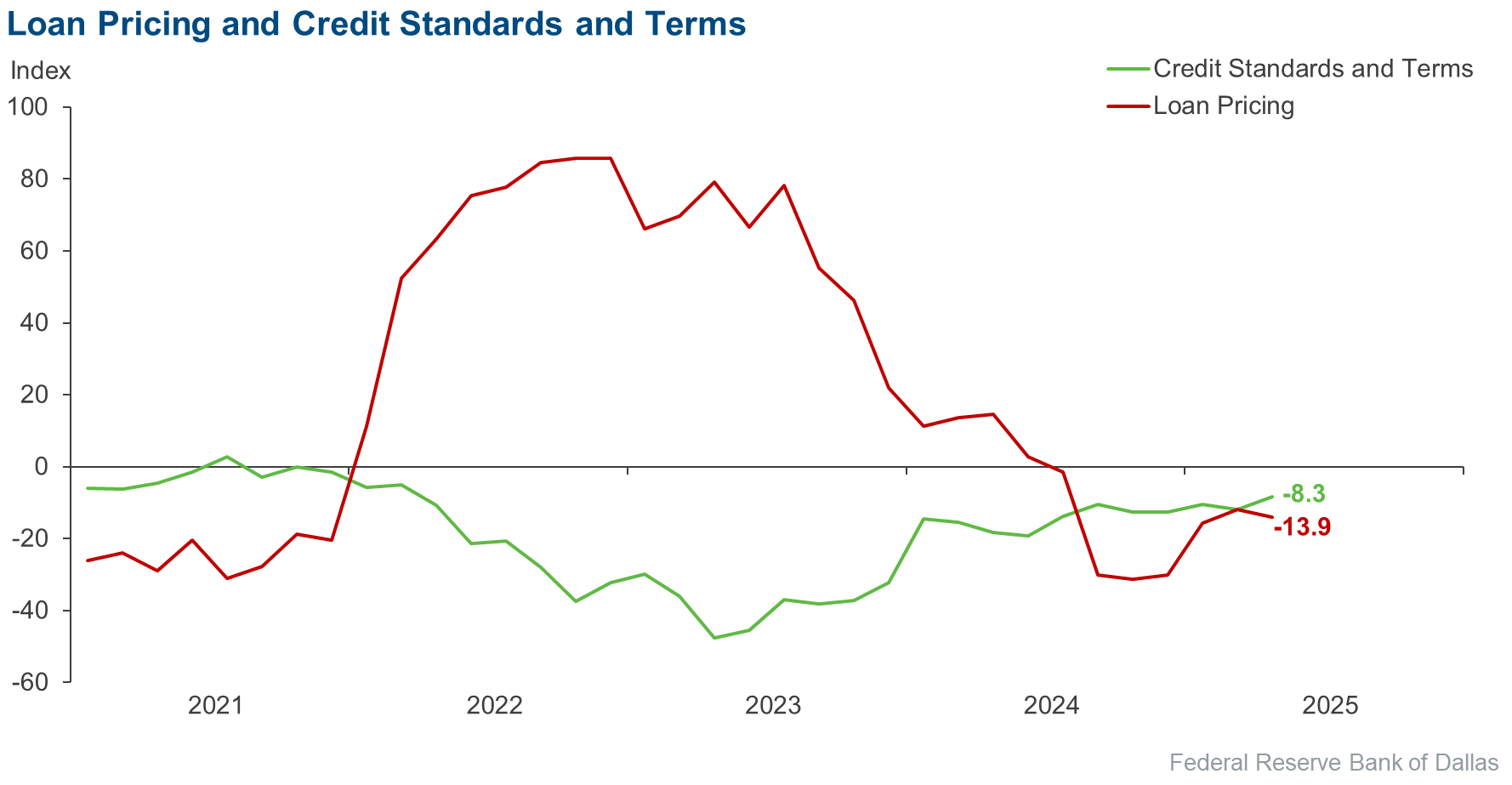

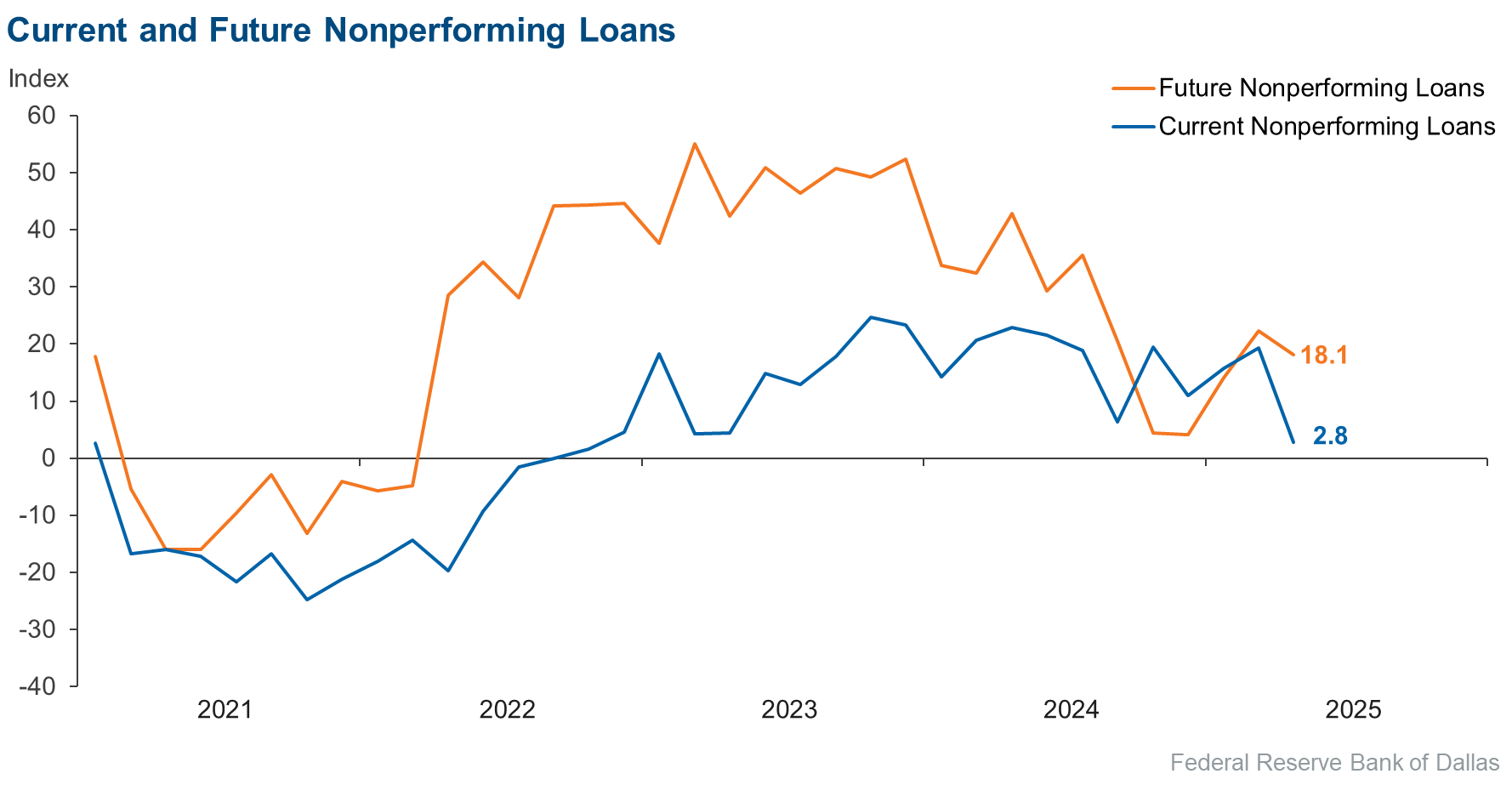

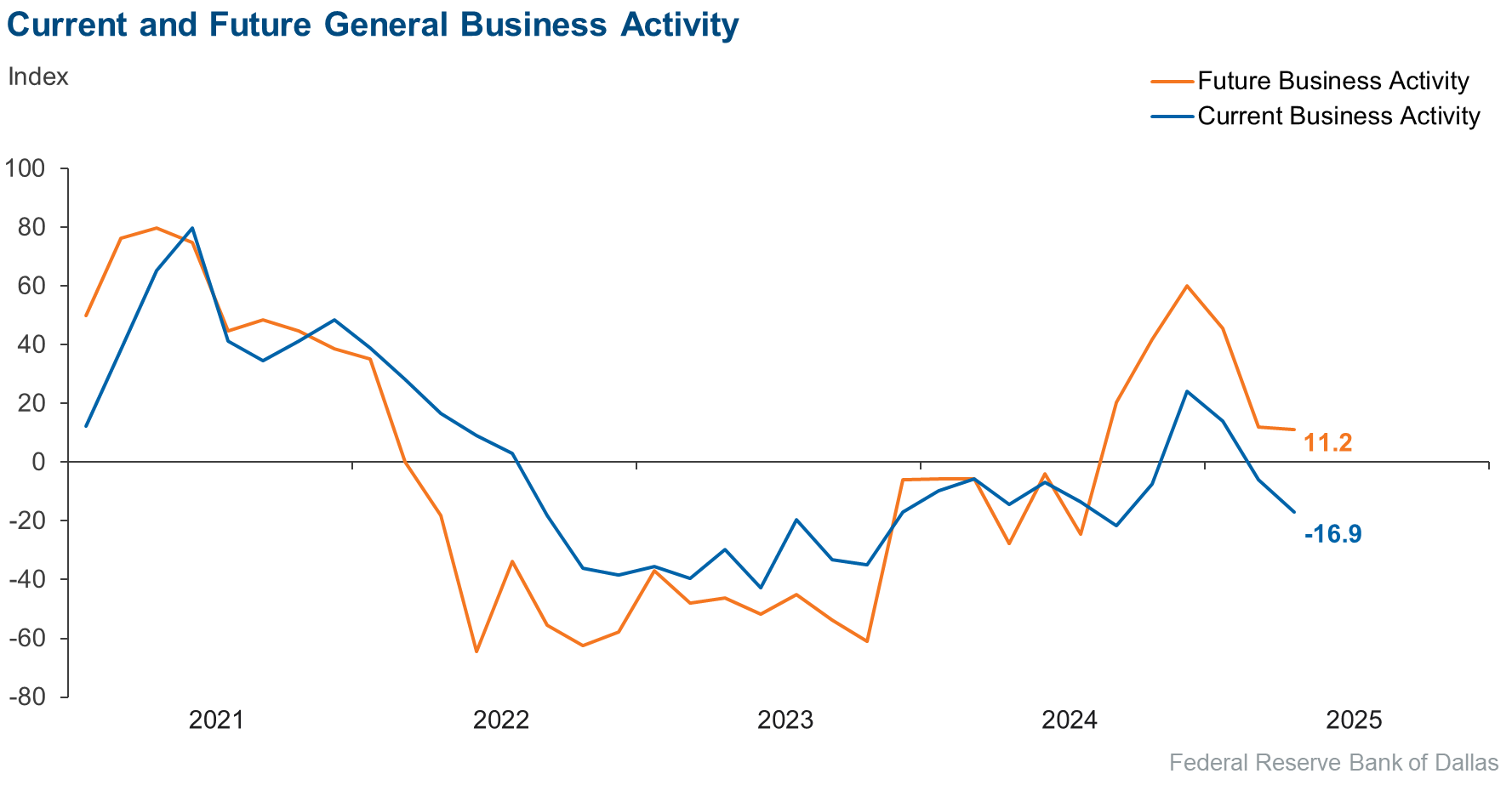

Loan volume grew slightly while loan demand was unchanged in May. Credit tightening continued, but loan pricing declined. Loan nonperformance decelerated sharply, increasing at the slowest pace since the end of 2022. Nevertheless, bankers reported a continued contraction in general business activity. Bankers are less optimistic about the outlook. On net, survey respondents still expect an improvement in loan demand and business activity six months from now, but that sentiment is less broad based than in previous months, and loan nonperformance is expected to increase.

Next release: June 30, 2025

Data were collected May 6-14, and 72 financial institutions responded to the survey. The Federal Reserve Bank of Dallas conducts the Banking Conditions Survey twice each quarter to obtain a timely assessment of activity at banks and credit unions headquartered in the Eleventh Federal Reserve District. CEOs or senior loan officers of financial institutions report on how conditions have changed for indicators such as loan volume, nonperforming loans and loan pricing. Respondents are also asked to report on their banking outlook and their evaluation of general business activity.

Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease (or tightening) from the percentage reporting an increase (or easing). When the share of respondents reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior reporting period. If the share of respondents reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior reporting period. An index will be zero when the number of respondents reporting an increase is equal to the number reporting a decrease.

Results Summary

Historical data are available from March 2017.

| Total Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | 4.2 | 3.0 | 30.6 | 43.1 | 26.4 |

Loan demand | 0.0 | 6.1 | 31.0 | 38.0 | 31.0 |

Nonperforming loans | 2.8 | 19.4 | 12.5 | 77.8 | 9.7 |

Loan pricing | –13.9 | –11.9 | 2.8 | 80.6 | 16.7 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

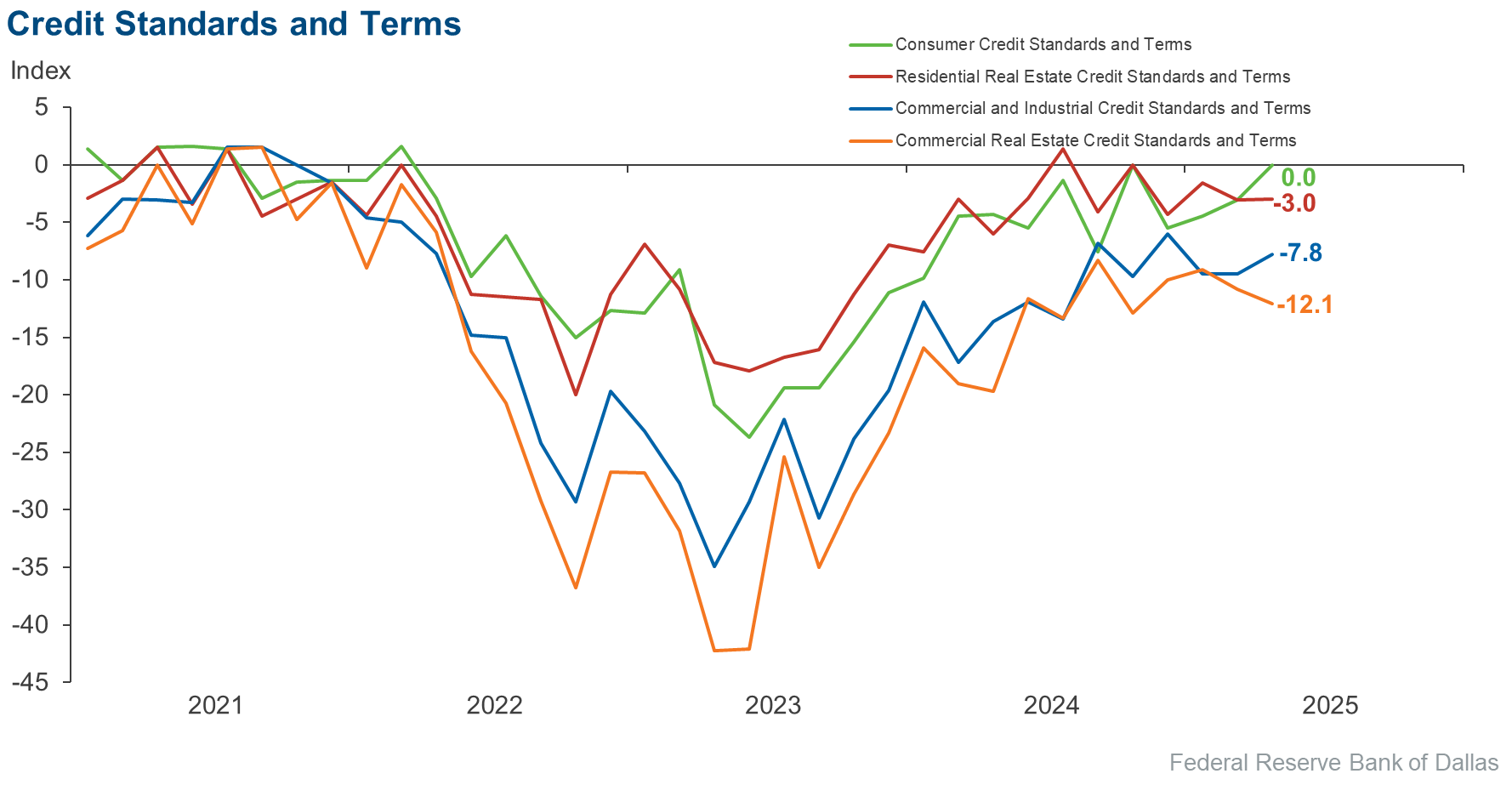

Credit standards and terms | –8.3 | –11.9 | 0.0 | 91.7 | 8.3 |

| Commercial and Industrial Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

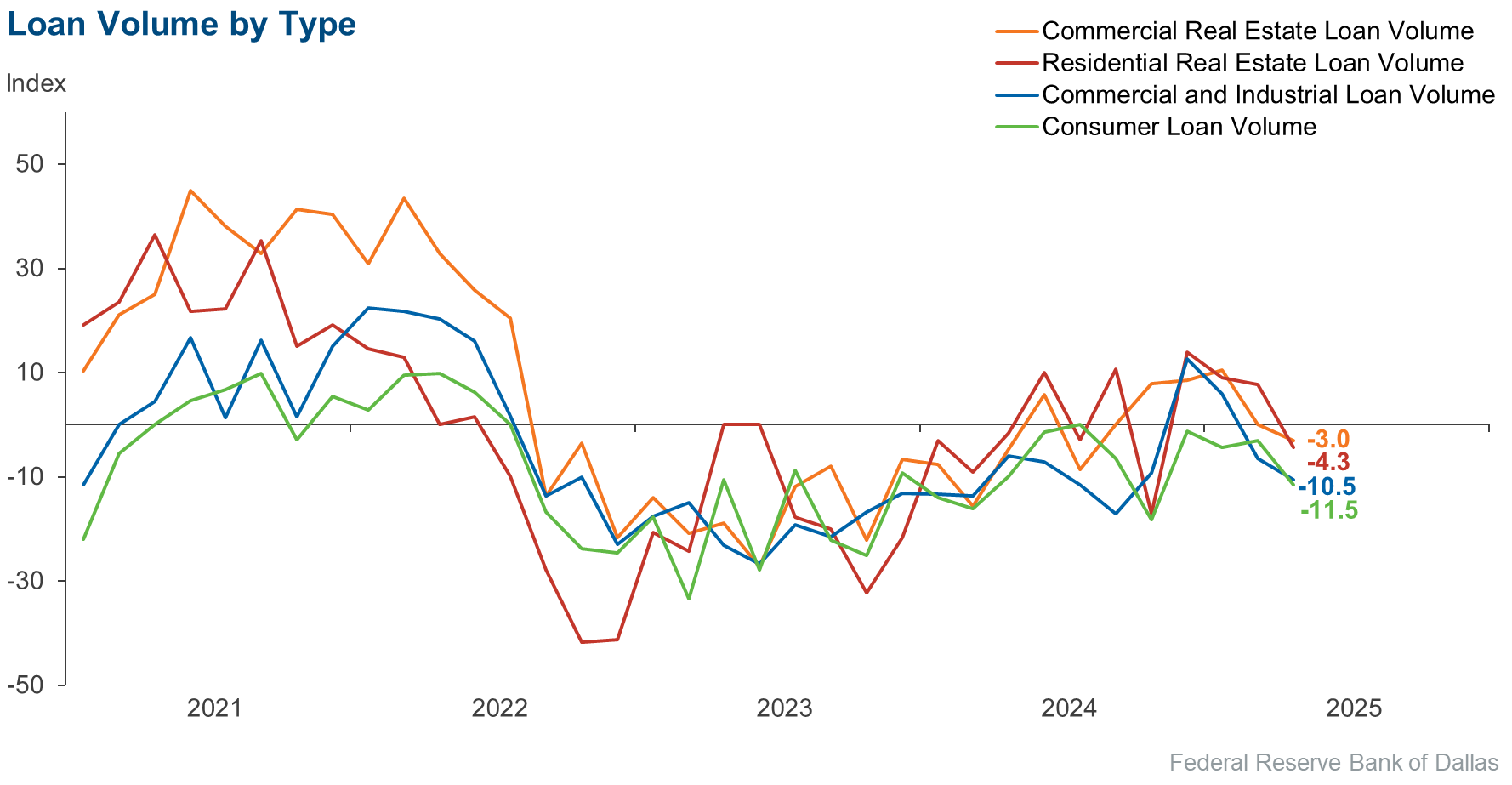

Loan volume | –10.5 | –6.4 | 13.4 | 62.7 | 23.9 |

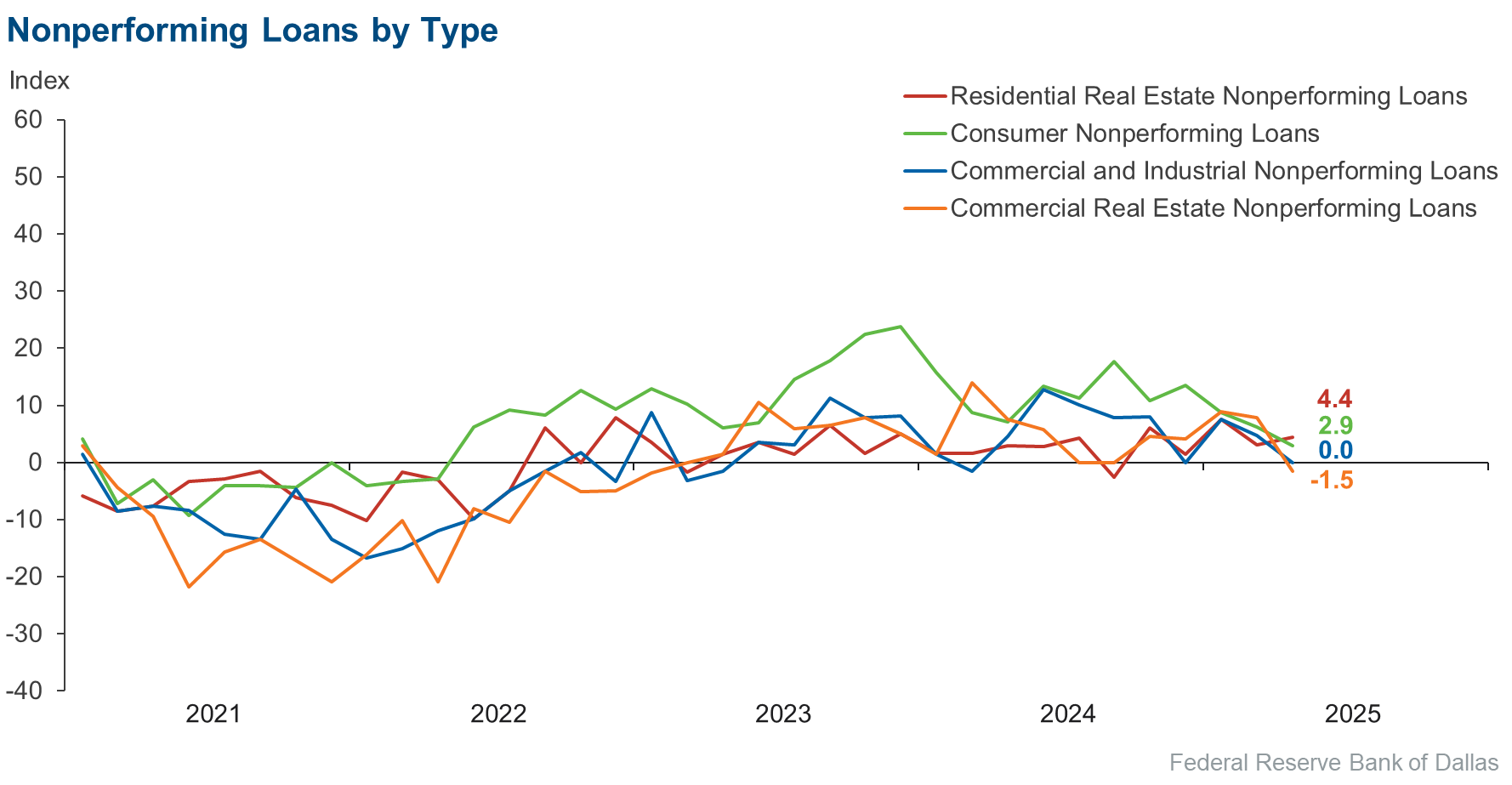

Nonperforming loans | 0.0 | 4.7 | 6.0 | 88.1 | 6.0 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –7.8 | –9.5 | 0.0 | 92.2 | 7.8 |

| Commercial Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | –3.0 | 0.0 | 25.4 | 46.3 | 28.4 |

Nonperforming loans | –1.5 | 7.8 | 6.0 | 86.6 | 7.5 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –12.1 | –10.8 | 1.5 | 84.8 | 13.6 |

| Residential Real Estate Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | –4.3 | 7.7 | 20.3 | 55.1 | 24.6 |

Nonperforming loans | 4.4 | 3.1 | 5.8 | 92.8 | 1.4 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | –3.0 | –3.1 | 0.0 | 97.0 | 3.0 |

| Consumer Loans: Over the past six weeks, how have the following changed? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Loan volume | –11.5 | –3.1 | 17.1 | 54.3 | 28.6 |

Nonperforming loans | 2.9 | 6.3 | 8.7 | 85.5 | 5.8 |

| Indicator | Current Index | Previous Index | % Reporting Eased | % Reporting No Change | % Reporting Tightened |

Credit standards and terms | 0.0 | –3.1 | 1.5 | 97.0 | 1.5 |

| Banking Outlook: What is your expectation for the following items six months from now? | |||||

| Indicator | Current Index | Previous Index | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Total loan demand | 15.2 | 27.7 | 44.4 | 26.4 | 29.2 |

Nonperforming loans | 18.1 | 22.3 | 29.2 | 59.7 | 11.1 |

| General Business Activity: What is your evaluation of the level of activity? | |||||

| Indicator | Current Index | Previous Index | % Reporting Better | % Reporting No Change | % Reporting Worse |

Over the past six weeks | –16.9 | –5.9 | 21.1 | 40.8 | 38.0 |

Six months from now | 11.2 | 12.0 | 40.8 | 29.6 | 29.6 |

Survey participants are given the opportunity to submit comments on current issues that may be affecting their businesses. Some comments have been edited for grammar and clarity.

- Loan activity has held up, although it's softer than three to six months ago. The broader uncertainty in the economic outlook is driven by tariffs and government spending [cuts]. Nevertheless, there is hope that the uncertainty will dissipate as the tariff impact is more known along with potential interest rates cuts.

- Lots of companies and consumers paused [activity] due to tariff policy, but expectations of further negotiation with China should boost activity.

- Concerns around an increase in cost for construction supplies may impact current projects underway along with future residential construction projects being put on hold. Higher rates and insurance costs continue to impact the ability for some borrowers to qualify for residential home loans. [We are] anticipating a temporary slowdown in supplies due to tariffs and [them] possibly having a negative impact on inflation. Although we have seen some deposit costs come down, deposit pricing remains competitive within some of our markets.

- Tariffs and their impact on a local level are of great concern to our bank, specifically for oilfield companies and low-and-moderate-income individuals, two of our most-served markets. The impact of tariffs is unknown at this point, but how far their impact will potentially reach is concerning.

- No specific concern, but sentiment is weakening due to the unknown length and impact of tariffs.

- [We are concerned about] liquidity to keep up with loan demand.

- We continue to feel the pressure of the heightened level of economic and regulatory uncertainty. [We are] running a variety of scenarios, both formally and informally, to gauge the impact of different possible outcomes.

- Tariff uncertainties seem to have had the biggest impact over the last six weeks. Interest rates have not declined as expected, which has impacted loan demand. Consumer uncertainty and a decline in consumer confidence have had an impact on consumer spending. I am observing a wait-and-see attitude, so our members are cutting back on big purchases right now.

- Economic uncertainty created by tariffs (real or threatened) and decreasing consumer sentiment at the local level are not helpful for consumers or the banking industry.

- Tariffs are causing uncertainty with small businesses and in the economy in general. This needs to be resolved as soon as possible. Banks will be affected.

- Uncertainty regarding the potential effects of tariffs has certainly delayed capital-investment decisions for both business and consumer customers. We did not meet loan growth [projections] for the first quarter and probably will not meet these goals for the second quarter.

- Job insecurity has negatively impacted loan demand, both in the consumer and commercial areas.

Historical data can be downloaded dating back to March 2017. For the definitions, see data definitions.

NOTE: The following series were discontinued in May 2020: volume of core deposits, cost of funds, non-interest income and net interest margin.

Questions regarding the Banking Conditions Survey can be addressed to Mariam Yousuf at mariam.yousuf@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Banking Conditions Survey is released on the web.