Banking Conditions Survey

Special Questions

Special Questions

May 2023

For this survey, respondents were asked supplemental questions about their outlook, deposits, and commercial real estate lending. Data were collected May 2–10, and 62 bankers responded to the survey.

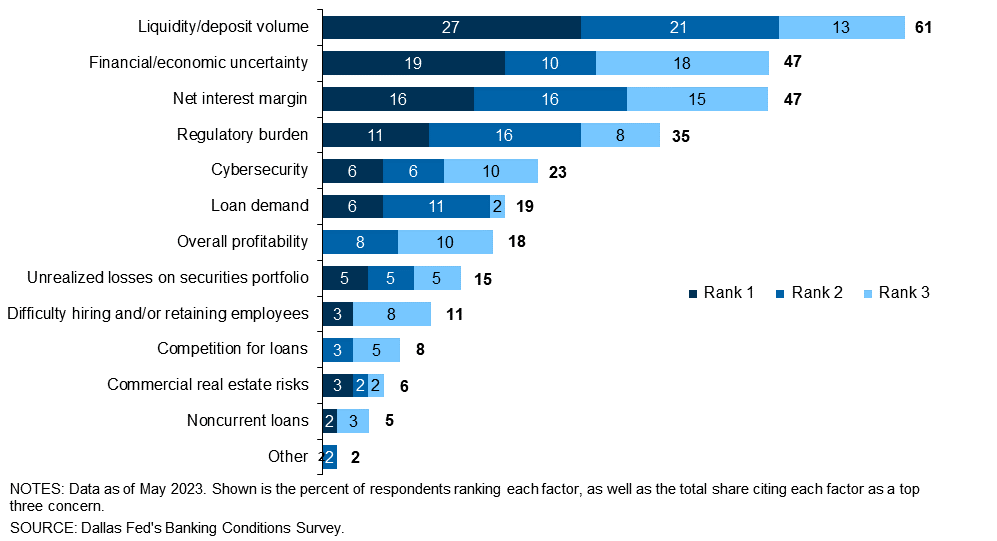

1. What are the top three concerns around your institution’s outlook over the next six months, if any? Please rank in order of importance.

| Total (percent) |

Rank 1 (percent) |

Rank 2 (percent) |

Rank 3 (percent) |

|

| Liquidity/deposit volume | 61.3 | 27.4 | 21.0 | 13.3 |

| Financial/economic uncertainty | 46.8 | 19.4 | 9.7 | 18.3 |

| Net interest margin | 46.8 | 16.1 | 16.1 | 15.0 |

| Regulatory burden | 35.5 | 11.3 | 16.1 | 8.3 |

| Cybersecurity | 22.6 | 6.5 | 6.5 | 10.0 |

| Loan demand | 19.4 | 6.5 | 11.3 | 1.7 |

| Overall profitability | 17.7 | 0.0 | 8.1 | 10.0 |

| Unrealized losses on securities portfolio | 14.5 | 4.8 | 4.8 | 5.0 |

| Difficulty hiring and/or retaining employees | 11.3 | 3.2 | 0.0 | 8.3 |

| Competition for loans | 8.1 | 0.0 | 3.2 | 5.0 |

| Commercial real estate risks | 6.5 | 3.2 | 1.6 | 1.7 |

| Noncurrent loans | 4.8 | 1.6 | 0.0 | 3.3 |

| Other | 1.6 | 0.0 | 1.6 | 0.0 |

NOTE: 62 responses.

2. Approximately what share of your volume of deposits is in each of the following categories?

| May '23 (percent) |

|

| Core deposits | 87.0 |

| Other non-core deposits | 11.2 |

| Brokered deposits | 1.8 |

NOTES: 59 responses. Respondents entered a value for each category; shown are the averages of those values.

2a. Over the past six weeks, how has your volume of core deposits changed?

| May '23 (percent) |

|

| Increased at a faster rate | 9.7 |

| Increased at a slower rate | 11.3 |

| No change | 32.3 |

| Decreased at a faster rate | 19.4 |

| Decreased at a slower rate | 27.4 |

NOTE: 62 responses.

2b. Over the past six weeks, how has your volume of brokered deposits changed?

| May '23 (percent) |

|

| Increased at a faster rate | 8.8 |

| Increased at a slower rate | 5.3 |

| No change | 82.5 |

| Decreased at a faster rate | 1.8 |

| Decreased at a slower rate | 1.8 |

NOTE: 57 responses.

3. What net change do you expect in your total volume of deposits over the next six weeks?

| May '23 (percent) |

|

| Increase slightly | 31.7 |

| Increase significantly | 8.3 |

| No change | 13.3 |

| Decrease slightly | 46.7 |

| Decrease significantly | 0.0 |

NOTE: 60 responses.

4. Approximately what share of your existing loan volume is in each of the following categories?

| May '23 (percent) |

|

| Commercial real estate | 39.0 |

| Consumer | 22.8 |

| Residential real estate | 22.0 |

| Commercial and industrial | 12.5 |

| Other | 3.7 |

NOTES: 58 responses. Respondents entered a value for each category; shown are the averages of those values.

5. Approximately what share of your existing commercial real estate loan volume is in each of the following categories?

| May '23 (percent) |

|

| Construction and land development | 21.7 |

| Industrial | 14.3 |

| Retail | 14.3 |

| Multifamily | 13.6 |

| Office | 11.6 |

| Hotels/lodging | 7.9 |

| Other | 16.6 |

NOTES: 48 responses. Respondents entered a value for each category; shown are the averages of those values.

5a. How concerned are you about the performance of the following categories in your commercial real estate loan portfolio, on a scale of 1 (not concerned at all) to 5 (extremely concerned)?

| 1 (not concerned at all) |

2 |

3 |

4 |

5 (extremely concerned) |

|

| Percent of responses | |||||

| Construction and land development | 23.1 | 46.2 | 23.1 | 7.7 | 0.0 |

| Retail | 20.0 | 48.0 | 22.0 | 8.0 | 2.0 |

| Office | 29.4 | 31.4 | 23.5 | 11.8 | 3.9 |

| Multifamily | 50.0 | 35.4 | 10.4 | 4.2 | 0.0 |

| Industrial | 30.6 | 53.1 | 10.2 | 6.1 | 0.0 |

| Hotels/lodging | 34.0 | 36.0 | 24.0 | 4.0 | 2.0 |

NOTE: 52 responses.

Special Questions Comments

These comments have been edited for publication.

- The Federal Reserve's delay in starting the cycle of rate increases and the speed at which it hiked 75 basis points several times has shocked the financial banking system, while the market remains spared. The flood of stimulus from monetary and fiscal sources created the inflation issue, and until the consumer spends down the excess savings, inflation will not significantly decline. In the meantime, with each Fed rate hike, the banking system will be negatively impacted. We are competing with the U.S. Treasury for deposits. The banking system took in too much liquidly during the pandemic, and now we are facing a liquidity crunch and the funds are leaving the banking system and being funneled into the market. Rate increases have initiated the beginning of a credit crunch cycle, and the Fed needs to wait and allow the impact from operating in a higher rate environment along with the lack of funding for new loans play out and allow the process to impact a decline in inflation, which may take six months. By that time, the consumer should have depleted any savings received from stimulus funds.

- Senior-living commercial real estate continues to struggle and is my main concern.

- My opinion is the Federal Reserve should allow the past rate hikes to soak in before raising rates again. Also, they could raise the rate by 10, 15, 25 basis points to help facilitate a softer landing. Just my opinion, but we started late, went fast, and now let’s slow this ship down before we crash.

- Raising rates also raises capital rates and lowers collateral values.

- We are generally not concerned with our commercial real estate loan portfolio. Single-family residences (owner occupied and rental-type properties) are our largest concentrations. We are monitoring home values and rental rates very closely with an expectation that values will continue to decline based on the economic conditions and interest rate environment.

Questions regarding the Banking Conditions Survey can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Banking Conditions Survey is released on the web.