Special Questions

Special Questions

September 24, 2018

Results below include responses from participants of all three surveys: Texas Manufacturing Outlook Survey, Texas Service Sector Outlook Survey and Texas Retail Outlook Survey.

Texas Business Outlook Surveys

Data were collected Sept. 11–19, and 364 Texas business executives responded to the surveys.

See data files for a full history of results.

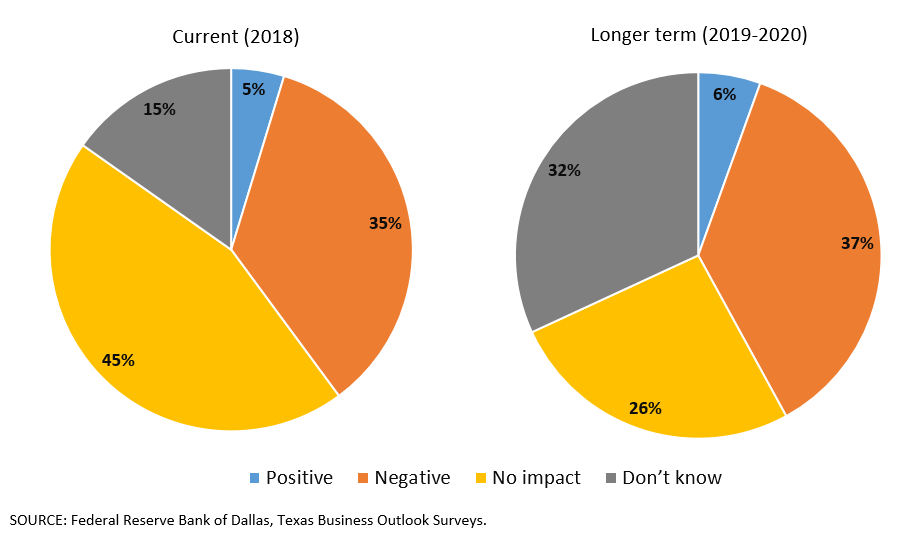

What is the net impact on your firm of the tariffs announced and/or implemented by the U.S. and other countries this year as well as other potential changes to trade policy?*

| Current (2018) |

Longer term (2019–2020) |

|

| No impact | 45 | 26 |

| Positive | 5 | 6 |

| Negative | 35 | 37 |

| Don't know | 15 | 32 |

What is the net impact of tariffs announced and/or implemented by the U.S. and other countries this year on the following aspects of your firm’s business?

| Increased (percent) |

Decreased (percent) |

No impact (percent) |

|

| Input costs | 44 | 2 | 54 |

| Selling prices | 28 | 3 | 69 |

| Supplier delivery times | 20 | 3 | 77 |

| Production/revenue/sales | 11 | 19 | 70 |

| Employment | 6 | 8 | 87 |

| Capital spending plans | 10 | 14 | 76 |

| Uncertainty | 55 | 3 | 42 |

| Company outlook | 10 | 20 | 71 |

*A similar question was posed to survey participants in the April 2018 special questions.

Texas Manufacturing Outlook Survey

Data were collected Sept. 11–19, and 110 Texas manufacturers responded to the survey.

See data files for a full history of results.

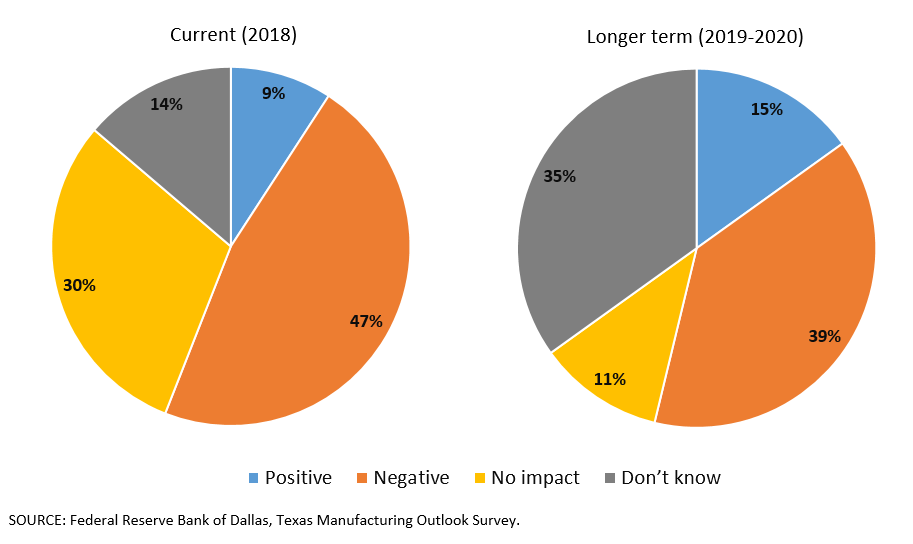

What is the net impact on your firm of the tariffs announced and/or implemented by the U.S. and other countries this year as well as other potential changes to trade policy?*

| Current (2018) |

Longer term (2019–2020) |

|

| No impact | 30 | 11 |

| Positive | 9 | 15 |

| Negative | 47 | 39 |

| Don't know | 14 | 35 |

What is the net impact of tariffs announced and/or implemented by the U.S. and other countries this year on the following aspects of your firm’s business?

| Increased (percent) |

Decreased (percent) |

No impact (percent) |

|

| Input costs | 59 | 3 | 38 |

| Selling prices | 39 | 7 | 54 |

| Supplier delivery times | 25 | 1 | 74 |

| Production/revenue/sales | 14 | 25 | 61 |

| Employment | 10 | 10 | 81 |

| Capital spending plans | 12 | 20 | 68 |

| Uncertainty | 65 | 5 | 30 |

| Company outlook | 18 | 24 | 58 |

*A similar question was posed to survey participants in the April 2018 special questions.

Special Questions Comments

These comments have been edited for publication.

Chemical Manufacturing

- We have tried for years to sell our products in China with no luck due to high Chinese tariffs (25 percent). Hopefully, this will change and open a new market for us. There are at least 17 facilities that could potentially use our products.

Nonmetallic Mineral Product Manufacturing

- As of yet, the expected import tariffs on cement are not impacting the business. It is our assessment that given the very low price elasticity of the product, tariffs could be positive to the company’s bottom line.

Primary Metal Manufacturing

- The uncertainty of whether tariffs will be implemented, in what amounts, and for how long makes long-term commitments challenging. We have net winners for what is clearly bad policy.

- We have to rely on foreign sources for raw aluminum in the United States.

- We can pass on the cost increases, but our customers may not be able to pass them on if they compete with products made in Mexico, China or Asia.

Fabricated Metal Product Manufacturing

- Aluminum and other metals are being used up as inventories have fallen. There are fewer sizes and certainly higher prices across the board, plastics included. On contracts, people are wanting to rebid if we won’t take the price we gave them initially, chancing losing the business. Lead times resulting from lack of stock materials makes delivery less predictable.

- We are third tier in the supply chain; therefore, it is too early to make a knowledge assessment. Our customers are primarily contract manufacturers. Uncertainty over the fear of tariffs could result in increased revenue due to additional manufacturing in the U.S. vs. offshoring, or a decrease in revenue due to customers’ higher costs of imported materials.

- Tariffs may be good for domestic steel producers and mills, but they have not been helpful for steel fabricators. The imposition of tariffs was followed immediately by a series of price increases of raw steel, causing losses on projects under contract. Steady, predictable market conditions are much more desirable.

- If you are selling steel, good news. In almost all cases, increased costs are able to be pushed through. Supply and availability trumps price right now for end users—that and the ability to get product delivered. Also, there are huge issues with cost and availability of delivered freight.

Machinery Manufacturing

- Suppliers are asking for forecasts for longer horizons, a longer time period. Some material lead times have increased.

- The tariffs have increased our input costs, but we’ve increased our prices to compensate, and our customers understand the situation and continue to buy our products. The tariffs as best as I can tell will have little or no effect on anyone’s buying habits. It’s been a political debate that will not stop anyone from buying that next pair of shoes or sneakers.

- We buy magnets from China, and the actual cost may go up $30 on a $220 item. Our selling price, however, is $850. So we increased our price $50. No one has yet said they won’t buy this product because of the price increase. Fear seems to be the biggest outcome of the tariffs that political analysts have heaped on the American public. And you can probably include economists, too.

- The second round of tariffs affected some, but not all, of the raw materials that we use for manufacturing. We have started to increase our prices on just the products that are produced from the more expensive raw materials. However, we have also notified our customers that if the tariffs are eliminated in the future, we will reduce our prices accordingly.

Electrical Equipment, Appliance, and Component Manufacturing

- Unfair dumping of products by China needs to be addressed.

Transportation Equipment Manufacturing

- We’re getting killed on aluminum pricing and potential availability.

Food Manufacturing

- Our biggest impact is in relation to our capital spending plans. Infrastructure costs (concrete, steel, etc.) are all significantly more expensive than they were five years ago, even excluding potential tariffs. Overall, we do not expect tariffs to last long term.

Paper Manufacturing

- Some customers might be negatively affected and some positively. The positive will lag the negative, so long term, the impact is still unsure.

Miscellaneous Manufacturing

- Tariffs hurt our business, but we believe that the trade issues need to be addressed even if that means some short-term suffering. We want a balanced playing field with countries like China, as it is currently not fair to U.S. companies selling into China or owning assets in China. We are working with our partners in China to move production to other countries, and if the tariffs do not get resolved this year, most of those changes will be permanent by mid-2019. We are also moving production back to the U.S. and increasing production here where we can. Our market does not have access to enough quality and cost-effective labor, so there is a limit to how much we can bring back to the U.S. Some production in China is simply unable to be done in the U.S. due to a lack of skilled labor and available supply chain to support it.

Texas Service Sector Outlook Survey

Data were collected Sept. 11–19, and 254 Texas business executives responded to the survey.

See data files for a full history of results.

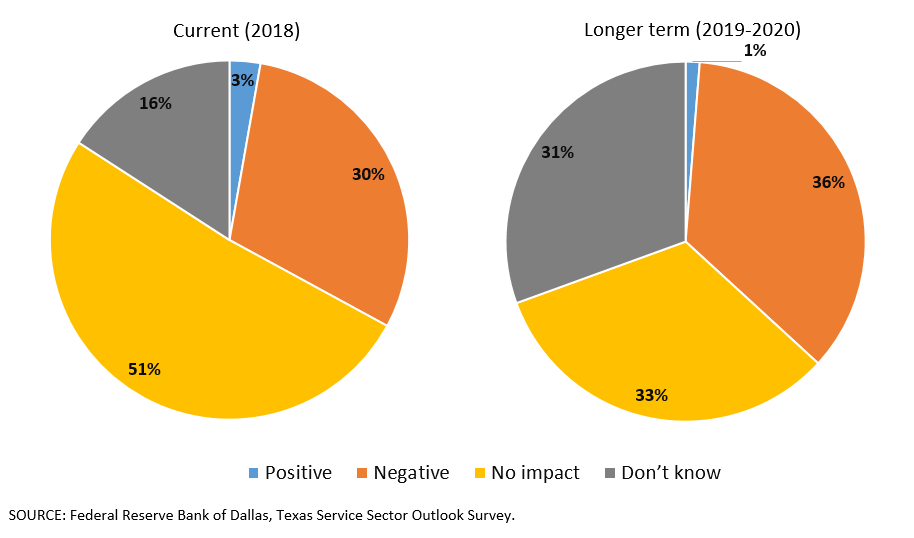

What is the net impact on your firm of the tariffs announced and/or implemented by the U.S. and other countries this year as well as other potential changes to trade policy?*

| Current (2018) |

Longer term (2019–2020) |

|

| No impact | 51 | 33 |

| Positive | 3 | 1 |

| Negative | 30 | 36 |

| Don't know | 16 | 31 |

What is the net impact of tariffs announced and/or implemented by the U.S. and other countries this year on the following aspects of your firm’s business?

| Increased (percent) |

Decreased (percent) |

No impact (percent) |

|

| Input costs | 37 | 1 | 61 |

| Selling prices | 23 | 2 | 75 |

| Supplier delivery times | 18 | 3 | 79 |

| Production/revenue/sales | 9 | 16 | 74 |

| Employment | 4 | 7 | 89 |

| Capital spending plans | 8 | 12 | 80 |

| Uncertainty | 50 | 2 | 48 |

| Company outlook | 6 | 18 | 76 |

*A similar question was posed to survey participants in the April 2018 special questions.

Special Questions Comments

These comments have been edited for publication.

Specialty Trade Contractors

- We deal with piping, steel and copper. We have many suppliers using the tariffs as an excuse for pricing increases.

Truck Transportation

- Tariffs affect us only when exports of meat and food are limited.

Support Activities for Transportation

- We handle several customers that have been impacted by the tariffs implemented. We have seen some customers increase volumes of shipments in and out of Mexico as well as other customers that have significantly reduced inventory levels of product once warehoused on the border. Among our customers that do business in Mexico, we have yet to see a decrease in shipment volume.

Data Processing, Hosting and Related Services

- Our business thus far is not impacted by the tariffs. We sell to U.S. businesses only, and primarily purchase from U.S. businesses. Occasionally, we farm out minor software projects to international programmers.

Credit Intermediation and Related Activities

- In predominantly rural markets, it is hard to measure the impact of tariffs in actual statistics, but there is the psychological impact that creates anxiety from the news of impending doom. We just have not identified much definitive impact. The one result we have heard is the delay in completing the second phase of our windmill farm due to the parts for the windmills coming out of China.

Real Estate

- Input costs for construction materials are rising right in the middle of a current project. Tariffs will push new projects that are marginal to the sideline ... the economics don’t work.

Professional, Scientific and Technical Services

- As a service provider, the tariffs impact my clients, which in turn impacts me. Uncertainty is a major impact on my business.

- Temporary tariffs should help U.S. companies located in the U.S. overall. Since we are in the enterprise software industry, which is led by U.S. suppliers and companies, we expect no impact on us in the short or long term.

- We are an engineering service provider. While we do not manufacture or purchase raw materials, we do spec pumps, valves etc. These items have increased in price due to steel pricing.

- As engineering consultants, we are not in the material supply chain directly. However, our clients buy large quantities of material (for building projects) that may be affected by the tariffs. Costs for these projects may increase, which may force some projects to be postponed or canceled.

- We’re not really sure yet what the impact of tariffs will be. Clients express concerns in the context of not knowing what’s ahead, but there is nothing specific at this time that we can connect to our marketing and advertising business.

Management of Companies and Enterprises

- We’re not sure how the agricultural market will be affected.

Administrative and Support Services

- It is uncertain how the tariffs will impact our business overall. In the short term, I believe they will have a negative effect until such time that domestic producers can catch up and begin to bring foreign production back to the U.S. I suspect that the higher material costs will impact certain industries’ short-term profitability until their prices can be adjusted for higher material costs. This may impact hiring, which would directly impact my business.

- We are a professional service company, and we have not been impacted by any tariffs so far.

- Land and building materials prices are up.

- Tariffs are always a bad thing.

Educational Services

- I agree that we have been on the receiving end of bad trade deals for a long time. The short-term pain of tariffs is negligible as compared with the benefits of renegotiating trade deals not in our favor, but in a more balanced way. I stand behind the administration in this effort—it is long overdue.

- As a nonprofit, and based on the market we serve, tariffs have no impact on our business whatsoever.

Ambulatory Health Care Services

- As a service provider, our costs are almost solely related to workforce and local infrastructure. Higher costs for imported goods and materials will raise the costs of doing business for all of us but will not directly impact this company.

- Tariffs will only affect our market if the agricultural industry suffers. Oil and gas along with government contracting in our area will support the rest of the economy.

Food Services and Drinking Places

- In our recovery and rebuilding from Hurricane Harvey, we’re needing steel and other building materials. Costs and uncertainty in delivery times seem to have increased.

Texas Retail Outlook Survey

Data were collected Sept. 11–19, and 42 Texas retailers responded to the survey.

See data files for a full history of results.

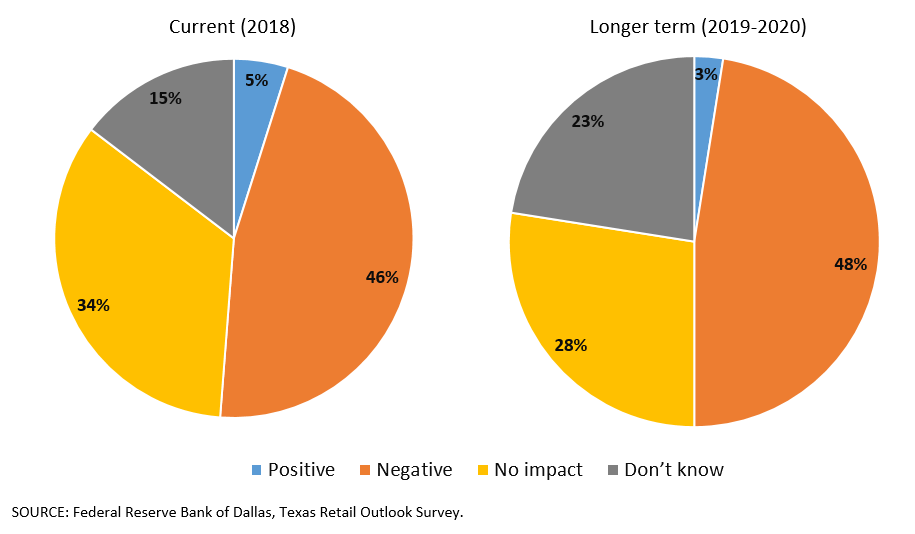

What is the net impact on your firm of the tariffs announced and/or implemented by the U.S. and other countries this year as well as other potential changes to trade policy?*

| Current (2018) |

Longer term (2019–2020) |

|

| No impact | 34 | 28 |

| Positive | 5 | 3 |

| Negative | 46 | 48 |

| Don't know | 15 | 23 |

What is the net impact of tariffs announced and/or implemented by the U.S. and other countries this year on the following aspects of your firm’s business?

| Increased (percent) |

Decreased (percent) |

No impact (percent) |

|

| Input costs | 70 | 3 | 28 |

| Selling prices | 70 | 3 | 28 |

| Supplier delivery times | 23 | 8 | 69 |

| Production/revenue/sales | 23 | 26 | 51 |

| Employment | 8 | 8 | 85 |

| Capital spending plans | 10 | 8 | 83 |

| Uncertainty | 58 | 3 | 40 |

| Company outlook | 8 | 16 | 76 |

*A similar question was posed to survey participants in the April 2018 special questions.

Special Questions Comments

These comments have been edited for publication.

Merchant Wholesalers, Durable Goods

- We need certainty on tariffs so we can best determine how to proceed for our business.

- The products we sell that have been or might be impacted by tariffs are generally not only imported by us, but by our competitors. Therefore, we are all subject to the same increased costs. How quickly those costs are passed on to the customers is the issue causing the short-term negative impact.

Merchant Wholesalers, Nondurable Goods

- Our concern is that farmers and ranchers will be and are losing existing and potential buyers for their products. We help feed the world, and pushing our international buyers to look for another supplier has the potential to alter the agricultural landscape.

Motor Vehicle and Parts Dealers

- It is too early to really know what changes there will be. Therefore, the uncertainty is causing some concern. Only time will tell. Our hope is that the present uncertainty will go away if the president’s threats are only bargaining tools to achieve a better state of affairs for our country.

- The impact of tariffs in general is unknown. Of course, it also depends on which country, so it’s difficult to fully answer the questions.

Building Material and Garden Equipment and Supplies Dealers

- Revenues did increase due to customers attempting to avoid the full tariff amount. However, input prices increased rapidly, which resulted in lower margins. Revenue did drop off after an initial surge immediately following the tariff announcement, but it has increased in the past 30-60 days.

- Most of our inventory is produced domestically, but there is some negative impact to tariffs on our costs.

- The greater concern is the damage done to our suppliers and customers, which then affects our costs as well as demand for our products.

Clothing and Clothing Accessories Stores

- As a retailer, we rely on manufacturers of brand-name products. For the most part, they are still uncertain as to the impact.

Questions regarding the Texas Business Outlook Surveys can be addressed to Emily Kerr at emily.kerr@dal.frb.org,

Sign up for our email alert to be automatically notified as soon as the latest surveys are released on the web.