Special Questions

Special Questions

June 24, 2019

Results below include responses from participants of all three surveys: Texas Manufacturing Outlook Survey, Texas Service Sector Outlook Survey and Texas Retail Outlook Survey.

Texas Business Outlook Surveys

Data were collected June 11–19, and 363 Texas business executives responded to the surveys.

See data files with a full history of results.

What net impact have U.S. and foreign tariffs implemented since last year had on the following aspects of your firm’s business?

| Sep. ’18 | Jun. ’19 | ||||||

| No impact (percent) |

Increased (percent) |

Decreased (percent) |

No impact (percent) |

Increased (percent) |

Decreased (percent) |

||

| Input costs | 54.2 | 44.1 | 1.7 | 61.1 | 36.4 | 2.5 | |

| Selling prices | 68.5 | 28.0 | 3.5 | 73.0 | 21.6 | 5.3 | |

| Profit margins | N/A | N/A | N/A | 67.0 | 3.9 | 29.0 | |

| Supplier delivery times | 77.4 | 20.0 | 2.6 | 78.8 | 18.1 | 3.1 | |

| Production/revenue/sales | 70.3 | 10.8 | 19.0 | 76.2 | 6.5 | 17.3 | |

| Employment | 86.5 | 5.9 | 7.6 | 86.5 | 3.9 | 9.6 | |

| Capital spending plans | 76.2 | 9.6 | 14.2 | 79.0 | 3.4 | 17.6 | |

| Uncertainty | 42.3 | 54.8 | 2.9 | N/A | N/A | N/A | |

| Company outlook | 70.6 | 9.6 | 19.8 | 65.0 | 6.6 | 28.3 | |

NOTE: 360 responses.

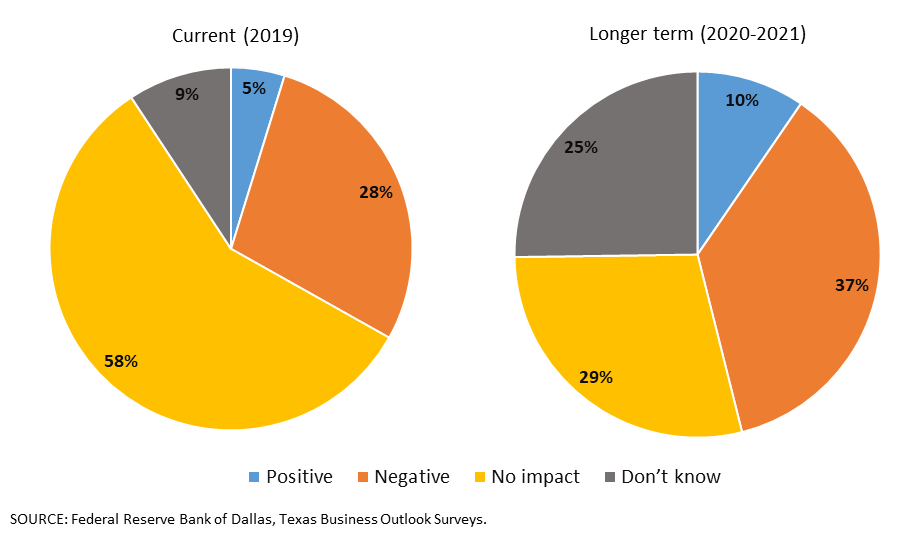

What net impact have U.S. and foreign tariffs implemented since last year had on your firm overall, and what do you expect for the longer term?

| Current (2019) |

Longer term (2020–2021) |

|

| No impact | 57.6 | 28.7 |

| Positive | 4.8 | 9.6 |

| Negative | 28.4 | 36.5 |

| Don’t know | 9.3 | 25.2 |

NOTES: 362 responses.

A similar question was posed to survey participants in the September 2018 special questions.

What factors, if any, have allowed your firm to mitigate the negative tariff impact? Please select all that apply.*

| Percent | |

| Passing cost increases through to customers | 41.0 |

| Finding new domestic supplier(s) | 22.0 |

| Moving up purchases ahead of full tariff implementation | 13.0 |

| Bringing production or processes in-house that were formerly outsourced; i.e., insourcing | 12.0 |

| Finding new foreign supplier(s) | 11.0 |

| The strengthening dollar lowering cost of foreign inputs | 9.0 |

| Reclassifying items into nontariff categories | 2.0 |

| Other | 17.0 |

| None | 33.0 |

*This question was posed only to respondents who answered “negative” to “Current (2019)” in the previous question.

NOTE: 100 responses.

In which country or countries is/are the new foreign supplier(s) located?*

China/Mexico; Greece/Turkey; Philippines/Lithuania; India; South America; Thailand; Vietnam/Malaysia; Vietnam; Vietnam; Unknown

*This question was posed only to respondents who answered “Finding new foreign supplier(s)” to the previous question.

NOTE: 10 responses. This was an open-ended question, with the responses shown above.

What net impact have U.S. and foreign tariffs announced and/or implemented since last year—as well as other potential changes to trade policy—had on uncertainty regarding your firm’s outlook and business decisions?

| Percent | |

| No impact | 55.7 |

| Increased | 35.4 |

| Decreased | 8.9 |

NOTES: 359 responses.

Uncertainty was included in a similar question posed to survey participants in the September 2018 special questions.

What impact, if any, has the increased uncertainty had on your firm, beyond the direct impact of the tariffs themselves? Please describe.

This question was posed only to respondents who answered “increased” to the previous question. These comments have been edited for publication.

Texas Manufacturing Outlook Survey

Petroleum and Coal Products Manufacturing

- We see slowing capital expenditures in some segments.

Chemical Manufacturing

- It has reduced the certainty of our customers’ sales to China customers.

- Increased the level of uncertainty in the market altogether, which may affect future sales. It is difficult to put a finger on the exact effect the tariffs will have. I can just affirm that it is increasing uncertainty.

Primary Metal Manufacturing

- Very little. We continue to watch spending, all costs, and stay on the same path we are now.

- Much greater uncertainty.

Fabricated Metal Product Manufacturing

- We don’t know how it will affect our customer base. They might sell more or they might sell less. We are not sure how tariffs will impact customers long term.

- The forecasting of long-term demand growth.

- We are having to spend much more time to bid projects, for lack of finding materials that were once easier to find, as well as availability of material sizes. This is causing more cost and more work to modify, with expensive time lost all around.

- On-and-off-again tariffs create uncertainty. There is no clear communicated strategy.

- Lower margins and uncertainty attitudes are increasing as we enter another political election cycle.

- Reduction in the market; we could not ship into Mexico with a 25 percent tariff. Reduced purchases of raw materials and reduced expenditures.

Nonmetallic Mineral Product Manufacturing

- We see a downturn in the economy due to expected inflation.

- It makes planning difficult, specifically in regard to capital investment. Do we bring manufacturing in-house? But what if the tariffs are dropped in a month? What if tariffs increase beyond 25 percent? What if China tensions increase further and exports slow or stop from China?

Machinery Manufacturing

- We are just being more cautious during this downturn in the electronics industry.

- Uncertainty stifles hiring, expansion and capital expenditures. Threats of tariffs cause uncertainty.

- It has led to austerity measures even in a year of projected overall revenue growth, but with lower margins, and to headcount/hiring freezes even with record production in some areas of the company.

- The long-term projects are being reviewed with an eye on possible delays. Trying to keep employees under those conditions is very difficult. The oil industry is already under stress with lower prices, and it wouldn’t take much to shut them down again on spending.

- Tariffs have raised our raw material cost (steel), but I support President Trump’s efforts. He’s put Americans back to work and called the Chinese bluff, which is long overdue. We have a president who is finally negotiating in America’s best interest, instead of giving away the store.

Computer and Electronic Product Manufacturing

- We moved production to minimize the direct impact. Customers have moved their production for the same reason.

- High growth in 2018 will be very hard to repeat in 2019, so from that perspective, it will seem like a slowdown. We had extra backlog from 2018, so 2019 shipments should look good, but 2020 is unknown. 2020 is also an election year, so we are expecting a crazy time.

Electrical Equipment, Appliance and Component Manufacturing

- The threat of increasing prices is causing project managers and buyers to rethink needs.

Transportation Equipment Manufacturing

- Investments in manpower and capital-expenditure projects have become more challenging, while each new hire and each project has become more important relative to before. This is resulting in more time and resources being put into decision-making models.

- We are concerned that increased costs and longer lead times for delivery will adversely impact our capability to deliver timely and within budget.

- A very small impact, if any, and there are scenarios that are both positive and negative.

- We see increased foreign imports of semi-finished and finished products that do not have tariffs imposed. Although tariffs are imposed if the product is brought in during its raw stage (i.e., steel bar or tubing has stiff import tariffs), Asian manufacturers are able to produce a semi-finished or finished product from this raw material and ship into the country with 0–2 percent penalties. This reduces the U.S. manufacturers’ ability to compete fairly with the foreign competition.

Food Manufacturing

- None at this point. There may be an impact via imported vegetables and ingredients we purchase due to either limited availability in the U.S. or dramatic pricing variations.

- Items we or customers export have seen decreased demand and have led to lower prices and sales.

- The policies themselves have brought into question the bigger picture of where we are headed. There is uncertainty as to how this will impact our suppliers of key inputs.

- Our outlook on the future has worsened. Disruptions in the company’s supply chain have put a lot of stress in the organization. Growth projections are becoming less certain. Capital expenditures are beginning to be delayed or placed on hold.

- Our exports to Mexico have been curtailed by the weak peso and strong dollar. We feel that border tensions and tariff threats have contributed.

Textile Product Mills

- The threat of tariffs against Mexico has stalled my new-business opportunities and killed one strategic joint venture that was close to being executed.

Wood Product Manufacturing

- We see fear as to what may happen.

Miscellaneous Manufacturing

- Increased uncertainty has caused an absence of capital expenditures.

- Our partners overseas are afraid and not making investments in production or expansion, leading to longer lead times and the inability to keep up with demand. Currently, our gross margins are falling, but we are not passing on the costs to customers. The reduced cash flow is making it more difficult to invest in employees and manufacturing; at the same time, it is needed more than ever. Utilizing overseas production for certain products is the only option for small, growing businesses or certain low-volume products. Lack of good access to overseas production will hurt small business the most.

Texas Service Sector Outlook Survey

Utilities

- Businesses are cutting back as they evaluate the impact of these tariffs on the entire economy.

Truck Transportation

- Tariffs affect our customers who transport imports and exports. When they slow down, our business slows down.

Pipeline Transportation

- Uncertainty makes it difficult to make capital allocation decisions.

- Steel tariffs are the largest impact—about 5–7 percent of total projects.

Support Activities for Transportation

- Due to China tariffs and potential tariffs with Mexico, U.S. brokers have urged their importers to begin paying applicable duties/taxes directly with customs via their own ACH (automated clearinghouse) line. U.S. brokers have historically paid duties on behalf of their importers.

- Grain exports, automotive imports and fresh-produce imports are currently impacted or may soon be negatively impacted by tariffs.

Warehousing and Storage

- The uncertainty restricts the investment potential of our clients. Without a clear avenue for planning for extended periods without random policy changes, an investment in equipment, training of labor and buildings is too risky.

Credit Intermediation and Related Activities

- There has been very little impact observed to date.

Securities, Commodity Contracts, and Other Financial Investments and Related Activities

- We are very concerned about the impact of increased tariffs on the U.S. economy and consumer.

- Uncertainty hinders investment activity because of potential degradation of returns.

Real Estate

- More tariffs mean higher building costs, which means fewer commercial loans, which means fewer real estate appraisals.

Professional, Scientific and Technical Services

- Unknown.

- We do work for Mexican nationals who have opened businesses in the United States. Increased tariffs on Mexican imports may cause a slowdown in the growth of those businesses or the opening of new businesses.

- Tariffs create uncertainty. The more the uncertainty, the less investment in the energy and petrochemical area (as well as others). That means less consulting work available for my firm.

- As a consulting firm, the impact of tariffs is indirect to us. Our manufacturing clients are the ones directly impacted. Our uncertainty stems from our lagging indications of the impact on our clients. It is hard for us to get direct and timely feedback on projects in late 2019 and going into 2020.

- We can’t plan ahead. This is no way to manage the economy. We just reviewed all of our supply chain to adjust to the China tariffs and now they come up with Mexico tariffs. What’s next?

- We are concerned tariffs will lead to higher construction costs, and therefore, less construction and less architectural work for us.

- Again, back to the capriciousness of this administration on this subject. I am not in the camp that believes tariffs are the best tool. I do believe we needed to strike a better deal with the Chinese and other trading partners but believe a lot shouldn’t have been done in the public eye, making it a win-lose type of battle. It is too combative, and I have done enough business in China to know that is not the best way to work.

- Clients are cutting back expansion plans, which reduces the need for our services.

- Creates market uncertainty which slows down overall business appetite.

- We have changed our quoting language to say there is no longer a 30-day pricing guarantee. So far, everyone seems to understand. We have tried to accelerate some sales in fear of increasing tariffs, and lead times have increased, which can lower our overall sales outlook, but so far it has been minimal.

- We are a live engagements/conference and exposition general contractor that works with almost all industries. This diversification should provide us with some protection against any specific tariffs placed on specific industries; however, this means that some of these conferences may decrease in size, which will reduce our revenue opportunity. Sustained tariffs could possibly destroy small businesses that exhibit in these events to extend their brands.

- We have seen no direct impacts as we are a professional service firm, but as tariffs (real or imagined) are discussed or implemented, they have a direct impact on the cost of our clients’ projects (real estate development), so they will have a downward effect on some projects.

Management of Companies and Enterprises

- There is uncertainty about the impact on general economic activity in Central Texas as well as the impact on our direct customer base.

- How long the trade tariffs remain will determine the impact on the agriculture industry (i.e., commodity prices) and related industries, such as equipment manufacturers and dealers. This potential “ripple effect” is the unknown and the cause of the uncertainty.

Administrative and Support Services

- The cost of goods increased in contracts signed previous to the increase; this absolutely kills the margin.

- Project timelines are being pushed out/not started.

- I’m concerned when considering future commercial development projects whether tariffs may slow things enough globally to tip the U.S. into recession and thereby freeze buyers out of my market.

- We are continuing to monitor the situation and increase the number of potential vendors for each of our products.

- The fear that they have instilled in our current customers. People are not wanting to invest in new equipment for fear of what a tariff or trade war will start next.

- Since we are not affected directly by tariffs, all the impact is indirect, i.e., impacts hiring of contractor labor by our clients.

Educational Services

- The threat of changes from tariffs reduces the ability for our customers to make decisions. Therefore, uncertainty increases.

Ambulatory Health Care Services

- Our business is dependent upon adequate disposable income and that high consumer confidence conditions will continue. It is primarily optional for the consumer. If tariffs either actually reduce available disposable income or cause consumer confidence to decline, it will negatively impact us.

Hospitals

- There is direct negative impact on investment returns used to fund pension obligations.

Social Assistance

- We source produce from Mexico, so it is difficult to forecast our costs. Any tariffs would likely add to our costs, but it is difficult to predict whether or not tariffs will be imposed, as well as the level of any tariff.

Accommodation

- The uncertainty—both pricing and availability—has caused delays with capital spending/property-level improvements. Additionally, we have been forced to spend money and time identifying alternative suppliers in the event of excessive pricing or limited product availability.

Food Services and Drinking Places

- Decreases our desire to take risks and grow. There is worry over rising food and labor costs.

- All food and operating costs are rapidly increasing.

- Some impact on foods coming out of Mexico.

Religious, Grantmaking, Civic, Professional and Similar Organizations

- There’s a sense that a downturn, or at least an overall slowing of growth, is being designed and enforced by President Trump. We do not expect the economy to continue to resist being spooked by hubris and ignorance.

- We provide services to the global oil industry, so anything that impacts trade in crude oil and natural gas can impact our business.

- Members looking to reduce expenses may drop membership.

Texas Retail Outlook Survey

Merchant Wholesalers, Durable Goods

- We are concerned the economy is slowing due to lack of confidence in the Trump administration’s handling of tariffs—their impact on the consumer.

- There has become an oversupply of recycled metal domestically as well as an oversupply of new steel from the mills due to them ramping up their production to near capacity.

Merchant Wholesalers, Nondurable Goods

- My industry in general relies on a steady inflow of agriculture products to mitigate the cost of inputs. Picking fights with Mexico and Canada, our two largest trading partners, makes inflow of agriculture products in and out of both countries uncertain.

- Farmers are net exporters. Foreign countries that respond with tariffs usually levy them against agriculture.

- Mexican imports.

- The continued failure of the Federal Reserve to realize that there is no inflation, the employment numbers are worse than the Federal Reserve believes, and labor force participation continues to decline.

- The Fed may be able to cause a recession, which will then bring the Fed to reduce rates. That is a Machiavellian scenario that would probably please Chairman Powell who only seems to be happy when he can increase rates. Banks are continuing to finance developers who will develop as long as they can get money. Banks need large loans, and they are facilitating corporate takeovers with loans having reduced covenants. We may find ourselves with a repeat of 2007–08.

Building Material and Garden Equipment and Supplies Dealers

- Taxes hit consumers hard and reduce their discretionary spending.

Clothing and Clothing Accessories Stores

- It has been very difficult to plan future shipments given the uncertainty of future costs from suppliers.

Nonstore Retailers

- Our increased uncertainty has caused us to keep an eye on the situation to assess what impacts might occur to our business and to plan strategies to avoid these impacts. However, we don’t feel we have a lot of control other than to pass through cost increases to our customers. We don’t have a lot of options for alternate product sources, and it’s not something we can easily substitute without dramatically reducing our sales.

Survey respondents were given the opportunity to provide general comments. These comments can be found on the individual survey Special Questions results pages, accessible by the tabs above.

Texas Manufacturing Outlook Survey

Data were collected June 11–19, and 115 Texas manufacturers responded to the surveys.

See data files with a full history of results.

What net impact have U.S. and foreign tariffs implemented since last year had on the following aspects of your firm’s business?

| Sep. ’18 | Jun. ’19 | ||||||

| No impact (percent) |

Increased (percent) |

Decreased (percent) |

No impact (percent) |

Increased (percent) |

Decreased (percent) |

||

| Input costs | 38.3 | 58.9 | 2.8 | 43.5 | 53.0 | 3.5 | |

| Selling prices | 54.2 | 39.3 | 6.5 | 58.8 | 33.3 | 7.9 | |

| Profit margins | N/A | N/A | N/A | 51.3 | 7.8 | 40.9 | |

| Supplier delivery times | 73.6 | 25.5 | 0.9 | 73.0 | 25.2 | 1.7 | |

| Production/revenue/sales | 61.3 | 14.2 | 24.5 | 60.9 | 13.0 | 26.1 | |

| Employment | 81.0 | 9.5 | 9.5 | 78.3 | 7.0 | 14.8 | |

| Capital spending plans | 67.9 | 12.3 | 19.8 | 64.9 | 7.9 | 27.2 | |

| Uncertainty | 29.9 | 65.4 | 4.7 | N/A | N/A | N/A | |

| Company outlook | 57.9 | 17.8 | 24.3 | 57.1 | 10.7 | 32.1 | |

NOTE: 115 responses.

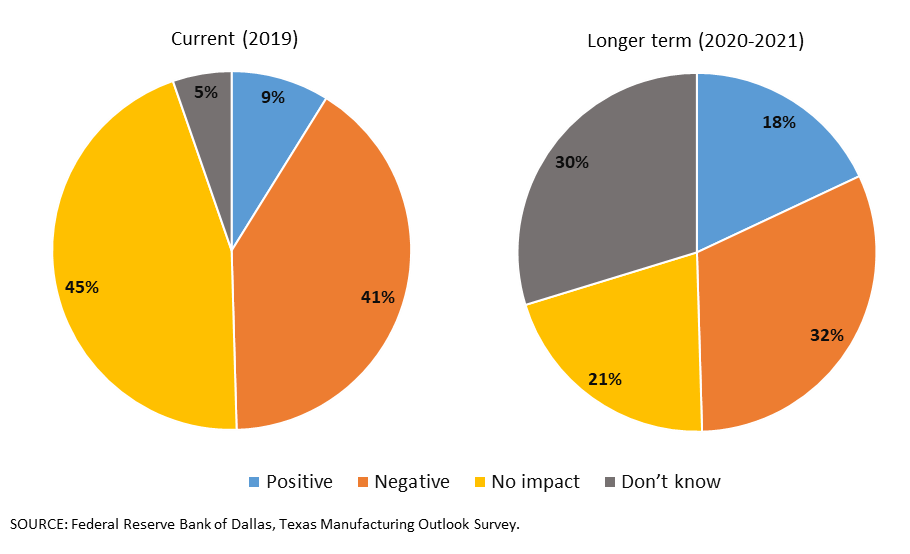

What net impact have U.S. and foreign tariffs implemented since last year had on your firm overall, and what do you expect for the longer term?

| Current (2019) |

Longer term (2020–2021) |

|

| No impact | 45.1 | 20.7 |

| Positive | 8.8 | 18.0 |

| Negative | 40.7 | 31.5 |

| Don’t know | 5.3 | 29.7 |

NOTES: 114 responses.

A similar question was posed to survey participants in the September 2018 special questions.

What factors, if any, have allowed your firm to mitigate the negative tariff impact? Please select all that apply.*

| Percent | |

| Passing cost increases through to customers | 54.3 |

| Finding new domestic supplier(s) | 17.4 |

| Bringing production or processes in-house that were formerly outsourced; i.e., insourcing | 17.4 |

| Moving up purchases ahead of full tariff implementation | 13.0 |

| The strengthening dollar lowering cost of foreign inputs | 10.9 |

| Finding new foreign supplier(s) | 10.9 |

| Reclassifying items into nontariff categories | 0.0 |

| Other | 17.4 |

| None | 23.9 |

*This question was posed only to respondents who answered “negative” to “Current (2019)” in the previous question.

NOTE: 46 responses.

In which country or countries is/are the new foreign supplier(s) located?*

Philippines/Lithuania; India; Thailand; Vietnam

*This question was posed only to respondents who answered “Finding new foreign supplier(s)” to the previous question.

NOTE: 4 responses. This was an open-ended question, with the responses shown above.

What net impact have U.S. and foreign tariffs announced and/or implemented since last year—as well as other potential changes to trade policy—had on uncertainty regarding your firm’s outlook and business decisions?

| Percent | |

| No impact | 50.9 |

| Increased | 41.2 |

| Decreased | 7.9 |

NOTES: 114 responses.

Uncertainty was included in a similar question posed to survey participants in the September 2018 special questions.

What impact, if any, has the increased uncertainty had on your firm, beyond the direct impact of the tariffs themselves? Please describe.

This question was posed only to respondents who answered “increased” to the previous question. These comments have been edited for publication.

Petroleum and Coal Products Manufacturing

- We see slowing capital expenditures in some segments.

Chemical Manufacturing

- It has reduced the certainty of our customers’ sales to China customers.

- Increased the level of uncertainty in the market altogether, which may affect future sales. It is difficult to put a finger on the exact effect the tariffs will have. I can just affirm that it is increasing uncertainty.

Primary Metal Manufacturing

- Very little. We continue to watch spending, all costs, and stay on the same path we are now.

- Much greater uncertainty.

Fabricated Metal Product Manufacturing

- We don’t know how it will affect our customer base. They might sell more or they might sell less. We are not sure how tariffs will impact customers long term.

- The forecasting of long-term demand growth.

- We are having to spend much more time to bid projects, for lack of finding materials that were once easier to find, as well as availability of material sizes. This is causing more cost and more work to modify, with expensive time lost all around.

- On-and-off-again tariffs create uncertainty. There is no clear communicated strategy.

- Lower margins and uncertainty attitudes are increasing as we enter another political election cycle.

- Reduction in the market; we could not ship into Mexico with a 25 percent tariff. Reduced purchases of raw materials and reduced expenditures.

Nonmetallic Mineral Product Manufacturing

- We see a downturn in the economy due to expected inflation.

- It makes planning difficult, specifically in regard to capital investment. Do we bring manufacturing in-house? But what if the tariffs are dropped in a month? What if tariffs increase beyond 25 percent? What if China tensions increase further and exports slow or stop from China?

Machinery Manufacturing

- We are just being more cautious during this downturn in the electronics industry.

- Uncertainty stifles hiring, expansion and capital expenditures. Threats of tariffs cause uncertainty.

- It has led to austerity measures even in a year of projected overall revenue growth, but with lower margins, and to headcount/hiring freezes even with record production in some areas of the company.

- The long-term projects are being reviewed with an eye on possible delays. Trying to keep employees under those conditions is very difficult. The oil industry is already under stress with lower prices, and it wouldn’t take much to shut them down again on spending.

- Tariffs have raised our raw material cost (steel), but I support President Trump’s efforts. He’s put Americans back to work and called the Chinese bluff, which is long overdue. We have a president who is finally negotiating in America’s best interest, instead of giving away the store.

Computer and Electronic Product Manufacturing

- We moved production to minimize the direct impact. Customers have moved their production for the same reason.

- High growth in 2018 will be very hard to repeat in 2019, so from that perspective, it will seem like a slowdown. We had extra backlog from 2018, so 2019 shipments should look good, but 2020 is unknown. 2020 is also an election year, so we are expecting a crazy time.

Electrical Equipment, Appliance and Component Manufacturing

- The threat of increasing prices is causing project managers and buyers to rethink needs.

Transportation Equipment Manufacturing

- Investments in manpower and capital-expenditure projects have become more challenging, while each new hire and each project has become more important relative to before. This is resulting in more time and resources being put into decision-making models.

- We are concerned that increased costs and longer lead times for delivery will adversely impact our capability to deliver timely and within budget.

- A very small impact, if any, and there are scenarios that are both positive and negative.

- We see increased foreign imports of semi-finished and finished products that do not have tariffs imposed. Although tariffs are imposed if the product is brought in during its raw stage (i.e., steel bar or tubing has stiff import tariffs), Asian manufacturers are able to produce a semi-finished or finished product from this raw material and ship into the country with 0–2 percent penalties. This reduces the U.S. manufacturers’ ability to compete fairly with the foreign competition.

Food Manufacturing

- None at this point. There may be an impact via imported vegetables and ingredients we purchase due to either limited availability in the U.S. or dramatic pricing variations.

- Items we or customers export have seen decreased demand and have led to lower prices and sales.

- The policies themselves have brought into question the bigger picture of where we are headed. There is uncertainty as to how this will impact our suppliers of key inputs.

- Our outlook on the future has worsened. Disruptions in the company’s supply chain have put a lot of stress in the organization. Growth projections are becoming less certain. Capital expenditures are beginning to be delayed or placed on hold.

- Our exports to Mexico have been curtailed by the weak peso and strong dollar. We feel that border tensions and tariff threats have contributed.

Textile Product Mills

- The threat of tariffs against Mexico has stalled my new-business opportunities and killed one strategic joint venture that was close to being executed.

Wood Product Manufacturing

- We see fear as to what may happen.

Miscellaneous Manufacturing

- Increased uncertainty has caused an absence of capital expenditures.

- Our partners overseas are afraid and not making investments in production or expansion, leading to longer lead times and the inability to keep up with demand. Currently, our gross margins are falling, but we are not passing on the costs to customers. The reduced cash flow is making it more difficult to invest in employees and manufacturing; at the same time, it is needed more than ever. Utilizing overseas production for certain products is the only option for small, growing businesses or certain low-volume products. Lack of good access to overseas production will hurt small business the most.

Special Questions Comments

These comments have been edited for publication.

Food Manufacturing

- Only Mexican import tariffs have a direct adverse effect on our business.

Textile Product Mills

- There’s no impact yet. In two weeks, we will learn how the Chinese tariffs will affect our imported raw materials. We are holding our breath.

Apparel Manufacturing

- All of our material purchases have to be U.S. made, so these foreign tariffs have no effect.

Paper Manufacturing

- The new tariffs have caused a price increase on only one of our raw materials, and it is a very small percentage of our purchases. Very few of our raw materials come from China or Mexico.

Chemical Manufacturing

- I believe that our customers’ sales into the Chinese market have been reduced due to the Chinese tariffs.

Plastics and Rubber Products Manufacturing

- We export very little. We import some, and the net direct effect is insignificant. Retail sales are important to us; so far, things seem to be holding up.

Fabricated Metal Manufacturing

- We have had to develop alternate products for fabrication as demand shifts.

- Tariffs helped the profitability of the U.S. steel industry and U.S. steel distributors. But tariffs don’t create demand. Economic activity creates long-term profitability. None of our steel end users suffered any hardship over the last 12 months of tariff-induced higher prices. They either ate the increase or passed it along. But none of them tanked due to tariffs. Today, even with tariffs, steel prices are down 15–20 percent. It is demand and capacity driven.

- From what we can see, “Buy American” is becoming more and more popular.

Computer and Electronic Product Manufacturing

- We find tariffs generally unhelpful for business activity.

Electrical Equipment, Appliance and Component Manufacturing

- We filed a petition along with one of our competitors against the dumping of aluminum wire by the Chinese. Initial results have been positive for us. Margins still need to improve, but the trend is good.

- In our industry, the tariffs further reinforce competitors to build products with Chinese components in Mexico and import into the U.S. with a finished-product HTS [Harmonized Tariff Schedule] code that is not subject to the same level of tariffs or duties.

Transportation Equipment Manufacturing

- We assume it is temporary and will end up as net positive for economy.

Texas Service Sector Outlook Survey

Data were collected June 11–19, and 248 Texas business executives responded to the surveys.

See data files with a full history of results.

What net impact have U.S. and foreign tariffs implemented since last year had on the following aspects of your firm’s business?

| Sep. ’18 | Jun. ’19 | ||||||

| No impact (percent) |

Increased (percent) |

Decreased (percent) |

No impact (percent) |

Increased (percent) |

Decreased (percent) |

||

| Input costs | 61.3 | 37.4 | 1.3 | 69.4 | 28.5 | 2.1 | |

| Selling prices | 75.0 | 22.9 | 2.1 | 79.8 | 16.1 | 4.1 | |

| Profit margins | N/A | N/A | N/A | 74.6 | 2.1 | 23.3 | |

| Supplier delivery times | 79.1 | 17.5 | 3.4 | 81.6 | 14.8 | 3.7 | |

| Production/revenue/sales | 74.3 | 9.3 | 16.5 | 83.6 | 3.4 | 13.0 | |

| Employment | 89.0 | 4.2 | 6.8 | 90.5 | 2.5 | 7.1 | |

| Capital spending plans | 79.8 | 8.4 | 11.8 | 85.8 | 1.3 | 13.0 | |

| Uncertainty | 47.9 | 50.0 | 2.1 | N/A | N/A | N/A | |

| Company outlook | 76.4 | 5.9 | 17.7 | 68.8 | 4.7 | 26.5 | |

NOTE: 245 responses.

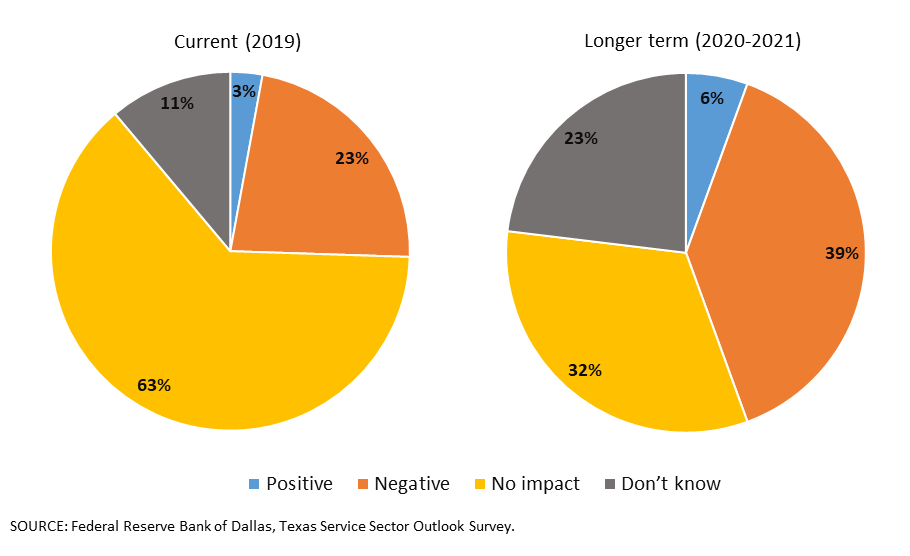

What net impact have U.S. and foreign tariffs implemented since last year had on your firm overall, and what do you expect for the longer term?

| Current (2019) |

Longer term (2020–2021) |

|

| No impact | 63.4 | 32.5 |

| Positive | 2.9 | 5.6 |

| Negative | 22.6 | 38.9 |

| Don’t know | 11.1 | 23.1 |

NOTES: 248 responses.

A similar question was posed to survey participants in the September 2018 special questions.

What factors, if any, have allowed your firm to mitigate the negative tariff impact? Please select all that apply.*

| Percent | |

| Passing cost increases through to customers | 29.6 |

| Finding new domestic supplier(s) | 25.9 |

| Moving up purchases ahead of full tariff implementation | 13.0 |

| Finding new foreign supplier(s) | 11.1 |

| The strengthening dollar lowering cost of foreign inputs | 7.4 |

| Bringing production or processes in-house that were formerly outsourced; i.e., insourcing | 7.4 |

| Reclassifying items into nontariff categories | 3.7 |

| Other | 16.7 |

| None | 40.7 |

*This question was posed only to respondents who answered “negative” to “Current (2019)” in the previous question.

NOTE: 54 responses.

In which country or countries is/are the new foreign supplier(s) located?*

China/Mexico; Greece/Turkey; South America; Vietnam/Malaysia; Vietnam; Unknown

*This question was posed only to respondents who answered “Finding new foreign supplier(s)” to the previous question.

NOTE: 6 responses. This was an open-ended question, with the responses shown above.

What net impact have U.S. and foreign tariffs announced and/or implemented since last year—as well as other potential changes to trade policy—had on uncertainty regarding your firm’s outlook and business decisions?

| Percent | |

| No impact | 58.0 |

| Increased | 32.7 |

| Decreased | 9.4 |

NOTES: 245 responses.

Uncertainty was included in a similar question posed to survey participants in the September 2018 special questions.

What impact, if any, has the increased uncertainty had on your firm, beyond the direct impact of the tariffs themselves? Please describe.

This question was posed only to respondents who answered “increased” to the previous question. These comments have been edited for publication.

Utilities

- Businesses are cutting back as they evaluate the impact of these tariffs on the entire economy.

Truck Transportation

- Tariffs affect our customers who transport imports and exports. When they slow down, our business slows down.

Pipeline Transportation

- Uncertainty makes it difficult to make capital allocation decisions.

- Steel tariffs are the largest impact—about 5–7 percent of total projects.

Support Activities for Transportation

- Due to China tariffs and potential tariffs with Mexico, U.S. brokers have urged their importers to begin paying applicable duties/taxes directly with customs via their own ACH (automated clearinghouse) line. U.S. brokers have historically paid duties on behalf of their importers.

- Grain exports, automotive imports and fresh-produce imports are currently impacted or may soon be negatively impacted by tariffs.

Warehousing and Storage

- The uncertainty restricts the investment potential of our clients. Without a clear avenue for planning for extended periods without random policy changes, an investment in equipment, training of labor and buildings is too risky.

Credit Intermediation and Related Activities

- There has been very little impact observed to date.

Securities, Commodity Contracts, and Other Financial Investments and Related Activities

- We are very concerned about the impact of increased tariffs on the U.S. economy and consumer.

- Uncertainty hinders investment activity because of potential degradation of returns.

Real Estate

- More tariffs mean higher building costs, which means fewer commercial loans, which means fewer real estate appraisals.

Professional, Scientific and Technical Services

- Unknown.

- We do work for Mexican nationals who have opened businesses in the United States. Increased tariffs on Mexican imports may cause a slowdown in the growth of those businesses or the opening of new businesses.

- Tariffs create uncertainty. The more the uncertainty, the less investment in the energy and petrochemical area (as well as others). That means less consulting work available for my firm.

- As a consulting firm, the impact of tariffs is indirect to us. Our manufacturing clients are the ones directly impacted. Our uncertainty stems from our lagging indications of the impact on our clients. It is hard for us to get direct and timely feedback on projects in late 2019 and going into 2020.

- We can’t plan ahead. This is no way to manage the economy. We just reviewed all of our supply chain to adjust to the China tariffs and now they come up with Mexico tariffs. What’s next?

- We are concerned tariffs will lead to higher construction costs, and therefore, less construction and less architectural work for us.

- Again, back to the capriciousness of this administration on this subject. I am not in the camp that believes tariffs are the best tool. I do believe we needed to strike a better deal with the Chinese and other trading partners but believe a lot shouldn’t have been done in the public eye, making it a win-lose type of battle. It is too combative, and I have done enough business in China to know that is not the best way to work.

- Clients are cutting back expansion plans, which reduces the need for our services.

- Creates market uncertainty which slows down overall business appetite.

- We have changed our quoting language to say there is no longer a 30-day pricing guarantee. So far, everyone seems to understand. We have tried to accelerate some sales in fear of increasing tariffs, and lead times have increased, which can lower our overall sales outlook, but so far it has been minimal.

- We are a live engagements/conference and exposition general contractor that works with almost all industries. This diversification should provide us with some protection against any specific tariffs placed on specific industries; however, this means that some of these conferences may decrease in size, which will reduce our revenue opportunity. Sustained tariffs could possibly destroy small businesses that exhibit in these events to extend their brands.

- We have seen no direct impacts as we are a professional service firm, but as tariffs (real or imagined) are discussed or implemented, they have a direct impact on the cost of our clients’ projects (real estate development), so they will have a downward effect on some projects.

Management of Companies and Enterprises

- There is uncertainty about the impact on general economic activity in Central Texas as well as the impact on our direct customer base.

- How long the trade tariffs remain will determine the impact on the agriculture industry (i.e., commodity prices) and related industries, such as equipment manufacturers and dealers. This potential “ripple effect” is the unknown and the cause of the uncertainty.

Administrative and Support Services

- The cost of goods increased in contracts signed previous to the increase; this absolutely kills the margin.

- Project timelines are being pushed out/not started.

- I’m concerned when considering future commercial development projects whether tariffs may slow things enough globally to tip the U.S. into recession and thereby freeze buyers out of my market.

- We are continuing to monitor the situation and increase the number of potential vendors for each of our products.

- The fear that they have instilled in our current customers. People are not wanting to invest in new equipment for fear of what a tariff or trade war will start next.

- Since we are not affected directly by tariffs, all the impact is indirect, i.e., impacts hiring of contractor labor by our clients.

Educational Services

- The threat of changes from tariffs reduces the ability for our customers to make decisions. Therefore, uncertainty increases.

Ambulatory Health Care Services

- Our business is dependent upon adequate disposable income and that high consumer confidence conditions will continue. It is primarily optional for the consumer. If tariffs either actually reduce available disposable income or cause consumer confidence to decline, it will negatively impact us.

Hospitals

- There is direct negative impact on investment returns used to fund pension obligations.

Social Assistance

- We source produce from Mexico, so it is difficult to forecast our costs. Any tariffs would likely add to our costs, but it is difficult to predict whether or not tariffs will be imposed, as well as the level of any tariff.

Accommodation

- The uncertainty—both pricing and availability—has caused delays with capital spending/property-level improvements. Additionally, we have been forced to spend money and time identifying alternative suppliers in the event of excessive pricing or limited product availability.

Food Services and Drinking Places

- Decreases our desire to take risks and grow. There is worry over rising food and labor costs.

- All food and operating costs are rapidly increasing.

- Some impact on foods coming out of Mexico.

Religious, Grantmaking, Civic, Professional and Similar Organizations

- There’s a sense that a downturn, or at least an overall slowing of growth, is being designed and enforced by President Trump. We do not expect the economy to continue to resist being spooked by hubris and ignorance.

- We provide services to the global oil industry, so anything that impacts trade in crude oil and natural gas can impact our business.

- Members looking to reduce expenses may drop membership.

Special Questions Comments

These comments have been edited for publication.

Support Activities for Mining

- Although tariffs do not impact us directly, they do affect our customers. So, there is a trickle-down effect on our business activity.

Utilities

- The tariffs are not right. Consumers pay the bill, not China.

Support Activities for Transportation

- The China–U.S. trade war is benefiting the trade with Mexico, and therefore, increasing the volume of business at the border.

Broadcasting (Except Internet)

- If there is an impact from tariffs, we anticipate it will be negative but minimal and can be absorbed without significantly impacting profitability and pricing.

Insurance Carriers and Related Activities

- The negative impacts will be indirect. If business productivity drops or the level of activity in Texas drops, our business insurance sales will drop (a lot of insurance cost depends on the sales and/or payroll of our clients).

Real Estate

- We don’t feel that the tariffs have directly impacted our business, but the psychology of the tariffs has affected our clients’ outlook, which ultimately will impact our business.

Rental and Leasing Services

- The tariff conversations have hurt business and increased our costs. We cannot tell how much, but I believe we need tough dialogue with those countries we are imposing tariffs on. We have subsidized this bunch of coat-tailing freeloading countries with our tax dollars for long enough. The thing that is killing business is the fear of anti-business bureaucrat Democrats and their brother, the media propaganda machine, taking over government next year.

Professional, Scientific and Technical Services

- Business and markets simply loathe uncertainty as we all know. It happens at times—a fact of life—but at present, it seems to come about too quickly, and we all sit waiting for the next tweet to complicate our lives. It is getting very old with this administration: too many ad hominem attacks, too many factual misstatements. It may resonate with many constituents, but it is also impacting them in a way they don’t fully comprehend right now (or just aren’t feeling yet, but it could, soon).

- What our government is doing with tariffs and our foreign policy should have been done a long time ago. We do feel that in the near future this could slow down our economy, but in the long term, it will greatly benefit us.

Management of Companies and Enterprises

- The cost of upcoming steel is hurting construction.

Administrative and Support Services

- I totally back President Trump on the China tariffs, but to threaten to pull the trigger on other countries seems almost like a game to him now. This craziness is hurting business in Texas and I believe throughout the country. I have no idea what else President Trump and Twitter will spark fear in next.

Educational Services

- At some point, we need to bring China to the table. Our economy is growing at 3-plus percent, and China needs our consumers to survive. I think using tariffs as the carrot-and-stick strategy gives short-term pain. But taking a long-term view, it’s the right policy prescription to solve this age-old problem of trade deficit and intellectual property theft.

Ambulatory Health Care Services

- Stop the madness in D.C. Tariffs will have little impact immediately on the medical community but will slow Texas expansion and impact local and regional capital expenditures and eventually, employment (all well-known I suspect).

- The health care sector is completely independent of the current issues with tariffs. As an observer, it is my opinion that tariffs may be the obvious way to get started to bring both parties to the table due to the acute pain on both sides, but it is critical not to push tariffs to be the end-all option, but to find a way to move forward. China usually plays for the long term unlike Europe or Mexico, which are not in a position to handle even short-term disruptions to their trade.

- As a local service provider for the region, there is little direct effect from the imposition of tariffs.

Social Assistance

- Since we are a nonprofit, we don’t sell anything or have a profit margin. We have seen additional food donated to us through the USDA [United States Department of Agriculture] from the trade mitigation program.

Amusement, Gambling and Recreation Industries

- Suppliers increase costs before tariffs are put in place.

Food Services and Drinking Places

- While there is some short-term noise around the tariffs for certain products, we have alternative suppliers, and the China swine flu situation is probably having more of an impact on input prices.

Texas Retail Outlook Survey

Data were collected June 11–19, and 48 Texas retailers responded to the surveys.

See data files with a full history of results.

What net impact have U.S. and foreign tariffs implemented since last year had on the following aspects of your firm’s business?

| Sep. ’18 | Jun. ’19 | ||||||

| No impact (percent) |

Increased (percent) |

Decreased (percent) |

No impact (percent) |

Increased (percent) |

Decreased (percent) |

||

| Input costs | 27.5 | 70.0 | 2.5 | 53.2 | 40.4 | 6.4 | |

| Selling prices | 27.5 | 70.0 | 2.5 | 56.5 | 37.0 | 6.5 | |

| Profit margins | N/A | N/A | N/A | 67.4 | 2.2 | 30.4 | |

| Supplier delivery times | 69.2 | 23.1 | 7.7 | 70.2 | 25.5 | 4.3 | |

| Production/revenue/sales | 51.3 | 23.1 | 25.6 | 81.8 | 6.8 | 11.4 | |

| Employment | 85.0 | 7.5 | 7.5 | 87.0 | 4.3 | 8.7 | |

| Capital spending plans | 82.5 | 10.0 | 7.5 | 88.9 | 0.0 | 11.1 | |

| Uncertainty | 40.0 | 57.5 | 2.5 | N/A | N/A | N/A | |

| Company outlook | 76.3 | 7.9 | 15.8 | 69.6 | 6.5 | 23.9 | |

NOTE: 47 responses.

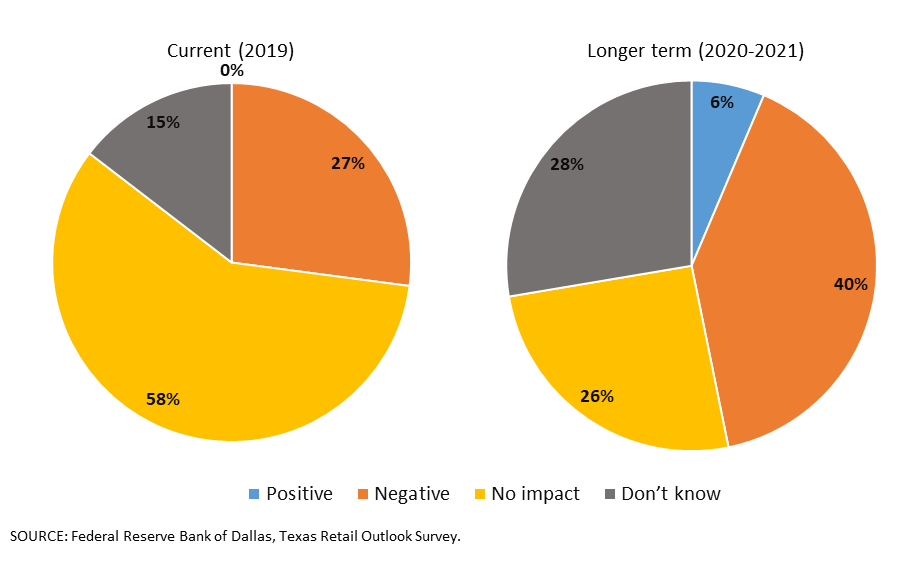

What net impact have U.S. and foreign tariffs implemented since last year had on your firm overall, and what do you expect for the longer term?

| Current (2019) |

Longer term (2020–2021) |

|

| No impact | 58.3 | 25.5 |

| Positive | 0.0 | 6.4 |

| Negative | 27.1 | 40.4 |

| Don’t know | 14.6 | 27.7 |

NOTES: 48 responses.

A similar question was posed to survey participants in the September 2018 special questions.

What factors, if any, have allowed your firm to mitigate the negative tariff impact? Please select all that apply.*

| Percent | |

| Passing cost increases through to customers | 30.8 |

| Moving up purchases ahead of full tariff implementation | 30.8 |

| Finding new domestic supplier(s) | 15.4 |

| Finding new foreign supplier(s) | 15.4 |

| Bringing production or processes in-house that were formerly outsourced; i.e., insourcing | 15.4 |

| The strengthening dollar lowering cost of foreign inputs | 7.7 |

| Reclassifying items into nontariff categories | 7.7 |

| Other | 15.4 |

| None | 38.5 |

*This question was posed only to respondents who answered “negative” to “Current (2019)” in the previous question.

NOTE: 13 responses.

In which country or countries is/are the new foreign supplier(s) located?*

Vietnam/Malaysia; Vietnam

*This question was posed only to respondents who answered “Finding new foreign supplier(s)” to the previous question.

NOTE: 2 responses. This was an open-ended question, with the responses shown above.

What net impact have U.S. and foreign tariffs announced and/or implemented since last year—as well as other potential changes to trade policy—had on uncertainty regarding your firm’s outlook and business decisions?

| Percent | |

| No impact | 54.2 |

| Increased | 37.5 |

| Decreased | 8.3 |

NOTES: 48 responses.

Uncertainty was included in a similar question posed to survey participants in the September 2018 special questions.

What impact, if any, has the increased uncertainty had on your firm, beyond the direct impact of the tariffs themselves? Please describe.

This question was posed only to respondents who answered “increased” to the previous question. These comments have been edited for publication.

Merchant Wholesalers, Durable Goods

- We are concerned the economy is slowing due to lack of confidence in the Trump administration’s handling of tariffs—their impact on the consumer.

- There has become an oversupply of recycled metal domestically as well as an oversupply of new steel from the mills due to them ramping up their production to near capacity.

Merchant Wholesalers, Nondurable Goods

- My industry in general relies on a steady inflow of agriculture products to mitigate the cost of inputs. Picking fights with Mexico and Canada, our two largest trading partners, makes inflow of agriculture products in and out of both countries uncertain.

- Farmers are net exporters. Foreign countries that respond with tariffs usually levy them against agriculture.

- Mexican imports.

- The continued failure of the Federal Reserve to realize that there is no inflation, the employment numbers are worse than the Federal Reserve believes, and labor force participation continues to decline.

- The Fed may be able to cause a recession, which will then bring the Fed to reduce rates. That is a Machiavellian scenario that would probably please Chairman Powell who only seems to be happy when he can increase rates. Banks are continuing to finance developers who will develop as long as they can get money. Banks need large loans, and they are facilitating corporate takeovers with loans having reduced covenants. We may find ourselves with a repeat of 2007–08.

Building Material and Garden Equipment and Supplies Dealers

- Taxes hit consumers hard and reduce their discretionary spending.

Clothing and Clothing Accessories Stores

- It has been very difficult to plan future shipments given the uncertainty of future costs from suppliers.

Nonstore Retailers

- Our increased uncertainty has caused us to keep an eye on the situation to assess what impacts might occur to our business and to plan strategies to avoid these impacts. However, we don’t feel we have a lot of control other than to pass through cost increases to our customers. We don’t have a lot of options for alternate product sources, and it’s not something we can easily substitute without dramatically reducing our sales.

Special Questions Comments

These comments have been edited for publication.

Merchant Wholesalers, Durable Goods

- If the trade talks with China are resolved quickly, we believe any negative impact will be minimal. If the trade talks/tariffs with China worsen or continue longer than six months, we will be forced to look for other countries to source product, which will have a negative impact on our business that we expect will last one to two years. Afterward, we expect our business will return to normal—similar to the period before the tariffs.

Merchant Wholesalers, Nondurable Goods

- Tariffs are not good for business, and continually using them for political influence and future votes goes against the core values of economics and good business sense, period. It is very frustrating in the commodity world to deal with the geopolitical interests of an administration whose interests don’t line up with common business sense.

Building Material and Garden Equipment and Supplies Dealers

- We have had some small increases on imported products, but manufacturers have absorbed the brunt of them as of now. Short-term pain may result in long-term gain in the future. We’re willing to support our leadership and the direction it takes.

Questions regarding the Texas Business Outlook Surveys can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest surveys are released on the web.