Special Questions

Special Questions

October 28, 2019

Results below include responses from participants of all three surveys: Texas Manufacturing Outlook Survey, Texas Service Sector Outlook Survey and Texas Retail Outlook Survey.

Texas Business Outlook Surveys

Data were collected Oct. 15–23, and 387 Texas business executives responded to the surveys.

See data files with a full history of results.

How do borrowing conditions facing your firm compare to those six months ago?

| Oct. ’15 (percent) |

Oct. ’16 (percent) |

Oct. ’17 (percent) |

Oct. ’18 (percent) |

Oct. ’19 (percent) |

|

| Eased substantially | 0.7 | 0.5 | 1.9 | 1.5 | 0.8 |

| Eased somewhat | 7.0 | 7.8 | 7.2 | 6.7 | 8.1 |

| No change | 47.4 | 46.5 | 47.2 | 45.9 | 49.0 |

| Tightened somewhat | 12.3 | 9.1 | 5.8 | 9.8 | 8.1 |

| Tightened substantially | 2.0 | 3.4 | 2.1 | 3.1 | 0.8 |

| Not applicable—haven’t sought credit | 30.8 | 32.7 | 35.8 | 33.0 | 33.3 |

NOTE: 384 responses.

How does the cost of credit compare to what it was six months ago?

| Oct. ’15 (percent) |

Oct. ’16 (percent) |

Oct. ’17 (percent) |

Oct. ’18 (percent) |

Oct. ’19 (percent) |

|

| Increased substantially | 0.3 | 0.8 | 0.8 | 7.3 | 0.5 |

| Increased somewhat | 13.6 | 16.6 | 26.3 | 40.2 | 5.2 |

| No change | 48.7 | 44.3 | 32.6 | 18.9 | 31.9 |

| Decreased somewhat | 5.6 | 6.2 | 3.7 | 1.8 | 26.4 |

| Decreased substantially | 1.3 | 0.8 | 0.5 | 0.0 | 3.1 |

| Not applicable—haven’t sought credit | 30.5 | 31.3 | 36.1 | 31.9 | 32.7 |

NOTE: 382 responses.

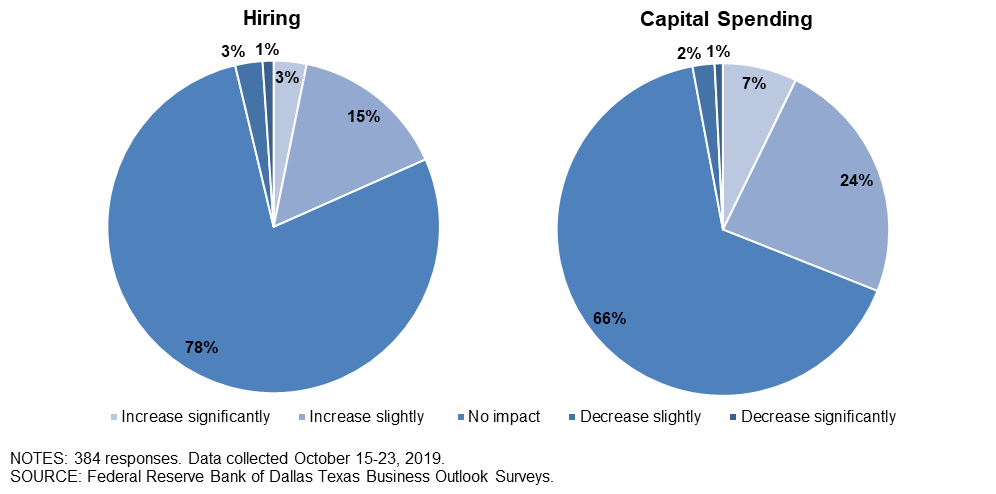

By some measures the cost of credit has declined by 15-20 percent so far this year. If the cost of credit were to decline an additional 15-20 percent, how would this impact your firm’s hiring and capital spending over the next 12 months?

| Hiring | Oct. ’19 (percent) |

| Increase significantly | 3.2 |

| Increase slightly | 15.2 |

| No impact | 77.9 |

| Decrease slightly | 2.7 |

| Decrease significantly | 1.1 |

| Capital spending | Oct. ’19 (percent) |

| Increase significantly | 7.2 |

| Increase slightly | 23.8 |

| No impact | 66.0 |

| Decrease slightly | 2.1 |

| Decrease significantly | 0.8 |

NOTE: 376 responses.

To what extent is your business having difficulty obtaining financing for desired long-term uses such as capital expenditures?

| Oct. ’15 (percent) |

Oct. ’16 (percent) |

Oct. ’17 (percent) |

Oct. ’18 (percent) |

Oct. ’19 (percent) |

|

| No difficulty | 42.0 | 43.5 | 38.8 | 40.0 | 39.6 |

| Some difficulty | 15.9 | 12.6 | 9.3 | 11.2 | 9.1 |

| Substantial difficulty | 2.4 | 2.4 | 3.7 | 1.6 | 2.3 |

| Extreme difficulty | 0.3 | 0.5 | 2.4 | 1.6 | 0.8 |

| Not applicable—haven’t sought credit | 39.3 | 41.1 | 45.7 | 45.7 | 48.2 |

NOTE: 386 responses.

To what extent is your business having difficulty obtaining financing for desired short-term uses such as paying workers and acquiring inventories of material or supplies?

| Oct. ’15 (percent) |

Oct. ’16 (percent) |

Oct. ’17 (percent) |

Oct. ’18 (percent) |

Oct. ’19 (percent) |

|

| No difficulty | 41.4 | 38.1 | 40.9 | 39.5 | 39.1 |

| Some difficulty | 9.2 | 9.2 | 7.8 | 7.3 | 7.8 |

| Substantial difficulty | 1.7 | 2.6 | 2.4 | 2.1 | 2.1 |

| Extreme difficulty | 0.0 | 0.5 | 1.1 | 1.3 | 0.8 |

| Not applicable—haven’t sought credit | 47.8 | 49.6 | 47.8 | 49.9 | 50.3 |

NOTE: 384 responses.

Has your firm’s production and/or sales been adversely affected by difficulty obtaining credit?

| Oct. ’15 (percent) |

Oct. ’16 (percent) |

Oct. ’17 (percent) |

Oct. ’18 (percent) |

Oct. ’19 (percent) |

|

| Yes— significantly | 0.7 | 1.6 | 1.1 | 1.3 | 1.3 |

| Yes—somewhat | 8.1 | 7.9 | 9.2 | 8.6 | 4.9 |

| No | 40.3 | 37.3 | 39.1 | 33.2 | 40.1 |

| Not applicable—haven’t had problems obtaining credit | 13.8 | 13.6 | 8.4 | 12.0 | 8.6 |

| Not applicable— haven’t sought credit | 37.2 | 39.6 | 42.3 | 44.9 | 45.1 |

NOTE: 384 responses.

NOTE: Survey respondents were given the opportunity to provide comments. These comments can be found on the individual survey Special Questions results pages, accessible by the tabs above.

Texas Manufacturing Outlook Survey

Data were collected Oct. 15–23, and 104 Texas manufacturers responded to the surveys.

See data files with a full history of results.

How do borrowing conditions facing your firm compare to those six months ago?

| Oct. ’15 (percent) |

Oct. ’16 (percent) |

Oct. ’17 (percent) |

Oct. ’18 (percent) |

Oct. ’19 (percent) |

|

| Eased substantially | 0.0 | 0.0 | 1.8 | 1.7 | 1.0 |

| Eased somewhat | 6.3 | 8.8 | 11.0 | 8.7 | 8.7 |

| No change | 47.9 | 50.9 | 43.1 | 48.7 | 54.8 |

| Tightened somewhat | 9.4 | 9.6 | 3.7 | 7.0 | 8.7 |

| Tightened substantially | 3.1 | 5.3 | 5.5 | 5.2 | 1.0 |

| Not applicable—haven’t sought credit | 33.3 | 25.4 | 34.9 | 28.7 | 26.0 |

NOTE: 104 responses.

How does the cost of credit compare to what it was six months ago?

| Oct. ’15 (percent) |

Oct. ’16 (percent) |

Oct. ’17 (percent) |

Oct. ’18 (percent) |

Oct. ’19 (percent) |

|

| Increased substantially | 0.0 | 1.8 | 0.9 | 7.0 | 0.0 |

| Increased somewhat | 17.7 | 10.5 | 24.8 | 37.4 | 7.8 |

| No change | 44.8 | 53.5 | 33.9 | 26.1 | 39.8 |

| Decreased somewhat | 3.1 | 7.9 | 4.6 | 2.6 | 24.3 |

| Decreased substantially | 2.1 | 0.9 | 1.8 | 0.0 | 1.0 |

| Not applicable—haven’t sought credit | 32.3 | 25.4 | 33.9 | 27.0 | 27.2 |

NOTE: 103 responses.

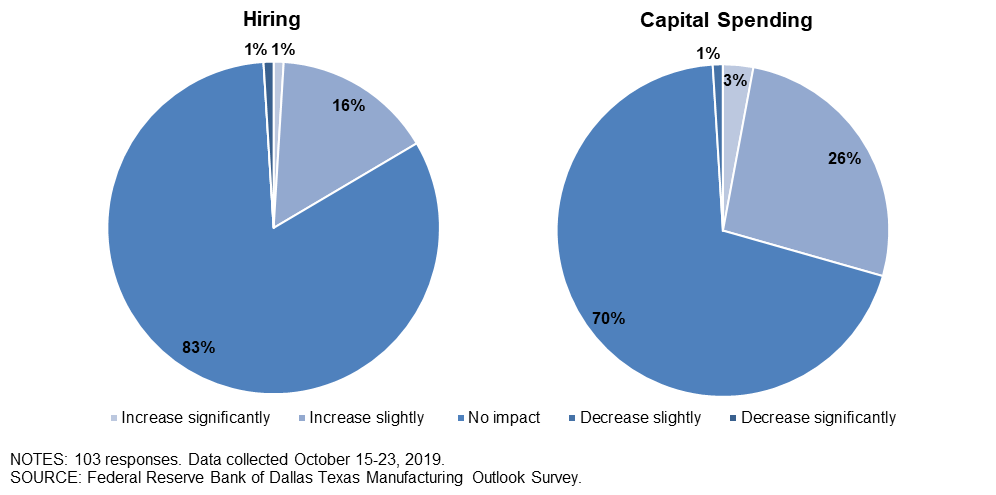

By some measures the cost of credit has declined by 15-20 percent so far this year. If the cost of credit were to decline an additional 15-20 percent, how would this impact your firm’s hiring and capital spending over the next 12 months?

| Hiring | Oct. ’19 (percent) |

| Increase significantly | 1.0 |

| Increase slightly | 15.5 |

| No impact | 82.5 |

| Decrease slightly | 0.0 |

| Decrease significantly | 1.0 |

| Capital spending | Oct. ’19 (percent) |

| Increase significantly | 2.9 |

| Increase slightly | 26.5 |

| No impact | 69.6 |

| Decrease slightly | 1.0 |

| Decrease significantly | 0.0 |

NOTE: 103 responses.

To what extent is your business having difficulty obtaining financing for desired long-term uses such as capital expenditures?

| Oct. ’15 (percent) |

Oct. ’16 (percent) |

Oct. ’17 (percent) |

Oct. ’18 (percent) |

Oct. ’19 (percent) |

|

| No difficulty | 42.4 | 45.5 | 38.9 | 44.3 | 49.5 |

| Some difficulty | 17.4 | 8.9 | 10.2 | 10.4 | 10.7 |

| Substantial difficulty | 3.3 | 4.5 | 5.6 | 1.7 | 1.9 |

| Extreme difficulty | 1.1 | 0.9 | 1.9 | 1.7 | 1.0 |

| Not applicable—haven’t sought credit | 35.9 | 40.2 | 43.5 | 41.7 | 36.9 |

NOTE: 103 responses.

To what extent is your business having difficulty obtaining financing for desired short-term uses such as paying workers and acquiring inventories of material or supplies?

| Oct. ’15 (percent) |

Oct. ’16 (percent) |

Oct. ’17 (percent) |

Oct. ’18 (percent) |

Oct. ’19 (percent) |

|

| No difficulty | 48.4 | 42.1 | 41.7 | 43.5 | 52.9 |

| Some difficulty | 16.1 | 10.5 | 8.3 | 7.8 | 4.8 |

| Substantial difficulty | 0.0 | 3.5 | 2.8 | 3.5 | 1.9 |

| Extreme difficulty | 0.0 | 0.9 | 0.0 | 1.7 | 1.0 |

| Not applicable—haven’t sought credit | 35.5 | 43.0 | 47.2 | 43.5 | 39.4 |

NOTE: 104 responses.

Has your firm’s production and/or sales been adversely affected by difficulty obtaining credit?

| Oct. ’15 (percent) |

Oct. ’16 (percent) |

Oct. ’17 (percent) |

Oct. ’18 (percent) |

Oct. ’19 (percent) |

|

| Yes— significantly | 0.0 | 2.7 | 0.9 | 0.9 | 1.9 |

| Yes—somewhat | 10.6 | 8.9 | 10.2 | 8.0 | 1.9 |

| No | 35.1 | 38.4 | 37.0 | 35.4 | 48.5 |

| Not applicable—haven’t had problems obtaining credit | 20.2 | 16.1 | 11.1 | 16.8 | 13.6 |

| Not applicable— haven’t sought credit | 34.0 | 33.9 | 40.7 | 38.9 | 34.0 |

NOTE: 103 responses.

Special Questions Comments

These comments have been edited for publication.

Primary Metal Manufacturing

- If a business is profitable, it can get a loan.

Machinery Manufacturing

- Banks are not interested in small company loans, and any efforts made to secure small loans are not worth the risks mandated by the lending institutions.

Computer and Electronic Product Manufacturing

- We are not having issues with credit, as our business generates ample cash. There is an issue of demand, which will slow our capital expenditures and employment.

Printing and Related Support Activities

- Credit concerns are way below those of labor concerns.

Texas Service Sector Outlook Survey

Data were collected Oct. 15–23, and 283 Texas business executives responded to the surveys.

See data files with a full history of results.

How do borrowing conditions facing your firm compare to those six months ago?

| Oct. ’15 (percent) |

Oct. ’16 (percent) |

Oct. ’17 (percent) |

Oct. ’18 (percent) |

Oct. ’19 (percent) |

|

| Eased substantially | 1.0 | 0.7 | 1.9 | 1.5 | 0.7 |

| Eased somewhat | 7.3 | 7.4 | 5.6 | 5.9 | 7.9 |

| No change | 47.1 | 44.6 | 48.9 | 44.7 | 46.8 |

| Tightened somewhat | 13.6 | 8.9 | 6.7 | 11.0 | 7.9 |

| Tightened substantially | 1.5 | 2.6 | 0.7 | 2.2 | 0.7 |

| Not applicable—haven’t sought credit | 29.6 | 35.8 | 36.2 | 34.8 | 36.1 |

NOTE: 280 responses.

How does the cost of credit compare to what it was six months ago?

| Oct. ’15 (percent) |

Oct. ’16 (percent) |

Oct. ’17 (percent) |

Oct. ’18 (percent) |

Oct. ’19 (percent) |

|

| Increased substantially | 0.5 | 0.4 | 0.7 | 7.4 | 0.7 |

| Increased somewhat | 11.7 | 19.1 | 26.9 | 41.3 | 4.3 |

| No change | 50.5 | 40.4 | 32.1 | 15.9 | 29.0 |

| Decreased somewhat | 6.8 | 5.5 | 3.4 | 1.5 | 27.2 |

| Decreased substantially | 1.0 | 0.7 | 0.0 | 0.0 | 3.9 |

| Not applicable—haven’t sought credit | 29.6 | 33.8 | 36.9 | 33.9 | 34.8 |

NOTE: 279 responses.

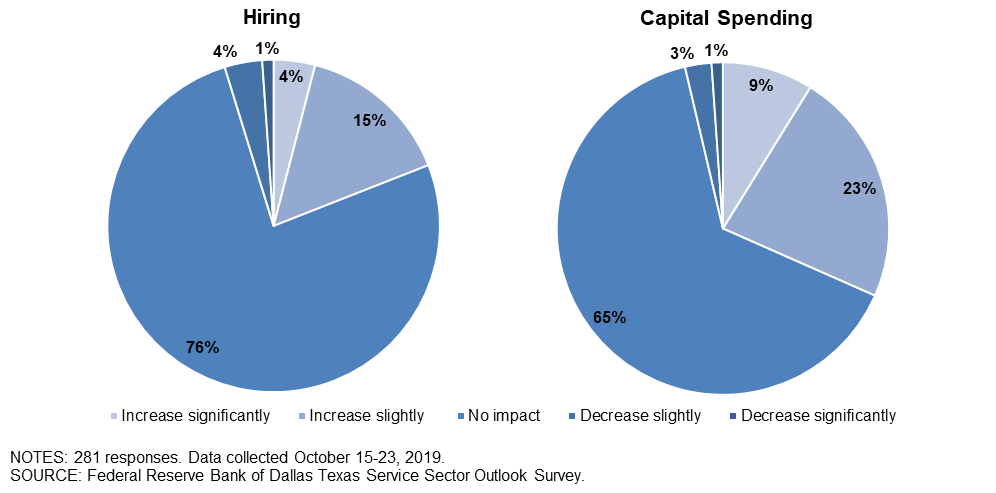

By some measures the cost of credit has declined by 15-20 percent so far this year. If the cost of credit were to decline an additional 15-20 percent, how would this impact your firm’s hiring and capital spending over the next 12 months?

| Hiring | Oct. ’19 (percent) |

| Increase significantly | 4.0 |

| Increase slightly | 15.0 |

| No impact | 76.2 |

| Decrease slightly | 3.7 |

| Decrease significantly | 1.1 |

| Capital spending | Oct. ’19 (percent) |

| Increase significantly | 8.8 |

| Increase slightly | 22.8 |

| No impact | 64.7 |

| Decrease slightly | 2.6 |

| Decrease significantly | 1.1 |

NOTE: 273 responses.

To what extent is your business having difficulty obtaining financing for desired long-term uses such as capital expenditures?

| Oct. ’15 (percent) |

Oct. ’16 (percent) |

Oct. ’17 (percent) |

Oct. ’18 (percent) |

Oct. ’19 (percent) |

|

| No difficulty | 41.9 | 42.6 | 38.8 | 38.1 | 36.0 |

| Some difficulty | 15.3 | 14.1 | 9.0 | 11.5 | 8.5 |

| Substantial difficulty | 2.0 | 1.5 | 3.0 | 1.5 | 2.5 |

| Extreme difficulty | 0.0 | 0.4 | 2.6 | 1.5 | 0.7 |

| Not applicable—haven’t sought credit | 40.9 | 41.5 | 46.6 | 47.4 | 52.3 |

NOTE: 283 responses.

To what extent is your business having difficulty obtaining financing for desired short-term uses such as paying workers and acquiring inventories of material or supplies?

| Oct. ’15 (percent) |

Oct. ’16 (percent) |

Oct. ’17 (percent) |

Oct. ’18 (percent) |

Oct. ’19 (percent) |

|

| No difficulty | 38.1 | 36.3 | 40.5 | 37.8 | 33.9 |

| Some difficulty | 5.9 | 8.6 | 7.6 | 7.0 | 8.9 |

| Substantial difficulty | 2.5 | 2.2 | 2.3 | 1.5 | 2.1 |

| Extreme difficulty | 0.0 | 0.4 | 1.5 | 1.1 | 0.7 |

| Not applicable—haven’t sought credit | 53.5 | 52.4 | 48.1 | 52.6 | 54.3 |

NOTE: 280 responses.

Has your firm’s production and/or sales been adversely affected by difficulty obtaining credit?

| Oct. ’15 (percent) |

Oct. ’16 (percent) |

Oct. ’17 (percent) |

Oct. ’18 (percent) |

Oct. ’19 (percent) |

|

| Yes— significantly | 1.0 | 1.1 | 1.1 | 1.5 | 1.1 |

| Yes—somewhat | 6.9 | 7.4 | 8.7 | 8.9 | 6.0 |

| No | 42.6 | 36.8 | 39.9 | 32.2 | 37.0 |

| Not applicable—haven’t had problems obtaining credit | 10.8 | 12.6 | 7.2 | 10.0 | 6.8 |

| Not applicable— haven’t sought credit | 38.7 | 42.0 | 43.0 | 47.4 | 49.1 |

NOTE: 281 responses.

Special Questions Comments

These comments have been edited for publication.

Truck Transportation

- We are a non-asset-based company.

Publishing Industries (except Internet)

- We are not capital intense, but cash flow is key for operating with growth.

Credit Intermediation and Related Activities

- If the cost of borrowing continues to decrease due to the Federal Reserve lowering rates, lenders would take this as an indicator that the economy is slowing even further, causing them to pause and/or take a more risk-averse stance to new or even existing borrowers.

Securities, Commodity Contracts, and Other Financial Investments and Related Activities

- Our firm gets capital through partnerships/selling equity and does not seek lending in the traditional banking approach.

Real Estate

- There is no difficulty obtaining credit for a good business with decent records. My only concern is that there be no loosening of regulation so that the quality of the borrowing will continue at a high level, minimizing the risk of another financial crisis.

Rental and Leasing Services

- Access to credit for good companies is not the problem. The problem is the uncertainty of a bunch of antibusiness politicians getting into office in the next year; just the fear is killing business—the fact will be devastating.

Professional, Scientific and Technical Services

- Small businesses like ours, especially in technology, are limited by capital to how fast and how big we can grow. Reducing capital (money) cost and making it more available from large and small banks and private equity/venture capital firms should be the central focus of government entities and the central bank.

- We are a 100-percent-service-based firm and have enough capital to cover any increase in employees at this time.

- No credit is needed—we are totally owner financed.

- We typically do not use credit to any significant degree and instead rely on internally generated capital.

Administrative and Support Services

- We have a line of credit. Due to poor sales performance in 2018, our LOC [line of credit] was reduced, leaving less cushion for strategic investments. The 2018 changes in revenue were related to capital investments, such that we anticipate a short-term J-curve before returning on the investment. Unfortunately, that doesn't factor into the bank's calculation of our ratios that impact our total available credit line.

Ambulatory Health Care Services

- Vendor financing is more aggressive than bank rates; we are seeing our loans going outside of our local banking channels due to interest savings. Our local banks are aggressively pursuing these loans but are generally unsuccessful.

- The lack of availability of credit (at any rate) is the key limiting factor in this company's success right now. This has been true for two to three years.

Food Services and Drinking Places

- We have good cash flow. We are not seeking credit at this time.

Texas Retail Outlook Survey

Data were collected Oct. 15–23, and 56 Texas retailers responded to the surveys.

See data files with a full history of results.

How do borrowing conditions facing your firm compare to those six months ago?

| Oct. ’15 (percent) |

Oct. ’16 (percent) |

Oct. ’17 (percent) |

Oct. ’18 (percent) |

Oct. ’19 (percent) |

|

| Eased substantially | 0.0 | 0.0 | 0.0 | 0.0 | 3.6 |

| Eased somewhat | 6.7 | 5.4 | 5.3 | 5.2 | 3.6 |

| No change | 51.1 | 57.1 | 59.6 | 56.9 | 49.1 |

| Tightened somewhat | 20.0 | 3.6 | 1.8 | 5.2 | 7.3 |

| Tightened substantially | 0.0 | 3.6 | 1.8 | 1.7 | 0.0 |

| Not applicable—haven’t sought credit | 22.2 | 30.4 | 31.6 | 31.0 | 36.4 |

NOTE: 55 responses.

How does the cost of credit compare to what it was six months ago?

| Oct. ’15 (percent) |

Oct. ’16 (percent) |

Oct. ’17 (percent) |

Oct. ’18 (percent) |

Oct. ’19 (percent) |

|

| Increased substantially | 0.0 | 0.0 | 1.8 | 10.3 | 0.0 |

| Increased somewhat | 13.3 | 19.3 | 33.3 | 44.8 | 7.1 |

| No change | 55.6 | 45.6 | 31.6 | 10.3 | 19.6 |

| Decreased somewhat | 4.4 | 5.3 | 0.0 | 1.7 | 35.7 |

| Decreased substantially | 2.2 | 0.0 | 0.0 | 0.0 | 1.8 |

| Not applicable—haven’t sought credit | 24.4 | 29.8 | 33.3 | 32.8 | 35.7 |

NOTE: 56 responses.

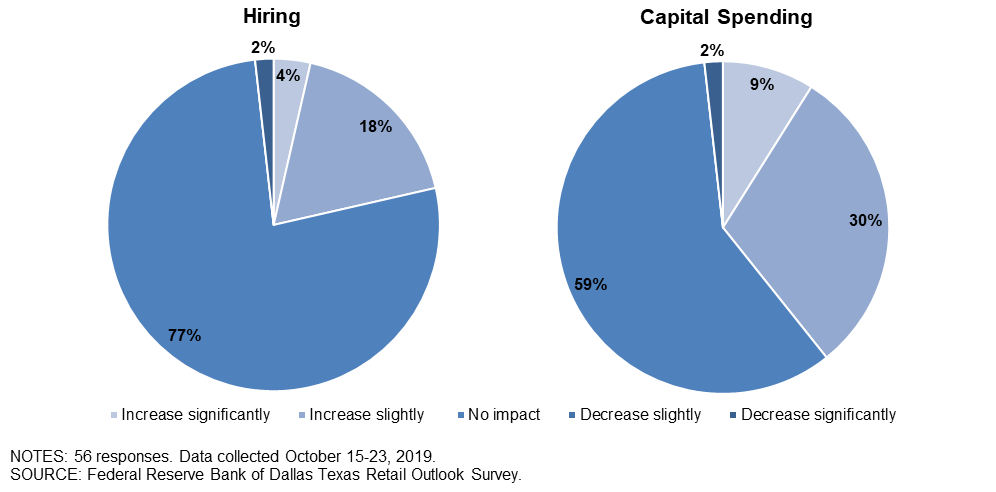

By some measures the cost of credit has declined by 15-20 percent so far this year. If the cost of credit were to decline an additional 15-20 percent, how would this impact your firm’s hiring and capital spending over the next 12 months?

| Hiring | Oct. ’19 (percent) |

| Increase significantly | 3.6 |

| Increase slightly | 17.9 |

| No impact | 76.8 |

| Decrease slightly | 0.0 |

| Decrease significantly | 1.8 |

| Capital spending | Oct. ’19 (percent) |

| Increase significantly | 8.9 |

| Increase slightly | 30.4 |

| No impact | 58.9 |

| Decrease slightly | 0.0 |

| Decrease significantly | 1.8 |

NOTE: 56 responses.

To what extent is your business having difficulty obtaining financing for desired long-term uses such as capital expenditures?

| Oct. ’15 (percent) |

Oct. ’16 (percent) |

Oct. ’17 (percent) |

Oct. ’18 (percent) |

Oct. ’19 (percent) |

|

| No difficulty | 57.8 | 57.9 | 49.1 | 46.6 | 41.1 |

| Some difficulty | 11.1 | 10.5 | 7.0 | 6.9 | 8.9 |

| Substantial difficulty | 2.2 | 1.8 | 1.8 | 1.7 | 0.0 |

| Extreme difficulty | 0.0 | 0.0 | 1.8 | 0.0 | 0.0 |

| Not applicable—haven’t sought credit | 28.9 | 29.8 | 40.4 | 44.8 | 50.0 |

NOTE: 56 responses.

To what extent is your business having difficulty obtaining financing for desired short-term uses such as paying workers and acquiring inventories of material or supplies?

| Oct. ’15 (percent) |

Oct. ’16 (percent) |

Oct. ’17 (percent) |

Oct. ’18 (percent) |

Oct. ’19 (percent) |

|

| No difficulty | 53.5 | 50.0 | 50.0 | 46.6 | 32.7 |

| Some difficulty | 7.0 | 10.3 | 8.9 | 5.2 | 9.1 |

| Substantial difficulty | 4.7 | 1.7 | 0.0 | 0.0 | 1.8 |

| Extreme difficulty | 0.0 | 0.0 | 1.8 | 0.0 | 1.8 |

| Not applicable—haven’t sought credit | 34.9 | 37.9 | 39.3 | 48.3 | 54.5 |

NOTE: 55 responses.

Has your firm’s production and/or sales been adversely affected by difficulty obtaining credit?

| Oct. ’15 (percent) |

Oct. ’16 (percent) |

Oct. ’17 (percent) |

Oct. ’18 (percent) |

Oct. ’19 (percent) |

|

| Yes— significantly | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Yes—somewhat | 6.8 | 5.4 | 8.9 | 7.0 | 8.9 |

| No | 56.8 | 46.4 | 41.1 | 40.4 | 39.3 |

| Not applicable—haven’t had problems obtaining credit | 11.4 | 17.9 | 10.7 | 8.8 | 8.9 |

| Not applicable— haven’t sought credit | 25.0 | 30.4 | 39.3 | 43.9 | 42.9 |

NOTE: 56 responses.

Special Questions Comments

These comments have been edited for publication.

Merchant Wholesalers, Durable Goods

- While we have not sought credit in the last 12 months, we believe we would have no issues in obtaining additional credit if needed. We believe that we are under-leveraged at less than 0.5 times EBITDA [earnings before interest, tax, depreciation and amortization] and 10 percent of liquid assets.

Merchant Wholesalers, Nondurable Goods

- Credit is not the question for our business. Consumer confidence and spending are critical. Business is very slow, and continued poor communication from [Federal Reserve] Chairman Powell is a detriment.

- The credit situation for my personal company has eased somewhat, but credit for my family’s business for capital expenditures has been difficult. Credit for my customers has also stiffened, and despite the easing by the Fed [Federal Reserve], they have seen little impact.

Motor Vehicle and Parts Dealers

- We see the banks’ willingness to improve terms on loans as it relates to fixed financing versus variable rates and increasing the length of the terms. These are all positive as they relate to our borrowing.

- Cost of funds is a major problem in our business (automotive). Generally, floor plan [financing rates are] prime plus 1.50 percentage points or more, plus flat charges, plus insurance. Our business is well-capitalized. Capital expenditures have been excessive for the last five years.

Building Material and Garden Equipment and Supplies Dealers

- We are able to internally fund most of our capital expenditures; however, we have noticed several projects stalling due to an inability to obtain credit.

- We are sitting on over $15 million in cash; if this keeps up, we’re going to put it to work.

Clothing and Clothing Accessories Stores

- Suppliers have become more demanding in terms of credit, given all the recent restructurings in the retail space.

Questions regarding the Texas Business Outlook Surveys can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest surveys are released on the web.