Special Questions

Special Questions

April 27, 2020

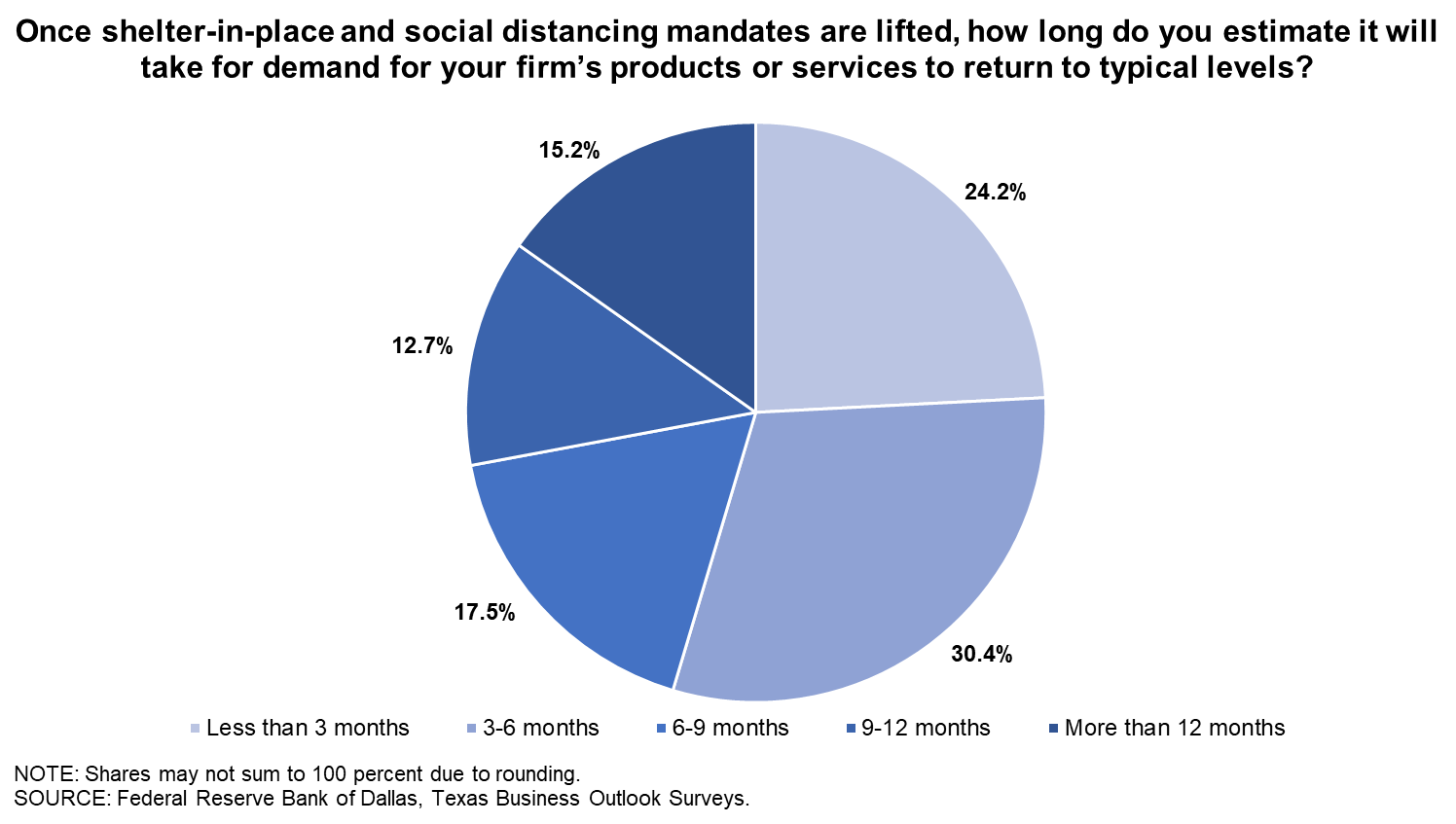

For this month’s survey, Texas business executives were asked supplemental questions on the impacts of the coronavirus (COVID-19). Results below include responses from participants of all three surveys: Texas Manufacturing Outlook Survey, Texas Service Sector Outlook Survey and Texas Retail Outlook Survey.

Texas Business Outlook Surveys

Data were collected April 14–22, and 407 Texas business executives responded to the surveys.

How has the coronavirus (COVID-19) impacted each of these measures of your business in April?

| No effect (percent) |

Slight negative effect (percent) |

Significant negative effect (percent) |

Negative effect, combined (percent) |

Slight positive effect (percent) |

Significant positive effect (percent) |

Positive effect, combined (percent) |

|

| Availability of materials/inputs | 37.6 | 40.4 | 19.4 | 59.8 | 1.5 | 1.0 | 2.5 |

| Production/revenue/sales | 12.1 | 26.2 | 54.7 | 80.9 | 4.2 | 2.7 | 6.9 |

| Demand for products or services | 10.6 | 21.5 | 56.4 | 78.0 | 4.5 | 6.9 | 11.4 |

| Number of employees | 48.4 | 26.9 | 20.5 | 47.4 | 3.0 | 1.2 | 4.2 |

| Hours worked | 29.5 | 34.9 | 28.5 | 63.4 | 5.0 | 2.2 | 7.2 |

| Capital spending | 30.8 | 21.8 | 44.5 | 66.3 | 1.5 | 1.5 | 3.0 |

NOTES: 407 responses. This same question was posed in March. See results.

Please estimate the impact on demand for products or services.

| Percent | |||

| Average negative impact | 45.7 | ||

| Average positive impact | 40.9 |

NOTES: This question was only posed to those indicating an effect on demand for products or services. The average negative impact calculation is based on 315 reponses. The average positive impact calculation is based on 46 responses.

Please indicate whether the change in employment is temporary or permanent.

| Temporary (percent) |

Permanent (percent) |

||

| Negative effect on employment | 75.1 | 24.9 | |

| Positive effect on employment | 58.3 | 41.7 |

NOTES: This question was only posed to those indicating an effect on number of employees. The negative effect breakouts are based on 173 responses. The positive effect breakouts are based on 12 responses.

Do you expect to rehire the same number of employees?

| Percent | |||

| Yes | 41.7 | ||

| No, we expect a slightly reduced headcount going forward | 34.8 | ||

| No, we expect a significantly reduced headcount going forward | 8.3 | ||

| Don't know | 15.2 |

NOTES: This question was only posed to those indicating a temporary negative effect on number of employees. 132 responses.

Please indicate which of the following best characterizes your firm’s current situation.

| Percent | |||

| Fully operational | 59.3 | ||

| Temporarily shut down part of our operations | 33.3 | ||

| Temporarily shut down all of our operations | 5.9 | ||

| Permanently shut down part of our operations | 1.0 | ||

| Permanently shut down all of our operations | 0.5 |

NOTE: 405 responses.

Please mark the reason(s) behind your firm’s shutdown.

| Percent | |||

| Employee protection/health | 46.9 | ||

| Our industry is subject to state/local operational restrictions | 46.3 | ||

| Weak demand/sales | 46.3 | ||

| Other | 10.5 |

NOTES: This question was only posed if any type of shutdown was selected. 162 responses.

Have you taken any of the following measures to cover shortfalls in revenues experienced as a result of the coronavirus (COVID-19) outbreak? Please select all that apply.

| Percent | |||

| Applied for the new SBA PPP | 68.0 | ||

| Drawn down cash reserves | 39.0 | ||

| Laid off employees | 26.7 | ||

| Reduced salaries | 25.6 | ||

| Drawn down line of credit | 23.8 | ||

| Applied for one of the other new SBA programs established by the CARES Act | 14.5 | ||

| Dipped into personal savings | 11.0 | ||

| Obtained a loan payment deferral | 10.2 | ||

| Obtained a rent payment deferral | 7.8 | ||

| Applied for a traditional SBA loan | 3.8 | ||

| Taken out a new loan (non-SBA) | 3.2 | ||

| Other | 14.0 |

NOTES: 389 responses. The most common 'other' measures specified were reduced work hours, lowered operational or capital spending, and implemented a hiring freeze. SBA stands for Small Business Administration, PPP is the Paycheck Protection Program and CARES is the Coronavirus Aid, Relief, and Economic Security Act.

Please mark which new SBA program(s) established by the CARES Act that you applied for, other than the PPP.

| Percent | |||

| EIDL Advance | 73.9 | ||

| SBA Express Bridge Loans | 26.1 | ||

| SBA Debt Relief | 19.6 |

NOTES: This question was only posed to those indicating they have applied for one of the other new SBA programs established by the CARES Act. 46 responses. EIDL stands for Economic Injury Disaster Loan.

NOTE: 401 responses

Survey respondents were given the opportunity to provide comments. These comments can be found on the individual survey Special Questions results pages, accessible by the tabs above.

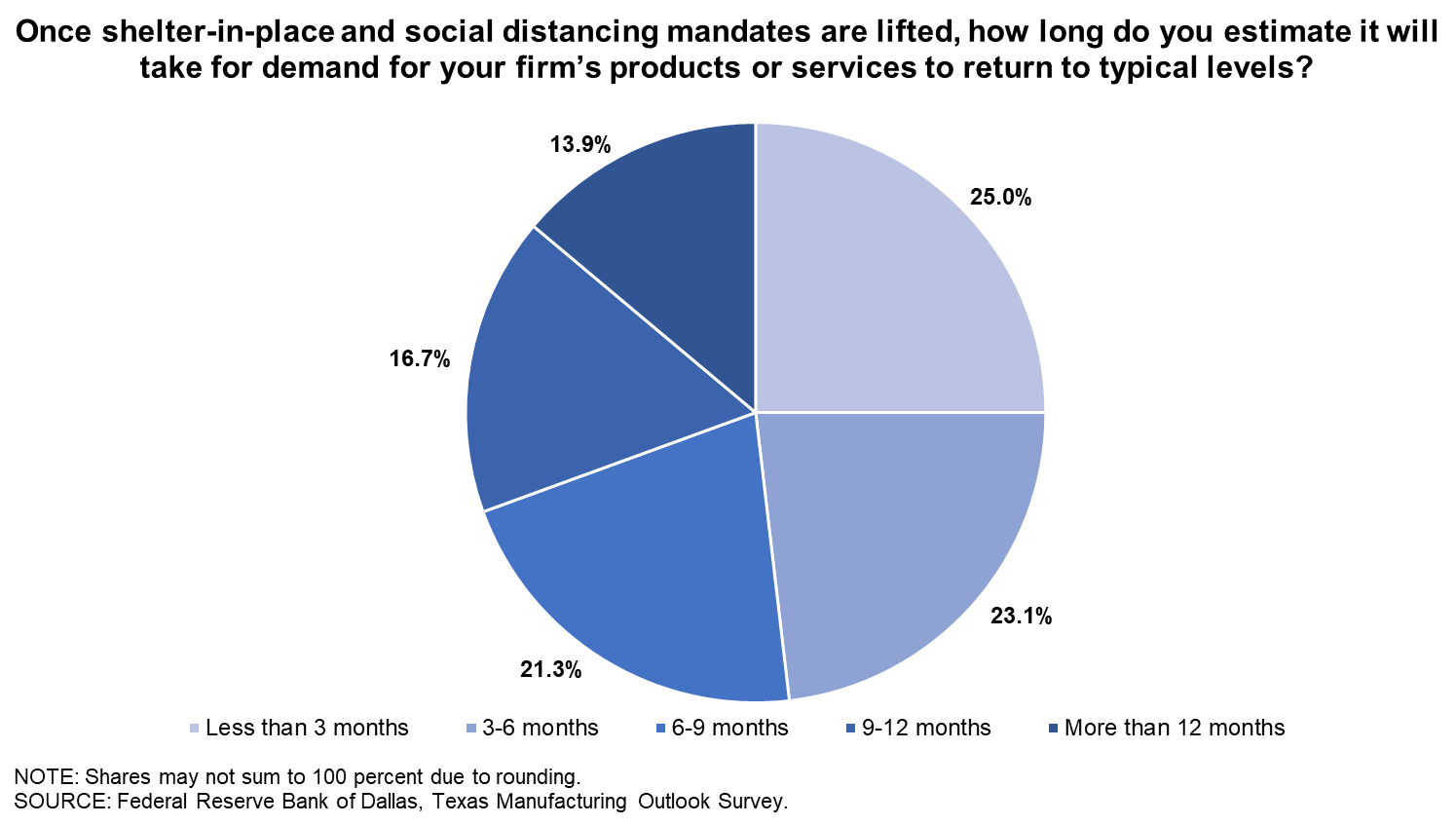

Texas Manufacturing Outlook Survey

Data were collected April 14–22, and 110 Texas manufacturers responded to the survey.

How has the coronavirus (COVID-19) impacted each of these measures of your business in April?

| No effect (percent) |

Slight negative effect (percent) |

Significant negative effect (percent) |

Negative effect, combined (percent) |

Slight positive effect (percent) |

Significant positive effect (percent) |

Positive effect, combined (percent) |

|

| Availability of materials/inputs | 37.4 | 48.6 | 11.2 | 59.8 | 1.9 | 0.9 | 2.8 |

| Production | 20.4 | 34.3 | 38.9 | 73.1 | 3.7 | 2.8 | 6.5 |

| Demand for products or services | 11.9 | 19.3 | 56.0 | 75.2 | 6.4 | 6.4 | 12.8 |

| Number of employees | 52.3 | 30.3 | 12.8 | 43.1 | 3.7 | 0.9 | 4.6 |

| Hours worked | 33.3 | 37.0 | 20.4 | 57.4 | 6.5 | 2.8 | 9.3 |

| Capital spending | 29.0 | 20.6 | 47.7 | 68.2 | 0.9 | 1.9 | 2.8 |

NOTES: 110 responses. This same question was posed in March. See results.

Please estimate the impact on demand for products or services.

| Percent | |||

| Average negative impact | 45.2 | ||

| Average positive impact | 26.8 |

NOTES: This question was only posed to those indicating an effect on demand for products or services. The average negative impact calculation is based on 82 reponses. The average positive impact calculation is based on 14 responses.

Please indicate whether the change in employment is temporary or permanent.

| Temporary (percent) |

Permanent (percent) |

||

| Negative effect on employment | 78.7 | 21.3 | |

| Positive effect on employment | 25.0 | 75.0 |

NOTES: This question was only posed to those indicating an effect on number of employees. The negative effect breakouts are based on 47 responses. The positive effect breakouts are based on 4 responses.

Do you expect to rehire the same number of employees?

| Percent | |||

| Yes | 55.3 | ||

| No, we expect a slightly reduced headcount going forward | 15.8 | ||

| No, we expect a significantly reduced headcount going forward | 7.9 | ||

| Don't know | 21.1 |

NOTES: This question was only posed to those indicating a temporary negative effect on number of employees. 38 responses.

Please indicate which of the following best characterizes your firm’s current situation.

| Percent | |||

| Fully operational | 73.4 | ||

| Temporarily shut down part of our operations | 21.1 | ||

| Temporarily shut down all of our operations | 4.6 | ||

| Permanently shut down part of our operations | 0.9 | ||

| Permanently shut down all of our operations | 0.0 |

NOTE: 109 responses.

Please mark the reason(s) behind your firm’s shutdown.

| Percent | |||

| Employee protection/health | 71.4 | ||

| Our industry is subject to state/local operational restrictions | 50.0 | ||

| Weak demand/sales | 32.1 | ||

| Other | 7.1 |

NOTES: This question was only posed if any type of shutdown was selected. 28 responses.

Have you taken any of the following measures to cover shortfalls in revenues experienced as a result of the coronavirus (COVID-19) outbreak? Please select all that apply.

| Percent | |||

| Applied for the new SBA PPP | 73.7 | ||

| Drawn down cash reserves | 38.9 | ||

| Drawn down line of credit | 28.4 | ||

| Laid off employees | 23.2 | ||

| Reduced salaries | 17.9 | ||

| Applied for one of the other new SBA programs established by the CARES Act | 15.8 | ||

| Obtained a loan payment deferral | 10.5 | ||

| Dipped into personal savings | 7.4 | ||

| Applied for a traditional SBA loan | 6.3 | ||

| Taken out a new loan (non-SBA) | 5.3 | ||

| Obtained a rent payment deferral | 3.2 | ||

| Other | 16.8 |

NOTES: 105 responses. SBA stands for Small Business Administration, PPP is the Paycheck Protection Program and CARES is the Coronavirus Aid, Relief, and Economic Security Act.

Please mark which new SBA program(s) established by the CARES Act that you applied for, other than the PPP.

| Percent | |||

| EIDL Advance | 84.6 | ||

| SBA Express Bridge Loans | 23.1 | ||

| SBA Debt Relief | 7.7 |

NOTES: This question was only posed to those indicating they have applied for one of the other new SBA programs established by the CARES Act. 13 responses. EIDL stands for Economic Injury Disaster Loan.

NOTE: 108 responses

Special Questions Comments

These comments have been edited for publication.

Chemical Manufacturing

- We have asked for rent payment deferrals for our leased facilities and have not received them, as landlords are also struggling. We elected to permanently consolidate operations in fewer sites to strengthen cash flow until we see normality return, possibly two years.

- There is some evidence that customers built inventory before the U.S. shutdown in anticipation of shortages. We are operating with many hourly workers furloughed, with pay 50 percent of time.

Plastics and Rubber Product Manufacturing

- COVID-19 hasn’t impacted our facility. We are a critical manufacturer due to the need of our products in the oil field. We’ve taken steps to mitigate exposure through social distancing, working remotely and asking all non-employees to contact us prior to arriving at the facility.

Nonmetallic Mineral Product Manufacturing

- Construction will have a lagging COVID-19 impact. A slowdown is coming, but we do not know when or for how long.

Fabricated Metal Manufacturing

- I don’t understand the rush to open up the nation. Yes, social distancing is working. But, then, you have all the recent fools that think the government is doing something to take away their rights.

- We have not decreased staff. We have had some take personal time for their families and to take care of children who are out of school. Our business is strong, but limiting movement of employees and going through health checks each day slows our processes.

Machinery Manufacturing

- We estimate that the demand for oil may take up to a year to return to previous levels.

- The oil price will be the biggest driver for us. We are a long-cycle oil and gas/energy-driven business. If oil demand and the oil price increase rapidly following the lifting of lockdowns, we will likely see little overall impact. If the oil price remains depressed, we will see a significant decline—2014 on steroids.

- Forecasting is really up in the air right now with oilfield work. If [oil] prices do not rise back to semi-normal levels, we will see a dramatic decline in sales for 2020 and beyond.

- The price of oil has a dramatic impact on our business. Tell me when the oil price recovers to $40 per barrel, and that will get us up and running six months later. Big oil is in a state of shock right now, and it will take some time to return to normal. Dividends right now have a higher priority than any other business dealings. So if you’re a shareholder of their stock, you should feel good.

Computer and Electronic Product Manufacturing

- We are hoping that demand will pick back up in three to six months, but we are worried that some of that demand will be muted by the smaller number of workers. We will have some pent-up demand for new systems, but we expect those systems to be smaller as a result of a smaller workforce.

- PPP has provided funds to keep employees on the payroll for the time being, but if reduced demand continues for months, we likely cannot sustain that level of employment. We don’t think we will see the real impact for months, as we manufacture for other businesses. It will take time for those businesses to assess what direction they need to move with regard to production. Oil prices have had more impact to date than COVID-19, but we think COVID-19-related shelter-in-place results will impact our customers in the second and third quarters, likely impacting us in the third and fourth quarters, but we don’t really know.

Transportation Equipment Manufacturing

- The virus has caused a collapse in the oil price.

- Short term, we are in relatively good shape. We have an existing-order backlog still of eight-plus months. However, new orders are being delayed and customer budgets are being cut. So we anticipate much lower volumes of new orders this year, which will mean lower deliveries and revenues for 2021 than previously forecasted.

- So much is unknown that it is hard to answer with confidence most questions about the future. The outlook is not good.

- We subcontract a significant amount of work to small businesses. We anticipate that many of our current subcontractors will not be able to withstand the current diminishment of business. It will take us several months to identify and qualify replacements for these vendors.

Food Manufacturing

- We are fully operational, and we expect lengthened work hours and will bring our administrative team working from home back in-house.

Beverage and Tobacco Product Manufacturing

- As far as return to normal, that is the million-dollar question. If all pre-COVID jobs return and oil bounces back, I would say less than three months. If most pre-COVID jobs return but oil stays low, it’s three to six months. If unemployment stays above 6–7 percent, I don’t know. If fear (of virus, layoffs, etc.) remains, I don’t know. The longer that this drags out, the more people’s perceptions and behaviors will be changed moving forward. I would like to think that we will have a quick bounce back to “Trump economy normal,” but I am afraid that it may not be so easy. I’ve never hoped more to be incorrect.

Paper Manufacturing

- I think the federal government has taken meaningful steps to help businesses during this chaotic time. It has been and will continue to be my stance that the best thing I can do is to keep my employees working. The PPP program has helped me to do that.

Printing and Related Support Activities

- Lift the shutdown immediately.

- The overall economic fallout is of greater concern than the virus. Our business will depend on the length of the recession.

Miscellaneous Manufacturing

- The economy must open back up in a meaningful way very soon—as in 2–3 weeks—to avoid further catastrophic negative effects on sales volumes. We received the PPP loan/grant on April 8, 2020, and immediately brought all employees back for 40 hours per week for the next eight weeks. If business doesn’t pick up by the end of that period, we are planning to lay off employees and cut the hours of remaining ones commensurate with the level of business.

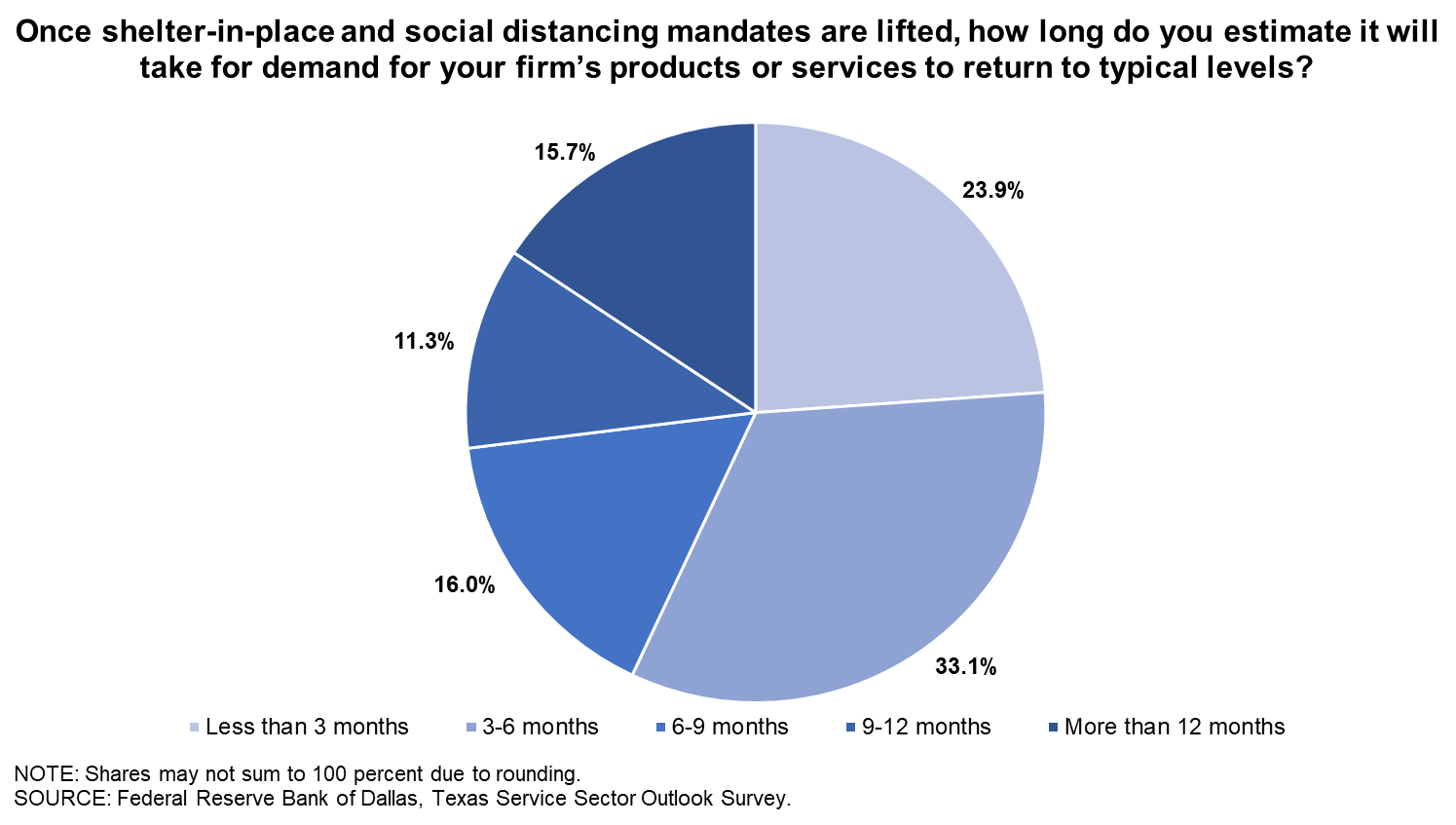

Texas Service Sector Outlook Survey

Data were collected April 14–22, and 297 Texas business executives responded to the survey.

How has the coronavirus (COVID-19) impacted each of these measures of your business in April?

| No effect (percent) |

Slight negative effect (percent) |

Significant negative effect (percent) |

Negative effect, combined (percent) |

Slight positive effect (percent) |

Significant positive effect (percent) |

Positive effect, combined (percent) |

|

| Availability of materials/inputs | 37.7 | 37.4 | 22.5 | 59.9 | 1.4 | 1.0 | 2.4 |

| Revenue/sales | 9.1 | 23.3 | 60.5 | 83.8 | 4.4 | 2.7 | 7.1 |

| Demand for products or services | 10.2 | 22.4 | 56.6 | 79.0 | 3.7 | 7.1 | 10.8 |

| Number of employees | 47.0 | 25.7 | 23.3 | 49.0 | 2.7 | 1.4 | 4.1 |

| Hours worked | 28.0 | 34.1 | 31.4 | 65.5 | 4.4 | 2.0 | 6.4 |

| Capital spending | 31.4 | 22.2 | 43.3 | 65.5 | 1.7 | 1.4 | 3.1 |

NOTES: 297 responses. This same question was posed in March. See results.

Please estimate the impact on demand for products or services.

| Percent | |||

| Average negative impact | 45.9 | ||

| Average positive impact | 47.9 |

NOTES: This question was only posed to those indicating an effect on demand for products or services. The average negative impact calculation is based on 233 reponses. The average positive impact calculation is based on 32 responses.

Please indicate whether the change in employment is temporary or permanent.

| Temporary (percent) |

Permanent (percent) |

||

| Negative effect on employment | 73.8 | 26.2 | |

| Positive effect on employment | 75.0 | 25.0 |

NOTES: This question was only posed to those indicating an effect on number of employees. The negative effect breakouts are based on 126 responses. The positive effect breakouts are based on 8 responses.

Do you expect to rehire the same number of employees?

| Percent | |||

| Yes | 36.2 | ||

| No, we expect a slightly reduced headcount going forward | 42.6 | ||

| No, we expect a significantly reduced headcount going forward | 8.5 | ||

| Don't know | 12.8 |

NOTES: This question was only posed to those indicating a temporary negative effect on number of employees. 94 responses.

Please indicate which of the following best characterizes your firm’s current situation.

| Percent | |||

| Fully operational | 54.1 | ||

| Temporarily shut down part of our operations | 37.8 | ||

| Temporarily shut down all of our operations | 6.4 | ||

| Permanently shut down part of our operations | 1.0 | ||

| Permanently shut down all of our operations | 0.7 |

NOTE: 296 responses.

Please mark the reason(s) behind your firm’s shutdown.

| Percent | |||

| Our industry is subject to state/local operational restrictions | 49.3 | ||

| Employee protection/health | 46.3 | ||

| Weak demand/sales | 41.0 | ||

| Other | 11.2 |

NOTES: This question was only posed if any type of shutdown was selected. 134 responses.

Have you taken any of the following measures to cover shortfalls in revenues experienced as a result of the coronavirus (COVID-19) outbreak? Please select all that apply.

| Percent | |||

| Applied for the new SBA PPP | 65.9 | ||

| Drawn down cash reserves | 39.0 | ||

| Reduced salaries | 28.5 | ||

| Laid off employees | 28.1 | ||

| Drawn down line of credit | 22.1 | ||

| Applied for one of the other new SBA programs established by the CARES Act | 14.1 | ||

| Dipped into personal savings | 12.4 | ||

| Obtained a loan payment deferral | 10.0 | ||

| Obtained a rent payment deferral | 9.6 | ||

| Applied for a traditional SBA loan | 2.8 | ||

| Taken out a new loan (non-SBA) | 2.4 | ||

| Other | 12.9 |

NOTES: 284 responses. SBA stands for Small Business Administration, PPP is the Paycheck Protection Program and CARES is the Coronavirus Aid, Relief, and Economic Security Act.

Please mark which new SBA program(s) established by the CARES Act that you applied for, other than the PPP.

| Percent | |||

| EIDL Advance | 69.7 | ||

| SBA Express Bridge Loans | 27.3 | ||

| SBA Debt Relief | 24.2 |

NOTES: This question was only posed to those indicating they have applied for one of the other new SBA programs established by the CARES Act. 33 responses. EIDL stands for Economic Injury Disaster Loan.

NOTE: 293 responses

Special Questions Comments

These comments have been edited for publication.

Support Activities for Mining

- The demand is factored by both the COVID-19 and the drop in oil prices. COVID-19 caused much of the backlog to be delayed six-plus months, while the delay due to the decline in oil prices will be much longer.

Warehousing and Storage

- Oil takes more than a month to stop flowing, so we expect a slight decrease (10–20 percent drop) in revenues in April but a far more significant drop in the three- to six-month period, perhaps as great as 50 percent. We have a large amount of cash on our balance sheet and an open line of credit, so we do not expect any drastic response will be needed. We will take austerity measures as needed to help reduce expenses by 10–15 percent for the balance of the year but do not plan to reduce workforce, hours worked or pay.

Broadcasting (Except Internet)

- Demand for our radio broadcasting services is 40 percent of the normal demand (loss of 60 percent).

Credit Intermediation and Related Activities

- We have concerns with the long-term effects of the COVID-19 shutdown, particularly the effects on construction/contractors.

- We have started working in teams—seven days on and seven days off for each team—but essential employees are able to work from home when rotating out of the bank. All employees continue to be paid a full salary.

- As a financial institution, we will be adding significant revenue (25 to 30 percent increase) to our allowance for loan losses. We anticipate significant business closures and increased loan losses over the next 12 months.

Securities, Commodity Contracts, and Other Financial Investments and Related Activities

- Landlords for our various offices across Texas and Arizona are giving the same response (almost verbatim). They will not allow for any rent payment deferral even though our revenues are significantly down. Universally, we have been told to apply for the PPP [Paycheck Protection Program] loan instead of getting a rent deferral. We need both rent deferral and the PPP loan to maintain appropriate levels of cash flow.

- The virus worries and the oil markets’ $10–$12 price make for a terrible situation. Manpower and shop work is hurt by the virus, and our significant market (oil and gas equipment) has closed its door.

Real Estate

- Uncertainty causes fear. People will be hesitant to return to regular fun activities until more is known about the coronavirus. It may take until there is a vaccine or treatment for the virus. There are too many unknowns right now. Buying a home will be put on hold. Buyers will want assurance that they have a job. Sellers will be nervous letting outsiders (real estate agents, buyers) come into their homes. Buyers may take advantage of low interest rates if they feel good about their employment status.

- The recovery is directly tied to how the reopening of the country is handled, how businesses are able to acquire the materials (PPE [personal protective equipment], etc.) they need to reopen in compliance with new regulations, the timing of the discovery of effective virus treatments, and the timing of discovery of a vaccine and the release and distribution of it.

Rental and Leasing Services

- I think the naive think when summer comes this is all over and we're back to business as usual. I think we will never be back to normal; it will be a new normal, but I don't know what that looks like—more-conservative cash flow, debt control, expense control, reserve control. Until we have a vaccine or an efficacious treatment for the coronavirus, this is going to be on everyone's mind; just like a cancer, patients never forget they have cancer. It will weigh in on every major decision they make. But it's not the coronavirus I'm most concerned about; it's the next [virus]—more contagious, more lethal. It's a new world and we're never going back.

Professional, Scientific and Technical Services

- We have been busy helping our customers be able to work remotely but see the pipeline for hardware sales softening significantly starting now.

- We need to get back to work. We cannot extend the shelter in place. The economy needs activity to operate.

- The EIDL [Economic Injury Disaster Loan] advance was available to self-employed individuals, but the PPP loans were offered by the SBA [Small Business Administration] on a staggered schedule, with business entities able to apply starting April 3 but the self-employed not able to apply until April 10. SBA rules for the April 10 application were not released timely, resulting in changes to supporting documentation required by lenders on April 13. By April 14 at 10 a.m., the SBA stopped taking applications for PPP loans. Also, most banks would only accept applications from their current customers, but not all banks are SBA lenders, so many small businesses and self-employed individuals have been unable to participate. More approved lenders were added, but by then, the funds were already committed. If Congress approves additional funding, hopefully self-employed and other small businesses left out of the first round will be successful in obtaining the CARES [Coronavirus Aid, Relief and Economic Security] Act relief.

- Some of the firm's private projects put on hold may remain on hold until companies get finances and business back in control. Publicly funded work could remain impacted into 2021.

- Traditional election year uncertainty adds to the difficulty to forecast the future.

- We moved to a remote work status across the firm beginning on March 18 and have been fully functional for the most part. We have yet to see a slowdown in hours or collections but expect to see some impact on both in the months to come.

- Again, there is a great deal of uncertainty. We’ve seen a double hit with oil and then COVID-19. Restarting operations in our facilities will be a challenge as well. All markets will be different, and myriad views exist on what life after COVID-19 will look like. There will be no simple "back to normal" with this.

- The unknown is the demand curve on return. We are hoping it is steep, as is being seen for legal demand in Asia on return to business, but we are planning for a three- to six-month lag.

- This is a worldwide issue of energy business turning down due to demand reduction by the virus. Oil prices are falling due to the virus and of course the Saudi/Russia price war. It just shows that Saudi Arabia is not much of an ally and Russia is definitely not. If Trump believes either one is an ally, he is sadly mistaken.

- Overseas customers buy 40 percent of our products. We expect overseas sales to come back to normal after a longer time than ones from the U.S.

- The uncertainty of what the business and economic environment will look like when the shelter-in-place policies are lifted warrants extreme caution and has a paralyzing effect on any business decisions beyond the next 30 days.

- Lower-wage employees are beginning to realize they can make more per week on unemployment (because of the additional $600) than working. This could be a problem down the road, driving wage increases.

- Much depends on how many of our clients' businesses survive and of those that do, how long it will take them to ramp up to provide their services/products based on prevailing demand.

- Demand for engineering services will lag recovery of the energy and chemical processing sectors.

- Business valuation is somewhat countercyclical, and we remain open.

- Our clients are 95 percent public sector planning and capital project development. I expect the real impact will occur when government agencies fully realize their impacts on property and sales tax. This will be offset by federal funds made available for these agencies.

- Estimation of time to go back to normal is just a guess. The uncertainty is tremendous.

- We service both food manufacturers and retailer grocers/distributors. First-quarter sales are larger than projected. Cash is the uncertainty at this point since they are all having to add salaries to cover the demand of the current climate. With such dramatic swings in the stock market and unknown length of the economic impact, the whole grocery supply chain is holding assets close.

Management of Companies and Enterprises

- Due to the SBA PPP loans and the fact that we have not locked our doors, we have opened more accounts and loans than we ever have in a very short period of time.

Administrative and Support Services

- My elected leaders have really blown the call on this economy and the businesses that support it. Even though my business is considered essential for DOD [Department of Defense] contracts and aircraft support, I cannot get my elected officials to answer questions; even my bank is dodging my calls for an SBA-backed loan or even a "normal" loan. We small businesses have long memories, and it will show soon enough in the coming elections.

- Each industry will be different in its time to return to normal. Physical retail will be very slow to return. Manufacturing should return over the next six months. In entertainment and retail, chains will return in six months, but smaller operations and individual restaurants will take more than a year. Real estate will come back promptly.

- We work in a reservation center. I think that is not a good environment for our employees; we are adapting quite well to working from home. Our old behavior at work and at home will change forever. I am sure we will adapt and then will defeat the virus.

- We expect the recovery to be longer and more complicated than anticipated.

- Being an essential business trying to remain operational has been difficult. Sending employees out to do service calls and mingle with the public is uncomfortable to say the least. Also, adhering to government mandates can be trying. We have been trying to acquire everyday masks to protect our employees. Good ones are difficult to find, and now some counties just mandate we must have them without helping us find suppliers.

- If not for an election year, I would estimate a shorter return to normal, but that adds an element to consider in the latter part of the year. If Trump is re-elected, then I am expecting next year we will see things normalize. That said, the energy supply chain may not recover to its former state (ever), and Texas' economy is tied heavily to the energy sector.

- Many employees have just stopped coming to work. This has caused significant shortfalls in production.

Educational Services

- Because we operate on an annual enrollment cycle, it will take a year or more for normal enrollment levels to resume.

Ambulatory Health Care Services

- We expect there to be a larger-than-normal need for substance use and mental health services.

- Cosmetic dentistry is a large percentage of our business. Inquiries for cosmetic consultations is actually a leading indicator of consumer confidence index levels each month, due in part to most folks needing to borrow to pay for major cosmetic [procedures], and they won't do so if concerned about their job or the economy's effect on future employment. Therefore, while general dentistry will come back faster, half our revenues will be severely depressed likely until either an effective treatment or preventive vaccine is available and the fear is reversed.

Social Assistance

- It will take time for businesses to reopen—with many not being able to—so the demand for jobs is not expected to be at the same levels as prior to when shelter-in-place measures went into effect. We don't expect for the job demand to be up and running until certain factors are fully in place; these relate to social distancing public health needs, such as a vaccine, as well as full testing for the virus and community-spread tracing. We also expect for poverty and inequality to increase during the process, which will increase the need for our services and for related federal/state and local investments to meet the need.

- We provide free training at the community college; for those who remain unemployed and need to up their skills, our services will be essential.

Amusement, Gambling and Recreation Industries

- Once the shelter in place has been lifted and the governor starts to let people go back to work, we estimate that restaurants, movie theaters, hotels and performing arts venues will have the slowest uphill climb to return to profitability. First of all, it is going to take people some time to feel comfortable in settings with large numbers of people eating or playing close to each other, particularly indoors. Secondly, this crisis is going to take a tremendous toll on the viability of businesses wanting to do entertaining or meetings (Zoom may become the new norm). Until these businesses are on firm footing again, their return back to restaurants and hotels will be limited. Thirdly, individuals will need to get on firm footing again before they feel comfortable spending money on entertainment.

- Until we can operate rides without social distancing, we cannot operate, even in a limited way.

Food Services and Drinking Places

- We have an oil bust in Texas, too.

- Once lifted [shelter in place], I think it will still take some time for people to feel safe going out in the community. Obviously, a cure or treatment will greatly ease fears. I don't think this is permanent, but it is extremely crippling right now.

Repair and Maintenance

- Most of our customers are considered essential and, therefore, we are an essential contractor. Even so, some of them have decided to curtail construction activities for a minimum of 30 days. They are however, allowing us to work on their items in our facility. This will cover 50–60 percent of workforce, plus the Payroll Protection Program will cover the rest for eight weeks. The PPP appears to be a good program. It allows us to keep our workforce in place and keeps some off unemployment rolls.

Religious, Grantmaking, Civic, Professional and Similar Organizations

- We are heavily dependent on revenue from conferences, and I believe that no matter what happens from a policy standpoint, it will be difficult to attract people to our events until after vaccinations are available.

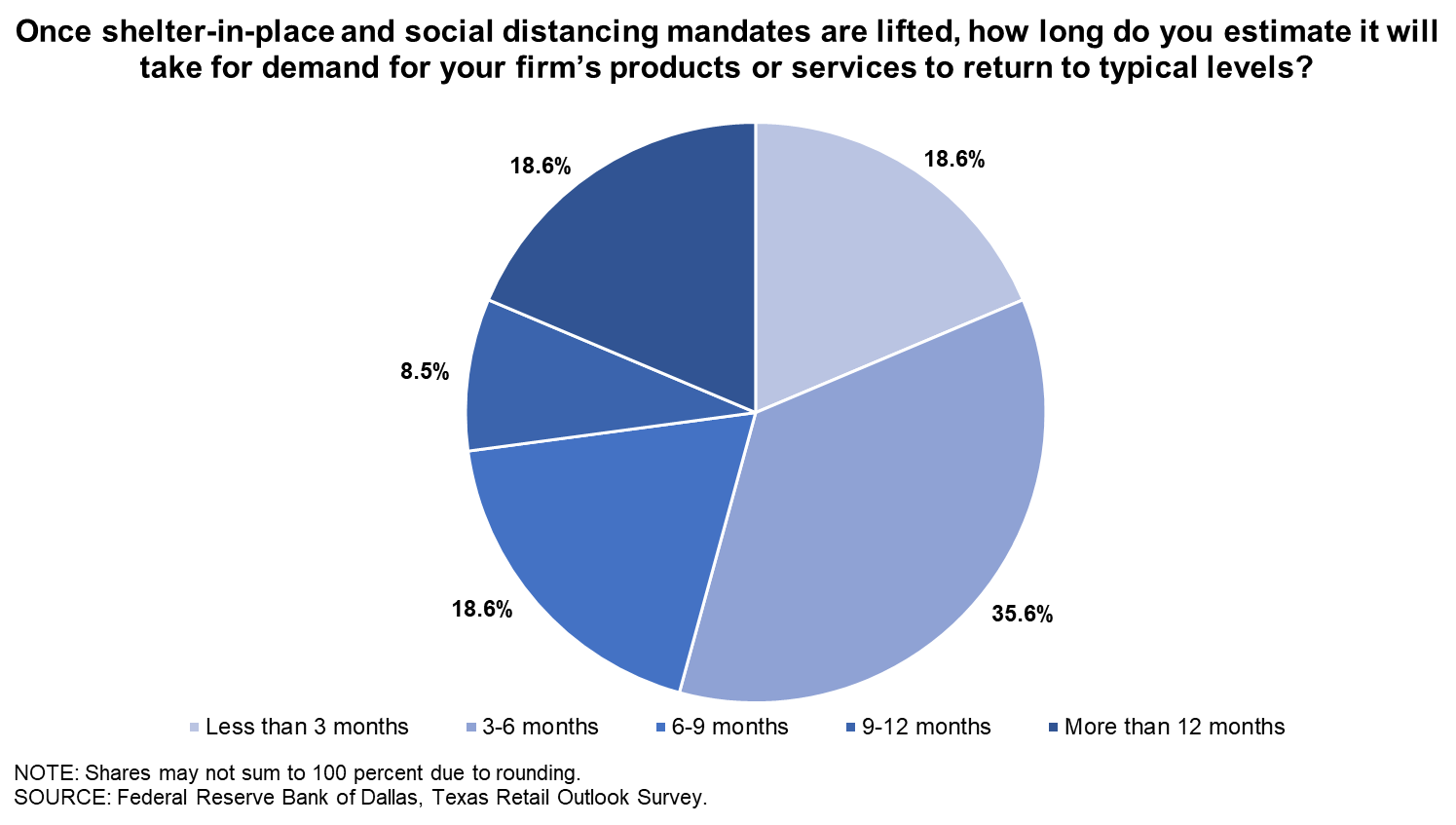

Texas Retail Outlook Survey

Data were collected April 14–22, and 59 Texas retailers responded to the survey.

How has the coronavirus (COVID-19) impacted each of these measures of your business in April?

| No effect (percent) |

Slight negative effect (percent) |

Significant negative effect (percent) |

Negative effect, combined (percent) |

Slight positive effect (percent) |

Significant positive effect (percent) |

Positive effect, combined (percent) |

|

| Availability of materials/inputs | 28.8 | 37.3 | 33.9 | 71.2 | 0.0 | 0.0 | 0.0 |

| Sales | 1.7 | 15.3 | 79.7 | 94.9 | 1.7 | 1.7 | 3.4 |

| Demand for products or services | 3.4 | 18.6 | 74.6 | 93.2 | 1.7 | 1.7 | 3.4 |

| Number of employees | 33.9 | 35.6 | 28.8 | 64.4 | 0.0 | 1.7 | 1.7 |

| Hours worked | 16.9 | 50.8 | 30.5 | 81.4 | 0.0 | 1.7 | 1.7 |

| Capital spending | 22.0 | 27.1 | 50.8 | 78.0 | 0.0 | 0.0 | 0.0 |

NOTES: 59 responses. This same question was posed in March. See results.

Please estimate the impact on demand for products or services.

| Percent | |||

| Average negative impact | 45.6 | ||

| Average positive impact | 62.5 |

NOTES: This question was only posed to those indicating an effect on demand for products or services. The average negative impact calculation is based on 55 reponses. The average positive impact calculation is based on 2 responses.

Please indicate whether the change in employment is temporary or permanent.

| Temporary (percent) |

Permanent (percent) |

||

| Negative effect on employment | 71.9 | 28.1 | |

| Positive effect on employment | 100.0 | 0.0 |

NOTES: This question was only posed to those indicating an effect on number of employees. The negative effect breakouts are based on 32 responses. The positive effect breakouts are based on 1 response.

Do you expect to rehire the same number of employees?

| Percent | |||

| Yes | 37.5 | ||

| No, we expect a slightly reduced headcount going forward | 37.5 | ||

| No, we expect a significantly reduced headcount going forward | 8.3 | ||

| Don't know | 16.7 |

NOTES: This question was only posed to those indicating a temporary negative effect on number of employees. 24 responses.

Please indicate which of the following best characterizes your firm’s current situation.

| Percent | |||

| Fully operational | 52.5 | ||

| Temporarily shut down part of our operations | 39.0 | ||

| Temporarily shut down all of our operations | 8.5 | ||

| Permanently shut down part of our operations | 0.0 | ||

| Permanently shut down all of our operations | 0.0 |

NOTE: 59 responses.

Please mark the reason(s) behind your firm’s shutdown.

| Percent | |||

| Weak demand/sales | 59.3 | ||

| Our industry is subject to state/local operational restrictions | 55.6 | ||

| Employee protection/health | 48.1 | ||

| Other | 3.7 |

NOTES: This question was only posed if any type of shutdown was selected. 27 responses.

Have you taken any of the following measures to cover shortfalls in revenues experienced as a result of the coronavirus (COVID-19) outbreak? Please select all that apply.

| Percent | |||

| Applied for the new SBA PPP | 70.9 | ||

| Reduced salaries | 34.5 | ||

| Laid off employees | 32.7 | ||

| Drawn down cash reserves | 27.3 | ||

| Drawn down line of credit | 23.6 | ||

| Dipped into personal savings | 14.5 | ||

| Applied for one of the other new SBA programs established by the CARES Act | 10.9 | ||

| Obtained a rent payment deferral | 9.1 | ||

| Obtained a loan payment deferral | 5.5 | ||

| Applied for a traditional SBA loan | 3.6 | ||

| Taken out a new loan (non-SBA) | 3.6 | ||

| Other | 5.5 |

NOTES: 56 responses. SBA stands for Small Business Administration, PPP is the Paycheck Protection Program and CARES is the Coronavirus Aid, Relief, and Economic Security Act.

Please mark which new SBA program(s) established by the CARES Act that you applied for, other than the PPP.

| Percent | |||

| EIDL Advance | 50.0 | ||

| SBA Express Bridge Loans | 33.3 | ||

| SBA Debt Relief | 16.7 |

NOTES: This question was only posed to those indicating they have applied for one of the other new SBA programs established by the CARES Act. 6 responses. EIDL stands for Economic Injury Disaster Loan.

NOTE: 59 responses

Special Questions Comments

Merchant Wholesalers, Durable Goods

- Until oil demand recovers, Texas is in trouble.

- Business is down 30 percent. We project declines of 40–50 percent while shelter in place is in effect. Once shelter in place is called off, we expect six months for normalcy to return.

- The price of oil will have to return to $40-plus before manufacturers in DFW, many of whom rely on this industry, see an uptick in business.

Merchant Wholesalers, Nondurable Goods

- Because we serve the casual dining segment, I'm optimistic that there is significant pent-up demand to eat out. However, I can't quantify how many of those customers have lost their income/employment to reasonably predict what portion will return when dining rooms are reopened.

Motor Vehicle and Parts Dealers

- We elected not to lay off people until we had details of the SBA PPP. We have established a contingency plan as necessary for layoffs, reduction of salaries/compensation and work schedules. Actions taken by the federal and state governments and our OEMs [original equipment manufacturers] will impact how quickly our firm's business returns to a reasonable level.

- The economic damage from shelter in place is enormous.

- Once the stay-at-home and social distancing requirements are lifted, I expect business to gradually return to normal by the end of the second quarter.

- The return to normal demand levels for vehicle sales will follow [improvements in] unemployment and economic health. Some sort of stimulus to assist with used car values could have an important effect on our business. New car demand would follow.

Building Material and Garden Equipment and Supplies Dealers

- We expect consumer demand to be negatively impacted for a very long time.

Health and Personal Care Stores

- If the supply chain issues ease, we believe our sales will return quickly.

Questions regarding the Texas Business Outlook Surveys can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest surveys are released on the web.