Special Questions

Special Questions

For this month’s survey, Texas business executives were asked supplemental questions on credit conditions. Results below include responses from participants of all three surveys: Texas Manufacturing Outlook Survey, Texas Service Sector Outlook Survey and Texas Retail Outlook Survey.

Texas Business Outlook Surveys

Data were collected October 14–22, and 309 Texas business executives responded to the surveys.

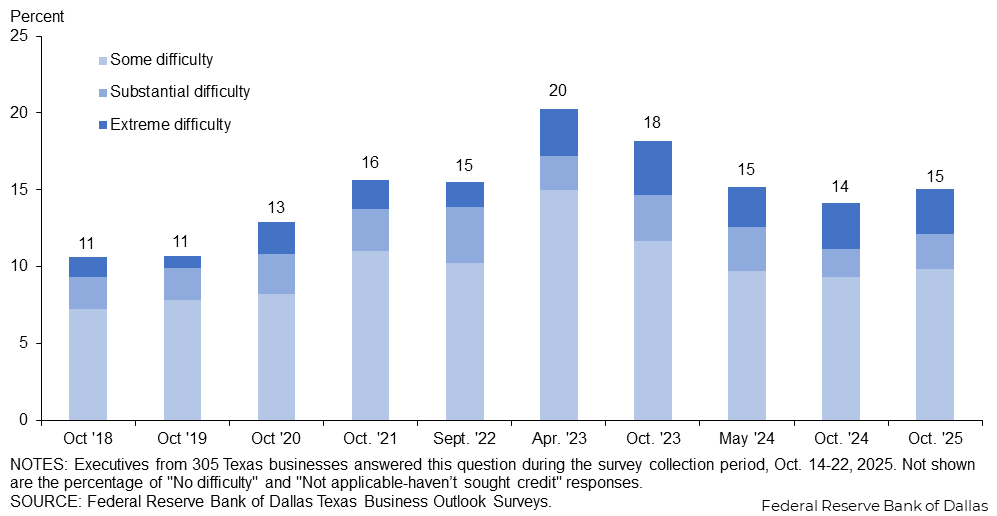

Fifteen percent of responding Texas businesses say they are having at least some difficulty accessing short-term credit, largely unchanged from a year ago. The share is down from a peak of 20 percent in April 2023 but above the pre-pandemic results in 2018-19.

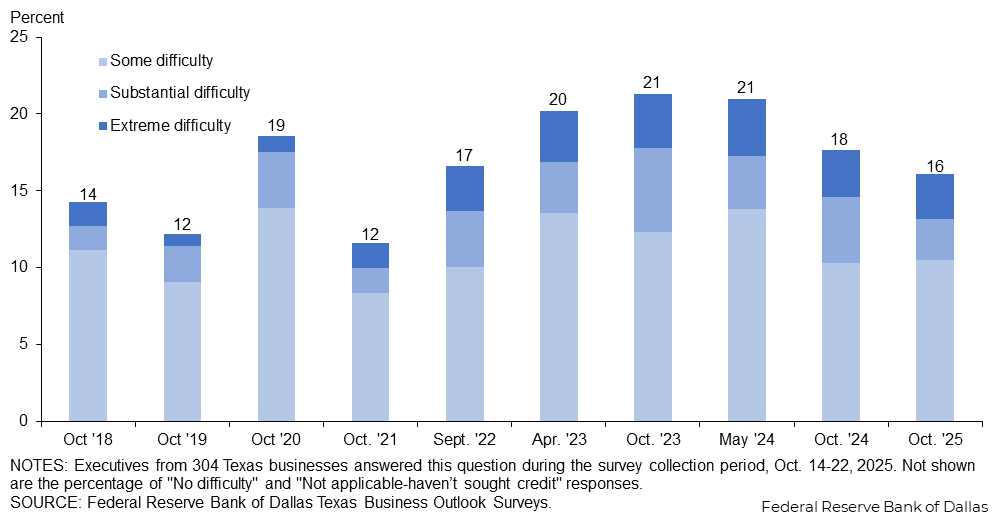

Similarly, 16 percent of responding Texas businesses say they are having at least some difficulty accessing long-term credit. This is down slightly from a year ago and down from a peak of 21 percent in 2023, and somewhat elevated relative to 2018-19.

Survey respondents were given the opportunity to also provide comments, which can be found in the Comments tab above.

Texas Business Outlook Surveys

Data were collected October 14-22 and 72 Texas manufacturers responded to the survey.

| Oct. '19 (percent) |

Oct. '20 (percent) |

Oct. '21 (percent) |

Sept. '22 (percent) |

Oct. '23 (percent) |

Oct. '24 (percent) |

Oct. '25 (percent) |

|

| No difficulty | 52.9 | 51.1 | 48.0 | 47.1 | 42.9 | 37.8 | 31.9 |

| Some difficulty | 4.8 | 8.9 | 7.0 | 9.2 | 4.4 | 9.8 | 13.9 |

| Substantial difficulty | 1.9 | 6.7 | 6.0 | 4.6 | 1.1 | 3.7 | 1.4 |

| Extreme difficulty | 1.0 | 0.0 | 4.0 | 1.1 | 5.5 | 2.4 | 2.8 |

| Not applicable-haven’t sought credit | 39.4 | 33.3 | 35.0 | 37.9 | 46.2 | 46.3 | 50.0 |

NOTES: 72 responses.

| Oct. '19 (percent) |

Oct. '20 (percent) |

Oct. '21 (percent) |

Sept. '22 (percent) |

Oct. '23 (percent) |

Oct. '24 (percent) |

Oct. '25 (percent) |

|

| No difficulty | 49.5 | 51.1 | 60.0 | 51.7 | 36.3 | 44.4 | 30.6 |

| Some difficulty | 10.7 | 13.3 | 4.0 | 8.0 | 14.3 | 4.9 | 13.9 |

| Substantial difficulty | 1.9 | 6.7 | 3.0 | 1.1 | 3.3 | 6.2 | 2.8 |

| Extreme difficulty | 1.0 | 0.0 | 4.0 | 4.6 | 3.3 | 4.9 | 0.0 |

| Not applicable-haven’t sought credit | 36.9 | 28.9 | 29.0 | 34.5 | 42.9 | 39.5 | 52.8 |

NOTE: 72 responses.

Survey respondents were given the opportunity to also provide comments, which can be found in the Comments tab above.

Texas Business Outlook Surveys

Data were collected October 14-22 and 237 Texas business executives responded to the survey.

| Oct. '19 (percent) |

Oct. '20 (percent) |

Oct. '21 (percent) |

Sept. '22 (percent) |

Oct. '23 (percent) |

Oct. '24 (percent) |

Oct. '25 (percent) |

|

| No difficulty | 33.9 | 38.9 | 40.6 | 35.4 | 29.6 | 32.0 | 33.9 |

| Some difficulty | 8.9 | 8.1 | 12.5 | 10.5 | 14.1 | 9.2 | 8.6 |

| Substantial difficulty | 2.1 | 1.3 | 1.5 | 3.4 | 3.6 | 1.2 | 2.6 |

| Extreme difficulty | 0.7 | 2.7 | 1.1 | 1.7 | 2.9 | 3.2 | 3.0 |

| Not applicable-haven’t sought credit | 54.3 | 49.0 | 44.3 | 49.0 | 49.8 | 54.4 | 51.9 |

NOTES: 233 responses.

| Oct. '19 (percent) |

Oct. '20 (percent) |

Oct. '21 (percent) |

Sept. '22 (percent) |

Oct. '23 (percent) |

Oct. '24 (percent) |

Oct. '25 (percent) |

|

| No difficulty | 36.0 | 34.2 | 42.2 | 35.3 | 27.3 | 32.3 | 32.8 |

| Some difficulty | 8.5 | 14.1 | 10.0 | 10.6 | 11.6 | 12.1 | 9.5 |

| Substantial difficulty | 2.5 | 2.7 | 1.1 | 4.5 | 6.2 | 3.6 | 2.6 |

| Extreme difficulty | 0.7 | 1.3 | 0.7 | 2.4 | 3.6 | 2.4 | 3.9 |

| Not applicable-haven’t sought credit | 52.3 | 47.7 | 45.9 | 47.3 | 51.3 | 49.6 | 51.3 |

NOTE: 232 responses.

Survey respondents were given the opportunity to also provide comments, which can be found in the Comments tab above.

Texas Business Outlook Surveys

Data were collected October 14-22 and 43 Texas retailers responded to the survey.

| Oct. '19 (percent) |

Oct. '20 (percent) |

Oct. '21 (percent) |

Sept. '22 (percent) |

Oct. '23 (percent) |

Oct. '24 (percent) |

Oct. '25 (percent) |

|

| No difficulty | 32.7 | 54.2 | 36.2 | 44.8 | 28.8 | 37.8 | 31.0 |

| Some difficulty | 9.1 | 0.0 | 8.5 | 5.2 | 15.4 | 11.1 | 7.1 |

| Substantial difficulty | 1.8 | 0.0 | 0.0 | 6.9 | 1.9 | 0.0 | 4.8 |

| Extreme difficulty | 1.8 | 0.0 | 2.1 | 1.7 | 0.0 | 0.0 | 0.0 |

| Not applicable-haven’t sought credit | 54.5 | 45.8 | 53.2 | 41.4 | 53.8 | 51.1 | 57.1 |

NOTES: 42 responses.

| Oct. '19 (percent) |

Oct. '20 (percent) |

Oct. '21 (percent) |

Sept. '22 (percent) |

Oct. '23 (percent) |

Oct. '24 (percent) |

Oct. '25 (percent) |

|

| No difficulty | 41.1 | 45.8 | 34.0 | 47.4 | 30.8 | 34.1 | 33.3 |

| Some difficulty | 8.9 | 12.5 | 8.5 | 8.8 | 9.6 | 9.1 | 9.5 |

| Substantial difficulty | 0.0 | 0.0 | 2.1 | 3.5 | 5.8 | 4.5 | 2.4 |

| Extreme difficulty | 0.0 | 0.0 | 2.1 | 3.5 | 0.0 | 0.0 | 2.4 |

| Not applicable-haven’t sought credit | 50.0 | 41.7 | 53.2 | 36.8 | 53.8 | 52.3 | 52.4 |

NOTE: 42 responses.

Survey respondents were given the opportunity to also provide comments, which can be found in the Comments tab above.

Questions regarding the Texas Business Outlook Surveys can be addressed to Emily Kerr at emily.kerr@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest surveys are released on the web.

Special Questions Comments

Survey participants are given the opportunity to submit comments. Some comments have been edited for grammar and clarity.