Texas Service Sector Activity Picks Back Up

Texas Service Sector Outlook Survey

June 30, 2020

Texas Service Sector Activity Picks Back Up

What’s New This Month

For this month’s survey, Texas business executives were asked supplemental questions on the impacts of COVID-19. Results for these questions from the Texas Manufacturing Outlook Survey, Texas Service Sector Outlook Survey and Texas Retail Outlook Survey have been released together. Read the special questions results.

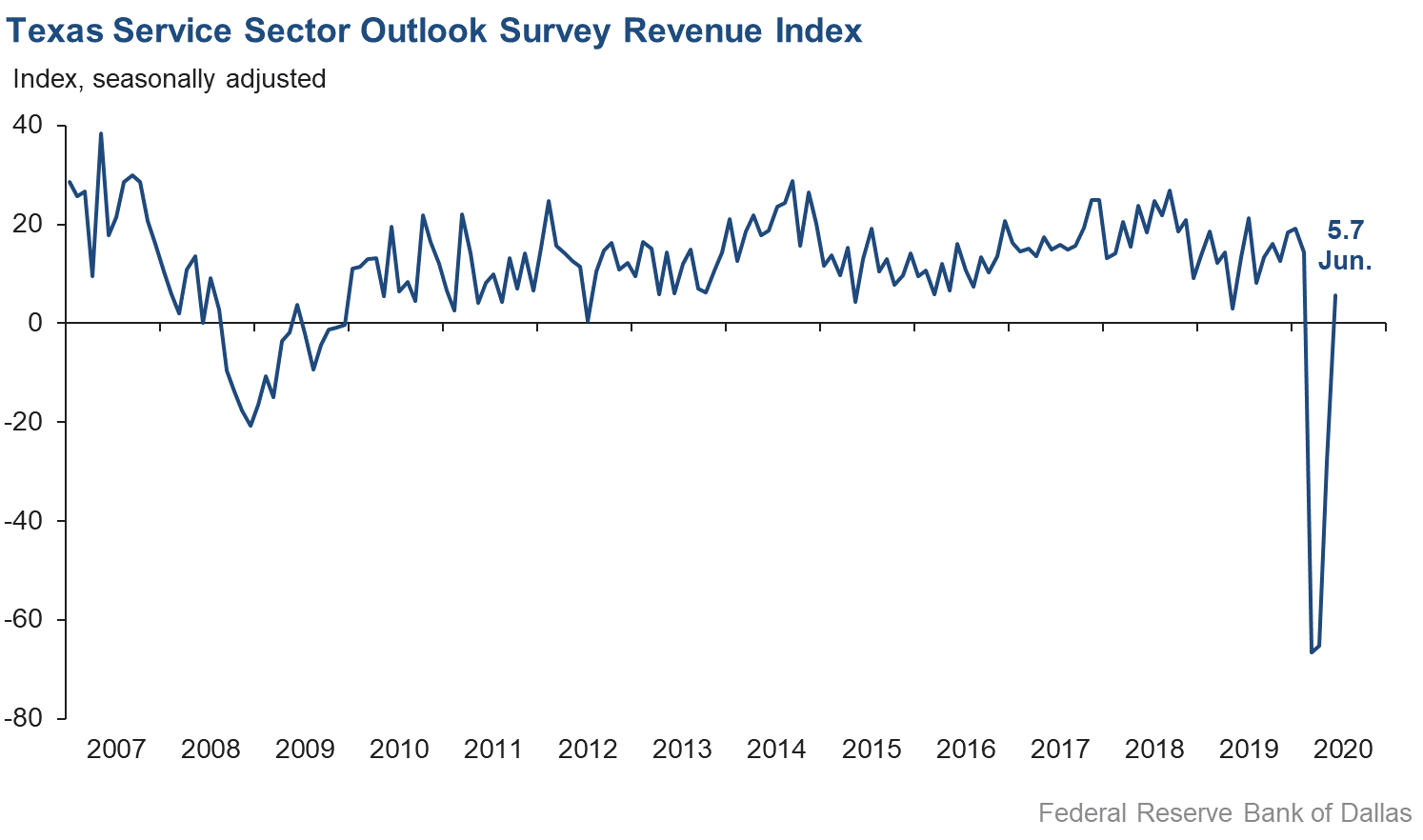

Following three months of steep decline, the Texas service sector showed signs of growth in June, according to business executives responding to the Texas Service Sector Outlook Survey. The revenue index, a key measure of state service sector conditions, rebounded to positive territory, advancing from -28.1 in May to 5.7 in June.

Labor market indicators reflected mostly stable employment and workweek length in June. The employment index rose over eight points to -1.9, suggesting little net change in jobs compared with May. The hours worked index ticked up over nine points to -0.2.

Perceptions of broader business conditions turned positive for the first time since February. The general business activity index rose nearly 44 points to a reading of 2.1, while the company outlook index rose from -30.2 in May to 2.2 in June. Meanwhile, the outlook uncertainty index declined to 5.9, significantly below the 2019 average level.

Wage pressures rose notably in June, while price pressures were mixed. The wages and benefits index turned positive at 7.8, adding 15 points from May. The selling prices index remained negative, though it increased from -19.7 to -2.2, while the input prices index climbed 7.6 points to 17.5, suggesting increasing inflation in firms’ input costs.

Respondents’ expectations regarding future business conditions were optimistic in June. The future general business activity index increased from -11.1 to 6.8, with over one-third of respondents expecting improvement six months from now compared with about 28 percent expecting worsening conditions. The future company outlook index improved about 12 points to 6.2. Other indexes of future service sector activity, such as revenue and employment, continued to increase and were near or above their 12-month averages, suggesting expectations of significant improvement over the next six months.

Texas Retail Outlook Survey

June 30, 2020

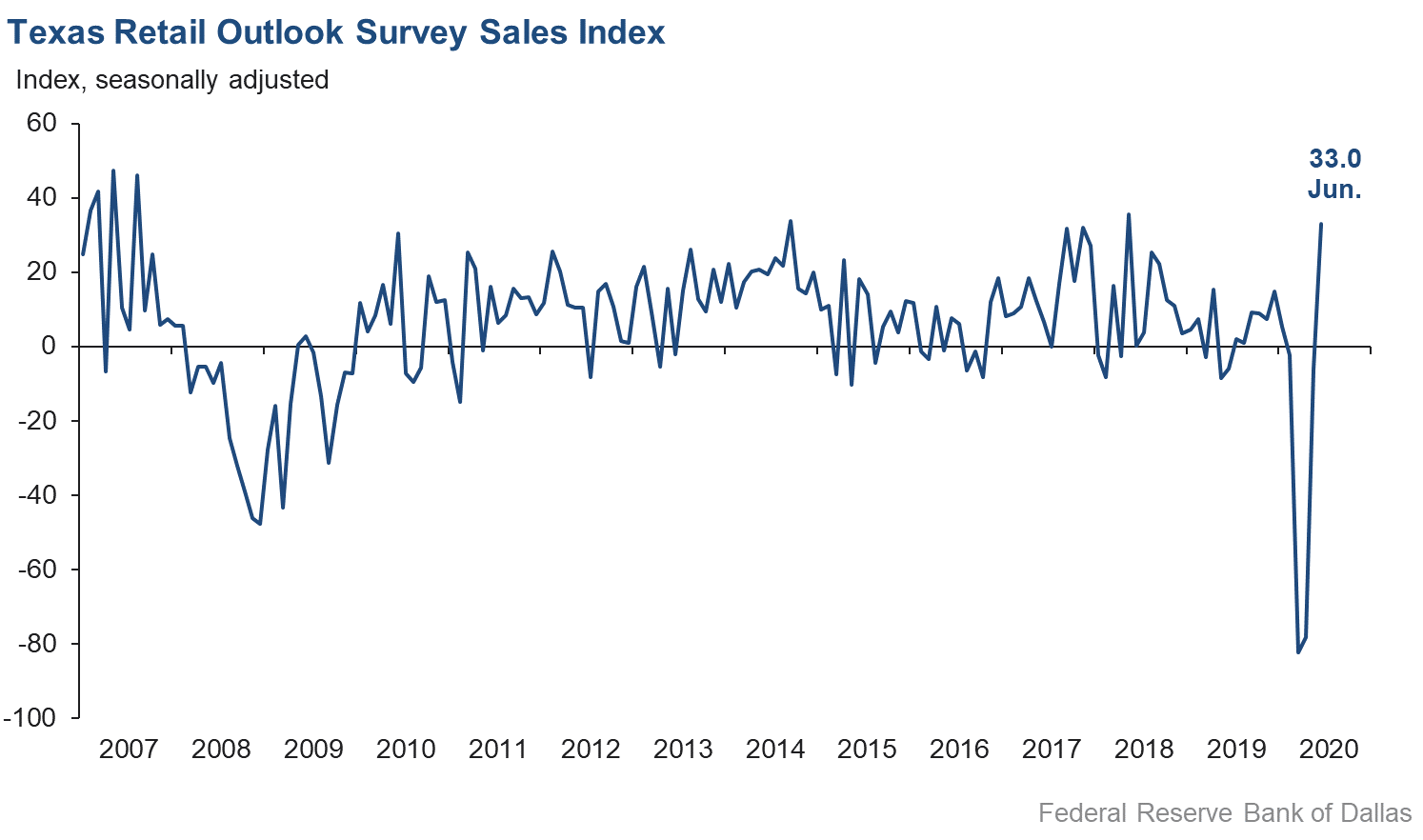

Texas Retail Sales Rebound Sharply

Retail sales activity surged in June, according to business executives responding to the Texas Retail Outlook Survey. The sales index, a key measure of state retail activity, rose from -6.2 in May to 33.0 in June, its highest reading in two years. Over half of respondents reported increased sales compared with May, while less than one-quarter reported decreases. Inventories continued to decline at a rapid pace, with the inventories index remaining in deeply negative territory at -34.3 compared with -41.8 in May.

While retail labor market indicators improved, they continued to point toward declining employment and shortened workweeks in June. The employment index inched up from -7.2 to -5.0, while the hours worked index added nine points but was still negative at -6.2. Just over one-fifth of respondents noted a decrease in hours compared with 16 percent noting an increase in hours.

Retailers’ perceptions of broader business conditions surged with optimism compared with May readings. The general business activity index advanced from -17.9 to a six-year high of 29.6, while the company outlook index rose from -12.8 to 16.5. The outlook uncertainty index also declined to -9.6, its first indication of reduced uncertainty since last December.

Retail wages ticked up slightly in June, while price pressures rose sharply. The wages and benefits index turned positive for the first time since February, rising from -21.4 to 2.8. The selling prices index surged from -9.1 in May to 17.2 in June, while the input prices index added nearly 25 points, for a reading of 27.9—its highest reading since 2018.

Retailers’ perceptions of future conditions remained positive in June, although optimism was somewhat dampened compared with May. The future general business activity index held positive but declined from 24.3 to 12.7. Similarly, the future company outlook index shed over 10 points for a reading of 19.3. Nevertheless, other indexes of future retail activity, such as sales and employment, continued to increase, pointing to overall expectations of healthier future activity.

The Texas Retail Outlook Survey is a component of the Texas Service Sector Outlook Survey that uses information only from respondents in the retail and wholesale sectors.

Next release: July 28, 2020

|

Data were collected June 16–24, and 239 Texas service sector and 54 retail sector business executives responded to the survey. The Dallas Fed conducts the Texas Service Sector Outlook Survey monthly to obtain a timely assessment of the state’s service sector activity. Firms are asked whether revenue, employment, prices, general business activity and other indicators increased, decreased or remained unchanged over the previous month. Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase. When the share of firms reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior month. If the share of firms reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior month. An index will be zero when the number of firms reporting an increase is equal to the number of firms reporting a decrease. Data have been seasonally adjusted as necessary. |

Texas Service Sector Outlook Survey

June 30, 2020

Historical data are available from January 2007 to the most current release month.

| Business Indicators Relating to Facilities and Products in Texas Current (versus previous month) | ||||||||

| Indicator | Jun Index | May Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Revenue | 5.7 | –28.1 | +33.8 | 11.0 | 1(+) | 35.7 | 34.2 | 30.0 |

Employment | –1.9 | –10.4 | +8.5 | 6.1 | 4(–) | 13.3 | 71.5 | 15.2 |

Part–Time Employment | –5.2 | –14.5 | +9.3 | 1.3 | 4(–) | 6.5 | 81.8 | 11.7 |

Hours Worked | –0.2 | –9.4 | +9.2 | 2.2 | 4(–) | 16.9 | 66.0 | 17.1 |

Wages and Benefits | 7.8 | –7.2 | +15.0 | 14.1 | 1(+) | 16.7 | 74.4 | 8.9 |

Input Prices | 17.5 | 9.9 | +7.6 | 25.0 | 2(+) | 25.2 | 67.1 | 7.7 |

Selling Prices | –2.2 | –19.7 | +17.5 | 5.0 | 4(–) | 13.4 | 71.0 | 15.6 |

Capital Expenditures | –5.6 | –23.2 | +17.6 | 9.9 | 4(–) | 12.8 | 68.8 | 18.4 |

| General Business Conditions Current (versus previous month) | ||||||||

| Indicator | Jun Index | May Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | 2.2 | –30.2 | +32.4 | 4.9 | 1(+) | 26.2 | 49.8 | 24.0 |

General Business Activity | 2.1 | –41.7 | +43.8 | 2.7 | 1(+) | 31.3 | 39.5 | 29.2 |

| Indicator | Jun Index | May Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Outlook Uncertainty† | 5.9 | 26.2 | –20.3 | 13.3 | 29(+) | 26.8 | 52.3 | 20.9 |

| Business Indicators Relating to Facilities and Products in Texas Future (six months ahead) | ||||||||

| Indicator | Jun Index | May Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Revenue | 34.1 | 6.6 | +27.5 | 36.8 | 2(+) | 55.0 | 24.1 | 20.9 |

Employment | 11.4 | 4.5 | +6.9 | 21.6 | 2(+) | 29.2 | 53.0 | 17.8 |

Part–Time Employment | 1.1 | –8.0 | +9.1 | 6.3 | 1(+) | 14.6 | 71.9 | 13.5 |

Hours Worked | 13.1 | 12.9 | +0.2 | 5.3 | 2(+) | 21.7 | 69.7 | 8.6 |

Wages and Benefits | 19.1 | 13.9 | +5.2 | 35.9 | 2(+) | 30.0 | 59.1 | 10.9 |

Input Prices | 27.4 | 24.1 | +3.3 | 43.7 | 162(+) | 33.8 | 59.8 | 6.4 |

Selling Prices | 10.2 | 1.2 | +9.0 | 22.8 | 2(+) | 23.8 | 62.6 | 13.6 |

Capital Expenditures | 4.6 | –8.3 | +12.9 | 23.3 | 1(+) | 22.4 | 59.8 | 17.8 |

| General Business Conditions Future (six months ahead) | ||||||||

| Indicator | Jun Index | May Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | 6.2 | –5.9 | +12.1 | 16.0 | 1(+) | 31.2 | 43.7 | 25.0 |

General Business Activity | 6.8 | –11.1 | +17.9 | 12.7 | 1(+) | 34.3 | 38.2 | 27.5 |

Texas Retail Outlook Survey

June 30, 2020

Historical data are available from January 2007 to the most current release month.

| Business Indicators Relating to Facilities and Products in Texas Retail (versus previous month) | ||||||||

| Indicator | Jun Index | May Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Retail Activity in Texas | ||||||||

Sales | 33.0 | –6.2 | +39.2 | 5.9 | 1(+) | 56.0 | 21.0 | 23.0 |

Employment | –5.0 | –7.2 | +2.2 | 1.8 | 4(–) | 11.2 | 72.6 | 16.2 |

Part–Time Employment | –3.8 | –12.9 | +9.1 | –2.1 | 4(–) | 9.4 | 77.4 | 13.2 |

Hours Worked | –6.2 | –15.5 | +9.3 | –2.0 | 5(–) | 15.5 | 62.8 | 21.7 |

Wages and Benefits | 2.8 | –21.4 | +24.2 | 9.3 | 1(+) | 10.8 | 81.2 | 8.0 |

Input Prices | 27.9 | 3.2 | +24.7 | 18.7 | 2(+) | 32.4 | 63.1 | 4.5 |

Selling Prices | 17.2 | –9.1 | +26.3 | 9.9 | 1(+) | 31.5 | 54.2 | 14.3 |

Capital Expenditures | –2.4 | –27.6 | +25.2 | 7.8 | 4(–) | 10.1 | 77.4 | 12.5 |

Inventories | –34.3 | –41.8 | +7.5 | 2.7 | 5(–) | 20.9 | 23.9 | 55.2 |

Companywide Retail Activity | ||||||||

Companywide Sales | 28.8 | –23.7 | +52.5 | 7.3 | 1(+) | 53.5 | 21.8 | 24.7 |

Companywide Internet Sales | 11.9 | –13.1 | +25.0 | 6.3 | 1(+) | 24.4 | 63.1 | 12.5 |

| General Business Conditions, Retail Current (versus previous month) | ||||||||

| Indicator | Jun Index | May Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | 16.5 | –12.8 | +29.3 | 3.2 | 1(+) | 34.7 | 47.1 | 18.2 |

General Business Activity | 29.6 | –17.9 | +47.5 | –1.0 | 1(+) | 48.2 | 33.2 | 18.6 |

| Outlook Uncertainty Current (versus previous month) | ||||||||

| Indicator | Jun Index | May Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Outlook Uncertainty† | –9.6 | 5.4 | –15.0 | 10.9 | 1(–) | 15.4 | 59.6 | 25.0 |

| Business Indicators Relating to Facilities and Products in Texas, Retail Future (six months ahead) | ||||||||

| Indicator | Jun Index | May Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Retail Activity in Texas | ||||||||

Sales | 39.8 | 33.1 | +6.7 | 31.8 | 2(+) | 53.8 | 32.2 | 14.0 |

Employment | 7.6 | 4.6 | +3.0 | 11.7 | 2(+) | 25.7 | 56.3 | 18.1 |

Part–Time Employment | 6.4 | –2.1 | +8.5 | 0.5 | 1(+) | 21.2 | 64.0 | 14.8 |

Hours Worked | 5.3 | 15.8 | –10.5 | 2.6 | 2(+) | 17.6 | 70.1 | 12.3 |

Wages and Benefits | 7.0 | 20.3 | –13.3 | 26.9 | 2(+) | 20.9 | 65.2 | 13.9 |

Input Prices | 23.5 | 21.8 | +1.7 | 32.5 | 2(+) | 29.4 | 64.7 | 5.9 |

Selling Prices | 17.3 | 24.5 | –7.2 | 28.6 | 2(+) | 26.9 | 63.5 | 9.6 |

Capital Expenditures | 1.9 | –5.5 | +7.4 | 17.0 | 1(+) | 15.4 | 71.2 | 13.5 |

Inventories | 25.8 | 5.3 | +20.5 | 7.9 | 2(+) | 42.6 | 40.7 | 16.8 |

Companywide Retail Activity | ||||||||

Companywide Sales | 38.6 | 19.8 | +18.8 | 30.4 | 2(+) | 54.4 | 29.8 | 15.8 |

Companywide Internet Sales | 31.5 | 28.6 | +2.9 | 21.7 | 3(+) | 42.9 | 45.7 | 11.4 |

| General Business Conditions, Retail Future (six months ahead) | ||||||||

| Indicator | Jun Index | May Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | 19.3 | 29.9 | –10.6 | 16.6 | 2(+) | 34.3 | 50.7 | 15.0 |

General Business Activity | 12.7 | 24.3 | –11.6 | 12.3 | 2(+) | 34.6 | 43.5 | 21.9 |

*Shown is the number of consecutive months of expansion or contraction in the underlying indicator. Expansion is indicated by a positive index reading and denoted by a (+) in the table. Contraction is indicated by a negative index reading and denoted by a (–) in the table.

**Shown is the number of consecutive months of improvement or worsening in the underlying indicator. Improvement is indicated by a positive index reading and denoted by a (+) in the table. Worsening is indicated by a negative index reading and denoted by a (–) in the table.

†Added to survey in January 2018.

Data have been seasonally adjusted as necessary, with the exception of the outlook uncertainty index which does not yet have a sufficiently long time series to test for seasonality.

Texas Service Sector Outlook Survey

June 30, 2020

Texas Retail Outlook Survey

June 30, 2020

Texas Service Sector Outlook Survey

June 30, 2020

Comments from Survey Respondents

These comments are from respondents’ completed surveys and have been edited for publication.

Support Activities for Mining

- The continuing uncertainty with coronavirus and reopening the economy is introducing more uncertainty into the business climate.

Utilities

- It appears that the slowdown is affecting the retail electricity business.

Pipeline Transportation

- Uncertainty prevails. There is just no good way to see beyond the next month, much less into the next quarter or next year.

- [We are a] midstream company moving energy to markets. Global demand drives volumes, so [we are] dependent upon continued global recovery for meaningful growth opportunities.

Support Activities for Transportation

- Things seem to be leveling out, but we are concerned about a second shutdown.

Warehousing and Storage

- We believe we are beginning to see a stabilization in the level of crude exports and other business activity. We are continuing to control costs and capital expenditures and expect to do that for at least the third quarter but then expect to begin working to expand our business and plan for the recovery.

Publishing Industries (Except Internet)

- Generally, the same issues mentioned before seem to still apply. The end of 2020/2021 will see a noteworthy recovery in general. For software, [there will be] continued acceleration in remote and easier, great experiences with no-touch interfaces, including the key areas of training and education for enabling skills needed for sustained adoption.

Data Processing, Hosting and Related Services

- Purchase inquiries have increased over the past few weeks.

Credit Intermediation and Related Activities

- We see continued compression in interest rates and uncertainty of values. Layoffs are expected in the company to cut costs.

- Lenders seem resistant to the MSLP [Main Street Lending Program].

- Sales for the area increased due to increased activity both locally and from the influx of work crews for the pipelines and electrical lines coming through the county. Loan demand is slowing after the influx of PPP [Paycheck Protection Program] loans funding, which created a greater demand on staff. We now are waiting for the interim final rules on the PPP loan forgiveness phase of the CARES [Coronavirus Aid, Relief and Economic Security] Act and are hoping the process for the smaller PP loans is simplified before the rush by borrowers to begin the process of applying for forgiveness of their debt. Since the state has been opening for business, traffic counts are noticeably increasing, as well as the number of positive confirmations of COVID-19 cases. Cautious optimism exists, and the general attitude is a strong desire to get past this pandemic and [unrest].

- We are hoping for a smooth recovery but are expecting a bumpy ride. We still think 2021 will present more challenges than 2020 with all the government programs propping the economy up.

- In the banking sector, capital costs are increasing, and there is net interest margin pressure. Allowances for loan losses are increasing. Capital preservation will slow growth. General economic activity is slowing. Commercial businesses generally are not looking to expand but are cautious.

Securities, Commodity Contracts, and Other Financial Investments and Related Activities

- The second wave of COVID-19 is going to be a problem. We were back at the office for several weeks, but the rise of cases in our building has caused us to send everyone to work from home again for the next month. We are concerned about the election, racial tension/divide, impact of slowing government stimulus on employment and spending, and the high levels of the stock market. Lots to be watchful/wary about.

- Business is slow and getting slower. Certainly, the oil and gas equipment is gone. The remaining business is very slow now.

- We are having difficulty finding employees to hire. We typically get around 50–60 applicants each week. We are having five to six now. On top of the decline in the number of applicants, the quality of applicants has significantly declined. Most of the small number of applicants we get cannot pass the first initial screening. In a labor market with mass unemployment, we are puzzled by the dramatic decline in applicants. We can only speculate that the additional unemployment benefits being offered are keeping people from applying. It is causing a major issue as the lack of applicants may begin to stall the growth we do have.

- Retail sales are better than expected. Lack of rain is causing problems for agriculture.

Insurance Carriers and Related Activities

- We have seen a significant increase in activity in June from May across all product segments.

Real Estate

- Our company deals in disposing of surplus assets, and we feel demand for our services will increase.

- Our market is experiencing lots of refinancing by homeowners, Listing inventory is down and has driven some prices up in the $300,000 and below [range]. The [over $500,000 range] is somewhat saturated.

- It's still too early to assess the impact of the economic shutdown in our market. I'm optimistic that we may fare better than most.

- We are cautiously optimistic that we will see a slow recovery over the next year or two, only if there are no more shutdowns and businesses are allowed to reopen at 75 percent [capacity] or above. If there is another shutdown or the restrictions on opening are maintained, the recovery will be at least five years.

- Three weeks ago, people were getting out and looking at properties. Now with the increase in COVID-19 cases and [the county judge] requiring face masks, people seem to be staying in their houses again.

Rental and Leasing Services

- My uncertainty hasn’t changed because it couldn't get any more uncertain!

Professional, Scientific and Technical Services

- My general outlook has not changed, as it has remained dismal. I do not expect the energy business economy to recover significantly until late 2021. Improvement in the world demand for hydrocarbons is a long way off.

- The U.S. government SBA [Small Business Administration] PPP loan is helping us tremendously to cope with the COVID-19-related slowdown, keep the R&D [Research and Development] activity going and grow back the business. The Federal Reserve Bank also did the perfect job and took the timely actions. As a small business, we are very thankful and happy.

- We are in an almost unpredictable state at this point. We are waiting and watching. There are some favorable signs but many negatives. This is especially true in Texas right now with escalating COVID-19 cases. There is some optimism about the fall time frame, but we are not sure that optimism is truly warranted. I am more of the view that conditions have to change but am not sure it will be for the positive.

- Thank God we were allowed to return to work.

- Approximately 30 percent of the design side projects have been placed on temporary hold. Approximately 10 percent of the construction projects (ones that were scheduled to start) have been placed on hold. Most of our clients indicate they think they will "restart" the cycle in September/October. The big unknown is if September/October is realistic. The SBA loan will allow us to weather the interim period.

- We are feeling a bit better but uncertainty prevails.

- The rise in COVID-19 cases is concerning. We need everyone to be back at work and many in their offices. There is a level of complacency and disinterest that is so concerning. I am worried about the Texas economy and our ability to recover.

- We are still amazed at how well the residential real estate market continues to perform. Our orders are up 30 percent, and revenue is up 14 percent year over year. The commercial market is another story. Orders and revenue continue to trail last year by 50–60 percent, and we don't see this improving in the near future. The general consensus is that things will begin to pick up in the third and fourth quarter of this year.

- We are seeing a meaningful decrease in billable hours in real estate and finance and corporate transactions. Bankruptcy is very strong of course. Litigation is steady.

- Stock market volatility is too unpredictable. The volume of trading is excessive. Purchases of stock should not be able to be sold in the same day. The level of short-term electronic trading is not what the markets were designed for. A public company has no time to invest funds to create long-term value when their stock is purchased and sold by the same person within seconds, minutes, hours or days.

- Our consulting engineering business tends to lag the overall economic trends by six to nine months. Our pipeline of incoming work began to soften in June. Clients have slashed budgets for 2020 and expect some cuts to extend into 2021.

- We met with all firm practice leaders last week, and they all have a positive and reasonably optimistic outlook for the remainder of the year on demand for services and the economic recovery. Of course, the optimism presumes no significant surge in COVID-19 cases that would result in a second shutdown of the economy.

Administrative and Support Services

- Due to extreme cost cutting and combining three of our offices with three other offices while having the ability to service the same markets, we have remained profitable. We cannot predict the future at this time.

- The travel depression for the luxury market continues to stagnate. There are no positive signals for this level of traveler to return for the enjoyment or enlightenment of travel. Corporate travel is 90 percent below previous levels with no signs of improvement due to the company not wanting to place staff at risk. Our expectation for substantial sales is not until late 2021or into 2022.

- Interest rates and the Fed [Federal Reserve] stimulus are driving short-term economic activity. The key question is how long do rates stay low and the stimulus continue? COVID-19 infection rates continue to be a major overhang. Political leadership is also becoming a major issue.

- The aviation area overall has remained consistent. No real changes in requests for AOG [aircraft-on-ground] services. Scheduled heavy maintenance has remained steady, with the pre-COVID schedule still taking place for the corporate aviation sector. I am hoping for higher utilization rates of private and charter aircraft to increase the inspection frequency requirements. The commercial sector has remained flatter than usual. We see no increase in the commercial side until late this winter or early spring of next year. The industrial area has slowed down to a trickle of what it used to be as compared with last year. The oil sector, well, is just nonexistent at this point. I see and hear of no increase in this sector for a long time. The machined-parts sector has slowed, but we are still being asked for quotes, and a few smaller jobs come in to the lab. We expect this sector to increase as it usually does for us beginning late summer to early fall. The code welding inspection sector is slow. I see no increases to this for another year, as more commercial properties are becoming available and less new construction for specialty buildings is occurring. At this point, I stray from my colleagues. As soon as we have the next presidential election, I believe that the perceived increased decision stability from electing a "new" president will help the economy more than the masks and hand sanitizer will at this point.

- At this point, I have confidence we will not see a complete shutdown of the economy again. As a result, I believe we can work our way out of the slump in sales due to customer closings.

- While I have seen a noticeable drop in revenue for April and May, June and July seem to be back to normal. That said, my outlook is less optimistic given the uncertainties with our economy, politics and public health.

- We are not in the hospitality or retail business and neither are our customers. The opening of those businesses has not improved the outlook for our customers. The continuing increase in COVID-19 cases and reluctance of people to return to work is keeping clients from hiring.

Waste Management and Remediation Services

- Attempting to gauge the outlook the past 30 days has been challenging for our customers and suppliers. Many are cautiously optimistic that business activity will be better in the latter part of the third quarter and fourth quarter, but it's speculation.

Educational Services

- We are in the summer months, and a lot of our full-time employees (FTEs) are off for the summer but still receiving a paycheck until August contracts begin. Our year-round staff are back at the office, and we all know that increased testing in Texas will equate to higher positive outcomes for some of our fellow Texans. The consensus around me is that we can't afford to close our country’s economy and, specifically, the Texas economy, regardless of how the virus reacts during increased business and social activity. The liquidity moves by the Federal Reserve were definitely a positive and provided the necessary impetus to maintain the necessary liquidity the system needs. I spent last weekend at the beach in Corpus Christi and was excited to see the activity at the hotel and restaurant where I had a reservation for dinner. Safety was on the minds of all, but they were also happy getting back to normal. It was welcome to see!

Ambulatory Health Care Services

- Coronapocalypse much worse than disease from Lyme; when it is safe to be normal, will be listening for the chime; struggling whether to open or close; impossible choices, no one knows; but an effective vaccine by EOY [end of year] would be utterly sublime. Medical practices and practitioners are facing economic and emotional devastation. I have heard of and am aware of more experienced and valuable physicians retiring or planning retirement or phasing out of clinical medicine [now] than at any time in my career. Small numbers have died or become ill. Some are overwhelmed by burdens—most with the most-precipitous drop in income and stability in generations. Many [offices] will never reopen. Many will be scarred and unable to generate level of income and efficiency. Many have or will cut staff. Patient access will suffer. Cap ex is almost zero in many cases. The issue is it requires two decades to go from medical school to an experienced physician and once lost, that experience will be lost forever.

- We are operating at about 75 percent normal volume, which is sustainable. There has been no continued uptick, so we are preparing for diminished volumes and revenues over the next two to three months.

Nursing and Residential Care Facilities

- The senior living industry continues to struggle with no relief from the government despite our pleas. We are "hopeful" there will be some relief for us in the next round, but that is unknown. We are incurring enormous extra costs to run our business, and our occupancy and revenue are dropping because of the inability to move in new residents at a normal pace due to necessary access restrictions. As a result, we recently disclosed substantial doubt about our ability to continue as a "going concern."

Social Assistance

- The need for workforce development services increased significantly during the pandemic, which substantially decreased uncertainty regarding our company's outlook. We expect for this trend to continue for as long as the economy goes through its recovery—based on local business activity and demand for talent.

Museums, Historical Sites and Similar Institutions

- We have opened to the public with normal hours and some modifications in procedures to prevent crowds. Attendance by the public is 30 percent of what it should be in a normal June.

Amusement, Gambling and Recreation Industries

- One of the main problems we are having, besides the obvious, is that we continue to be inundated with mixed messages on how we should/can open for business. The federal government says one thing, the governor one thing, the mayor says something else. We are getting guidelines from the CDC [Centers for Disease Control], WHO [World Health Organization], Texas Restaurant Association, National Club Association, our insurance companies and other varieties of entities. Not only do we need some clarity into the very murky crystal ball we are looking into, but so do our customers. We can open and be ready, but our potential customers are being told "go out," "stay home," "go out," "stay home," etc. I understand that this virus does not act rationally, but it certainly would help if we could get some kind of clear message. We are all suffering from severe whiplash!

Accommodation

- While we note revenues and employment are increasing from May, that is only because we had suspended operations in May. We are forecasting to see business levels lower than last year by 60 to 70 percent for the remainder of 2020. It is difficult to forecast past 30 days until we know what happens with air travel and group meetings and events.

- The hospitality industry has been the most impacted of any major industry in the country. We just reopened June 1, and we are slowly ramping up. Most tourist-related activities are starting operations this week. I believe my business will grow until about mid-August when school goes back into session. After that period, we have no significant convention or group activity on the books for the remainder of 2020.

Food Services and Drinking Places

- Seems like things are getting a little better in Texas. So much fear and hypocrisy on the news lately; hopefully, it will not impact the general population.

- My hot dog carts at the Home Depot stores are still closed due to the Home Depot Corporation, which represents my 66 percent loss of revenue. I really hope they can call me soon and let me open.

- We have slowly been allowed to open more of our restaurants. Our game rooms were allowed to open last week. Business is still soft, and we will run negative comps as long as social distancing is required. We can't operate at capacity with part of our tables out of service. We are having problems with employees coming back due to the lucrative federal unemployment benefits. Hopefully, that will stop at the end of July and not be renewed at that high amount. Most of our employees are making more money on unemployment than they have ever made.

- When one employee is infected, we are forced to [send home] all employees who had contact with the infected one. This has created a shortage of help in our stores. It is a financial burden too since all continue to be paid.

- My concern being a heavy Houston-based company and with oil prices being down is there will be some big layoffs that will affect the Houston economy. We are a byproduct of the local economy.

- This is going to get worse. I do not foresee people eating in restaurants or for catering/events to come back for a very long time.

Personal and Laundry Services

- When we were allowed to open in early May, business started off strong. Business has since slowed dramatically, and an increase in COVID-19 cases has created more uncertainty.

Religious, Grantmaking, Civic, Professional and Similar Organizations

- The virus continues to have a negative effect on businesses and the public getting out and back to normal.

- Failure to put citizens’ safety over employers’ profits has/will cause a ripple effect.

Merchant Wholesalers, Durable Goods

- Sales are picking back up as states open up after lockdowns.

- This is the worst time since the company’s inception.

- With all the new cases and no statistics as to where they come from, it's hard to predict business. If we knew if they were coming from restaurants, vacations or protests, we could change accordingly.

Merchant Wholesalers, Nondurable Goods

- Our business sells a lot to the education sector. As such, we have been hit very hard. A lot of what happens next is built around if and when schools reopen.

- COVID-19 remains the big issue regarding any type of business outlook moving forward. We remain conservative in all of our decision-making. Unfortunately, we are holding on and just trying to stay relevant. We are a small, family-owned business with 35 employees and hope to keep everyone employed.

- As dining rooms reopen, our customers are placing orders for inventory to be restocked. There is still some older inventory in the pipeline that's being consumed, but I expect velocity to pick up through the summer. Our food costs have stayed the same. Our transportation costs have increased 10–15 percent, so we are holding the selling price without passing on the freight increases. Once order frequency can be established (in the next four weeks), we will most likely pass along the freight increases.

Motor Vehicle and Parts Dealers

- My outlook for six months from now is based on a stabilized virus rate. If the virus hits with a second wave in the fall, my outlook will be much different.

- New-vehicle inventories are declining daily. We should see a gradual increase over the next 90 days. Used-vehicle inventories are declining daily and expected to continue to decline over the next 90 days.

- Our retail activity improved substantially in May. This spike in sales combined with production issues from new-vehicle manufacturers has created a significant short-term increase in used-car values; manufacturers have reduced incentives, effectively raising prices on new and used cars. We do not see this continuing long term.

- We are hoping for the best but not expecting too much over the next month or two.

- Automotive inventories remain low, and we should see some relief by August.

- New and pre-owned inventories are extremely low at this time. New inventories will be at an all-year low in July, and then we should see significant improvement, if production is not disrupted by COVID-19. May sales were strong, following a disappointing 8.6 million SAAR [seasonally adjusted annualized rate] in April. We anticipate SAAR to improve throughout the balance of the year, but there are too many unknowns and challenges ahead. Production? Parts shortages? OEMs’ [original equipment manufacturers] conservative support of incentives? We expect pullback.

Building Material and Garden Equipment and Supplies Dealers

- If the coronavirus pops up again, the good will get bad again.

Clothing and Clothing Accessories Stores

- The company filed Chapter 11 reorganization on May 10, 2020. Sales were strong when stores were first reopened due to a combination of pent-up demand and help from the stimulus programs. Subsequently, those two factors have become less obvious as sales have started to weaken.

Historical Data

Historical data can be downloaded dating back to January 2007.

Indexes

Download indexes for all indicators. For the definitions of all variables, see Data Definitions.

Texas Service Sector Outlook Survey |

Texas Retail Outlook Survey |

| Unadjusted | Unadjusted |

| Seasonally adjusted | Seasonally adjusted |

All Data

Download indexes and components of the indexes (percentage of respondents reporting increase, decrease, or no change). For the definitions of all variables, see Data Definitions.

Texas Service Sector Outlook Survey |

Texas Retail Outlook Survey |

| Unadjusted | Unadjusted |

| Seasonally adjusted | Seasonally adjusted |

Questions regarding the Texas Service Sector Outlook Survey can be addressed to Christopher Slijk at christopher.slijk@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Texas Service Sector Outlook Survey is released on the web.