Texas Service Sector Outlook Survey

Texas service sector activity continues to decline

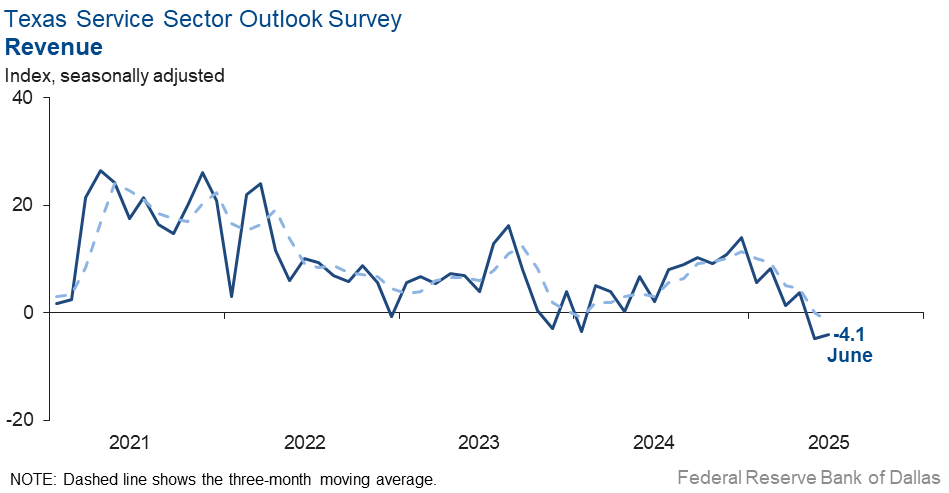

Texas service sector activity remained in contractionary territory in June, according to business executives responding to the Texas Service Sector Outlook Survey. The revenue index, a key measure of state service sector conditions, held fairly steady at -4.1, suggesting revenue declined at about the same pace as in May.

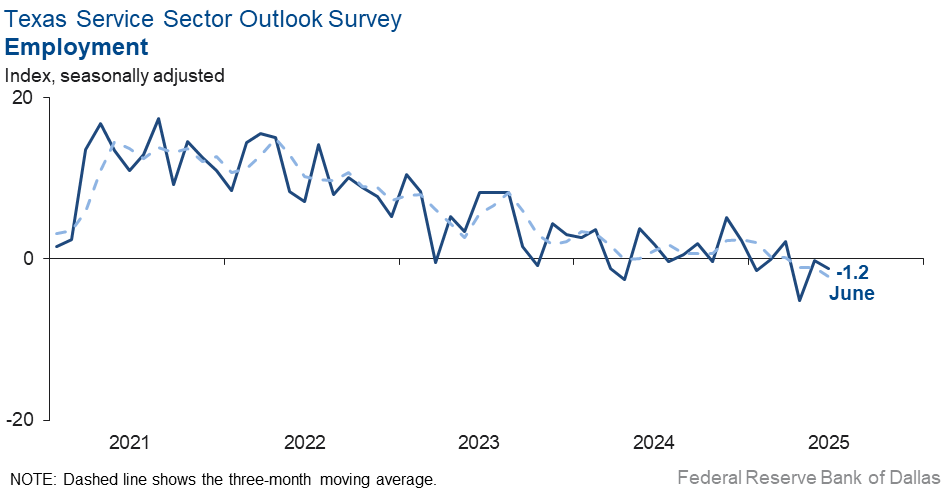

Labor market measures indicated employment and hours worked were largely unchanged again in June. The employment index edged down to -1.2, with the near-zero reading suggesting flat headcounts last month. The part-time employment index dipped to -1.7 from -0.7, while the hours-worked index came in at 0.0.

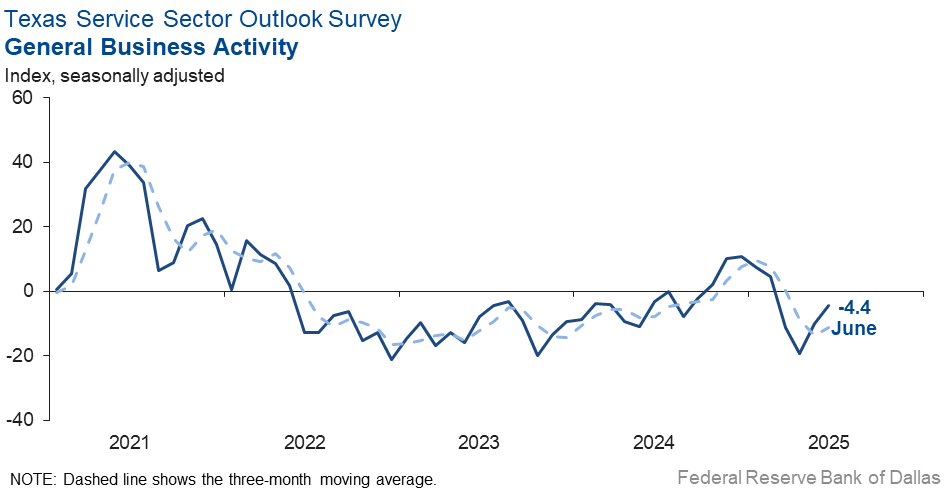

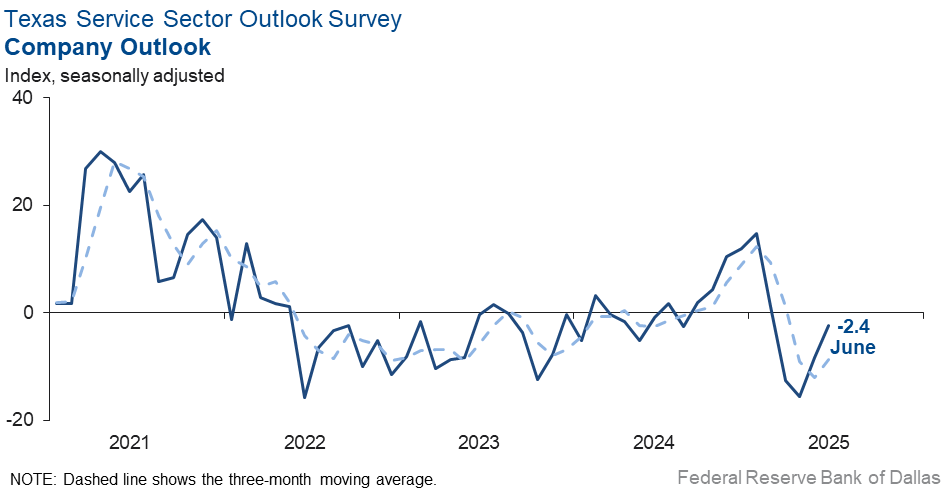

Perceptions of broader business conditions continued to worsen in June, though the indexes were less negative than the prior month. The company outlook index increased six points to -2.4, and the general business activity index also rose six points to -4.4. The outlook uncertainty index came in at 19.7, similar to May’s reading and still well above the series average of 13.6.

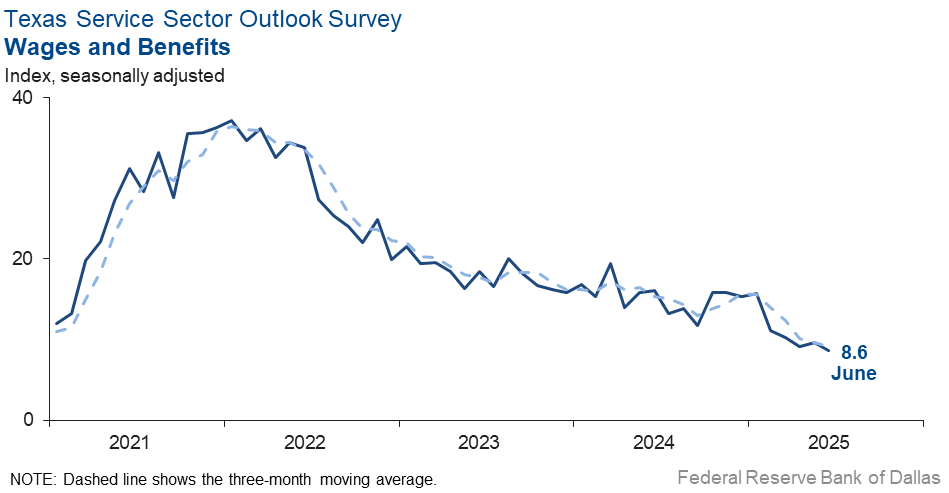

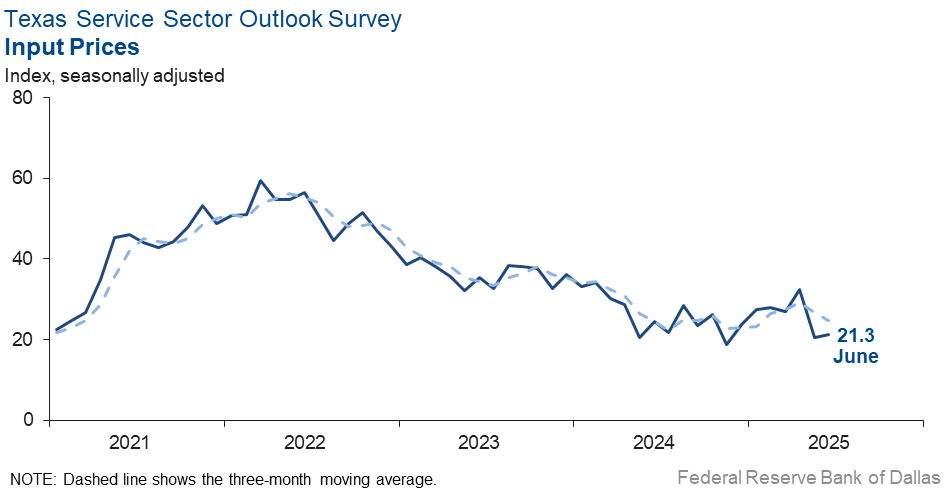

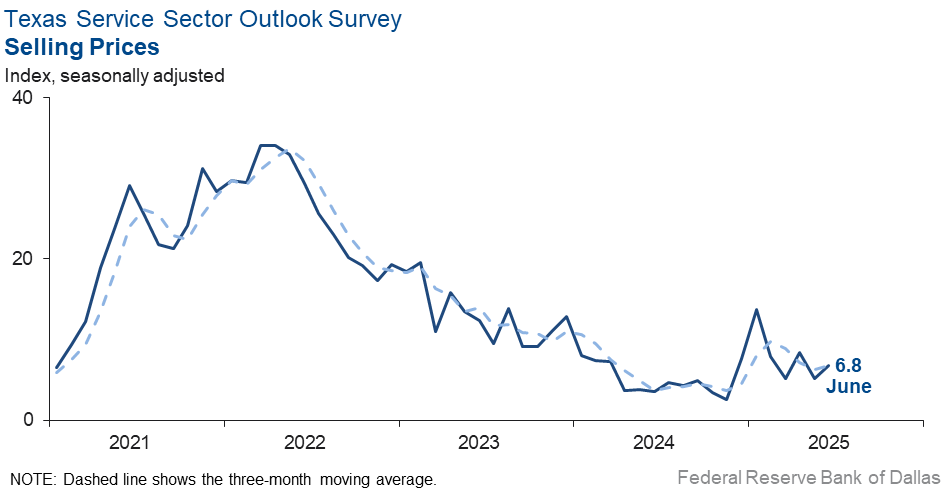

Price and wage growth were stable in June. The selling prices index increased slightly to 6.8 from 5.2, but the input prices index held steady at 21.3. The wages and benefits index remained largely unchanged at 8.6, below its average value.

Respondents’ expectations regarding future business activity improved slightly in June. The future general business activity index edged up to 1.5 from -0.3. The future revenue index also rose. Other future service sector activity indexes, such as employment, increased, rising further into positive territory.

Texas Retail Outlook Survey

Texas retail sales contract further

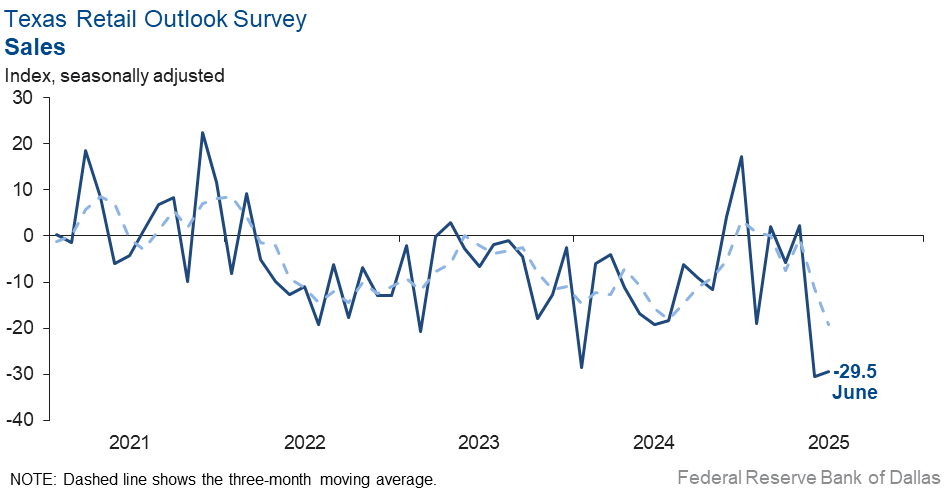

Retail sales continued to decline in June, according to business executives responding to the Texas Retail Outlook Survey. The sales index, a key measure of state retail activity, was largely unchanged at -29.5. Retailers’ inventories shrunk, with the index remaining in negative territory at -2.8 in June.

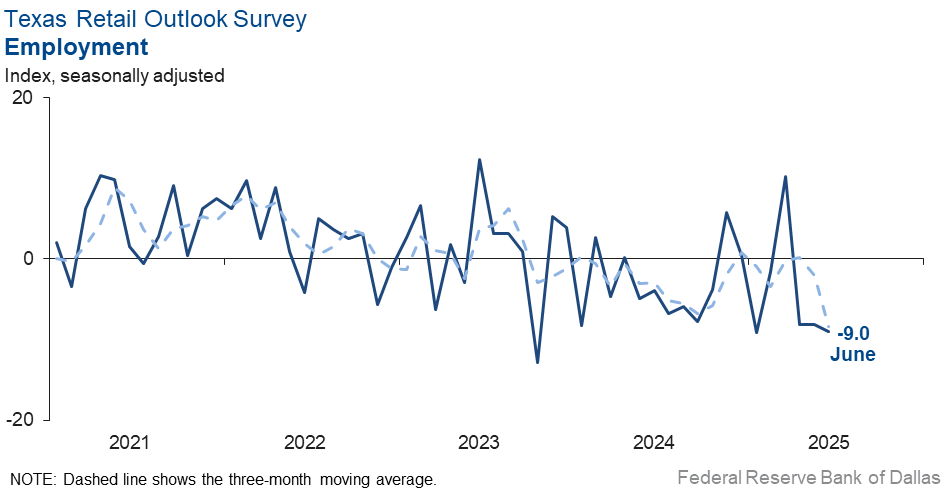

Retail sector labor market indicators suggested a continued contraction in employment and hours worked. The employment index was little changed at -9.0, and the part-time employment index ticked down slightly to -4.9, both negative readings suggesting a decline in hiring. Meanwhile, the hours worked index plunged 10 points to -14.1.

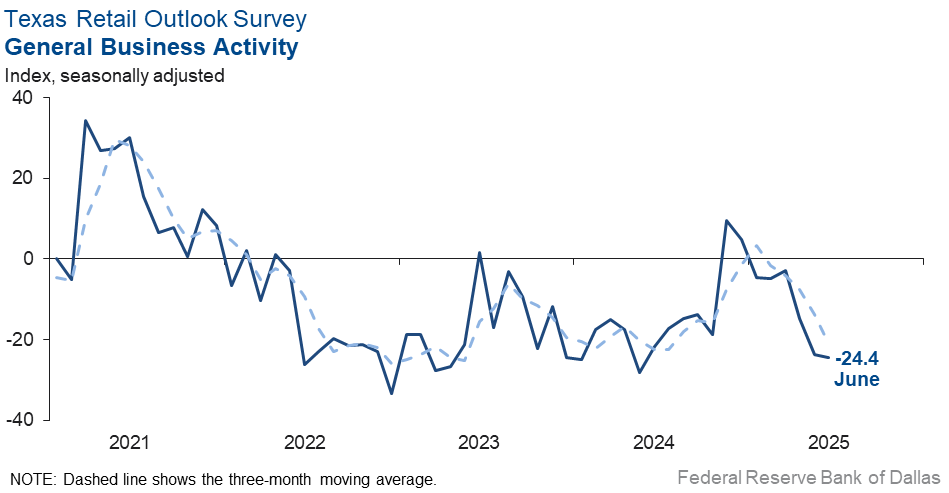

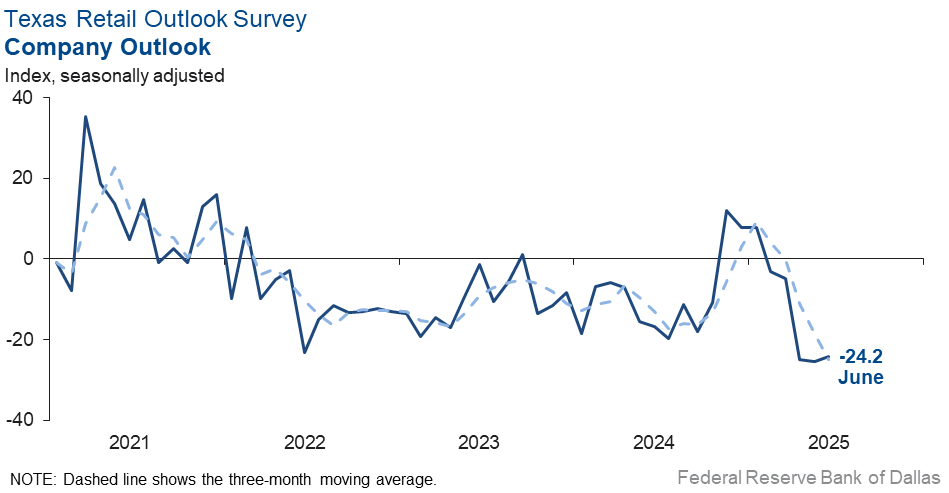

Perceptions of broader business conditions deteriorated further in June. Both the general business activity index and company outlook index were little changed from May, remaining deep in negative territory at -24.4 and -24.2, respectively. The outlook uncertainty index held steady at 18.8, well above its series average of 11.4.

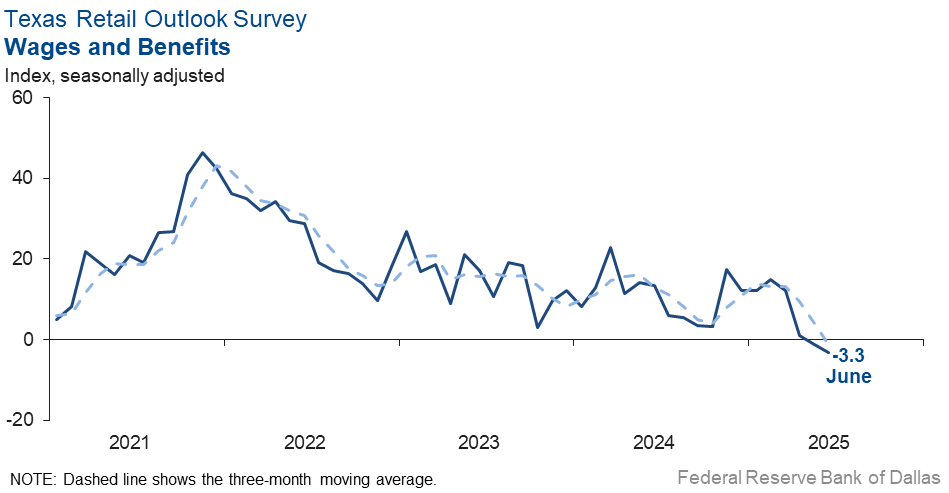

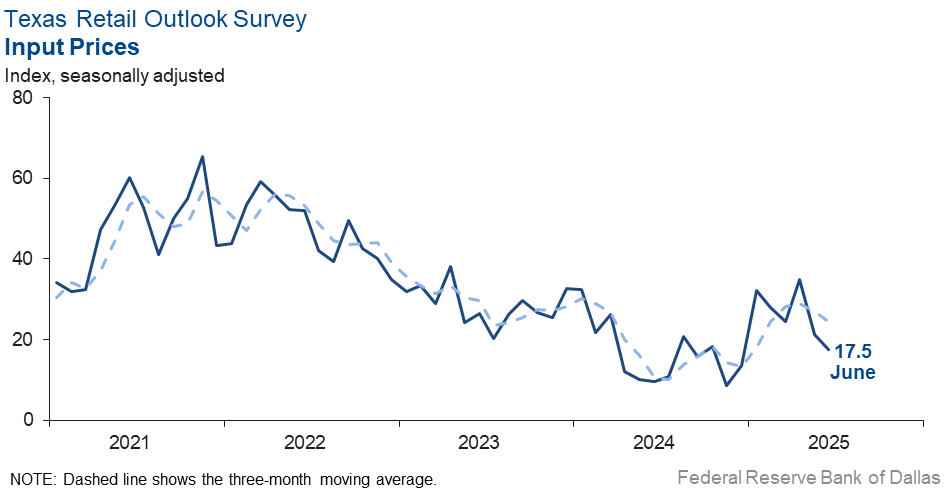

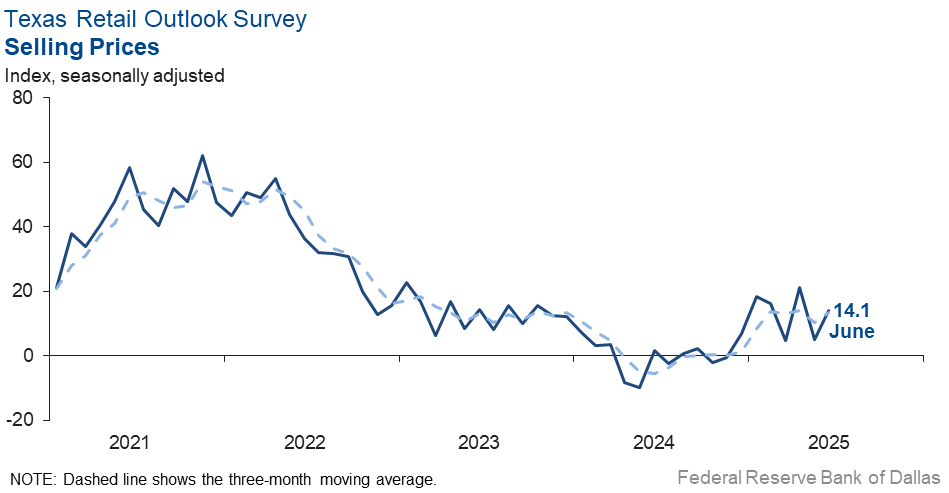

Selling price growth accelerated while input price and wage pressures eased. The selling prices index rose nine points to 14.1, pushing above its series average of 13.1. The input prices index dipped four points to a below-average reading of 17.5, while the wages and benefits index ticked down two points to -3.3.

Expectations for future retail activity were mixed but leaned more positive overall, suggesting the future outlook improved from May. While the future general business activity index dipped to -3.2 from -1.3, the future company outlook index moved up eight points to 4.3. The future sales index rose to 19.1, and the future employment index rose to 13.4. The future capital expenditures index also increased.

Next release: July 29, 2025

Data were collected June 17–25, and 259 of the 371 Texas service sector business executives surveyed submitted responses. The Dallas Fed conducts the Texas Service Sector Outlook Survey monthly to obtain a timely assessment of the state’s service sector activity. Firms are asked whether revenue, employment, prices, general business activity and other indicators increased, decreased or remained unchanged over the previous month.

Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase. When the share of firms reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior month. If the share of firms reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior month. An index will be zero when the number of firms reporting an increase is equal to the number of firms reporting a decrease.

Data have been seasonally adjusted as necessary.

Texas Service Sector Outlook Survey

Historical data are available from January 2007 to the most current release month.

| Business Indicators Relating to Facilities and Products in Texas Current (versus previous month) | ||||||||

| Indicator | Jun Index | May Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Revenue | –4.1 | –4.7 | +0.6 | 10.4 | 2(–) | 21.1 | 53.7 | 25.2 |

Employment | –1.2 | –0.2 | –1.0 | 6.0 | 3(–) | 9.7 | 79.4 | 10.9 |

Part–Time Employment | –1.7 | –0.7 | –1.0 | 1.3 | 4(–) | 3.4 | 91.5 | 5.1 |

Hours Worked | 0.0 | –1.2 | +1.2 | 2.5 | 1() | 6.9 | 86.2 | 6.9 |

Wages and Benefits | 8.6 | 9.7 | –1.1 | 15.6 | 61(+) | 13.6 | 81.4 | 5.0 |

Input Prices | 21.3 | 20.5 | +0.8 | 27.8 | 62(+) | 25.9 | 69.5 | 4.6 |

Selling Prices | 6.8 | 5.2 | +1.6 | 7.5 | 59(+) | 13.1 | 80.6 | 6.3 |

Capital Expenditures | 7.5 | 4.4 | +3.1 | 9.8 | 59(+) | 14.6 | 78.3 | 7.1 |

| General Business Conditions Current (versus previous month) | ||||||||

| Indicator | Jun Index | May Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | –2.4 | –8.3 | +5.9 | 4.1 | 4(–) | 13.5 | 70.5 | 15.9 |

General Business Activity | –4.4 | –10.1 | +5.7 | 2.1 | 4(–) | 14.7 | 66.2 | 19.1 |

| Indicator | Jun Index | May Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Outlook Uncertainty | 19.7 | 18.7 | +1.0 | 13.6 | 49(+) | 29.3 | 61.1 | 9.6 |

| Business Indicators Relating to Facilities and Products in Texas Future (six months ahead) | ||||||||

| Indicator | Jun Index | May Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Revenue | 33.4 | 27.2 | +6.2 | 37.3 | 62(+) | 47.9 | 37.6 | 14.5 |

Employment | 19.9 | 17.6 | +2.3 | 23.0 | 62(+) | 28.9 | 62.1 | 9.0 |

Part–Time Employment | –1.2 | 3.2 | –4.4 | 6.5 | 1(–) | 6.9 | 85.0 | 8.1 |

Hours Worked | 0.1 | 4.7 | –4.6 | 5.9 | 2(+) | 7.3 | 85.5 | 7.2 |

Wages and Benefits | 38.4 | 34.2 | +4.2 | 37.4 | 62(+) | 41.3 | 55.7 | 2.9 |

Input Prices | 31.7 | 47.7 | –16.0 | 44.3 | 222(+) | 38.8 | 54.1 | 7.1 |

Selling Prices | 16.6 | 23.7 | –7.1 | 24.5 | 62(+) | 26.3 | 64.0 | 9.7 |

Capital Expenditures | 14.0 | 13.7 | +0.3 | 22.6 | 61(+) | 23.2 | 67.6 | 9.2 |

| General Business Conditions Future (six months ahead) | ||||||||

| Indicator | Jun Index | May Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | 7.1 | 3.2 | +3.9 | 15.4 | 2(+) | 24.5 | 58.1 | 17.4 |

General Business Activity | 1.5 | –0.3 | +1.8 | 12.0 | 1(+) | 23.3 | 54.9 | 21.8 |

Historical data are available from January 2007 to the most current release month.

| Business Indicators Relating to Facilities and Products in Texas Retail (versus previous month) | ||||||||

| Indicator | Jun Index | May Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

| Retail Activity in Texas | ||||||||

Sales | –29.5 | –30.5 | +1.0 | 2.8 | 2(–) | 9.8 | 50.9 | 39.3 |

Employment | –9.0 | –8.1 | –0.9 | 1.4 | 3(–) | 2.3 | 86.4 | 11.3 |

Part–Time Employment | –4.9 | –3.6 | –1.3 | –1.5 | 4(–) | 2.6 | 89.9 | 7.5 |

Hours Worked | –14.1 | –3.8 | –10.3 | –2.3 | 7(–) | 0.2 | 85.5 | 14.3 |

Wages and Benefits | –3.3 | –1.1 | –2.2 | 11.1 | 2(–) | 7.5 | 81.7 | 10.8 |

Input Prices | 17.5 | 21.3 | –3.8 | 22.5 | 62(+) | 32.5 | 52.5 | 15.0 |

Selling Prices | 14.1 | 5.2 | +8.9 | 13.1 | 7(+) | 28.1 | 57.9 | 14.0 |

Capital Expenditures | 6.9 | –2.3 | +9.2 | 7.4 | 1(+) | 12.7 | 81.5 | 5.8 |

Inventories | –2.8 | –10.7 | +7.9 | 2.7 | 5(–) | 19.3 | 58.6 | 22.1 |

| Companywide Retail Activity | ||||||||

Companywide Sales | –24.0 | –35.8 | +11.8 | 4.1 | 2(–) | 9.0 | 58.0 | 33.0 |

Companywide Internet Sales | –16.0 | –25.2 | +9.2 | 3.6 | 4(–) | 11.1 | 61.8 | 27.1 |

| General Business Conditions, Retail Current (versus previous month) | ||||||||

| Indicator | Jun Index | May Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | –24.2 | –25.3 | +1.1 | 1.1 | 5(–) | 4.2 | 67.4 | 28.4 |

General Business Activity | –24.4 | –23.7 | –0.7 | –2.8 | 6(–) | 5.7 | 64.2 | 30.1 |

| Outlook Uncertainty Current (versus previous month) | ||||||||

| Indicator | Jun Index | May Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Outlook Uncertainty | 18.8 | 19.7 | –0.9 | 11.4 | 11(+) | 27.1 | 64.6 | 8.3 |

| Business Indicators Relating to Facilities and Products in Texas, Retail Future (six months ahead) | ||||||||

| Indicator | Jun Index | May Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

| Retail Activity in Texas | ||||||||

Sales | 19.1 | 13.7 | +5.4 | 30.1 | 25(+) | 38.8 | 41.5 | 19.7 |

Employment | 13.4 | 11.0 | +2.4 | 12.6 | 2(+) | 22.1 | 69.2 | 8.7 |

Part–Time Employment | –8.1 | 2.8 | –10.9 | 1.4 | 1(–) | 7.7 | 76.5 | 15.8 |

Hours Worked | –12.3 | –1.4 | –10.9 | 2.2 | 6(–) | 2.9 | 81.9 | 15.2 |

Wages and Benefits | 27.5 | 26.2 | +1.3 | 28.9 | 62(+) | 30.5 | 66.5 | 3.0 |

Input Prices | 23.1 | 47.7 | –24.6 | 33.9 | 62(+) | 38.5 | 46.2 | 15.4 |

Selling Prices | 24.4 | 13.7 | +10.7 | 28.3 | 62(+) | 36.6 | 51.2 | 12.2 |

Capital Expenditures | 19.0 | 16.5 | +2.5 | 16.4 | 2(+) | 24.6 | 69.8 | 5.6 |

Inventories | 9.6 | 0.1 | +9.5 | 10.6 | 2(+) | 28.9 | 51.8 | 19.3 |

| Companywide Retail Activity | ||||||||

Companywide Sales | 15.4 | 11.8 | +3.6 | 28.5 | 2(+) | 35.4 | 44.6 | 20.0 |

Companywide Internet Sales | 3.2 | 18.7 | –15.5 | 21.1 | 17(+) | 18.8 | 65.6 | 15.6 |

| General Business Conditions, Retail Future (six months ahead) | ||||||||

| Indicator | Jun Index | May Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | 4.3 | –3.3 | +7.6 | 14.6 | 1(+) | 25.7 | 52.9 | 21.4 |

General Business Activity | –3.2 | –1.3 | –1.9 | 10.2 | 3(–) | 24.5 | 47.8 | 27.7 |

*Shown is the number of consecutive months of expansion or contraction in the underlying indicator. Expansion is indicated by a positive index reading and denoted by a (+) in the table. Contraction is indicated by a negative index reading and denoted by a (–) in the table.

**Shown is the number of consecutive months of improvement or worsening in the underlying indicator. Improvement is indicated by a positive index reading and denoted by a (+) in the table. Worsening is indicated by a negative index reading and denoted by a (–) in the table.

Data have been seasonally adjusted as necessary.

Texas Service Sector Outlook Survey

Texas Retail Outlook Survey

Texas Service Sector Outlook Survey

Comments from survey respondents

Survey participants are given the opportunity to submit comments on current issues that may be affecting their businesses. Some comments have been edited for grammar and clarity.

- My sense is we are in a very short-term market in terms of buying decisions by consumers. They are making purchasing decisions based on the latest economic headline. June will be a good (not great) month because positive things occurred that helped the consumer feel confident. On the next tariff [deadline] of July 9, we will see how it plays out and where the psyche of the consumer goes.

- We are in the process of a fire sale to get out of the business. If it doesn't sell in a month, we will be closing.

- Corporations and government entities have reduced their travel budgets due to cuts in personnel and [overall] budgets. Our leisure department also had reductions in sales due to fear of traveling abroad, economic issues and new passport and visa requirements.

- Uncertainty is high due to several active wars, tariffs in question, tax reform in question, the President threatening to unleash the army on law abiding U.S. citizens, etc.

- Heightened tensions between Israel and Iran have not translated into a specific impact with respect to our clients (at least not in obvious ways).

- [Our] major concern is unpredictability of macro environment and the U.S.’s inability to reduce fiscal deficits.

- There is a continued tightening of open jobs and hiring. [Businesses are] reluctant to make decisions about candidates. There are lengthy interviewing processes.

- People are not coming out [to our establishment] because discretionary income is being used to purchase food.

- Between the uncertainty of tariffs, some tariffs coming into effect and increasing some of our costs, general unease about both domestic and international political situations and customers seeming to be continuing to pull back spending on food and beverage, we have adjusted downward our projections for the second half of 2025. Also, the beer market, especially craft beer, has been in decline. That has been a headwind we have been fighting for at least the past twelve months.

- The biggest concern is understanding what might happen if the global conflicts escalate and the debt of United States can’t be brought under control. We hope the economy has a possibility of providing a solution through growth stimulation. There are a lot of obstacles to overcome, including political disruption. The time wasted in the process of introducing solutions is costing billions of dollars.

- Washington is telling us that everything is great, tariffs are working, the war in Iran went as planned and the U.S. has no plans on regime change following the Iran war. There’s a lot of what-ifs in the air. So, my concern is, what if they are wrong? It is a time to keep our powder dry.

- Nothing really newsworthy this month. Insurance rates on property are moderating, so selling prices are more static.

- Cost of living increases—especially in food, insurance and ad valorem taxes—are causing cost-of-living wage increases in order to retain quality employees.

- Real estate costs continue to increase and affect margins. Labor remains steady in applicants and wage requirements.

- There was an injunction filed to stop a 10 percent decrease in title insurance rates that was to go into effect on July 1, 2025.

- Uncertainty continues to lead my concerns. Bombing Iran just adds to the situation. President Trump and his administration are totally unpredictable.

- There is a lot of unnecessary uncertainty in the environment right now. All we need is clear rules and no more changes to policy.

- While the tariffs were a bit of "cold water" on the economy, I think it has found a satisfactory equilibrium. I anticipate the economy to remain moderately strong the remainder of 2025 and on into 2026.

- Although we understand the Fed's cautious stance to not lower rates, those companies with rates locked will see no relief as we enter the Department of Defense (DoD)’s fiscal fourth quarter. Refinancing is probably out of the question, and margins will get even tighter in a competitive market. The real question is how contract procurement will be impacted by federal workforce cuts. On our National Institute of Health contract, several government employees were rehired to continue to work on scheduled software and database upgrades.

- Geopolitical uncertainty and fallout from federal agencies’ employee cuts. Federal agencies are in chaos and seeing a huge loss of institutional knowledge and experience as seasoned employees are being replaced by new, inexperienced staff. Much loss of momentum and effectiveness.

- We are seeing a record number of proposals across our 900-client list in Texas and Louisiana. A record number of projects are getting kicked off in the land development sectors in Houston and Dallas as well as liquefied natural gas, water treatment, power development and data centers across the regions. Mid- to high-rise development is the only one that has slowed somewhat. Our industrial and commercial outlook recently improved from even one or two months ago. Versus our typical business cycle, sentiment has improved substantially across our offices in Brownsville, Austin, Dallas, Houston (HQ) and Beaumont regions. We are looking to increase our engineering and overall staff headcount by 10–15 percent in the next 6 months.

- Cut the rates.

- Clients do not appear to be influenced by tariffs at this point.

- Tariff psychosis continues in Washington, and we are starting to see effects in construction costs that will put downward pressure on construction and our business as an engineering consultant.

- Things might be picking up.

- Continued chaos and lack of coherent tariff policy has significantly impacted business.

- We are projecting a small slowdown for the third and fourth quarters.

- June had an unexpected stall in new contracts for services. Projects have been delayed or reduced in scope to bare necessities. No consistent explanations given.

- Main issue is continued risks, timing shifts and uncertain budget conditions particularly for government/DOD potential planned orders.

- Global trade issues are still the primary source of uncertainty for our business and our customers, but given the ambiguity of go-forward policy, our outlook has not changed. However, a single announcement could dramatically improve or deteriorate our outlook.

- Uncertainty continues to be a lingering issue. Not so much for the immediate future, but the fact that tariffs continue to get delayed makes uncertainty a greater concern for the 3- to 6-month timeframe. Because our industry comes from discretionary household income, our future impact is uncertain until we see how the recent activity with Iran is going to impact consumers.

- Levels of uncertainty driven by rapid and incoherent policy changes are at an all-time high. Instead of just fearing economic impacts, I now fear for the whole of our country. Fortunately, since we manage apartments and people still need a place to live, we should be okay. But genuine prosperity today looks more like wishful thinking rather than something we can work for and impact.

- No one wants to admit it, but the uncertainty coupled with on again/off again tariffs is eroding confidence at all levels. Leadership has been absolutely appalling, and the full impact is far from known since this tariff war and imagined "unfairness" by other nations towards the U.S. in trade is so contrived that it's like we are dealing with children on the policy front.

- Interest rates continue to be an issue. General economy questions still seem to be an issue. I think most people can't see if the economy is getting better, worse or staying the same. Seems pretty stable to me, but I think there is a general worry, and people are playing it safe right now.

- Reduction in supply of new multifamily properties in Texas appears to be headed toward healthier conditions to allow for more acquisitions/dispositions and improved fundamentals for new development delivering in the 2027 onward timeframe.

- Commercial real estate activity has been steady, with the company increasing market share, now [at] $1.7 billion.

- The chaos caused by Immigration and Customs Enforcement, tariffs, future tax policies and overall lack of leadership of any political group has caused our company and our customer base to pause expenses, including upgrades or equipment acquisition, for the rest of this year.

- Future direction of tariffs and the continued lack of an intelligent, strategic tariff strategy is choking off most capital expenditure commitments in our manufacturing clients’ plans. We are concerned that we will also be seeing significant slowdowns in consumer spending due to tariff impacts in future quarters.

- I'm starting to see a lot more bargain shoppers. People are being squeezed. An increase in Chapter 11 bankruptcy filing in the headlines. Increased war activity in the Middle East. All affecting uncertainty and consumer behavior.

- I do think that easing employment demand will help small businesses find more qualified people. Finding good people is a problem at the moment.

- There still feels like there is some “wait and see” in the marketplace for our services. What would likely increase revenue would be a rate cut and/or a clearer policy from Washington.

- Farmers in the area are benefiting from good rains. Employment levels are steady, with low unemployment.

- Negatives include China tariffs still at 55 percent, Fed chairman holding interest rates high and high levels of uncertainty reducing consumer spending and corporate growth. Potential positives include enforcement of the Department of Transportation’s English language proficiency mandate potentially removing nondomiciled commercially licensed drivers and reducing excess capacity, allowing rates to move back to profitability (vs. operating at or below cost).

- High tariffs and constant updates are making forecasting and planning impossible.

- Relatively stable outlook at the moment, barring additional escalation in the Gulf region with Iran.

- Tariff chaos is the primary driver for uncertainty.

- Decreased demand [is an issue impacting our business].

- We're still unsure about the effect of tariffs. We have seen some price increases and supply shortages, but nothing significant at this point.

- [Environment is] highly uncertain still.

- Tariffs are still a big topic of discussion with my customers in Latin America, although there isn't any definitive evidence that we are being impacted. My concern is still that tariffs might induce our customers to look for alternative sources if the U.S. goods we export are perceived to be too expensive. Some of that could also be posturing by the customers because we have not seen any material changes to their ordering patterns.

- Our number of part-time employees has increased, with some summer internships filling some hiring gaps. Plus, we have hired three part-time employees that are retired from other jobs but were looking for income to supplement their retirement funds.

- New vehicle inventory declined by 30 percent between May and June, which is the reason for the decline in sales for June. The market is still strong, and we expect new vehicle availability to return to normal in July and August.

- Tariff uncertainty remains an issue for new vehicle sales. Manufacturers are reducing vehicle purchase incentives to [offset] tariffs. Consumer traffic in our showrooms is slowing due to a lack of incentives and general uneasiness over the economy.

- Tariffs have increased transaction prices, and customers are struggling to afford selling prices and/or monthly payments.

- Everything coming out of Washington is negative for our business: uncertainty regarding tariffs, stripping the workforce of workers and more federal debt. How disconnected can they be?

- There is a lot of uncertainty in the market. We anticipate a downturn in the latter half of the year.

- Right now, I'm a little worried about a "black swan" event, given the new war in the Middle East and the unending war in Ukraine. Also, it is still really difficult to hire qualified truck drivers who have a work history of spending longer than one year at every job.

Historical Data

Historical data can be downloaded dating back to January 2007.

Indexes

Download indexes for all indicators. For the definitions of all variables, see data definitions.

Texas Service Sector Outlook Survey |

Texas Retail Outlook Survey |

| Unadjusted | Unadjusted |

| Seasonally adjusted | Seasonally adjusted |

All Data

Download indexes and components of the indexes (percentage of respondents reporting increase, decrease, or no change). For the definitions of all variables, see data definitions.

Texas Service Sector Outlook Survey |

Texas Retail Outlook Survey |

| Unadjusted | Unadjusted |

| Seasonally adjusted | Seasonally adjusted |

Questions regarding the Texas Service Sector Outlook Survey can be addressed to Mariam Yousuf at mariam.yousuf@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Texas Service Sector Outlook Survey is released on the web.