Texas Service Sector Activity Declines

Texas Service Sector Outlook Survey

July 28, 2020

Texas Service Sector Activity Declines

What’s New This Month

For this month’s survey, Texas business executives were asked supplemental questions on the impacts of COVID-19. Results for these questions from the Texas Manufacturing Outlook Survey, Texas Service Sector Outlook Survey and Texas Retail Outlook Survey have been released together. Read the special questions results.

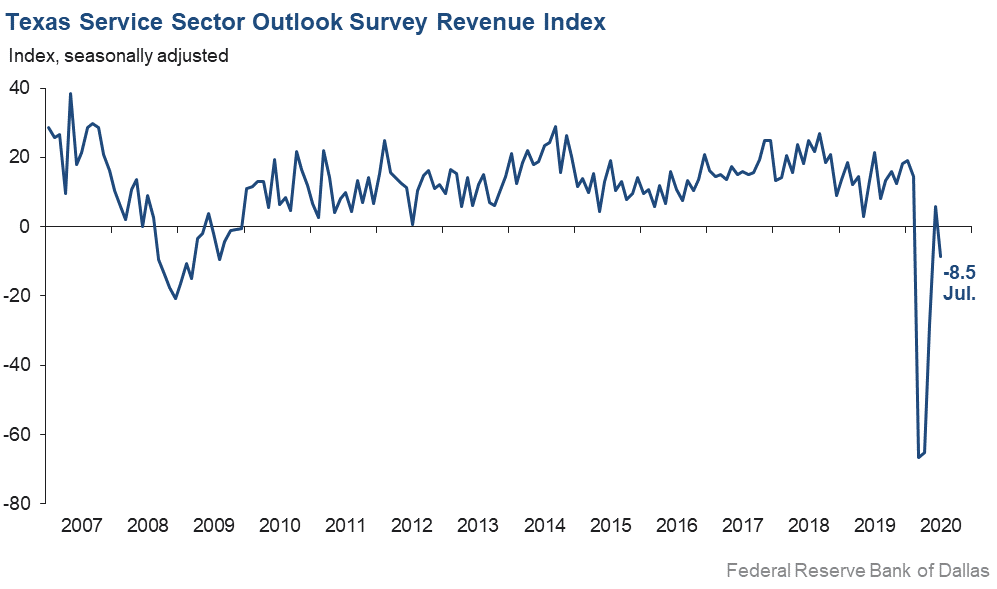

Activity in the Texas service sector contracted in July after showing moderate growth in June, according to business executives responding to the Texas Service Sector Outlook Survey. The revenue index, a key measure of state service sector conditions, dropped to negative territory, falling from 5.7 in June to -8.5 in July.

Labor market indicators reflected a further deterioration in employment and shortening workweek length in July. The employment index fell five points to -6.8, suggesting an acceleration in job declines compared with June, while the hours worked index declined three-and-a-half points to -3.7.

Perceptions of broader business conditions turned negative in July. The general business activity index plunged nearly 29 points to -26.7, while the company outlook index fell from 2.2 to -15.8. One-third of respondents noted a worsening of their outlook, compared with 17 percent noting an improved outlook. The outlook uncertainty index surged to 29.4, its highest reading since April.

Wages flattened out in July, while price pressures were mixed. The wages and benefits index declined seven points to 0.4, a level indicating little net change in employee compensation. The selling prices index fell from -2.2 to -5.9, while the input prices index was roughly unchanged at 17.8, suggesting continued inflation in firms’ input costs.

Respondents’ expectations regarding future business activity were mixed in July. The future general business activity index shed 16 points to -9.2, with 34 percent of respondents expecting worsening activity in six months. The future revenue index, though still positive, dropped from 34.1 to 17.9. Other indexes of future service sector activity such as employment were still positive but below their 12-month averages, suggesting expectations of slower improvement over the next six months.

Texas Retail Outlook Survey

July 28, 2020

Texas Retail Sales Plunge

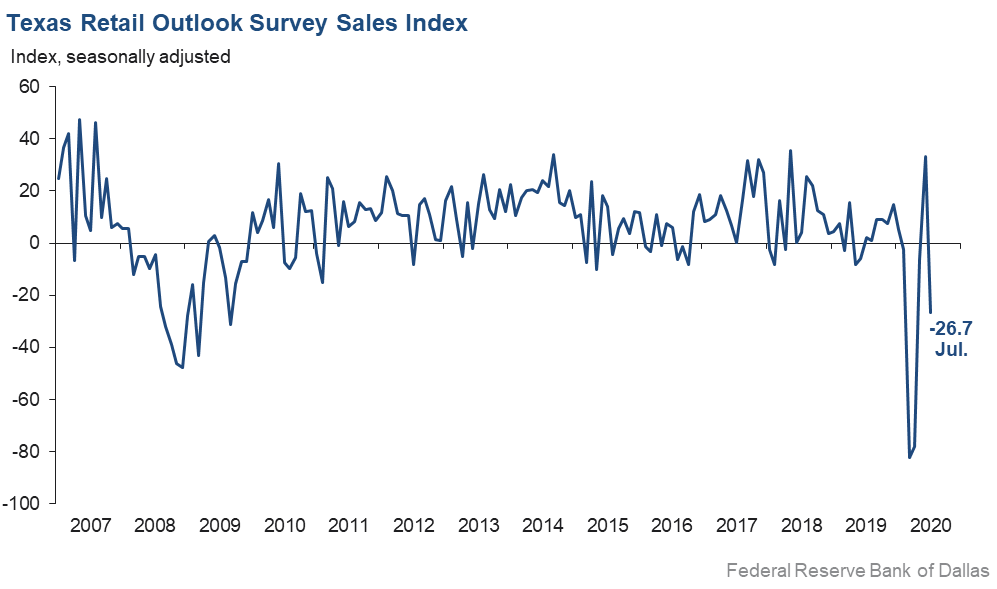

Retail sales activity declined sharply in July, according to business executives responding to the Texas Retail Outlook Survey. The sales index, a key measure of state retail activity, plummeted nearly 60 points to -26.7, its weakest reading since April. Nearly half of respondents reported decreased sales compared with June, while just 21 percent reported increases. Inventories continued to fall at a rapid pace, with the inventories index increasing but remaining starkly negative at -21.3.

Retail labor market indicators worsened in July, pointing toward an acceleration in job losses and shortening workweek lengths. The employment index fell from -5.0 to -10.7, while the part-time employment index shed over 11 points, falling to -15.4. The hours worked index slipped slightly from -6.2 in June to -7.8 in July.

Retailers’ perceptions of broader business conditions turned sharply negative compared with June’s optimism. The general business activity index lost over 53 points, dropping to -23.7, while the company outlook index declined from 16.5 in June to -6.8 in July. The outlook uncertainty index also spiked from -9.6 to 13.7, pointing to heightened uncertainty compared with June.

Retail wages declined in July, while price pressures eased notably. The wages and benefits index fell into negative territory, dipping from 2.8 in June to -5.3 in July. The selling prices index decreased over 15 points to 2.0, suggesting mild inflation pressures, while the input prices index dropped about 11 points to 17.1.

Retailers’ perceptions of future activity were subdued in July compared with June. The future general business activity index fell from 12.7 to -3.4. Meanwhile, the future sales index declined over seven points, though at 32.3 it still suggests expectations of sales growth six months ahead. Other indexes of future retail activity such as employment remained positive but fell, pointing to overall expectations of a weaker increase in future activity.

The Texas Retail Outlook Survey is a component of the Texas Service Sector Outlook Survey that uses information only from respondents in the retail and wholesale sectors.

Next release: September 1, 2020

|

Data were collected July 14–22, and 244 Texas service sector and 53 retail sector business executives responded to the survey. The Dallas Fed conducts the Texas Service Sector Outlook Survey monthly to obtain a timely assessment of the state’s service sector activity. Firms are asked whether revenue, employment, prices, general business activity and other indicators increased, decreased or remained unchanged over the previous month. Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase. When the share of firms reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior month. If the share of firms reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior month. An index will be zero when the number of firms reporting an increase is equal to the number of firms reporting a decrease. Data have been seasonally adjusted as necessary. |

Texas Service Sector Outlook Survey

July 28, 2020

Historical data are available from January 2007 to the most current release month.

| Business Indicators Relating to Facilities and Products in Texas Current (versus previous month) | ||||||||

| Indicator | Jul Index | Jun Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Revenue | –8.5 | 5.7 | –14.2 | 10.9 | 1(–) | 27.6 | 36.2 | 36.1 |

Employment | –6.8 | –1.9 | –4.9 | 6.0 | 5(–) | 9.6 | 73.9 | 16.4 |

Part–Time Employment | –11.5 | –5.2 | –6.3 | 1.2 | 5(–) | 2.5 | 83.5 | 14.0 |

Hours Worked | –3.7 | –0.2 | –3.5 | 2.2 | 5(–) | 10.3 | 75.7 | 14.0 |

Wages and Benefits | 0.4 | 7.8 | –7.4 | 14.0 | 2(+) | 11.1 | 78.2 | 10.7 |

Input Prices | 17.8 | 17.5 | +0.3 | 24.9 | 3(+) | 24.4 | 69.0 | 6.6 |

Selling Prices | –5.9 | –2.2 | –3.7 | 5.0 | 5(–) | 11.5 | 71.1 | 17.4 |

Capital Expenditures | –7.9 | –5.6 | –2.3 | 9.8 | 5(–) | 10.1 | 71.9 | 18.0 |

| General Business Conditions Current (versus previous month) | ||||||||

| Indicator | Jul Index | Jun Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | –15.8 | 2.2 | –18.0 | 4.8 | 1(–) | 17.2 | 49.7 | 33.0 |

General Business Activity | –26.7 | 2.1 | –28.8 | 2.5 | 1(–) | 15.6 | 42.1 | 42.3 |

| Indicator | Jul Index | Jun Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Outlook Uncertainty† | 29.4 | 5.9 | +23.5 | 13.8 | 30(+) | 43.1 | 43.2 | 13.7 |

| Business Indicators Relating to Facilities and Products in Texas Future (six months ahead) | ||||||||

| Indicator | Jul Index | Jun Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Revenue | 17.9 | 34.1 | –16.2 | 36.7 | 3(+) | 44.4 | 29.0 | 26.5 |

Employment | 5.1 | 11.4 | –6.3 | 21.5 | 3(+) | 24.0 | 57.1 | 18.9 |

Part–Time Employment | 0.0 | 1.1 | –1.1 | 6.3 | 1() | 14.8 | 70.4 | 14.8 |

Hours Worked | 7.6 | 13.1 | –5.5 | 5.3 | 3(+) | 16.5 | 74.6 | 8.9 |

Wages and Benefits | 19.1 | 19.1 | 0.0 | 35.8 | 3(+) | 27.5 | 64.1 | 8.4 |

Input Prices | 27.8 | 27.4 | +0.4 | 43.6 | 163(+) | 36.2 | 55.4 | 8.4 |

Selling Prices | 5.9 | 10.2 | –4.3 | 22.7 | 3(+) | 20.6 | 64.7 | 14.7 |

Capital Expenditures | 1.8 | 4.6 | –2.8 | 23.1 | 2(+) | 21.4 | 58.9 | 19.6 |

| General Business Conditions Future (six months ahead) | ||||||||

| Indicator | Jul Index | Jun Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | –3.1 | 6.2 | –9.3 | 15.9 | 1(–) | 26.0 | 45.0 | 29.1 |

General Business Activity | –9.2 | 6.8 | –16.0 | 12.5 | 1(–) | 24.9 | 41.0 | 34.1 |

Texas Retail Outlook Survey

July 28, 2020

Historical data are available from January 2007 to the most current release month.

| Business Indicators Relating to Facilities and Products in Texas Retail (versus previous month) | ||||||||

| Indicator | Jul Index | Jun Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Retail Activity in Texas | ||||||||

Sales | –26.7 | 33.0 | –59.7 | 5.7 | 1(–) | 21.2 | 30.9 | 47.9 |

Employment | –10.7 | –5.0 | –5.7 | 1.7 | 5(–) | 7.8 | 73.7 | 18.5 |

Part–Time Employment | –15.4 | –3.8 | –11.6 | –2.2 | 5(–) | 1.9 | 80.8 | 17.3 |

Hours Worked | –7.8 | –6.2 | –1.6 | –2.0 | 6(–) | 5.9 | 80.4 | 13.7 |

Wages and Benefits | –5.3 | 2.8 | –8.1 | 9.2 | 1(–) | 6.3 | 82.1 | 11.6 |

Input Prices | 17.1 | 27.9 | –10.8 | 18.6 | 3(+) | 23.3 | 70.5 | 6.2 |

Selling Prices | 2.0 | 17.2 | –15.2 | 9.8 | 2(+) | 20.9 | 60.1 | 18.9 |

Capital Expenditures | –6.2 | –2.4 | –3.8 | 7.7 | 5(–) | 4.5 | 84.8 | 10.7 |

Inventories | –21.3 | –34.3 | +13.0 | 2.6 | 6(–) | 21.1 | 36.6 | 42.4 |

Companywide Retail Activity | ||||||||

Companywide Sales | –21.7 | 28.8 | –50.5 | 7.1 | 1(–) | 23.4 | 31.6 | 45.1 |

Companywide Internet Sales | –10.5 | 11.9 | –22.4 | 6.2 | 1(–) | 12.0 | 65.5 | 22.5 |

| General Business Conditions, Retail Current (versus previous month) | ||||||||

| Indicator | Jul Index | Jun Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | –6.8 | 16.5 | –23.3 | 3.1 | 1(–) | 21.9 | 49.4 | 28.7 |

General Business Activity | –23.7 | 29.6 | –53.3 | –1.2 | 1(–) | 17.0 | 42.3 | 40.7 |

| Outlook Uncertainty Current (versus previous month) | ||||||||

| Indicator | Jul Index | Jun Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Outlook Uncertainty† | 13.7 | –9.6 | +23.3 | 11.0 | 1(+) | 35.3 | 43.1 | 21.6 |

| Business Indicators Relating to Facilities and Products in Texas, Retail Future (six months ahead) | ||||||||

| Indicator | Jul Index | Jun Index | Change | Series Average | Trend* | % Reporting Increase | % Reporting No Change | % Reporting Decrease |

Retail Activity in Texas | ||||||||

Sales | 32.3 | 39.8 | –7.5 | 31.8 | 3(+) | 51.8 | 28.7 | 19.5 |

Employment | 2.3 | 7.6 | –5.3 | 11.7 | 3(+) | 25.4 | 51.6 | 23.1 |

Part–Time Employment | –8.0 | 6.4 | –14.4 | 0.5 | 1(–) | 13.1 | 65.8 | 21.1 |

Hours Worked | 5.0 | 5.3 | –0.3 | 2.6 | 3(+) | 17.2 | 70.6 | 12.2 |

Wages and Benefits | 21.1 | 7.0 | +14.1 | 26.9 | 3(+) | 30.7 | 59.7 | 9.6 |

Input Prices | 27.4 | 23.5 | +3.9 | 32.5 | 3(+) | 39.2 | 49.0 | 11.8 |

Selling Prices | 19.6 | 17.3 | +2.3 | 28.5 | 3(+) | 33.3 | 52.9 | 13.7 |

Capital Expenditures | 2.0 | 1.9 | +0.1 | 16.8 | 2(+) | 21.6 | 58.8 | 19.6 |

Inventories | 11.1 | 25.8 | –14.7 | 7.9 | 3(+) | 34.8 | 41.6 | 23.7 |

Companywide Retail Activity | ||||||||

Companywide Sales | 23.7 | 38.6 | –14.9 | 30.3 | 3(+) | 45.6 | 32.5 | 21.9 |

Companywide Internet Sales | 7.5 | 31.5 | –24.0 | 21.6 | 4(+) | 25.0 | 57.5 | 17.5 |

| General Business Conditions, Retail Future (six months ahead) | ||||||||

| Indicator | Jul Index | Jun Index | Change | Series Average | Trend** | % Reporting Improved | % Reporting No Change | % Reporting Worsened |

Company Outlook | 5.2 | 19.3 | –14.1 | 16.5 | 3(+) | 29.8 | 45.6 | 24.6 |

General Business Activity | –3.4 | 12.7 | –16.1 | 12.2 | 1(–) | 27.8 | 41.0 | 31.2 |

*Shown is the number of consecutive months of expansion or contraction in the underlying indicator. Expansion is indicated by a positive index reading and denoted by a (+) in the table. Contraction is indicated by a negative index reading and denoted by a (–) in the table.

**Shown is the number of consecutive months of improvement or worsening in the underlying indicator. Improvement is indicated by a positive index reading and denoted by a (+) in the table. Worsening is indicated by a negative index reading and denoted by a (–) in the table.

†Added to survey in January 2018.

Data have been seasonally adjusted as necessary, with the exception of the outlook uncertainty index which does not yet have a sufficiently long time series to test for seasonality.

Texas Service Sector Outlook Survey

July 28, 2020

Texas Retail Outlook Survey

July 28, 2020

Texas Service Sector Outlook Survey

July 28, 2020

Comments from Survey Respondents

These comments are from respondents’ completed surveys and have been edited for publication.

Support Activities for Mining

- The uncertainty over the reopening of the economy is greater today than a month ago. Some of our customers are requiring their employees to stay home as they did a month or two ago.

Utilities

- Business activity has declined some with the resurgence of COVID-19.

- Bad debt is increasing for the company.

Transportation Equipment Manufacturing

- The lack of consistency of mandatory safety measures against COVID-19 at the federal and state level is creating a lot of uncertainty and added cost to protect the employees. In addition, when there are confirmed cases (all of them have been community related thus far, not contracted at work), the contact tracing and isolation of potentially affected employees while awaiting test results is creating challenges for business continuity.

Truck Transportation

- It's time for the talk about shutdowns and closing the economy due to [COVID-19] to stop. No one will spend any money when all they hear is [about a] possible shutdown again!

- [We] need government to step aside and let us work.

Pipeline Transportation

- COVID-19 hotspots have created more uncertainty in energy-demand trajectory paths.

- The uncertainty around the pandemic and the level of economic activity remain a primary concern.

Warehousing and Storage

- We believe that shipment levels of liquid bulk, especially finished products, should have bottomed out in June and should show slight improvement the remainder of the year. However, the drastic and alarming growth in COVID-19 incidence and death rates in the immediate area pose a greater risk of uncertainty, to the extent that [workers in] facilities in the local area contract the disease and it forces shutdown of operations. We will continue to try to mitigate revenue losses with cost control, which could, going into 2021–22, result in natural attrition of workforce without replacement.

Publishing Industries (Except Internet)

- [We have the] same issues as before and significant near-term planned business risks/timing exist. Cash remains king for decisions. Expectations for our focus on breakout, high-growth-tech-market opportunities remain strong in spite of limited direct customer/buyer in-person meetings to advance and close business. The demand for proprietary advanced UI (user interface) with intelligence and intuitive ease of use remains of great interest. Government and larger pharmaceutical/medical and general market training/education segments remain an ample opportunity. We do see COVID-19-related spend needs way up, making DOD [Department of Defense]/government budgets for this year more limited due to shifting funds to COVID-19 related use.

Data Processing, Hosting and Related Services

- Uncertainty lies around the ability to hire good talent. Although many folks are available in the market, there are not many with deep skills in modern technologies.

Credit Intermediation and Related Activities

- Except for fear of the pandemic, business is stable in rural communities, with slight increases in sales tax revenue due in part to infrastructure construction projects, both public and private. Deposits continue to be elevated above budget expectations, and loan activity has slowed down slightly. There is concern now about drought conditions impacting agriculture operations. Cattle prices are still down, due in part to the effect of slaughter plant partial shutdowns this past month and the backlog of cattle on feed. The market for goats is still extremely strong, topping $3 per pound. Wildfires are starting to create hazards across Central and West Texas and in the Panhandle.

- We are in the consumer-lending space, and the large amount of government stimulus to our subprime customer space has resulted in great credit quality but no loan demand. So, our revenue has dropped roughly 30 percent year over year and continues to decline. We recently laid off 20 percent of our U.S. employees and completely shut down our U.K. operations (150 employees) due to declining revenue.

- We anticipate that as (1) PPP [Paycheck Protection Program] proceeds are spent, (2) previously approved payment deferrals expire and (3) second quarter 2020 financials are reported, defaults will increase. This will impact revenues and loan-loss reserves. The true impact of these events will not even start to be felt until mid-to-late August. Further, if we can justify extensions of payment deferrals for another three months, the impact of a worsening economy will not be felt until mid-to-late November. We are certainly in a "wait-and-see" environment.

Securities, Commodity Contracts, and Other Financial Investments and Related Activities

- Hiring replacement positions continues to be a significant problem. We have very few applicants despite increased spending on advertising positions, etc. We are also seeing a dip in remote employee work output. We attribute this to the general societal mood related to an increase in the infection count and a phase-back of the reopening. General morale seems down, and employees are beginning to have a wane in motivation. Sales activity has picked up some as customers appear to be adjusting to the "new normal."

Real Estate

- We are a commercial real estate broker, and our activity and revenue have fallen 80 percent and show no sign of recovery, yet.

- With an increase in COVID-19 cases, many buyers and sellers stayed at home. The market is good with low interest rates but bad with the media telling us to stay home.

- The constant media focus on COVID-19 and uncertainty over what leaders will do regarding letting businesses open or stay open is a huge drag on the recovery. If all leaders would simply confirm that they will not repeat the shutdown but may (if needed) add other restrictions to help with spikes, that alone would help the recovery. Additionally, I have great concern that the reality of business for the mom-and-pop businesses is that their customers aren't coming back, either out of fear or lack of need since [those] customers are out of school, working from home or out of work. Getting businesses back requires people working, kids being in school, daycares being open and leadership that believes we need to fully reopen.

- [It is] really difficult to quantify the exact value and cost of the slowdown. But there definitely is a slowdown of business and people.

- I feel we are experiencing short-term increases in sales driven by pent-up demand from late March through mid-May. We believe September through December will likely slow due to increases in job losses in the greater Houston area.

- Increased infection levels statewide are adding additional uncertainty.

- There are fewer properties coming on the market, but buying demand has remained consistent.

Rental and Leasing Services

- I have said all along the Texas economy would not reboot just because we lift the lockdown and that until there is a vaccine or a treatment and maybe you add herd immunity, people are going to conserve their money. And that is exactly what we see them doing. I am offended by the PPP government program—[funds were given] to many undeserving recipients [that are] either poorly run companies that deserve to go out of business or very well-run companies that are minimally impacted by the virus and did not need the PPP funds but qualified.

Professional, Scientific and Technical Services

- Uncertainty is the key issue. Projects in the energy sector are not moving forward, as the markets are unpredictable—except to be slow. While the presidential election will have a great impact on the direction of the country (no matter which way it goes), it will not improve the level of business since we are a consumer-driven economy in the middle of a pandemic. The fact that the stock market keeps going up in spite of such an uncertain future is solely the work of the Federal Reserve plowing money into it. The Fed is propping us up and making the rich richer and will eventually result in a disaster. It may make the major investors and the hedge fund managers happy, but it is not helping the rest of us in the real world.

- Working or trying to work remotely in the business of selling has not been effective, at least for me. Many other factors like when can people go back to work and the uncertainty of that seems to dominate everything. I do not think that a vaccine will be the final answer, as they typically do not stop all viruses. The total political unrest in this country and the lack of where to go to get the real truth seem to permeate everything right now; with none of us liking change, I believe we are in for a low-to-even-lower production through all of 2020 unless some sanity can be brought into the equation that is believable by the working class and not dominated by politicians.

- We get delayed bad or good economic news as our buyers are larger companies whose IT decision-making takes place slower.

- [The] view six months from now is somewhat optimistic. Myriad variables can [make an] impact, and we continue to watch and move forward. [Have] settled into WFH [work from home] fine, and now just hoping business activity improves as everyone adapts to the current environment. COVID-19 escalation in Texas could derail hopes.

- COVID-19 and uncertainty reign.

- Client demand remains reasonably strong, though not at the level that we originally forecast but stronger year over year. Market uncertainty has created a continuing anxiety, but deals are continuing. Our M&A [mergers and acquisitions] activity is higher than we would have expected. Most of our energy-related work is focused around restructuring, but [there is] considerable activity in that sector.

- The residential real estate market continues to outpace last year, and we have seen a slight increase in commercial transactions the past month. Although the economy seems to be showing signs of recovery, we are very concerned that the increase in COVID-19 cases and deaths will force the governor to order another shelter-in-place mandate, which will devastate our economy.

- Demand for industrial engineering projects has declined, as the industrial sector has cut production and spending. We expect this pattern to last through the third quarter and hope industrial production trends upward in the fourth quarter.

- We are braced for a lackluster four quarters and have planned accordingly.

- Projects placed on hold remain on hold. Projects have not been canceled, but developers are uncertain when they will move forward. The increase in capital spending is associated with replacement of old equipment/trucks, not company expansion.

Administrative and Support Services

- We are feeling a lag due to the negativity of the economy from our customers. Overall, business activity is down 33 percent from last year. Our corporate aviation customers are slowing down dramatically, with only mandated maintenance action being complied with unless the owner of the aircraft can defer the maintenance. The industrial sector has been absent for three months now, with not even RFQs [requests for quotation] being submitted for future projects. The petrochemical sector continues to be flat. The machined-parts sector has dropped 54 percent since last year. We hear no good news from these customers at this time. I am optimistic; I believe once we get a "result" on at least one of the vaccines in current trials, the service market will come back quickly. The majority of the people I talk with believe the same. I commend Gov. [Greg] Abbott on taking the initiative, albeit a little late to implement a statewide order for PPE [personal protective equipment] use. I believe that this will go a long way toward getting Texas back into the fight.

- [We see] a continuation of cancellations of high school and college athletic activities.

- Despite the increase in cases and continued unemployment issues, it seems as though general business activity has normalized and is better than we were anticipating. What we aren't certain of is the long-term outlook and how industries like oil and gas and commercial real estate will impact the business climate.

- By cutting or lowering every possible expense, we have managed to maintain a decent profit.

- There is anxiety over underlying economic performance given the level of unemployment, etc., versus the performance of the public equity market. [There is the] general feeling that the economic stimulus, while effective, is contributing to unrealistic market expectations. Low interest rates, PPP and other programs have in many ways blunted the economic impact of COVID-19. As we approach what appears to be round two of stay-at-home and social distancing protocols, there is a lot of uncertainty about economic activity.

- Our clients continue work-from-home patterns and plan to do so in the near future. Two of our clients told us they will not be bringing staff back to the office until 2021. As one would imagine, hiring is very slow, and contract positions are not being filled when one leaves unexpectedly.

- Without PPP we would be closed. I think it’s important for everyone to know that. Also, we still generated some revenue. Without the combination of revenue and PPP, we would have closed for sure.

- Nurses are in high demand right now!

- We are slammed and tremendously understaffed. Supplies are hard to get. COVID-19 HR nightmares abound everywhere. These HR issues cause huge internal and operational issues. We get upward of 25 applicants a week, and virtually no one shows up for an interview. Some are truthful; they come right out and tell us they just have to show they applied. This is the most absolutely messed up economy I have ever experienced. We are stressed out. Our new line: it is what it is, and it isn't anything else.

- [These are] very disruptive times.

Ambulatory Health Care Services

- The first week of July was the strongest since March, but we are seeing a dip of about 20 percent in procedure and patient volume this week, attributed to the COVID-19 surge here in Houston. We will stay open for the duration, so many patients have deferred critical imaging, and we are seeing cases of medical and oncologic disease that is more advanced than typical. In my medical opinion, the risks of lockdown far outweigh the risks of COVID-19, unless medical facilities are overrun. That is not the case in Houston at this time. A significant drop of reported COVID-19 cases was noted yesterday, but it is too early to assume this represents a true downward trend.

- Even in the gallows, the limericks and humor keep us going: Professional stresses are getting the better of me; too many without masks despite my poignant plea; loss of life deeply tragic; docs need dose of magic; if pandemic does end, we will all eventually have PTSD [post-traumatic stress disorder].

- The increase in media focus on total cases (increasing along with testing increasing) rather than on infection mortality (decreasing as the denominator rapidly increases and infection cohorts shift younger) puts pressure on Gov. Abbott to consider shutdowns again. This then translates into a rapid drop in consumer confidence (specifically whether their income will be cut off again), which affects our cosmetic dentistry business dramatically, since most folks finance cosmetics and are less likely to do so now if worried about having income to pay it back. Google searches for cosmetic dentistry terms are down sharply the last two weeks versus the last two weeks in June—likely for that reason.

Nursing and Residential Care Facilities

- The senior living industry continues to struggle, with no relief from the government despite our pleas. We are hopeful there will be some relief for us in the next round, but that is unknown. We are incurring enormous extra costs to run our business, and our occupancy and revenue are dropping because of the inability to move in new residents at a normal pace due to necessary access restrictions. As a result, we recently disclosed substantial doubt about our ability to continue as an ongoing concern.

Social Assistance

- The COVID-19 surge in Dallas has caused a decrease in traffic and required temporary closures of certain retail stores when employees fall sick.

Museums, Historical Sites and Similar Institutions

- Visitation by the public has been extremely low despite putting many measures in place to promote public safety. We are considerably curtailing hours and have furloughed approximately 25 percent of our workforce.

Amusement, Gambling and Recreation Industries

- As a private city club, we were excited to reopen on June 1. We spent a good deal of time and money to protect our staff and members. The reopening started slow, but it built steadily throughout the month. Then we sort of got another kick in the pants so to speak. We were not ordered to close down completely like the bars, but the effect was basically the same as the mayor and governor asked everyone to stay home as the number of COVID-19 cases was increasing. Our in-restaurant business fell way off, but our to-go business picked back up. We have had to make the very hard decision to lay more people off until there is a return of business. These are very challenging times.

- We have been allowed only 11 days to be open since Labor Day 2019. As an amusement park, we have lost over $2,250,000 by not being allowed to open due to the virus.

Accommodation

- One word describes the outlook: uncertainty

Food Services and Drinking Places

- Restaurants are dying a slow painful death.

- It appears people are running out of money. Lines at the drive-thru have become shorter. Last month, we thought we would equal last year’s sales this month, but that will not happen, and sales are coming down. We did 93 percent of last year in June and will be lucky to do 89 percent in July. It is difficult to staff stores, and there have been some [stores] closing due to labor shortage. The food service industry will take a big hit unless things open up very soon, and I am not optimistic.

- We are unsure if the governor or the mayor of Houston will close down the state or the city. We are also concerned about the oil industry since we are a byproduct of the economy.

- My mobile carts selling hot dogs outside of some [hardware stores] are still not operating due to [their] corporate office not allowing us to go back to work. The decision is still pending, and we are hoping [for a resolution].

- Fear and uncertainty continue at high levels. The anti-police protests are not helping either.

- In Texas, business is fairly stable. Cheese prices have been very high, which has increased costs. We are also having problems with stale-dated product we are having to waste from our distributors because volume is lower than pre-COVID-19 levels. New Mexico has shut us down again, so that is a drain on those locations.

Personal and Laundry Services

- My current business is down about 50 percent versus June. Business has significantly slowed, so I now have to cut back employee work hours as well as reduce business hours at one location. I am optimistic that six months from now things will be better; however, this is wishful thinking. I see no indications that business will improve.

Religious, Grantmaking, Civic, Professional and Similar Organizations

- Tenants are not paying rent and local SUD [special utility district] increased fees for water usage.

- State and federal leadership from executive branches are profoundly affecting our business outlooks. Trust in non-local public officials has been replaced with the assumption they are making the wrong choices for us.

- We need to focus on herd immunity, personal choice and personal responsibility.

- Everyone needs to wear masks! I don't really understand why wearing masks should be a political issue. We need to do everything possible to control the pandemic.

- Rising COVID-19 infections combined with failed leadership by the president have worsened our outlook and current new normal.

Merchant Wholesalers, Durable Goods

- We prepared for the worst and hoped for the best. The second quarter was much, much better than we expected; every month we gained momentum as our daily sales increased in May over April, in June over May, and so July appears to be on track to beat June. We are grateful. I spoke to a large customer in Midland this morning and we agreed that we both did not think oil would get back to $40/barrel as quickly as it did; this coupled with residential construction continuing to normalize are good news for Texas economy.

Merchant Wholesalers, Nondurable Goods

- As restaurant dining rules are relaxed in markets we serve, we're getting orders (as anticipated) for more food. There has been a lot of pent-up demand for people to eat out, and we're starting to see the flow-through, as more people are allowed to eat in-house at the casual-dining rooms. Interestingly, my casual-dining-restaurant customers have also had great success selling online via Grubhub, UberEats, etc., during the COVID-19 shutdown. Some of their go-to-market strategy is going to permanently change to capture more online sales. If there are secondary shutdowns because of spikes in COVID-19 cases, the casual-dine segment is better prepared to handle it short term.

Motor Vehicle and Parts Dealers

- Inventories are still short but starting to improve.

- The COVID-19 scare is causing a decrease in sales activity. This issue is compounded by the challenge of low inventories as a result of factory shutdowns.

- July demand is the same as June. However, lower inventory in July caused sales to decline. We are not expecting normal new-vehicle inventory until September–October. If used-vehicle demand stays high, then there will be continual difficulty in acquiring necessary inventory. Prices at auction for used vehicles are increasing weekly.

- We see sales softening the first 10 days of July versus June's torrid pace. We don't believe current retail activity is sustainable given the economic uncertainty.

Building Material and Garden Equipment and Supplies Dealers

- COVID-19 has everyone scared again; things really picked up about two months ago. Now, the last two weeks are down about 50 percent.

Clothing and Clothing Accessories Stores

- [Our] stores filed bankruptcy in May 2020. Unless a buyer comes forward, the company will be forced to liquidate all of our stores.

Nonstore Retailers

- We are struggling to obtain new customers due to decision-makers working from home. Ours sales cycle is primarily cold calling and face-to-face selling of our vending, coffee and market services. Our most-effective tactic currently is contacting existing customers and adding services they don't currently have.

Historical Data

Historical data can be downloaded dating back to January 2007.

Indexes

Download indexes for all indicators. For the definitions of all variables, see Data Definitions.

Texas Service Sector Outlook Survey |

Texas Retail Outlook Survey |

| Unadjusted | Unadjusted |

| Seasonally adjusted | Seasonally adjusted |

All Data

Download indexes and components of the indexes (percentage of respondents reporting increase, decrease, or no change). For the definitions of all variables, see Data Definitions.

Texas Service Sector Outlook Survey |

Texas Retail Outlook Survey |

| Unadjusted | Unadjusted |

| Seasonally adjusted | Seasonally adjusted |

Questions regarding the Texas Service Sector Outlook Survey can be addressed to Christopher Slijk at christopher.slijk@dal.frb.org.

Sign up for our email alert to be automatically notified as soon as the latest Texas Service Sector Outlook Survey is released on the web.